FXTF 2025 Review: Everything You Need to Know

Summary

FXTF is a customer-focused foreign exchange and CFD broker. The company has been serving individual and institutional clients since 2006. This fxtf review aims to provide a complete analysis of the broker's offerings, highlighting both strengths and areas for improvement.

The broker stands out with an extremely low minimum deposit requirement of just 1 JPY and strong fund protection measures including negative balance protection. FXTF serves mainly traders seeking low-barrier entry into the forex market. The company offers multiple platform options including MetaTrader 4, FXTF GX, mobile platforms, proprietary platforms, and web-based solutions.

The broker operates under the regulation of Japan's Financial Services Agency (JFSA), ensuring fund segregation and implementing negative balance protection for client security. With leverage options up to 1:25 and support for various asset classes including forex and contracts for difference (CFD), FXTF positions itself as an accessible option for both novice and experienced traders. However, user feedback shows mixed experiences regarding customer service quality and overall satisfaction, suggesting areas where the broker could enhance its service delivery.

Important Notice

This review focuses on FXTF's operations primarily regulated under Japan's Financial Services Agency (JFSA). Regulatory requirements and trading conditions may differ significantly in other jurisdictions where the broker operates or accepts clients.

Potential traders should verify the specific regulatory framework applicable to their region before opening an account. This evaluation is based on available information from multiple sources and user feedback collected through various platforms. The assessment aims to provide an objective analysis of FXTF's trading environment, but individual experiences may vary.

Traders are advised to conduct their own due diligence and consider their specific trading needs and risk tolerance before making any investment decisions.

Rating Framework

Overall Rating: 7.0/10

Broker Overview

FXTF was established in 2006. The company has since positioned itself as a reliable provider of foreign exchange and CFD trading solutions. Based in Japan, the company focuses on delivering competitive trading conditions and diverse platform options to meet the varying needs of individual and institutional clients.

The broker's business model emphasizes accessibility and customer protection, as evidenced by its minimal entry requirements and comprehensive safety measures. The company operates under a multi-platform approach, supporting various trading environments to accommodate different trader preferences and experience levels. FXTF's commitment to regulatory compliance and fund protection has helped establish its reputation in the Japanese market, though user feedback suggests room for improvement in service delivery and customer satisfaction.

According to available information, FXTF supports trading in foreign exchange and contracts for difference (CFD), providing traders with access to global financial markets. The broker operates under the oversight of Japan's Financial Services Agency (JFSA), which ensures adherence to strict regulatory standards for client fund protection and business operations. This fxtf review examines how these foundational elements translate into practical trading experiences for users.

Regulatory Jurisdiction: FXTF operates under the regulation of Japan's Financial Services Agency (JFSA). This provides traders with regulatory protection and ensures compliance with Japanese financial standards.

Deposit and Withdrawal Methods: Specific information regarding deposit and withdrawal methods was not detailed in available sources. Potential clients need to contact the broker directly for comprehensive payment options.

Minimum Deposit Requirements: The broker sets an exceptionally low minimum deposit of 1 JPY (approximately ¥1000). This makes it particularly accessible for new traders and those with limited initial capital.

Bonus and Promotional Offers: Available sources did not provide specific information about current bonus structures or promotional campaigns offered by FXTF.

