Eight Plus Capital 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive eight plus capital review gives an objective assessment of this Cyprus-based forex and CFD broker for 2025. Eight Plus Capital was established in 2010 and has its headquarters in Nicosia, Cyprus, where it operates under the regulation of the Cyprus Securities and Exchange Commission (CySEC). The broker positions itself as a European regulated online trading platform. It dedicates itself to providing secure trading environments built on trust and transparency.

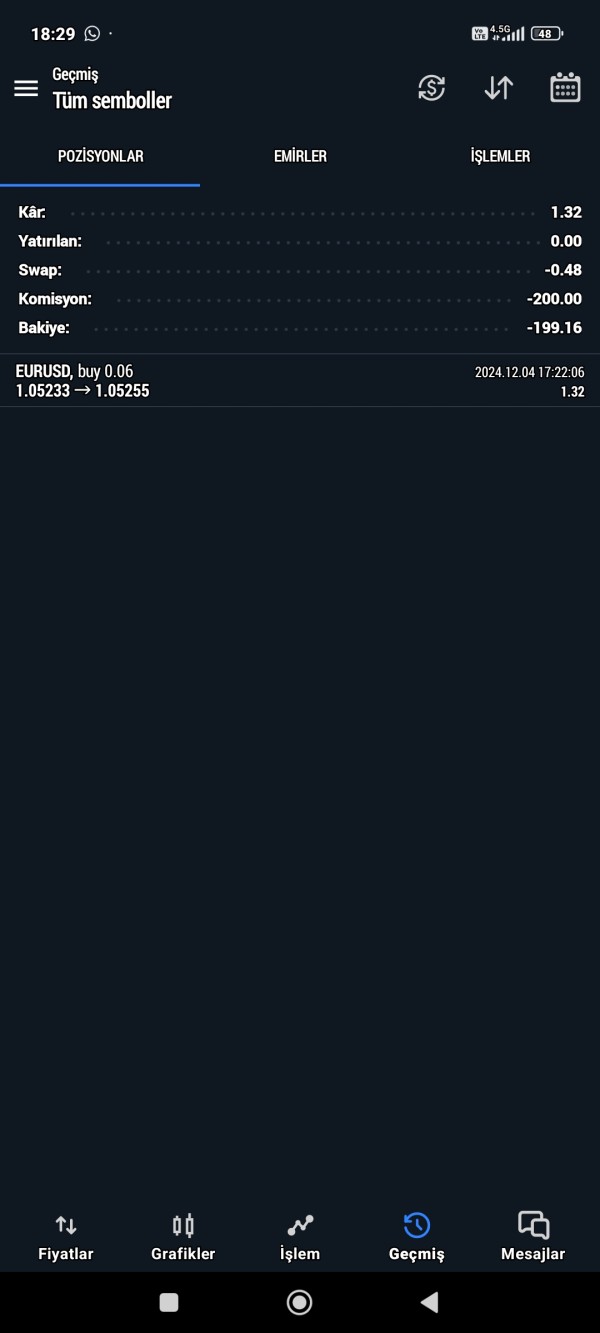

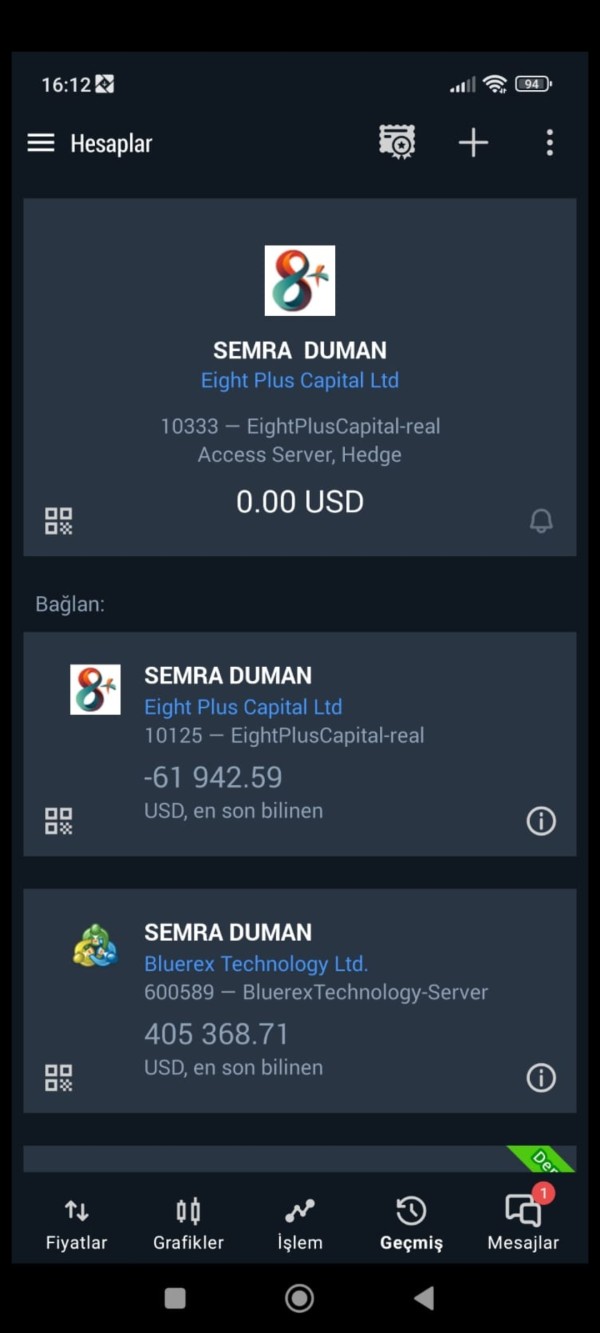

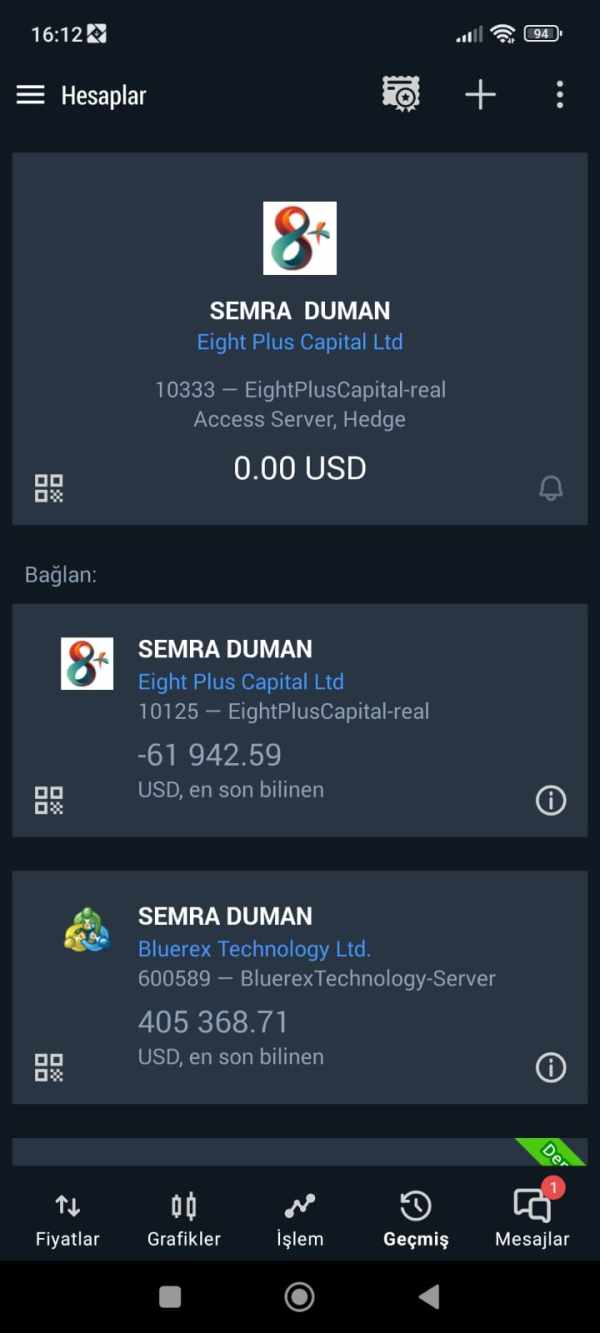

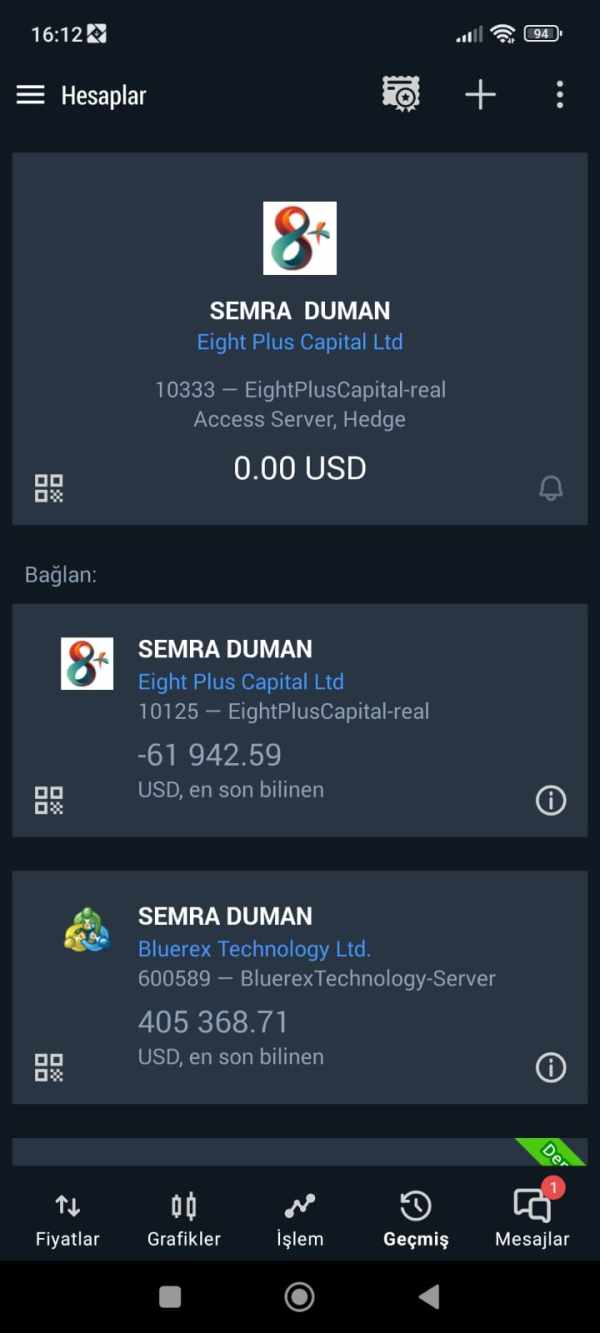

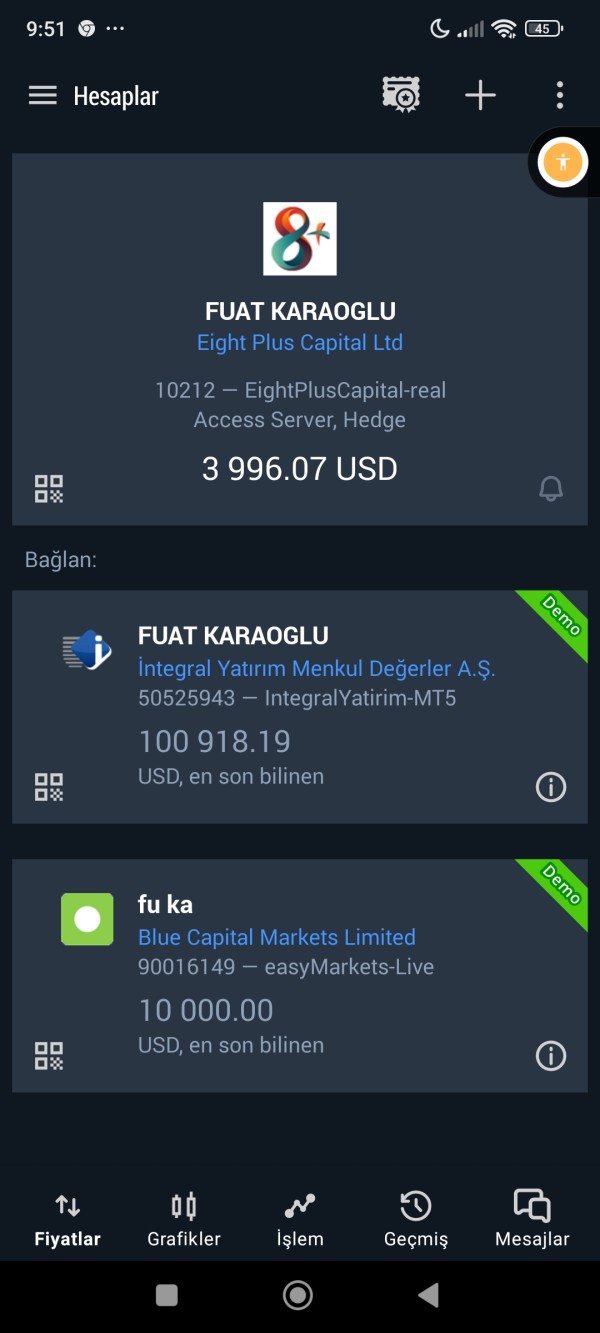

Eight Plus Capital offers trading across multiple asset classes including forex, CFDs, indices, precious metals, commodities, and bonds. With a minimum deposit requirement of $200 and maximum leverage of 1:100, the broker primarily targets beginner and intermediate traders who seek accessible entry points into financial markets. However, our analysis reveals mixed user feedback and regulatory concerns. Potential clients should carefully consider these issues.

The broker uses leading technology to facilitate trading operations. However, specific platform details remain limited in available documentation. While Eight Plus Capital demonstrates certain strengths in its product offerings and regulatory framework, areas of concern include customer service quality and increasing user complaints that have attracted regulatory attention.

Important Disclaimer

This eight plus capital review is based on publicly available information and user feedback collected through various sources. Readers should note that regulatory standards and trading conditions may vary across different jurisdictions. This variation could potentially affect the services and protections available to traders in specific regions.

The evaluation presented here represents an independent assessment conducted through analysis of official documentation, user testimonials, and regulatory filings. Given the dynamic nature of forex brokerage services, prospective clients are advised to verify current terms, conditions, and regulatory status directly with Eight Plus Capital before making investment decisions. All trading involves substantial risk. Past performance does not guarantee future results.

