Garnet Trade 2025 Review: Everything You Need to Know

Executive Summary

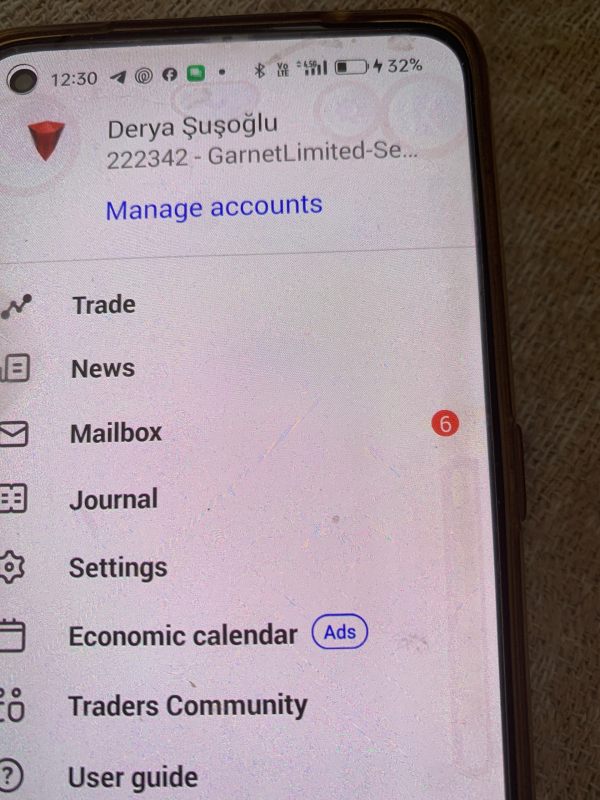

This comprehensive garnet trade review examines one of the emerging players in the forex brokerage landscape. Garnet Trade was established in 2010. The company presents itself as a regulated forex broker offering competitive trading conditions with high leverage capabilities and accessible entry requirements. The broker operates under ASIC and MISA regulation. It provides traders with leverage up to 1:500 and requires a minimum deposit of just 100 USD.

Based on available user feedback, Garnet Trade demonstrates strong customer satisfaction with an impressive 99% of users providing 5-star ratings. The broker primarily targets novice and intermediate traders. It particularly focuses on those seeking high leverage opportunities and low barrier-to-entry requirements. Operating through STP and ECN execution models, Garnet Trade positions itself as a viable option for traders looking for regulated trading environments with competitive conditions. However, comprehensive information about specific trading tools, educational resources, and detailed platform features remains limited in publicly available sources.

Important Notice

Garnet Trade operates across multiple international markets with offices in Sydney, Fomboni, London, and Skopje. Different regional entities may be subject to varying regulatory requirements and trading conditions depending on local jurisdiction. This review is based on publicly available information and user feedback compiled from various sources as of 2025. Potential traders should verify current terms, conditions, and regulatory status directly with the broker before making any investment decisions. Forex trading involves significant risk and may not be suitable for all investors.

Rating Framework

Broker Overview

Garnet Trade was established in 2010. Since then, it has developed into a multi-jurisdictional forex broker with its primary operations based in Australia and Mwali. The company provides trading execution and clearing services through both STP (Straight Through Processing) and ECN (Electronic Communication Network) models. This positioning allows it to serve a diverse range of trading strategies and preferences. With offices strategically located in Sydney, Fomboni, London, and Skopje, Garnet Trade demonstrates a commitment to serving international markets while maintaining regulatory compliance across multiple jurisdictions.

The broker's business model focuses on providing transparent trading conditions with competitive leverage offerings and low entry barriers. According to available information, Garnet Trade operates under the regulatory oversight of both the Australian Securities and Investments Commission (ASIC) and the Mwali International Services Authority (MISA). This dual regulatory structure provides clients with enhanced protection. It ensures adherence to international trading standards. The company's approach emphasizes accessibility for retail traders while maintaining institutional-grade execution standards through its hybrid STP/ECN model.

Regulatory Framework (ASIC & MISA Oversight)

Garnet Trade operates under dual regulatory supervision from ASIC and MISA. This provides clients with comprehensive protection measures including compensation fund coverage up to €20,000. This regulatory structure ensures adherence to strict financial conduct standards.

