Regarding the legitimacy of 77markets forex brokers, it provides FSA and WikiBit, .

Is 77markets safe?

Risk Control

License

Is 77markets markets regulated?

The regulatory license is the strongest proof.

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

Leadcapital Corp Ltd

Effective Date:

--Email Address of Licensed Institution:

info@leadcapitalcrp.comSharing Status:

No SharingWebsite of Licensed Institution:

https://www.leadcapitalcrp.com, https://www.77markets.comExpiration Time:

--Address of Licensed Institution:

Block B, Global Village, Jivan’s Complex, Mont Fleuri, Mahe, Seychelles.Phone Number of Licensed Institution:

(+248) 4322279Licensed Institution Certified Documents:

Is 77Markets A Scam?

Introduction

77Markets is a relatively new player in the forex trading arena, positioning itself as a broker offering a diverse range of assets, including forex, stocks, indices, and commodities. Given the rapid growth of online trading platforms, potential investors must exercise caution and conduct thorough evaluations of any broker before committing their funds. The forex market, while offering significant profit potential, is also rife with risks, including scams and fraudulent practices. In this article, we will explore the legitimacy of 77Markets, analyzing its regulatory status, company background, trading conditions, customer safety measures, user experiences, platform performance, and overall risk assessment. Our investigation is based on a comprehensive review of user feedback, regulatory information, and expert analyses to provide a balanced perspective on whether 77Markets is safe or a scam.

Regulation and Legitimacy

The regulatory status of a forex broker is paramount in determining its credibility and safety. 77Markets claims to be regulated by the Financial Services Authority (FSA) of Seychelles, which, while providing a degree of oversight, is often viewed as less stringent compared to regulatory bodies in more established jurisdictions. Below is a summary of the broker's regulatory information:

| Regulatory Authority | License Number | Regulated Region | Verification Status |

|---|---|---|---|

| FSA Seychelles | SD 007 | Seychelles | Verified |

While being regulated by the FSA indicates some level of compliance, it is crucial to note that the Seychelles regulatory environment is often criticized for its leniency. For instance, the minimum capital requirement to obtain a brokerage license in Seychelles is significantly lower than in regions like Europe, where it can exceed €730,000. This raises concerns about the quality of regulatory oversight and the protection afforded to traders. Furthermore, the lack of a robust compensation scheme means that clients of 77Markets may not have recourse in the event of the broker's insolvency. This limited regulatory framework necessitates a cautious approach from potential clients when evaluating whether 77Markets is safe.

Company Background Investigation

77Markets operates under the parent company Lead Capital Corp. Ltd., which was established in 2014. The company has positioned itself as a provider of trading and investment services across various financial markets. However, the relatively short operational history raises questions about its stability and reliability. The management team's background and expertise are critical in assessing the company's capability to navigate the complexities of the financial markets. Unfortunately, detailed information regarding the management team is scarce, which can be a red flag for potential investors.

Transparency is another vital aspect of a broker's credibility. 77Markets provides limited information about its operations, which can hinder investor confidence. A reputable broker should offer comprehensive insights into its ownership structure, management team, and operational history. In this case, the lack of detailed disclosure may lead traders to question the broker's commitment to transparency and ethical practices. Overall, while 77Markets presents itself as a regulated entity, the opacity surrounding its management and corporate structure may deter cautious investors.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for evaluating its overall value proposition. 77Markets provides various account types, each with different minimum deposit requirements and trading costs. The overall fee structure appears to be competitive, but it is essential to analyze the specifics. Below is a comparison of key trading costs:

| Fee Type | 77Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 3 pips (EUR/USD) | 1-2 pips |

| Commission Model | 0.2% + $10 | 0-0.1% |

| Overnight Interest Range | Varies | Varies |

The spreads offered by 77Markets are notably wider than the industry average, which may significantly impact trading profitability, especially for high-frequency traders. Additionally, the commission structure, particularly for shares, raises concerns as it may result in higher trading costs compared to other brokers. The presence of high spreads and commissions can be a potential deterrent for traders seeking low-cost trading options. Thus, while 77Markets may offer a range of assets and account types, the overall trading conditions may not be as favorable as those provided by more established brokers.

Customer Funds Safety

The safety of customer funds is a critical consideration when evaluating any broker. 77Markets claims to implement several measures to protect client funds, including the use of segregated accounts and adherence to banking security protocols. However, the specifics of these measures are not clearly outlined, which can lead to uncertainty among potential clients.

