DMA Capitals 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

DMA Capitals positions itself as an enticing low-cost forex trading platform appealing to new and less capitalized traders seeking a variety of financial instruments, including forex, commodities, and contracts for difference (CFDs). With a minimum deposit requirement as low as $10 and maximum leverage reaching an appealing 1:500, it presents attractive trading conditions for those aiming to maximize their market engagement. However, this accessible entry-point comes with significant caveats, chiefly due to its lack of regulatory oversight.

The absence of proper regulation poses profound risks concerning fund safety and overall reliability. Multiple reviews raise red flags, highlighting user concerns over withdrawal difficulties and compounded by a dearth of transparent fee structures. Therefore, while DMA Capitals may initially appear to offer an accessible trading platform, potential users must carefully weigh its low costs against the serious implications of unregulated trading.

⚠️ Important Risk Advisory & Verification Steps

- Warning: Trading with an unregulated broker can result in substantial financial loss. Verify the legitimacy of any broker before depositing funds.

- Potential Risks:

- No regulatory oversight.

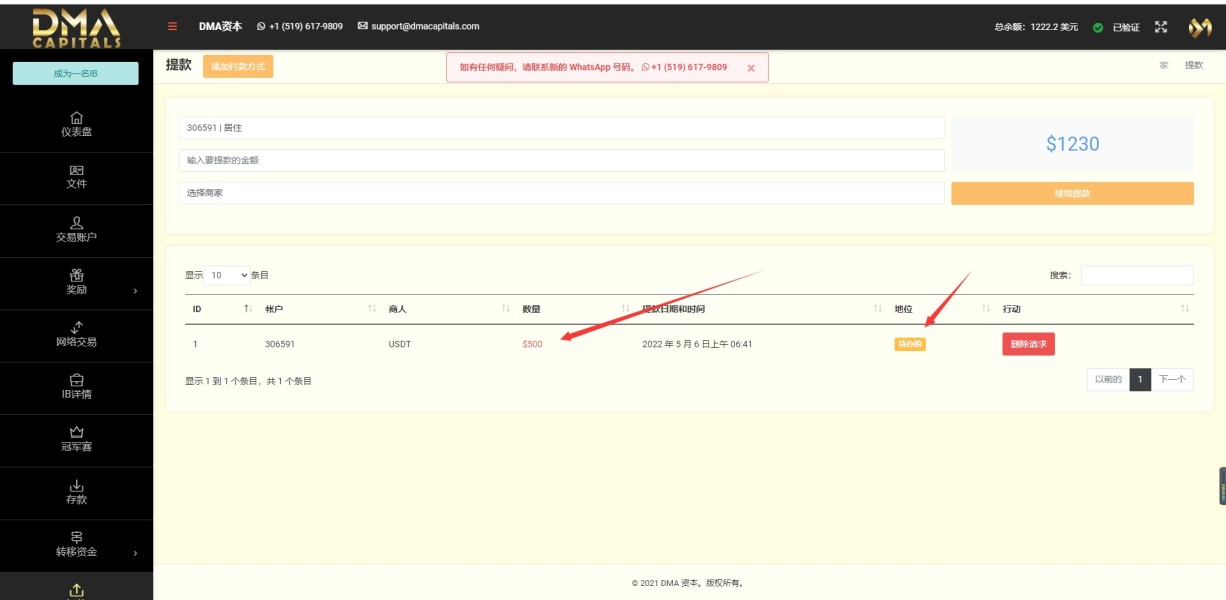

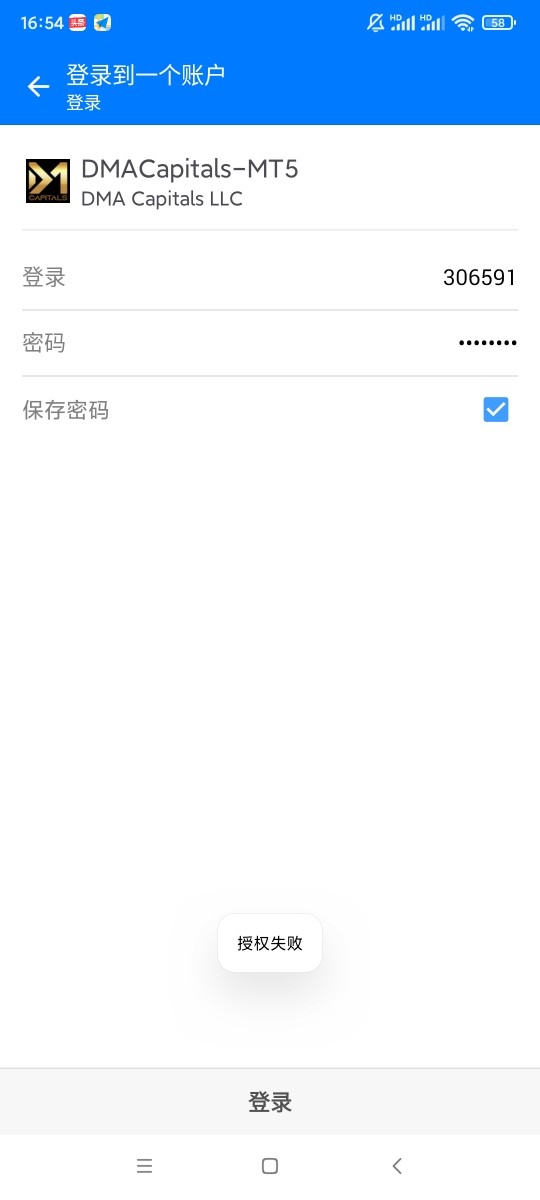

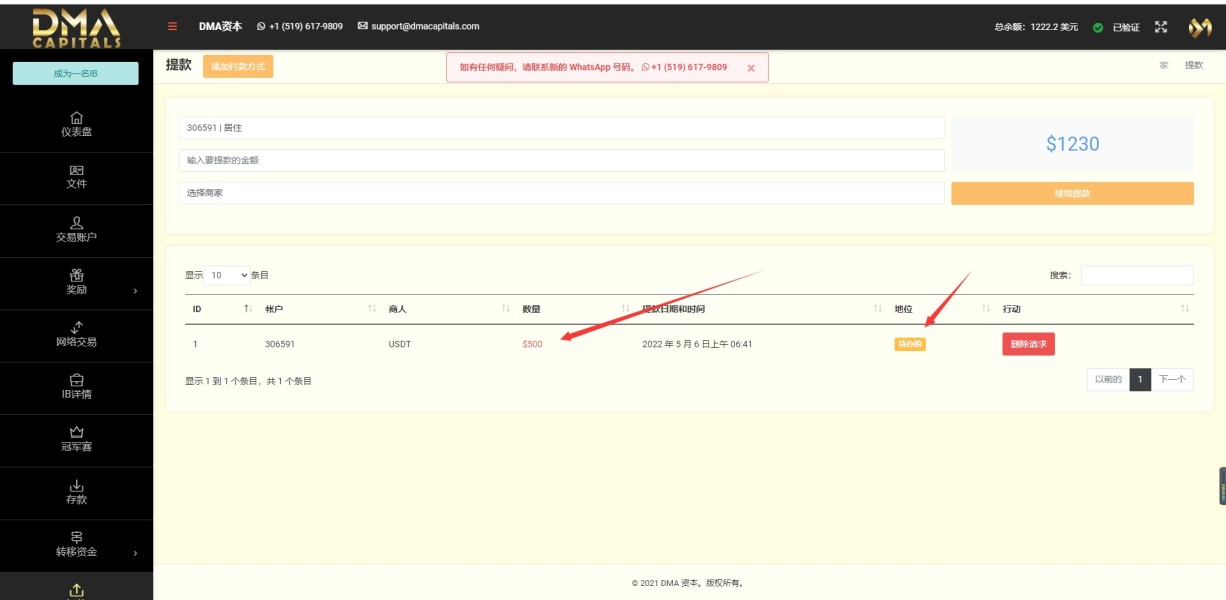

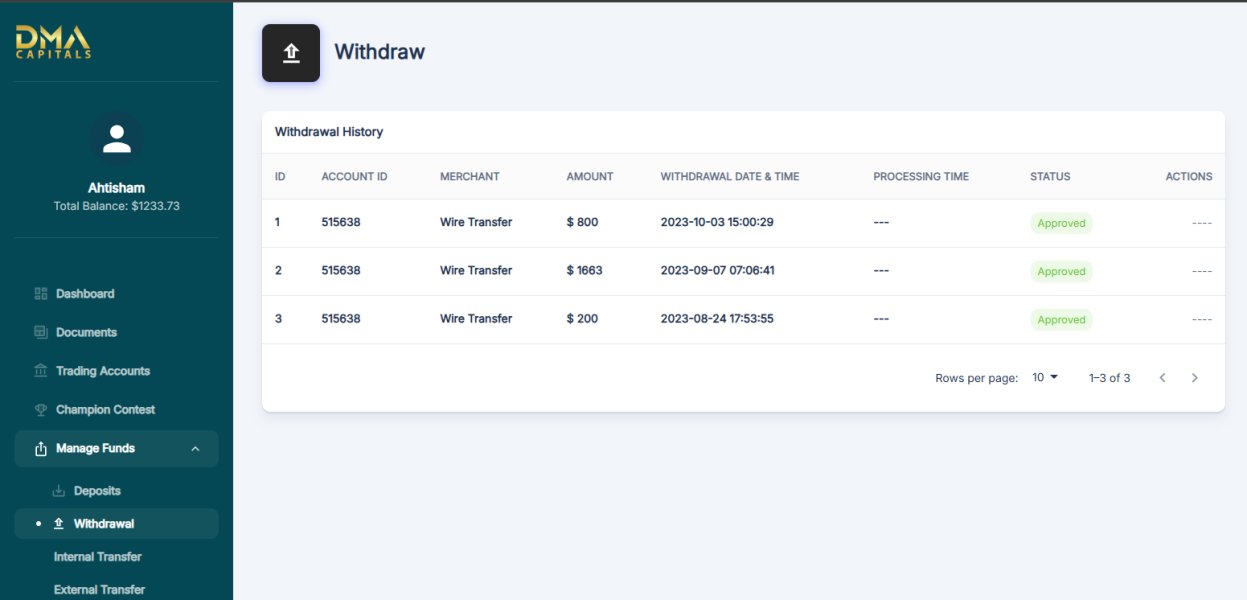

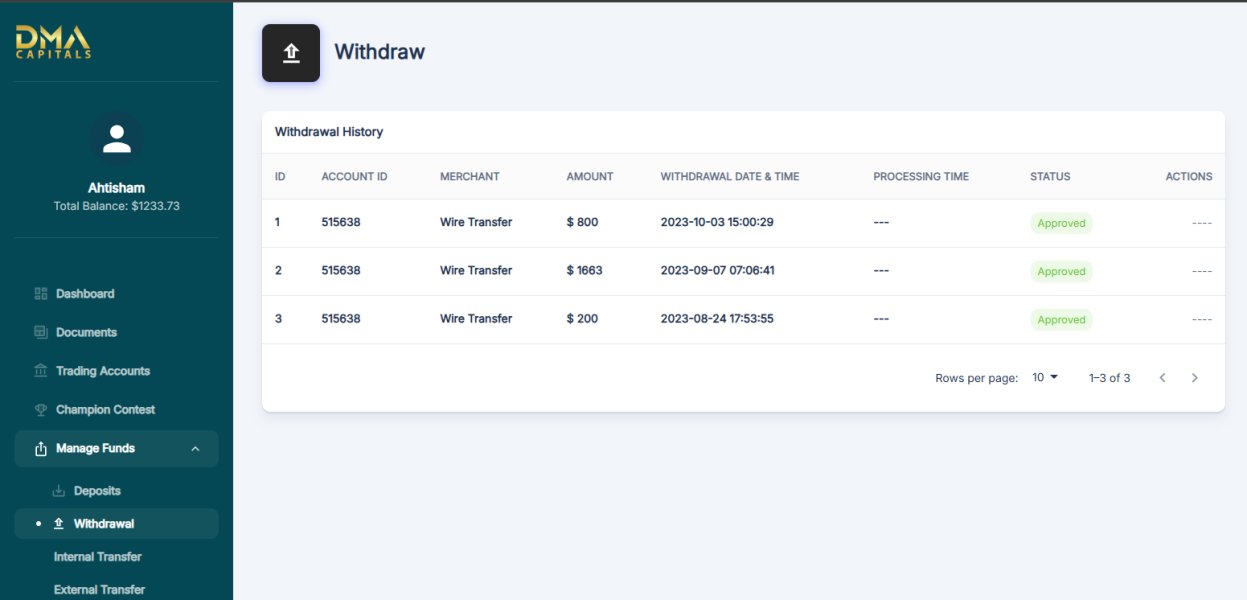

- History of withdrawal difficulties reported by users.

- Possible hidden fees and high spreads.

Self-Verification Steps:

- Visit the official websites of recognized regulatory authorities (e.g., NFA, FCA).

- Search using the broker's name in the relevant databases to confirm regulatory status.

- Review user feedback on independent platforms for insights into others' experiences with withdrawals and fund safety.

Rating Framework

Broker Overview

Company Background and Positioning

Founded in 2021, DMA Capitals operates as a forex broker based out of Saint Vincent and the Grenadines. The appeal of this broker is its attractive trading conditions, tailored primarily to a demographic seeking high leverage and low entry costs. However, its positioning in a notorious offshore jurisdiction raises significant concerns, as the region is often associated with lax regulation and susceptibility to fraudulent practices.

