Amega Review 2025: Everything You Need to Know

Executive Summary

This comprehensive Amega review examines one of the emerging players in the global forex brokerage landscape. Amega Finance positions itself as an innovative STP (Straight Through Processing) broker, offering traders a compelling combination of competitive trading conditions and diverse asset coverage. According to multiple industry sources, Amega has garnered generally positive user feedback for its trading environment and execution quality. The broker's standout features include exceptionally low spreads starting from 0.1 pips, zero commission trading across various account types, and leverage up to 1:1000 for qualified traders.

These conditions particularly appeal to scalping strategies and high-frequency trading approaches. Amega operates under the regulatory oversight of the Mauritius Financial Services Commission, providing a level of institutional credibility while maintaining competitive offshore advantages. The platform primarily targets active traders seeking cost-effective trading solutions without compromising on execution quality.

User testimonials consistently highlight the broker's market execution efficiency and the comprehensive nature of its MetaTrader 5 integration. However, potential clients should note that specific minimum deposit requirements and detailed promotional structures remain less transparently communicated compared to some industry competitors. Based on available user data and industry analysis, Amega appears well-suited for experienced traders prioritizing low-cost, high-leverage trading environments, though newcomers may benefit from more detailed educational resource availability verification.

Important Disclaimers

Regional Service Limitations: Amega does not provide services to individuals residing in the United States, North Korea, and Iran. Potential clients should verify their regional eligibility before account registration, as regulatory compliance requirements vary significantly across jurisdictions.

Review Methodology: This evaluation is based on publicly available information from the broker, verified user reviews from multiple platforms including Trustpilot and industry forums, and regulatory documentation. Trading conditions and features mentioned may be subject to change, and prospective clients should confirm current terms directly with the broker before making investment decisions.

Rating Framework

Broker Overview

Amega Finance has established itself as a global STP forex broker, focusing on providing direct market access through advanced technological infrastructure. While the exact founding date remains unspecified in available documentation, the company has built its reputation on delivering institutional-grade trading conditions to retail clients.

The broker operates under a transparent business model that emphasizes direct market execution rather than dealing desk interventions. The company's core business philosophy centers on eliminating traditional barriers that often limit trading efficiency. By implementing a zero-commission structure across account types and maintaining consistently low spreads, Amega positions itself as a cost-conscious alternative to traditional full-service brokers.

This approach particularly benefits active trading strategies where transaction costs significantly impact overall profitability. Amega's trading ecosystem revolves around the MetaTrader 5 platform, providing clients access to advanced charting capabilities, automated trading systems, and comprehensive market analysis tools.

The broker supports trading across multiple asset classes including forex pairs, global indices, cryptocurrencies, individual stocks, and commodity markets. This diversification allows traders to implement cross-market strategies and capitalize on various market conditions. Under the regulatory supervision of the Mauritius Financial Services Commission, Amega maintains compliance with international financial standards while offering competitive offshore advantages.

This regulatory framework provides essential client protections while enabling the broker to offer enhanced leverage ratios and flexible trading conditions that may not be available under more restrictive jurisdictions.

Regulatory Jurisdiction: Amega Markets LLC operates under the authorization and supervision of the Mauritius Financial Services Commission, ensuring compliance with international financial regulations and maintaining institutional credibility for client fund handling. Payment Solutions: The broker provides multiple deposit and withdrawal methods designed to accommodate traders from various geographical regions.

User feedback indicates efficient processing times and reasonable accessibility across different payment systems, though specific method availability may vary by location. Minimum Deposit Requirements: Specific minimum deposit thresholds are not explicitly detailed in available public documentation, requiring direct broker consultation for accurate account opening requirements.

Promotional Offerings: Current bonus and promotional structures are not comprehensively outlined in accessible materials, suggesting potential clients should inquire directly about available incentive programs. Tradeable Assets: Amega supports comprehensive trading across forex currency pairs, major global indices, popular cryptocurrencies, individual equity stocks, and commodity markets, providing substantial diversification opportunities for portfolio construction.

Cost Structure: The broker implements a competitive fee framework featuring spreads from 0.1 pips and zero commission charges across account types. This pricing model particularly benefits high-frequency trading strategies and scalping approaches where transaction costs significantly impact profitability.

Leverage Ratios: Maximum leverage reaches 1:1000 for qualified accounts, appealing to traders seeking enhanced capital efficiency, though such high leverage requires careful risk management consideration. Platform Technology: MetaTrader 5 serves as the primary trading platform, offering advanced analytical tools, automated trading system support, and comprehensive market monitoring capabilities essential for professional trading operations.