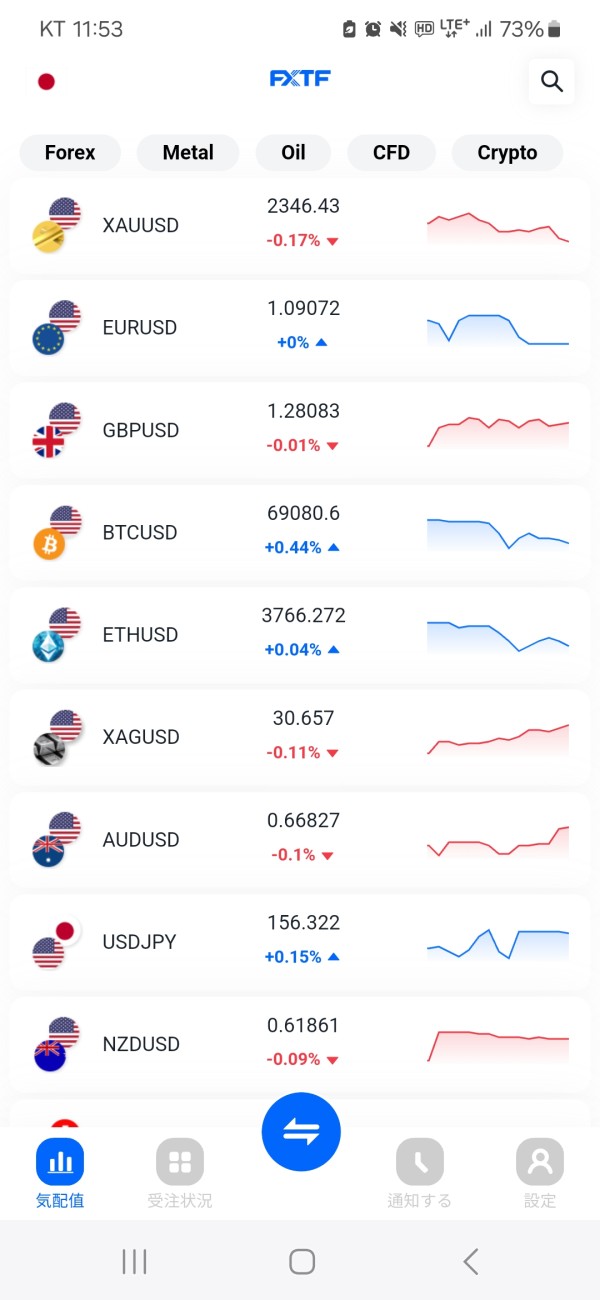

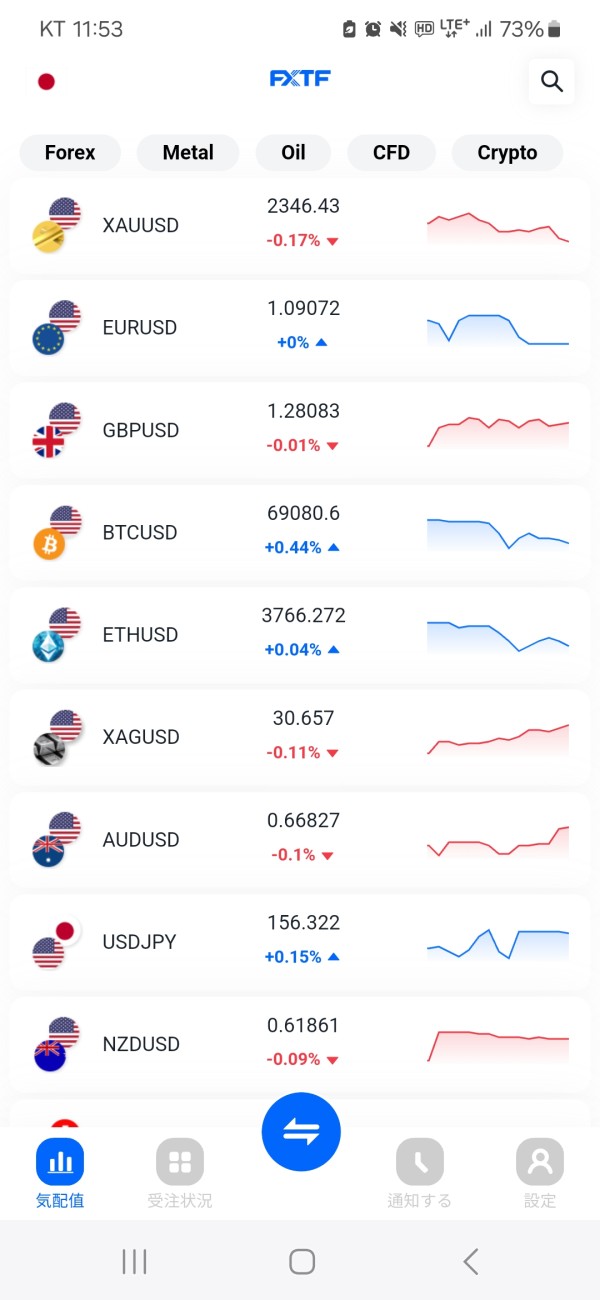

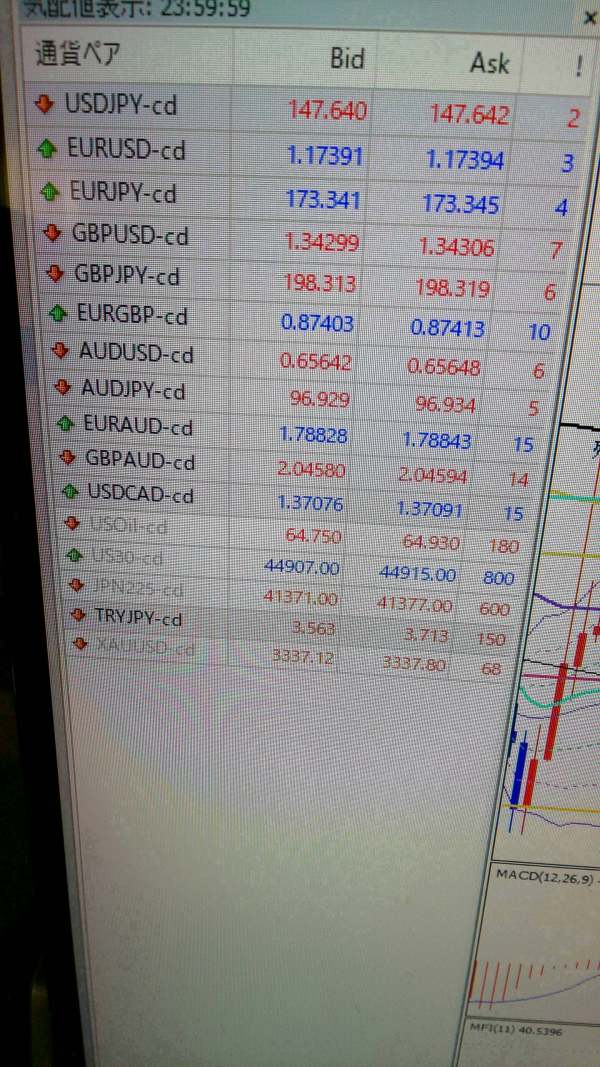

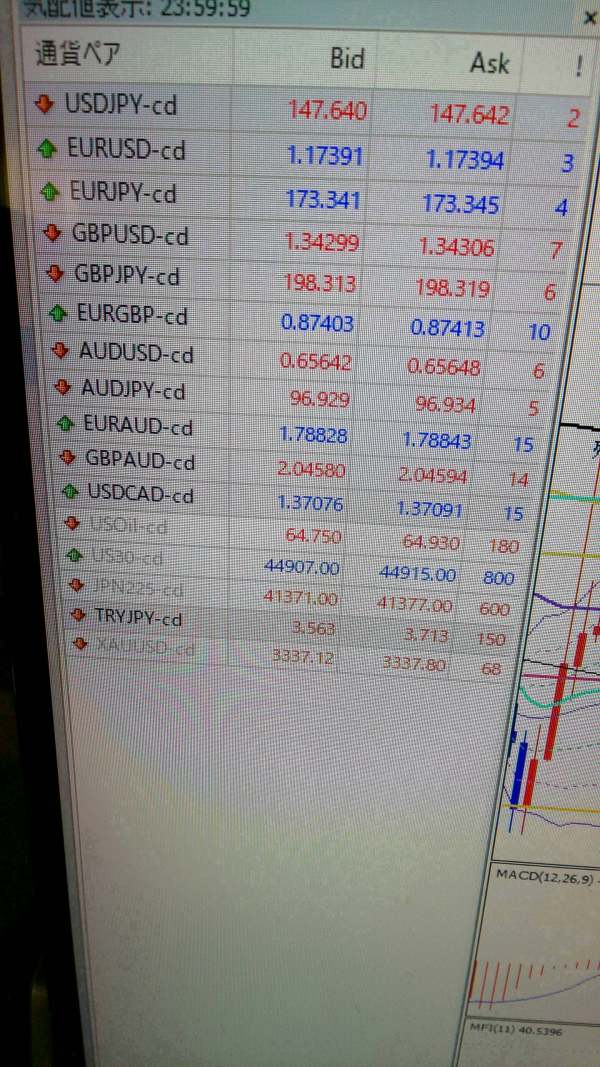

Tradeable Assets: FXTF provides access to foreign exchange markets and contracts for difference (CFD). However, specific details about the number of instruments and asset categories were not comprehensively detailed in source materials.

Cost Structure: Detailed information about spreads, commissions, and other trading costs was not specified in available sources. This indicates the need for direct inquiry with the broker for complete pricing information.

Leverage Ratios: The broker offers leverage up to 1:25. This aligns with regulatory requirements and provides reasonable risk management for traders across different experience levels.

