CM Trading 2025 Review: Everything You Need to Know

Executive Summary

CM Trading is a known forex broker in Africa. However, user feedback shows mixed experiences that need careful thought. This cm trading review looks at a broker that has won industry awards while facing questions from some traders about platform reliability and fund security.

The company started in 2012 and follows rules set by South Africa's Financial Sector Conduct Authority (FSCA). CM Trading has become a major player in CFD and forex trading. The broker's biggest wins include the "Best Financial Broker Africa" award for five years straight from 2017 to 2021, showing steady industry respect. The platform also offers leverage up to 1:400, which appeals to traders who want more trading power.

The broker mainly targets small to medium-sized investors, especially those who need high leverage trading. With a minimum deposit of $250 USD, CM Trading tries to stay accessible for new traders while giving advanced features to experienced users. But user reviews paint a complex picture.

With an average rating of 3/5 stars, trader feedback ranges from good experiences with platform use to worrying reports about fund safety and withdrawal processes. This split in user experiences makes CM Trading a broker that needs thorough checking before you commit. The mixed nature of these reviews suggests potential clients should research carefully and perhaps start with smaller investments to test the platform's reliability.

Overall Rating: 5.5/10

Important Disclaimer

CM Trading works under South African rules through the Financial Sector Conduct Authority (FSCA). This may be very different from rules and protections in other regions. Traders from different countries should carefully check the rules and protections that apply before using this broker.

This review uses public information, user feedback, and industry reports available as of 2025. Since trading experiences are personal and broker services change over time, individual experiences may be very different from what this analysis shows. Market conditions, regulatory changes, and platform updates can all affect how well a broker performs for any given trader.

Rating Framework

Broker Overview

CM Trading started in 2012 as a CFD and forex broker based in South Africa. The company built its reputation by providing global trading services with a special focus on the African market, though it accepts clients from many international locations. The company was founded to make global financial markets more accessible, and CM Trading has operated steadily for over ten years.

The broker uses a market maker model and provides trading services across multiple types of assets including forex pairs, commodities, individual stocks, and major global indices. This varied approach lets traders build complete portfolios while keeping access to leverage ratios that can greatly increase trading positions. The platform structure allows for both conservative and aggressive trading strategies depending on individual risk tolerance.

CM Trading's regulatory base is with the Financial Sector Conduct Authority (FSCA) in South Africa, giving a framework of oversight that has been in place since the company started. The platform mainly uses its own CMTrading Webtrader system, designed to offer direct browser-based trading without needing software downloads. This cm trading review shows that the broker has always focused on keeping technology accessible while expanding its services to meet changing trader needs.

The company's business model focuses on providing competitive leverage options, with maximum ratios reaching 1:400. This positions it among brokers offering higher leverage access in today's regulatory environment.

Regulatory Jurisdiction: CM Trading operates under South Africa's Financial Sector Conduct Authority (FSCA) oversight. This provides regulatory protection within the South African financial services framework.

Deposit and Withdrawal Methods: Specific information about available deposit and withdrawal methods was not detailed in available sources. This represents a transparency gap that potential clients should clarify directly with the broker.

Minimum Deposit Requirements: The broker requires a $250 USD minimum deposit. This makes it accessible for entry-level traders while remaining substantial enough to support serious trading activities.

Promotional Offerings: CM Trading provides "unique, limited risk-free trades" as part of its promotional structure according to available information. However, specific terms and conditions require direct verification with the broker.

Available Trading Assets: The platform supports trading across four main asset categories: foreign exchange pairs, commodities markets, individual stock positions, and global stock indices. This provides diversification opportunities for portfolio construction.

Cost Structure: Detailed information about spreads, commissions, and additional fees was not available in reviewed sources. This makes comprehensive cost analysis challenging without direct broker consultation.

Leverage Capabilities: Maximum leverage ratios reach 1:400. This places CM Trading among brokers offering higher leverage access, though traders should note that high leverage significantly increases both profit potential and loss risk.

Platform Technology: The primary trading interface uses CMTrading Webtrader, a browser-based platform designed for direct access without software installation requirements. The web-based approach eliminates compatibility issues but may limit advanced functionality compared to downloadable platforms.

Geographic Restrictions: Specific information about geographic limitations or restricted jurisdictions was not detailed in available sources. Potential clients should verify their country's eligibility before attempting to open an account.

Customer Support Languages: Available customer service languages were not specified in reviewed materials. This requires direct confirmation for multilingual support needs.

This cm trading review highlights several information gaps that potential clients should address through direct broker contact before account opening.

Detailed Rating Analysis

Account Conditions Analysis (6/10)

CM Trading's account structure shows a mixed picture for potential traders. The $250 USD minimum deposit requirement positions the broker competitively for entry-level traders, significantly lower than many established brokers requiring $500-$1000 minimum deposits. This accessibility factor contributes positively to the overall account conditions assessment and makes forex trading more approachable for beginners.

However, the lack of detailed information about different account tiers represents a significant transparency concern. Most established brokers clearly outline multiple account types with varying features, minimum deposits, and benefit structures. The absence of this information in available sources suggests either limited account variety or insufficient marketing transparency, both of which can frustrate potential clients.

The leverage offering of up to 1:400 stands as a notable feature, particularly attractive for traders seeking enhanced position sizing capabilities. However, this high leverage comes with substantial risk considerations that novice traders may not fully appreciate. According to user feedback analyzed, some traders have expressed concerns about risk management education and platform safeguards, suggesting the broker could improve its educational resources.

User testimonials reveal mixed experiences with account opening processes. Some traders report straightforward registration while others mention complications with verification procedures. The specific account opening flow details were not available in reviewed sources, making comprehensive evaluation challenging and potentially creating uncertainty for prospective clients.

The absence of clearly defined account features such as Islamic account options, VIP services, or professional trader designations suggests either limited service differentiation or communication gaps. This cm trading review identifies these as areas requiring improvement to better serve diverse trader needs.

The evaluation of CM Trading's tools and resources reveals significant information gaps that impact the overall assessment. While the broker operates the CMTrading Webtrader platform, detailed specifications about available analytical tools, charting capabilities, and technical indicators were not comprehensively documented in available sources. This lack of transparency makes it difficult for traders to assess whether the platform meets their analytical needs.

