9cents 2025 Review: Everything You Need to Know

Summary

This 9cents review looks at an unregulated forex broker that gets mixed reactions from traders. 9Cents Financials Ltd. works without any regulatory oversight, offering trading services across forex, commodities, indices, stocks, and precious metals through the MT5 platform. The broker attracts traders with its zero commission structure and high leverage ratios up to 1:400. However, user feedback shows big concerns about platform reliability and customer service quality.

The broker targets traders who want high leverage opportunities with a minimum deposit of just $100. This makes it accessible to retail investors. However, the lack of regulatory protection raises major red flags for potential clients. According to Trustpilot data, user opinions split sharply with 80% giving 5-star ratings while 20% provide 1-star reviews. This shows polarized experiences among users.

Key features include zero commission trading, maximum leverage of 1:400, and support for multiple asset classes. The platform serves traders willing to accept higher risks in exchange for potentially favorable trading conditions. However, the absence of regulatory oversight significantly impacts the overall safety profile of this broker.

Important Notice

Regional Entity Differences: As an unregulated forex broker, 9cents operates without oversight from recognized financial authorities. This may result in varying levels of legal protection and safety standards across different jurisdictions. The legitimacy and security of services may differ significantly depending on your location and local financial regulations.

Review Methodology: This evaluation is based on comprehensive analysis of user feedback from multiple sources, publicly available platform information, and market research. Due to limited regulatory transparency, some aspects of this review rely heavily on user experiences and third-party assessments rather than verified regulatory documentation.

Rating Framework

Broker Overview

9Cents Financials Ltd. operates as an unregulated forex broker in the competitive online trading market. The company's establishment date remains unclear from available sources. However, it has positioned itself as a platform offering aggressive trading conditions to attract retail traders. The broker's business model focuses on providing high leverage ratios and zero commission structures. This comes at the cost of regulatory protection and oversight.

The platform operates primarily through the MetaTrader 5 trading platform. It supports multiple asset classes including forex pairs, commodities, stock indices, individual stocks, and precious metals. Despite offering diverse trading instruments, the broker's unregulated status raises significant concerns about client fund protection and operational transparency. The company lacks oversight from major financial regulatory bodies. These typically provide essential safeguards for retail traders.

According to available information, 9cents targets traders who prioritize high leverage and low-cost trading over regulatory security. The platform's marketing approach emphasizes quick wealth generation opportunities. However, such claims should be viewed with considerable caution given the inherent risks in forex trading and the broker's unregulated nature.

Regulatory Regions: 9cents operates as an unregulated broker without oversight from recognized financial authorities. No specific regulatory regions or licenses are mentioned in available sources. This indicates the platform functions outside traditional regulatory frameworks.

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal methods is not detailed in available sources. The platform accepts a minimum deposit of $100.

Minimum Deposit Requirements: The broker requires a minimum deposit of $100. This makes it accessible to retail traders with limited capital.

Bonuses and Promotions: Available sources do not provide specific information about bonus offerings or promotional campaigns.

Tradeable Assets: The platform supports trading in forex pairs, commodities, stock indices, individual stocks, and precious metals. This provides diversification opportunities for traders.

