77markets 2025 Review: Everything You Need to Know

77markets, a relatively new player in the forex brokerage scene, has garnered attention for its diverse asset offerings and robust trading platforms. However, user experiences and expert opinions reveal a mixed bag of reviews, highlighting both positive features and significant concerns. Key aspects include the broker's regulatory status and the level of customer service provided.

Note: It is crucial to recognize that 77markets operates under a regulatory framework that may vary across regions. This could affect the broker's legitimacy and the safety of clients' funds. Therefore, it is essential to approach trading with 77markets with caution and conduct thorough research.

Rating Overview

How We Rate Brokers: Our ratings are based on a comprehensive analysis of user reviews, expert insights, and factual data regarding the broker's offerings.

Broker Overview

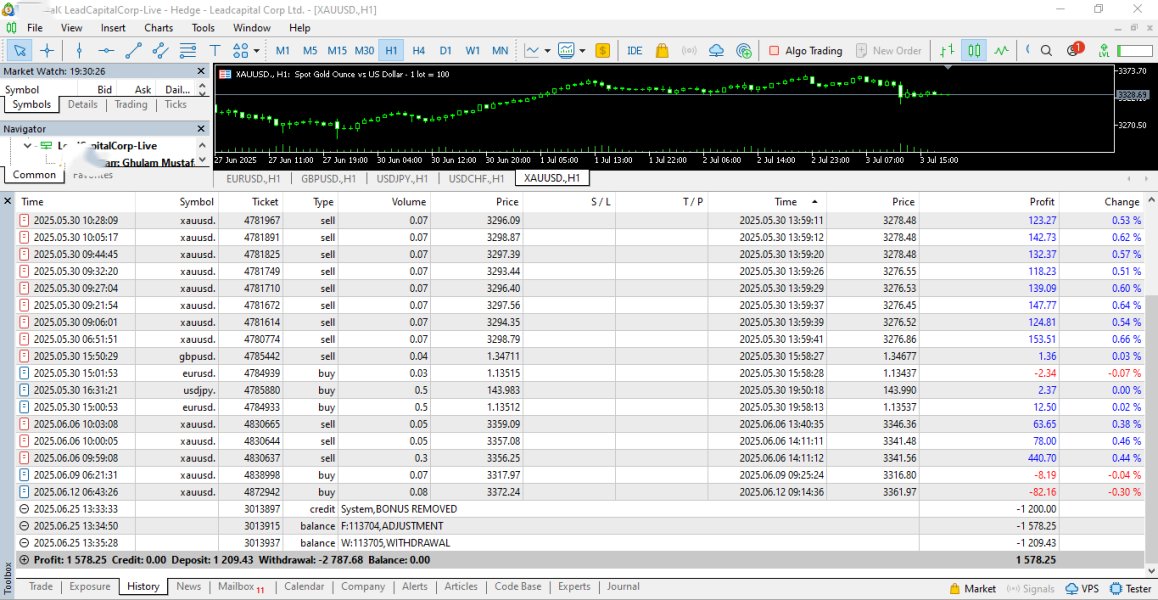

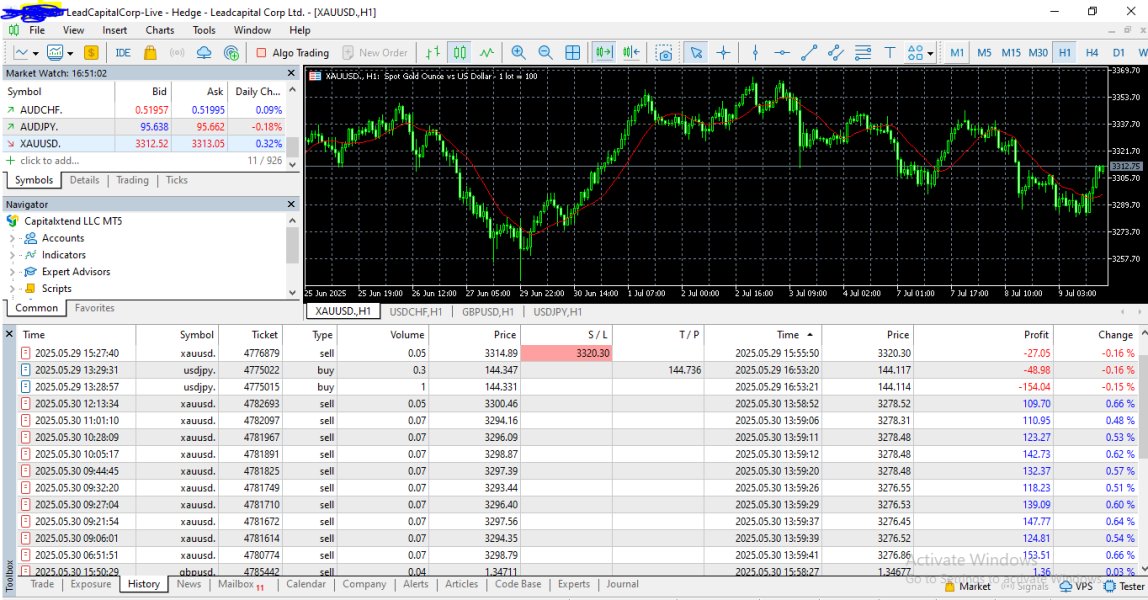

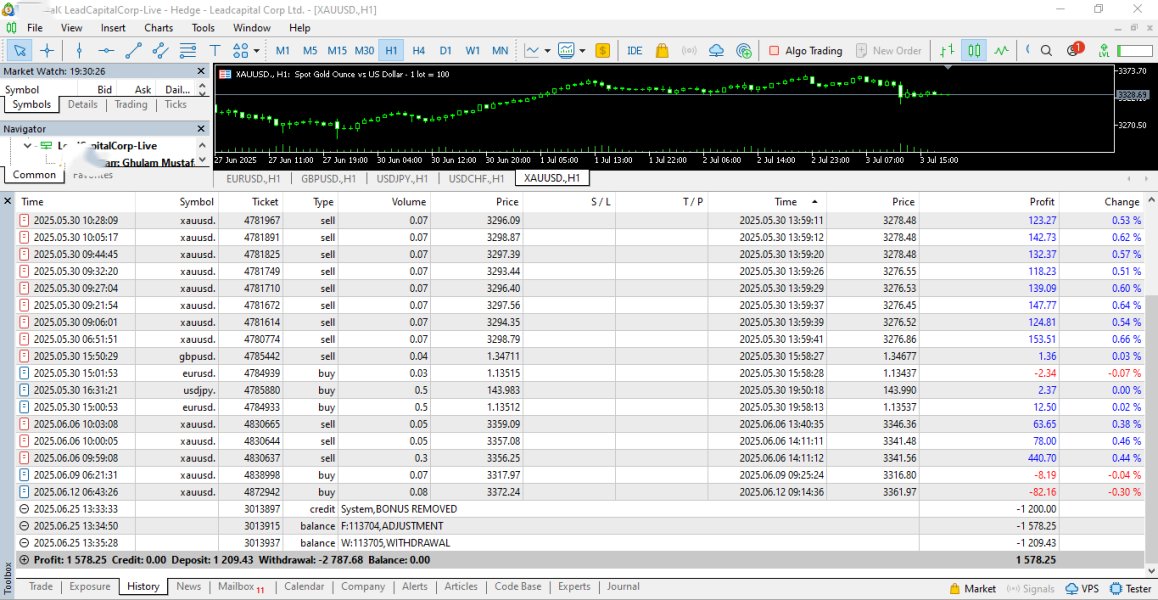

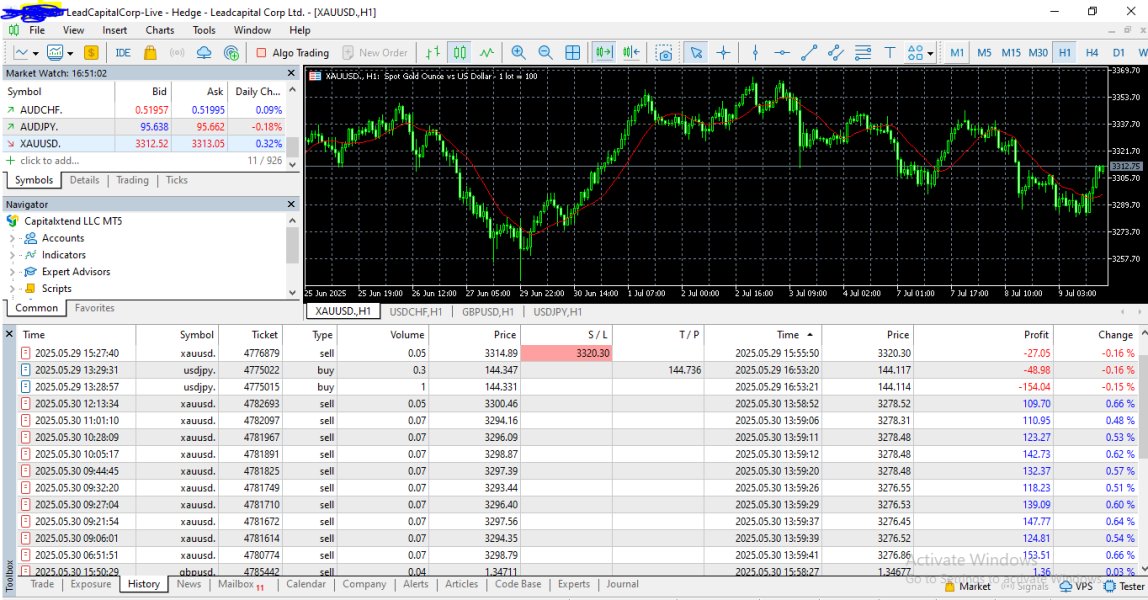

Founded in 2021, 77markets is operated by Lead Capital Corp. Ltd. and is based in Seychelles. The broker claims to be regulated by the Seychelles Financial Services Authority (FSA). It offers a wide array of trading instruments, including stocks, forex, indices, commodities, and cryptocurrencies. The trading platforms available to users include the popular MetaTrader 5 (MT5) and a proprietary web-based platform known as WebTrader.

Detailed Analysis

Regulatory Jurisdiction