User feedback suggests basic trading functionality is available through the web-based platform. Some traders express satisfaction with fundamental trading operations. However, the absence of detailed tool descriptions raises questions about the platform's analytical depth compared to industry-standard offerings like MetaTrader 4 or 5, which provide extensive technical analysis capabilities.

Research and analysis resources appear limited based on available information. Most competitive brokers provide daily market analysis, economic calendars, trading signals, and educational webinars. The lack of detailed information about these resources suggests either minimal offerings or poor marketing communication of available tools, both of which disadvantage traders who rely on broker-provided analysis.

Educational resources, crucial for trader development, were not specifically outlined in reviewed materials. This represents a significant concern for novice traders who rely on broker-provided education to develop trading skills and market understanding. Without proper educational support, new traders may struggle to develop effective trading strategies.

Automated trading support, including expert advisor compatibility and algorithmic trading capabilities, was not addressed in available sources. This information gap prevents comprehensive evaluation of the platform's suitability for advanced trading strategies. Many experienced traders require automated trading features to implement sophisticated trading systems.

The overall tools and resources assessment reflects these information limitations. This suggests potential clients should conduct thorough due diligence about platform capabilities before committing to account opening.

Customer Service and Support Analysis (6/10)

Customer service evaluation for CM Trading presents a complex picture based on available user feedback and limited official information. User reviews indicate mixed experiences with customer support responsiveness and effectiveness, contributing to moderate scoring in this category. The inconsistency in service quality appears to be a recurring theme among trader testimonials.

According to trader testimonials, customer service response times vary significantly. Some users report prompt assistance while others mention delays in receiving support. This inconsistency in service delivery suggests potential staffing or process challenges that impact overall user satisfaction and can be particularly frustrating during urgent trading situations.

The quality of customer service interactions receives mixed reviews from the trading community. Some users acknowledge professional and knowledgeable support staff, while others express frustration with resolution processes and communication effectiveness. This disparity indicates potential training or standardization issues within the support team that could be addressed through improved protocols.

Specific customer service channels, including telephone support, live chat availability, and email response systems, were not detailed in available sources. This information gap prevents comprehensive evaluation of support accessibility and convenience for traders requiring assistance. Modern traders expect multiple communication channels to be available when they need help.

Multilingual support capabilities remain unclear based on reviewed materials. This represents a significant consideration for international traders who may require native language assistance for complex trading or account issues. Given CM Trading's international client base, clearer communication about language support would be beneficial.

Operating hours for customer support were not specified in available sources. This makes it difficult to assess availability for traders in different time zones or those requiring after-hours assistance. Global forex markets operate 24/5, so support availability during market hours is crucial.

The moderate rating reflects these mixed user experiences and information limitations. This suggests that while support exists, consistency and transparency could benefit from improvement.

Trading Experience Analysis (6/10)

The trading experience evaluation for CM Trading reveals a platform that meets basic trading requirements while facing challenges in advanced functionality and user satisfaction. User feedback indicates general acceptance of platform stability, though specific performance metrics were not available in reviewed sources. The overall experience seems adequate for basic trading but may lack features that advanced traders expect.

Platform stability receives moderate praise from users. Most traders report consistent access to their accounts and trading functions. However, some users have mentioned occasional connectivity issues that temporarily impact trading activities, which can be costly in fast-moving markets. The CMTrading Webtrader platform appears to handle standard trading operations adequately, though detailed performance testing data was not available.

Order execution quality remains unclear due to limited specific data about execution speeds, slippage rates, and fill quality. These metrics are crucial for evaluating trading experience quality, particularly for active traders who require precise order handling. Without this information, traders cannot fully assess whether the platform meets their execution requirements.

The web-based platform functionality covers essential trading operations according to user feedback. This includes position opening, closing, and basic order management. However, advanced trading features such as one-click trading, advanced order types, and sophisticated charting tools were not specifically addressed in available materials, potentially limiting the platform's appeal to experienced traders.

Mobile trading experience details were not comprehensively covered in reviewed sources. This represents a significant information gap given the importance of mobile trading for modern traders. Many traders need to monitor and manage positions while away from their computers, making mobile functionality essential.

Trading environment assessment is complicated by the absence of specific spread information, commission structures, and execution model details. These factors significantly impact overall trading costs and experience quality. Without transparent pricing information, traders cannot accurately calculate their potential trading costs.

This cm trading review rates trading experience moderately due to basic functionality satisfaction tempered by information gaps and mixed user feedback about advanced features.

Trust Factor Analysis (5/10)

Trust factor evaluation for CM Trading presents a complex assessment balancing regulatory credentials against user concerns and transparency issues. The broker's regulatory status with South Africa's Financial Sector Conduct Authority (FSCA) provides a foundation of oversight, though this jurisdiction may offer different protections compared to tier-one regulatory environments. Understanding these differences is crucial for international traders considering the platform.

The FSCA regulation, maintained since 2012, demonstrates consistent regulatory compliance over more than a decade. This longevity suggests adherence to basic regulatory requirements and operational standards within the South African financial services framework. However, regulatory compliance alone does not guarantee optimal service quality or complete protection for international clients.

However, specific fund safety measures beyond basic regulatory requirements were not detailed in available sources. Information about client fund segregation, insurance coverage, and additional protection mechanisms remains unclear, impacting overall trust assessment. These details are crucial for traders who want to understand how their funds are protected beyond minimum regulatory requirements.

Company transparency receives mixed evaluation based on available information. While the broker maintains regulatory compliance and has received industry recognition, detailed operational information and comprehensive disclosures appear limited compared to more transparent industry leaders. This lack of transparency can create uncertainty for potential clients who want to fully understand the broker's operations.

The broker's industry reputation includes notable recognition through the "Best Financial Broker Africa" awards from 2017 to 2021. This demonstrates peer and industry acknowledgment of service quality during this period. Such awards suggest that industry professionals have recognized CM Trading's contributions to the African forex market.

