FPM Review 1

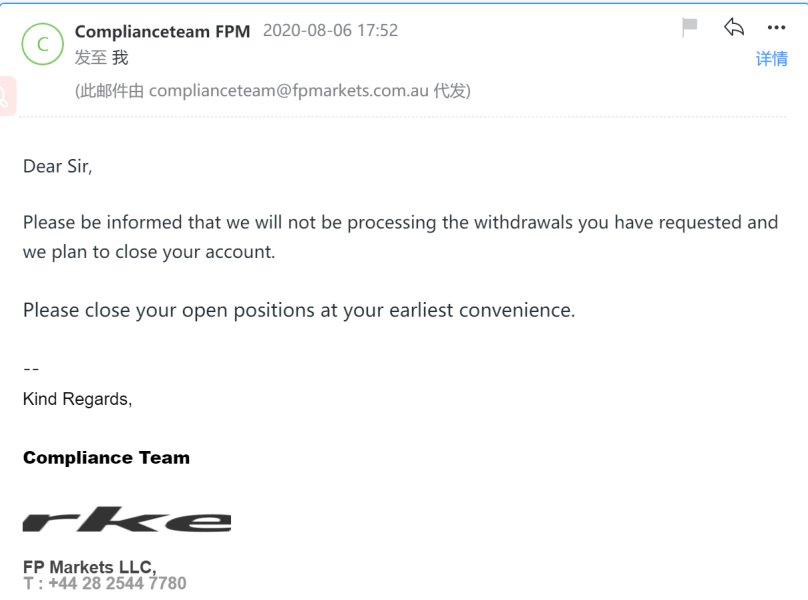

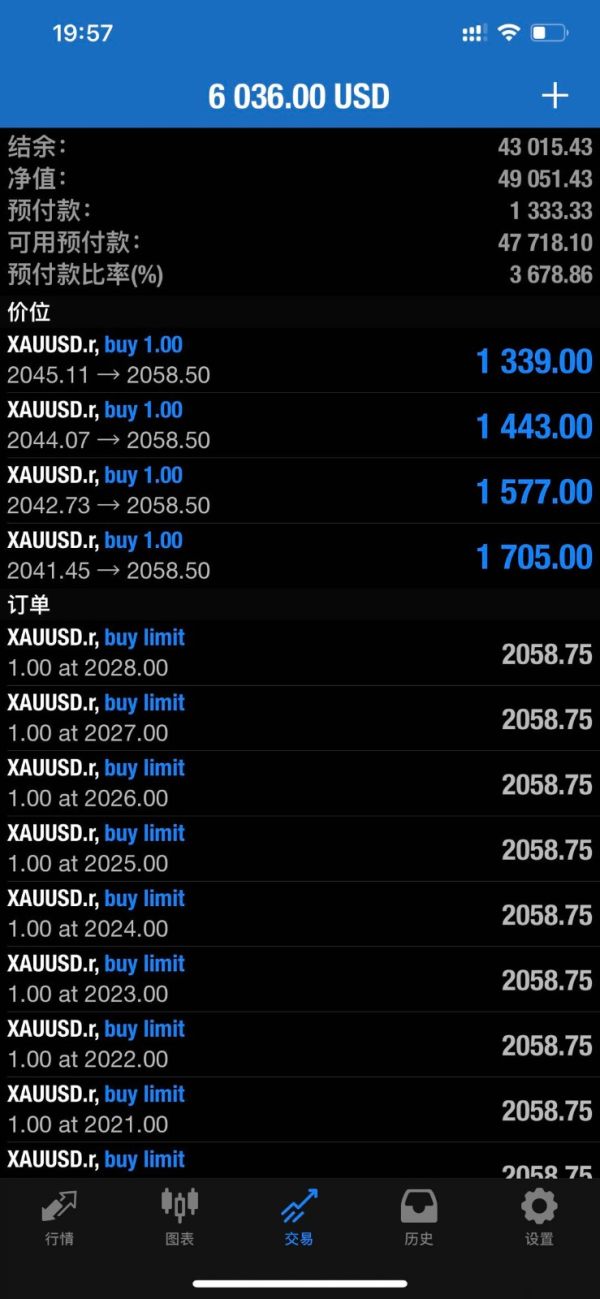

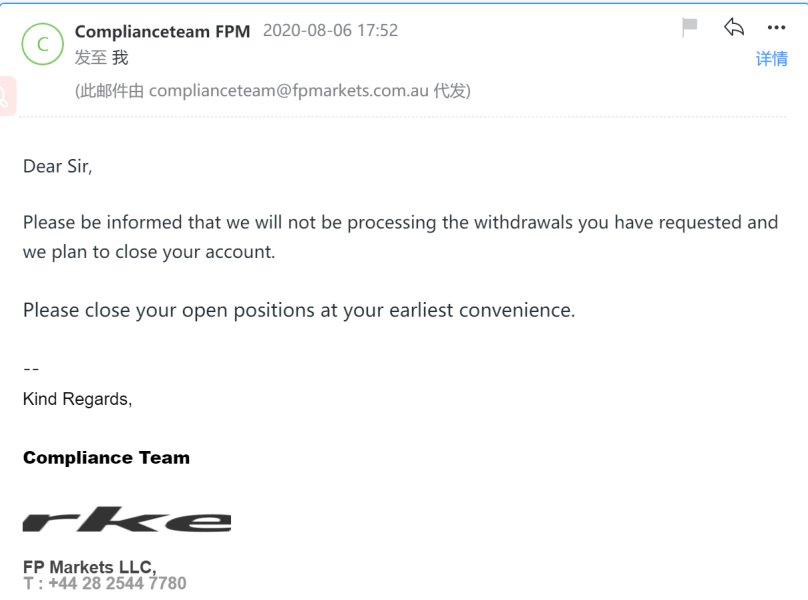

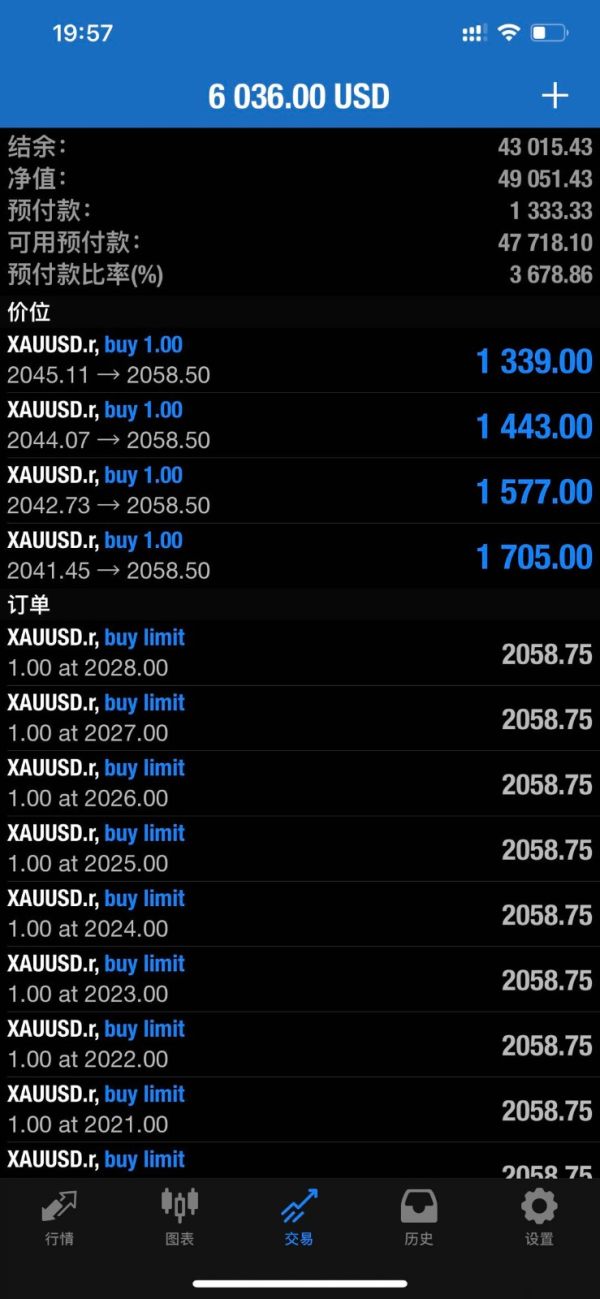

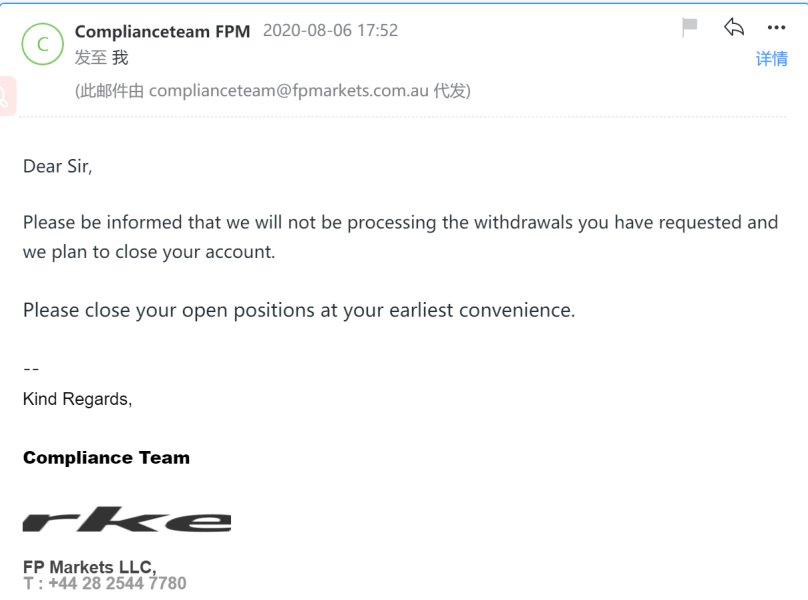