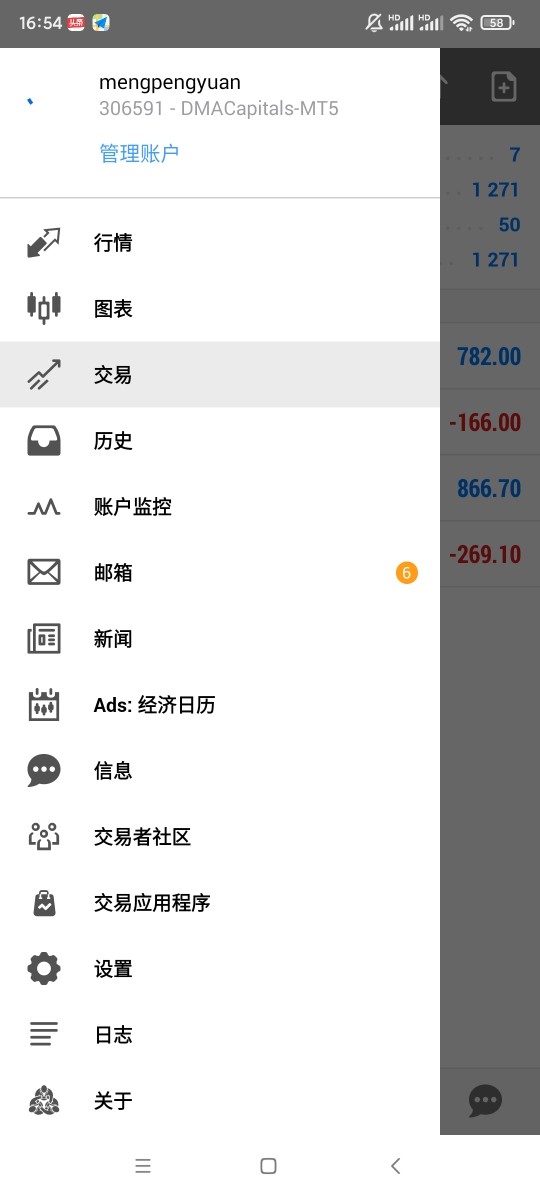

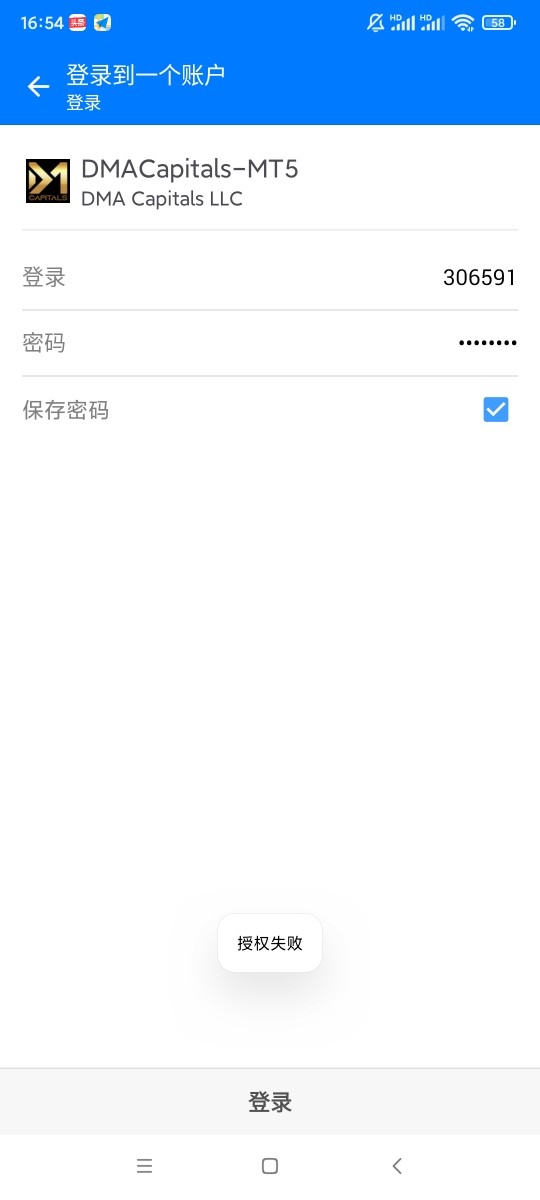

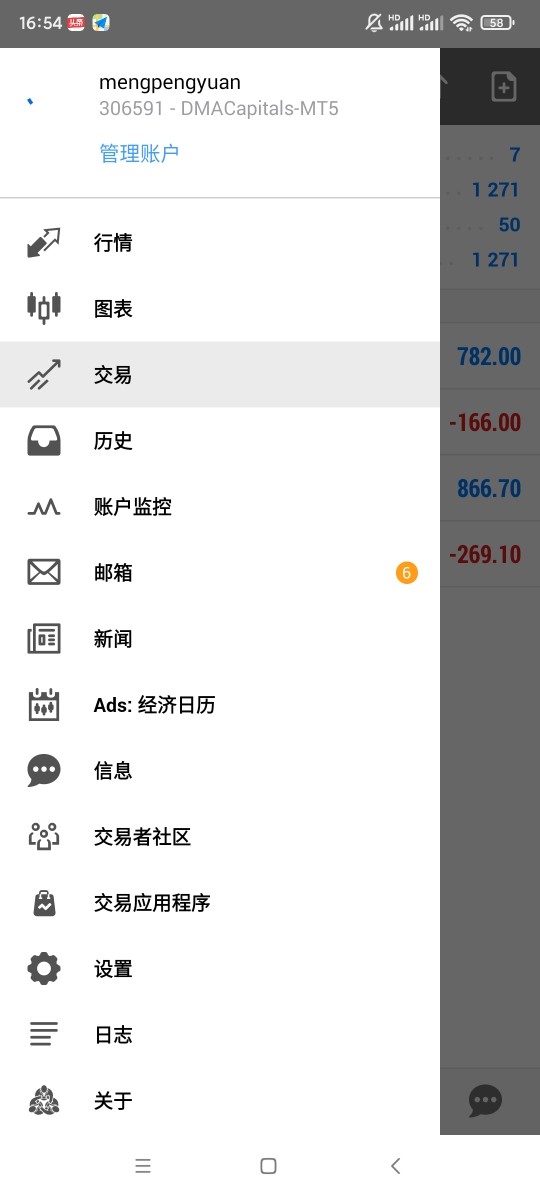

Core Business Overview

DMA Capitals claims to provide a broad array of trading options, including forex pairs, commodities, CFDs, and various other instruments. Utilizing the popular MetaTrader 5 (MT5) platform, it enables traders to access sophisticated tools for technical analysis and automated trading. Yet, important regulatory affiliations are absent, marking a significant deviation from standards practiced by reputable, licensed brokers that typically ensure higher levels of client protection.

Quick-Look Details Table

In-Depth Analysis of Each Dimension

Trustworthiness Analysis

The trustworthiness of DMA Capitals is undermined by its unregulated status, eliciting questions about fund safety. The broker claims an operational presence in Saint Vincent and the Grenadines, but authentic verification indicates a lack of regulatory oversight.

Regulatory Information Conflicts: The contradicting information about DMA Capitals raises eyebrows, with many reviews pointing out the broker's failure to meet basic regulatory standards. Sources affirm that the Financial Services Authority of Saint Vincent and the Grenadines does not provide oversight, leaving funds potentially exposed.

User Self-Verification Guide:

Navigate to the NFA's BASIC website.

Check for any listed entities using the broker's name.

Review the latest compliance and disciplinary actions to ascertain the broker's integrity.

Industry Reputation and Summary: User feedback often paints DMA Capitals as unreliable, with multiple individuals voicing concerns over fund safety and withdrawal processes:

“I submitted a withdrawal request but never received my funds. It feels like I was scammed.” – User Review