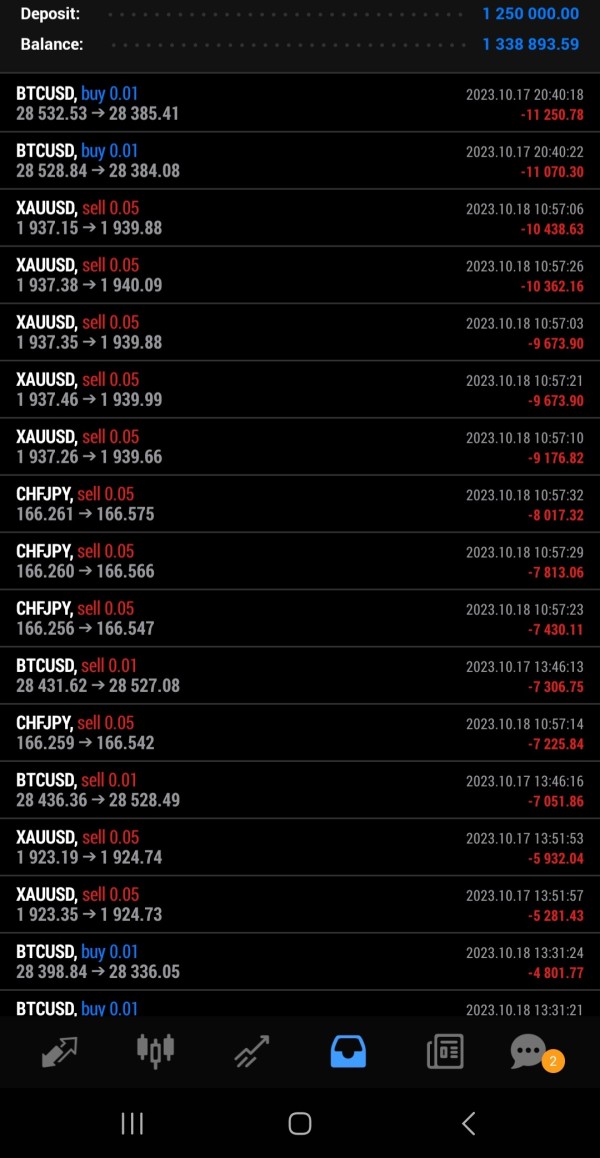

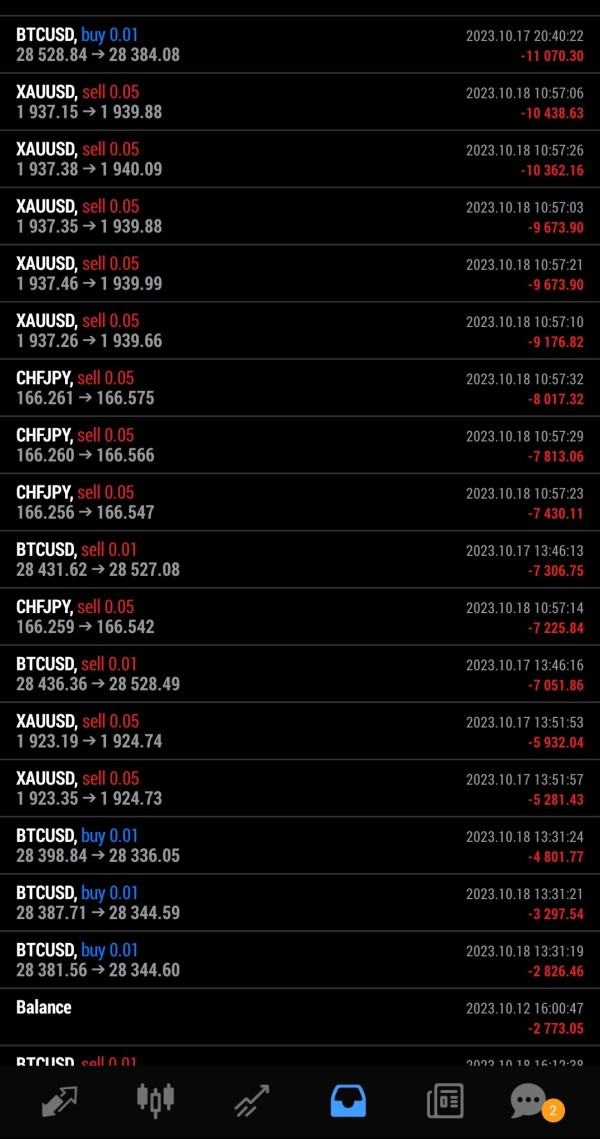

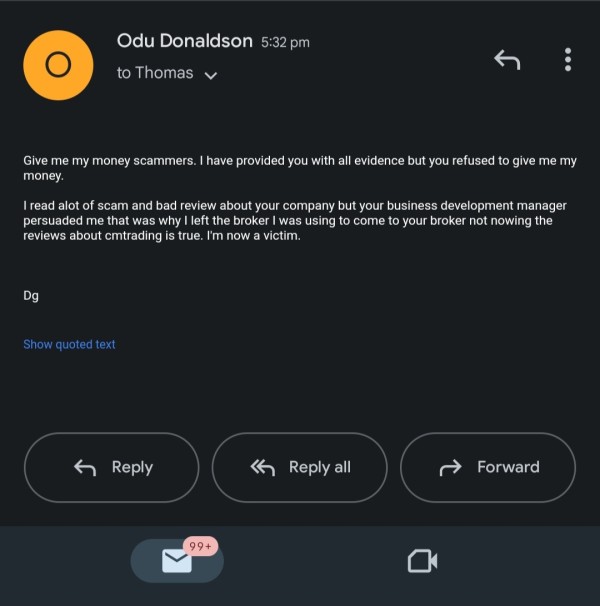

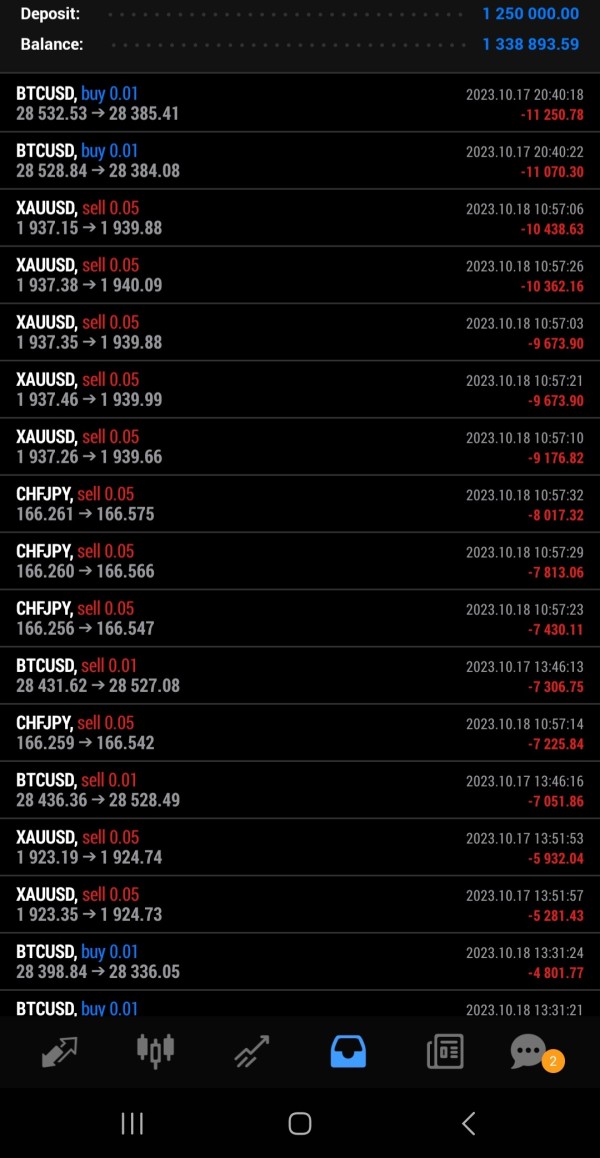

However, user feedback reveals concerning elements. Some traders express skepticism about platform reliability and fund security. According to forex-ratings.com, some users have characterized the platform as potentially problematic, though these represent individual experiences rather than verified incidents that would indicate systematic issues.

The moderate trust rating reflects this balance between regulatory foundation and user concerns. This suggests careful due diligence before commitment.

User Experience Analysis (5/10)

User experience evaluation for CM Trading reveals a polarized landscape of trader satisfaction. The overall 3/5 star rating reflects significant variation in individual experiences. This moderate satisfaction level indicates that while some traders find the platform adequate, substantial room for improvement exists across multiple areas of service delivery.

Interface design and usability receive generally positive feedback from users who appreciate the web-based platform's accessibility and straightforward navigation. The CMTrading Webtrader system appears to provide intuitive basic functionality that allows traders to execute standard trading operations without extensive learning curves. This simplicity can be particularly valuable for new traders who are still learning how to navigate trading platforms.

However, registration and verification processes have generated mixed user feedback. Some traders report smooth account opening while others mention complications or delays in verification procedures. The specific requirements and timelines for account verification were not detailed in available sources, creating uncertainty for potential clients about what to expect during the onboarding process.