In terms of investor protection, the FSA does not offer a compensation scheme for clients in the event of broker insolvency, which is a significant risk factor. Furthermore, the absence of negative balance protection can leave traders vulnerable to losing more than their initial deposits. Historical issues regarding fund security and withdrawal difficulties have been reported by users, further complicating the assessment of 77Markets' safety. Overall, while the broker may have some security measures in place, the lack of comprehensive investor protection raises concerns about the safety of customer funds.

Customer Experience and Complaints

Customer feedback is an invaluable resource for assessing a broker's reliability. Reviews of 77Markets reveal a mixed bag of experiences, with some users reporting positive interactions, while others highlight significant issues. Common complaints include difficulties with withdrawals, aggressive sales tactics, and inadequate customer support. Below is a summary of the primary complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| High-pressure Sales Tactics | Medium | Vague responses |

| Poor Customer Support | High | Automated replies |

One notable case involved a user who struggled to withdraw their funds after repeated attempts, leading to frustration and financial loss. Another individual reported aggressive tactics from account managers, pressuring them to deposit more funds despite their initial reluctance. These recurring themes of withdrawal difficulties and poor customer service suggest that 77Markets may not prioritize customer satisfaction, raising further doubts about its legitimacy.

Platform and Trade Execution

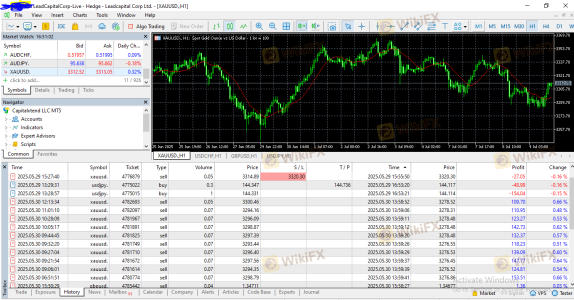

The trading platform's performance is crucial for a seamless trading experience. 77Markets offers both a web-based platform and the popular MetaTrader 5 (MT5) for its users. While MT5 is known for its advanced features and user-friendly interface, the overall execution quality and order handling at 77Markets have come under scrutiny. Users have reported instances of slippage and rejected orders, which can significantly affect trading outcomes.

The platform's stability and reliability are also essential factors to consider. Although some users have praised the platform's interface, others have raised concerns about its performance during high volatility. Any signs of platform manipulation or execution issues can indicate a lack of integrity on the broker's part, further complicating the assessment of whether 77Markets is safe.

Risk Assessment

Using 77Markets as a trading platform carries inherent risks, particularly due to its regulatory status and customer feedback. Below is a simplified risk scorecard summarizing key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Offshore regulation with low oversight. |

| Financial Risk | Medium | High spreads and withdrawal issues reported. |

| Platform Risk | Medium | Potential execution issues and slippage. |

| Customer Service Risk | High | Poor customer support and high-pressure sales tactics. |

To mitigate these risks, potential traders should conduct thorough due diligence before opening an account. It is advisable to start with a demo account to familiarize themselves with the platform and its features before committing real funds. Additionally, traders should be cautious of high-pressure sales tactics and avoid depositing more than they can afford to lose.

Conclusion and Recommendations

In conclusion, while 77Markets presents itself as a regulated broker offering a wide range of trading options, several red flags suggest that potential traders should proceed with caution. The broker's regulatory status, coupled with mixed customer feedback regarding fund safety, withdrawal issues, and customer service, raises significant concerns about its overall legitimacy.

For traders seeking a reliable and trustworthy trading experience, it may be prudent to explore alternative brokers with stronger regulatory oversight and a proven track record of customer satisfaction. Some reputable options include brokers regulated by tier-one authorities, such as the FCA in the UK or ASIC in Australia. Ultimately, potential clients should prioritize due diligence and ensure that they fully understand the risks associated with trading on platforms like 77Markets before making any financial commitments.

In summary, is 77Markets safe? The evidence suggests that while it may not be outright fraudulent, there are enough concerns to warrant careful consideration and a cautious approach.

Is 77markets a scam, or is it legit?

The latest exposure and evaluation content of 77markets brokers.

77markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

77markets latest industry rating score is 4.19, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 4.19 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.