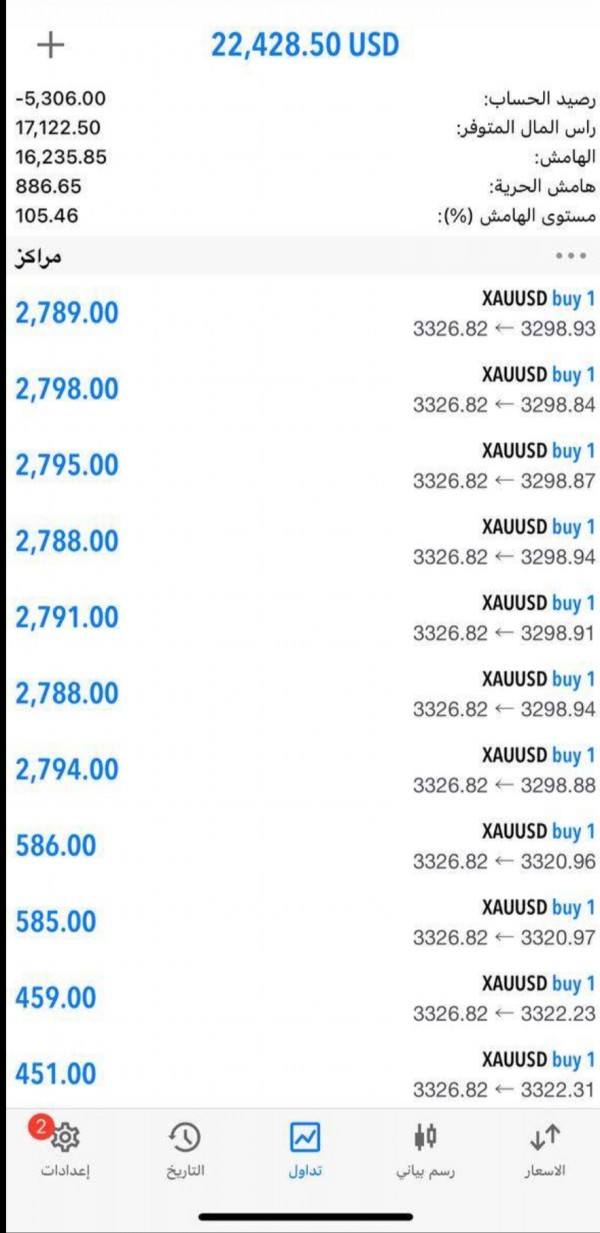

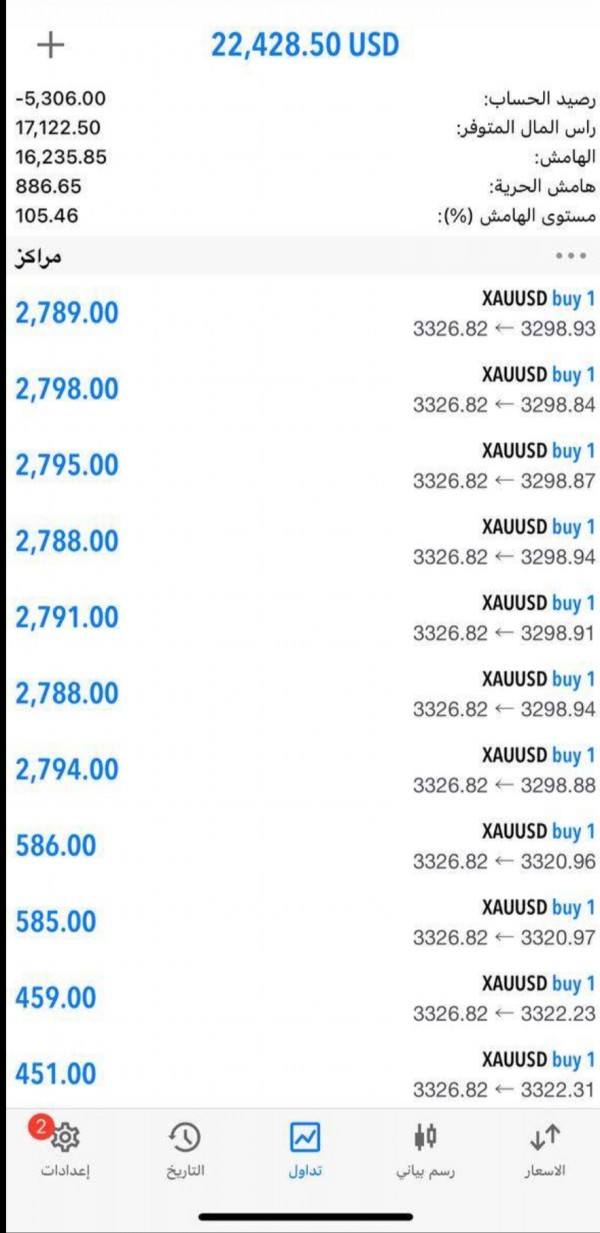

Cost Structure: Trading costs include spreads ranging between 16-20 pips for various instruments. The broker charges zero commission across all asset classes.