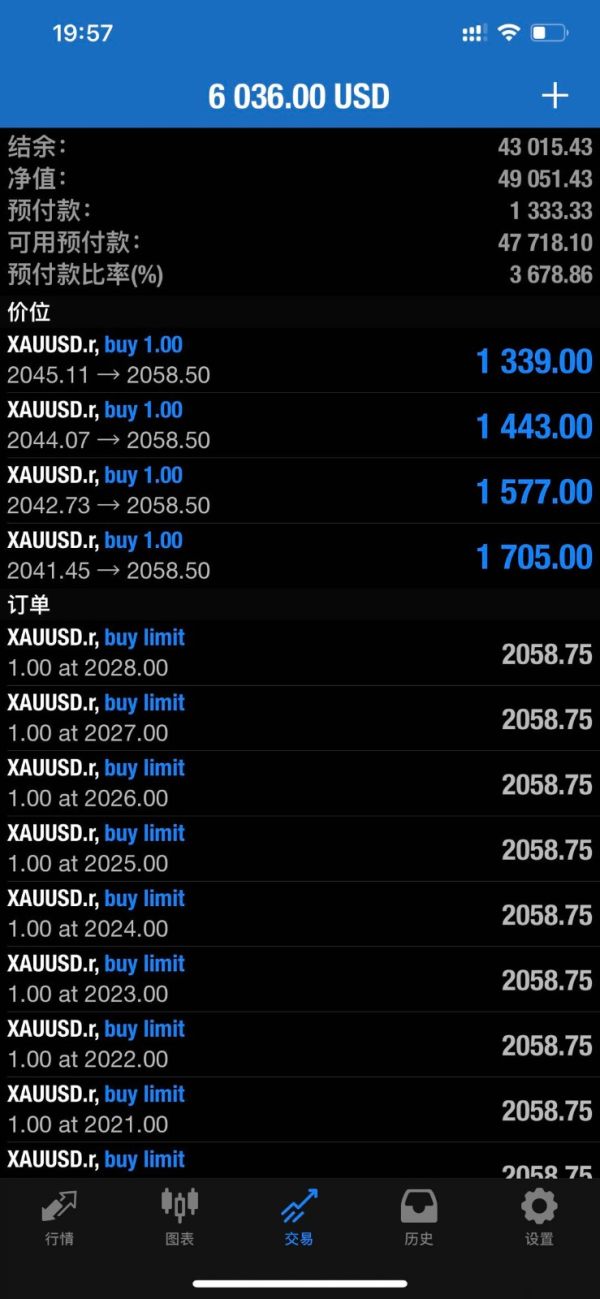

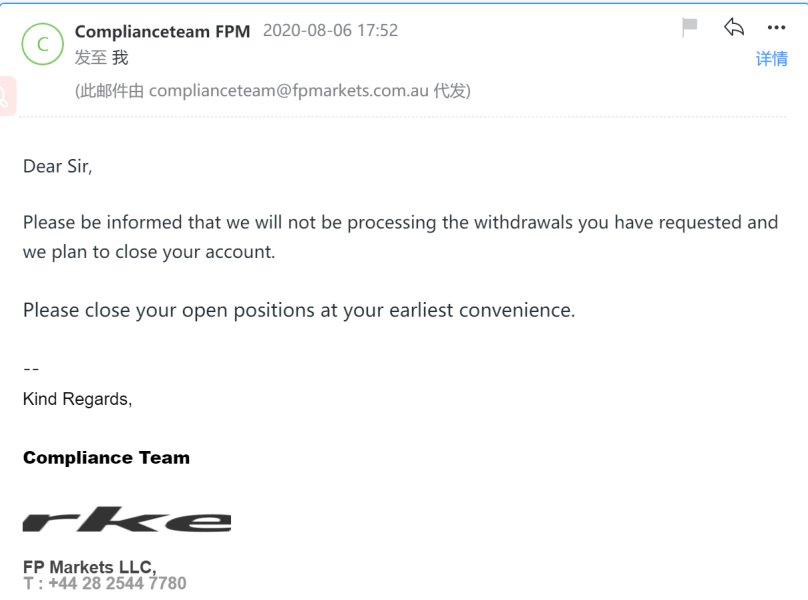

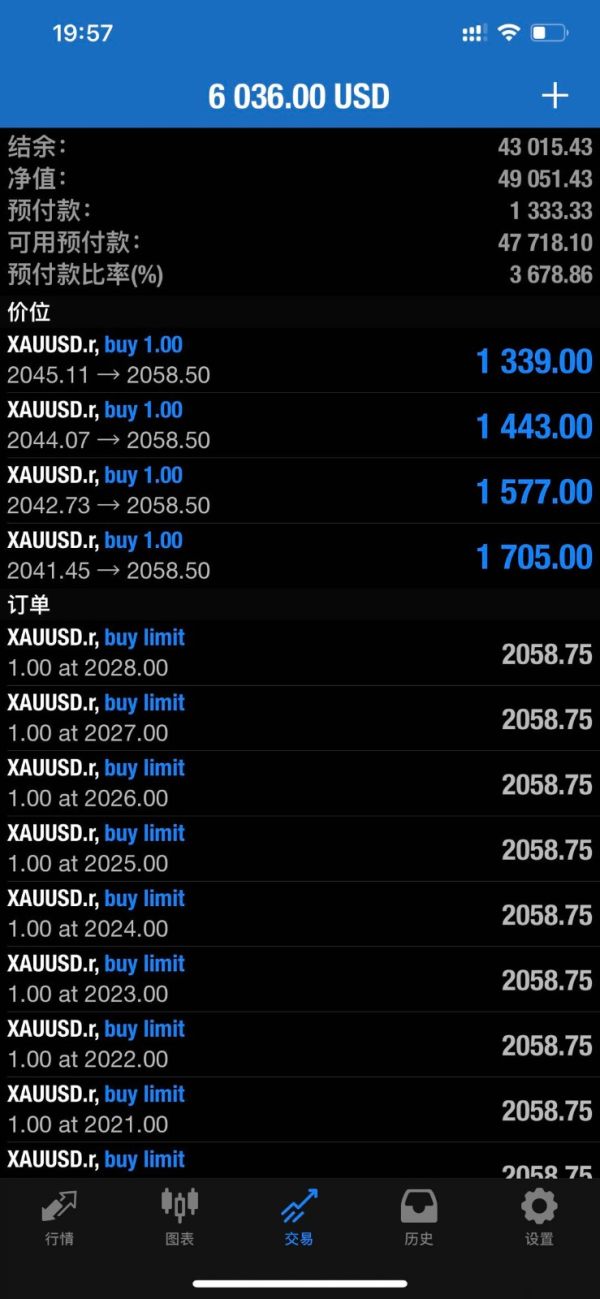

FPM gave no access to fund and profit. I should profited hundreds of thousands of money on XAU/USD.

FPM Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

FPM gave no access to fund and profit. I should profited hundreds of thousands of money on XAU/USD.

FPM started in 2019. It is an online forex and CFD broker based in Belize that offers trading services across multiple financial instruments. This fpm review shows a mixed picture of a broker that provides certain trading advantages but faces big challenges in user satisfaction and overall service quality.

