AI 2025 Review: Everything You Need to Know

Executive Summary

Our comprehensive ai review reveals that artificial intelligence has fundamentally transformed the trading landscape in 2025. It offers sophisticated automated trading solutions and advanced analytical tools. AI-powered trading platforms have emerged as game-changers for tech-savvy traders and investors seeking automated trading solutions. According to FINRA reports, AI applications are proliferating across the securities industry, with large firms establishing centers of excellence to review and build expertise around AI implementation. The technology encompasses everything from AI stock trading bots to automated trade execution tools. It provides diverse options for different trading styles. Target users include technology-oriented traders, institutional investors, and retail traders looking to leverage algorithmic trading strategies. While AI trading platforms offer significant technological advantages, the rapidly evolving nature of this sector means traders must carefully evaluate each platform's specific capabilities, regulatory compliance, and track record before committing capital.

Important Notice

This ai review is based on available industry information and public reports about AI trading platforms and applications. Due to the diverse nature of AI trading solutions and varying regulatory frameworks across different jurisdictions, users should note that trading conditions, available features, and regulatory status may differ significantly between regions and individual platforms. The AI trading landscape is rapidly evolving. New platforms and tools emerge regularly. This review analyzes the general state of AI trading technology based on current available information, though specific user feedback and detailed company backgrounds for individual platforms may be limited. Traders should conduct their own due diligence and verify current platform specifications before making investment decisions.

Rating Framework

Broker Overview

The AI trading sector has experienced unprecedented growth. Artificial intelligence has revolutionized industries worldwide according to comprehensive industry overviews. While specific founding dates and company backgrounds vary across different AI trading platforms, the sector has gained significant momentum over the past few years. The business model centers around leveraging machine learning algorithms, natural language processing, and predictive analytics to enhance trading decisions and automate execution processes. Major financial institutions and fintech startups have invested heavily in developing AI-powered trading solutions. This creates a competitive landscape of innovative platforms.

According to StockBrokers.com analysis, the best AI trading platforms for 2025 offer sophisticated algorithmic trading capabilities. Some platforms provide fully automated investing solutions starting from as low as $3 subscription fees. The trading platform ecosystem includes robo-advisors, automated trade execution systems, and advanced analytical tools. Asset classes typically covered include stocks, ETFs, cryptocurrencies, and various derivatives, though specific offerings vary by platform. This ai review indicates that regulatory oversight comes from traditional financial authorities like FINRA, which has published specific guidance on AI applications in the securities industry. This ensures platforms comply with existing financial regulations while embracing technological innovation.

Regulatory Landscape: AI trading platforms operate under existing financial regulations. FINRA provides specific guidance on AI applications in the securities industry. However, specific regulatory jurisdictions vary by individual platform and their operational base.

Funding Methods: Available sources do not specify standardized deposit and withdrawal methods across AI trading platforms. These vary significantly between different providers and their banking partnerships.

Minimum Investment Requirements: According to available research, some AI trading solutions start from as low as $3 for subscription-based services. Automated trade execution services may charge approximately $1.22 per trade, though minimum deposit requirements are not standardized across platforms.

Promotional Offers: Specific bonus and promotional information is not detailed in available industry sources. These vary by individual platform and are subject to change.

Available Assets: While specific asset classes are not uniformly detailed, AI trading platforms typically focus on stocks, ETFs, and increasingly cryptocurrency markets. Some platforms expand into forex and commodity trading.

Cost Structure: Pricing models vary significantly. They range from subscription-based services starting at $3 monthly to per-trade execution fees around $1.22, though comprehensive cost breakdowns require individual platform analysis.

Leverage Options: Leverage specifications are not standardized across AI trading platforms. They depend on individual platform policies and regulatory requirements.

Platform Technology: Based on industry analysis, AI trading platforms utilize advanced algorithms, machine learning models, and automated execution systems. Some offer fully hands-off robo-advisory services.

Geographic Restrictions: Specific regional limitations are not detailed in available sources. They vary by individual platform's regulatory compliance and operational licenses.

Customer Support Languages: Language support information is not specified in available industry sources. It varies by platform provider.

This comprehensive ai review highlights the diversity and complexity of the AI trading ecosystem. It requires individual evaluation of specific platforms based on personal trading needs and regulatory requirements.

Account Conditions Analysis

The account conditions across AI trading platforms vary significantly. This makes standardized evaluation challenging based on available industry information. Different platforms offer varying account types, from basic robo-advisory accounts to sophisticated algorithmic trading setups. According to industry reports, some platforms provide entry-level access with minimal initial investments, while others cater to institutional clients with higher capital requirements. The account opening process typically involves standard KYC procedures. However, the integration of AI technology may streamline verification and onboarding processes.

