Regarding the legitimacy of EIGHT PLUS CAPITAL forex brokers, it provides CYSEC and WikiBit, (also has a graphic survey regarding security).

Is EIGHT PLUS CAPITAL safe?

Business

License

Is EIGHT PLUS CAPITAL markets regulated?

The regulatory license is the strongest proof.

CYSEC Forex Execution License (STP)

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

UnverifiedLicense Type:

Forex Execution License (STP)

Licensed Entity:

GTSE Capital Group Ltd

Effective Date: Change Record

2017-08-10Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

gteprime.comExpiration Time:

--Address of Licensed Institution:

Joanna Court, Office 201, Floor 2, 61 Omirou Street, 3096 Mesa Geitonia, Limassol, CyprusPhone Number of Licensed Institution:

+357 22 222 804Licensed Institution Certified Documents:

Is Eight Plus Capital A Scam?

Introduction

Eight Plus Capital, a brokerage firm operating primarily in the forex market, claims to offer a diverse range of trading services, including forex, CFDs, and commodities. With a minimum deposit requirement of $200, it positions itself as an accessible option for both novice and experienced traders. However, the forex market is notoriously fraught with risks, and traders must exercise caution when selecting a broker. The importance of due diligence cannot be overstated, as the choice of a broker can significantly impact trading outcomes. This article aims to provide a comprehensive evaluation of Eight Plus Capital by examining its regulatory status, company background, trading conditions, customer experience, and overall risks associated with trading through this platform.

Regulation and Legitimacy

The regulatory environment in which a broker operates is crucial for ensuring the safety of client funds and the integrity of trading practices. Eight Plus Capital is regulated by the Cyprus Securities and Exchange Commission (CySEC), which is known for its stringent regulatory framework. The following table summarizes the core regulatory information for Eight Plus Capital:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| CySEC | 334/17 | Cyprus | Verified |

The significance of regulation lies in the oversight it provides. Regulated brokers are required to adhere to specific standards that protect clients, such as maintaining a minimum level of capital, segregating client funds, and providing transparent pricing. However, it is worth noting that while CySEC is a reputable authority, it does not offer the same level of investor protection as some of the tier-one regulators like the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC). Historical compliance reviews reveal that Eight Plus Capital has faced scrutiny, especially regarding complaints related to its data security policies and operational practices. This raises concerns about the broker's legitimacy and operational integrity.

Company Background Investigation

Eight Plus Capital was established in Cyprus and has undergone several transformations, including changes in ownership and regulatory compliance. The company operates under the name Eight Plus Capital Ltd, previously known as Acier FX Ltd. This history of rebranding may raise red flags for potential investors, as it can indicate attempts to distance the firm from past controversies. The management team comprises individuals with varying degrees of experience in the finance and trading sectors, but specific details about their backgrounds are not readily available, which could affect the perceived transparency of the firm.

Transparency is critical in the financial services industry, and Eight Plus Capital's lack of readily available information about its management and operational practices can be concerning. According to user reviews, the company has been criticized for its communication practices and the clarity of its terms and conditions. This lack of transparency can lead to mistrust among potential clients, highlighting the necessity for brokers to provide comprehensive information about their operations and management.

Trading Conditions Analysis

When evaluating a broker, the trading conditions they offer are paramount. Eight Plus Capital provides a variety of trading instruments, including forex, CFDs, and commodities, with variable spreads starting from 0.1 pips. However, the overall fee structure is crucial for traders to understand the total cost of trading. The following table compares the core trading costs associated with Eight Plus Capital against industry averages:

| Cost Type | Eight Plus Capital | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.1 pips | 1.0 pips |

| Commission Structure | $3.50 per lot | $5.00 per lot |

| Overnight Interest Range | Varies | Varies |

While the spreads appear competitive, the commission structure may not be as attractive when compared to other brokers. Additionally, the absence of clear information regarding overnight interest rates and any potential withdrawal fees can add to the complexity and cost of trading with Eight Plus Capital. Traders should be particularly cautious about any hidden fees that may not be immediately apparent, as these can significantly affect profitability.

Client Funds Security

The security of client funds is a critical consideration when choosing a broker. Eight Plus Capital claims to implement measures to protect client funds, including segregating client accounts and maintaining compliance with regulatory requirements. However, the effectiveness of these measures is contingent upon the broker's adherence to regulatory guidelines.