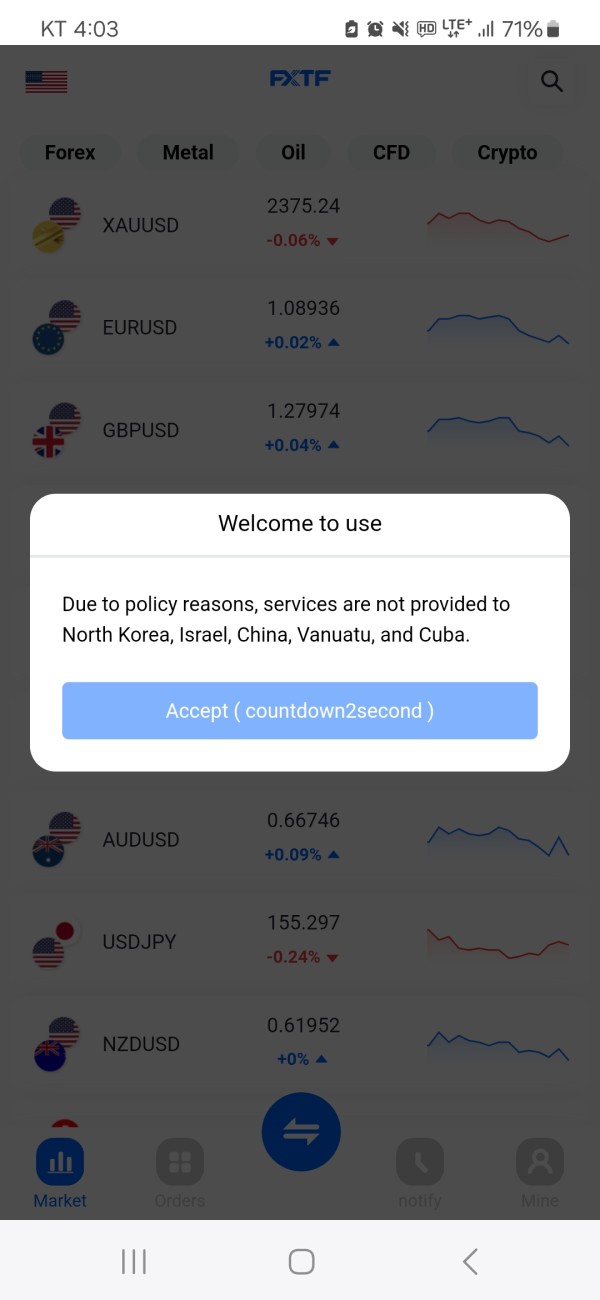

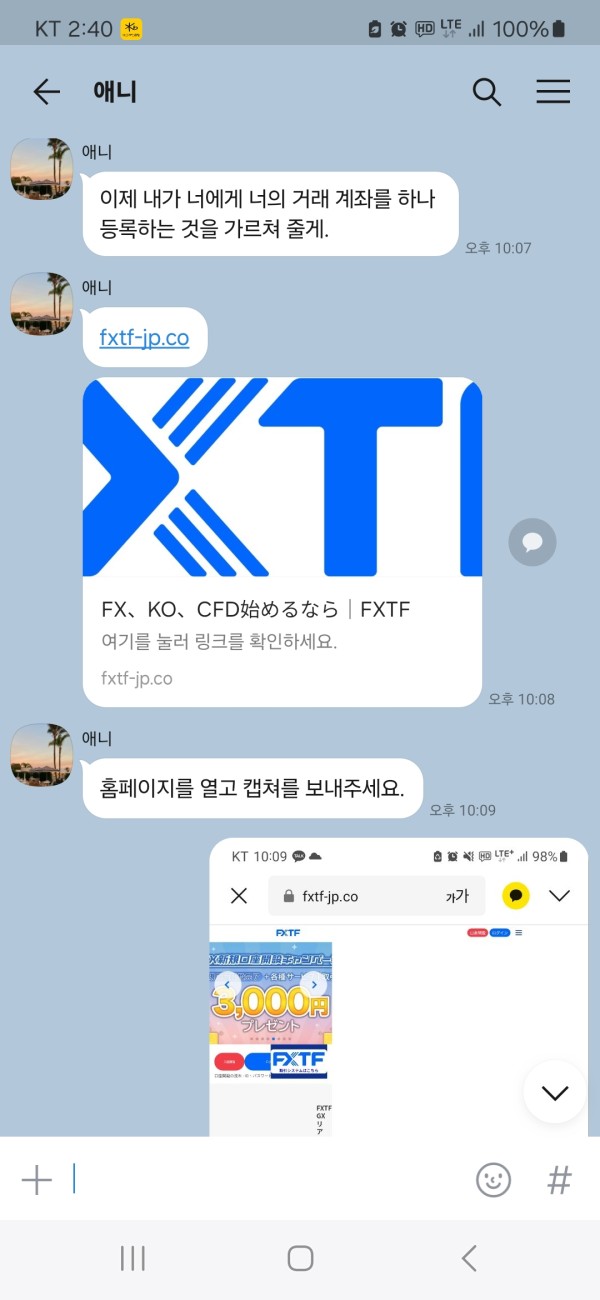

Platform Options: FXTF supports multiple trading platforms including MetaTrader 4 (MT4), FXTF GX, mobile applications, proprietary platforms, and web-based trading interfaces. These options cater to diverse trader preferences and technical requirements.

Geographic Restrictions: Specific information about geographic limitations or restricted territories was not detailed in available source materials.

Customer Support Languages: Available sources did not specify the range of languages supported by FXTF's customer service team.

This fxtf review notes that several key operational details require direct verification with the broker, as comprehensive information was not available in source materials.

Detailed Rating Analysis

Account Conditions Analysis (8/10)

FXTF demonstrates strong performance in account conditions. This is primarily due to its exceptionally accessible entry requirements. The minimum deposit of just 1 JPY represents one of the lowest barriers to entry in the forex industry, making the platform particularly attractive to new traders and those testing the waters with limited capital.

This approach aligns with the broker's customer-focused philosophy and demonstrates a commitment to market accessibility. However, the evaluation is somewhat limited by the lack of detailed information about specific account types and their respective features. Available sources did not provide comprehensive details about tiered account structures, special features for different account levels, or specific benefits that might differentiate various account categories.

The absence of information about Islamic accounts or other specialized account options also impacts the overall assessment. The account opening process details were not extensively covered in available materials, making it difficult to evaluate the efficiency and user-friendliness of the onboarding experience. Similarly, specific information about account maintenance fees, inactivity charges, or other account-related costs was not readily available, which could be important factors for potential clients.

User feedback regarding account conditions appears generally positive, particularly praising the low entry barrier. However, some users have noted the need for more transparency regarding account features and associated costs. When compared to industry standards, FXTF's minimum deposit requirement stands out as exceptionally competitive, though the lack of detailed account structure information prevents a more comprehensive comparison.

This fxtf review finds that while the basic account accessibility is excellent, more detailed information would enhance the overall evaluation.