Rating Framework

Broker Overview

Eight Plus Capital was founded in 2010 by an entrepreneur from the financial sector. This person had the vision of creating an innovative approach to online trading. According to the company's official documentation, the broker was established to offer comprehensive FX and CFD trading solutions while using cutting-edge technology and experienced staff to deliver optimal trading experiences. The company emphasizes its commitment to maintaining the highest standards of account security and superior customer service. These serve as core operational principles.

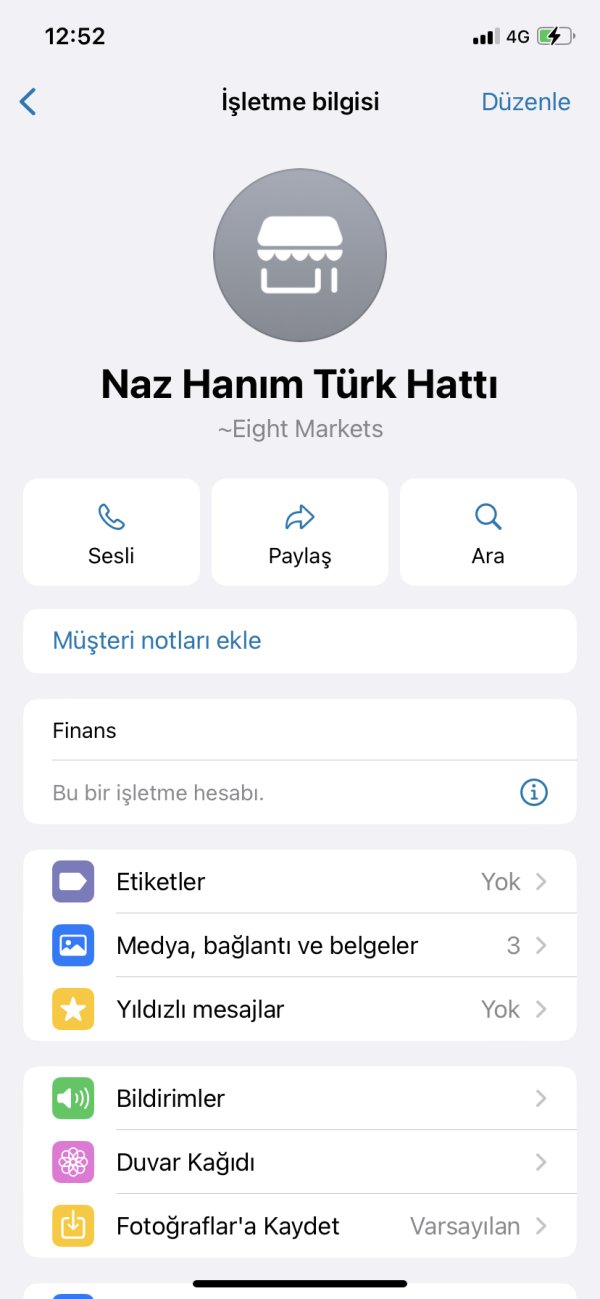

Eight Plus Capital has its headquarters at Athallasas 62, Strovolos, 3rd Floor, Office 301, Nicosia, Cyprus. It operates as a European regulated online broker specializing in CFD trading. The company's business model focuses on providing secure trading environments built on principles of trust and transparency. As reported by LinkedIn business profiles, the company maintains a relatively small team with 44 followers. It positions itself within the financial services sector targeting both retail and institutional clients.

The broker offers access to diverse financial instruments across multiple asset classes. These include foreign exchange pairs, contracts for difference, stock indices, precious metals, commodities, and bond markets. Eight Plus Capital operates under the regulatory oversight of the Cyprus Securities and Exchange Commission (CySEC). This commission provides the primary regulatory framework for the company's operations. This eight plus capital review notes that while the broker maintains regulatory compliance, specific license numbers and detailed regulatory information require verification through official channels.

Regulatory Jurisdiction: Eight Plus Capital operates under the supervision of the Cyprus Securities and Exchange Commission (CySEC). This commission provides regulatory oversight for the broker's operations within the European Union framework. However, specific license numbers and detailed regulatory documentation were not explicitly detailed in available materials.

