Regarding the legitimacy of FXCL forex brokers, it provides VFSC and WikiBit, .

Is FXCL safe?

Pros

Cons

Is FXCL markets regulated?

The regulatory license is the strongest proof.

VFSC Forex Trading License (EP)

Vanuatu Financial Services Commission

Vanuatu Financial Services Commission

Current Status:

RevokedLicense Type:

Forex Trading License (EP)

Licensed Entity:

FXCL Markets Ltd

Effective Date:

2017-03-30Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

Suite 305, Griffith Corporate Center, P.O. Box 1510, Beachmont, Kingstown, St. Vincent and the GrenadinesPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is FXCL A Scam?

Introduction

FXCL, or FX Clearing Ltd, is a forex broker that has been operating since 2006, primarily registered in Saint Vincent and the Grenadines. Its positioning in the forex market is as a provider of various trading instruments, including forex pairs, commodities, and cryptocurrencies, facilitated through the popular MetaTrader 4 (MT4) platform. Given the volatile nature of the forex market and the prevalence of scams, it is essential for traders to conduct thorough due diligence before engaging with any broker. This article aims to objectively evaluate whether FXCL is a trustworthy broker or if it raises red flags that suggest it may not be safe for trading. The assessment is based on a comprehensive review of FXCL's regulatory status, company background, trading conditions, customer experiences, and more.

Regulation and Legitimacy

The regulatory environment is a critical factor in assessing the safety and legitimacy of a forex broker. FXCL claims to be registered with the Financial Services Authority (FSA) of Saint Vincent and the Grenadines, but it lacks regulation from major financial authorities. The absence of stringent oversight raises concerns about the broker's practices and the safety of client funds.

| Regulatory Body | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| SVG FSA | N/A | Saint Vincent | Unregulated |

The lack of a robust regulatory framework means that FXCL is not subject to the same level of scrutiny as brokers regulated by reputable authorities such as the FCA, ASIC, or CySEC. This absence of oversight can lead to potential risks for traders, including the possibility of fund mismanagement and limited recourse in the event of disputes. Moreover, several reviews indicate that the SVG FSA does not regulate forex brokers, which further questions the legitimacy of FXCL's claims. The broker's registration in an offshore jurisdiction, known for lax regulations, adds another layer of concern regarding its operational integrity.

Company Background Investigation

FXCL Markets Ltd was established in 2006 and is primarily registered in Saint Vincent and the Grenadines. The company operates under the umbrella of FX Clearing Group Holding. However, the broker's history raises questions about its transparency and governance. Limited information is available regarding its ownership structure and management team, which is essential for assessing the broker's credibility.

The management teams background and professional experience are crucial in determining the broker's reliability. Unfortunately, FXCL does not provide substantial information about its leadership, which hinders potential clients' ability to evaluate the broker's expertise. Transparency is a critical component of trust in the financial services industry, and FXCL's lack of detailed disclosures about its management and operational practices may deter potential investors.

Trading Conditions Analysis

An analysis of FXCL's trading conditions reveals a mixed picture. The broker offers competitive spreads and high leverage, which can be attractive for traders. However, the overall fee structure and any unusual or problematic fees should be carefully examined.

| Fee Type | FXCL | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | From 0.1 pips | From 0.5 pips |

| Commission Model | Variable | Varies |

| Overnight Interest Range | Varies | Varies |

FXCLs spreads, particularly on its ECN accounts, claim to start from as low as 0.1 pips, which is competitive compared to industry averages. However, the broker also imposes commissions on certain accounts, which can vary based on the asset class. Additionally, some reviews highlight the presence of hidden fees or unfavorable trading conditions, which can significantly impact overall trading costs. The broker's fee structure, while initially appearing attractive, may not be as straightforward as it seems, warranting careful scrutiny by potential traders.

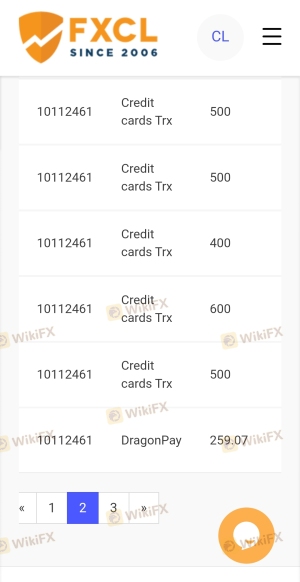

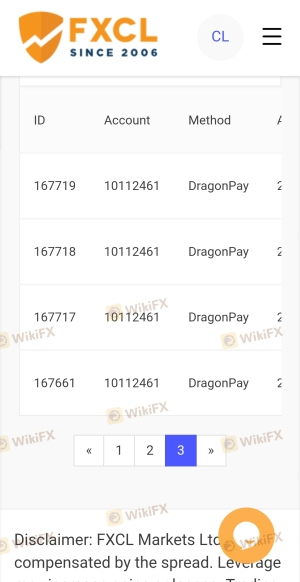

Client Fund Safety

The safety of client funds is paramount when evaluating a forex broker. FXCL claims to implement measures such as segregated accounts and negative balance protection, which are designed to safeguard client funds. However, the broker's lack of regulation raises concerns about the effectiveness of these measures.