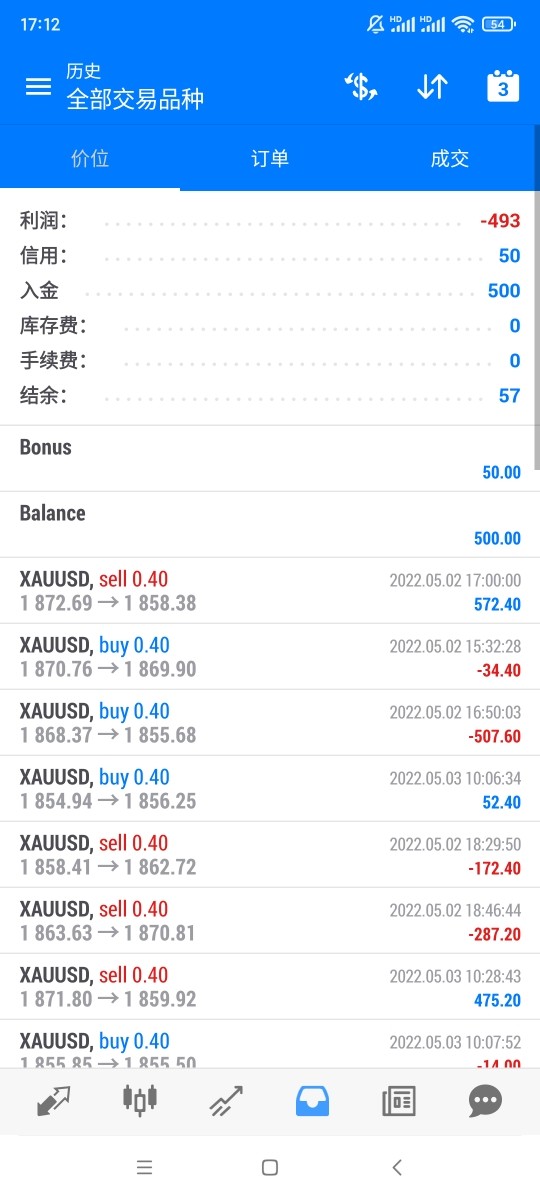

Trading Costs Analysis

Although DMA Capitals showcases a low-cost trading environment, the associated fees and conditions could lead to an unforeseen increase in overall trading costs.

Advantages in Commissions: The broker advertises a low commission structure, crucial in attracting traders who wish to minimize their operational costs.

The "Traps" of Non-Trading Fees: However, substantial withdrawal fees and ambiguous non-trading expenses signal a "double-edged sword":

“Their withdrawal fees were shockingly high, eating into my profits.” – User Complaint

- Cost Structure Summary: For inexperienced traders, the low minimum deposit may seem inviting, yet the potential for withdrawal hurdles complicates the cost-effectiveness of trading here.

While DMA Capitals provides access to the powerful MT5 platform, the overall user experience may be less favorable.

Platform Diversity: MT5 is recognized for its advanced analytical capabilities, making it a preferred choice for many traders. However, its reliable execution does not offset the platform's reliability itself.

Quality of Tools and Resources: Despite the accessibility of trading tools, DMA Capitals lacks comprehensive educational resources that could benefit novice traders.

Platform Experience Summary: User reviews indicate mixed experiences with the platform, with professionals appreciating its features while novices may find it lacking in guidance:

“The MT5 platform worked well, but I struggled to find help when I needed it.” – User Feedback

User Experience Analysis

The onboarding process at DMA Capitals appears to be straightforward; however, the overall user journey reveals more complex challenges.

Onboarding Process: Account registration is reported as a user-friendly experience, although signs of a tempered usability in subsequent experiences emerged.

User Feedback on Experience: Reviews indicate varied sentiment, with some users claiming satisfactory trading experiences while others note an alarming lack of support:

“Great platform initially, but customer support was nowhere to be found when I had an issue.” – User Complaint

- Overall User Experience Summary: Positive experiences may be overshadowed by negative interactions, compounding frustrations for both new and experienced traders.

Customer Support Analysis

Customer support for DMA Capitals has faced criticism from users pointing towards unresponsive assistance.

Support Channels Available: DMA Capitals offers support through email and live chat, but many report delays or lack of response.

User Feedback on Support: The general sentiment reflects disappointment:

“I reached out for help multiple times, but my messages went unanswered.” – User Review

- Overall Support Summary: The customer support experience appears inconsistent, potentially jeopardizing users' trust in the platform and investment security.

Account Conditions Analysis

DMA Capitals has structured its account offerings to be accessible, particularly for new traders.

Account Types Overview: Four account types are available, all with low entry points but varying trading conditions that may impact profitability significantly.

Trading Conditions and Limitations: Each account type has minimum deposits ranging from $10 to $500, with spreads that vary notably based on account tiers, which may leave traders navigating varied costs.

Overall Account Conditions Summary: While DMA Capitals offers various choices to accommodate different trading preferences, caution is advised given their unregulated status and potentially unfriendly trading conditions.

Conclusion

DMA Capitals presents a range of advantages catering to low-cost forex trading enthusiasts; however, the risks associated with trading on an unregulated platform cannot be overlooked. From withdrawal difficulties to user complaints regarding support, potential traders are strongly advised to evaluate these factors against the lure of low entry costs and high leverage. Ultimately, while some may view DMA Capitals as a viable option for trading, the substantial risks indicate it may be wiser to consider regulated alternatives to ensure fund safety and reliable trading experiences.