iForex Review 2025: Legal Insights & Features

iFOREX is a prominent name in the world of forex trading. As we look towards 2025, understanding its offerings is crucial. This review will delve into the platform's features and user experience.

Forex trading in India has unique legal considerations. It's vital to know the legal status of iFOREX in this context. The platform's compliance with Indian regulations is a key focus.

iFOREX offers a range of financial instruments. Traders can access forex, commodities, indices, and more. The platform's user-friendly interface enhances the trading experience.

At the same time, security is a top priority for iFOREX. The platform employs encryption and two-factor authentication to protect user data and transactions.

Moreover, iFOREX's brokerage charges are competitive. Understanding these fees is essential for traders. We'll explore how they compare to other platforms.

iForex makes educational resources available for all skill levels. The resources include webinars, tutorials, and market analysis that make traders knowledgeable.

Customer support is another important aspect. iFOREX offers 24x5 assistance in multiple languages to address user queries.

In this review, we'll cover all these aspects and more. Our goal is to provide a comprehensive analysis of iFOREX in 2025.

What is iFOREX? Company Overview and History

iFOREX is a globally recognized forex and CFD trading platform. With over two decades in the industry, it has carved a significant niche. The platform, since founded in 1996, has expanded its presence worldwide.

The company is headquartered in the British Virgin Islands, a common locale for financial services. Its longevity in the market speaks volumes about its reliability. iFOREX offers a plethora of trading instruments to cater to diverse needs.

Key aspects of iFOREX include:

- Wide range of trading instruments

- Advanced trading tools and resources

- Multilingual customer support

iFOREX's mission focuses on providing a secure and user-friendly trading environment. Its platform integrates technological advances that meet the needs of modern traders. This focus on technology enhances its global appeal.

The platform has consistently adapted to changing market conditions. Its strategic adjustments have helped maintain its competitiveness. iFOREX's rich history is a testament to its adaptability and foresight.

iFOREX Platform Features and Trading Instruments

The iFOREX platform is designed with modern traders in mind. It offers a robust suite of features that cater to diverse trading styles. Its user-friendly interface ensures ease of navigation for beginners and experts alike.

One key feature is its extensive range of trading instruments. Traders can access forex pairs, commodities, indices, and cryptocurrencies. This variety allows for diversified trading strategies, enhancing potential profit avenues.

The platform also incorporates advanced trading tools to optimize decision-making. Charts, indicators, and real-time data analyses are integral parts of the iFOREX experience. These tools empower traders to execute informed and precise trades.

Notable features include:

- Real-time market updates

- Customizable charting options

- Technical and fundamental analysis tools

iFOREX supports multiple account types to suit varying levels of expertise. Whether one is a novice or a seasoned trader, iFOREX provides the necessary resources to grow. Educational materials, including tutorials and webinars, are abundantly available.

Advanced security measures safeguard user data and transactions. Encryption and two-factor authentication protect against unauthorized access. This commitment to security builds user trust and platform reliability.

Moreover, iFOREX's platform supports various device interfaces. Traders can seamlessly shift between web, mobile, and desktop platforms. This flexibility ensures trading opportunities are not missed due to device constraints.

Account Types, Registration, and Onboarding Process

iFOREX offers several account types tailored to meet varied trader needs. Each account provides distinct benefits, ensuring flexibility and customization. Traders can choose based on their trading goals and experience levels.

The registration process on iFOREX is straightforward and designed for simplicity. Potential users can begin by visiting the iFOREX website and filling out a short registration form. This requires basic personal information and contact details.

iFOREX prioritizes security during the registration phase. New users must undergo a verification process to confirm their identities. This includes submitting valid identification documents and proof of address, adhering to international KYC norms.

Once registered, users are guided through an intuitive onboarding process. The platform offers demo accounts for practice without financial risk. This feature is particularly beneficial for newcomers looking to understand forex trading dynamics.

Key aspects of iFOREX account options include:

- Demo accounts for risk-free practice

- Live trading accounts with varied leverage options

- Access to educational resources and trading tools

Finally, the platform provides visual aids and step-by-step guides. These assist traders in getting acquainted with the platform's features and functionalities. Such resources ensure a smooth transition from registration to active trading.