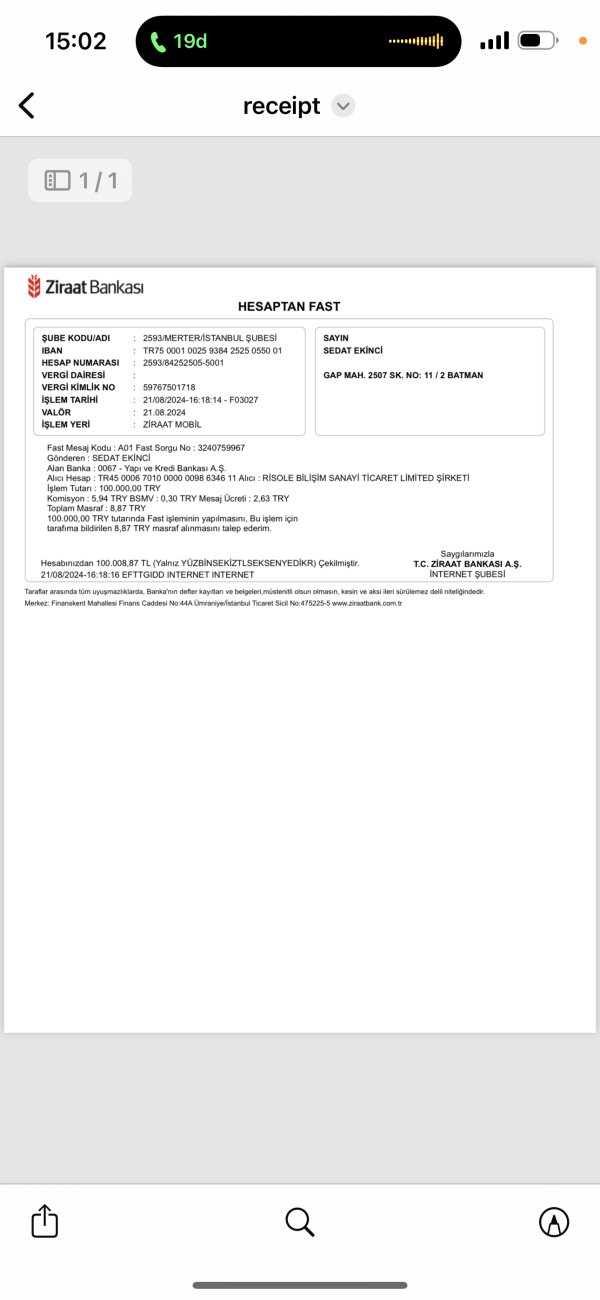

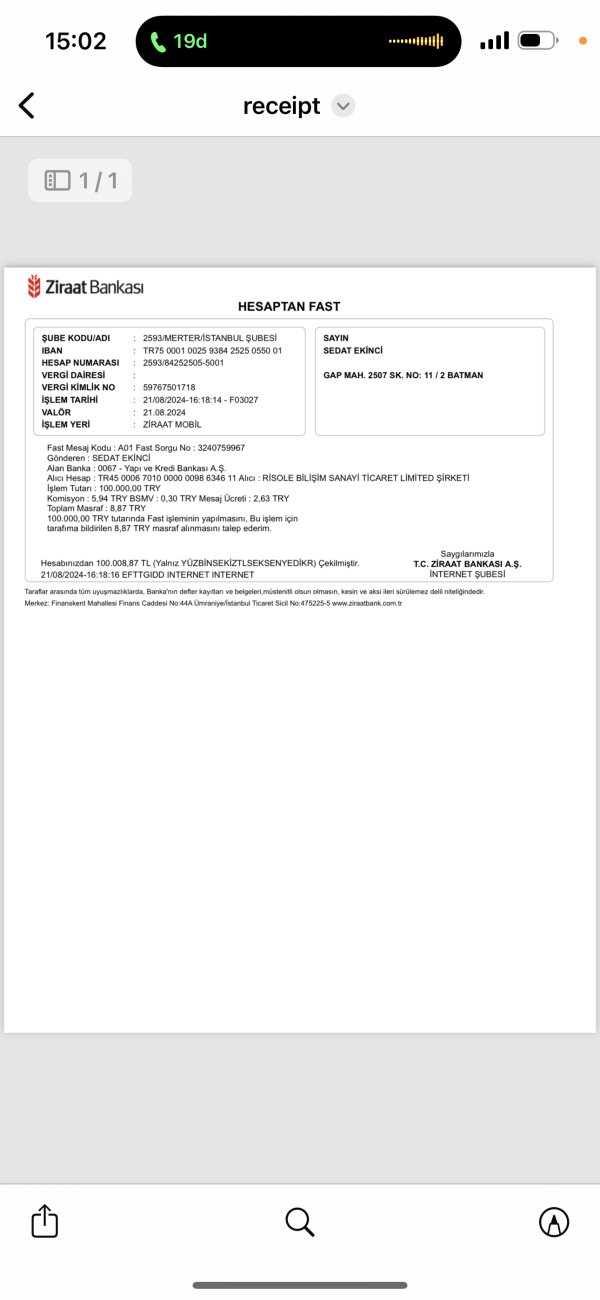

Deposit and Withdrawal Methods: Specific information regarding deposit and withdrawal methods was not comprehensively detailed in available documentation. This requires prospective clients to contact the broker directly for current payment processing options.

Minimum Deposit Requirements: The broker maintains a minimum deposit requirement of $200. This positions it as accessible to beginner and intermediate traders seeking entry-level investment thresholds.

Bonus and Promotional Offers: Details regarding current bonus structures and promotional campaigns were not specified in available documentation during this review period.

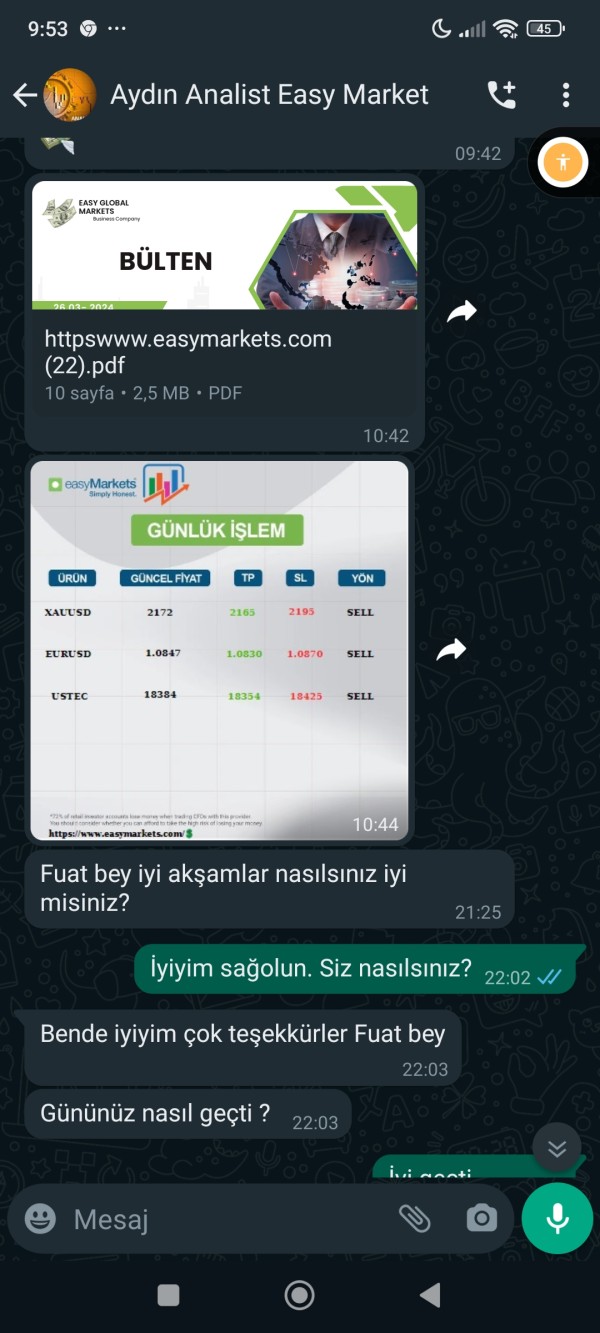

Available Trading Assets: Eight Plus Capital provides access to multiple asset categories. These include forex currency pairs, contracts for difference (CFDs), stock indices, precious metals, commodities, and bond instruments, offering diversified trading opportunities across global markets.

Cost Structure and Fees: While the broker advertises competitive trading costs, specific spread ranges, commission structures, and additional fees were not comprehensively detailed in available materials. This requires direct inquiry for current pricing information.

Leverage Options: Maximum leverage is capped at 1:100. This aligns with European regulatory requirements while providing reasonable amplification for trading positions.

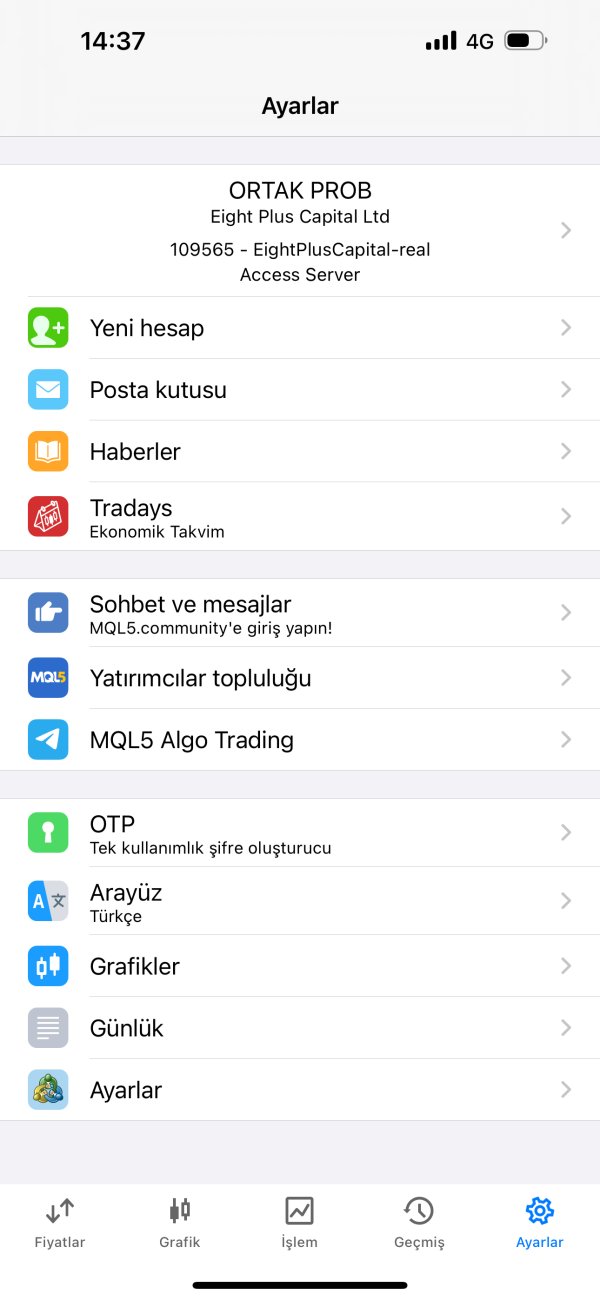

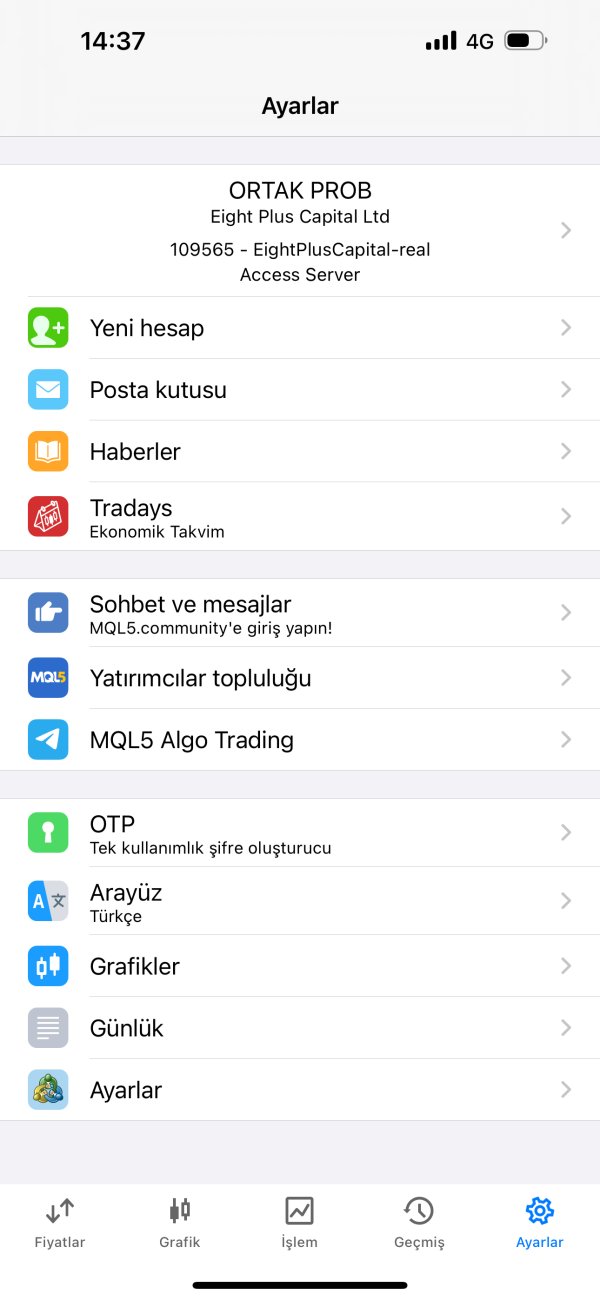

Trading Platform Options: The broker uses leading technology platforms. However, specific platform names and detailed functionality descriptions were not explicitly provided in available documentation.