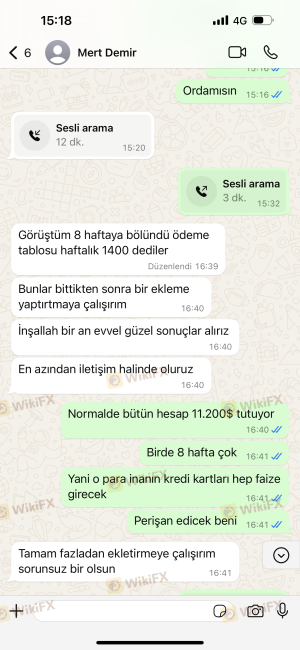

The company does not explicitly mention providing negative balance protection, which is a crucial safeguard for traders, especially in volatile markets. The lack of such a policy can expose traders to significant risks, particularly if they engage in high-leverage trading. Additionally, there have been historical concerns regarding fund security, with reports of clients experiencing difficulties in withdrawing their funds. Such incidents raise questions about the reliability of Eight Plus Capital's operational practices and the safety of client investments.

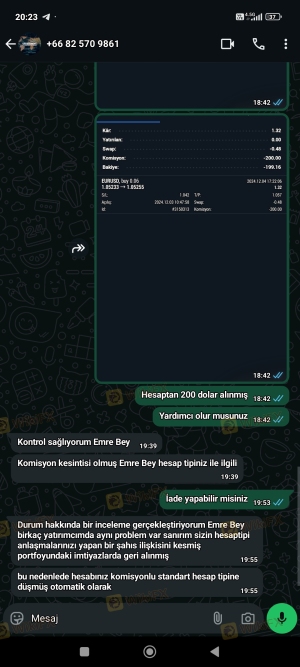

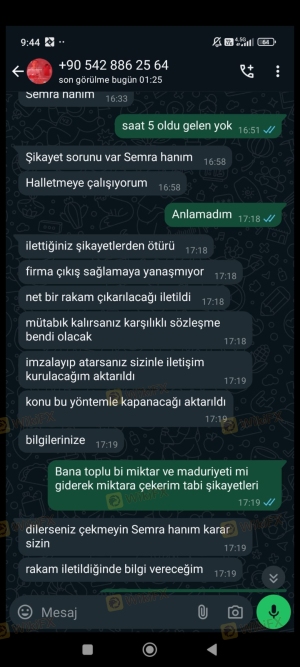

Customer Experience and Complaints

Customer feedback is an essential indicator of a broker's reliability and service quality. Reviews of Eight Plus Capital reveal a mixed bag of experiences, with some users praising the platform's features and customer support, while others report significant issues. Common complaints include difficulties in withdrawing funds, unclear fee structures, and lack of timely communication from the support team.

The following table summarizes the primary complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Lack of Transparency | Medium | Inconsistent |

| Customer Support Availability | Medium | Limited hours |

Several users have reported being unable to withdraw their funds, often citing various excuses from the broker regarding fees or account verification processes. These patterns of complaints suggest potential operational issues within the firm, which could be indicative of larger systemic problems.

Platform and Execution

The trading platform is a crucial element of the trading experience. Eight Plus Capital offers the popular MetaTrader 4 (MT4) platform, known for its user-friendly interface and advanced trading tools. However, the platform's performance, including execution quality and slippage rates, has been a point of contention among users.

Reports of order rejections and significant slippage during volatile market conditions have surfaced, which can severely impact trading outcomes. The potential for platform manipulation, where brokers may interfere with order execution, is an area of concern that traders should be aware of.

Risk Assessment

Trading with any broker involves inherent risks, and Eight Plus Capital is no exception. The following risk assessment summarizes key risk areas associated with trading through this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | Medium | CySEC regulation, but with concerns about past compliance issues. |

| Fund Safety | High | Historical withdrawal issues raise concerns about fund security. |

| Customer Support | Medium | Mixed reviews on support responsiveness and effectiveness. |

| Platform Reliability | Medium | Reports of execution issues and potential manipulation. |

To mitigate these risks, traders are advised to conduct thorough due diligence, ensure they understand the fee structures, and consider starting with a demo account to familiarize themselves with the platform before committing significant capital.

Conclusion and Recommendations

In conclusion, while Eight Plus Capital presents itself as a legitimate forex broker regulated by CySEC, several factors warrant caution. The mixed reviews regarding customer experience, historical compliance issues, and concerns about fund security raise significant red flags.

Traders should approach Eight Plus Capital with caution, particularly if they are new to forex trading. It may be prudent to explore alternative brokers with stronger regulatory oversight, better customer support, and a proven track record of reliability. Some recommended alternatives include brokers regulated by tier-one authorities such as the FCA or ASIC, which typically offer higher levels of investor protection and transparency.

Ultimately, the choice of a broker should align with individual trading goals, risk tolerance, and the need for security and support in the trading journey.

Is EIGHT PLUS CAPITAL a scam, or is it legit?

The latest exposure and evaluation content of EIGHT PLUS CAPITAL brokers.

EIGHT PLUS CAPITAL Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

EIGHT PLUS CAPITAL latest industry rating score is 1.61, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.61 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.