iFOREX Brokerage Charges, Fees, and Spreads

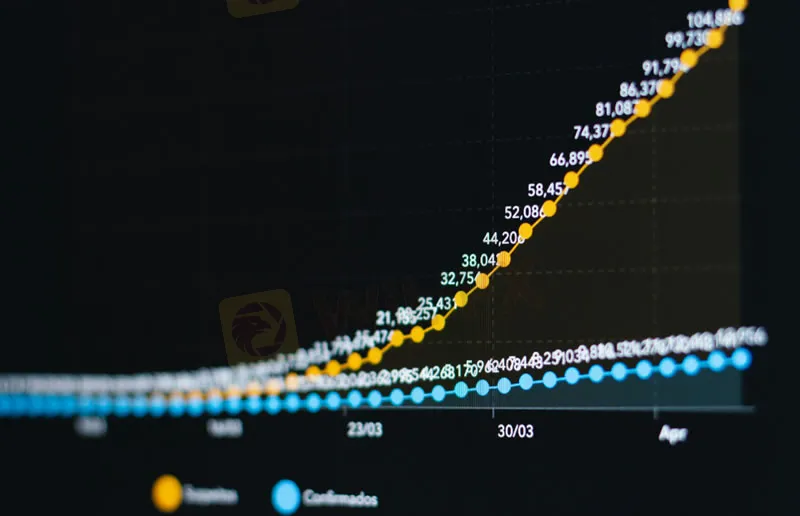

Understanding the fees associated with iFOREX is crucial for cost management in trading. The platform is known for competitive brokerage charges, making it even more appealing for traders.

iFOREX adopts a spread-based pricing model, meaning there are no direct commission fees. Instead, traders pay via the difference between buy and sell prices. This can be beneficial for traders looking to avoid fixed commission expenses.

Spreads on iFOREX are variable, changing with market conditions. However, they remain competitive, which allows for cost-effective trading across diverse financial instruments.

Traders should also be aware of potential additional fees. These may include overnight rollover fees, which apply when positions are held open beyond a specified period. Being informed of such costs can help plan and manage trading strategies effectively.

List of standard fees associated with iFOREX:

- Spread costs depending on instrument and market liquidity

- No direct commission charges on trades

- Overnight rollover fees for certain positions

Besides these, iFOREX may impose withdrawal fees. It's crucial for traders to review these before initiating any fund withdrawal. Understanding these charges helps anticipate total trading costs and ensures financial preparedness.

Overall, iFOREX offers a transparent fee structure. This allows traders to focus more on market trends and strategies rather than hidden costs. For a visual representation, please review the typical spread comparisons below:

Trading Experience: Web, Mobile, and Desktop Platforms

iFOREX offers a seamless trading experience across web, mobile, and desktop platforms, ensuring flexibility for its users. Each platform version caters to different trading needs and preferences.

The web platform is accessible from any browser without a need for downloads. It's designed for traders who prefer an easy-to-use interface with all essential trading tools at their fingertips. Users can quickly access their accounts, execute trades, and analyze markets with ease.

For those who prefer trading on the go, the iFOREX mobile app is available. This app offers full functionality on both iOS and Android devices. Mobile users can trade, monitor their portfolios, and receive market alerts, providing an uninterrupted trading experience.

Desktop users are not left out as iFOREX offers a robust application tailored for intensive trading activities. This platform version is equipped with advanced charting tools and fast execution speeds ideal for professional traders seeking enhanced performance.

Heres a breakdown of the key features available on each platform:

- Web Platform: Easy access, no downloads, comprehensive tools

- Mobile App: Trading on the go, instant alerts, fully functional

- Desktop Application: Advanced tools, high-speed execution, tailored for professionals

Each platform features an intuitive design with customizable layouts, allowing traders to organize their workspace according to their preferences and enhancing their trading efficiency.

Security, Regulation, and Client Protection

iFOREX prioritizes the security of its users' funds and personal information. This commitment is evident through its adoption of advanced security protocols and regulatory compliance.

The platform uses encryption technologies to safeguard data and transactions. Two-factor authentication further enhances security by adding an extra layer of protection against unauthorized access.

Despite its global presence, iFOREX is not an RBI-approved forex broker in India. Nevertheless, it complies with regulations in various jurisdictions, providing a level of comfort for traders concerned about legitimacy.

For client protection, iFOREX employs several measures to ensure a safe trading environment:

- Encryption: Protects data with advanced technologies

- Two-factor Authentication: Enhances login security

- Regulatory Compliance: Adheres to rules in several countries

To maintain transparency and trust, iFOREX continuously improves its security systems. These efforts reflect its dedication to upholding high standards in client protection.

iFOREX in India: Legal Status, RBI Approval, and Compliance

The legal status of iFOREX in India presents crucial concerns for prospective traders. Notably, the platform is not sanctioned by the Reserve Bank of India (RBI), which has significant implications.

