Regarding the legitimacy of AMEGA forex brokers, it provides FSA and WikiBit, (also has a graphic survey regarding security).

Is AMEGA safe?

Software Index

License

Is AMEGA markets regulated?

The regulatory license is the strongest proof.

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

Amega Finance Ltd

Effective Date:

--Email Address of Licensed Institution:

info@amega.financeSharing Status:

No SharingWebsite of Licensed Institution:

https://amega.financeExpiration Time:

--Address of Licensed Institution:

IMAD Complex, 1st Floor, Unit 213, Ile Du Port, Mahe, SeychellesPhone Number of Licensed Institution:

+248 4243884Licensed Institution Certified Documents:

Is Amega Safe or a Scam?

Introduction

Amega is an online forex and CFD broker that has gained attention for its commission-free trading and high leverage options, catering to both novice and experienced traders. Founded in 2018 and regulated by the Financial Services Commission (FSC) in Mauritius, Amega positions itself as a competitive player in the forex market. However, with the proliferation of online trading platforms, it has become increasingly important for traders to exercise caution and thoroughly evaluate the legitimacy and reliability of brokers before committing their funds. This article aims to provide a comprehensive analysis of Amega, focusing on its regulatory status, company background, trading conditions, client fund safety, customer feedback, platform performance, and overall risk assessment. The evaluation is based on extensive research, including reviews from traders, regulatory information, and expert analyses.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor in determining its safety and reliability. Amega is regulated by the Financial Services Commission (FSC) in Mauritius, which provides a certain level of oversight. However, it is important to note that the FSC is not considered a top-tier regulatory body compared to authorities such as the FCA (UK) or ASIC (Australia). The lack of stringent regulatory oversight raises questions about the broker's compliance and the protection of traders' funds.

| Regulatory Authority | License Number | Regulated Region | Verification Status |

|---|---|---|---|

| Financial Services Commission (FSC) | GB22200548 | Mauritius | Verified |

While Amega claims to adhere to the regulations set forth by the FSC, the quality of oversight provided by this authority is often questioned. Many traders prefer brokers regulated by more reputable organizations that offer additional investor protections, such as compensation schemes in the event of broker insolvency. Furthermore, the absence of tier-one regulation means that Amega may not be subject to the same rigorous compliance standards as those enforced by more established regulatory bodies.

Company Background Investigation

Amega's corporate history is relatively short, having been established in 2018. The broker operates under the ownership of Amega Global Ltd, which is registered in Mauritius. The management team behind Amega includes individuals with backgrounds in finance and trading, although specific details about their experience and qualifications are not widely disclosed. This lack of transparency regarding the management's credentials may raise concerns for potential investors.

The company's commitment to transparency and information disclosure is also crucial in assessing its credibility. Amega provides basic information about its services and trading conditions on its website, but further details about its operational practices and management structure are limited. This opacity can be a red flag for traders who value comprehensive information about the brokers they choose to work with.

Trading Conditions Analysis

Amega offers a variety of trading conditions that are appealing to many traders, including commission-free trading and high leverage of up to 1:1000. However, it is essential to analyze the overall cost structure and identify any potentially problematic fee policies that may not be immediately apparent.

| Fee Type | Amega | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.8 pips | 1.0 pips |

| Commission Model | $0 | $3 per lot |

| Overnight Interest Range | Varies | Varies |

While Amega advertises low spreads and zero commissions, traders should be aware of any hidden costs associated with trading, such as withdrawal fees or inactivity charges. Additionally, the broker's policy on overnight interest rates can vary significantly based on market conditions, potentially impacting trading profitability.

Client Fund Safety

The safety of client funds is paramount when choosing a broker. Amega claims to implement several measures to protect client funds, including segregated accounts, which ensure that client deposits are kept separate from the broker's operational funds. This practice is essential for safeguarding traders' capital in the event of financial difficulties faced by the broker.

Moreover, Amega provides negative balance protection, meaning that traders cannot lose more than their account balance, which adds an extra layer of security. However, the broker's reliance on an offshore regulatory authority raises concerns about the effectiveness of these safety measures.

Historically, there have been no significant reports of fund safety issues or disputes involving Amega, but the lack of stringent regulation means that traders should remain cautious and conduct thorough due diligence.

Customer Experience and Complaints

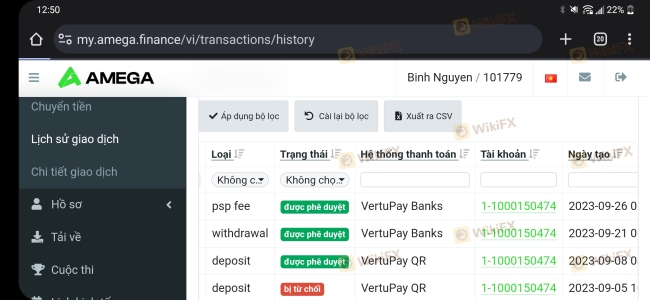

Customer feedback is a valuable resource for assessing a broker's reliability. Amega has received mixed reviews from users, with some praising its trading conditions and customer service, while others have reported issues, particularly regarding withdrawal processes.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response times |

| Customer Support | Medium | Generally helpful, but inconsistent |

| Platform Stability | Low | Generally stable |

Common complaints among users include difficulties in withdrawing funds, which can lead to frustration and mistrust. While Amega's customer support team is available to assist with inquiries, the quality and speed of their responses have been inconsistent, which may deter potential traders.

Notably, some users have reported success in resolving their issues, while others have expressed dissatisfaction with the company's handling of complaints. A few specific cases illustrate these concerns, where traders experienced delays in fund withdrawals and inadequate support during critical trading periods.

Platform and Trade Execution

Amega utilizes the widely recognized MetaTrader 5 (MT5) platform, known for its robust features and user-friendly interface. The platform supports various trading instruments, including forex, stocks, commodities, and cryptocurrencies, providing traders with diverse opportunities.

In terms of order execution, Amega claims to offer fast processing times of approximately 0.1 seconds. However, traders should be cautious of potential slippage and order rejections, which can occur during periods of high market volatility. While there have been no widespread reports of platform manipulation, traders should remain vigilant and monitor their trading experiences closely.

Risk Assessment

Engaging with Amega involves several inherent risks, primarily due to its offshore regulatory status and the mixed reviews from users. Traders should carefully consider their risk tolerance and assess the broker's potential pitfalls before opening an account.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Limited oversight from a tier-one regulator |

| Fund Safety | Medium | Segregated accounts and negative balance protection, but offshore regulation raises concerns |

| Customer Service | Medium | Mixed feedback on responsiveness and issue resolution |

To mitigate risks when trading with Amega, it is advisable for traders to start with a small investment, utilize risk management strategies, and remain informed about the broker's practices and market conditions.

Conclusion and Recommendations

Based on the comprehensive analysis, Amega presents itself as a competitive broker with attractive trading conditions, including commission-free trading and high leverage. However, the lack of robust regulatory oversight and mixed customer feedback raises significant concerns about its reliability and safety.

Traders should approach Amega with caution, particularly those who prioritize regulatory protection and customer service quality. For those considering trading with Amega, it is essential to conduct thorough research, start with minimal investments, and implement sound risk management practices.

For traders seeking more reliable alternatives, consider brokers regulated by top-tier authorities such as the FCA or ASIC, which provide enhanced investor protections and a more transparent trading environment.

Is AMEGA a scam, or is it legit?

The latest exposure and evaluation content of AMEGA brokers.

AMEGA Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

AMEGA latest industry rating score is 2.22, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.22 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.