Geographic Restrictions: Specific information regarding geographic restrictions and service availability across different jurisdictions was not detailed in available materials.

Customer Support Languages: Available customer support languages were not specified in the documentation reviewed for this eight plus capital review.

Detailed Rating Analysis

Account Conditions Analysis (Score: 6/10)

Eight Plus Capital's account conditions present a mixed picture for potential traders. The broker's $200 minimum deposit requirement positions it competitively within the industry standard range. This makes it accessible to beginner traders while not being so low as to raise quality concerns. This threshold strikes a reasonable balance between accessibility and serious trading intent.

However, significant information gaps exist regarding specific account types and their respective features. Available documentation does not clearly outline whether the broker offers multiple account tiers, Islamic accounts for Muslim traders, or specialized accounts for different trading strategies. The lack of transparency in account structure details represents a notable weakness in the broker's presentation.

The maximum leverage of 1:100 complies with European regulatory requirements while providing sufficient amplification for most trading strategies. This conservative approach to leverage demonstrates regulatory compliance but may limit appeal for traders seeking higher risk-reward ratios available elsewhere.

User feedback regarding account conditions has been mixed, with some complaints noted about account management processes. The absence of detailed information about account opening procedures, verification requirements, and ongoing account maintenance fees creates uncertainty for prospective clients. This eight plus capital review identifies the need for greater transparency in account condition communication as a key area for improvement.

Eight Plus Capital demonstrates strength in providing comprehensive trading tools and technical resources for market analysis. According to available information, the broker offers various technical indicators, charting capabilities, and economic calendar features that support informed trading decisions. These tools appear to meet the basic requirements for technical analysis across multiple asset classes.

The broker's commitment to using leading technology suggests investment in platform capabilities. However, specific details about proprietary tools or unique analytical features remain unclear. The availability of standard trading tools positions Eight Plus Capital competitively within the industry, particularly for intermediate traders seeking robust analytical capabilities.

However, educational resources and research materials appear to be less comprehensively documented. The absence of detailed information about trading education, market research publications, or educational webinars represents a potential weakness for beginner traders. These traders often require substantial educational support during their learning phase.

User feedback regarding tool effectiveness has been generally positive, though the lack of specific platform performance data makes it difficult to assess the quality and reliability of the provided tools comprehensively. The broker would benefit from more detailed documentation of its technological capabilities and educational resource offerings.

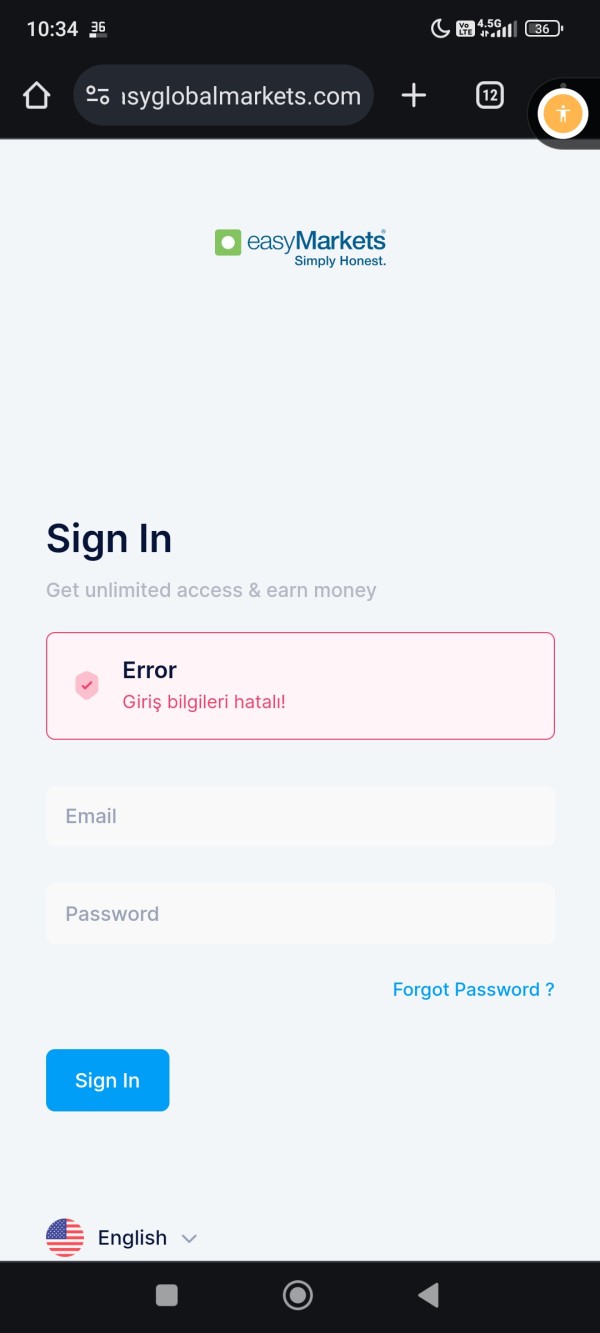

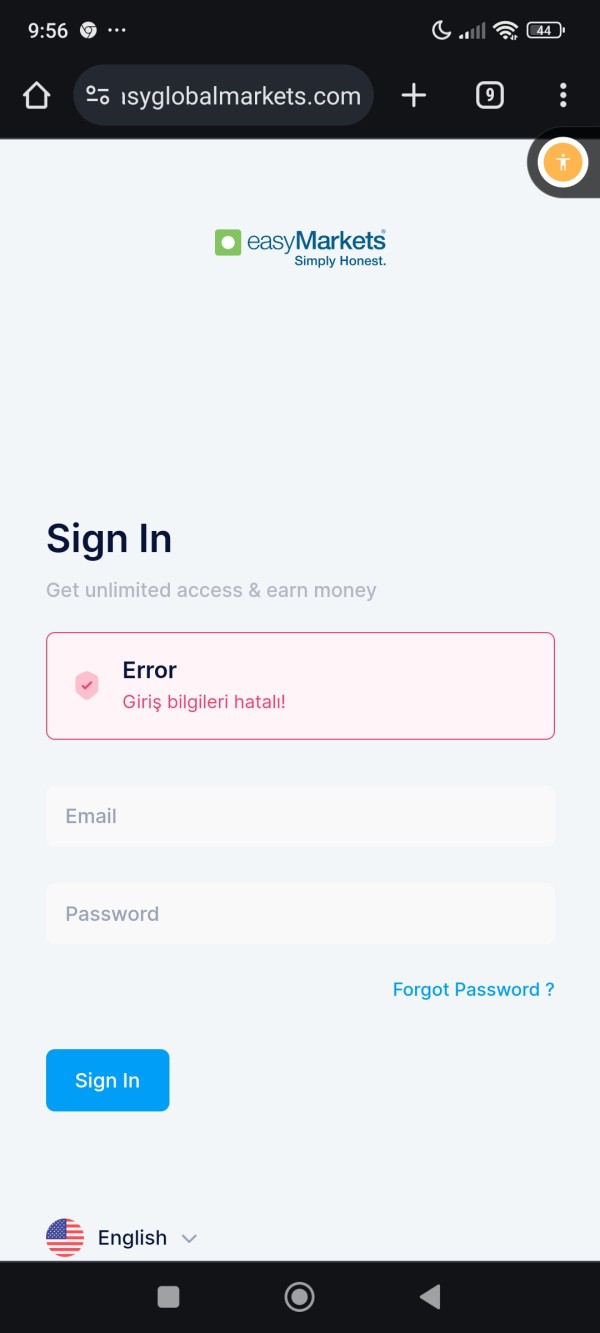

Customer Service and Support Analysis (Score: 5/10)