Leverage Ratios: Maximum leverage reaches 1:400. This is significantly higher than regulated brokers in major jurisdictions.

Platform Options: 9cents exclusively offers the MetaTrader 5 platform. User feedback suggests room for improvement in platform stability and functionality.

Regional Restrictions: Specific geographical restrictions are not detailed in available sources.

Customer Support Languages: Information about supported languages for customer service is not specified in available materials.

Detailed Rating Analysis

Account Conditions Analysis

The 9cents review of account conditions reveals a mixed picture of accessibility and risk. The broker's $100 minimum deposit requirement positions it as accessible to retail traders. This particularly benefits those beginning their forex trading journey. This low barrier to entry aligns with industry standards for unregulated brokers seeking to attract volume through reduced initial requirements.

However, available sources do not specify different account types or their respective features. This suggests a simplified account structure. The zero commission policy across all trading instruments represents a significant advantage for frequent traders. It potentially reduces overall trading costs compared to commission-based competitors. This fee structure particularly benefits scalpers and high-frequency traders who execute multiple daily transactions.

The absence of detailed information about account opening procedures and verification requirements raises questions about the broker's compliance standards. User feedback indicates a relatively straightforward registration process. However, some clients report delays in account activation. The lack of specialized account features, such as Islamic accounts for Sharia-compliant trading, may limit the broker's appeal to certain demographic segments.

9cents provides the MetaTrader 5 platform as its primary trading interface. It offers standard technical analysis tools and charting capabilities. MT5's reputation in the industry generally receives positive feedback for its comprehensive analytical features. These include multiple timeframes, technical indicators, and automated trading support through Expert Advisors.

However, user feedback reveals concerns about platform stability and performance consistency. The broker appears to lack substantial educational resources, market analysis, or research materials that typically support trader development. This deficiency particularly impacts novice traders who rely on educational content to improve their trading skills and market understanding.

The absence of proprietary trading tools or advanced market research distinguishes 9cents from more established brokers. These competitors invest heavily in client education and market analysis. This limitation may affect trader retention and success rates. Comprehensive educational resources often correlate with improved trading outcomes and client satisfaction.

Customer Service and Support Analysis

Customer service represents a significant weakness in the 9cents offering. This assessment is based on available user feedback. While the broker provides email and telephone support channels, response times and service quality receive mixed reviews from clients. Some users report extended waiting periods for inquiry resolution. This becomes particularly problematic during market volatility when timely support becomes crucial.

The quality of customer service appears inconsistent. Some clients receive satisfactory assistance while others express frustration with unresolved issues. This inconsistency suggests inadequate staff training or insufficient support infrastructure to handle client volume effectively. The lack of 24/7 support availability may also impact traders operating in different time zones.

Language support information is not specified in available sources. This potentially limits accessibility for non-English speaking traders. The absence of live chat functionality, increasingly standard among modern brokers, further reduces support accessibility and response efficiency.

Trading Experience Analysis

The 9cents review of trading experience reveals concerning issues with platform reliability and execution quality. User feedback indicates occasional platform delays and connectivity issues that can significantly impact trading performance. This becomes particularly problematic during high-volatility market conditions when stable platform performance becomes essential.

Slippage and requote situations appear problematic based on user reports. These issues potentially affect trade execution quality and profitability. These technical issues can result in trades executing at prices different from those intended. This creates additional costs and frustration for traders. The spreads ranging from 16-20 pips appear relatively wide compared to regulated competitors, potentially impacting overall trading costs.