Trading with a non-RBI approved platform involves inherent risks. It is paramount for traders to fully understand the legal landscape before proceeding with iFOREX. Non-compliance with Indian regulations can potentially attract severe legal consequences.

Despite the lack of RBI approval, iFOREX continues to attract Indian traders. However, due diligence is essential for anyone considering engaging with this platform. This includes understanding both the benefits and potential pitfalls.

For traders in India, these are critical factors to consider:

- iFOREX is not recognized as a legal forex trading app in India.

- Compliance with RBI guidelines is not assured.

- Understanding legal ramifications is crucial.

Risk-awareness is a key element when trading forex in India. Legal compliance should be a priority for all traders, especially when dealing with international platforms like iFOREX.

There are strict regulations in India regarding forex trading. These rules are designed to protect individual investors and maintain financial stability within the country.

Certain considerations for compliance include:

- Operating with RBI-approved forex brokers in India.

- Ensuring full understanding of local trading laws.

- Consulting legal professionals if necessary.

The absence of iFOREX authorization from the RBI signifies the need for caution. Traders must weigh the potential rewards against the significant risks involved.

Punishment for Forex Trading in India: What Traders Need to Know

Forex trading in India is not without legal complexity. Engaging in unauthorized forex trading activities can lead to significant legal repercussions.

Indian forex traders must be aware of the potential penalties for unlawful trading. Violating Indian forex regulations may result in fines or more serious legal actions. Understanding the law is crucial to avoid these pitfalls.

The Foreign Exchange Management Act (FEMA) governs forex trading in India. This law stipulates strict guidelines on currency trading. The penalties for infringement can be severe and include both financial and non-financial consequences.

Here are some key consequences of illegal forex trading:

- Financial penalties and fines.

- Restrictions on future trading activities.

- Possible legal proceedings.

It is imperative for traders to prioritize legal compliance by sticking with RBI-approved forex brokers and platforms. Staying within the legal framework not only safeguards traders but also ensures a stable trading environment.

iFOREX Office in India and Customer Support

iFOREX has expanded its presence globally but lacks a dedicated office in India. Despite this, it offers robust customer support designed to meet the needs of Indian traders.

Traders can access support through various channels. Customer assistance is available via live chat, email, and phone support. This multi-channel approach ensures swift solutions to a wide range of queries.

Benefits of iFOREX customer support include:

- 24/5 availability for assistance.

- Multilingual support to cater to diverse traders.

- Responsive email and chat services.

While the lack of a physical office in India may be seen as a limitation, iFOREX aims to provide comprehensive support remotely. This support framework helps address user concerns efficiently, maintaining a reliable service record.

Educational Resources and Tools for Traders

iFOREX provides a variety of educational resources tailored for both novice and experienced traders. These resources are designed to enhance traders' skills and knowledge.

The platform offers detailed tutorials that cover a wide range of trading concepts. These tutorials are complemented by webinars conducted by trading experts. They offer insights into current market trends and strategies.

iFOREXs educational offerings include:

- Interactive tutorials and video guides.

- Webinars led by seasoned traders.

- Market analysis and trading tips.

In addition to these resources, iFOREX offers a demo account feature. This allows traders to practice with virtual funds, providing a risk-free way to develop their trading strategy.

These educational tools and resources underscore iFOREXs commitment to empowering traders. By furnishing them with essential knowledge, iFOREX aims to help its users make informed trading decisions.

User Reviews, Reputation, and Community Insights

iFOREX has garnered a mixed reputation in the trading community. Many users appreciate the platform's comprehensive toolset and educational materials. These resources are often highlighted as key positives in user reviews.

However, criticisms exist as well, particularly regarding customer service responsiveness. Some traders have experienced delays in support and withdrawal processes. These issues have been topics of discussion among the trading community.

The community regularly shares insights and experiences on forums and social media. Such platforms allow traders to exchange strategies and tips, thus enhancing the overall user experience.

Key discussion points among users include:

- The effectiveness of iFOREX's trading tools.

- Customer service and support response times.

- Experiences with the withdrawal process.

Overall, the platform remains popular, especially for its educational offerings and diverse instruments. Yet, improving service aspects and addressing user concerns could enhance its reputation further.

Pros and Cons of iFOREX in 2025

Evaluating iFOREX in 2025 presents a balanced view with notable advantages and drawbacks. The platform is celebrated for its comprehensive educational resources and a wide range of trading instruments. These features attract both novice and experienced traders looking for diverse opportunities. Additionally, its user-friendly interface and advanced trading tools are major selling points that enhance the trading experience significantly.