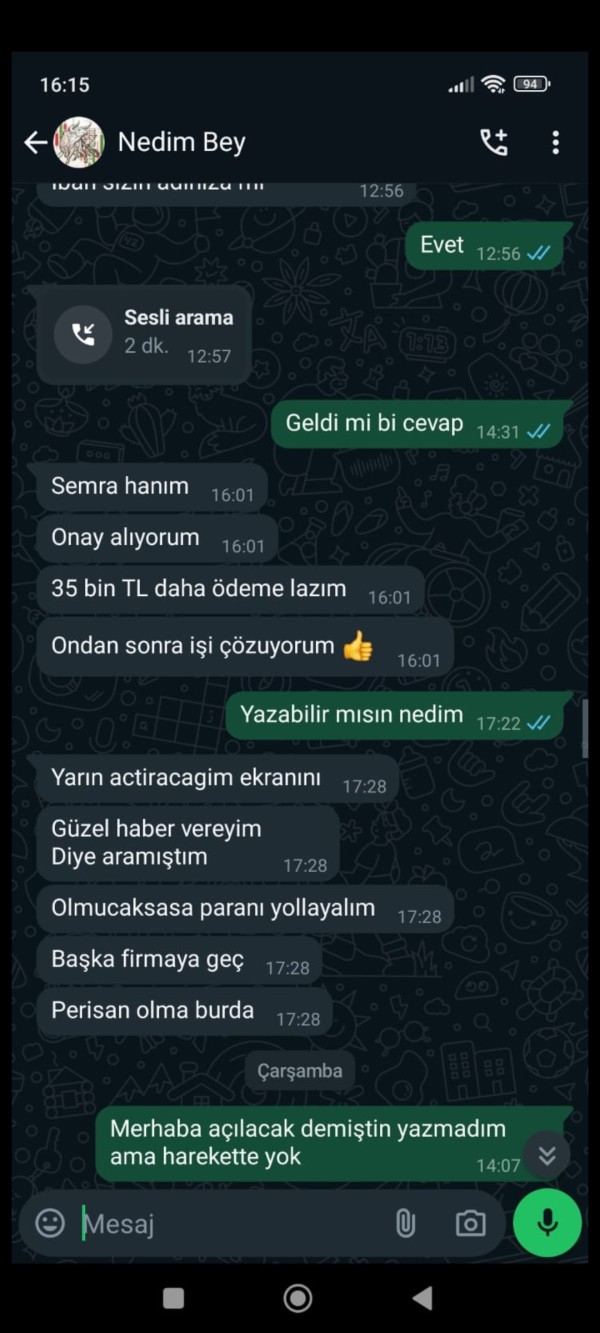

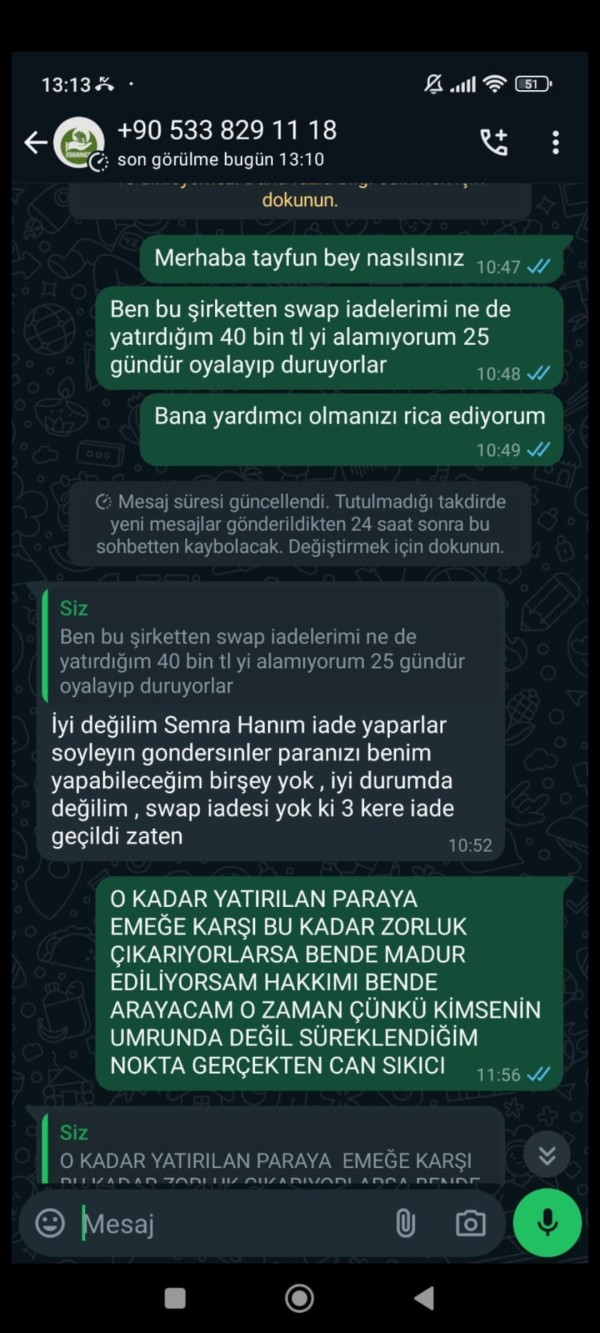

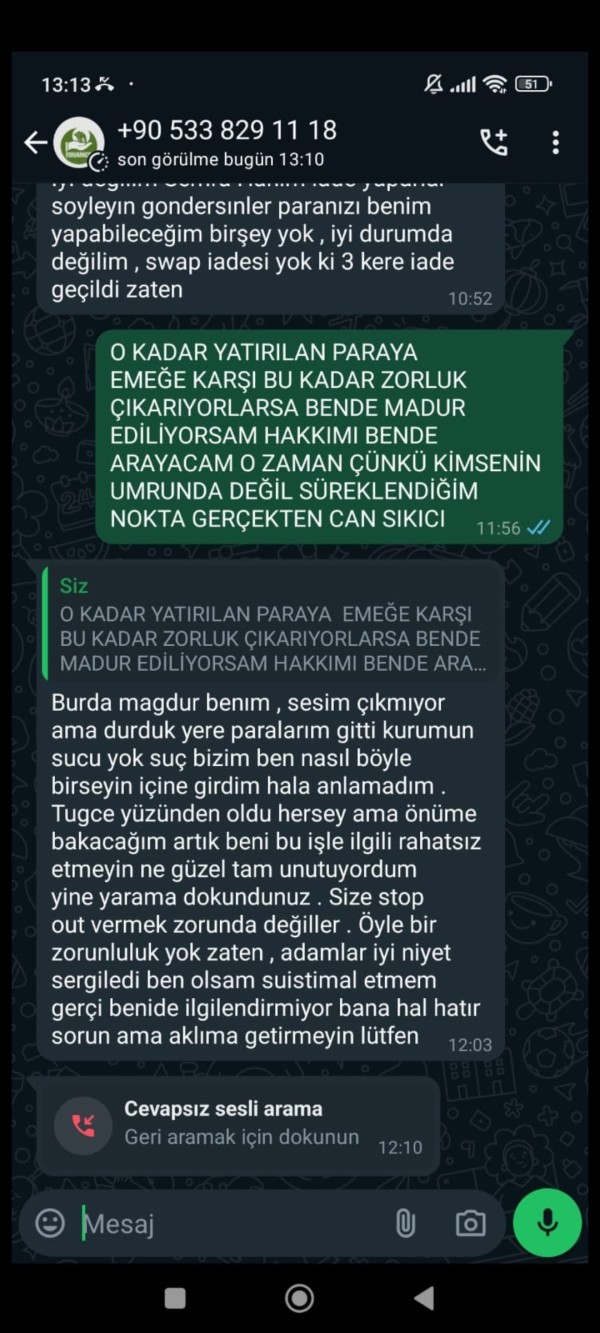

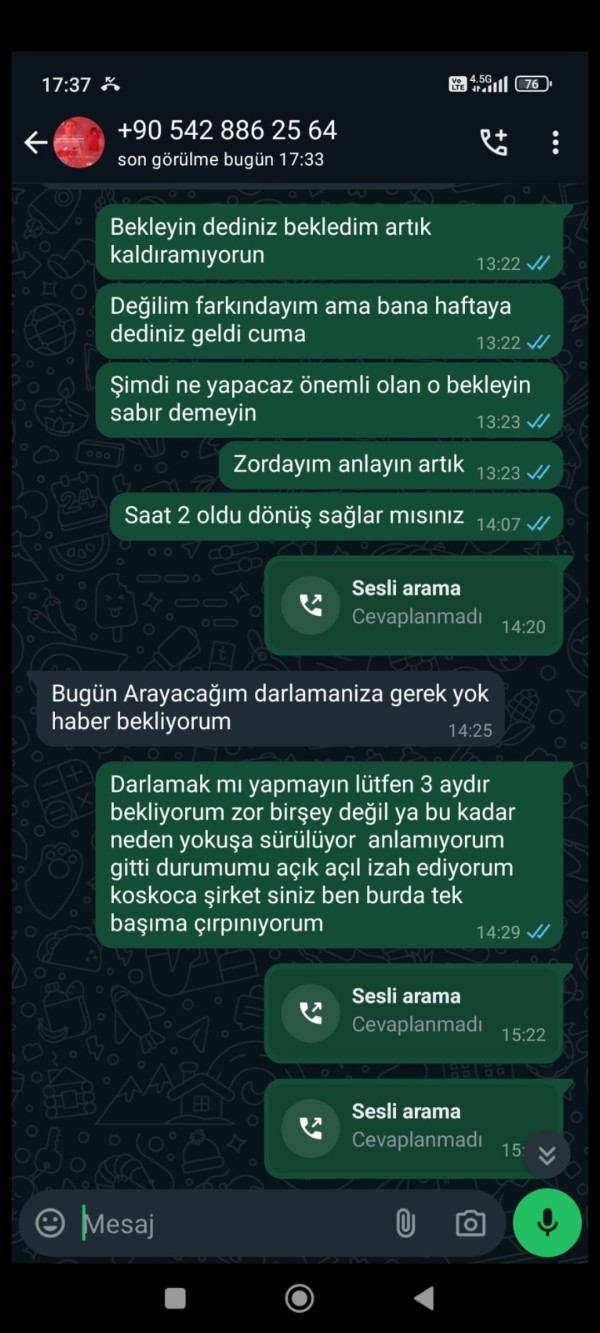

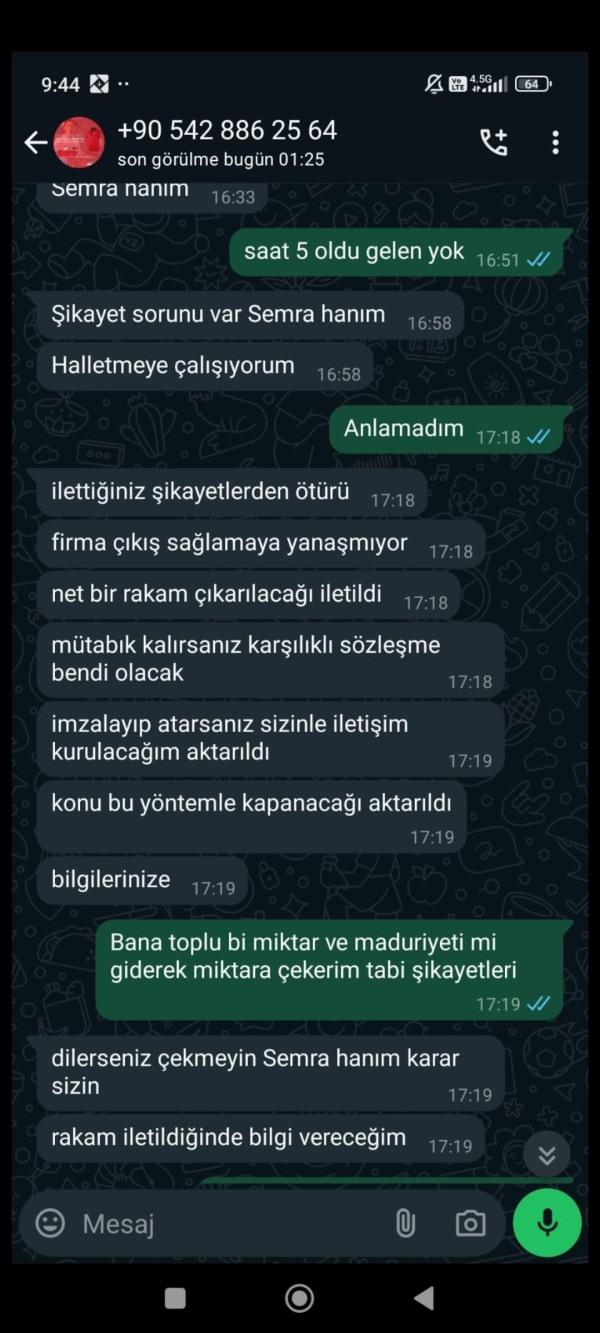

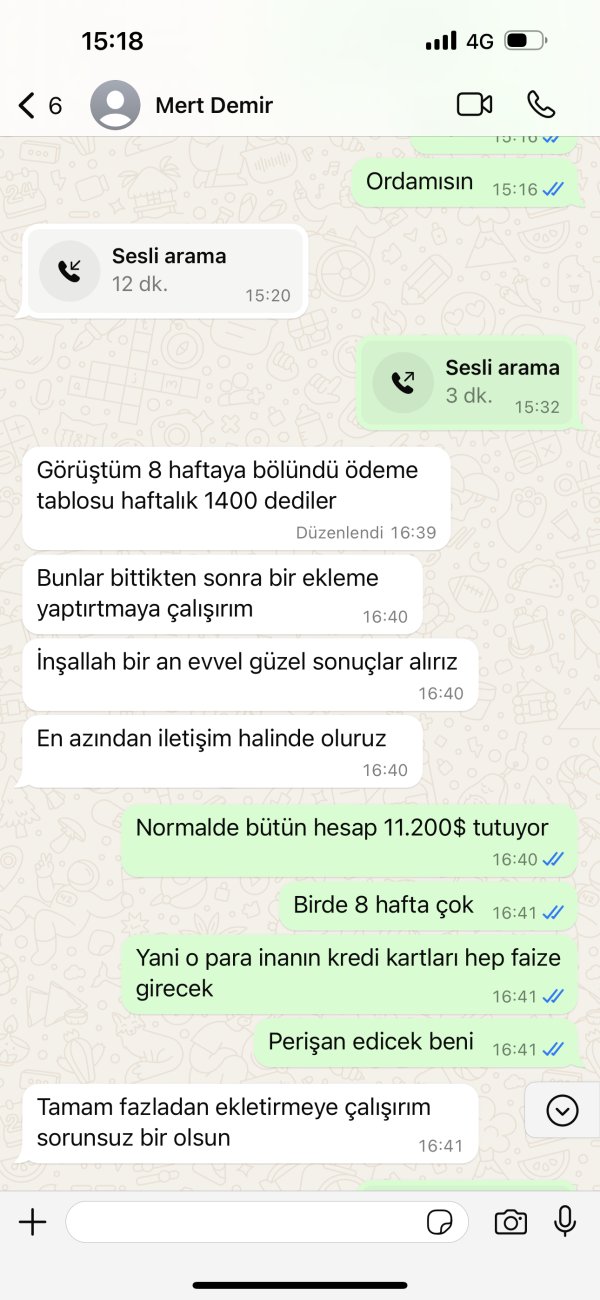

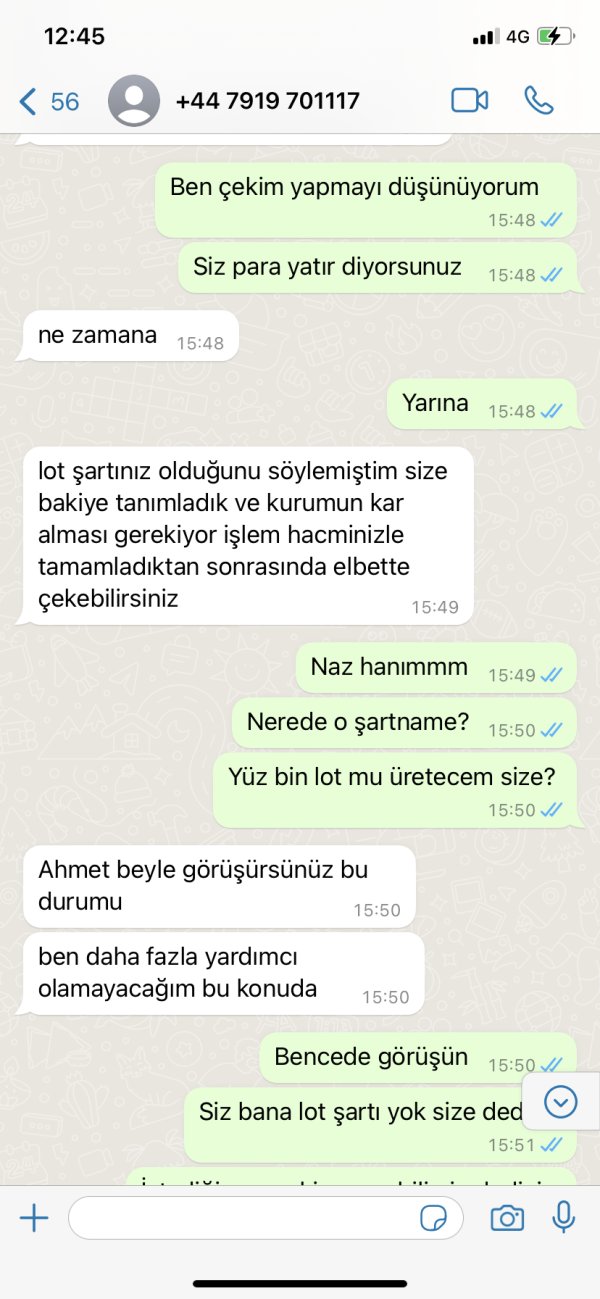

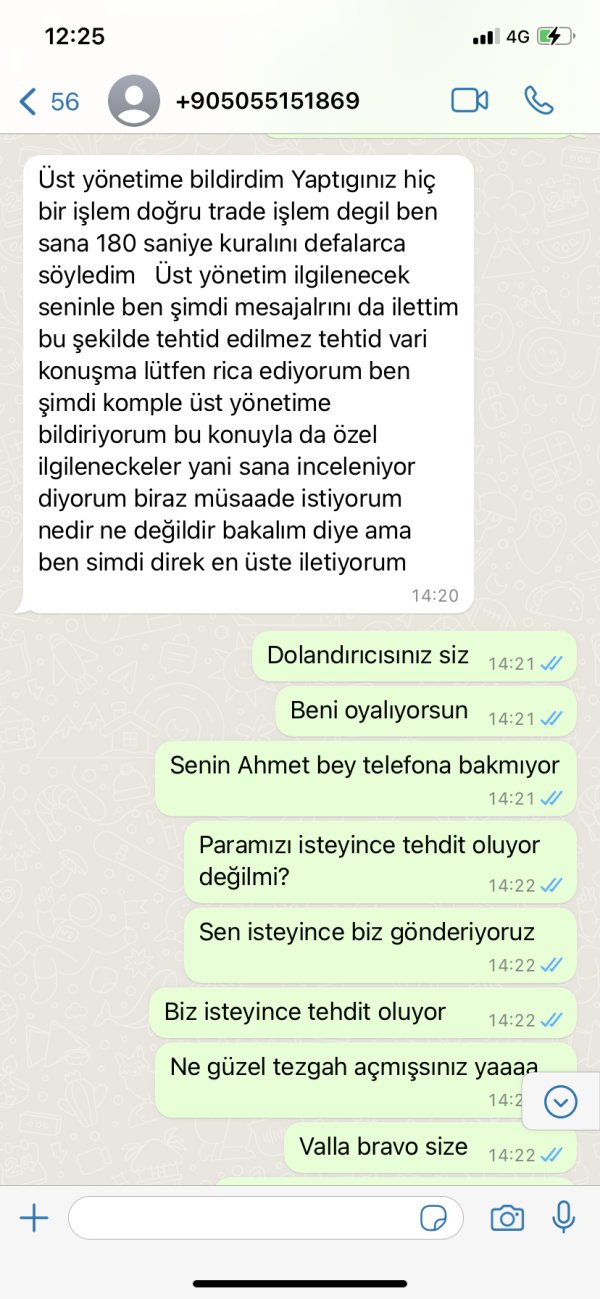

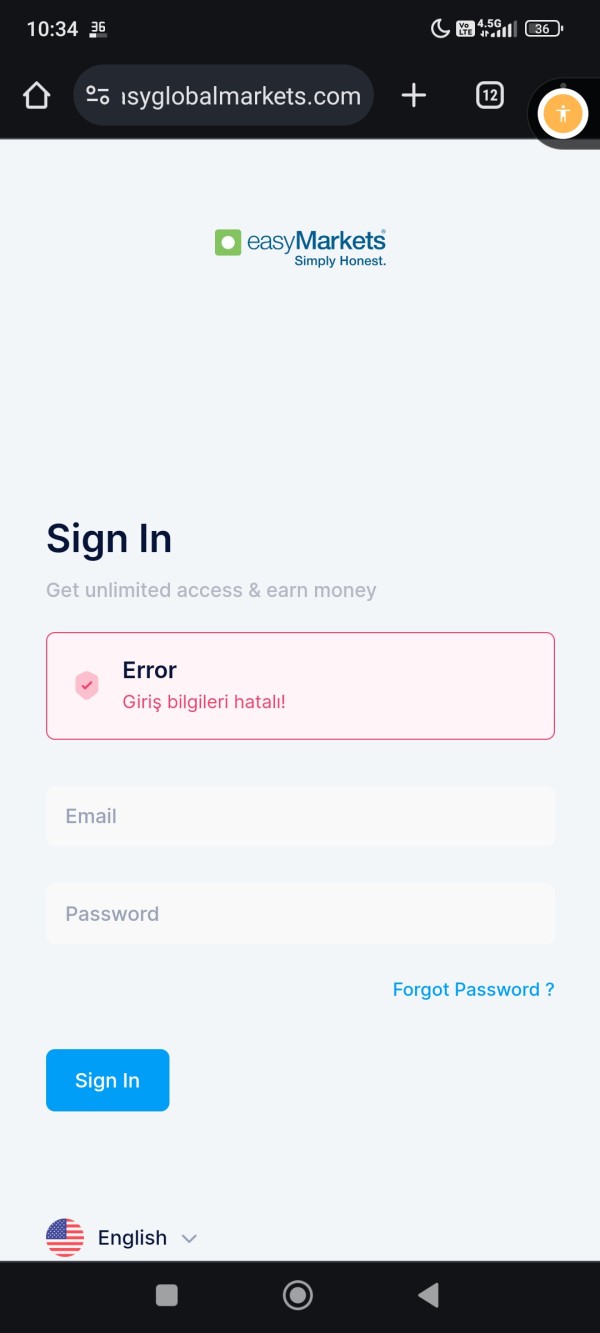

Customer service represents a significant concern area for Eight Plus Capital based on available feedback and documentation. User complaints have been noted across multiple platforms, suggesting systematic issues with service quality and responsiveness. The presence of these complaints has attracted regulatory attention. This indicates that service problems may be more than isolated incidents.

