Quantfury 2025 Review: Everything You Need to Know

Executive Summary

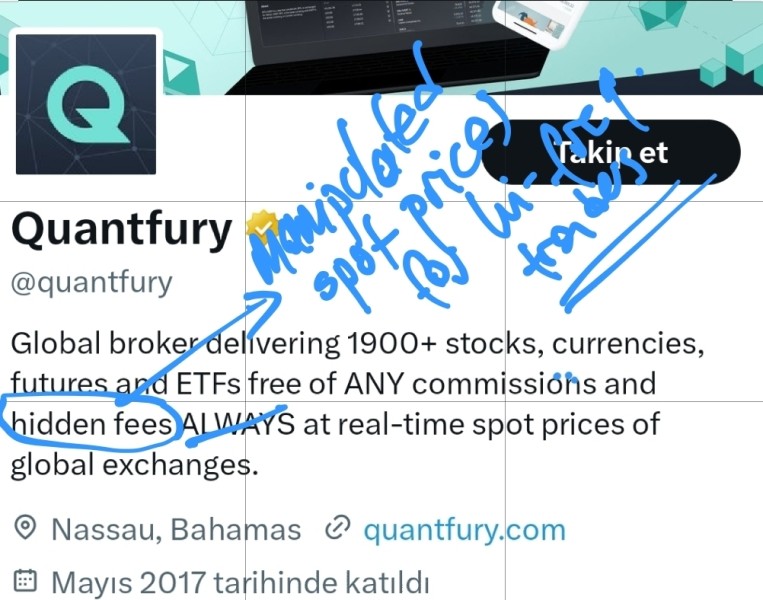

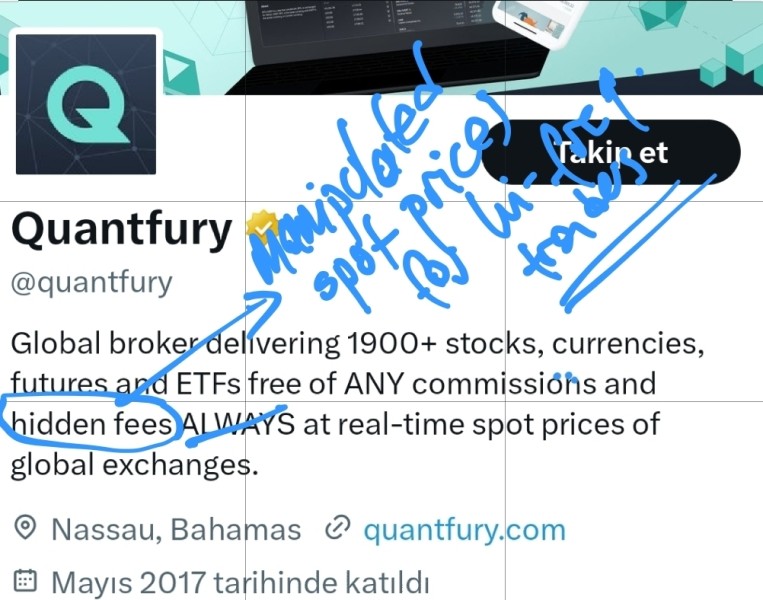

This comprehensive Quantfury review looks at a trading platform that calls itself a game-changer in retail trading. The company promises more fairness and transparency in financial markets, which sounds great to many traders. Quantfury works as a commission-free trading platform that offers real-time spot price trading across multiple types of assets. The platform stands out from traditional brokers through its unique business model that makes money through hedging operations rather than charging trading fees or making spreads wider.

The platform mainly serves retail investors who want diverse trading opportunities across stocks, cryptocurrencies, ETFs, futures, and currency pairs. However, user feedback shows mixed results, with some traders worried about the platform's offshore nature and service quality. According to various user reviews, Quantfury offers cool features like zero-commission trading and real-time pricing. Questions still exist about its regulatory oversight and how well customer support works.

Our analysis shows that Quantfury appeals most to traders interested in multi-asset portfolio diversification who want cost-effective trading solutions. The platform's promise to eliminate traditional brokerage fees represents a big change from industry norms. This innovative approach comes with certain trade-offs that potential users should think about carefully.

Important Notice

Due to Quantfury's limited disclosure of specific regulatory information in available materials, users across different regions may face varying legal frameworks and risk exposures when using the platform. The regulatory landscape for this broker looks complex. Traders should do thorough research about their local jurisdiction's requirements before opening accounts.

