FXCL 2025 Review: Everything You Need to Know

Executive Summary

FXCL is an online forex and CFD broker established in 2006. The company is headquartered in Saint Vincent and the Grenadines with regulatory oversight provided by the VFSC. This fxcl review reveals a mid-tier broker with an overall trust score of 62, according to industry analysis. The platform stands out through competitive low spreads and high leverage ratios reaching up to 1:1000. This makes it accessible to traders across different experience levels with a minimal deposit requirement of just $1.

The broker mainly serves beginner and intermediate traders. It particularly targets those seeking high-leverage trading opportunities in forex and CFD markets. FXCL operates through the widely-used MetaTrader 4 platform, offering access to various financial instruments including forex pairs, commodities, and cryptocurrencies. While the low entry barrier and competitive trading conditions present attractive features, users should be aware of the limited educational resources and mixed customer feedback regarding platform reliability and trust factors.

Important Notice

FXCL operates as an offshore broker under VFSC regulation. This means clients in different regions may encounter varying regulatory environments and legal protections compared to brokers regulated by major financial authorities. Users should carefully consider their local regulatory framework and the implications of trading with an offshore entity.

This evaluation is based on comprehensive market feedback, industry analysis, and official information provided by FXCL. The assessment combines user experiences, regulatory data, and platform features to provide an objective overview of the broker's services and reliability.

Rating Framework

Broker Overview

FXCL Markets Ltd. was established in 2006 as an online forex and CFD broker. The company positions itself as a prime brokerage service provider in the competitive retail trading market. Based in Saint Vincent and the Grenadines, the company has maintained operations for nearly two decades, building its reputation through accessible trading conditions and competitive spreads. The broker operates under a business model designed to accommodate traders with varying experience levels.

This includes newcomers seeking low-barrier entry and experienced traders requiring advanced leverage options. The platform primarily uses the MetaTrader 4 (MT4) trading environment, one of the industry's most recognized and widely-adopted trading platforms. FXCL's asset portfolio includes multiple financial instruments such as major and minor forex pairs, contracts for difference (CFDs), commodities such as gold and oil, and cryptocurrency trading options. The company operates under the regulatory oversight of the VFSC (Financial Services Commission of Saint Vincent and the Grenadines) with license number 1637.

Regulatory Jurisdiction: FXCL operates under VFSC regulation with license number 1637. This provides oversight within the Saint Vincent and the Grenadines regulatory framework.