77markets is regulated by the FSA of Seychelles, which is known for its relatively lenient regulatory standards compared to stricter jurisdictions like the UK or the US. While this regulation provides some level of oversight, it does not guarantee the same level of client protection found in more robust regulatory environments. The broker's license number is SD 007, but potential clients should be aware of the risks associated with trading with an offshore broker.

Deposit/Withdrawal Currency/Cryptocurrency

77markets accepts deposits in multiple currencies, including USD, EUR, and GBP. The minimum deposit required to open a trading account is $250 for the Discovery account, which is relatively accessible for new traders. However, higher-tier accounts, such as Gold and Platinum, require significantly higher deposits, which may deter some potential clients.

The broker offers various promotional bonuses, including deposit bonuses that can reach up to 100%. However, such bonuses often come with stringent withdrawal conditions that can make it challenging for traders to access their funds. This practice is common among brokers operating in less regulated environments and should be approached with caution.

Tradable Asset Classes

77markets boasts a diverse selection of over 400 tradable assets, covering forex pairs, stocks, commodities, indices, and cryptocurrencies. This range allows traders to diversify their portfolios and explore various market opportunities. However, some users have reported high spreads on certain assets, which can impact trading profitability.

Costs (Spreads, Fees, Commissions)

The broker's cost structure includes variable spreads, which can start from 0.12 pips for certain assets. However, spreads for major currency pairs like EUR/USD can be as high as 3 pips, which is above the industry average. Additionally, commissions apply to shares, with a fee of 0.2% plus $10 per trade. Such costs can accumulate quickly, particularly for active traders.