This review is based on available user feedback, platform documentation, and publicly accessible information about Quantfury's services. Given the changing nature of financial regulations and the platform's relative newness in the market, prospective users should verify current regulatory status and terms of service directly with the company before making investment decisions.

Rating Framework

Broker Overview

Quantfury appeared in the financial technology world in 2017 with a big mission to transform the retail trading industry through better fairness and transparency. The company sees itself as a disruptor in the traditional brokerage space. It challenges conventional fee structures and market access models that have ruled the industry for decades. Unlike traditional brokers who profit from spreads and commissions, Quantfury's business model focuses on making money through sophisticated hedging operations, which theoretically aligns the platform's interests more closely with those of its users.

The platform's basic philosophy revolves around giving traders direct access to real-time spot prices across multiple asset classes. This eliminates the markup typically associated with retail trading platforms. This approach represents a big departure from industry standards, where brokers traditionally profit from the difference between bid and ask prices or charge explicit commissions on trades.

Quantfury review data shows that the platform supports an impressive range of tradeable assets, including stocks, cryptocurrencies, ETFs, futures, and traditional currency pairs. This multi-asset approach serves modern traders' desire for portfolio diversification within a single platform environment. The proprietary Quantfury platform serves as the primary trading interface. However, detailed information about its technological infrastructure and performance metrics remains limited in publicly available documentation.

The company's regulatory status presents some confusion, as specific oversight authorities are not clearly detailed in available materials. This regulatory uncertainty has led to mixed user sentiment. Some traders express confidence in the platform's innovative approach while others voice concerns about transparency and accountability measures.

Regulatory Jurisdiction: Available documentation does not specify particular regulatory authorities overseeing Quantfury's operations. This creates uncertainty about compliance frameworks and investor protection measures across different jurisdictions.

Deposit and Withdrawal Methods: Specific information regarding funding options, processing times, and associated fees for deposits and withdrawals is not detailed in accessible platform materials.

Minimum Deposit Requirements: The platform has not disclosed explicit minimum deposit thresholds in available documentation. This makes it difficult for potential users to assess entry barriers.

Bonus and Promotional Offers: Current promotional structures, welcome bonuses, or loyalty programs are not specified in the materials reviewed for this Quantfury review.

Tradeable Assets: The platform supports a comprehensive range of financial instruments including equities, digital currencies, exchange-traded funds, futures contracts, and foreign exchange pairs. This provides traders with extensive diversification opportunities.

Cost Structure: Quantfury promotes a zero-commission trading model, though specific details about spreads, overnight fees, or other potential charges are not comprehensively outlined in available information.

Leverage Ratios: Specific leverage offerings across different asset classes are not detailed in the documentation reviewed. This leaves potential users without clear information about available margin trading options.

Platform Options: Trading activities are conducted through the proprietary Quantfury platform. However, technical specifications, supported devices, and feature comparisons with industry-standard platforms are not extensively documented.

Geographic Restrictions: Specific country limitations or regional access restrictions are not clearly outlined in available materials.

Customer Support Languages: The range of supported languages for customer service communications is not specified in reviewed documentation.

Detailed Rating Analysis

Account Conditions Analysis (Score: 5/10)

Quantfury's account structure presents several areas of concern that contribute to its average rating in this category. The platform's documentation lacks transparency regarding specific account types, their respective features, and associated requirements. This information gap makes it challenging for potential users to make informed decisions about which account tier might best suit their trading needs and financial circumstances.

The absence of clearly stated minimum deposit requirements creates uncertainty for traders attempting to assess the platform's accessibility. While some users appreciate this apparent flexibility, others express frustration with the lack of concrete financial parameters. Traditional brokers typically provide detailed account specifications, including minimum funding thresholds, maintenance requirements, and tier-based benefits. This makes Quantfury's approach notably different from industry standards.

Account opening procedures are not comprehensively detailed in available materials. This leaves questions about verification requirements, documentation needs, and approval timeframes. Some user feedback suggests that the onboarding process can be confusing due to limited guidance and unclear expectations. The platform does not appear to offer specialized account types such as Islamic accounts for traders requiring Sharia-compliant trading conditions.

This Quantfury review finds that the platform's account conditions represent a significant area for improvement, particularly in terms of transparency and user guidance. The lack of detailed information may deter users who prefer clear, upfront disclosure of terms and conditions before committing to a trading platform.