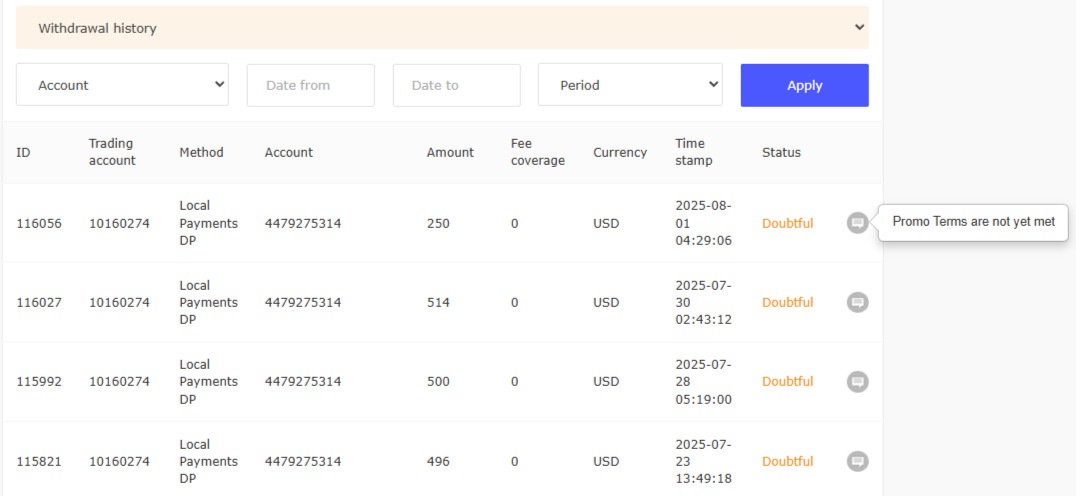

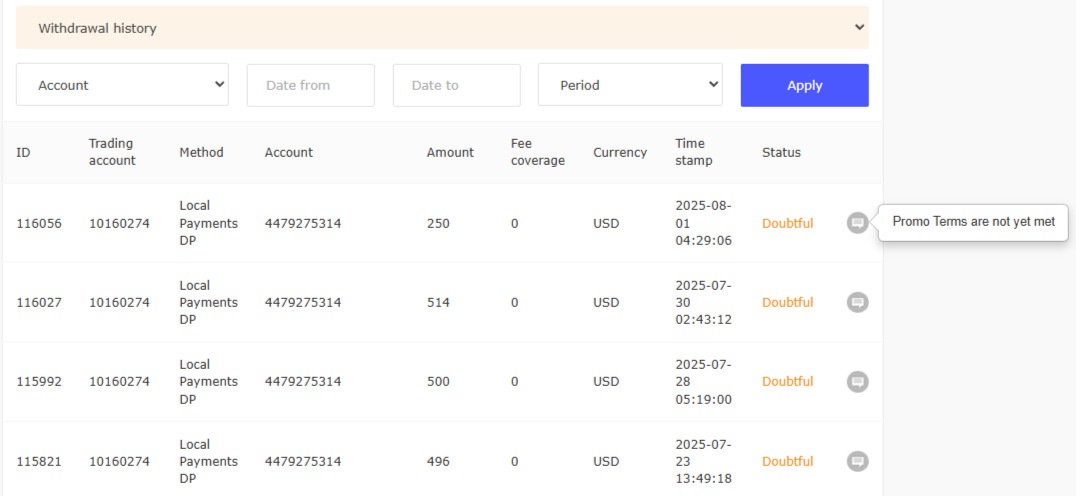

Deposit and Withdrawal Methods: Specific information regarding available deposit and withdrawal methods was not detailed in available materials.

Minimum Deposit Requirements: The broker maintains an exceptionally low minimum deposit requirement of $1. This makes it accessible to traders with limited initial capital.

Bonus and Promotional Offers: Details regarding specific bonus programs and promotional offers were not specified in available documentation.

Tradeable Assets: The platform provides access to forex currency pairs, CFDs on various underlying assets, commodity trading including precious metals and energy products, and cryptocurrency trading opportunities.

Cost Structure: According to available information, FXCL offers competitive low spreads. However, specific commission structures were not detailed in the source materials.

Leverage Ratios: The broker offers high leverage ratios up to 1:1000. This provides significant amplification potential for trading positions.

Platform Options: FXCL primarily operates through the MetaTrader 4 (MT4) platform. It offers comprehensive charting tools and automated trading capabilities.

Geographic Restrictions: Information regarding specific geographic restrictions was not available in the provided materials.

Customer Support Languages: Specific details about supported languages for customer service were not mentioned in available sources.

This comprehensive fxcl review section highlights the key operational aspects while noting areas where additional information may be beneficial for potential clients.

Account Conditions Analysis

FXCL shows strong performance in account conditions, earning an 8/10 rating based on its accessible entry requirements and flexible account structures. The broker's standout feature is its remarkably low minimum deposit requirement of just $1, which significantly lowers the barrier to entry for new traders and those with limited initial capital. This approach aligns with the broker's strategy to attract beginner and intermediate traders who may be hesitant to commit substantial funds when starting their trading journey.

The account opening process appears streamlined based on user feedback. Traders report relatively straightforward registration procedures. FXCL offers multiple account options designed to accommodate different trading styles and experience levels, though specific details about account tiers and their respective features were not extensively detailed in available materials. User feedback generally indicates satisfaction with the account conditions, particularly praising the low entry threshold and reasonable trading requirements.

However, the evaluation notes that while the basic account conditions are competitive, some advanced account features and specialized account types (such as Islamic accounts for Sharia-compliant trading) were not clearly documented in available sources. This fxcl review finds that while the fundamental account conditions are strong, traders seeking specialized account features may need to contact the broker directly for detailed information about advanced account options and their specific terms and conditions.