Account features often include automated portfolio rebalancing, AI-driven asset allocation, and risk management tools. However, specific details about Islamic accounts, professional trader classifications, or premium account tiers are not uniformly detailed across available sources. The lack of standardized account information in this ai review reflects the diverse nature of AI trading platforms. Each platform has unique value propositions and target demographics. Prospective users should directly evaluate individual platforms for specific account conditions, as the AI trading sector lacks the standardization found in traditional forex brokerage account structures.

The tools and resources available through AI trading platforms represent a significant strength in this sector evaluation. According to FINRA reports, AI applications in the securities industry include sophisticated trading algorithms, risk analysis tools, and automated execution systems. StockBrokers.com analysis identifies various AI stock trading bots that provide automated trading capabilities, while platforms like Signal Stack offer automated trade execution services for alert-based trading strategies.

Research and analytical resources typically include machine learning-driven market analysis, predictive modeling tools, and real-time data processing capabilities. Many platforms provide backtesting environments where users can evaluate AI trading strategies against historical data. Educational resources vary by platform, though the technical nature of AI trading often requires more sophisticated user knowledge compared to traditional trading platforms.

The automation support represents a key differentiator. Platforms offer everything from simple robo-advisory services to complex algorithmic trading systems. According to available analysis, some platforms provide fully automated investing solutions, while others focus on trade execution automation. The diversity of AI trading tools creates opportunities for various trading styles, from passive long-term investing to active algorithmic strategies. However, the complexity of these tools may require significant technical understanding, potentially limiting accessibility for novice traders seeking simple trading solutions.

Customer Service and Support Analysis

Customer service and support information for AI trading platforms is not comprehensively detailed in available industry sources. This reflects the diverse nature of this sector. Unlike traditional brokers with standardized support structures, AI trading platforms often operate with varying service models depending on their target market and business approach. Some platforms may offer traditional customer support channels including phone, email, and live chat, while others might rely more heavily on automated support systems and comprehensive FAQ sections.

Response times and service quality metrics are not standardized across the AI trading sector. This makes comparative analysis challenging. The technical nature of AI trading platforms may require specialized support staff with understanding of algorithmic trading concepts, machine learning applications, and automated execution systems. This specialized knowledge requirement potentially impacts both the availability and quality of customer support.

Multilingual support capabilities vary significantly between platforms. This is particularly true as many AI trading solutions originate from different geographical markets with varying language requirements. The lack of comprehensive customer service information in available sources suggests that prospective users should prioritize platforms that clearly outline their support capabilities, available contact methods, and response time commitments. Customer service quality often becomes crucial when dealing with automated trading systems where technical issues can have immediate financial implications.

Trading Experience Analysis

The trading experience offered by AI trading platforms differs substantially from traditional manual trading environments. Specific performance metrics are not comprehensively detailed in available sources. Platform stability and execution speed become critical factors when dealing with automated trading systems that may execute multiple trades without human intervention. The integration of artificial intelligence introduces both opportunities and complexities in the trading experience.

Order execution quality varies across different AI trading platforms. Some focus on optimizing execution through algorithmic analysis of market conditions, while others prioritize simplicity and ease of use for retail investors. The automated nature of many AI trading solutions means that traditional concerns about manual order placement become less relevant, while new considerations around algorithm performance and system reliability gain importance.

Mobile trading experiences are not uniformly detailed across available sources. However, the trend toward mobile-first technology suggests that leading AI trading platforms likely offer sophisticated mobile applications. However, the complexity of AI trading tools may present challenges in mobile interface design, potentially limiting the full functionality available on mobile devices compared to desktop platforms. This ai review indicates that trading environment evaluation requires careful consideration of individual platform capabilities rather than industry-wide standards. The AI trading sector lacks the standardization found in traditional forex and stock trading platforms.

