Regarding the legitimacy of GARNETTRADE forex brokers, it provides MISA and WikiBit, .

Is GARNETTRADE safe?

Pros

Cons

Is GARNETTRADE markets regulated?

The regulatory license is the strongest proof.

MISA Forex Trading License (EP)

Mwali International Services Authority

Mwali International Services Authority

Current Status:

RegulatedLicense Type:

Forex Trading License (EP)

Licensed Entity:

GARNET TRADE LTD

Effective Date:

2023-12-15Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

https://garnet-trade.com/Expiration Time:

2026-12-15Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Garnet Trade A Scam?

Introduction

Garnet Trade has emerged as a notable player in the forex market, offering a range of trading services that appeal to both novice and experienced traders. With claims of competitive spreads and high leverage, it has attracted attention in a crowded marketplace. However, the influx of online trading platforms has also led to an increase in fraudulent activities, making it imperative for traders to exercise caution when choosing a broker. Evaluating the legitimacy of a forex broker like Garnet Trade involves scrutinizing various aspects, including regulatory compliance, company background, trading conditions, and customer feedback. This article aims to provide a comprehensive assessment of Garnet Trade by examining these dimensions, utilizing multiple sources and relevant data to determine whether this broker is a safe choice or a potential scam.

Regulation and Legitimacy

The regulatory environment plays a crucial role in determining the safety and reliability of a forex broker. Garnet Trade claims to be registered in Saint Vincent and the Grenadines (SVG), an offshore jurisdiction known for its lax regulatory framework. While being registered in an offshore zone can raise red flags, Garnet Trade also claims to be a member of the Financial Commission (Finacom), which offers some level of protection to traders. However, it is essential to note that membership in Finacom does not equate to regulatory oversight in the traditional sense.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Financial Commission | N/A | Offshore | Verified |

| ASIC | 001305577 | Australia | Limited |

| MISA | T2023429 | Comoros | Offshore |

The table above summarizes Garnet Trade's regulatory status. While it holds a license from ASIC, which is considered a reputable authority, it operates under an "appointed representative" status, which may not offer the same level of investor protection as a fully licensed broker. Additionally, the regulation by MISA in Comoros raises concerns, as this jurisdiction is known for its weak regulatory framework. The lack of stringent oversight could expose traders to higher risks, especially in terms of fund safety and dispute resolution.

Company Background Investigation

Garnet Trade is operated by Garnet Trade Ltd., which claims to have a presence in multiple countries, including Australia, Canada, and the UK. However, the companys history is relatively short, having been established in 2010. The ownership structure appears to be somewhat opaque, with limited information available about its management team. A transparent broker typically provides detailed information about its leadership and operational history, which is crucial for building trust with potential clients.

Furthermore, the companys claims of being affiliated with a legitimate Australian brokerage have come under scrutiny. Many users have reported inconsistencies regarding the information presented on their website and the actual regulatory status of their operations. The lack of clear and accessible information diminishes the broker's credibility, leading to concerns about transparency and accountability.

Trading Conditions Analysis

Garnet Trade offers a range of trading conditions that include competitive spreads and high leverage, which can be appealing to traders looking to maximize their potential returns. However, it is essential to examine the overall fee structure and any unusual policies that might affect trading profitability.

| Fee Type | Garnet Trade | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.9 pips | 1.0 pips |

| Commission Model | No commission | Varies widely |

| Overnight Interest Range | Varies | Varies widely |

The table above illustrates the trading costs associated with Garnet Trade. While the spread for major currency pairs is slightly below the industry average, the absence of a commission model raises questions. Brokers that do not charge commissions often compensate through wider spreads or hidden fees, which could impact overall profitability. Additionally, the variability in overnight interest rates suggests that traders should be cautious and fully understand the potential costs associated with holding positions overnight.

Client Fund Security

The safety of client funds is a critical consideration when evaluating any broker. Garnet Trade claims to implement various security measures, including segregated accounts and investor protection provisions. However, the effectiveness of these measures is contingent upon the regulatory framework governing the broker's operations.