FXCLs segregated accounts are intended to keep client funds separate from the broker's operational funds, theoretically providing a layer of protection. Additionally, negative balance protection ensures that traders cannot lose more than their initial investment, which is particularly beneficial for less experienced traders. Nevertheless, the absence of regulatory oversight means that there may be limited recourse or guarantees in place should issues arise.

Moreover, historical accounts of fund safety issues or disputes with clients have not been prominently documented, but the lack of regulatory backing raises questions about the broker's accountability. Traders should consider these factors carefully before committing their capital.

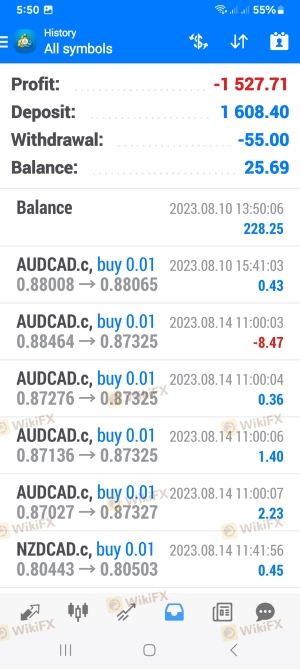

Customer Experience and Complaints

Customer feedback is a crucial element in assessing a broker's reliability. Reviews of FXCL indicate a mix of experiences, with some traders reporting positive interactions, while others have raised significant complaints regarding withdrawals and customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Poor Customer Support | Medium | Limited availability |

| Account Management Issues | High | Unresolved issues |

Common complaints include difficulties in withdrawing funds and unresponsive customer support. For instance, several traders have reported that their withdrawal requests were ignored or delayed, leading to frustration and distrust. The quality of customer support has also been criticized, with users noting long response times and limited availability, which can exacerbate issues when traders need immediate assistance.

One notable case involved a trader who faced significant delays in withdrawing funds, claiming that the broker continued to trade their remaining balance without consent, leading to losses. Such incidents raise serious concerns about the broker's operational integrity and responsiveness to client needs.

Platform and Trade Execution

The trading platform is another critical aspect of the trading experience. FXCL primarily utilizes the MetaTrader 4 (MT4) platform, which is known for its stability and user-friendly interface. However, the quality of order execution, including slippage and rejections, is essential for traders, especially in a fast-paced market.

Traders have reported varying experiences with FXCL's execution quality. While some users appreciate the platform's reliability, others have noted instances of slippage during high volatility periods, which can lead to unexpected losses. Additionally, concerns about potential platform manipulation have been raised, particularly given the broker's unregulated status. This lack of oversight can create an environment where unethical practices may go unchecked.

Risk Assessment

Using FXCL carries inherent risks, particularly due to its regulatory status and customer feedback. Understanding these risks is crucial for traders considering this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of regulation raises concerns about fund safety. |

| Withdrawal Risk | High | Reports of delayed or unprocessed withdrawals. |

| Execution Risk | Medium | Potential for slippage and rejected orders. |

To mitigate these risks, traders should approach FXCL with caution. It is advisable to start with a minimal investment and thoroughly test the platform before committing larger sums. Additionally, diversifying trading activities across multiple brokers can help reduce exposure to any single entity.

Conclusion and Recommendations

In conclusion, while FXCL presents itself as a forex broker with competitive trading conditions, the lack of robust regulatory oversight and numerous customer complaints raise significant concerns about its legitimacy and safety. The absence of a reputable regulatory body overseeing its operations is a major red flag, suggesting that traders should exercise extreme caution.

For those considering trading with FXCL, it is crucial to weigh the potential risks against the benefits. Traders may be better served by opting for well-regulated brokers with a proven track record of reliability. Alternatives such as brokers regulated by the FCA, ASIC, or CySEC can provide a more secure trading environment, ensuring that client funds are better protected and that there are clear avenues for recourse in the event of disputes.

Is FXCL a scam, or is it legit?

The latest exposure and evaluation content of FXCL brokers.

FXCL Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FXCL latest industry rating score is 2.24, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.24 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.