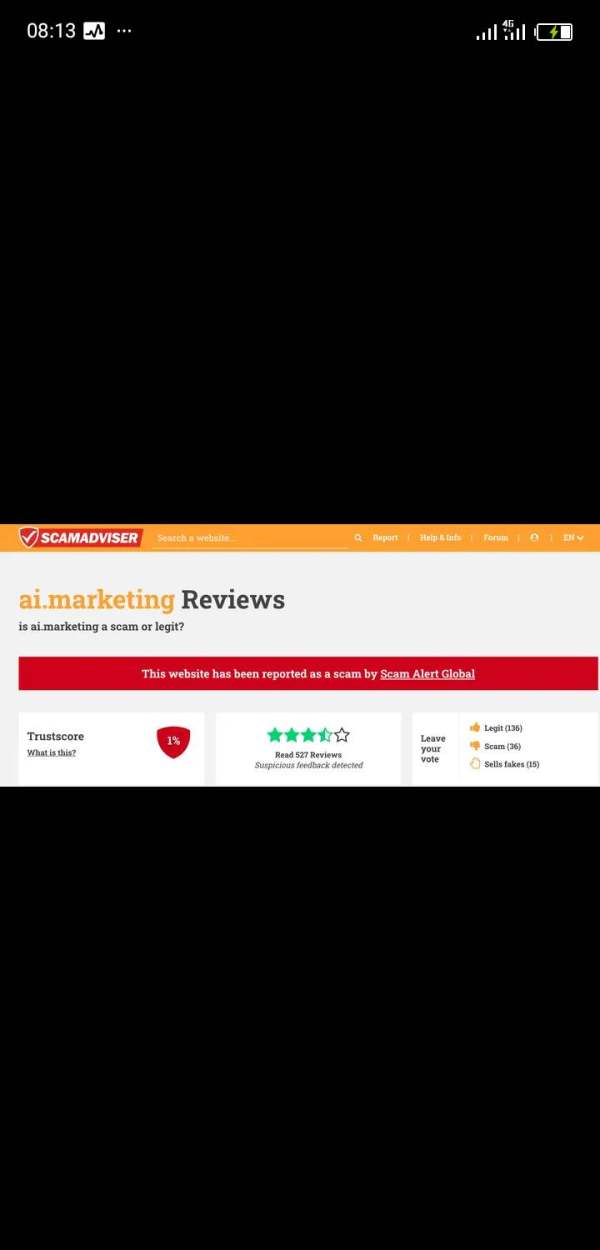

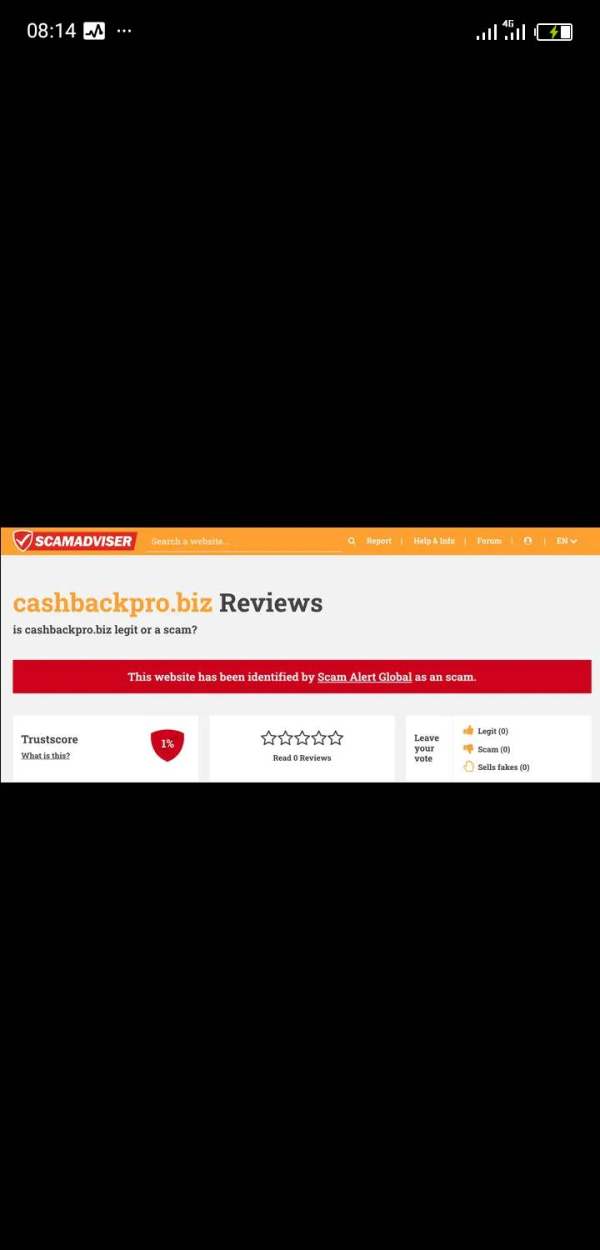

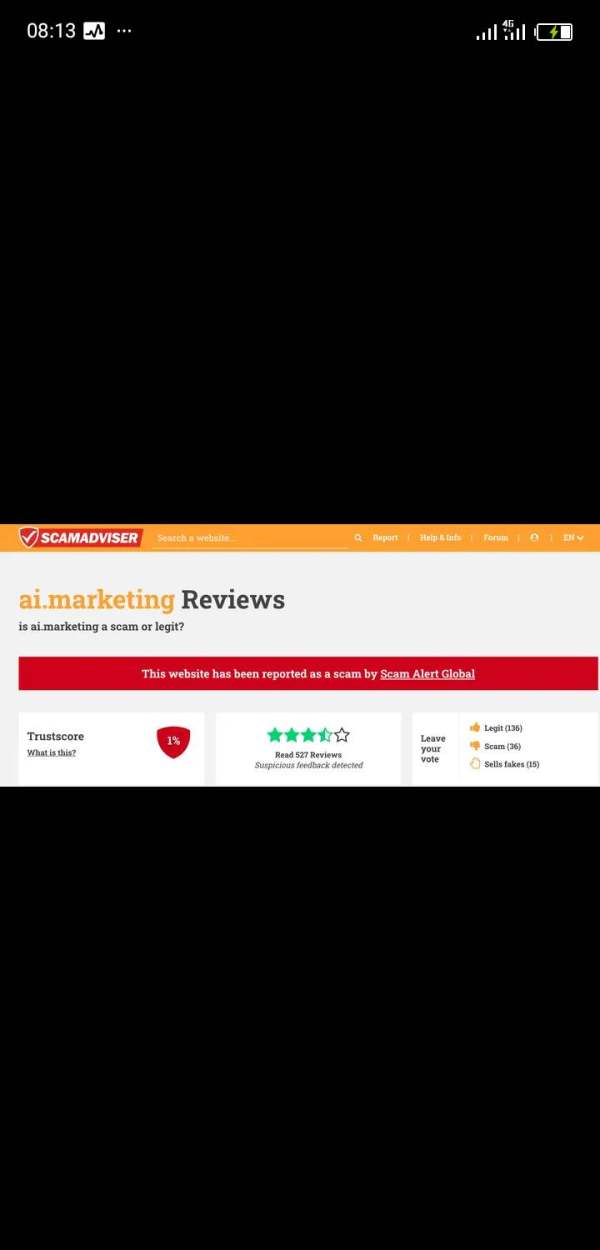

Trust and Reliability Analysis

Trust and reliability assessment for AI trading platforms presents unique challenges due to the diverse nature of providers and varying levels of available information. Regulatory oversight comes primarily through existing financial authorities, with FINRA providing specific guidance on AI applications in the securities industry. However, specific regulatory licenses and compliance details vary significantly between individual platforms and are not comprehensively detailed in available industry sources.

Fund safety measures and segregation policies are not standardized across AI trading platforms. This requires individual evaluation of each provider's client protection mechanisms. The relatively recent emergence of many AI trading platforms means that long-term track records and regulatory compliance histories may be limited compared to established traditional brokers. Company transparency varies widely, with some platforms providing detailed information about their algorithms and risk management approaches, while others maintain proprietary secrecy around their trading methodologies.

Industry reputation assessment is complicated by the rapid evolution of the AI trading sector and the diverse range of companies involved. These range from established financial institutions to emerging fintech startups. The handling of negative events or system failures is not uniformly documented across available sources, though the automated nature of AI trading systems introduces unique risks that require specific management approaches. Prospective users should prioritize platforms with clear regulatory compliance, transparent operational procedures, and established track records in automated trading system management.

User Experience Analysis

Overall user satisfaction metrics for AI trading platforms are not comprehensively available in current industry sources. This reflects the diverse and evolving nature of this sector. Interface design and usability vary significantly between platforms, with some prioritizing simplicity for retail investors while others offer sophisticated tools for professional traders. The balance between automation and user control represents a key design challenge that different platforms address in varying ways.