Service Restrictions: Trading services are not available to residents of the United States, North Korea, and Iran due to regulatory compliance requirements. Customer Support Languages: Specific language support details are not comprehensively documented in available materials, requiring direct verification for multilingual assistance availability.

Account Conditions Analysis

Amega's account structure demonstrates a commitment to flexible trading arrangements that accommodate various trading styles and experience levels. According to user feedback compiled from multiple review platforms, the broker offers multiple account configurations designed to meet different capital requirements and trading frequency patterns.

The zero-commission model across account types represents a significant advantage for active traders who execute numerous transactions monthly. The account opening process receives consistent positive feedback from users, with many highlighting the streamlined verification procedures and efficient documentation processing. This efficiency particularly benefits traders seeking rapid market access without extended waiting periods.

However, the absence of clearly published minimum deposit requirements in promotional materials suggests potential variation in account accessibility that may require direct consultation for clarification. User testimonials frequently emphasize the broker's accommodating approach to different trading strategies, particularly noting the absence of restrictions on scalping and high-frequency trading techniques.

This flexibility extends to automated trading system implementation, with users reporting smooth Expert Advisor integration and reliable algorithmic execution. The account infrastructure appears well-designed to support both manual trading approaches and systematic trading strategies without artificial limitations. Compared to industry competitors, Amega's account conditions rank favorably in terms of cost efficiency and trading freedom.

The combination of zero commissions and competitive spread pricing creates an attractive value proposition, particularly for traders whose profitability depends heavily on minimizing transaction costs. This Amega review indicates that the broker's account structure successfully addresses many common trader concerns about hidden fees and restrictive trading conditions.

The broker's tool ecosystem centers on MetaTrader 5 integration, providing traders access to professional-grade analytical capabilities and execution infrastructure. User feedback consistently praises the platform's stability and feature comprehensiveness, noting the availability of advanced charting tools, technical indicator libraries, and market monitoring capabilities that support sophisticated trading strategies.

Amega's asset coverage spans multiple market categories, enabling traders to implement diversified strategies across forex, indices, cryptocurrencies, stocks, and commodities. This breadth provides substantial opportunities for cross-market analysis and correlation trading, particularly valuable during periods of high market volatility or when seeking uncorrelated return sources. The platform's automated trading support receives particular attention from users who rely on algorithmic strategies.

Reports indicate reliable Expert Advisor execution with minimal technical disruptions, suggesting robust server infrastructure and effective trade routing systems. This reliability proves crucial for systematic trading approaches where execution consistency directly impacts strategy performance.

While specific details about proprietary research resources and educational materials are not extensively documented in available sources, user feedback suggests adequate analytical support for independent trading decisions. Industry experts generally recognize MetaTrader 5's comprehensive analytical capabilities as sufficient for most trading requirements, though traders seeking extensive fundamental analysis or market commentary may need to supplement with external resources.

Customer Service and Support Analysis

Customer service quality emerges as a generally positive aspect of the Amega trading experience, based on user feedback aggregated from multiple review platforms. Traders report access to various communication channels including phone support and live chat functionality, with many noting responsive assistance for technical and account-related inquiries.

Response time experiences vary among users, with some reporting rapid resolution of issues while others indicate occasional delays during peak trading periods. This variation suggests adequate but potentially inconsistent service capacity, which may reflect the broker's growth phase or regional support distribution challenges. The professional competency of support staff receives positive recognition from users, with many highlighting knowledgeable assistance for platform-related questions and trading condition clarifications.

This expertise proves particularly valuable for traders transitioning to the MetaTrader 5 environment or implementing new trading strategies requiring technical guidance. However, comprehensive information about multilingual support capabilities and specific service hours remains limited in available documentation.

International traders may need to verify language availability and time zone coverage to ensure adequate support accessibility for their trading schedules and communication preferences.

Trading Experience Analysis

User feedback consistently emphasizes Amega's strong execution quality as a defining characteristic of the trading experience. Traders report reliable order processing with minimal slippage incidents and rare requote occurrences, suggesting effective liquidity management and server infrastructure.

This execution reliability proves particularly important for scalping strategies and time-sensitive trading approaches where execution delays can significantly impact profitability. The low spread environment, starting from 0.1 pips, creates favorable conditions for frequent trading strategies and helps minimize the market impact of transaction costs. Users specifically highlight this cost advantage when implementing high-frequency approaches or managing larger position sizes where spread costs can accumulate substantially over time.

