Regarding the legitimacy of EMPEROR Xpro forex brokers, it provides HKGX, SFC and WikiBit, .

Is EMPEROR Xpro safe?

Software Index

License

Is EMPEROR Xpro markets regulated?

The regulatory license is the strongest proof.

HKGX Precious Metals Trading (AGN)

Hong Kong Gold Exchange

Hong Kong Gold Exchange

Current Status:

UnverifiedLicense Type:

Precious Metals Trading (AGN)

Licensed Entity:

英皇金號有限公司

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

https://www.empfs.com/about-us/licensesExpiration Time:

--Address of Licensed Institution:

香港灣仔軒尼詩道288號英皇集團中心28樓Phone Number of Licensed Institution:

28356688Licensed Institution Certified Documents:

SFC Market Making License (MM)

Securities and Futures Commission of Hong Kong

Securities and Futures Commission of Hong Kong

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

Emperor International Exchange (Hong Kong) Company Limited

Effective Date:

2005-01-20Email Address of Licensed Institution:

support@empfs.comSharing Status:

No SharingWebsite of Licensed Institution:

www.empfs.comExpiration Time:

--Address of Licensed Institution:

香港灣仔軒尼詩道288號英皇集團中心26-29樓Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Emperor Xpro Safe or a Scam?

Introduction

Emperor Xpro is a relatively new player in the forex trading market, established in 2020 and based in Saint Vincent and the Grenadines. As a broker, it positions itself to cater to a global audience by offering a variety of trading instruments, including forex, precious metals, and contracts for difference (CFDs). However, the rise of online trading platforms has also led to an increase in fraudulent schemes, making it crucial for traders to conduct thorough evaluations of forex brokers before committing their funds. This article aims to investigate whether Emperor Xpro is a safe trading option or if it exhibits characteristics commonly associated with scams. To arrive at a comprehensive assessment, we will analyze regulatory compliance, company background, trading conditions, customer experiences, and overall risk factors associated with this broker.

Regulation and Legitimacy

The regulatory status of a brokerage is one of the most significant indicators of its legitimacy and safety. A well-regulated broker is typically subject to strict oversight, which helps protect traders' funds and ensures fair trading practices. In the case of Emperor Xpro, the broker claims to be regulated by the Chinese Gold & Silver Exchange Society (CGSE) and the Securities and Futures Commission (SFC) of Hong Kong. However, both regulatory bodies have flagged Emperor Xpro as a "suspicious clone," raising serious concerns about its legitimacy.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| CGSE | ACJ 776 | Hong Kong | Suspicious Clone |

| SFC | ACJ 776 | Hong Kong | Suspicious Clone |

The designation of "suspicious clone" suggests that Emperor Xpro may not be operating under the legitimate licenses it claims. This lack of robust regulatory oversight is alarming, as it leaves traders vulnerable to potential fraud and mismanagement of funds. Furthermore, the absence of a solid regulatory framework means that traders have limited avenues for recourse should issues arise. Overall, the regulatory landscape surrounding Emperor Xpro raises significant red flags, indicating that traders should proceed with caution when considering whether Emperor Xpro is safe.

Company Background Investigation

Emperor Xpro is owned by EMX Pro Limited, a company registered in Saint Vincent and the Grenadines. The company operates in a jurisdiction known for its lenient regulatory environment, which can be a double-edged sword. While it allows for easier entry into the market, it also raises questions about the oversight and protection of investors. The management team behind Emperor Xpro has not been extensively detailed in available resources, contributing to concerns about transparency and accountability.

The company's history is relatively short, having been founded only in 2020. This lack of a proven track record may deter experienced traders who typically prefer brokers with a long-standing history of reliability and compliance. Transparency regarding ownership structure and management experience is minimal, which further complicates the assessment of whether Emperor Xpro is safe. The limited information available about the company and its operators raises concerns about its commitment to ethical trading practices and customer service.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions they offer is essential. Emperor Xpro provides various account types, including Standard, Premium, and Prestige accounts, each with different minimum deposit requirements and trading conditions. However, the overall fee structure may not be as competitive as it appears at first glance.

| Fee Type | Emperor Xpro | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | From 1.8 pips | 1.0 - 1.5 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Varies | Varies |

The spreads offered by Emperor Xpro are relatively high, particularly for the Standard account, which starts at 1.8 pips for major currency pairs. This is above the industry average, suggesting that traders may incur higher costs than necessary. Additionally, the absence of a clear commission structure raises questions about how the broker generates revenue, which is often a critical factor in determining a broker's trustworthiness. Traders should be cautious of any unusual or hidden fees that could impact their overall profitability.