Registration and verification processes typically follow standard financial industry KYC requirements. Some platforms may leverage AI technology to streamline identity verification and risk assessment procedures. The onboarding experience often includes education about AI trading concepts and platform-specific features, which can be more complex than traditional trading platform setup due to the technical nature of automated trading systems.

Fund deposit and withdrawal experiences are not uniformly detailed across available sources. These processes depend on individual platform partnerships with payment processors and banking institutions. Common user complaints are not systematically documented in available industry analysis, though potential concerns likely include algorithm performance, system reliability, and the complexity of understanding automated trading decisions.

The user demographic for AI trading platforms typically skews toward technology-oriented investors and those seeking automated solutions. Specific user profile analysis is not detailed in available sources. The learning curve for AI trading platforms may be steeper than traditional trading interfaces, potentially impacting user satisfaction for those unfamiliar with algorithmic trading concepts.

Conclusion

This comprehensive ai review reveals a dynamic and rapidly evolving sector that offers significant technological advantages for traders seeking automated solutions and advanced analytical tools. The overall assessment remains cautiously optimistic, recognizing both the innovative potential and the inherent complexities of AI-driven trading platforms. The sector best serves technology-oriented investors, institutional traders seeking automation, and retail investors willing to embrace algorithmic trading approaches.

The primary strengths lie in the sophisticated application of artificial intelligence to trading processes. This offers capabilities ranging from simple robo-advisory services to complex algorithmic execution systems. However, the main limitations include the lack of standardized industry practices, limited comprehensive user feedback, and the complexity that may challenge less technically-oriented traders. Prospective users should carefully evaluate individual platforms based on their specific needs, technical comfort level, and risk tolerance before committing to AI trading solutions.