Minimum Deposit Requirements (Accessible Entry Point)

The broker sets its minimum deposit requirement at 100 USD. This makes it accessible to beginner traders and those with limited initial capital. This low threshold aligns with the broker's strategy to attract new market participants.

Leverage Capabilities (Up to 1:500)

Garnet Trade offers maximum leverage of 1:500. This provides traders with significant capital amplification opportunities. This high leverage ratio appeals particularly to experienced traders seeking enhanced position sizing flexibility.

Trading Execution Models (STP & ECN)

The broker employs both STP and ECN execution models. This allows for diverse trading strategies and potentially improved execution speeds. This hybrid approach aims to provide optimal order routing based on market conditions.

Geographic Presence (Multi-Office Operations)

With offices in Sydney, Fomboni, London, and Skopje, Garnet Trade maintains a global operational footprint. This geographic diversity supports international client servicing and regulatory compliance across different jurisdictions.

Cost Structure Information

Specific details regarding spreads, commissions, and other trading costs were not comprehensively available in the reviewed sources. This limits the ability to provide detailed cost analysis for this garnet trade review.

Payment Processing Methods

Detailed information about accepted deposit and withdrawal methods was not specified in available sources. Potential clients need to verify payment options directly with the broker.

Trading Platform Options

Specific trading platform offerings and technological infrastructure details were not clearly outlined in the reviewed materials. This represents an information gap for comprehensive evaluation.

Detailed Rating Analysis

Account Conditions Analysis (8/10)

Garnet Trade's account conditions demonstrate strong accessibility with a competitive minimum deposit requirement of 100 USD. This positions the broker favorably for new traders entering the forex market. This low entry threshold removes significant barriers that often prevent beginners from accessing professional trading environments. The broker's leverage offering of up to 1:500 provides substantial capital amplification opportunities. However, traders should exercise appropriate risk management given the increased exposure potential.

While specific account types and their individual features were not detailed in available sources, the fundamental conditions suggest a trader-friendly approach. The combination of low minimum deposits and high leverage creates an attractive proposition for both conservative traders seeking modest position sizes and aggressive traders pursuing enhanced market exposure. User feedback supporting 99% 5-star ratings indicates that clients generally find the account conditions satisfactory and competitive within the industry standard.

However, the lack of detailed information about account tiers, special features, or Islamic account options represents a limitation in fully assessing the comprehensive account offering. This garnet trade review recommends that potential clients inquire directly about specific account features that may align with their trading strategies and religious requirements.

The evaluation of Garnet Trade's trading tools and resources faces significant limitations due to insufficient publicly available information about the broker's analytical offerings, research capabilities, and educational resources. This information gap prevents a comprehensive assessment of the broker's commitment to supporting trader development and providing market analysis tools that are typically expected from modern forex brokers.

Professional trading environments generally include charting packages, economic calendars, market sentiment indicators, and automated trading support. Without clear documentation of these offerings, traders cannot adequately evaluate whether Garnet Trade provides the necessary tools for sophisticated market analysis and strategy implementation. The absence of detailed information about research resources, daily market commentary, or educational webinars further limits the assessment.

This represents a significant area where Garnet Trade could improve transparency by providing detailed information about their analytical tools, third-party integrations, and educational support systems. Potential clients should specifically inquire about available tools and resources to ensure they align with their trading requirements and analytical preferences.

