Regarding the legitimacy of easyMarkets forex brokers, it provides ASIC, CYSEC, FSC, FSA and WikiBit, (also has a graphic survey regarding security).

Is easyMarkets safe?

Pros

Cons

Is easyMarkets markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

EASYMARKETS PTY LTD

Effective Date: Change Record

2004-03-26Email Address of Licensed Institution:

danielb@easymarkets.comSharing Status:

No SharingWebsite of Licensed Institution:

www.easy-forex.com.auExpiration Time:

--Address of Licensed Institution:

EASY FOREX PTY LTD SE 703 65 YORK ST SYDNEY NSW 2000Phone Number of Licensed Institution:

1800176935Licensed Institution Certified Documents:

CYSEC Market Making License (MM) 20

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

Easy Forex Trading Ltd

Effective Date:

2007-05-29Email Address of Licensed Institution:

koula@easy-markets.comSharing Status:

Website of Licensed Institution:

easy-markets.com/eu, https://www.emarkets-global.com/eu/, https://www.easy-markets.com/, www.emarkets-global.com, www.easy-forex.com, www.easy-forex.com/eu, easymarkets.euExpiration Time:

--Address of Licensed Institution:

Kolonakiou 25, Zavos Kolonakiou CTR Block B, Office 101 Linopetra, 4103 Limassol, CyprusPhone Number of Licensed Institution:

+357 25 828 899Licensed Institution Certified Documents:

FSC Market Making License (MM)

British Virgin Islands Financial Services Commission

British Virgin Islands Financial Services Commission

Current Status:

Offshore RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

EF Worldwide Ltd

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

EF Worldwide Ltd

Effective Date:

--Email Address of Licensed Institution:

compliance@easymarkets.comSharing Status:

No SharingWebsite of Licensed Institution:

https://www.easymarkets.com/sycExpiration Time:

--Address of Licensed Institution:

CT House, Office 8F Providence, Mahe, SeychellesPhone Number of Licensed Institution:

+248 4373237Licensed Institution Certified Documents:

Is easyMarkets A Scam?

Introduction

easyMarkets, formerly known as Easy Forex, is a well-established online trading platform that has been operating since 2001. Based in Cyprus, it has positioned itself as a user-friendly broker catering to both novice and experienced traders. With a wide array of trading instruments, including forex, CFDs, commodities, and cryptocurrencies, easyMarkets aims to provide an accessible trading experience. However, as with any trading platform, it is essential for traders to carefully evaluate the credibility and reliability of the broker before committing their funds. This article seeks to provide an objective assessment of easyMarkets by analyzing its regulatory status, company background, trading conditions, customer fund safety, user experiences, platform performance, and associated risks. The information presented is based on an extensive review of reputable sources, including regulatory filings, user feedback, and expert evaluations.

Regulation and Legitimacy

The regulatory framework within which a broker operates plays a pivotal role in determining its legitimacy and trustworthiness. easyMarkets is regulated by two prominent authorities: the Cyprus Securities and Exchange Commission (CySEC) and the Australian Securities and Investments Commission (ASIC). These regulatory bodies enforce strict compliance standards, ensuring that brokers operate transparently and maintain a high level of client protection.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| CySEC | 079/07 | Cyprus | Active |

| ASIC | 246566 | Australia | Active |

The significance of regulation cannot be overstated. Both CySEC and ASIC are recognized for their rigorous standards, which include requirements for capital adequacy, segregation of client funds, and regular audits. This oversight helps protect traders from potential misconduct and ensures that their funds are handled responsibly. Additionally, easyMarkets participates in the Investor Compensation Fund (ICF) in Cyprus, which offers further protection for clients in the event of insolvency. Historically, easyMarkets has maintained a compliant record with these regulators, enhancing its reputation as a legitimate trading platform.

Company Background Investigation

easyMarkets was founded in 2001 and has undergone significant evolution since its inception. Initially launched as Easy Forex, the company rebranded in 2016 to reflect its broader range of services beyond just forex trading. The parent company, Blue Capital Markets Ltd, oversees easyMarkets and its subsidiaries, which include Easy Forex Trading Ltd (regulated by CySEC) and Easy Markets Pty Ltd (regulated by ASIC). This ownership structure allows easyMarkets to operate across various jurisdictions, catering to a global client base.

The management team of easyMarkets comprises industry professionals with extensive backgrounds in finance and trading. Their expertise contributes to the broker's operational integrity and commitment to client satisfaction. Furthermore, easyMarkets emphasizes transparency and information disclosure, providing clients with access to relevant trading information, educational resources, and market analysis.

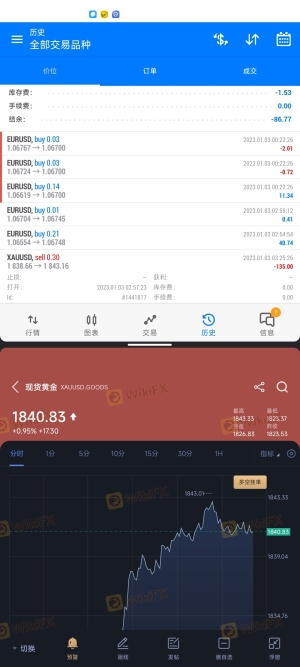

Trading Conditions Analysis

When assessing a broker, understanding the trading conditions, including fees and spreads, is crucial. easyMarkets offers a competitive trading environment with fixed spreads, which means that traders know their costs upfront without worrying about unexpected fluctuations during trading hours. The broker does not charge commissions on trades, generating revenue solely from the spreads.

| Fee Type | easyMarkets | Industry Average |

|---|---|---|

| Spread for Major Pairs | 1.0 - 1.8 pips | 1.5 - 2.0 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Varies | Varies |

While the fixed spreads are generally competitive, it is essential to note that they may be higher than those offered by some other brokers. Additionally, the broker has a unique feature called "deal cancellation," which allows traders to cancel losing trades within a specified timeframe for a fee. This feature can be beneficial for risk management but may also introduce additional costs that traders should consider.