On the downside, iFOREX faces criticism due to customer support issues and the lack of an RBI approval. These factors pose challenges, especially for Indian traders who prioritize regulatory compliance. Some users have also reported frustrations with withdrawal delays, which can be a significant drawback for those needing quick access to funds.

Pros:

- Extensive educational resources

- Diverse trading instruments

- User-friendly interface

Cons:

- Customer support issues

- Lack of RBI approval

- Withdrawal delays

By understanding these pros and cons, traders can make informed decisions about utilizing iFOREX in 2025.

iFOREX vs. Other Forex Brokers in India

Comparing iFOREX with other forex brokers in India reveals interesting insights. iFOREX is known for its educational tools and comprehensive market analysis. This is particularly beneficial for traders seeking knowledge-based approaches to trading. However, in India, many traders prioritize safety and legality when choosing a broker.

While some brokers have RBI approval, iFOREX operates without this important accreditation. This lack of recognition may deter Indian traders focused on legal compliance. Therefore, regulatory status is a significant factor when evaluating iFOREX against other brokers.

Indian forex platforms like Zerodha or Angel Broking offer local support and RBI-approved status. These brokers can provide traders with peace of mind regarding compliance and legal issues. In contrast, iFOREX appeals to traders seeking a broad range of global instruments and advanced features.

Key Comparisons:

- RBI Approval: iFOREX lacks, others may have

- Educational Resources: iFOREX excels

- Market Coverage: iFOREX offers diverse instruments

By reviewing these aspects, traders can determine which broker aligns best with their goals in 2025.

Future Outlook: iFOREX Innovations and Market Position

iFOREX consistently adapts to the evolving forex landscape. This adaptability involves embracing technological advancements and enhancing user experience. As we stand in 2025, iFOREX has highlighted a commitment to integrating cutting-edge technology and user-centric features.

The platform's focus on innovation promises a range of new tools and services. These additions are aimed at improving trading conditions and client satisfaction. By leveraging modern technology, iFOREX seeks to maintain its competitive edge in the industry.

iFOREX's strategy includes a dedication to sustainable practices. Its market position is bolstered by strategic partnerships and industry collaborations. By staying attuned to traders' needs and market trends, iFOREX aims to solidify its position as a prominent forex trading platform throughout 2025.

Innovations to Watch:

- Advanced AI-driven analytics

- Enhanced mobile trading features

- Expanded educational content

Frequently Asked Questions (FAQ)

Is iFOREX legal in India?

Yes, but traders should be aware of local laws. Though iFOREX operates globally, legality in India depends on compliance with regulations.

What are iFOREX's brokerage charges?

iFOREX provides competitive rates. Detailed charges vary depending on the trading instrument and account type.

Is there an iFOREX Office in India?

As of 2025, iFOREX does not have a specific office in India. Customer support services are, however, available online.

How secure is iFOREX for traders?

Security measures include encryption and two-factor authentication to protect user data and funds.

Does iFOREX offer a demo account?

Yes, iFOREX provides a demo account for risk-free practice. It helps new traders familiarize themselves with the platform.

What trading instruments are available on iFOREX?

The platform offers forex, commodities, indices, and cryptocurrencies as part of its trading portfolio.

Are there any promotional offers on iFOREX?

Yes, iFOREX often runs bonuses and promotional offers. These can boost trading capital.

How do I start trading on iFOREX?

Registration involves completing an online form. Verification of personal details and deposit of funds is required.

What is the minimum deposit on iFOREX?

The minimum deposit requirements may vary. It's best to check directly on the iFOREX platform for current amounts.

How does iFOREX support traders' education?

iFOREX offers webinars, tutorials, and market analysis to educate traders on various aspects of forex trading.

Conclusion: Is iFOREX Right for Indian Traders in 2025?

Choosing iFOREX as a trading platform requires careful consideration. Its features, such as competitive brokerage charges and diverse trading instruments, appeal to many traders. However, the absence of RBI approval poses a challenge for Indian users.

Traders must weigh the benefits of iFOREX's advanced tools against potential legal risks. Understanding local regulations is crucial. Without RBI approval, using iFOREX might lead to complications for Indian traders.

The platform's educational resources are noteworthy. They empower both beginners and experienced traders with valuable knowledge, enabling informed decision-making and skill development.

Ultimately, the decision to trade with iFOREX hinges on individual preferences and risk tolerance. For those seeking variety and educational support, iFOREX remains an attractive option. However, prospective users must consider legal aspects and personal circumstances before proceeding. By weighing the pros and cons, traders can make informed choices about their trading future with iFOREX in 2025.

More News

Best Forex Broker

latest News