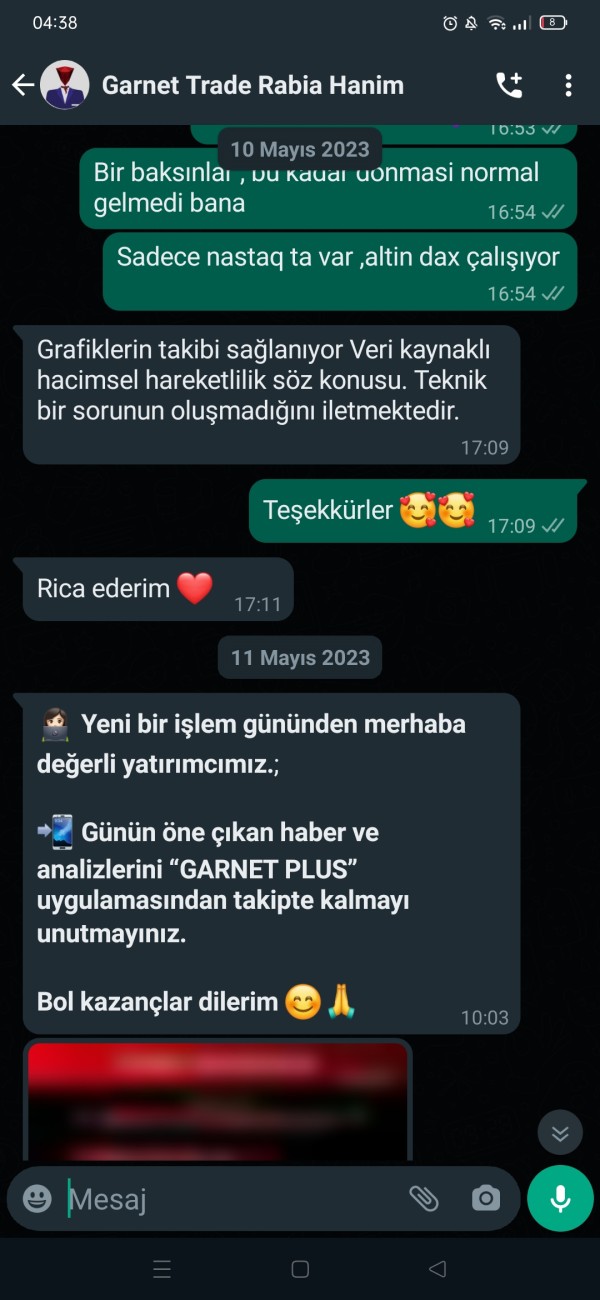

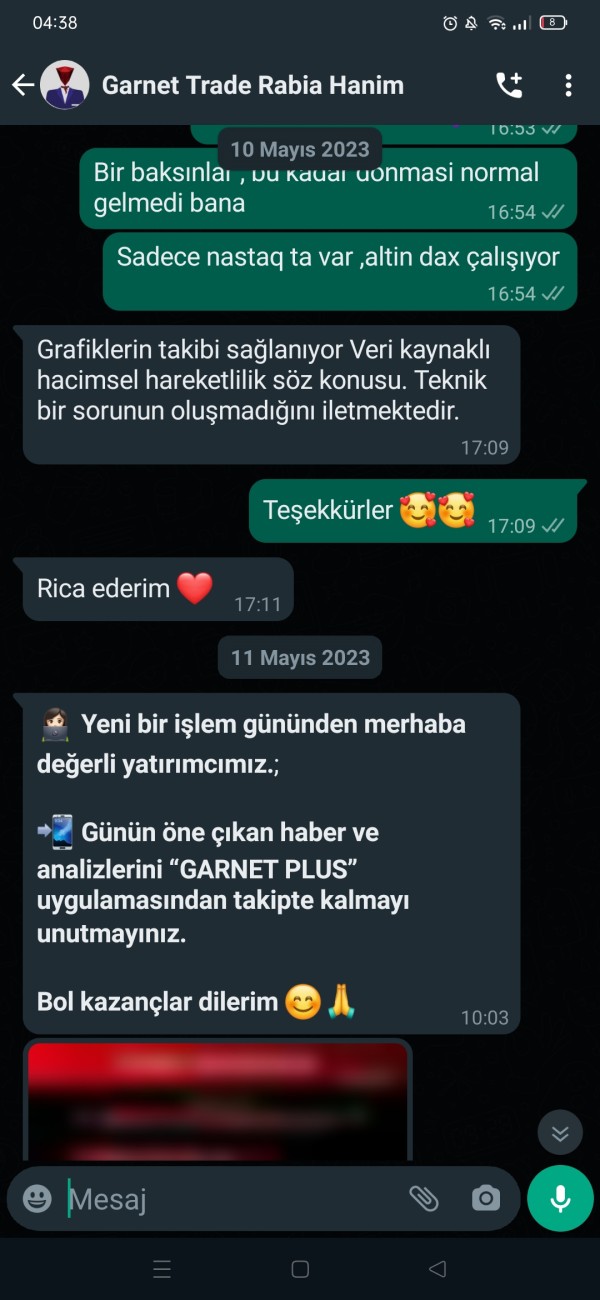

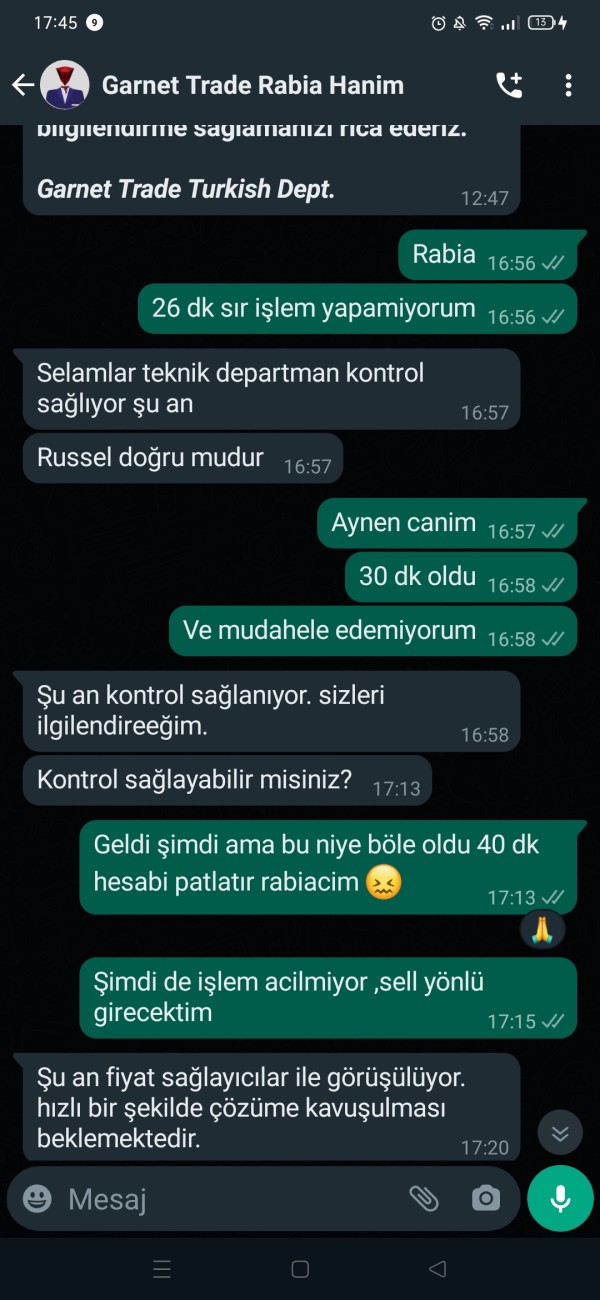

Customer Service and Support Analysis (5/10)

Customer service evaluation for Garnet Trade remains challenging due to limited publicly available information about support channels, response times, and service quality metrics. Modern forex brokers typically offer multiple communication channels including live chat, email support, phone assistance, and comprehensive FAQ sections. The absence of detailed information about these support mechanisms in available sources prevents thorough evaluation of the broker's commitment to client service.

Critical factors such as customer service availability hours, multilingual support options, and average response times could not be adequately assessed from the reviewed materials. These elements are crucial for international traders who may require assistance across different time zones and in various languages. This is particularly important given Garnet Trade's global office presence in Sydney, Fomboni, London, and Skopje.

The impressive 99% 5-star user rating suggests that clients who have experienced the broker's services generally report satisfaction. This may indicate adequate support quality. However, without specific details about support processes, escalation procedures, and service level agreements, potential clients cannot make informed decisions about whether the support infrastructure meets their requirements.