Leverage

77markets offers a maximum leverage of 1:150, which is typical for offshore brokers. While high leverage can amplify potential returns, it also significantly increases the risk of substantial losses. Traders should exercise caution and ensure they understand the implications of trading with high leverage.

Traders at 77markets can choose between the MT5 platform and the proprietary WebTrader platform. MT5 is widely regarded as one of the best trading platforms available, offering advanced charting tools, automated trading capabilities, and a user-friendly interface. WebTrader provides a simplified trading experience and is accessible from any web browser.

Restricted Regions

77markets does not accept clients from certain jurisdictions, including the United States. This restriction is common among offshore brokers and may limit accessibility for some traders.

Available Customer Support Languages

77markets offers customer support in multiple languages, including English and Arabic. However, user feedback indicates that response times can be slow and that the quality of customer service is inconsistent. Many users have reported difficulties in reaching support representatives and receiving timely assistance.

Final Rating Overview

In conclusion, while 77markets offers a range of trading options and platforms, potential clients should weigh the benefits against the risks associated with trading with an offshore broker. User reviews and expert opinions suggest that while there are positive aspects, significant concerns regarding customer service and regulatory oversight remain. Conducting thorough research and considering alternative brokers with stronger regulatory frameworks may be prudent for those looking to trade in the forex market.