FXCL receives a 6/10 rating for tools and resources, reflecting a mixed performance in this critical area. The broker's primary strength lies in providing access to the MetaTrader 4 platform, which offers a comprehensive suite of trading tools including advanced charting capabilities, technical indicators, and automated trading support through Expert Advisors (EAs). The MT4 platform's user-friendly interface and robust functionality provide traders with essential tools for market analysis and trade execution.

However, the evaluation reveals significant limitations in educational resources and research materials. User feedback consistently points to insufficient educational content, which represents a notable gap for a broker targeting beginner and intermediate traders. The lack of comprehensive learning materials, market analysis reports, and educational webinars limits the platform's value proposition for traders seeking to develop their skills and market knowledge.

The broker's research and analysis resources appear limited based on available information. There is no detailed mention of daily market reports, economic calendars, or professional market commentary. While the MT4 platform provides basic analytical tools, the absence of proprietary research content or third-party analysis integration reduces the overall value of the tools and resources offering. This gap in educational and research support represents a key area where FXCL could enhance its service quality to better serve its target market of developing traders.

Customer Service and Support Analysis

Customer service and support receives a 7/10 rating, indicating generally positive user experiences with some areas for improvement. According to user feedback, FXCL provides reasonable customer support with particular strength in trading guidance and mentor support. Traders have reported positive experiences with the broker's trading mentors, suggesting that the company invests in providing personalized guidance to help clients improve their trading performance.

The responsiveness of customer service appears adequate based on user reports. Response times for general inquiries and support requests are reasonable. The professional quality of support staff receives generally positive feedback, indicating that representatives possess sufficient knowledge to address common trading questions and technical issues. However, the evaluation notes that overall customer service infrastructure may not be as comprehensive as some larger, more established brokers in the market.

Areas for improvement include expanding support channels and potentially extending service hours to accommodate traders across different time zones. While the available support appears functional, some users have indicated that more comprehensive support options would enhance their overall experience. The customer service evaluation suggests that while FXCL provides adequate support for basic needs, traders requiring extensive hand-holding or complex technical assistance might find the current support level insufficient for their requirements.

Trading Experience Analysis

The trading experience receives a 7/10 rating, reflecting generally positive user feedback with some notable considerations. Users report good overall platform stability when using the MetaTrader 4 environment. The familiar interface provides a comfortable trading experience for both new and experienced traders. The platform's execution speed appears satisfactory for most trading styles, though some users have reported occasional slippage issues during high-volatility market conditions.

FXCL's trading environment benefits from the robust functionality of the MT4 platform, including comprehensive charting tools, multiple timeframes, and support for automated trading strategies. The broker's competitive spread offerings contribute positively to the overall trading experience, with users noting stable pricing conditions under normal market circumstances. The high leverage availability up to 1:1000 provides flexibility for traders seeking amplified market exposure, though this feature requires careful risk management.

However, this fxcl review notes that some users have expressed concerns about certain aspects of the trading environment, including occasional technical issues and questions about trade execution during volatile market periods. While the majority of user feedback is positive, the presence of some negative experiences suggests that trading conditions may vary depending on market circumstances and individual trading patterns. The overall trading experience is solid but may benefit from continued improvements in execution consistency and platform stability.

Trust and Reliability Analysis

Trust and reliability receives a 6/10 rating, reflecting the mixed reputation and regulatory considerations associated with FXCL. The broker operates under VFSC regulation with license number 1637, providing a basic regulatory framework. However, this offshore jurisdiction offers less comprehensive protection compared to major financial centers like the UK, EU, or Australia. The moderate trust score of 62 from industry analysis indicates average confidence levels among users and industry observers.

The regulatory status presents both advantages and limitations. While VFSC regulation provides legal oversight and operational standards, it may not offer the same level of investor protection or compensation schemes available through tier-one regulators. This regulatory positioning is typical for offshore brokers and may influence trader confidence, particularly among those prioritizing maximum regulatory protection.

User feedback regarding trust and reliability shows mixed results. Some traders express satisfaction with their experiences while others have raised concerns. Some negative reports exist regarding platform reliability and business practices, though these appear to be minority opinions rather than widespread issues. The company's longevity since 2006 provides some credibility, demonstrating sustained operations over nearly two decades. However, the overall trust assessment suggests that potential clients should carefully evaluate their comfort level with offshore regulation and conduct thorough due diligence before committing significant funds to the platform.