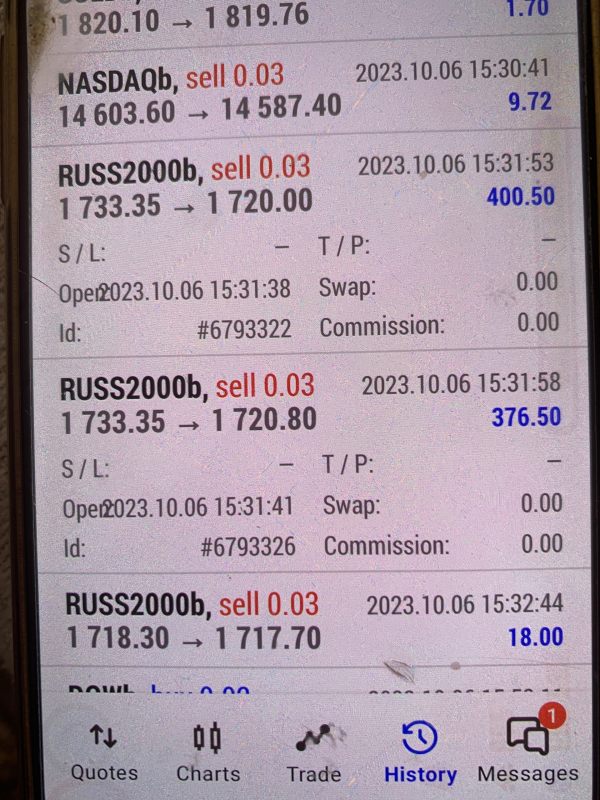

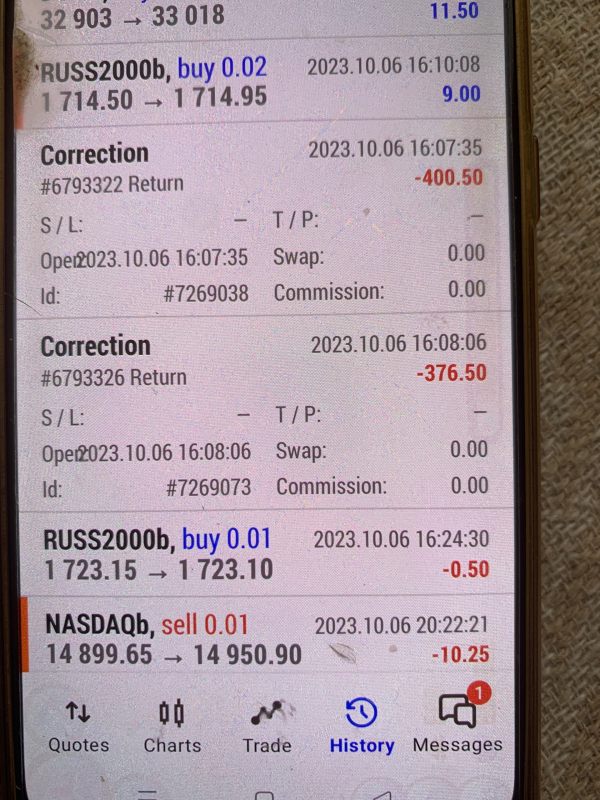

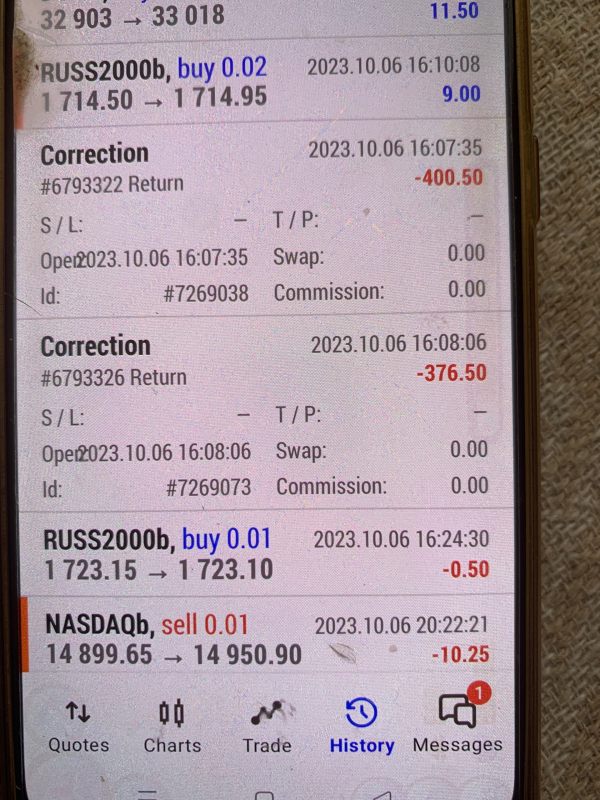