The MT5 platform provides comprehensive charting tools and technical indicators. It supports various trading strategies from scalping to swing trading. However, the underlying execution quality and server stability issues may undermine these technical capabilities. This creates an inconsistent trading environment that challenges both novice and experienced traders.

Trustworthiness Analysis

Trustworthiness represents the most significant concern in this 9cents review. This is primarily due to the broker's unregulated status. Operating without oversight from recognized financial authorities eliminates crucial protections typically available to retail traders. These include deposit insurance, segregated client funds, and regulatory dispute resolution mechanisms.

The lack of transparency regarding company ownership, financial statements, and operational procedures further diminishes trustworthiness. Regulated brokers typically provide detailed company information, regulatory compliance reports, and third-party audits that verify operational integrity. The absence of such transparency makes it impossible to assess the broker's financial stability or operational legitimacy.

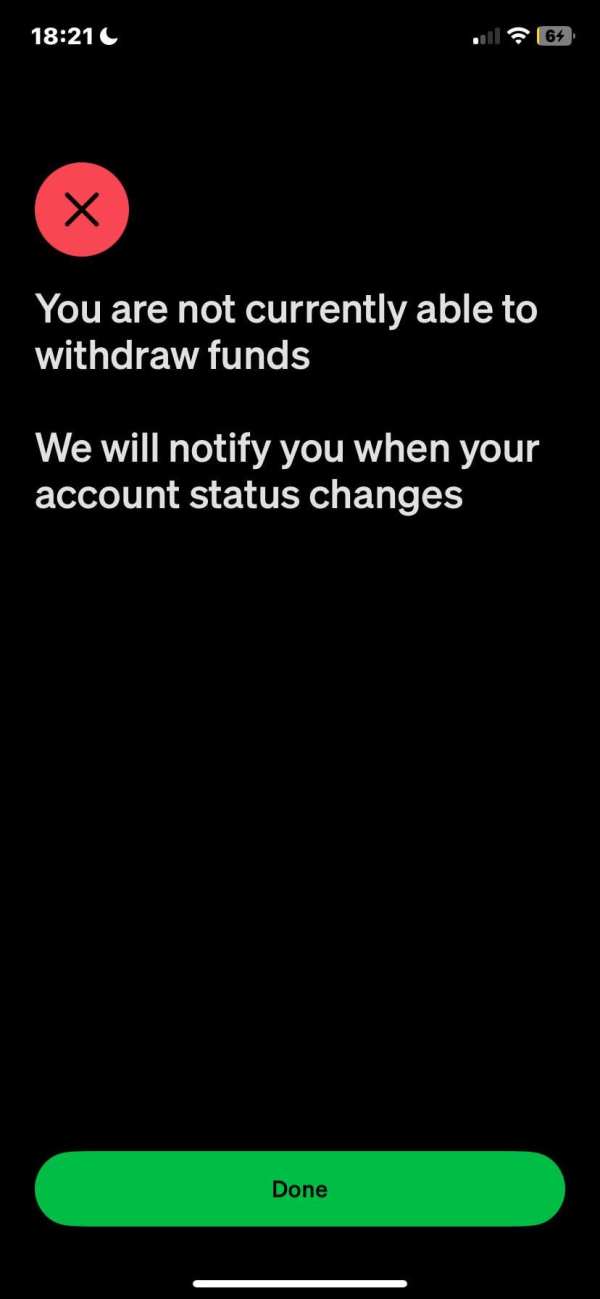

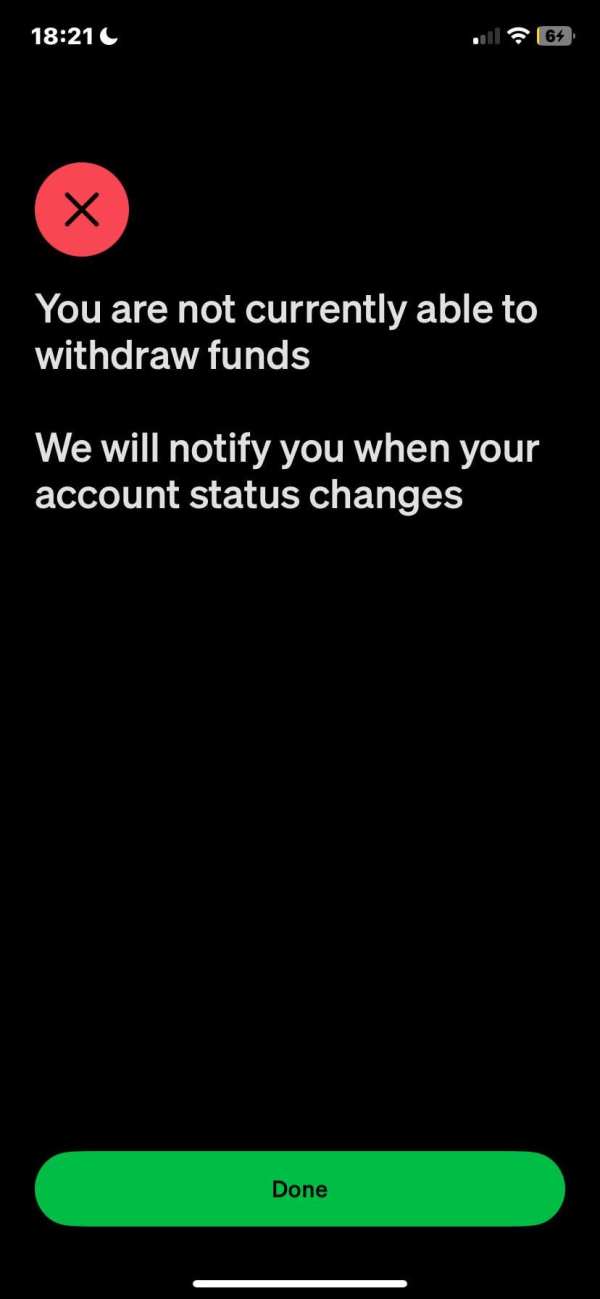

User reviews on Trustpilot show stark polarization. 80% provide maximum ratings while 20% give minimum scores. This extreme division suggests either manufactured positive reviews or genuine satisfaction among certain users. However, the negative feedback raises serious concerns about fund safety and withdrawal processing.

User Experience Analysis

Overall user satisfaction with 9cents appears mixed. This reflects the polarized nature of client feedback. The simplified registration process receives some positive feedback. However, verification procedures and account activation times generate complaints from certain users. Interface design and platform usability require improvement based on user suggestions.

The trading environment's inconsistency affects user experience significantly. Platform stability issues and execution problems create frustration among active traders. Users seeking reliable, professional trading environments may find 9cents inadequate compared to established, regulated alternatives.

Common complaints include customer service responsiveness, platform technical issues, and concerns about fund withdrawal processes. These recurring themes suggest systematic problems that impact client satisfaction and retention. The broker's appeal appears limited to traders prioritizing high leverage and low commissions over platform reliability and regulatory protection.

Conclusion

This comprehensive 9cents review reveals an unregulated forex broker offering aggressive trading conditions through high leverage and zero commissions. However, significant concerns about reliability and safety overshadow these potential advantages. While the platform may attract traders seeking high-risk, high-reward opportunities, the absence of regulatory oversight creates substantial risks that most traders should carefully consider.

The broker appears most suitable for experienced traders who understand the risks associated with unregulated platforms. These traders prioritize trading costs over safety measures. However, the mixed user feedback, platform stability issues, and lack of regulatory protection make 9cents unsuitable for most retail traders. This particularly affects those seeking reliable, long-term trading relationships.

Key advantages include competitive leverage ratios and zero commission structure. Major disadvantages encompass regulatory absence, inconsistent customer service, and platform reliability concerns that significantly impact the overall trading experience.