User Experience Analysis

User experience receives a 7/10 rating, indicating generally satisfactory interactions with some areas for enhancement. The overall user satisfaction appears positive among active traders, with many appreciating the straightforward account opening process and user-friendly MT4 platform interface. The low minimum deposit requirement particularly resonates well with new traders who value the ability to start with minimal financial commitment.

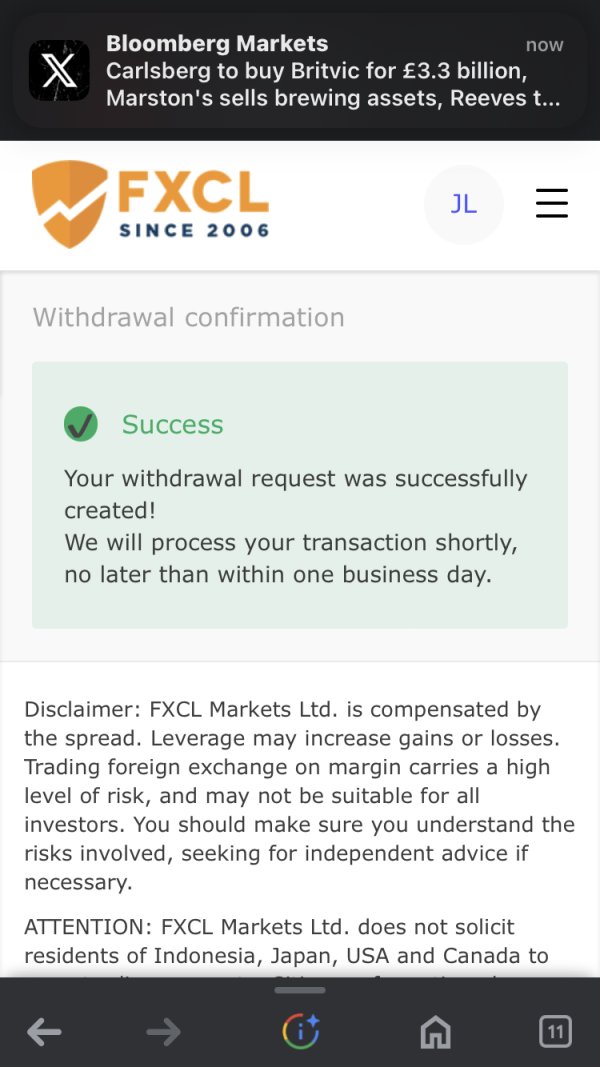

The platform's interface design benefits from the established MT4 framework, providing familiar navigation and functionality for traders experienced with this industry-standard platform. Registration and account verification processes appear streamlined based on user reports. Most traders can complete setup procedures without significant complications. The deposit process, while limited in detailed information about methods, appears functional for basic funding requirements.

Common user complaints center primarily around the limited educational resources and occasional platform performance issues. Some traders have expressed frustration with the lack of comprehensive learning materials, which impacts the experience for those seeking to develop their trading skills. Additionally, while most users report satisfactory experiences, some have encountered technical difficulties or customer service limitations that detracted from their overall platform experience. The user experience evaluation suggests that while FXCL provides a functional trading environment, enhanced educational support and continued platform optimization could significantly improve overall user satisfaction.

Conclusion

This comprehensive fxcl review reveals a broker that serves as a viable option for beginner and intermediate traders seeking accessible entry into forex and CFD markets. FXCL's primary strengths include its exceptionally low $1 minimum deposit requirement, competitive leverage ratios up to 1:1000, and the reliable MetaTrader 4 platform environment. These features make it particularly suitable for traders who prioritize low barriers to entry and high leverage trading opportunities.

However, the evaluation identifies several areas requiring consideration, including limited educational resources, mixed trust indicators, and the regulatory implications of offshore jurisdiction. While FXCL demonstrates adequate performance across most operational areas, traders should carefully evaluate whether the platform's current service level aligns with their specific trading needs and risk tolerance, particularly regarding regulatory protection and educational support requirements.