Garnet Trade does not provide clear information on whether client funds are held in segregated accounts at tier-1 banks, which is a standard practice among reputable brokers. Furthermore, the lack of a robust investor compensation scheme in the jurisdictions where it operates raises concerns about the potential loss of funds in the event of insolvency or fraud.

Historically, there have been reports of issues related to fund withdrawals and client complaints about the processing times. Such incidents underscore the importance of assessing a broker's fund security measures and their track record in handling client funds.

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability and service quality. An analysis of user experiences with Garnet Trade reveals a mixed bag of reviews, with some traders expressing satisfaction with the platform's functionality while others report significant issues.

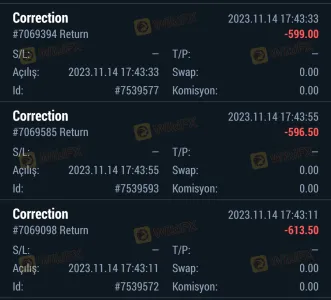

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Account Management Issues | Medium | Average |

| Customer Service Response | Low | Below Average |

The table above summarizes the primary complaints associated with Garnet Trade. The most severe issues revolve around withdrawal delays, which can be particularly alarming for traders who need quick access to their funds. Additionally, the company's response to complaints has been criticized for being slow and inadequate, further eroding trust among its user base.

One notable case involved a trader who reported being unable to withdraw funds after multiple requests. The lack of timely communication from the support team led to frustration and a sense of helplessness. Such experiences can deter potential clients from engaging with the broker.

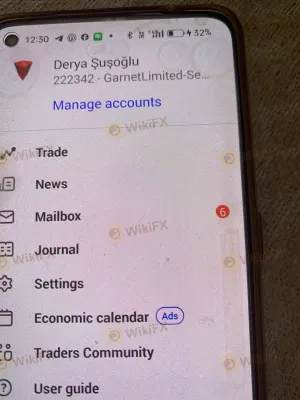

Platform and Trade Execution

Garnet Trade utilizes the MetaTrader 5 (MT5) platform, which is known for its advanced features and user-friendly interface. However, the performance of the platform is crucial in determining the overall trading experience. Traders have reported mixed experiences regarding order execution quality, with some noting instances of slippage and rejections during high volatility periods.

The potential for platform manipulation raises concerns, especially given the broker's offshore status. Traders should be vigilant and monitor their execution quality to ensure that they are receiving fair treatment.

Risk Assessment

Engaging with Garnet Trade comes with inherent risks that traders should be aware of. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Offshore regulation with weak oversight. |

| Fund Safety Risk | High | Lack of clear fund segregation and compensation schemes. |

| Customer Service Risk | Medium | Inadequate responses to complaints and withdrawal issues. |

| Platform Reliability | Medium | Mixed reviews on execution quality and potential for manipulation. |

To mitigate these risks, traders are advised to conduct thorough due diligence before committing funds. It may also be prudent to consider alternative brokers with stronger regulatory oversight and a proven track record.

Conclusion and Recommendations

In conclusion, while Garnet Trade presents itself as a legitimate forex broker, there are several red flags that warrant caution. The combination of offshore regulation, mixed customer feedback, and concerns about fund safety raises significant doubts about its reliability. Traders should approach this broker with a healthy degree of skepticism, particularly given the potential risks involved.

For traders seeking safer alternatives, it is advisable to consider brokers that are regulated by reputable authorities such as the FCA or ASIC, which offer robust investor protection and transparency. Some recommended alternatives include brokers with strong regulatory backgrounds and positive user reviews, ensuring a more secure trading environment.

Is GARNETTRADE a scam, or is it legit?

The latest exposure and evaluation content of GARNETTRADE brokers.

GARNETTRADE Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GARNETTRADE latest industry rating score is 5.98, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 5.98 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.