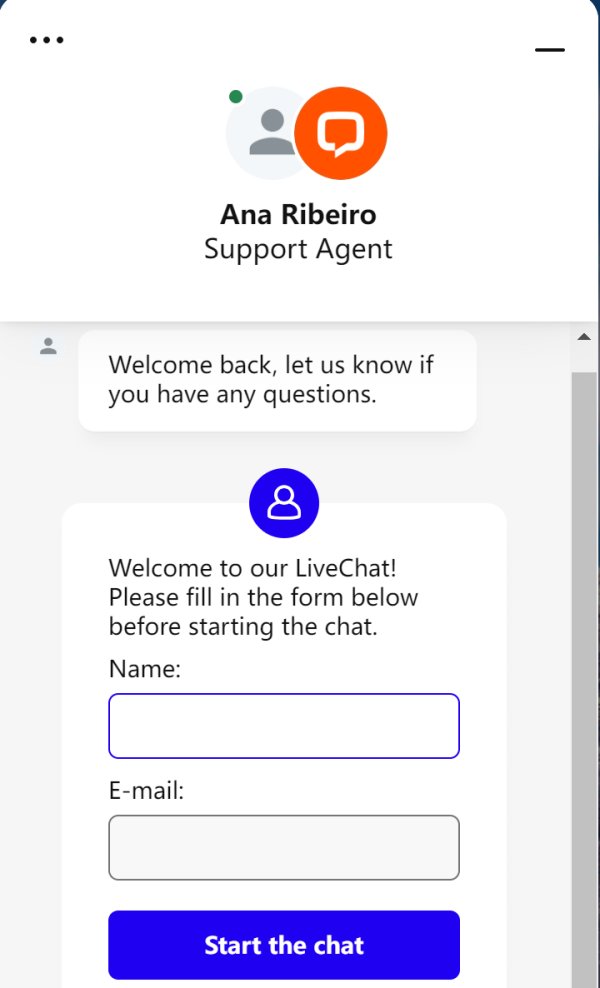

Available documentation does not provide clear information about customer support channels, availability hours, or response time commitments. This lack of transparency in support structure makes it difficult for potential clients to understand what level of service they can expect. The absence of detailed support information represents a significant weakness in the broker's client communication strategy.

Language support capabilities remain unclear, which could present barriers for international clients seeking assistance in their native languages. Multi-language support is typically essential for brokers serving diverse geographic markets. The lack of clear information about language capabilities raises questions about service accessibility.

The concerning pattern of user complaints suggests that Eight Plus Capital may need to invest significantly in improving customer service infrastructure and training. Regulatory warnings related to customer complaints indicate that service issues have reached levels requiring official intervention. This represents a serious red flag for potential clients considering this broker.

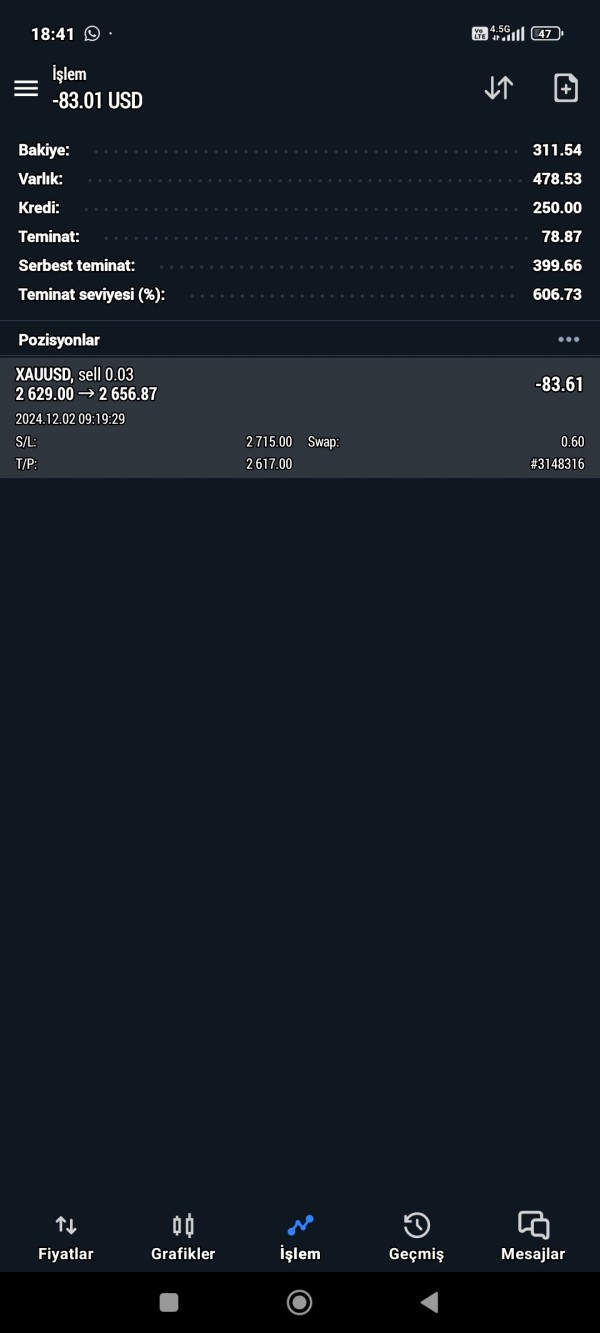

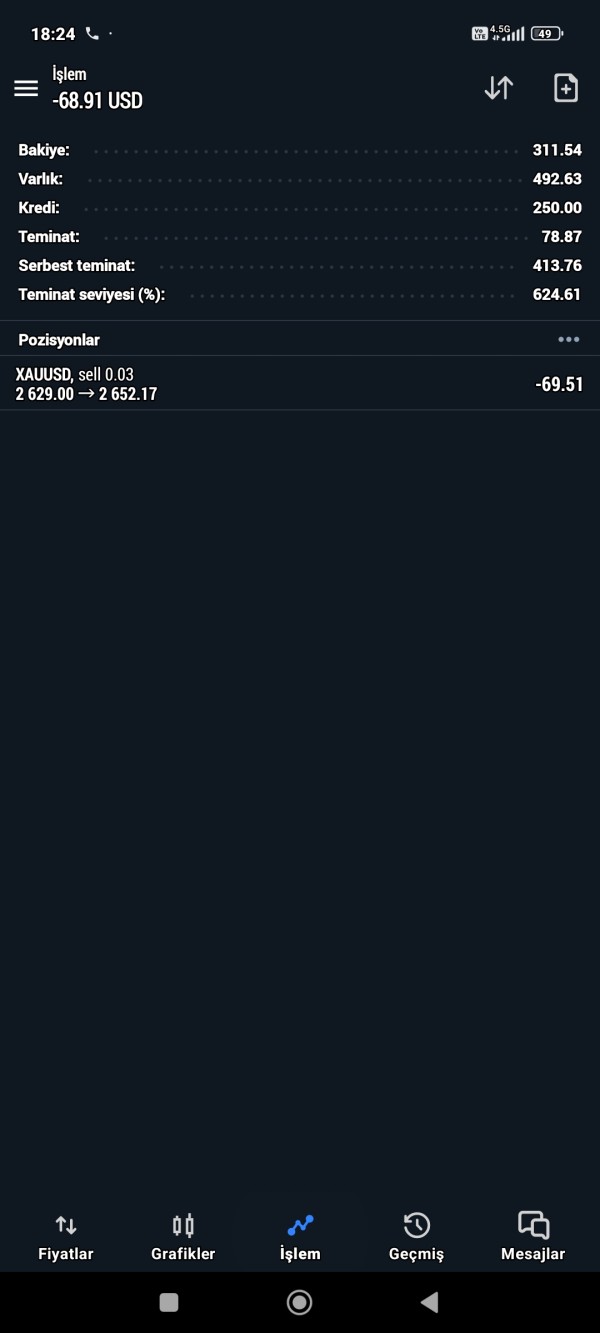

Trading Experience Analysis (Score: 7/10)

Eight Plus Capital reports trading speeds of 0ms, which, if accurate, would indicate excellent execution performance for client orders. However, the lack of independent verification or detailed performance metrics makes it difficult to assess the reliability and consistency of these execution speeds across different market conditions and trading volumes.

The broker's use of leading technology suggests investment in trading infrastructure. However, specific platform names and detailed functionality descriptions remain limited. Without clear information about the trading platforms offered, it becomes challenging to evaluate the complete trading experience, including interface design, order management capabilities, and advanced trading features.

Order execution quality, including slippage rates and requote frequency, lacks detailed documentation in available materials. These factors significantly impact trading experience, particularly for active traders and those employing scalping strategies. The absence of transparent execution statistics represents a gap in the broker's performance communication.

Mobile trading capabilities and cross-device synchronization features were not specifically addressed in available documentation. Given the increasing importance of mobile trading for modern traders, the lack of clear information about mobile platform capabilities represents a potential weakness in the broker's offering. This eight plus capital review notes that comprehensive platform information would significantly enhance trader confidence in the broker's technological capabilities.