Quantfury demonstrates strength in its tool offerings, particularly through its multi-asset trading capabilities and real-time spot price access. The platform's ability to provide direct market pricing across diverse asset classes represents a significant technological achievement that many users find valuable. This real-time pricing mechanism allows traders to access institutional-level market rates. It potentially reduces the cost disadvantage typically faced by retail investors.

The platform supports trading across stocks, cryptocurrencies, ETFs, futures, and forex markets. This provides users with comprehensive portfolio diversification opportunities within a single interface. This multi-asset approach aligns with modern trading preferences, where investors increasingly seek exposure to various market sectors and alternative investments. User feedback generally acknowledges the platform's broad asset coverage as a key strength.

However, the platform appears to have limitations in research and analytical resources. Traditional market analysis tools, economic calendars, technical indicators, and educational materials are not extensively documented in available information. Many competing platforms provide comprehensive research departments, market commentary, and educational resources that help traders make informed decisions. These are areas where Quantfury's offerings remain unclear.

Automated trading support, API access, and third-party integration capabilities are not detailed in reviewed materials. This potentially limits the platform's appeal to algorithmic traders and institutional users. Despite these limitations, the core trading tools and real-time pricing access earn Quantfury a good rating in this category.

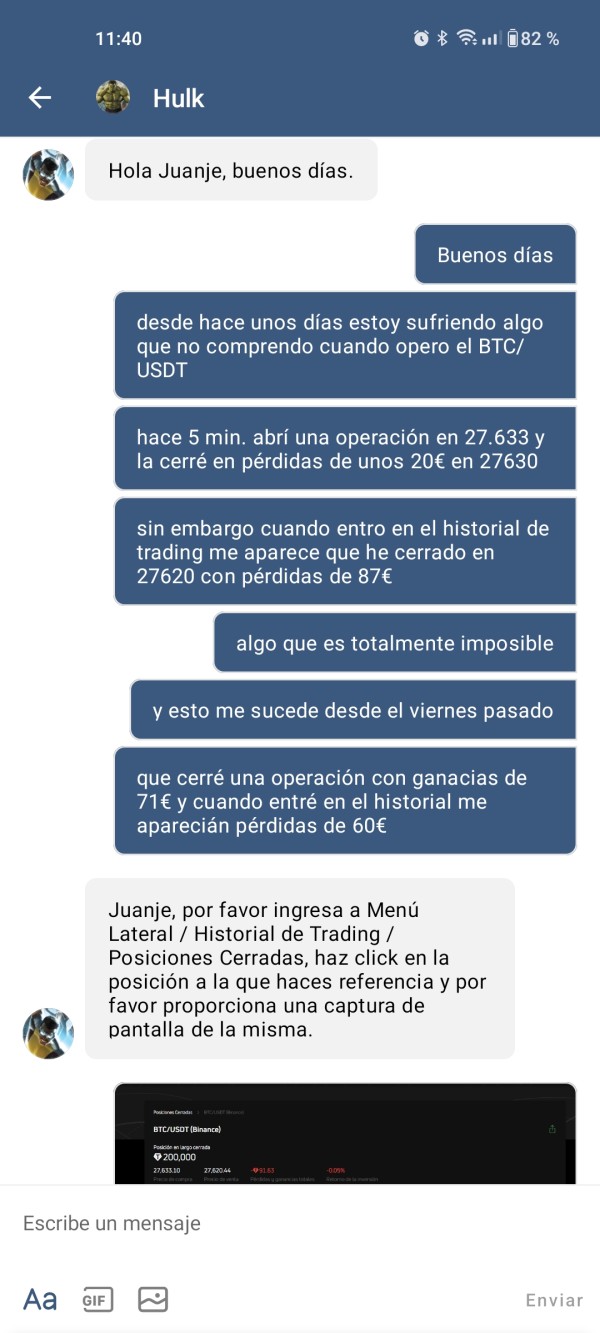

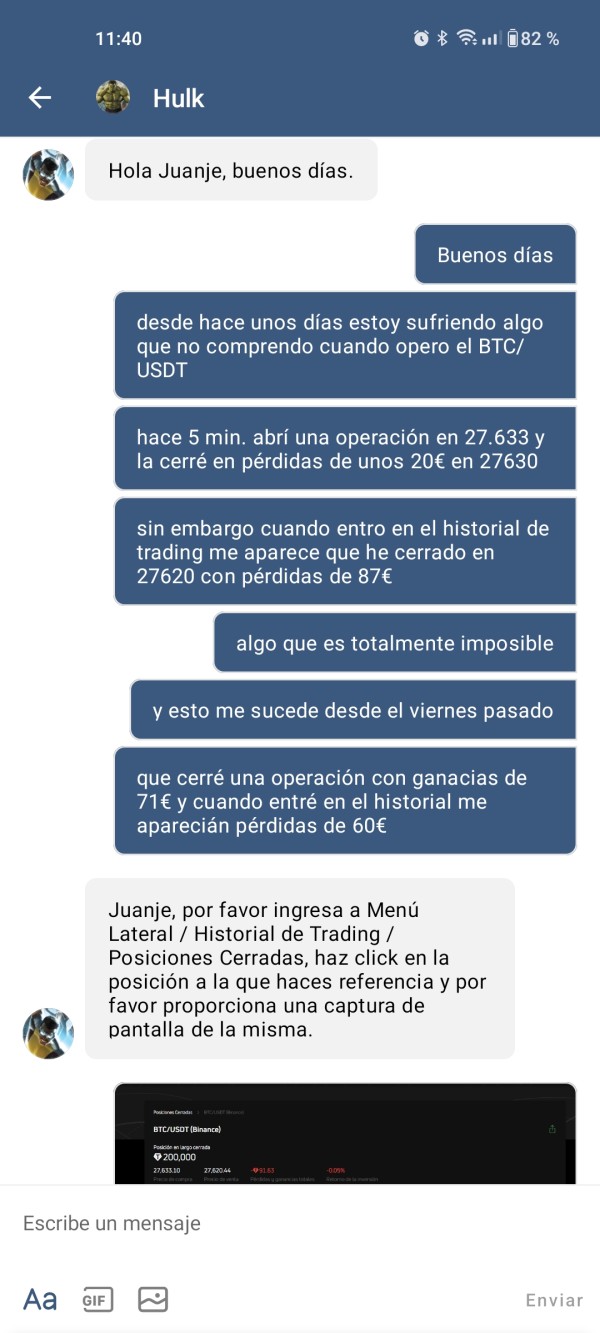

Customer Service and Support Analysis (Score: 4/10)

Customer service represents one of Quantfury's most significant challenges based on available user feedback and platform documentation. Multiple user reviews express concerns about the platform's support quality. Some characterize it as a "questionable offshore broker," indicating serious trust and communication issues that impact user satisfaction.

The platform's customer service channels, availability hours, and response time standards are not clearly outlined in available materials. This lack of transparency regarding support accessibility creates uncertainty for users who may need assistance with technical issues, account problems, or trading inquiries. Modern traders typically expect multiple contact methods, including live chat, email support, and telephone assistance, along with clearly defined service level agreements.

Language support capabilities remain unclear, which could pose significant barriers for international users seeking assistance in their native languages. Given the platform's global aspirations and multi-jurisdictional user base, comprehensive multilingual support would be expected. Yet this information is not readily available.

User feedback suggests inconsistent service quality, with some traders reporting difficulties in resolving account-related issues or obtaining timely responses to inquiries. The absence of detailed customer service policies, escalation procedures, and satisfaction guarantees contributes to user uncertainty about support reliability. These service concerns significantly impact the platform's overall trustworthiness and user confidence.