The broker works under the regulation of the Belize International Financial Services Commission and offers access to 39 different trading instruments across various asset classes including forex, stock CFDs, indices, commodities, and cryptocurrencies. FPM uses the MetaTrader 4 platform. It provides leverage of up to 1:500, making it potentially attractive to traders seeking high leverage opportunities.

However, our analysis shows that FPM gets mostly negative user reviews. Spreads start from 1.8 pips and various reported issues exist regarding customer service and trading experience. The broker appears to target forex and CFD traders who put high leverage access first, though potential users should carefully consider the reported service limits and regulatory framework before making a decision.

This review uses publicly available information and user feedback as of 2025. FPM operates under Belize FSC regulation, which may have different effects for users in various places around the world. Regulatory standards and investor protection measures may vary a lot compared to brokers regulated by top-tier financial authorities.

This evaluation does not give personal investment advice. Potential users should do their own research before opening an account. Trading forex and CFDs involves big risk and may not be right for all investors.

| Criteria | Score | Rating |

|---|---|---|

| Account Conditions | 5/10 | Below Average |

| Tools and Resources | 7/10 | Good |

| Customer Service | 4/10 | Poor |

| Trading Experience | 6/10 | Average |

| Trustworthiness | 4/10 | Poor |

| User Experience | 5/10 | Below Average |

FPM entered the financial services market in 2019 as an online forex and CFD broker. It set up its headquarters in Belize. The company works as a financial middleman, providing retail and institutional clients access to global financial markets through its trading platform.

FPM's business model focuses on offering leveraged trading across multiple asset classes while keeping operations under Belize jurisdiction. The broker has positioned itself in the competitive online trading space by offering high leverage ratios and a diverse range of trading instruments. Despite being relatively new to the market, FPM has tried to establish its presence by providing access to popular trading platforms and maintaining regulatory compliance within its operational jurisdiction.

FPM operates mainly through the MetaTrader 4 platform. It offers clients access to forex pairs, stock CFDs, market indices, commodities, and cryptocurrency instruments. The broker falls under the regulatory oversight of the Belize International Financial Services Commission, which governs its operational standards and compliance requirements. This fpm review looks at how these regulatory and operational frameworks translate into practical trading conditions for end users.

Regulatory Jurisdiction: FPM operates under the regulation of the Belize International Financial Services Commission. This regulatory framework provides basic operational oversight, though it may offer different investor protection standards compared to top-tier regulatory authorities.

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal options is not detailed in available materials. This represents a transparency gap that potential users should clarify directly with the broker.

Minimum Deposit Requirements: The minimum deposit threshold for opening an account with FPM is not specified in available documentation. Prospective clients need to contact the broker for this basic information.

Bonus and Promotional Offers: Available materials do not detail any specific bonus structures or promotional campaigns currently offered by FPM to new or existing clients.

Tradeable Assets: FPM provides access to 39 different trading instruments spanning multiple asset categories. These include major and minor forex pairs, stock CFDs covering various global markets, major market indices, commodity contracts, and cryptocurrency pairs.

Cost Structure: Trading costs begin with spreads from 1.8 pips. However, specific commission structures and additional fees are not detailed in available information. This lack of complete fee disclosure may impact traders' ability to accurately calculate total trading costs.

Leverage Options: The broker offers maximum leverage of up to 1:500. This represents one of the higher leverage ratios available in the retail trading market, particularly appealing to traders seeking amplified market exposure.

Platform Selection: FPM uses the MetaTrader 4 platform as its primary trading interface. This provides clients with access to the standard features and functionality associated with this widely-used trading software.

Geographic Restrictions: Specific information about geographic trading restrictions or country-based limitations is not detailed in available materials.

Customer Service Languages: The range of languages supported by FPM's customer service team is not specified in available documentation.

This fpm review highlights several information gaps that potential clients should address through direct communication with the broker before making account opening decisions.

FPM's account structure and conditions present several areas of concern for potential traders. The lack of detailed information about account types represents a big transparency issue, as traders cannot easily compare different account offerings or understand what features might be available at various account levels.

The absence of clearly stated minimum deposit requirements creates uncertainty for potential clients who need to plan their initial investment. This information gap forces prospective traders to engage directly with sales representatives, which may not align with preferences for transparent, upfront pricing information. Account opening procedures and verification requirements are not detailed in available materials, leaving questions about the complexity and time requirements for becoming a fully verified trader.

