Alpari International 2025 Review: Everything You Need to Know

Executive Summary

Alpari International stands out as a regulated forex and CFD broker. It delivers exceptional performance for traders across different experience levels. This alpari international review reveals a broker that has maintained its reputation since 1998. The company offers competitive trading conditions with spreads starting from 0 pips and an impressively low minimum deposit requirement of just $5 for ECN accounts. The broker supports both MetaTrader 4 and MetaTrader 5 platforms. It provides access to over 60 tradable instruments including forex pairs, CFDs, precious metals, and cryptocurrencies.

What sets Alpari International apart is its commitment to transparency and regulatory compliance. The company was named the Most Transparent Broker at the Global Forex Awards in 2020. The platform caters to both novice traders seeking low-cost entry points and experienced traders requiring fast execution speeds and advanced trading tools. With user ratings reaching 5/5 and 24/7 customer support, Alpari International demonstrates strong dedication to client satisfaction and service excellence.

Important Notice

Alpari International operates under different regulatory frameworks across various jurisdictions. This includes oversight by the Financial Services Authority (FSA) of Mauritius, the Financial Commission in Hong Kong, and CRFIN in Russia. Traders should be aware that regulatory protections and available services may vary depending on their geographical location and the specific Alpari entity serving their region.

This review is based on the most current available information and comprehensive user feedback. It uses a multi-dimensional assessment methodology to provide an objective evaluation of the broker's services and performance.

Rating Framework

Broker Overview

Founded in 1998, Alpari International has established itself as a prominent international forex and CFD broker. The company has a distinctive focus on emerging and frontier markets. The company has built its reputation on providing efficient trading experiences through competitive spreads and diverse account offerings that cater to traders with varying capital requirements and trading strategies. Despite facing past challenges, Alpari International has maintained its position as a trustworthy broker. It demonstrates resilience and commitment to serving its global client base.

The broker operates on both ECN (Electronic Communication Network) and STP (Straight Through Processing) models. This ensures direct market access and transparent pricing for its clients. According to forexexplore.com, Alpari International continues to focus on delivering value to traders in emerging markets while maintaining strict regulatory compliance. This alpari international review highlights the broker's evolution and current standing in the competitive forex industry.

Alpari International's trading ecosystem centers around the industry-standard MetaTrader 4 and MetaTrader 5 platforms. These provide traders with sophisticated charting tools, automated trading capabilities, and seamless order execution. The broker's asset portfolio encompasses over 60 trading instruments, including major and exotic forex pairs, CFDs on various underlying assets, precious metals, cryptocurrencies, and commodity futures. This comprehensive offering positions Alpari International as a one-stop solution for diversified trading strategies.

Key Features and Specifications

Regulatory Jurisdictions: Alpari International maintains regulatory compliance across multiple jurisdictions. It operates under the oversight of the FSA Mauritius, Financial Commission Hong Kong, and CRFIN Russia. This multi-regulatory approach provides clients with varying levels of protection depending on their location and applicable regulatory framework.

Deposit and Withdrawal Methods: The broker offers multiple funding options with quick deposit and withdrawal processing. However, specific payment methods are not extensively detailed in available documentation. The emphasis on fast fund transfers suggests support for major payment processors and banking systems.

Minimum Deposit Requirements: Alpari International sets highly competitive minimum deposit thresholds. It requires only $5 for ECN accounts and $100 for standard accounts. This low barrier to entry makes the platform particularly attractive to new traders and those with limited initial capital.

Promotional Offerings: Current promotional activities are not specifically detailed in available information. However, the broker's focus on competitive spreads and low minimum deposits serves as ongoing value propositions for clients.

Trading Assets: The platform provides access to 60+ trading instruments spanning forex pairs, CFDs, precious metals, cryptocurrencies, and commodity futures. This diverse asset selection enables traders to implement various strategies across different market sectors.

Cost Structure: Alpari International offers competitive pricing with spreads starting from 0 pips. This is particularly beneficial for high-frequency traders and scalping strategies. Specific commission structures vary by account type, with the ECN model typically incorporating commission-based pricing alongside tight spreads.

