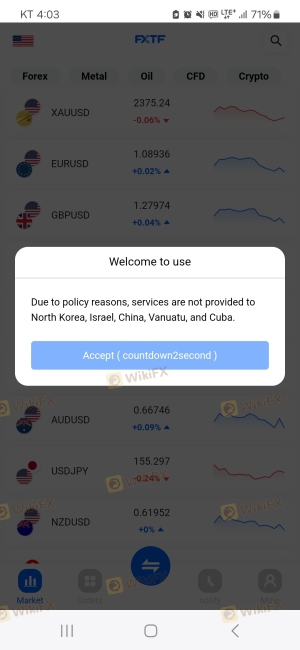

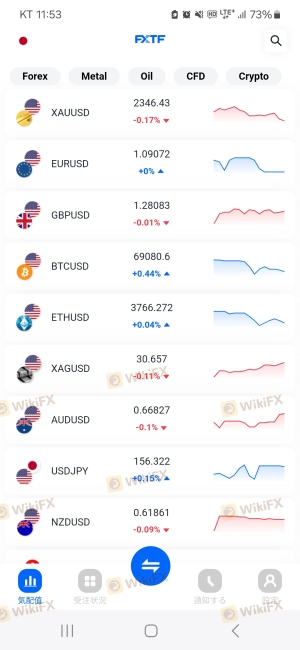

Regarding the legitimacy of FXTF forex brokers, it provides FSA and WikiBit, (also has a graphic survey regarding security).

Is FXTF safe?

Pros

Cons

Is FXTF markets regulated?

The regulatory license is the strongest proof.

FSA Market Making License (MM)

Financial Services Agency

Financial Services Agency

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

ゴールデンウェイ・ジャパン株式会社

Effective Date:

2007-09-30Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

東京都港区三田2-11-15Phone Number of Licensed Institution:

03-4577-6777Licensed Institution Certified Documents:

Is FXTF A Scam?

Introduction

FXTF, short for FX Trade Financial, is a forex broker based in Japan, primarily serving the domestic market. Established in 2006, FXTF has positioned itself as a player in the competitive forex landscape by offering services tailored to both individual and corporate clients. However, with the proliferation of online trading platforms, it has become increasingly vital for traders to assess the legitimacy and reliability of such brokers. In an environment rife with scams and fraudulent schemes, potential clients must exercise due diligence and evaluate the safety of their investments.

This article aims to provide an objective analysis of FXTF, exploring its regulatory status, company background, trading conditions, customer experiences, and overall risk profile. The investigation is based on a thorough review of multiple sources, including industry reports, user reviews, and regulatory filings, to deliver a comprehensive overview of whether FXTF can be considered a safe trading partner or a potential scam.

Regulation and Legitimacy

The regulatory environment surrounding a broker is crucial in determining its legitimacy. FXTF operates under the oversight of Japan's Financial Services Agency (FSA). Regulatory bodies like the FSA are essential in ensuring brokers adhere to strict operational standards, thereby safeguarding client interests.

| Regulatory Authority | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| Financial Services Agency (FSA) | No. 258 | Japan | Regulated |

FXTF is regulated under the FSA, which is known for its rigorous standards. This regulation requires brokers to maintain certain capital requirements, segregate client funds, and provide transparent reporting. The historical compliance of FXTF with regulatory standards is generally positive, and it has not faced significant sanctions or penalties, which adds to its credibility.

However, it's important to note that while FXTF is regulated, the quality of regulation varies by jurisdiction. Japan's regulatory framework, while robust, may not offer the same level of investor protection as those found in other regions such as Europe or the United States. Traders should remain aware of this and consider the implications for their investments.

Company Background Investigation

FXTF, operated by Golden Way Japan Co., Ltd., has been in the market for approximately 15-20 years. The company has undergone several transformations, including a rebranding in 2019, which reflects its commitment to evolving with the market. The ownership structure is transparent, with information readily available regarding its operational history and the management team.

The management team at FXTF comprises experienced professionals in the finance and trading sectors. Their expertise is crucial in navigating the complexities of the forex market and ensuring the platform's reliability. Furthermore, the company maintains a level of transparency regarding its operations, with financial statements and business practices disclosed on its website.

Despite its history, FXTF's focus appears to be primarily on the Japanese market, which may limit its appeal to international traders. The lack of extensive information in English may also deter non-Japanese speakers from engaging with the platform. Overall, FXTF's established presence in Japan, combined with its transparent practices, contributes positively to its reputation in the forex industry.