Customer Fund Safety

The safety of customer funds is a paramount concern for traders. Emperor Xpro claims to implement certain security measures, but the lack of regulatory oversight casts doubt on the effectiveness of these measures. The broker does not provide adequate information regarding fund segregation, investor protection, or negative balance protection policies.

Traders should be particularly wary of the absence of investor protection schemes, which are typically provided by regulated brokers. Without these protections, traders face the risk of losing their entire investment without any recourse. Historical complaints and reports of fund withdrawal issues further exacerbate concerns about the safety of funds with Emperor Xpro.

Customer Experience and Complaints

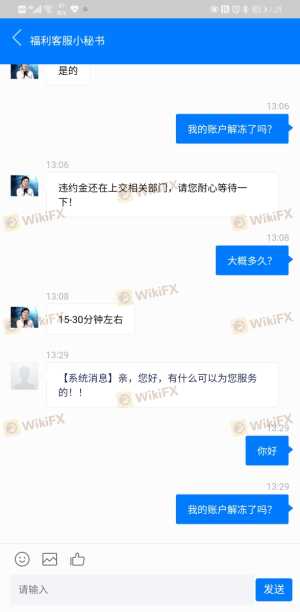

Customer feedback is a vital aspect of evaluating a broker's reliability. Reviews of Emperor Xpro reveal a concerning trend of negative experiences among users. Many complaints center around withdrawal difficulties, with several users claiming they were unable to access their funds after making deposits.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Unresponsive |

| Account Access Problems | High | Unresponsive |

| High Slippage | Medium | Limited Explanation |

Several users have reported being unable to withdraw their funds for extended periods, leading to accusations of fraud. These complaints highlight a pattern of dissatisfaction, suggesting that Emperor Xpro may not be prioritizing customer service or resolving issues effectively. The lack of timely responses from the company raises additional concerns about its commitment to maintaining a trustworthy trading environment.

Platform and Trade Execution

The trading platform provided by Emperor Xpro is based on the widely used MetaTrader 4 (MT4) software, which is known for its user-friendly interface and robust functionality. However, user reviews indicate that there may be issues with order execution quality, including instances of slippage and rejected orders.

The trading experience is critical for traders, and any signs of platform manipulation or execution issues can severely impact trading outcomes. Reports of high slippage and delayed executions raise questions about the reliability of Emperor Xpro's trading infrastructure.

Risk Assessment

Using Emperor Xpro presents several risks that traders should carefully consider. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of legitimate regulatory oversight |

| Fund Safety Risk | High | No investor protection or fund segregation |

| Customer Service Risk | Medium | Poor response to customer complaints |

| Execution Risk | High | Reports of slippage and rejected orders |

Traders should be particularly cautious about the high regulatory and fund safety risks associated with Emperor Xpro. To mitigate these risks, it is advisable to conduct thorough research and consider alternative brokers with better regulatory standing and customer service records.

Conclusion and Recommendations

In conclusion, the evidence gathered suggests that Emperor Xpro raises significant concerns regarding its safety and legitimacy. The lack of robust regulatory oversight, combined with numerous customer complaints about withdrawal issues and poor service, indicates that traders should exercise extreme caution. While Emperor Xpro may offer enticing trading conditions, the potential risks far outweigh the benefits.

For traders seeking a reliable and secure trading environment, it is highly recommended to consider alternatives with established reputations and regulatory compliance. Brokers that are well-regulated and have a history of positive customer experiences should be prioritized to ensure the safety of your investments. In summary, it is prudent to approach Emperor Xpro with skepticism and consider other options if you are serious about trading in the forex market.

Is EMPEROR Xpro a scam, or is it legit?

The latest exposure and evaluation content of EMPEROR Xpro brokers.

EMPEROR Xpro Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

EMPEROR Xpro latest industry rating score is 2.07, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.07 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.