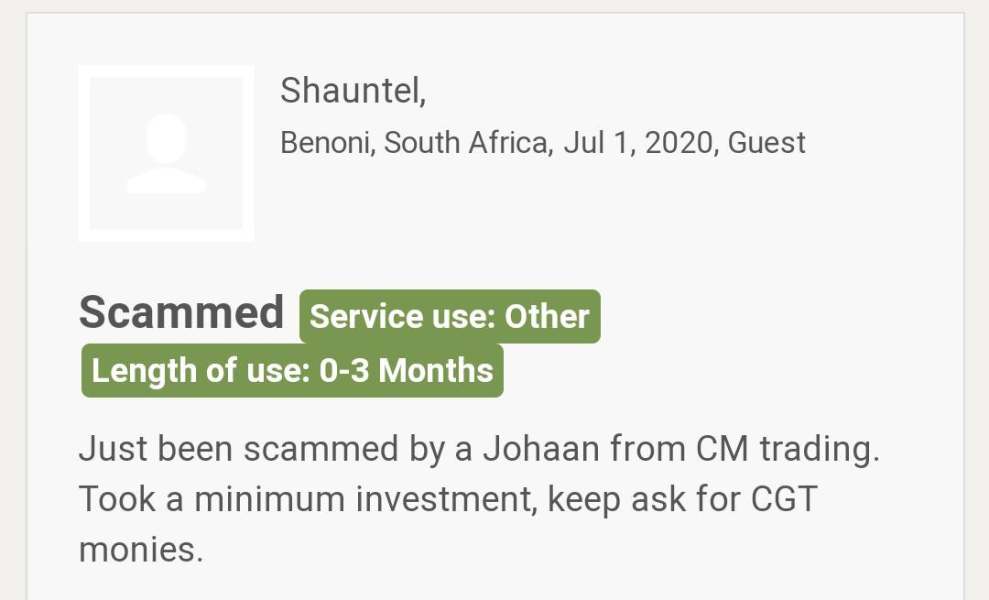

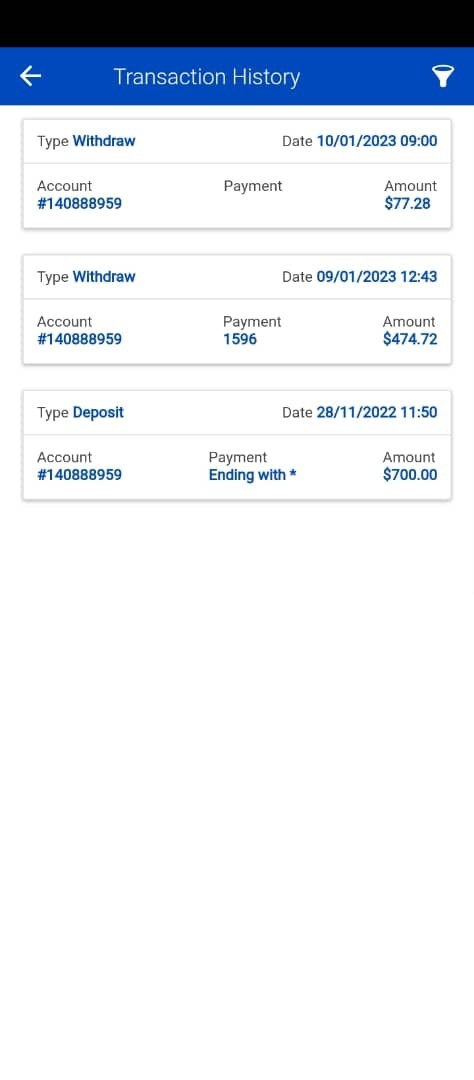

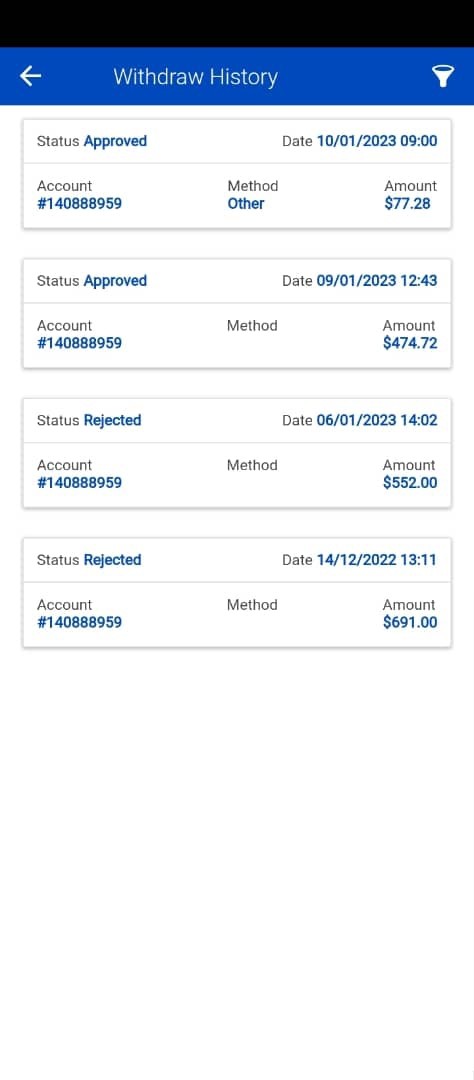

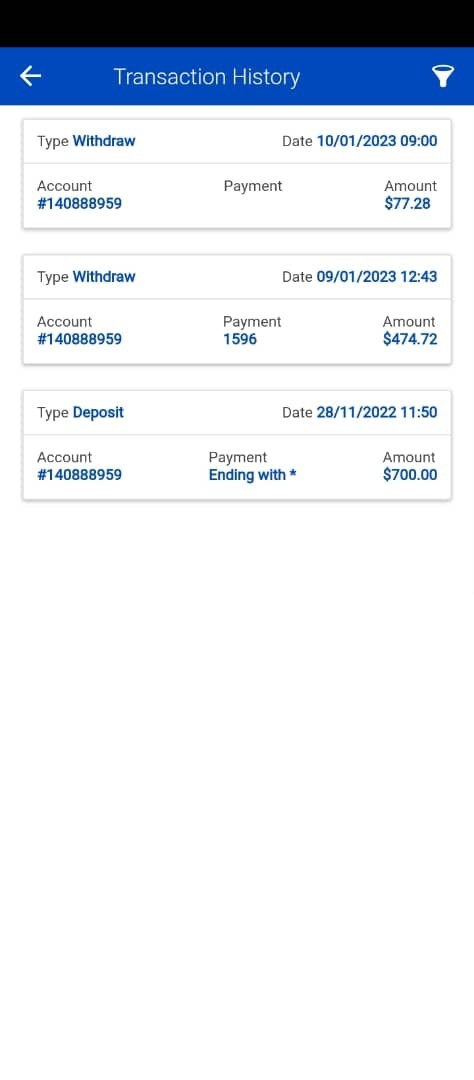

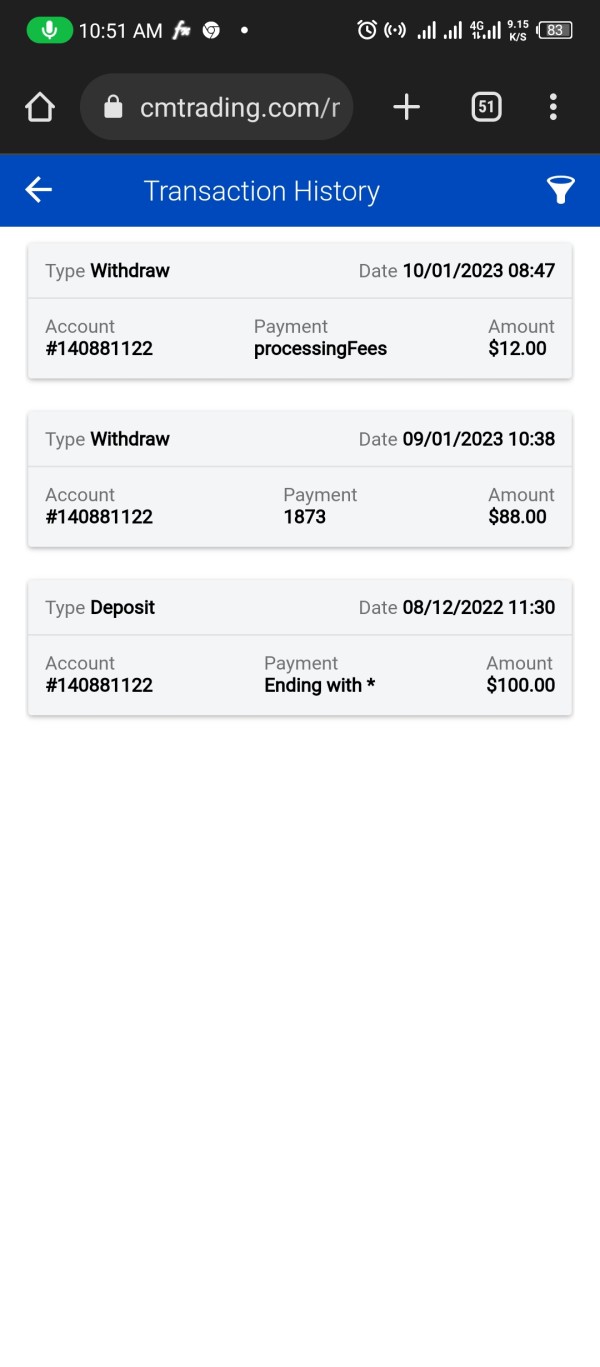

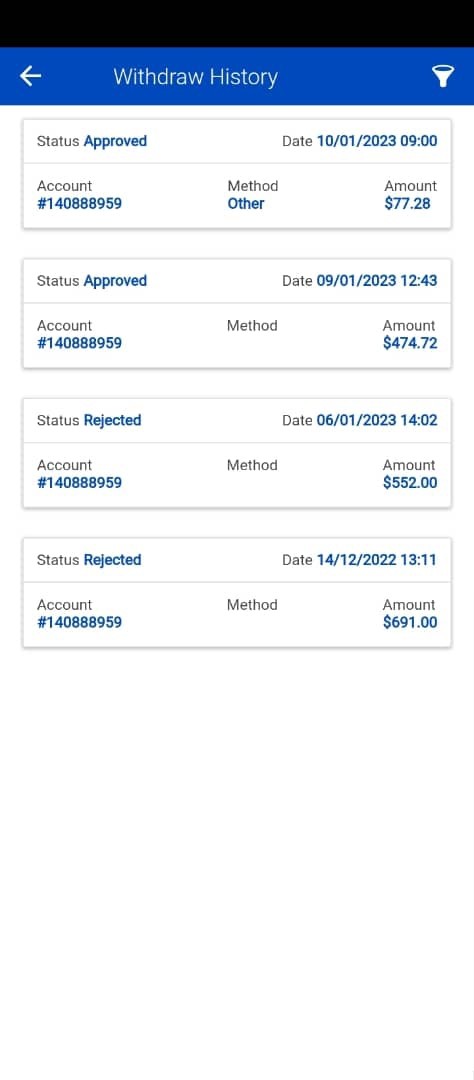

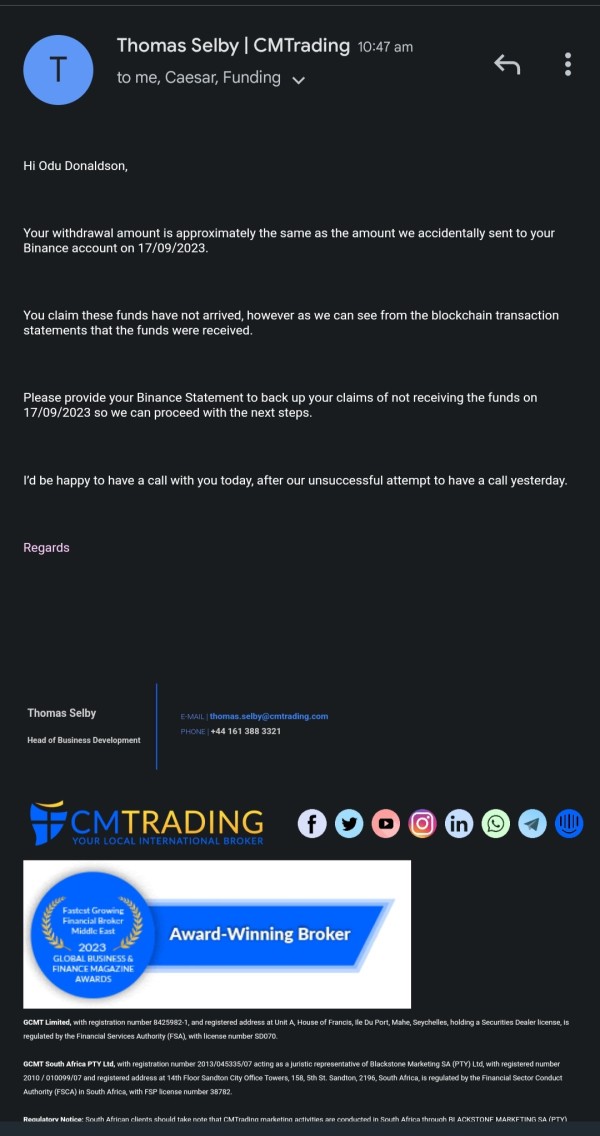

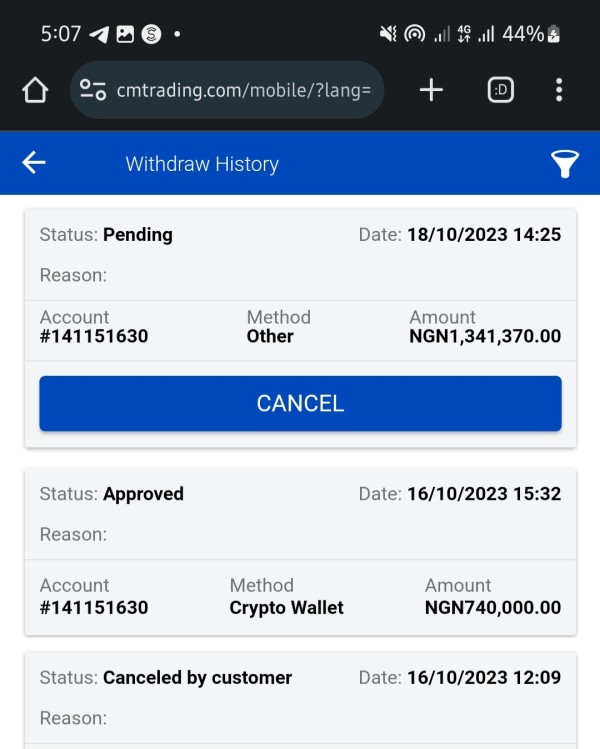

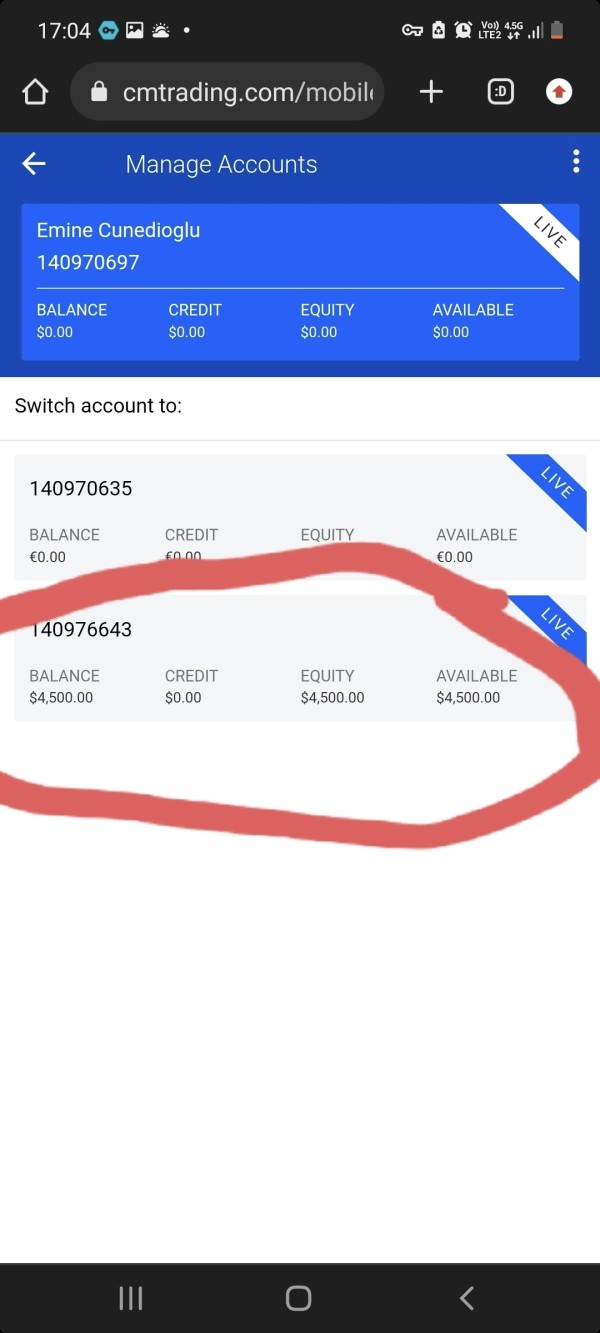

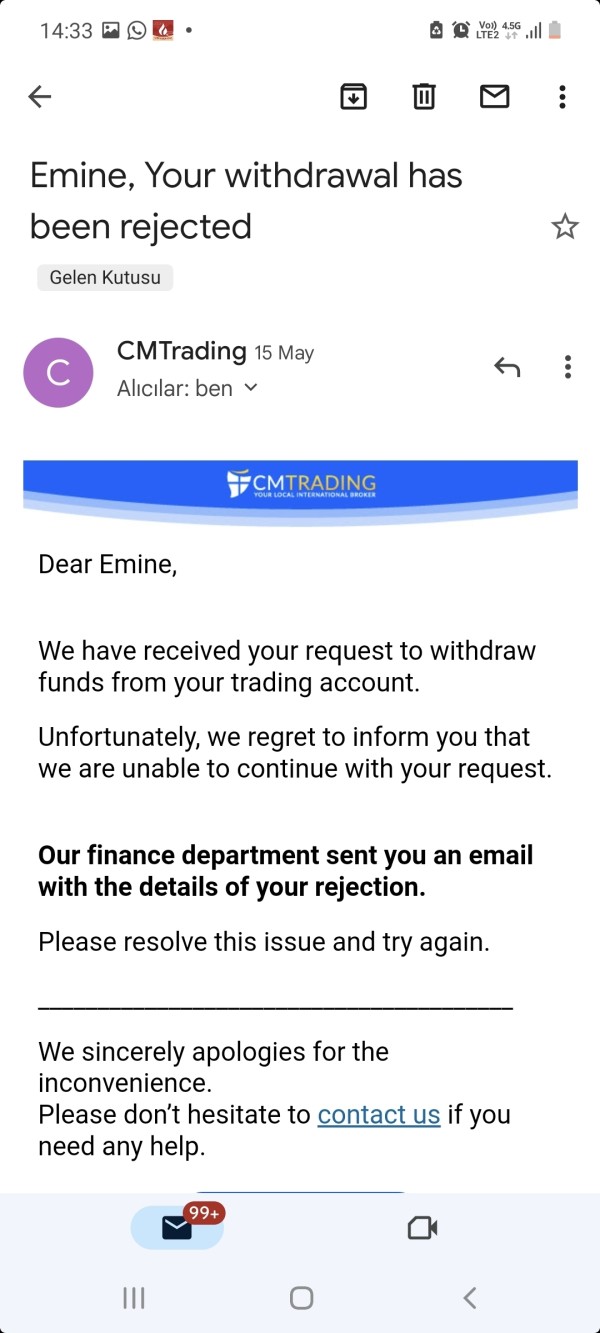

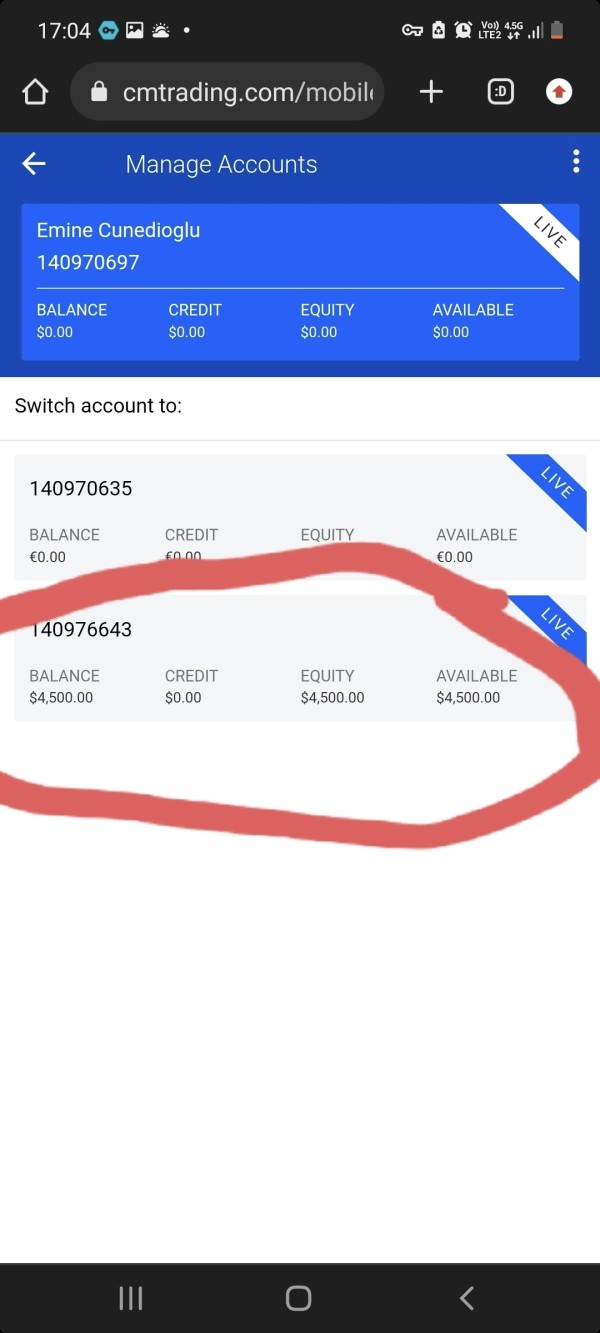

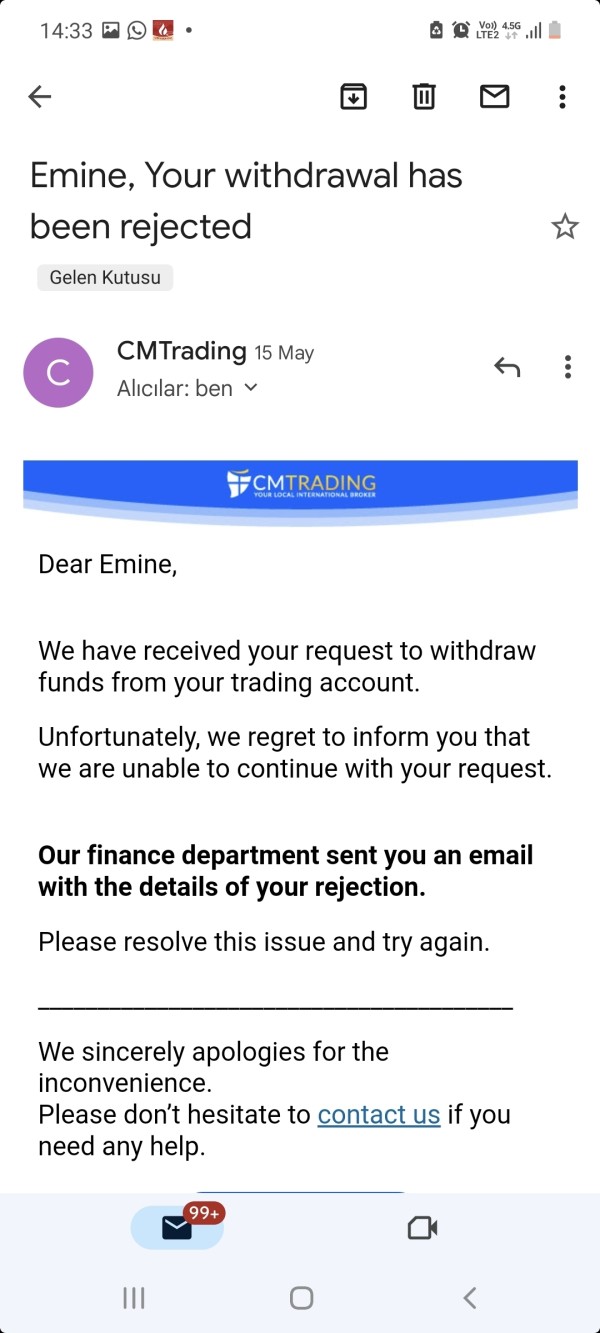

Fund management experiences present particular concerns based on user feedback. Some traders have expressed anxiety about deposit and withdrawal processes, though specific details about processing times, fees, and reliability were not