Regarding the legitimacy of Far East forex brokers, it provides HKGX and WikiBit, (also has a graphic survey regarding security).

Is Far East safe?

Rating Index

Software Index

Risk Control

Is Far East markets regulated?

The regulatory license is the strongest proof.

HKGX Type A1 License

Hong Kong Gold Exchange

Hong Kong Gold Exchange

Current Status:

RegulatedLicense Type:

Type A1 License

Licensed Entity:

遠東貴金屬(香港)有限公司

Effective Date:

--Email Address of Licensed Institution:

--53748:

No SharingWebsite of Licensed Institution:

https//www.fepm62.comExpiration Time:

--Address of Licensed Institution:

香港九龍尖沙咀山林道4號恒貿商業中心1101室Phone Number of Licensed Institution:

35280868Licensed Institution Certified Documents:

Is Far East Safe or Scam?

Introduction

Far East is a forex broker based in Hong Kong, established in 2017. It has positioned itself as a player in the foreign exchange market, attracting traders with various trading options and potential profitability. However, the forex market is notorious for its volatility and the presence of unscrupulous brokers. Therefore, it is crucial for traders to conduct thorough evaluations of any forex broker before committing their funds. This article aims to investigate whether Far East is a safe trading option or a potential scam. Our investigation is based on a comprehensive analysis of regulatory compliance, company background, trading conditions, customer experiences, and risk assessments.

Regulation and Legitimacy

Regulatory oversight plays a significant role in determining the safety of a forex broker. A broker's regulatory status provides insights into its legitimacy and operational standards. Far East claims to operate under the regulatory framework of the Chinese Gold & Silver Exchange Society (CGSE). However, it is essential to note that the CGSE is not considered a major regulatory authority like the FCA or ASIC.

Here is a summary of the regulatory information for Far East:

| Regulatory Authority | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| Chinese Gold & Silver Exchange Society | 062 | Hong Kong | Not widely recognized |

The lack of robust regulation raises concerns about the broker's operational integrity. Additionally, numerous complaints have been reported against Far East, with users alleging issues such as fund mismanagement and non-responsiveness to withdrawal requests. The quality of regulation is crucial, as it ensures that a broker adheres to strict operational guidelines, protects client funds, and maintains transparency.

Company Background Investigation

Far East was founded in 2017, making it a relatively new entrant in the forex industry. The broker's ownership structure and management team are critical factors in assessing its credibility. Unfortunately, detailed information about the company's ownership and management is scarce, which raises questions about its transparency. The absence of a well-established history in the forex market can be a red flag for potential investors.

The management teams background is also a vital aspect to consider. A team with extensive experience in finance and trading can enhance a broker's credibility. However, the lack of publicly available information about the team managing Far East makes it challenging to evaluate their expertise effectively. This opacity can lead to skepticism regarding the broker's operations and intentions.

Trading Conditions Analysis

When assessing whether Far East is safe, it is essential to examine its trading conditions, including fees and spreads. A transparent fee structure is a hallmark of a reputable broker. Far East offers various trading instruments, but its fee structure has raised concerns among users.

Heres a comparison of the core trading costs associated with Far East:

| Fee Type | Far East | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 - 2.0 pips |

| Commission Model | None | Varies by broker |

| Overnight Interest Range | High | Moderate |

The variable spread on major currency pairs can lead to higher trading costs, particularly during volatile market conditions. Additionally, the absence of a clear commission structure can be misleading, as hidden fees may exist. Traders should be cautious of brokers that do not provide full transparency regarding their fees, as this can significantly impact overall profitability.

Client Funds Safety

The safety of client funds is paramount when determining if Far East is a safe broker. The broker claims to implement various security measures to protect client funds. However, the specifics of these measures remain unclear.

An analysis of Far East's fund security measures reveals the following:

- Fund Segregation: There is no clear information indicating that client funds are held in segregated accounts, which is a standard practice among regulated brokers.

- Investor Protection: The absence of a compensation scheme for clients in case of broker insolvency is concerning.

- Negative Balance Protection: It is unclear whether Far East offers negative balance protection, which can safeguard traders from losing more than their initial investment.

The lack of transparency regarding these safety measures raises alarms about the overall security of client funds with Far East.

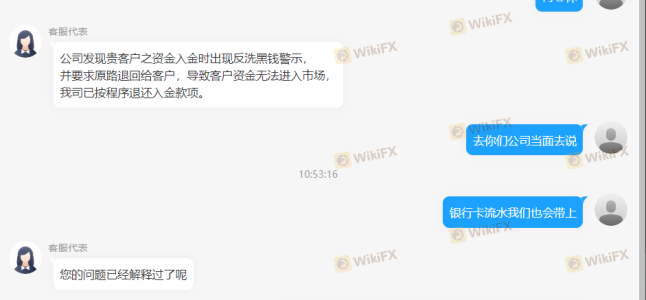

Customer Experience and Complaints

Customer feedback is a critical indicator of a broker's reliability. A review of user experiences with Far East reveals a troubling pattern of complaints. Many users have reported issues such as difficulty withdrawing funds, poor customer service, and inadequate responses to inquiries.

Here is a summary of the main types of complaints received:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Fund Mismanagement | High | Poor |

| Customer Service | Medium | Slow |

Typical cases include users stating that their withdrawal requests were delayed or denied without explanation. These issues highlight a potential lack of accountability and responsiveness from Far East, casting doubt on whether it is a safe broker for traders.

Platform and Execution

The performance and reliability of a trading platform are crucial factors in evaluating a broker's safety. Far East offers a trading platform that is reportedly user-friendly, but user reviews indicate concerns regarding its stability and execution quality.

Issues such as slippage and order rejections have been reported, which can significantly impact trading outcomes. Furthermore, any signs of platform manipulation should raise red flags for potential investors. Traders should be wary of brokers that do not provide clear information about their execution policies and platform reliability.

Risk Assessment

When considering whether Far East is safe, it is essential to evaluate the overall risks associated with using this broker.

Heres a summary of the key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of robust regulation raises concerns. |

| Fund Security | High | Unclear safety measures for client funds. |

| Customer Service | Medium | Numerous complaints regarding responsiveness. |

To mitigate these risks, traders should conduct thorough due diligence before engaging with Far East. It is advisable to start with a small investment and closely monitor trading conditions and customer service responses.

Conclusion and Recommendations

Based on the evidence gathered, it is clear that potential traders should exercise caution when considering Far East as a trading option. The combination of insufficient regulation, numerous customer complaints, and unclear safety measures raises significant concerns about its legitimacy.

While some traders may find success, the overall risk profile suggests that Far East is not a safe choice for most investors.

For those seeking reliable alternatives, consider brokers with strong regulatory oversight, transparent fee structures, and positive customer feedback. Always prioritize safety and due diligence in your trading endeavors.

Is Far East a scam, or is it legit?

The latest exposure and evaluation content of Far East brokers.

Far East Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Far East latest industry rating score is 6.48, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.48 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.