Platform stability receives consistent positive feedback, with users reporting minimal downtime and reliable connectivity during both regular trading hours and high-volatility market periods. The MetaTrader 5 infrastructure appears well-optimized for handling multiple simultaneous operations, supporting both manual trading and automated system execution without significant performance degradation.

Mobile trading experience details are not extensively covered in available user feedback, though the standard MetaTrader 5 mobile application provides comprehensive functionality for remote trading management. The high-liquidity trading environment and competitive leverage ratios create an attractive framework for active traders seeking efficient capital utilization. This Amega review suggests that the overall trading experience meets professional standards for execution quality and cost effectiveness.

Trust and Security Analysis

Regulatory oversight through the Mauritius Financial Services Commission provides essential institutional credibility for Amega's operations. This regulatory framework ensures compliance with international financial standards and provides basic client protection mechanisms, though the specific details of fund segregation and investor compensation schemes are not extensively detailed in available public documentation.

Industry reputation indicators suggest positive market perception, with user reviews generally reflecting confidence in the broker's operational integrity and financial stability. The absence of significant negative incidents or regulatory actions in accessible records supports the broker's developing reputation as a reliable trading partner. However, comprehensive information about specific fund protection measures, segregated account structures, and insurance coverage remains limited in publicly available materials.

Prospective clients seeking detailed security information may need to request specific documentation about client fund handling and protection protocols directly from the broker. Third-party industry evaluations generally position Amega favorably among offshore brokers, though the relatively limited operational history compared to established industry leaders means long-term stability assessments require ongoing monitoring.

User trust indicators remain positive based on available feedback, suggesting satisfactory experiences with fund security and withdrawal processing.

User Experience Analysis

Overall user satisfaction indicators suggest positive reception of Amega's service delivery, with traders frequently highlighting the combination of competitive trading conditions and reliable execution quality. The streamlined account opening process receives particular appreciation from users seeking efficient market access without extensive bureaucratic delays.

Interface design and usability benefit from the MetaTrader 5 platform's established user experience standards, providing familiar navigation and functionality for traders experienced with the platform ecosystem. New users generally report manageable learning curves, though comprehensive platform training resources may require external supplementation. The registration and verification workflow receives positive feedback for efficiency and clarity, with users noting straightforward documentation requirements and reasonable processing timeframes.