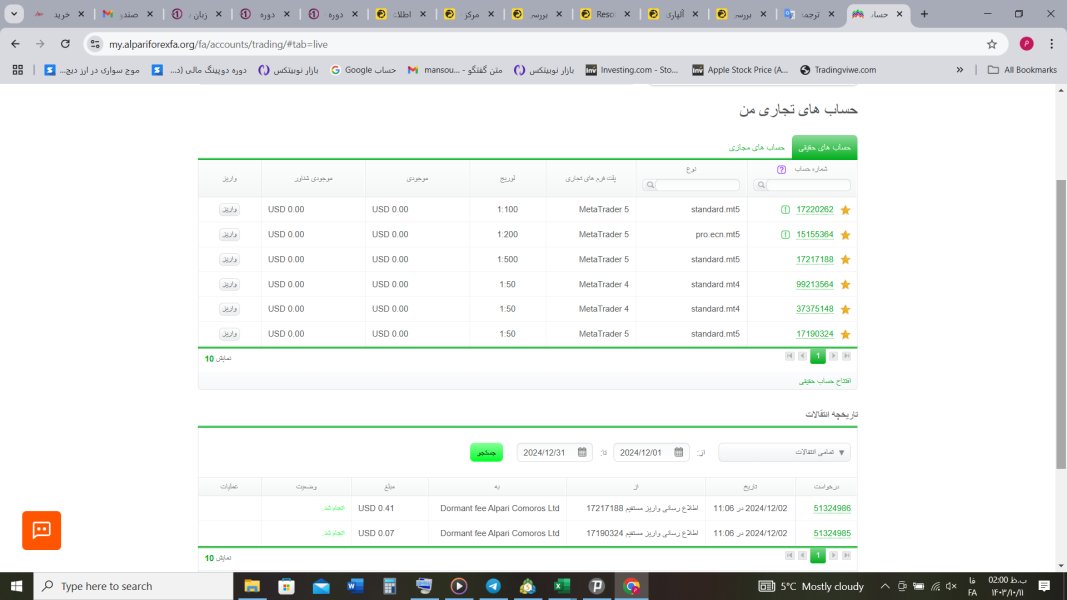

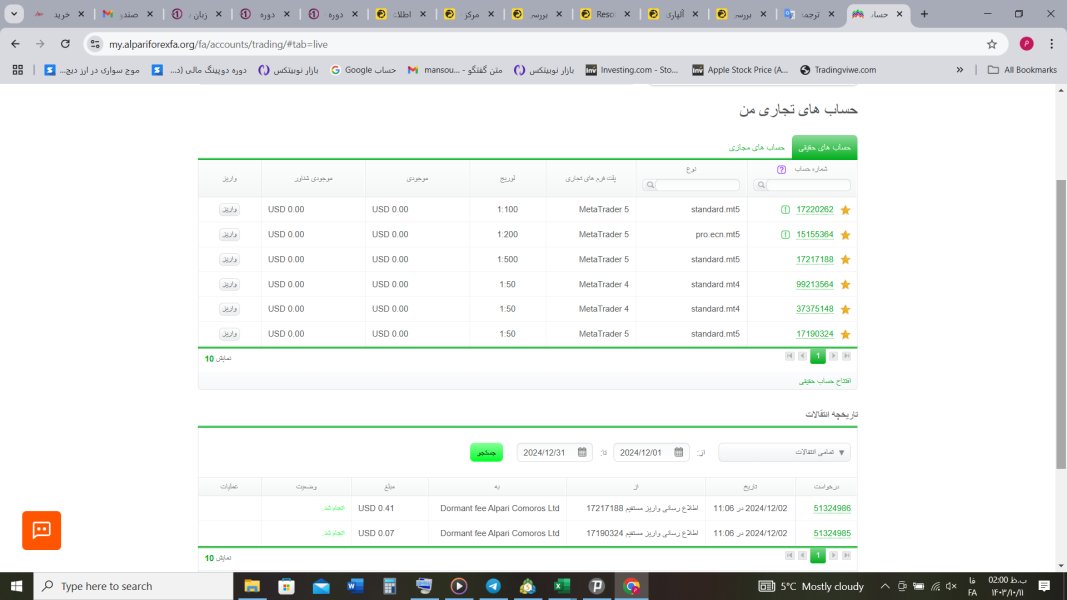

Platform Options: Traders can choose between MetaTrader 4 and MetaTrader 5 platforms. Both offer comprehensive trading tools, automated trading support through Expert Advisors, and mobile accessibility for on-the-go trading management.

This section of our alpari international review demonstrates the broker's commitment to providing flexible and accessible trading conditions across its service offerings.

Detailed Rating Analysis

Account Conditions Analysis (8/10)

Alpari International excels in providing flexible account structures that accommodate traders across different experience levels and capital ranges. The broker's ECN and STP account offerings demonstrate a clear understanding of diverse trading needs. The ECN accounts provide direct market access and the STP accounts offer streamlined execution for standard trading approaches.