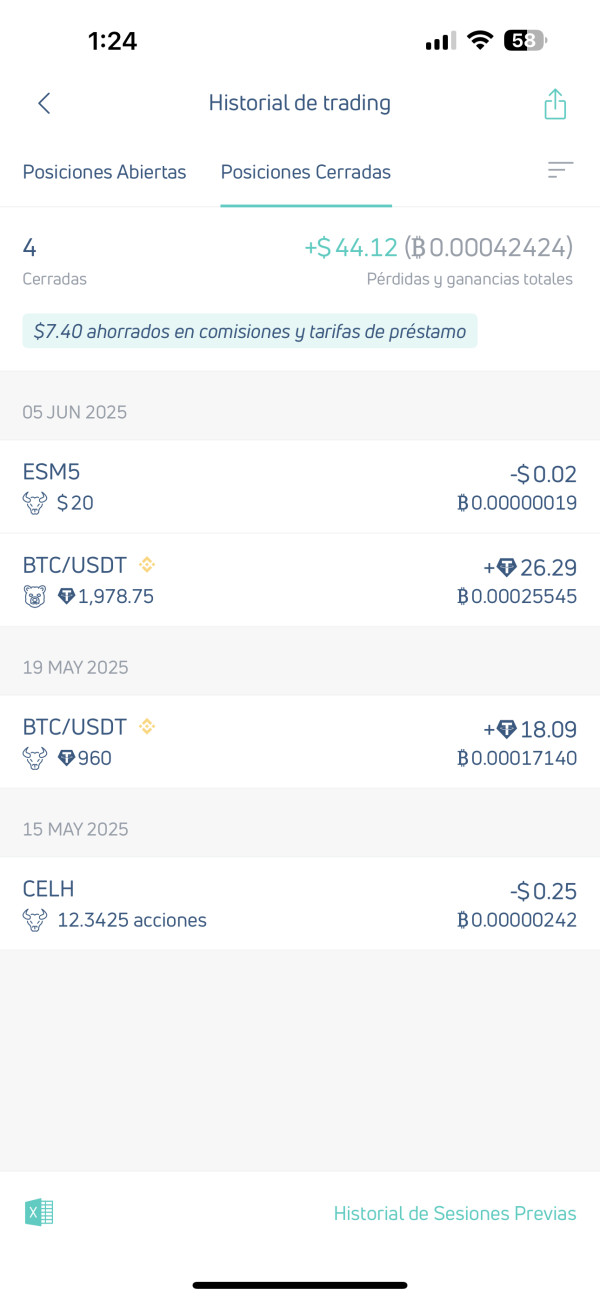

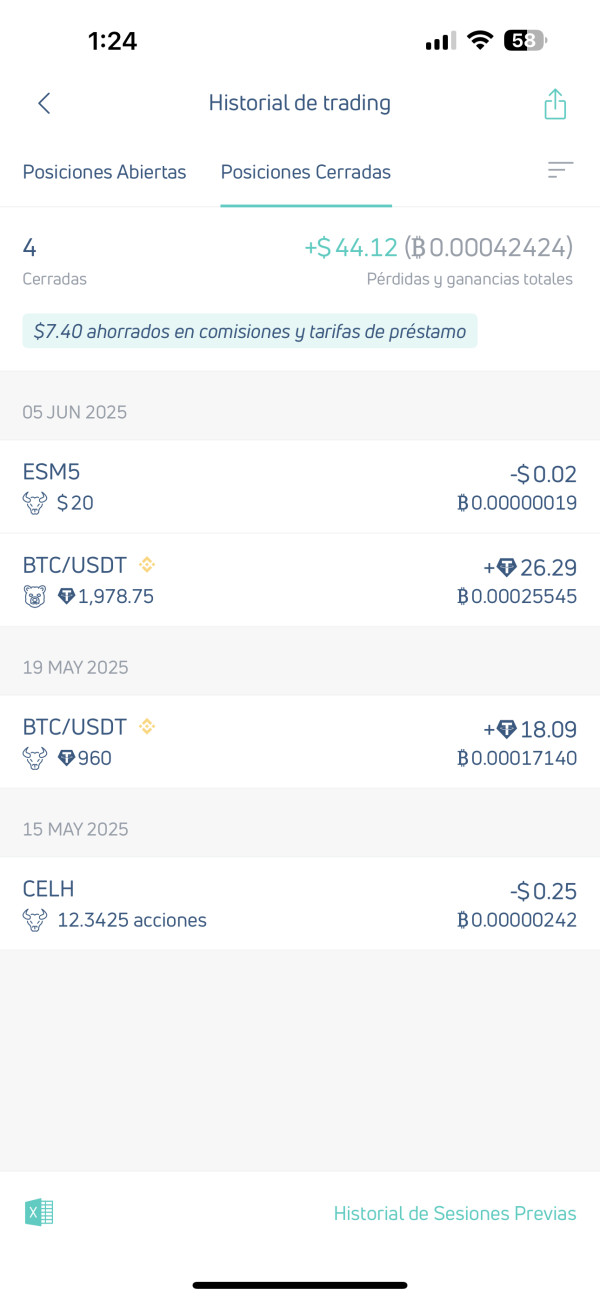

Trading Experience Analysis (Score: 6/10)

The trading experience on Quantfury presents a mixed picture, with innovative features balanced against concerns about platform stability and transparency. Users report varying experiences with the proprietary Quantfury platform. However, comprehensive performance data regarding execution speed, system uptime, and technical reliability is not publicly available.