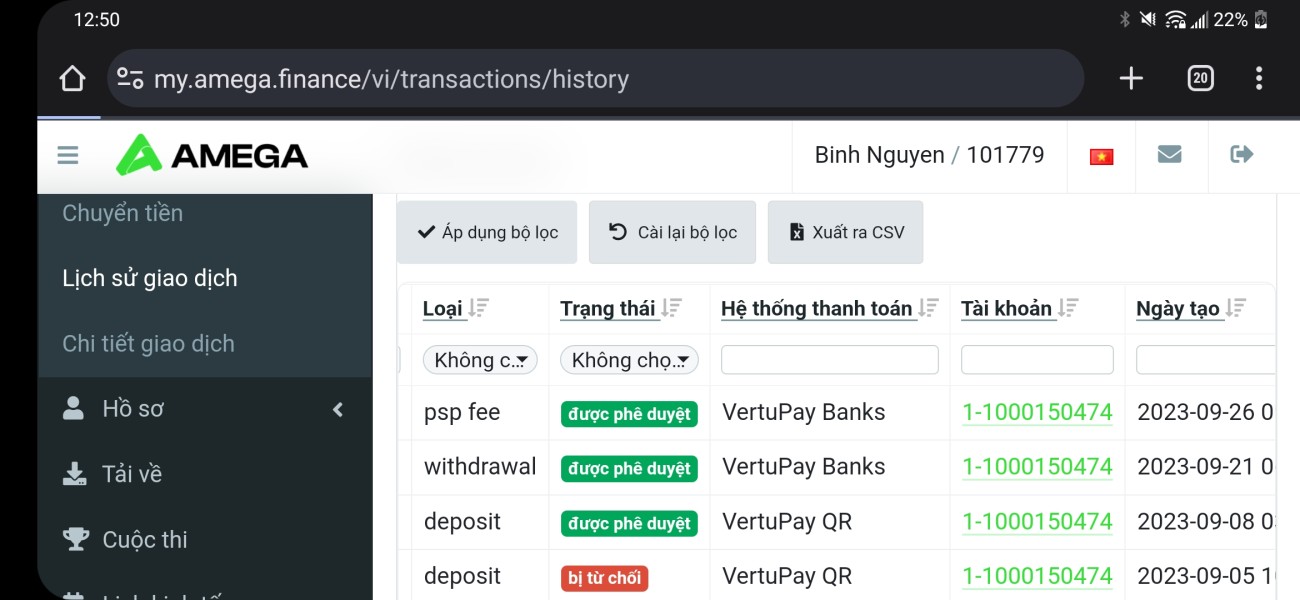

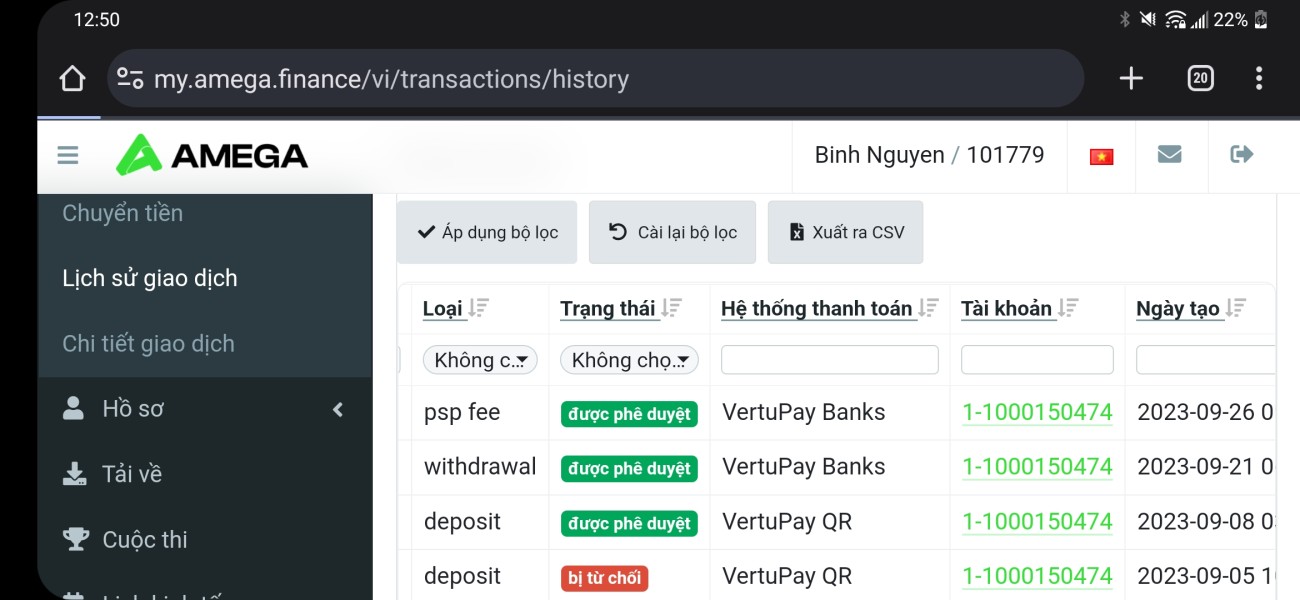

This efficiency particularly benefits traders seeking rapid account activation for time-sensitive trading opportunities. Fund operation experiences generally reflect user satisfaction with deposit and withdrawal processing, though specific timing and method availability details vary by geographic location and payment system selection.

The absence of extensively documented negative feedback suggests adequate operational efficiency in financial transaction handling. Common user concerns are not extensively detailed in available feedback, suggesting either limited significant issues or insufficient negative feedback documentation.

Prospective clients may benefit from direct communication with existing users or broker representatives to address specific operational questions and verify current service standards.

Conclusion

This comprehensive Amega review reveals a broker that successfully addresses many key requirements of active traders seeking cost-effective, high-quality trading conditions. The combination of zero commission trading, competitive spreads from 0.1 pips, and leverage up to 1:1000 creates an attractive proposition for traders prioritizing transaction cost minimization and capital efficiency.

Amega appears particularly well-suited for experienced traders implementing scalping strategies, high-frequency trading approaches, and automated trading systems. The broker's STP execution model and MetaTrader 5 integration provide the technological foundation necessary for professional trading operations while maintaining cost advantages over traditional full-service alternatives. The primary limitations center on information transparency regarding specific account requirements, detailed fund protection measures, and comprehensive educational resources.

While regulatory oversight through the Mauritius Financial Services Commission provides basic credibility, traders seeking extensive investor protection details may require additional verification. Overall, Amega demonstrates strong potential as a primary trading partner for cost-conscious, technically proficient traders who can effectively utilize the broker's competitive advantages while managing the inherent risks associated with high-leverage trading environments.