FXTF provides a solid foundation of trading tools through its support for multiple platforms, including MetaTrader 4. MT4 is widely regarded as an industry standard. The availability of MT4 ensures that traders have access to comprehensive charting capabilities, technical indicators, and automated trading functionality through Expert Advisors (EAs).

The platform diversity, including proprietary solutions like FXTF GX, mobile applications, and web-based platforms, demonstrates the broker's commitment to meeting varied trader preferences and technical requirements. The multi-platform approach allows traders to choose environments that best suit their trading styles and technical proficiency levels. Mobile platform availability ensures that traders can maintain market access and manage positions while away from their primary trading stations, which is essential in today's fast-paced trading environment.

However, available sources did not provide specific details about educational resources, market research capabilities, or analytical tools beyond the basic platform offerings. The absence of information about economic calendars, market analysis reports, trading tutorials, or webinars represents a significant gap in the assessment. Modern traders often rely heavily on educational content and market insights to develop their skills and make informed trading decisions.

User feedback suggests that while the platform variety is appreciated, some traders desire more comprehensive educational resources and research materials. The lack of detailed information about signal services, copy trading options, or advanced analytical tools also limits the evaluation. Trading automation support through MT4 is a positive aspect, but specific details about the broker's approach to algorithmic trading and strategy development were not extensively covered in available materials.

Customer Service and Support Analysis (6/10)

Customer service represents one of FXTF's more challenging areas based on available user feedback and limited information about support infrastructure. User reviews indicate inconsistent experiences with response times and service quality, suggesting that the broker's support system may not consistently meet client expectations across all interactions.

The variability in user experiences regarding customer service quality raises concerns about the consistency and reliability of support operations. Some users report satisfactory interactions with knowledgeable representatives, while others describe delays in response times and difficulties in resolving issues effectively. This inconsistency can be particularly problematic for traders who require timely assistance during critical market conditions or when facing technical difficulties.

Available sources did not provide comprehensive details about support channels, operating hours, or the specific expertise levels of customer service representatives. Information about multilingual support capabilities was also not readily available, which could be important for the broker's international client base. The absence of detailed information about support ticket systems, live chat availability, or phone support options makes it difficult to assess the full scope of customer service infrastructure.

Response time expectations and service level agreements were not clearly outlined in available materials, making it challenging for potential clients to understand what level of support they can expect. User feedback suggests that while some issues are resolved satisfactorily, the overall experience lacks the consistency that traders typically expect from professional forex brokers.

The customer service evaluation is further complicated by the limited availability of specific case studies or examples of problem resolution processes. Without clear information about escalation procedures, complaint handling mechanisms, or customer satisfaction metrics, it's difficult to provide a comprehensive assessment of the support quality.

Trading Experience Analysis (7/10)

FXTF's trading experience benefits from platform diversity and reasonable leverage options. However, the evaluation is limited by insufficient data about execution quality and trading conditions. The availability of multiple platforms, including the industry-standard MetaTrader 4, provides traders with familiar and robust trading environments equipped with comprehensive charting tools and technical analysis capabilities.

The leverage ratio of 1:25 aligns with regulatory requirements while providing sufficient flexibility for various trading strategies. This level of leverage strikes a reasonable balance between trading opportunity and risk management, making it suitable for both conservative and more aggressive trading approaches. The platform variety ensures that traders can select environments that match their technical preferences and trading styles.

However, critical trading experience factors such as execution speed, slippage rates, and order fill quality were not detailed in available sources. These elements are fundamental to evaluating the actual trading experience, as they directly impact profitability and strategy effectiveness. The absence of specific information about spreads, commission structures, and overall trading costs also limits the assessment of value proposition.

User feedback regarding trading experience shows mixed results, with some traders reporting satisfactory platform performance while others note areas for improvement. The lack of specific performance metrics, such as average execution times or slippage statistics, makes it difficult to provide objective comparisons with industry benchmarks.