The standout feature in account conditions is the remarkably low minimum deposit requirement of $5 for ECN accounts. This makes professional-grade trading accessible to virtually any interested trader. The standard account minimum of $100 remains competitive within the industry while providing access to enhanced features and potentially better trading conditions. According to available user feedback showing 5/5 ratings, these account conditions resonate well with the trading community.

Account opening procedures appear streamlined based on user satisfaction metrics. While they are not extensively detailed in available documentation, the results speak for themselves. The broker's focus on emerging and frontier markets suggests particular attention to accommodating international clients with varying documentation requirements and regulatory considerations.

The availability of both ECN and STP execution models provides traders with choices based on their trading styles and preferences. ECN accounts typically offer tighter spreads with commission-based pricing. STP accounts may provide commission-free trading with slightly wider spreads, allowing traders to select cost structures that align with their trading frequency and volume.

In this alpari international review, the account conditions represent a significant strength. However, the lack of detailed information about Islamic accounts or other specialized account types prevents a higher rating.

Alpari International demonstrates exceptional strength in its trading tools and resources offering. It provides access to over 60 tradable instruments across multiple asset classes. The comprehensive selection includes major and exotic forex pairs, CFDs on various underlying assets, precious metals, cryptocurrencies, and commodity futures. This enables traders to diversify their portfolios and implement sophisticated trading strategies.

The dual platform approach featuring both MetaTrader 4 and MetaTrader 5 ensures that traders can access industry-leading trading technology regardless of their platform preferences. MT4's popularity among forex traders is well-established. MT5 offers enhanced features for multi-asset trading and more advanced analytical capabilities. Both platforms support automated trading through Expert Advisors and provide comprehensive charting and technical analysis tools.

The broker's commitment to providing professional-grade tools is evident in its platform selection and asset variety. The 60+ instrument count places Alpari International competitively within the industry. It offers sufficient diversity for most trading strategies without overwhelming novice traders with excessive complexity.

While specific research and educational resources are not extensively detailed in available documentation, the high user satisfaction ratings suggest adequate support materials are available. The platform's focus on emerging markets may include specialized research and analysis relevant to these specific trading opportunities.

The automated trading support through MetaTrader platforms enables traders to implement algorithmic strategies and utilize signal services. This adds significant value for both experienced traders and those looking to automate their trading approaches.

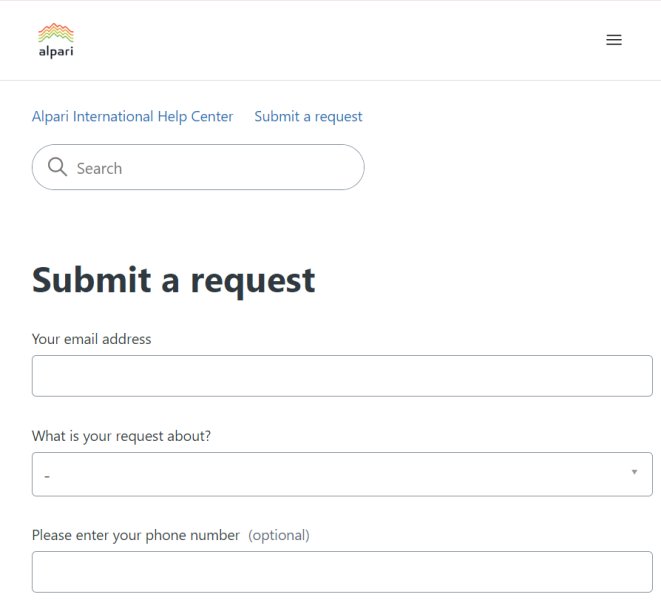

Customer Service and Support Analysis (7/10)

Alpari International provides 24/7 customer support. This demonstrates commitment to serving its global client base across different time zones. This round-the-clock availability is particularly important for forex traders who may need assistance during various market sessions and trading hours.

While the broker offers continuous support availability, specific details about response times, communication channels, and service quality metrics are not extensively documented in available information. The 5/5 user rating suggests generally positive customer service experiences. However, more detailed feedback would provide better insight into actual service quality and efficiency.

The multi-jurisdictional nature of Alpari International's operations likely requires customer service capabilities in multiple languages. However, specific language support details are not clearly outlined in available documentation. This represents a potential area where additional information would enhance the evaluation.

Customer service quality often correlates with regulatory oversight. Alpari International's multi-regulatory framework suggests adherence to various customer protection standards. However, without specific information about service level agreements, escalation procedures, or customer satisfaction metrics, the evaluation must rely primarily on available user ratings.

The broker's focus on emerging and frontier markets may require specialized customer service capabilities to address unique regional needs and regulatory requirements. However, specific adaptations for these markets are not detailed in available information.