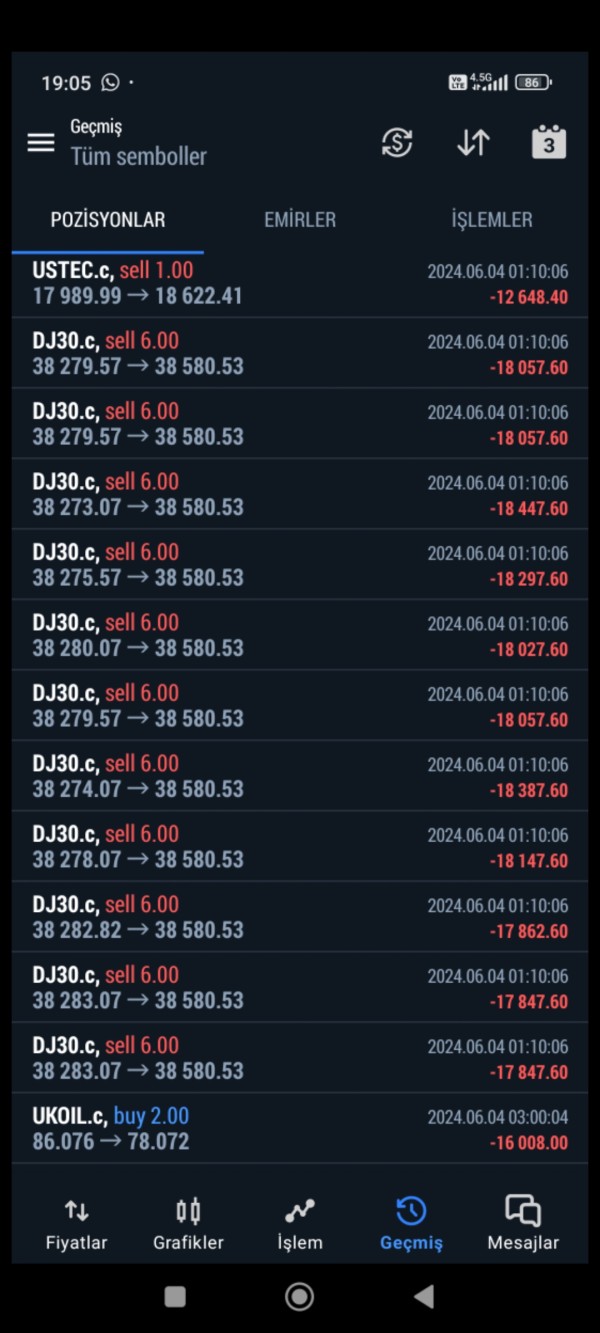

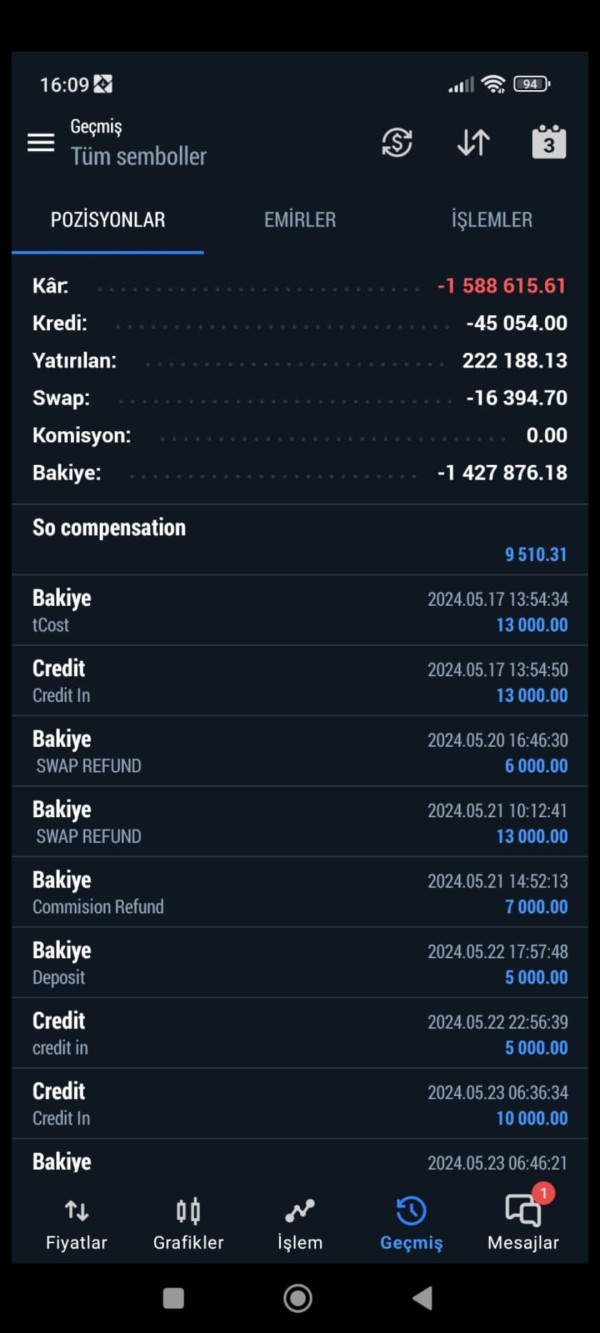

Trust and Reliability Analysis (Score: 4/10)

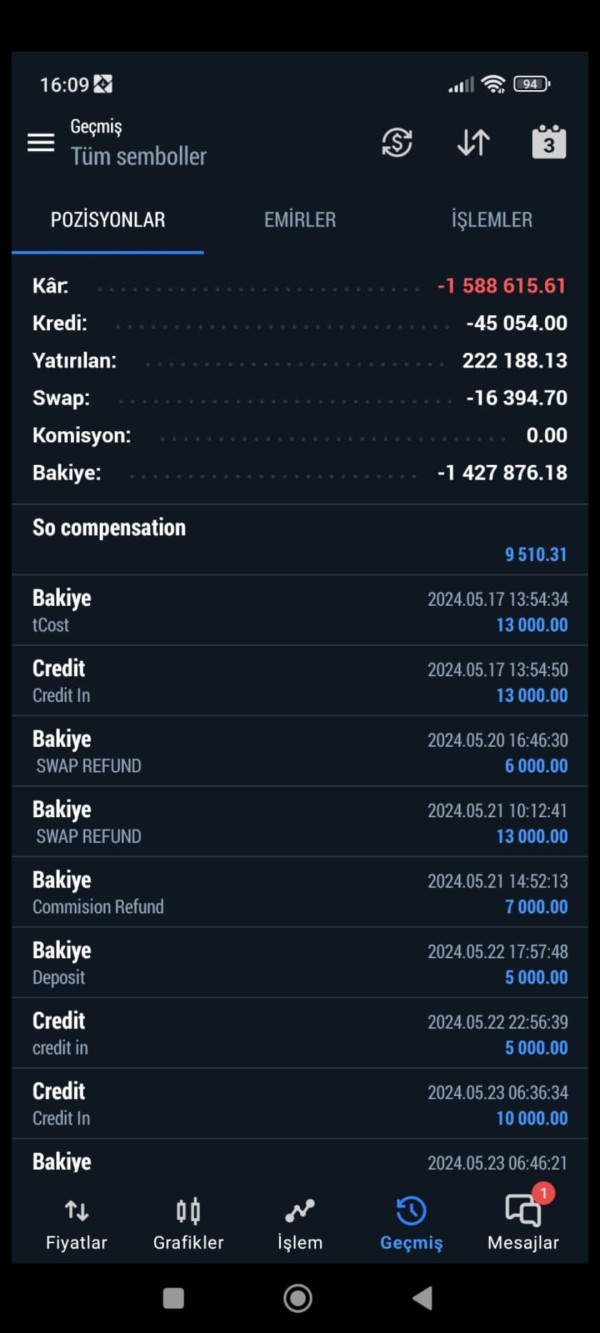

Trust and reliability represent the most concerning aspects of Eight Plus Capital's operations based on available information. While the broker operates under CySEC regulation, which provides a basic regulatory framework, the presence of regulatory warnings and increasing user complaints raises significant concerns about operational standards and client treatment.

The Cyprus Securities and Exchange Commission regulation provides some level of oversight. However, the specific license number and detailed regulatory compliance information were not readily available in reviewed documentation. This lack of transparency regarding regulatory credentials makes it difficult for clients to verify the broker's standing and compliance status independently.

Fund security measures and client protection protocols were not detailed in available materials. This represents a critical information gap for potential clients concerned about capital safety. The absence of clear information about segregated client accounts, deposit insurance, or compensation schemes raises questions about client fund protection standards.

The documented presence of user complaints and regulatory concerns indicates systematic issues that extend beyond isolated incidents. When regulatory bodies issue warnings or express concerns about a broker's operations, it typically indicates serious compliance or operational problems. These require immediate attention and resolution.

User Experience Analysis (Score: 6/10)

User experience feedback for Eight Plus Capital presents a mixed picture with notable concerns that impact overall satisfaction ratings. While some users may find the broker's services adequate for basic trading needs, the documented presence of complaints and negative feedback suggests that user satisfaction levels are inconsistent and problematic.

The broker's target demographic of beginner and intermediate traders requires particular attention to user experience design, educational support, and intuitive platform interfaces. However, available documentation does not provide detailed information about user interface design, onboarding processes, or user journey optimization. This makes it difficult to assess how well the broker serves its intended market segment.

Registration and account verification processes were not specifically detailed in available materials. However, user complaints suggest that these processes may present challenges or frustrations for some clients. Smooth onboarding experiences are crucial for broker success, particularly when targeting less experienced traders who may be unfamiliar with standard brokerage procedures.

The pattern of user complaints and regulatory concerns indicates that Eight Plus Capital faces significant challenges in delivering consistent, high-quality user experiences. Improvements in customer service, platform transparency, and communication clarity would be essential for enhancing overall user satisfaction. These changes would also help build long-term client relationships.

Conclusion

This comprehensive eight plus capital review reveals a broker with both potential strengths and significant areas of concern. Eight Plus Capital's regulatory framework under CySEC supervision and reasonable entry requirements make it potentially suitable for beginner and intermediate traders seeking accessible forex and CFD trading opportunities. However, documented user complaints, regulatory warnings, and transparency gaps in key operational areas present serious concerns. Prospective clients must carefully consider these issues.

The broker's strengths include competitive minimum deposit requirements, regulatory oversight, and comprehensive asset offerings across multiple financial markets. However, weaknesses in customer service quality, transparency in operational details, and concerning user feedback patterns significantly impact the overall assessment and recommendation.

Potential clients should conduct thorough due diligence, verify current regulatory status, and carefully consider the documented concerns before engaging with Eight Plus Capital for their trading activities.