Is 9Cents safe?

Pros

Cons

Is 9cents Safe or Scam?

Introduction

In the rapidly evolving world of forex trading, new platforms continually emerge, each promising lucrative opportunities for traders. One such platform is 9cents, which positions itself as a user-friendly forex trading platform. However, the rise of online trading also brings the risk of fraudulent schemes, making it essential for traders to thoroughly evaluate the credibility of any broker they consider. This article aims to investigate whether 9cents is a legitimate trading platform or merely a scam. Our analysis will rely on data from various reputable sources, including user reviews, regulatory information, and company background checks, to provide a comprehensive overview of the platform's safety and reliability.

Regulation and Legitimacy

The regulatory status of a trading platform is a critical factor in determining its legitimacy. Regulation ensures that brokers adhere to specific standards of transparency and accountability, providing a level of protection for traders. Unfortunately, 9cents operates without any regulatory oversight from recognized financial authorities such as the Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC). The absence of regulation raises significant concerns regarding the platform's credibility and safety.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

Without proper oversight, 9cents is not held to the same standards as regulated brokers, making it easier for them to engage in questionable practices. The platform's lack of transparency regarding its operations and the absence of verifiable regulatory credentials further exacerbate concerns about its legitimacy. Given these red flags, it is crucial for potential investors to exercise extreme caution when considering 9cents.

Company Background Investigation

A thorough background investigation into the company's history and ownership structure can provide further insight into its legitimacy. 9cents is operated by a company named 9 Cents Financials Ltd, based in Saint Lucia. However, detailed information about the companys history, development, and management team remains scarce. This lack of transparency raises questions about the platform's accountability and operational integrity.

The management teams expertise is another critical aspect to consider. A reputable trading platform typically has a team with extensive experience in finance and trading. However, 9cents has not provided sufficient information about its management team, which is concerning for potential traders. The absence of a transparent ownership structure and credible management team further diminishes the trustworthiness of 9cents.

Trading Conditions Analysis

When evaluating a trading platform, understanding its fee structure is essential. 9cents claims to offer competitive spreads and zero commission on trades, which may initially appear attractive. However, many users have reported hidden fees and unexpected charges, which are common tactics employed by fraudulent platforms to exploit unsuspecting traders.

| Fee Type | 9cents | Industry Average |

|---|---|---|

| Spread for Major Pairs | Starting from 0.0 pips | 1.0 - 2.0 pips |

| Commission Model | Zero | Varies |

| Overnight Interest Range | Unclear | Varies |

The potential for hidden fees and unclear pricing models raises significant concerns about the overall cost of trading with 9cents. Traders should be wary of platforms that do not provide clear information about their fee structures, as this can lead to unexpected financial losses. This lack of transparency in fees is a significant red flag when assessing whether 9cents is safe.

Client Fund Security

The safety of client funds is paramount when selecting a trading platform. 9cents has not demonstrated adequate measures for securing client funds, such as segregating client accounts or providing investor protection schemes. The absence of these critical safety measures exposes traders to significant risks, especially if the platform were to face financial difficulties or insolvency.

Additionally, 9cents has not disclosed any information regarding its policies on negative balance protection or compensation schemes for traders. This lack of information is concerning, and potential investors should be cautious. Historical data shows that unregulated platforms often face issues related to fund security, which can lead to significant financial losses for traders.

Customer Experience and Complaints

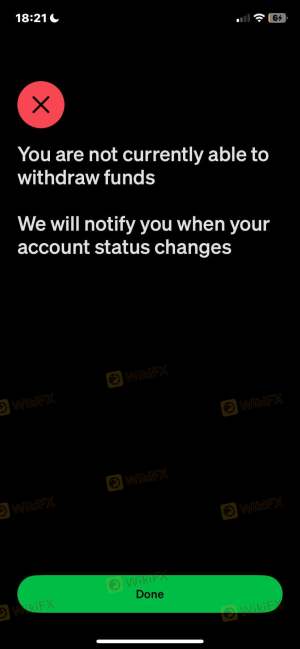

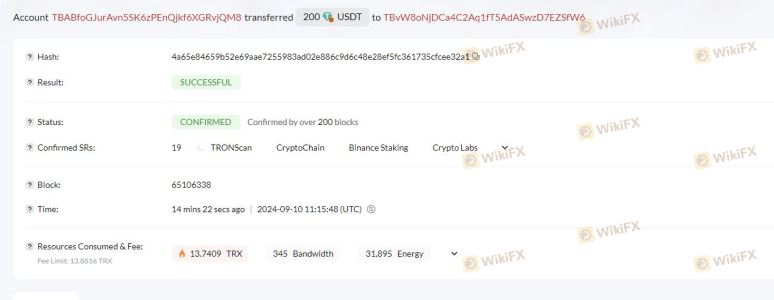

Analyzing customer feedback and real user experiences is crucial in assessing the reliability of a trading platform. Numerous complaints have been reported regarding 9cents, including difficulties in withdrawing funds, unresponsive customer support, and hidden fees. These issues reflect a broader pattern of dissatisfaction among users.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Unresponsive |

| Hidden Fees | Medium | Poor Communication |

| Customer Support | High | Slow Response Times |

For instance, many users have shared experiences of being unable to access their funds after requesting withdrawals, a classic warning sign of a potentially fraudulent platform. The poor quality of customer support further exacerbates the situation, as traders often find themselves without assistance when they encounter issues. These patterns of complaints should raise alarms for anyone considering trading with 9cents.

Platform and Trade Execution

The performance, stability, and user experience of a trading platform are essential factors to consider. While 9cents claims to offer advanced trading tools and a user-friendly interface, user reviews suggest otherwise. Many traders have reported issues with order execution quality, including slippage and rejected orders, which can significantly impact trading performance.

The potential for platform manipulation is another concern. Traders have raised alarms about the possibility of 9cents engaging in practices that disadvantage users, such as manipulating prices or executing trades in a manner that favors the broker rather than the trader. These concerns highlight the importance of choosing a platform that prioritizes fair and transparent trading practices.

Risk Assessment

Using 9cents presents several risks that traders should be aware of. The lack of regulation, hidden fees, questionable customer service, and poor execution quality all contribute to a high-risk trading environment.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No oversight from recognized authorities |

| Financial Risk | High | Potential for hidden fees |

| Customer Service Risk | Medium | Poor support can lead to unresolved issues |

| Execution Risk | High | Reports of slippage and rejected orders |

To mitigate these risks, traders should consider using regulated platforms with a proven track record of transparency and accountability. Additionally, conducting thorough research and only investing funds that one can afford to lose are essential strategies for risk management.

Conclusion and Recommendations

In conclusion, the evidence suggests that 9cents exhibits several characteristics commonly associated with fraudulent trading platforms. The lack of regulation, hidden fees, poor customer service, and negative user experiences all indicate that 9cents may not be a safe option for traders.

For those considering forex trading, it is advisable to seek out regulated brokers with a solid reputation and transparent practices. Platforms such as OANDA, IG, and Forex.com are examples of reputable alternatives that prioritize trader safety and offer a more secure trading environment.

Ultimately, it is crucial for traders to remain vigilant and conduct thorough due diligence before engaging with any trading platform, especially one like 9cents, which raises numerous red flags regarding its safety and legitimacy.

Is 9Cents a scam, or is it legit?

The latest exposure and evaluation content of 9Cents brokers.

9Cents Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

9Cents latest industry rating score is 1.84, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.84 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.