Is FPM safe?

Pros

Cons

Is FPM Safe or a Scam?

Introduction

FPM, also known as Forex Price Markets, positions itself as an online trading platform for forex and CFDs, attracting traders with its promises of high leverage and a wide range of trading instruments. However, as with any financial service, it is crucial for traders to carefully evaluate the credibility and safety of such brokers before committing their funds. The foreign exchange market is rife with both legitimate opportunities and potential scams, making due diligence an essential part of the trading process. This article aims to scrutinize FPM's legitimacy, focusing on its regulatory status, company background, trading conditions, customer fund safety, and user experiences. The analysis is based on a thorough review of multiple sources, including regulatory databases, user reviews, and expert assessments.

Regulation and Legitimacy

The regulatory framework surrounding a broker is a key indicator of its reliability. FPM claims to be regulated by the International Financial Services Commission (IFSC) in Belize. However, the effectiveness and reputation of the IFSC as a regulatory body have been questioned in various reviews. Below is a summary of FPM's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| IFSC | IFSC/60/487/TS/19 | Belize | Regulated |

The quality of regulation plays a pivotal role in safeguarding traders' interests. While the IFSC does provide a regulatory framework, it is often viewed as less stringent compared to top-tier regulators such as the UK's FCA or Australia's ASIC. This raises concerns about the level of investor protection offered by FPM. Additionally, the lack of transparency regarding FPM's compliance history further complicates the evaluation of its legitimacy. Past incidents involving unregulated brokers in Belize suggest that traders may be exposed to higher risks when dealing with such entities. Therefore, it is prudent to approach FPM with caution, as the question remains: Is FPM safe?

Company Background Investigation

FPM was established in 2019 and operates under the ownership of Forex Price Markets Ltd, with its headquarters located in Belize. The companys relatively short history raises questions about its experience and stability in the competitive forex market. The management team behind FPM is not prominently disclosed, which is a significant red flag for potential investors. Transparency regarding the leadership and their qualifications is essential for assessing the credibility of a trading platform.

The lack of comprehensive information about the management team and their professional backgrounds can be disconcerting for traders. A broker should ideally provide details about its executives and their experience in the financial industry to foster trust among its clients. Furthermore, the absence of a verifiable track record may lead to skepticism regarding the companys operational integrity.

In summary, while FPM presents itself as a forex trading platform, the limited information available about its history and management raises concerns about its reliability. This lack of transparency contributes to the ongoing question of whether FPM is safe for traders.

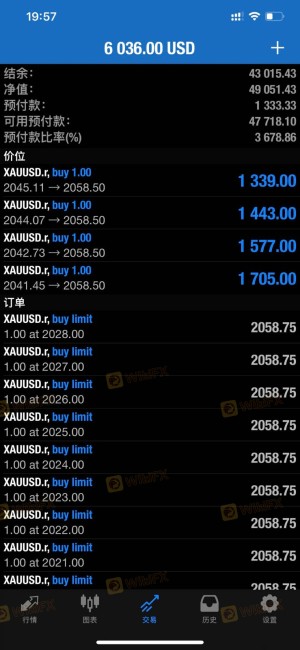

Trading Conditions Analysis

FPM offers a variety of trading conditions, including a minimum deposit of $100 and leverage up to 1:500, which can be appealing to many traders. However, it is essential to analyze the overall cost structure and any hidden fees that may affect profitability. Below is a comparison of core trading costs associated with FPM:

| Fee Type | FPM | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.8 pips | 1.2 pips |

| Commission Model | Variable | $3 per lot |

| Overnight Interest Range | Varies | Varies |

While the leverage offered by FPM is competitive, it is crucial to note that high leverage can magnify both profits and losses. The spreads, particularly for major currency pairs, appear to be higher than the industry average, which could eat into traders' profits. Additionally, the commission structure is not clearly defined, leading to potential confusion for traders regarding their overall trading costs.

The overall trading conditions at FPM may not be as favorable as they initially appear, and traders should exercise caution. High spreads and unclear commission structures could indicate a less trader-friendly environment, prompting the question: Is FPM safe?