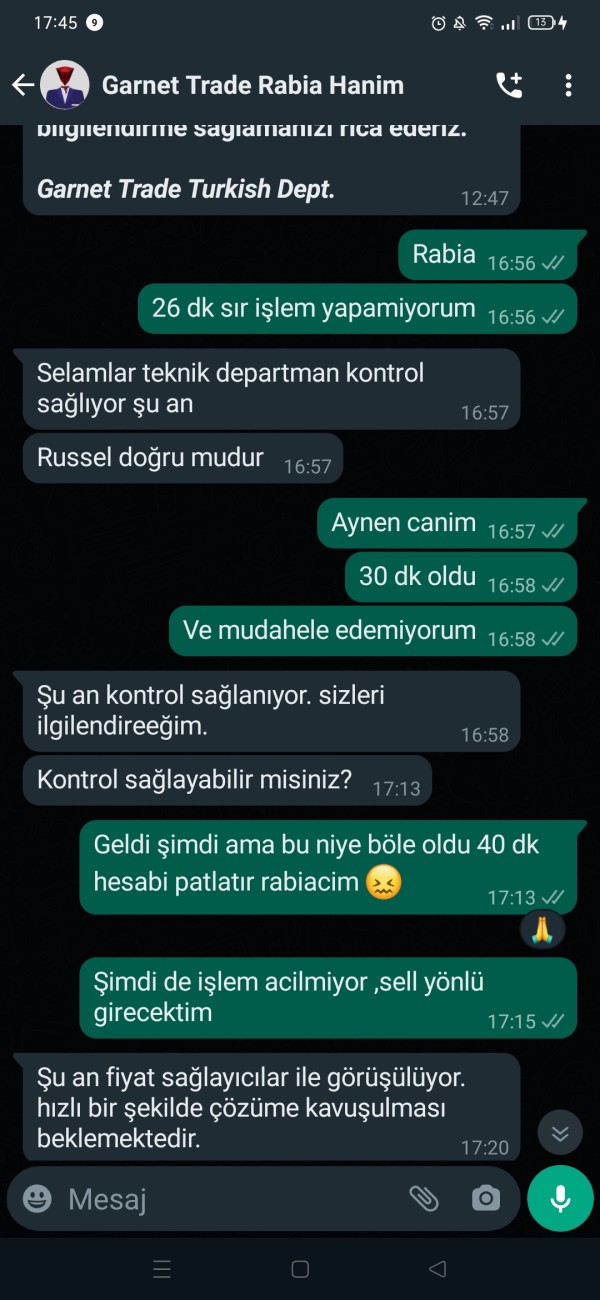

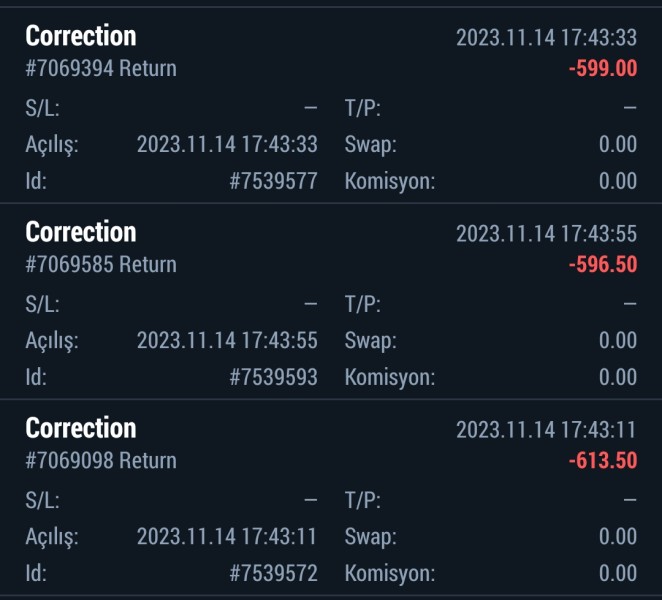

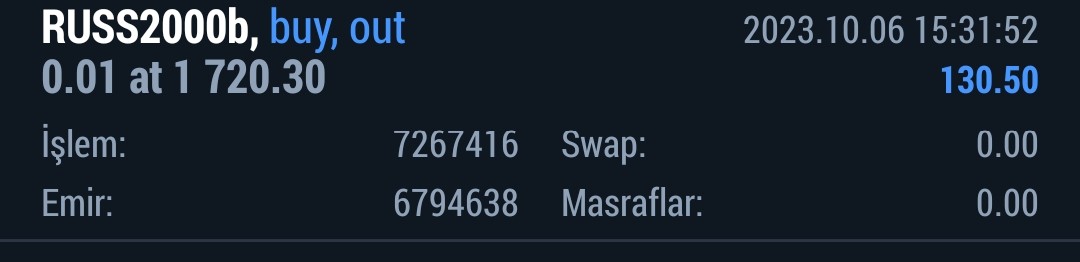

Trading Experience Analysis (5/10)