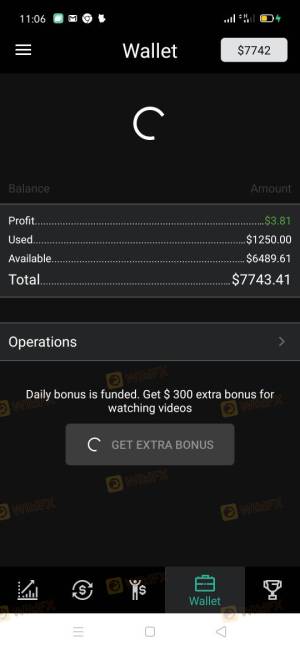

Customer Fund Safety

The safety of customer funds is a top priority for any reputable broker. easyMarkets implements several measures to ensure the security of client deposits. Client funds are held in segregated accounts, separate from the broker's operating funds, which minimizes the risk of loss in the event of financial difficulties. Additionally, the broker offers negative balance protection, ensuring that traders cannot lose more than their deposited amount, even during volatile market conditions.

Historically, easyMarkets has not faced significant controversies regarding fund safety. The regulatory oversight provided by CySEC and ASIC adds an additional layer of security, as these authorities enforce strict rules regarding fund management and client protection. However, it is important for traders to remain vigilant and conduct their due diligence before investing.

Customer Experience and Complaints

Analyzing customer feedback is crucial for understanding the overall user experience with a broker. easyMarkets has garnered a mix of positive and negative reviews from its clients. Many users appreciate the user-friendly platform, competitive spreads, and responsive customer support. However, some common complaints include issues with fund withdrawals and the handling of account verifications.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | Moderate | Mixed |

| Account Verification Issues | High | Slow |

| Trade Cancellation Fees | Moderate | Addressed |

One notable case involved a trader who experienced delays in withdrawing profits, leading to frustration and dissatisfaction. In contrast, other users reported smooth withdrawal processes and prompt assistance from customer support. This inconsistency in user experiences highlights the importance of assessing personal needs and expectations when choosing a broker.

Platform and Trade Execution

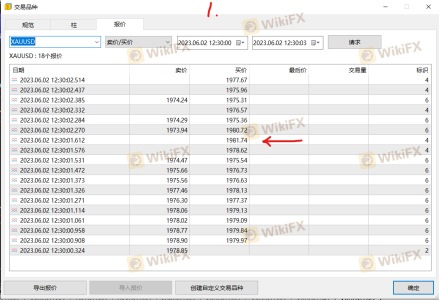

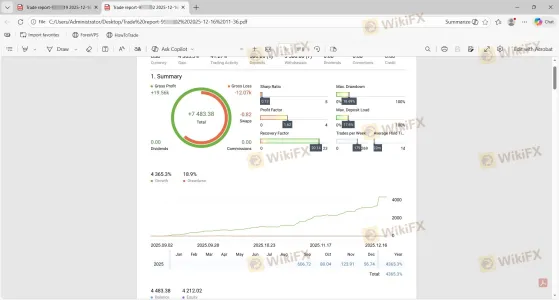

The performance and reliability of a trading platform are critical factors influencing a trader's success. easyMarkets provides a proprietary trading platform alongside the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. The proprietary platform is designed to be intuitive and user-friendly, offering features such as real-time market analysis, guaranteed stop-loss orders, and the unique deal cancellation feature.

In terms of trade execution, easyMarkets claims to have no slippage, which means that trades are executed at the expected price without unexpected changes. However, some users have reported instances of slippage during volatile market conditions. Overall, the platform's performance is generally regarded as reliable, but traders should remain cautious during periods of high volatility.

Risk Assessment

When trading with easyMarkets, it is essential to understand the associated risks. The broker operates in a highly leveraged environment, which can amplify both gains and losses. Additionally, the use of CFDs (Contracts for Difference) means that traders do not own the underlying assets, which can introduce additional complexities.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Market Risk | High | Volatile price movements can lead to significant losses. |

| Leverage Risk | High | High leverage can magnify losses beyond the initial investment. |

| Regulatory Risk | Medium | Potential issues related to regulatory compliance in certain jurisdictions. |

To mitigate these risks, traders should employ effective risk management strategies, such as setting stop-loss orders and only trading with funds they can afford to lose. Additionally, practicing on a demo account can help traders familiarize themselves with the platform and develop their trading skills before committing real money.

Conclusion and Recommendations

In conclusion, easyMarkets is a regulated broker that offers a range of trading instruments and features designed to cater to both novice and experienced traders. While its regulatory status with CySEC and ASIC provides a level of assurance regarding its legitimacy, potential clients should remain vigilant and conduct thorough research before investing.

The broker's trading conditions, including fixed spreads and unique features like deal cancellation, can be advantageous for many traders. However, some users have reported issues related to withdrawals and account verifications, which may warrant caution.

For traders considering easyMarkets, it is advisable to assess personal trading goals and risk tolerance. Beginners may find the platform's educational resources and user-friendly interface beneficial, while experienced traders might appreciate the competitive trading conditions.

If you are looking for alternatives, consider brokers like IG, OANDA, or Forex.com, which also offer robust regulatory oversight and a wide range of trading instruments. Ultimately, the choice of broker should align with your trading style, risk appetite, and investment objectives.

Is easyMarkets a scam, or is it legit?

The latest exposure and evaluation content of easyMarkets brokers.

easyMarkets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

easyMarkets latest industry rating score is 8.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 8.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.