Is DMACAPITALS safe?

Pros

Cons

Is DMA Capitals A Scam?

Introduction

DMA Capitals is a forex broker that positions itself as a multi-asset trading platform, offering a range of financial instruments including forex, commodities, indices, and stocks. As the online trading landscape continues to expand, the need for traders to rigorously evaluate the legitimacy and reliability of forex brokers becomes increasingly critical. With numerous reports of scams and fraudulent activities in the industry, traders must exercise caution before committing their funds. This article aims to investigate the credibility of DMA Capitals by analyzing its regulatory status, company background, trading conditions, customer fund security, user experiences, platform performance, and associated risks.

Regulation and Legitimacy

The regulatory framework surrounding a forex broker is paramount in determining its legitimacy and the safety of client funds. DMA Capitals claims to operate out of Saint Vincent and the Grenadines, a region known for its lenient regulatory environment. However, multiple sources indicate that the broker is unregulated, posing significant risks to potential investors. The following table summarizes the core regulatory information related to DMA Capitals:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The lack of regulatory oversight means that DMA Capitals does not adhere to any established financial authority's standards, which could provide essential protections for traders, such as segregated accounts and negative balance protection. This absence raises red flags about the broker's operational integrity and the safety of client funds, making it crucial for traders to approach this broker with caution.

Company Background Investigation

DMA Capitals was reportedly established in 2021, but there is scant information regarding its ownership structure and operational history. The broker claims to have a global presence, but the lack of transparency surrounding its management team and operational practices is concerning. A thorough background check reveals that the broker does not disclose the identities of its executives or their professional qualifications. This opacity can be a significant warning sign, as reputable brokers typically provide detailed information about their management teams to instill confidence among potential clients.

Furthermore, the broker's website lacks comprehensive disclosures about its business practices, which is essential for building trust. The combination of limited information and the offshore nature of its operations suggests that DMA Capitals may not be a reliable trading partner.

Trading Conditions Analysis

Understanding the trading conditions a broker offers is crucial for traders looking to maximize their investment potential. DMA Capitals advertises competitive trading conditions, including a low minimum deposit requirement of $10 and leverage of up to 1:500. However, the overall fee structure raises concerns. The following table compares DMA Capitals' core trading costs with industry averages:

| Cost Type | DMA Capitals | Industry Average |

|---|---|---|

| Spread for Major Currency Pairs | 0.6 pips | 0.2 - 0.5 pips |

| Commission Model | $5 - $7 per lot | $3 - $5 per lot |

| Overnight Interest Range | Varies | Varies |

While DMA Capitals offers spreads as low as 0.6 pips, this is still higher than the industry average, which may eat into traders' profits. Additionally, the commission structure is less favorable compared to other brokers, raising questions about the overall cost-effectiveness of trading with DMA Capitals.

Client Fund Security

Client fund security is one of the most critical aspects of a forex broker's operations. DMA Capitals does not provide clear information regarding its fund security measures. There are indications that client funds may not be held in segregated accounts, which is a standard practice among regulated brokers to protect client money from operational risks. Furthermore, the absence of negative balance protection means that traders could potentially lose more than their initial investment.

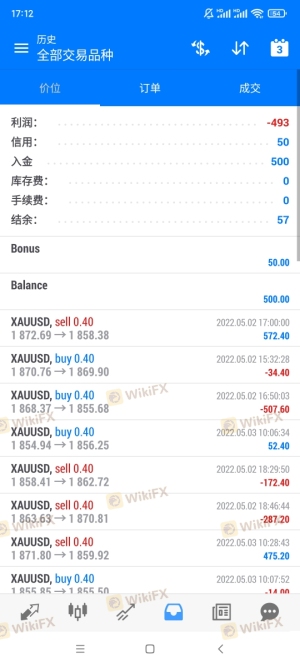

Historically, there have been allegations against DMA Capitals regarding withdrawal issues, where clients have reported difficulties in accessing their funds after making profits. Such incidents raise substantial concerns about the broker's financial practices and the safety of client investments.

Customer Experience and Complaints

The experiences of existing and former clients can provide valuable insights into the reliability of a broker. Reviews of DMA Capitals reveal a mixed bag of feedback, with numerous complaints centered around withdrawal difficulties and poor customer service. The following table summarizes the primary complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/Unresponsive |

| Poor Customer Support | Medium | Average |

| Misleading Promotions | High | Unclear |

Typical complaints involve clients being unable to withdraw their funds despite having profitable trades, leading to frustration and distrust. In several cases, users have reported that their withdrawal requests were ignored or delayed, which is a significant red flag for any trading platform.

Platform and Trade Execution

The trading platform offered by DMA Capitals is the widely recognized MetaTrader 5 (MT5), known for its advanced features and user-friendly interface. However, the quality of order execution and the potential for slippage are crucial factors that can impact trading outcomes. Reports from users indicate that while the platform itself is stable, there have been instances of slippage and rejected orders during high volatility periods.

Moreover, the lack of transparency regarding the broker's execution policies raises concerns about potential manipulation. Traders should be wary of platforms that do not clearly outline their order execution practices, as this can lead to unexpected trading outcomes.

Risk Assessment

Using DMA Capitals comes with inherent risks, particularly due to its unregulated status and reported customer service issues. The following risk assessment summarizes key risk areas associated with the broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status poses significant risks. |

| Fund Security Risk | High | Lack of segregation and negative balance protection. |

| Customer Service Risk | Medium | Frequent complaints about withdrawal issues. |

To mitigate these risks, traders should consider using smaller amounts for initial deposits and thoroughly research alternative brokers with established regulatory oversight and positive user experiences.

Conclusion and Recommendations

In conclusion, DMA Capitals exhibits several concerning traits that suggest it may not be a reliable trading partner. The absence of regulatory oversight, coupled with numerous complaints regarding withdrawal issues and a lack of transparency, raises significant red flags. While the broker offers competitive trading conditions, the associated risks may outweigh the benefits for many traders.

For those considering trading with DMA Capitals, it is advisable to proceed with caution and consider alternative options. Reputable brokers with solid regulatory frameworks, such as IG, OANDA, or Forex.com, may provide a safer trading environment. Ultimately, traders should prioritize their financial safety and choose brokers that demonstrate transparency, reliability, and compliance with industry standards.

Is DMACAPITALS a scam, or is it legit?

The latest exposure and evaluation content of DMACAPITALS brokers.

DMACAPITALS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

DMACAPITALS latest industry rating score is 2.05, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.05 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.