Without clear information about required documentation, verification timelines, or potential restrictions, users cannot properly prepare for the account opening process. Special account features such as Islamic accounts, professional trading accounts, or institutional services are not mentioned in available documentation. This lack of information suggests either limited account variety or insufficient transparency in communicating available options to potential clients.

User feedback about account conditions has been mostly negative. However, specific details about account-related complaints are not extensively documented. The overall negative sentiment suggests that account holders may experience difficulties with account management, functionality, or service delivery that impacts their trading experience.

Based on available information and user feedback patterns, FPM's account conditions receive a below-average rating, mainly due to transparency issues and negative user experiences. This fpm review recommends that potential clients seek detailed clarification of all account terms and conditions before proceeding with account opening.

FPM's offering of 39 trading instruments represents a solid foundation for traders seeking diversity across multiple asset classes. The range includes traditional forex pairs, stock CFDs, indices, commodities, and cryptocurrencies, providing reasonable coverage of major market sectors that many traders seek to access.

However, the availability of research and analytical resources appears limited based on available information. Modern traders typically expect access to market analysis, economic calendars, trading signals, or educational content to support their trading decisions. The apparent absence of detailed information about these resources suggests either limited offerings or insufficient communication about available tools.

Educational resources, which are increasingly important for broker competitiveness, are not detailed in available materials. New and intermediate traders particularly benefit from educational content, webinars, tutorials, and market analysis that help develop trading skills and market understanding. Automated trading support capabilities, including expert advisor compatibility and algorithmic trading tools, are not specifically addressed in available documentation.

Given that FPM uses MetaTrader 4, some automated trading functionality would typically be available. However, specific broker policies or limitations are not clarified. The MetaTrader 4 platform itself provides a standard set of technical analysis tools, charting capabilities, and order management features.

However, any additional proprietary tools, enhanced features, or platform customizations offered by FPM are not detailed in available materials. User feedback about tools and platform functionality has been mixed, with some positive aspects related to platform stability but concerns about overall resource availability. The tools and resources category receives a good rating mainly due to the diverse instrument offering and reliable platform choice, though enhancement in analytical and educational resources would strengthen the overall proposition.

Customer service represents one of FPM's most significant challenges based on available user feedback and information. The mostly negative user reviews consistently highlight customer service issues as a major concern for account holders and potential clients.

Response times appear to be problematic based on user reports. Customers experience delays in receiving support for account-related questions, technical issues, or trading concerns. Slow response times can be particularly problematic in the fast-moving forex market where timely support may be critical for resolving trading-related issues.

The quality of customer service interactions has received criticism in user feedback. However, specific details about the nature of service quality issues are not extensively documented. Poor service quality can show up in various ways including unhelpful responses, lack of expertise, or inadequate problem resolution capabilities.

Available customer service channels and their accessibility are not clearly detailed in available materials. Modern traders typically expect multiple contact options including live chat, email support, phone assistance, and potentially social media responsiveness. The lack of clear information about available channels creates uncertainty about how clients can seek assistance when needed.

Multilingual support capabilities are not specified. This may limit accessibility for international clients who prefer support in their native language. Given FPM's international focus, language support limitations could impact user experience for non-English speaking traders.

Customer service operating hours and timezone coverage are not detailed in available materials. For forex traders operating across different time zones, 24/5 support availability during market hours is often expected and valued. The customer service and support category receives a poor rating based on consistently negative user feedback and apparent service delivery challenges that impact the overall client experience.

The trading experience with FPM presents a mixed picture based on available information and user feedback. Platform stability issues have been reported by users, which can significantly impact trading effectiveness and user confidence.

Stability problems may show up as platform disconnections, slow order execution, or system unavailability during critical market periods. Order execution quality appears to be a concern based on user feedback, though specific data about slippage rates, requotes, or execution speeds is not detailed in available materials. Poor execution quality can significantly impact trading profitability, particularly for scalping strategies or during high-volatility market conditions.

The MetaTrader 4 platform provides standard functionality including technical indicators, charting tools, and order management capabilities. However, any platform customizations, additional features, or enhanced functionality provided by FPM is not detailed in available documentation. Mobile trading experience through MetaTrader 4 mobile applications would typically be available, but specific performance, features, or user experience feedback for FPM's mobile offering is not documented in available materials.

Trading environment factors including spread stability and market liquidity have received negative feedback from users. Starting spreads of 1.8 pips may be competitive for some currency pairs, but spread stability during volatile market conditions and overall liquidity provision appears to be areas of user concern.

