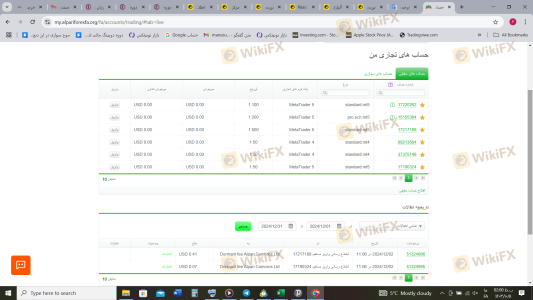

Regarding the legitimacy of Alpari forex brokers, it provides NBRB, CBR and WikiBit, (also has a graphic survey regarding security).

Is Alpari safe?

Pros

Cons

Is Alpari markets regulated?

The regulatory license is the strongest proof.

NBRB Forex Trading License (EP)

National Bank of the Republic of Belarus

National Bank of the Republic of Belarus

Current Status:

RegulatedLicense Type:

Forex Trading License (EP)

Licensed Entity:

Alpari Evrasia Limited Liability Company

Effective Date:

2016-06-23Email Address of Licensed Institution:

info@alpari.bySharing Status:

No SharingWebsite of Licensed Institution:

www.alpari.byExpiration Time:

--Address of Licensed Institution:

220004, Minsk, Pobediteley Ave. 7а, office 39Phone Number of Licensed Institution:

+375173880508Licensed Institution Certified Documents:

CBR Forex Trading License (EP)

Central Bank of Russia

Central Bank of Russia

Current Status:

UnverifiedLicense Type:

Forex Trading License (EP)

Licensed Entity:

Общество с ограниченной ответственностью "Альпари Форекс"

Effective Date:

2016-11-28Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

129164, г. Mосква, Pакетный бульваP, 16, 14-й этаж, поMещение № XXХVIII, коMнаты № 30, 34Phone Number of Licensed Institution:

84996537211Licensed Institution Certified Documents:

Is Alpari International A Scam?

Introduction

Alpari International is a well-established forex broker that has been operating since 1998, positioning itself as a key player in the global forex market. With a client base exceeding two million traders across more than 150 countries, Alpari has carved out a significant niche for itself in the highly competitive landscape of online trading. Given the proliferation of forex brokers, it is crucial for traders to exercise caution and thoroughly evaluate the legitimacy and reliability of any broker before committing their funds. This article aims to provide an objective and comprehensive analysis of Alpari International, assessing its regulatory status, company background, trading conditions, customer fund security, and overall reputation. The investigation relies on data collected from various reputable financial websites, reviews, and user testimonials, ensuring a balanced view of the broker's standing in the industry.

Regulation and Legitimacy

The regulatory status of a forex broker is one of the most critical factors to consider when determining its legitimacy. Alpari International operates under the jurisdiction of the Financial Services Commission (FSC) of Mauritius, possessing a license that grants it the authority to offer trading services. However, the FSC is not regarded as a top-tier regulatory body, which raises questions about the level of investor protection provided.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FSC | C113012295 | Mauritius | Active |

The importance of regulation cannot be overstated, as it ensures that brokers adhere to specific standards of conduct, including the segregation of client funds and the implementation of robust anti-money laundering measures. Alpari's compliance with the FSC's regulations allows it to operate legally; however, it lacks oversight from more stringent regulators such as the UK's Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC). This absence of higher-tier regulation may expose traders to greater risks, as the enforcement of regulatory standards is generally weaker in offshore jurisdictions.

Historically, Alpari has faced regulatory challenges, including the revocation of licenses in certain regions. For instance, its previous operations in the UK and the US have been curtailed, and it no longer accepts clients from these jurisdictions. While the broker has made strides to maintain a compliant operation, potential clients should be aware of the regulatory environment in which it operates and the implications this may have for their trading experience.

Company Background Investigation

Alpari was founded in 1998 during a tumultuous period in Russia's financial history, quickly establishing itself as a pioneer in the forex trading industry. Over the years, the company has expanded its operations internationally, with headquarters currently located in Saint Vincent and the Grenadines and additional offices in Mauritius and other regions. The ownership structure of Alpari is primarily under Exinity Limited, which adds a layer of corporate governance to its operations.

The management team at Alpari comprises experienced professionals with extensive backgrounds in finance and trading. This expertise is essential for navigating the complexities of the forex market and ensuring that the broker remains competitive. Transparency is a key aspect of Alpari's operations, as it provides users with access to a wealth of information regarding its services, trading conditions, and risk management practices.

Alpari's commitment to corporate social responsibility is evident in its charitable initiatives, which focus on supporting underprivileged children and contributing to various social causes. This philanthropic approach not only enhances the company's reputation but also demonstrates a commitment to ethical business practices.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions they offer is paramount. Alpari provides a variety of account types, each catering to different trader needs, from beginners to experienced professionals. The broker's fee structure is generally competitive, with low minimum deposits and various trading instruments available, including major and minor currency pairs, commodities, and cryptocurrencies.

| Fee Type | Alpari International | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 1.2 pips | 1.0 - 1.5 pips |

| Commission Model | $1.50 per lot (ECN) | $2.00 - $5.00 |

| Overnight Interest Range | Varies by position | Varies by broker |

Alpari's spreads start at 1.2 pips for standard accounts, which is slightly higher than some competitors but still reasonable for retail traders. The ECN account offers spreads starting from 0.4 pips, making it attractive for high-frequency traders. However, traders should be aware that commissions apply to this account type, which could impact overall trading costs.

One potential area of concern is the presence of inactivity fees, which are charged after six months of no trading activity. This practice is common among brokers but can be a disadvantage for less active traders. Additionally, while Alpari offers a range of funding options, traders should carefully review the associated fees for deposits and withdrawals, as these can vary significantly depending on the chosen method.

