Is Blue Ocean safe?

Business

License

Is Blue Ocean Safe or a Scam?

Introduction

Blue Ocean Financials, operating under the domain blueocex.com, positions itself as an online forex broker offering a wide array of trading instruments, including forex, commodities, and cryptocurrencies. As with any financial entity, traders must exercise caution when assessing the reliability of brokers, especially in a market rife with scams and unregulated platforms. The forex market, with its potential for high returns, also attracts unscrupulous operators who may mislead investors. Therefore, it is crucial to evaluate brokers based on their regulatory status, trading conditions, and customer feedback. This article investigates whether Blue Ocean is a safe trading platform or a potential scam, utilizing a structured assessment framework that includes regulatory scrutiny, company background, trading conditions, and customer experiences.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor in determining its legitimacy and safety for traders. Blue Ocean claims to be regulated; however, a closer examination reveals significant concerns. The broker operates out of Saint Vincent and the Grenadines, a jurisdiction known for its lack of stringent regulatory oversight for forex brokers.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Financial Services Authority (FSA) | None | Saint Vincent and the Grenadines | Unregulated |

The absence of a legitimate regulatory authority overseeing Blue Ocean raises red flags. While the FSA does not issue licenses for forex trading, Blue Ocean falsely claims to be licensed, which significantly undermines its credibility. The lack of regulation means that traders have no recourse in the event of disputes or fund mismanagement, making it imperative to question whether Blue Ocean is safe for investment.

Company Background Investigation

Blue Ocean Financials Limited was established recently, with claims of being operational since 2023. However, there are discrepancies regarding its history and ownership structure. The company is registered in an offshore location, which is often a tactic used by fraudulent brokers to evade regulatory scrutiny. The management team‘s credentials are also questionable, as the lack of transparency regarding their professional backgrounds raises concerns about their expertise and the company’s overall reliability.

The company does not provide adequate information on its website about its founders or key personnel, limiting transparency and making it difficult for potential clients to assess the qualifications of those managing their investments. A lack of clear disclosure about the company's operations and management is an immediate concern for any trader considering whether Blue Ocean is safe.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions they offer is crucial. Blue Ocean presents various trading accounts, with a minimum deposit of $100 and leverage up to 1:5000. However, such high leverage can be risky, especially for inexperienced traders.

| Fee Type | Blue Ocean | Industry Average |

|---|---|---|

| Spread for Major Pairs | From 1.5 pips | From 0.5 pips |

| Commission Model | No commission | Varies |

| Overnight Interest Range | Varies | Varies |

The trading conditions, while seemingly attractive, come with potential hidden costs. Reports suggest that the broker may impose withdrawal fees and other charges that are not clearly outlined. These practices are typically associated with unregulated brokers, raising further doubts about whether Blue Ocean is safe for trading.

Client Funds Security

The security of client funds is paramount in the forex trading landscape. Blue Ocean does not appear to implement effective measures to protect clients' investments. There is no indication of segregated accounts or investor protection schemes, which are standard practices among regulated brokers.

The absence of these safety measures leaves clients vulnerable to potential fund misappropriation. Furthermore, historical data on Blue Ocean does not indicate any previous incidents of fund security breaches, but the lack of a transparency framework makes it difficult to assess their commitment to safeguarding client assets. This situation raises critical questions about whether Blue Ocean is safe for traders looking to invest their money.

Customer Experience and Complaints

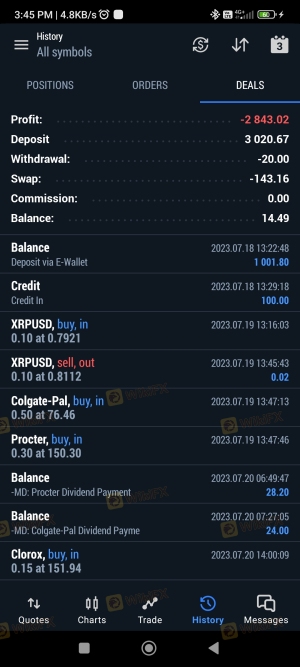

Analyzing customer feedback is essential to gauge a broker's reliability. Reviews of Blue Ocean indicate a pattern of dissatisfaction among users, with common complaints revolving around withdrawal issues and unresponsive customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response times |

| Lack of Transparency | Medium | Minimal clarification |

| Poor Customer Support | High | Inconsistent responses |

Many users have reported difficulties in withdrawing funds, often citing excessive fees or unfulfilled promises regarding their deposits. These complaints suggest that the broker may engage in practices that could be classified as fraudulent, casting doubt on whether Blue Ocean is safe for trading.

Platform and Execution

The trading platform offered by Blue Ocean is marketed as being user-friendly, featuring popular tools like MetaTrader 5. However, user experiences suggest that the platform may be prone to issues such as slippage and execution delays.

Traders have reported instances where orders were not executed at the expected prices, raising concerns about the integrity of the trading environment. Signs of potential platform manipulation, such as sudden price spikes or freezes during high volatility, have also been noted. This raises significant concerns about whether Blue Ocean is safe for traders who rely on timely and accurate order execution.

Risk Assessment

Engaging with Blue Ocean involves considerable risks, primarily due to its unregulated status and the lack of transparency.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No legitimate oversight |

| Financial Risk | High | Potential loss of funds |

| Execution Risk | Medium | Possible slippage and delays |

To mitigate these risks, traders should consider using only regulated brokers with transparent operations and robust customer support. Avoiding high leverage and thoroughly researching any broker before investing are essential steps to protect oneself from potential scams.

Conclusion and Recommendations

In conclusion, the evidence suggests that Blue Ocean is not safe for traders. The lack of regulation, questionable company practices, and negative customer feedback indicate a high risk of fraud. Traders are advised to exercise extreme caution and consider alternative options that offer better regulatory oversight and customer protection.

For those seeking reliable trading platforms, brokers such as IG, OANDA, or Forex.com provide a more secure environment backed by regulatory authorities. It is crucial for traders to prioritize their safety and ensure they are engaging with reputable and transparent brokers to protect their investments.

Is Blue Ocean a scam, or is it legit?

The latest exposure and evaluation content of Blue Ocean brokers.

Blue Ocean Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Blue Ocean latest industry rating score is 1.81, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.81 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.