The maximum leverage of 1:500 represents a potentially attractive feature for traders seeking high leverage. However, this also increases risk exposure and may not be suitable for all trading strategies or experience levels. Based on user feedback patterns and reported issues, the trading experience receives an average rating.

While some features like high leverage may appeal to certain traders, platform stability and execution quality concerns limit the overall fpm review rating in this category.

FPM's trustworthiness assessment reveals several areas of concern that potential clients should carefully consider. The broker operates under Belize FSC regulation, which provides basic regulatory oversight but may offer different investor protection standards compared to top-tier regulatory authorities such as the FCA, ASIC, or CySEC.

Regulatory compliance and licensing details, including specific license numbers and regulatory standing, are not fully detailed in available materials. Transparency in regulatory information is crucial for building client confidence and allowing proper due diligence. Fund safety measures and client money protection protocols are not detailed in available documentation.

Modern brokers typically implement segregated client accounts, negative balance protection, and deposit insurance schemes to protect client funds. However, FPM's specific protections are not clearly communicated. Company transparency about management, financial reporting, or corporate structure is limited in available materials.

Transparency in corporate governance and financial stability helps build trust with potential clients and demonstrates commitment to professional standards. Industry reputation appears to be challenged based on mostly negative user feedback and the absence of notable industry recognition or awards. Positive industry standing typically develops through consistent service delivery, regulatory compliance, and client satisfaction over time.

The handling of negative events, complaints, or disputes is not detailed in available materials. Effective complaint resolution procedures and transparent dispute handling are important indicators of broker reliability and client-focused operations. Third-party evaluations from industry rating agencies or independent review platforms are not extensively available, limiting external validation of FPM's operations and service quality.

Based on regulatory framework limitations, transparency gaps, and negative user feedback patterns, the trustworthiness category receives a poor rating. This indicates that potential clients should exercise particular caution and conduct thorough due diligence.

Overall user satisfaction with FPM appears to be significantly below industry standards based on available feedback and reviews. The majority of negative user experiences suggests systematic issues that impact client satisfaction and retention.

Interface design and platform usability receive mixed feedback. The MetaTrader 4 platform provides familiar functionality for experienced users, but potential customization or enhancement limitations may impact user experience. Platform aesthetics and user interface quality beyond the standard MT4 offering are not detailed in available materials.

Registration and account verification processes are not fully detailed in available documentation. This creates uncertainty about the complexity, time requirements, and documentation needed for account opening. Streamlined onboarding processes are increasingly important for user satisfaction and initial experience quality.

Fund management operations, including deposit and withdrawal experiences, appear to be problematic based on user feedback patterns. Efficient, transparent, and reliable fund operations are crucial for maintaining client confidence and satisfaction throughout the trading relationship. Common user complaints center around customer service quality, platform performance, and trading condition issues.

The consistency of negative feedback across multiple areas suggests systematic challenges rather than isolated incidents. User demographics appear to focus on traders seeking high leverage opportunities, though the broker's ability to effectively serve this target market appears limited based on satisfaction indicators. Successful brokers typically develop strong relationships with their target user base through tailored services and reliable delivery.

Improvement opportunities based on user feedback include enhanced customer service responsiveness, platform stability improvements, and greater transparency in trading conditions and company operations. The user experience category receives a below-average rating due to consistently negative feedback patterns and apparent service delivery challenges that impact overall client satisfaction.

This fpm review reveals a broker with certain attractive features, particularly regarding trading instrument diversity and leverage options. However, it faces significant challenges in service delivery and user satisfaction. FPM's offering of 39 trading instruments and maximum leverage of 1:500 may appeal to specific trader segments, but these advantages are overshadowed by consistent negative user feedback and transparency limitations.

The broker may be more suitable for experienced traders who put high leverage access first and can navigate potential service limitations. However, caution is advised given the mostly negative user experiences and regulatory framework considerations. New traders or those seeking complete support and educational resources may find better alternatives in the market.

Key advantages include diverse trading instruments and high leverage availability. However, significant disadvantages include poor customer service ratings, transparency gaps, and negative user experience patterns. Potential clients should conduct thorough due diligence and carefully consider whether FPM's specific offerings align with their trading needs and risk tolerance levels.

FX Broker Capital Trading Markets Review