The platform's real-time spot pricing mechanism represents its most distinctive feature. It potentially offers superior execution compared to traditional retail brokers who may apply markup to institutional prices. This direct market access approach could result in better fill prices and reduced trading costs. However, specific performance metrics and slippage statistics are not documented in available materials.

Order execution quality remains a question mark due to limited disclosure about liquidity providers, execution algorithms, and order routing procedures. Traditional brokers typically provide detailed execution quality reports and best execution policies. This information appears absent from Quantfury's public documentation. This transparency gap makes it difficult for users to assess whether they're receiving optimal trade execution.

Mobile trading capabilities and cross-platform synchronization are not extensively detailed, though the platform appears available on mobile devices based on app store listings. However, feature parity between desktop and mobile versions, offline capabilities, and user interface design quality are not comprehensively documented. This Quantfury review finds that while the platform offers innovative pricing mechanisms, the overall trading experience suffers from limited transparency about technical performance and execution quality.

Trust and Safety Analysis (Score: 3/10)

Trust and safety represent Quantfury's most concerning areas, primarily due to limited regulatory disclosure and user confidence issues. The platform's regulatory status remains unclear in available documentation. No specific oversight authorities or license numbers are prominently displayed. This regulatory ambiguity creates significant uncertainty about investor protection measures, dispute resolution procedures, and compliance standards.

Fund security measures, including client money segregation policies, deposit insurance coverage, and custodial arrangements, are not detailed in accessible materials. Traditional regulated brokers typically provide comprehensive information about how client funds are protected. This includes segregated account structures and regulatory compensation schemes. The absence of such disclosures raises questions about asset protection and recovery procedures in adverse scenarios.

Corporate transparency appears limited, with minimal information available about company financials, ownership structure, or operational audits. Public companies and regulated brokers typically provide regular financial reports, regulatory filings, and corporate governance information. This allows users to assess organizational stability and credibility.

User feedback includes references to the platform as a "questionable offshore broker," indicating significant trust concerns within the trading community. These reputation issues, combined with regulatory uncertainty, create substantial barriers to user confidence. The platform's innovative features cannot fully compensate for fundamental trust deficits that impact user willingness to deposit significant funds or maintain long-term trading relationships.

User Experience Analysis (Score: 5/10)

User experience on Quantfury reflects the platform's innovative ambitions alongside execution challenges that impact overall satisfaction. User feedback presents a polarized picture. Some traders appreciate the commission-free model and multi-asset access while others express frustration with service quality and transparency issues.

Interface design and usability details are not comprehensively documented in available materials. This makes it difficult to assess the platform's learning curve, navigation efficiency, and feature accessibility. Modern trading platforms typically emphasize user experience through intuitive design, customizable interfaces, and comprehensive help systems. These are areas where Quantfury's capabilities remain unclear.

Account registration and verification processes appear to create confusion for some users based on feedback indicating unclear requirements and expectations. Streamlined onboarding procedures have become industry standards. Leading platforms offer guided setup processes, clear documentation requirements, and predictable approval timeframes.

Funding and withdrawal experiences are not extensively documented, though user comments suggest some dissatisfaction with transaction procedures and transparency. Efficient money management represents a crucial aspect of user experience. This includes multiple payment options, reasonable processing times, and clear fee structures.

Common user complaints center on service quality, transparency concerns, and communication difficulties. These issues suggest that while Quantfury offers innovative features, the overall user experience suffers from execution problems that impact satisfaction and retention. The platform would benefit from enhanced customer communication, clearer policies, and improved support quality to better serve its user base.

Conclusion

Quantfury presents an intriguing proposition in the retail trading landscape through its commission-free model and multi-asset platform capabilities. The platform's innovative approach to eliminating traditional brokerage fees and providing real-time spot price access addresses genuine pain points in retail trading. However, significant concerns about regulatory transparency, customer service quality, and overall trustworthiness limit its appeal to risk-tolerant traders willing to navigate uncertainty for potential cost savings.

The platform best suits investors interested in diversified trading across multiple asset classes who prioritize cost efficiency over comprehensive support and regulatory clarity. While Quantfury's technological innovations and fee structure offer compelling advantages, the absence of clear regulatory oversight and mixed user feedback create substantial considerations for potential users seeking reliable, long-term trading relationships.