Assessing Garnet Trade's trading experience requires evaluation of platform stability, execution speed, order processing quality, and overall technological infrastructure. Unfortunately, detailed information about these critical performance metrics was not comprehensively available in the reviewed sources. Modern traders expect reliable platform performance, minimal slippage, fast execution speeds, and robust mobile trading capabilities.

The broker's utilization of both STP and ECN execution models suggests a commitment to providing quality order routing and potentially competitive execution conditions. However, without specific performance data, execution statistics, or detailed platform feature descriptions, traders cannot adequately evaluate whether Garnet Trade delivers the technological excellence required for serious trading activities.

Platform stability during high volatility periods, server reliability, and mobile application functionality are crucial factors that influence trading success. The lack of available information about these technical aspects represents a significant limitation in this garnet trade review. Potential clients should request detailed platform demonstrations and execution quality reports to properly assess the trading environment before committing funds.

Trust and Security Analysis (9/10)

Garnet Trade demonstrates strong credentials in trust and security through its dual regulatory oversight from ASIC and MISA. The Australian Securities and Investments Commission represents one of the world's most respected financial regulators. MISA provides additional jurisdictional oversight. This regulatory framework ensures adherence to strict capital adequacy requirements, client fund segregation, and professional conduct standards.

The provision of compensation fund protection up to €20,000 provides additional security for client deposits. This demonstrates the broker's commitment to client protection beyond basic regulatory requirements. This insurance coverage offers peace of mind for traders, particularly those operating with smaller account sizes that fall within the compensation threshold.

The broker's establishment in 2010 indicates operational longevity in the competitive forex industry. This suggests sustained business viability and regulatory compliance over more than a decade. The maintenance of offices across multiple jurisdictions (Sydney, Fomboni, London, and Skopje) further demonstrates organizational stability and commitment to international operations. However, the absence of detailed information about additional security measures, audit procedures, or corporate transparency initiatives prevents a perfect security rating.

User Experience Analysis (9/10)

User experience evaluation for Garnet Trade reveals exceptionally positive client sentiment, with an impressive 99% of users providing 5-star ratings according to available feedback data. This overwhelming positive response suggests that clients generally find their interaction with the broker satisfactory across multiple touchpoints including account opening, trading execution, and ongoing service delivery.

The fact that only 1% of users provided 1-star ratings indicates minimal serious dissatisfaction among the client base. The specific nature of these complaints was not detailed in available sources. Such high satisfaction rates typically reflect effective customer onboarding, reliable platform performance, and responsive customer support, even though detailed information about these specific areas was not comprehensively available.

The broker's focus on accessibility through low minimum deposits (100 USD) and high leverage (1:500) appears to resonate well with its target demographic of novice and intermediate traders. The positive user feedback suggests that Garnet Trade successfully delivers on its value proposition of providing accessible, regulated trading conditions. However, the limited availability of detailed user testimonials and specific experience descriptions prevents deeper analysis of particular strengths and potential improvement areas in the user journey.

Conclusion

This comprehensive garnet trade review reveals a regulated forex broker with strong fundamentals in accessibility and client satisfaction. Garnet Trade's combination of ASIC and MISA regulation, competitive leverage up to 1:500, and low minimum deposit requirements of 100 USD creates an attractive proposition for novice and intermediate traders seeking regulated trading environments.

The broker's exceptional user satisfaction rate of 99% 5-star ratings indicates successful service delivery. The dual regulatory oversight provides robust client protection including compensation fund coverage. However, the limited availability of detailed information about trading tools, platform features, and comprehensive service offerings represents areas where greater transparency would benefit potential clients.

Garnet Trade appears most suitable for traders prioritizing regulatory security, accessible entry requirements, and high leverage capabilities. It particularly appeals to those beginning their forex trading journey or seeking straightforward trading conditions without complex feature requirements.