Customer Fund Safety

Customer fund safety is a vital consideration for any trader. FPM claims to implement various measures to protect client funds, such as segregating client accounts from operational funds. However, the effectiveness of these measures is contingent on the regulatory framework under which the broker operates. The IFSC does not offer the same level of investor protection as more reputable regulators, which raises concerns about the safety of funds deposited with FPM.

Moreover, FPM does not provide negative balance protection, meaning that traders could potentially lose more than their initial investment. This lack of a safety net is particularly concerning for inexperienced traders who may not fully understand the risks associated with leveraged trading. Historical incidents involving offshore brokers have demonstrated that inadequate regulatory oversight can lead to fund mismanagement and loss.

In conclusion, while FPM asserts that it takes steps to ensure fund safety, the lack of robust regulatory protection and the absence of negative balance protection raise significant concerns. Therefore, it is crucial for traders to consider these factors when evaluating whether FPM is safe for their investments.

Customer Experience and Complaints

Analyzing customer feedback is essential for assessing a broker's reliability. Many reviews of FPM indicate a range of user experiences, with several traders expressing dissatisfaction with the platform. Common complaints include difficulties in withdrawing funds, high spreads, and a lack of responsive customer support. Below is a summary of the primary complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| High Spreads | Medium | Limited explanation |

| Customer Support | High | Inconsistent |

One notable case involved a trader who reported being unable to access their funds after multiple withdrawal requests, leading to frustration and concern over the broker's reliability. Such incidents highlight the importance of evaluating a broker's customer service and responsiveness, as these factors can significantly impact a trader's experience.

Overall, the feedback from users raises serious questions about the operational integrity of FPM. The recurring issues with withdrawals and customer support further complicate the assessment of whether FPM is safe for traders.

Platform and Execution

The trading platform is a critical component of the trading experience, influencing order execution quality and user satisfaction. FPM utilizes the widely recognized MetaTrader 4 platform, which offers a range of features for traders. However, reviews indicate mixed experiences regarding platform stability and execution speed.

Many users have reported instances of slippage and order rejections, which can adversely affect trading outcomes. These issues may suggest potential problems with liquidity or execution practices, raising further concerns about the platform's reliability. Any signs of manipulation or poor execution quality can significantly impact traders' trust in the broker.

In summary, while FPM provides access to a popular trading platform, the reported issues with execution quality and stability pose risks for traders. This leads to the ongoing question of whether FPM is safe for trading activities.

Risk Assessment

Using FPM as a trading platform carries several inherent risks that traders should be aware of. Below is a risk assessment summary:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Weak regulation may lead to inadequate protection. |

| Fund Safety Risk | High | Lack of negative balance protection increases risk. |

| Execution Risk | Medium | Reports of slippage and rejected orders. |

| Customer Support Risk | High | Poor responsiveness can lead to unresolved issues. |

To mitigate these risks, traders should consider diversifying their investments and using risk management strategies, such as setting stop-loss orders. Additionally, it is advisable to start with a demo account to familiarize oneself with the platform before committing significant funds.

In conclusion, while FPM may offer some attractive features, the associated risks cannot be overlooked. Traders must weigh these factors carefully when evaluating whether FPM is safe for their trading endeavors.

Conclusion and Recommendations

In summary, the investigation into FPM reveals several concerning aspects regarding its legitimacy and safety. The weak regulatory framework, combined with customer complaints about fund withdrawals and execution quality, raises significant red flags. While FPM may appeal to traders seeking high leverage and diverse trading options, the risks involved suggest that caution is warranted.

For traders considering FPM, it is essential to conduct thorough research and consider alternative brokers with more robust regulatory oversight and proven track records. Reputable options may include brokers regulated by top-tier authorities such as the FCA or ASIC, which offer better protection for traders' funds and a more transparent trading environment.

Ultimately, the question remains: Is FPM safe? Based on the evidence presented, it is advisable for traders to approach FPM with caution and consider more reputable alternatives for their trading activities.

Is FPM a scam, or is it legit?

The latest exposure and evaluation content of FPM brokers.

FPM Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FPM latest industry rating score is 1.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.