Mobile trading capabilities appear to be well-supported, which is essential for modern traders who require flexibility and market access across different devices. However, detailed information about mobile platform features, functionality limitations, or performance characteristics was not comprehensively available. This fxtf review finds that while the basic trading infrastructure appears sound, more detailed performance data would significantly enhance the evaluation.

Trust and Safety Analysis (8/10)

FXTF demonstrates strong performance in trust and safety measures. This is primarily through its regulation by Japan's Financial Services Agency (JFSA). This regulatory oversight provides significant protection for client funds and ensures adherence to strict operational standards.

The JFSA is recognized as a reputable regulatory authority with comprehensive oversight mechanisms, which adds substantial credibility to FXTF's operations. The implementation of fund segregation and negative balance protection represents important safety measures that protect client interests. Fund segregation ensures that client deposits are kept separate from the broker's operational funds, providing additional security in the unlikely event of business difficulties.

Negative balance protection prevents clients from losing more than their deposited funds, which is particularly valuable during periods of extreme market volatility. However, the evaluation is somewhat impacted by the presence of two negative exposure reports mentioned in available sources. While the specific nature and resolution status of these exposures were not detailed, their existence warrants attention from potential clients.

The broker's handling of these situations and any remedial measures taken would be important factors in assessing overall trustworthiness. Company transparency information was not extensively available in source materials, making it difficult to assess the broker's approach to disclosure and communication with clients. Details about company financial health, ownership structure, or third-party audits were not readily accessible, which could be important considerations for institutional clients or larger individual traders.

The regulatory framework provided by the JFSA includes investor compensation schemes and dispute resolution mechanisms, which add layers of protection for clients. However, specific details about compensation limits or claim procedures were not detailed in available sources. Industry reputation and peer recognition information was also limited, preventing a more comprehensive assessment of the broker's standing within the professional trading community.

User Experience Analysis (6/10)

User experience evaluation reveals mixed satisfaction levels among FXTF clients. Feedback indicates both positive aspects and areas requiring improvement. The overall user sentiment appears to be variable, suggesting that while some clients find the platform satisfactory, others experience challenges that impact their overall satisfaction with the broker's services.

The diversity of user experiences makes it difficult to establish consistent patterns of satisfaction or dissatisfaction. Some users appreciate the low entry barriers and platform variety, while others express concerns about service quality and responsiveness. This variability suggests that the broker's service delivery may not be consistently optimized across all client interactions and service touchpoints.

Available sources did not provide detailed information about interface design, user-friendliness, or the intuitiveness of the trading platforms. Modern traders increasingly value streamlined, efficient interfaces that facilitate quick decision-making and order execution. The absence of specific feedback about platform navigation, customization options, or learning curves for new users limits the assessment of overall user experience quality.

Registration and account verification processes were not comprehensively detailed in available materials, making it difficult to evaluate the efficiency and user-friendliness of the onboarding experience. Similarly, information about fund deposit and withdrawal experiences, including processing times and ease of use, was not readily available.

The presence of negative feedback alongside positive reviews suggests that user experience may be inconsistent across different service areas or client segments. Common user complaints were not specifically detailed in available sources, making it challenging to identify particular areas where improvements might be most beneficial. The broker would benefit from addressing consistency issues and enhancing overall service quality to improve user satisfaction ratings.

Conclusion

This fxtf review reveals a broker with notable strengths in accessibility and regulatory protection. These are balanced against areas requiring improvement in service consistency and user experience. FXTF's exceptionally low minimum deposit requirement of 1 JPY and strong regulatory oversight by Japan's Financial Services Agency create an attractive foundation for traders seeking secure, accessible forex trading opportunities.

The broker best serves individual traders looking for low-barrier market entry and institutional clients requiring regulated trading environments. The platform diversity and reasonable leverage options make it suitable for various trading styles and experience levels, while the fund protection measures provide important security reassurances.

However, the mixed user feedback regarding customer service quality and overall experience suggests that FXTF must focus on improving service consistency and client satisfaction. The presence of negative exposures, while not fully detailed, indicates the need for continued attention to operational excellence and client relations. Potential traders should weigh the attractive entry conditions against the reported service inconsistencies when considering FXTF for their trading needs.