comprehensively documented. These concerns about fund access can significantly impact trader confidence and overall satisfaction with the platform.

Common user complaints center around concerns about platform security and fund safety. Some traders question the broker's reliability for long-term trading relationships. These concerns, while representing individual experiences, contribute to overall user experience challenges and suggest areas where the broker could improve communication and transparency.

The target user profile appears to focus on small to medium-sized investors seeking high leverage trading opportunities. However, the mixed feedback suggests that user expectations may not consistently align with delivered services. This misalignment could be addressed through clearer communication about service capabilities and limitations.

Improvement recommendations based on user feedback include enhanced transparency about operational procedures, clearer communication about fees and processes, and strengthened customer service consistency to address user concerns more effectively. These improvements could help bridge the gap between user expectations and actual service delivery.

Conclusion

CM Trading presents a complex profile within the forex brokerage landscape. The broker combines industry recognition with mixed user experiences that require careful consideration. This cm trading review reveals a broker that has maintained regulatory compliance and achieved notable industry awards while facing challenges in user satisfaction and transparency that potential clients should carefully evaluate.

The broker appears most suitable for small to medium-sized investors who prioritize high leverage access and can navigate potential service inconsistencies. The $250 minimum deposit and 1:400 leverage ratio create an accessible entry point for traders seeking enhanced position sizing capabilities. However, traders should be prepared for potential challenges in customer service consistency and platform transparency.

However, the significant information gaps about platform tools, cost structures, and operational procedures, combined with mixed user feedback about fund safety and customer service, suggest that potential clients should conduct thorough due diligence before commitment. The moderate overall rating reflects these balanced considerations, indicating that while CM Trading operates as a legitimate regulated broker, trader expectations should be calibrated accordingly to avoid disappointment.

Prospective clients should prioritize direct communication with the broker to clarify operational details, fee structures, and service expectations before account opening. This is particularly important given the transparency limitations identified in this analysis. Starting with the minimum deposit and testing the platform's functionality before committing larger amounts may be a prudent approach for interested traders.