Trading Conditions Analysis

FXTF offers a competitive trading environment, but understanding its fee structure is essential for traders. The broker operates a commission-free model, which is attractive for many traders. However, it is crucial to analyze the potential hidden costs that may arise during trading.

| Cost Type | FXTF | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.1 - 1.0 pips | 1.0 - 2.0 pips |

| Commission Model | None | Varies (often $5-10 per lot) |

| Overnight Interest Range | Varies | Varies |

FXTF's spreads are reported to be competitive, particularly for major currency pairs, often starting as low as 0.1 pips. This is significantly lower than the industry average, making FXTF an appealing choice for cost-conscious traders. However, it is essential to remain vigilant about any additional fees that may apply, especially regarding overnight positions.

Moreover, the absence of a clear commission structure can lead to confusion among traders. While the broker claims to have no commissions, the underlying costs associated with spreads and overnight financing can affect overall profitability. Traders should carefully review their trading strategies and consider how these costs will impact their bottom line.

Client Fund Security

The security of client funds is paramount when selecting a forex broker. FXTF implements several measures to ensure the safety of its clients' assets. The company adheres to the regulatory requirement of segregating client funds from its operational capital, which is a standard practice among reputable brokers.

FXTF also participates in the Japan Investor Protection Fund, which provides additional security for clients in the event of the broker's insolvency. This fund is designed to protect investors by compensating them for losses up to a certain limit. Furthermore, FXTF does not have a history of significant security breaches or financial disputes, which adds to its credibility.

However, potential clients should be aware that while these measures are in place, trading in the forex market inherently carries risks. The lack of negative balance protection means that traders could potentially lose more than their initial investment, particularly in volatile market conditions. It is advisable for traders to implement robust risk management strategies to mitigate potential losses.

Customer Experience and Complaints

Customer feedback is an invaluable resource for assessing a broker's reliability. Reviews of FXTF vary, with some users praising its trading conditions and customer service, while others have raised concerns about withdrawal processes and responsiveness.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response times reported |

| Customer Support | Medium | Mixed reviews on effectiveness |

| Platform Stability | Low | Generally positive feedback |

Common complaints about FXTF include difficulties in withdrawing funds and slow customer support responses. Some users have reported challenges when attempting to access their capital, which can be a significant red flag for potential clients. However, it is worth noting that FXTF generally responds to inquiries, although the timeliness of these responses has been questioned.

One notable case involved a trader who experienced delays in processing a withdrawal request. While FXTF eventually resolved the issue, the delay raised concerns about the broker's operational efficiency. Such feedback should be taken into account by potential clients when considering FXTF as a trading partner.

Platform and Execution

FXTF offers its clients access to the popular MetaTrader 4 (MT4) platform, known for its user-friendly interface and robust trading tools. The platform's performance, stability, and execution quality are critical factors for traders.

Traders generally report positive experiences with FXTF's platform, citing its reliability and speed. However, some users have mentioned instances of slippage during high-volatility periods, which can affect trading outcomes. The broker has not been associated with any significant platform manipulation, but traders should remain vigilant and monitor their trades closely.

Risk Assessment

Engaging with FXTF, like any broker, comes with its own set of risks. While the broker is regulated and has implemented several safety measures, potential clients should be aware of the following risk factors:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Regulatory standards in Japan may not offer the same protections as in other regions. |

| Withdrawal Risk | High | Complaints regarding slow withdrawal processes could indicate potential issues. |

| Market Risk | High | Forex trading is inherently risky, and traders can lose more than their initial investment. |

To mitigate these risks, traders should conduct thorough research, utilize risk management strategies, and consider starting with a demo account to familiarize themselves with the platform before committing significant capital.

Conclusion and Recommendations

In conclusion, FXTF presents a mixed picture. While it is a regulated broker with a solid operational history and competitive trading conditions, potential clients should exercise caution. The complaints regarding withdrawal processes and customer support responsiveness are concerning and warrant careful consideration.

For traders looking for a reliable forex broker, FXTF may be a viable option, especially for those based in Japan. However, traders should remain vigilant and ensure they understand the fee structure and risks involved. For those seeking alternatives, brokers with stronger regulatory protections and a more extensive international presence may be worth exploring.

Ultimately, the decision to trade with FXTF should be informed by a thorough understanding of both the opportunities and risks presented by the broker.

Is FXTF a scam, or is it legit?

The latest exposure and evaluation content of FXTF brokers.

FXTF Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FXTF latest industry rating score is 8.38, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 8.38 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.