Customer Funds Security

The security of customer funds is a critical consideration for any forex trader. Alpari has implemented several measures to safeguard client assets, including the segregation of funds. This means that client deposits are held in separate accounts from the broker's operational funds, reducing the risk of misappropriation.

Furthermore, Alpari is a member of the Financial Commission, which provides an additional layer of protection for traders. This membership allows clients to access a compensation fund that covers claims up to €20,000 in case of disputes. Negative balance protection is also offered, ensuring that clients cannot lose more than their deposited amount, which is a significant advantage for risk management.

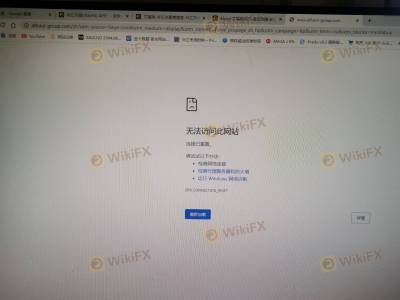

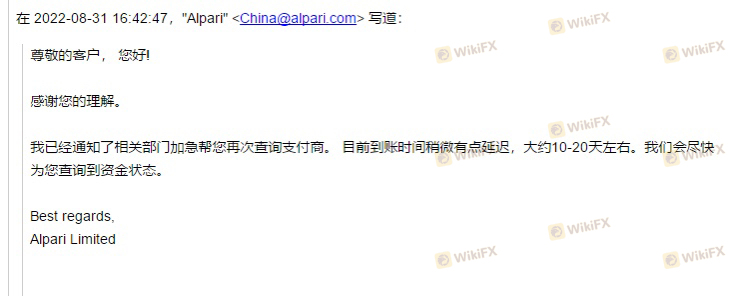

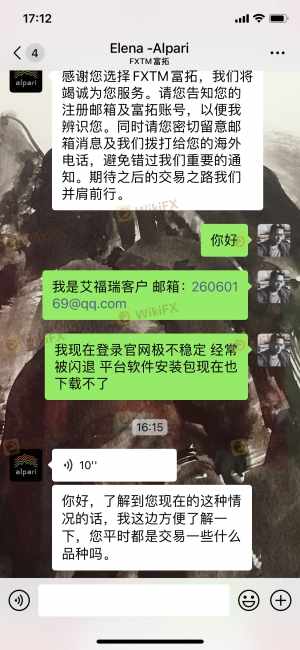

Despite these measures, there have been historical complaints regarding fund withdrawals and delays in processing. While many users report positive experiences, others have cited issues with accessing their funds, raising concerns about the broker's reliability in this area.

Customer Experience and Complaints

Customer feedback plays a vital role in assessing a broker's reputation. Alpari has received a mix of reviews from traders, with some praising its trading conditions and customer support, while others have reported issues related to withdrawals and account management.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Account Management Issues | Medium | Generally responsive |

| Slippage and Requotes | Medium | Addressed in FAQs |

Common complaints include delays in withdrawal processing, which have led some traders to question the broker's reliability. Additionally, instances of slippage and requotes during volatile market conditions have been reported, although these issues are not uncommon in the forex industry. Alpari's customer support team is generally responsive, but the effectiveness of their resolutions can vary.

For example, one trader reported a withdrawal request that took longer than expected to process, leading to frustration and concerns about fund safety. In contrast, another user highlighted the broker's efficient customer service and quick responses to inquiries, illustrating the variability in user experiences.

Platform and Trade Execution

Alpari offers two primary trading platforms: MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Both platforms are widely recognized for their user-friendly interfaces and robust trading tools, catering to traders of all experience levels. The platforms support automated trading through Expert Advisors (EAs), allowing users to implement algorithmic trading strategies effectively.

The execution quality on Alpari's platforms is generally regarded as good, with many users reporting minimal slippage and fast order processing. However, instances of requotes during high volatility have been noted, which can be a drawback for scalpers and high-frequency traders.

Overall, the trading experience on Alpari's platforms is competitive, with a focus on providing users with the necessary tools to navigate the forex market effectively.

Risk Assessment

Using Alpari International involves several risks that traders should be aware of before opening an account. While the broker is regulated by the FSC of Mauritius and offers a degree of investor protection, the lack of oversight from more reputable regulatory bodies raises concerns about the overall safety of client funds.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Limited oversight from top-tier regulators. |

| Withdrawal Risk | Medium | Historical complaints regarding withdrawal delays. |

| Market Risk | High | Volatility in forex markets can lead to significant losses. |

To mitigate these risks, traders are advised to conduct thorough research, utilize risk management strategies, and remain aware of the potential for market volatility. Additionally, maintaining open communication with customer support can help address any issues that may arise during trading.

Conclusion and Recommendations

In conclusion, Alpari International is not a scam but does present certain risks that potential traders should carefully consider. While the broker has a long-standing history and offers competitive trading conditions, the lack of regulation from top-tier authorities and historical complaints regarding withdrawals warrant caution.

For traders seeking a reliable forex broker, it is crucial to weigh these factors against their individual trading needs and risk tolerance. Beginners may find Alpari's low minimum deposit and user-friendly platforms appealing, while more experienced traders might seek alternatives with stronger regulatory oversight and a broader range of trading instruments.

If you're looking for alternatives, consider brokers like IC Markets or Pepperstone, which have robust regulatory frameworks and positive reputations in the trading community. Ultimately, due diligence is key to ensuring a safe and profitable trading experience.

Is Alpari a scam, or is it legit?

The latest exposure and evaluation content of Alpari brokers.

Alpari Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Alpari latest industry rating score is 2.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.