Trading Experience Analysis (8/10)

Alpari International delivers a strong trading experience characterized by fast execution speeds and competitive spreads starting from 0 pips. These conditions are particularly advantageous for active traders, scalpers, and those implementing high-frequency trading strategies where execution speed and cost efficiency are paramount.

The combination of ECN and STP execution models ensures that traders can access the execution type that best suits their trading style. ECN accounts provide direct market access with institutional-grade execution. STP accounts offer streamlined processing for standard retail trading approaches. User feedback indicating 5/5 satisfaction suggests these execution models perform effectively in practice.

Platform stability and functionality benefit from the proven MetaTrader infrastructure. Both MT4 and MT5 offer robust performance and comprehensive trading capabilities. The platforms' widespread adoption and continuous development by MetaQuotes ensure reliable performance and regular feature updates.

Quick deposit and withdrawal processing enhances the overall trading experience by reducing friction in fund management. This efficiency is particularly important for active traders who may need to adjust their account funding based on trading opportunities and market conditions.

While mobile trading capabilities are implied through MetaTrader platform support, specific details about mobile app features and performance are not extensively documented. The overall trading environment appears well-suited for both desktop and mobile trading based on platform selections.

This portion of our alpari international review highlights the broker's focus on execution quality and trading efficiency as key differentiators in the competitive forex market.

Trust and Reliability Analysis (9/10)

Alpari International demonstrates high trustworthiness through its multi-jurisdictional regulatory compliance and industry recognition. Operating under oversight from the FSA Mauritius, Financial Commission Hong Kong, and CRFIN Russia provides multiple layers of regulatory protection. It demonstrates the broker's commitment to maintaining proper operational standards.

The broker's recognition as the Most Transparent Broker at the Global Forex Awards in 2020 represents significant third-party validation of its operational practices and client communication standards. This award specifically recognizes transparency, which is crucial for building and maintaining trader confidence in an industry where information asymmetry can be problematic.

Alpari International's longevity since 1998 provides additional credibility. It demonstrates the company's ability to navigate various market cycles and regulatory changes while maintaining operations. According to forexexplore.com, despite past difficulties, the broker has maintained its trustworthy status with a continued focus on emerging and frontier markets.

The multi-regulatory framework provides clients with varying levels of protection depending on their jurisdiction. However, this also means that protection levels may differ significantly between regions. This regulatory diversity can be both a strength and a complexity that traders must understand based on their location.

While specific information about fund segregation, insurance coverage, or other client protection measures is not detailed in available documentation, the regulatory oversight from established financial authorities suggests adherence to standard client protection protocols.

User Experience Analysis (7/10)

User experience at Alpari International appears generally positive based on the 5/5 user rating. This indicates high overall satisfaction among the broker's client base. This rating suggests that the combination of trading conditions, platform functionality, and service delivery meets or exceeds user expectations across key performance areas.

The low minimum deposit requirements of $5 for ECN accounts and $100 for standard accounts create an inclusive user experience that accommodates traders with varying capital levels. This accessibility is particularly important for new traders who may want to test the platform and services before committing larger amounts.

Platform accessibility through MetaTrader 4 and MetaTrader 5 ensures that users can work with familiar, industry-standard interfaces that offer comprehensive functionality without requiring extensive learning curves. The widespread adoption of these platforms means that educational resources and community support are readily available.

While specific details about user interface design, account management features, and onboarding processes are not extensively documented, the high user satisfaction ratings suggest these elements perform adequately. The broker's focus on emerging markets may include specialized features or adaptations that enhance user experience for these specific client segments.

Registration and verification processes appear streamlined based on user satisfaction metrics. While they are not detailed in available information, the results are clear. Quick deposit and withdrawal processing contributes positively to the overall user experience by reducing administrative friction and enabling efficient account management.

Conclusion

Alpari International emerges as a reliable and well-regulated forex and CFD broker that successfully serves a diverse client base ranging from newcomers to experienced traders. The broker's combination of competitive spreads starting from 0 pips, low minimum deposit requirements, and comprehensive regulatory oversight creates a compelling value proposition in the crowded forex brokerage market.

The platform particularly excels in providing accessible trading conditions through its $5 minimum deposit for ECN accounts and fast execution speeds that support various trading strategies. The multi-jurisdictional regulatory framework and industry recognition for transparency demonstrate the broker's commitment to maintaining high operational standards and client protection.

Alpari International is especially well-suited for traders seeking cost-effective trading solutions, those interested in emerging market opportunities, and both novice and experienced traders who value execution speed and competitive pricing. The broker's strengths in account flexibility, tool variety, and regulatory compliance make it a solid choice for serious forex and CFD trading activities.