Understanding Forex Trading Hours in India

Forex trading is a global market that never sleeps. Understanding its hours is crucial for traders in India.

The forex market operates 24 hours a day, five days a week. This continuous operation is due to different time zones.

In India, knowing when the market opens and closes can impact trading strategies. It helps in planning trades effectively.

Forex trading involves various sessions, each with unique characteristics. These sessions include the Asian, London, New York, and Sydney sessions.

Each session has peak times when trading activity is highest. This affects market volatility and liquidity.

For Indian traders, aligning with these sessions can optimize trading opportunities. It ensures participation during high activity periods.

This guide will explore forex trading hours in India, helping you make informed trading decisions.

What is Forex Trading and Why Do Trading Hours Matter?

Forex trading involves exchanging currencies in a decentralized global market. This market is highly liquid and offers numerous opportunities.

Trading hours play a crucial role in forex trading. They influence market activity and volatility, impacting potential profits.

Different regions have different forex trading sessions. Each session offers unique characteristics due to localized economic activity.

Heres why trading hours matter:

- Liquidity: Higher during overlapping sessions, ensuring smooth transactions.

- Volatility: Changes during different sessions, affecting price movement.

- Opportunities: Vary across sessions, depending on economic news.

In India, knowing the right time to trade can maximize success. Understanding these times enhances your trading strategy. By syncing with active sessions, traders can seize better opportunities, leading to potentially higher gains.

Overview of the Global Forex Market Hours

The forex market operates 24 hours a day due to time zone differences. This ensures that currencies are constantly being traded across the globe. Understanding when the market is most active is key to successful trading.

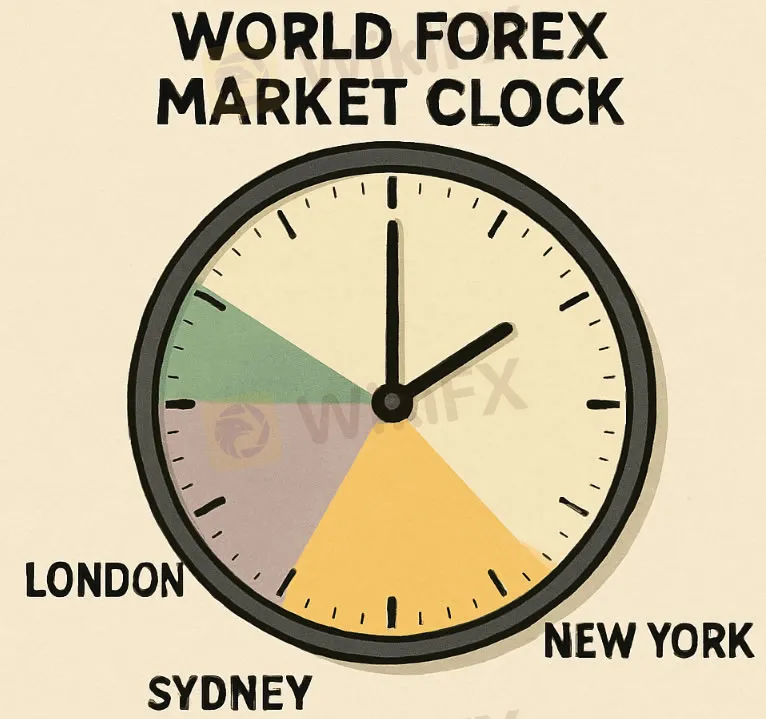

The forex market consists of four major sessions: Sydney, Tokyo, London, and New York. These sessions correspond to major financial centers around the world. Each session reflects the time when key financial markets in these areas are open for business.

Here's an overview of the global forex market session times:

- Sydney Session: Opens first and overlaps with Tokyo.

- Tokyo Session: Known for early volatility from Asia.

- London Session: Most active, overlaps with both Tokyo and New York.

- New York Session: Concludes the trading day with overlaps providing heightened activity.

During the London and New York overlap, market activity surges, providing traders with vital opportunities. Each session has its unique features, and traders can choose the session that aligns with their strategies. Being aware of these hours helps traders take advantage of peak activity periods, optimizing their trade decisions.

Forex Market Opening and Closing Times in India

Forex trading in India aligns with the global market, although it has specific local start and end times. Knowing these helps Indian traders schedule their activities effectively.

The forex market effectively opens on Monday morning with the Sydney session and closes on Friday night with the New York session. In India, this translates to a market opening on Monday at 5:30 AM and closing at around 2:30 AM Saturday morning.

Within India, the forex market functions as follows:

- Monday to Friday: Active throughout due to different sessions.

- Main Trading Hours: From 5:30 AM IST when the Asian market opens.

- Closure for the Weekend: Closes officially at 2:30 AM IST on Saturday.

These opening and closing times provide numerous trading opportunities throughout the week. Understanding these timings allows traders to plan ahead. It's crucial to recognize periods of overlap, like the London-New York overlap, known for high liquidity. Using this info, traders can align their strategies to exploit the best market conditions available.

Major Forex Trading Sessions Explained

Forex trading spans across various global financial hubs, with each hosting major sessions. Understanding these sessions helps traders make informed decisions regarding the best times to trade.

The major trading sessions are:

- Asian Session: Primarily led by Tokyo, creating the opening activity.

- European Session: Headed by London, this session sees a surge in trading volume.

- North American Session: Dominated by New York, marking high market volatility.

- Pacific Session: With Sydney leading, often a quieter time that starts the trading week.

These sessions overlap at certain times, increasing the market's liquidity. It's vital to note that trading during these overlaps, like the London-New York overlap, can be advantageous. Each session has unique characteristics, influencing currency pairs differently. By aligning trades with these sessions, traders can optimize their strategies. Adapting to the rhythm of these sessions can help traders capitalize on the opportunities each market provides.

Asian Session (Tokyo Session) Forex Time in India

The Asian session, also called the Tokyo session, starts activity for the week. In India, it runs from 5:30 AM to 2:30 PM IST. This period showcases moderate activity with the Japanese yen widely traded.

Key aspects of the Asian session include:

- Market Opening: Sparks worldwide trading.

- Currency Focus: JPY, AUD, and NZD.

- Volatility: Typically low, offering stable trading conditions.

Traders interested in Asian currencies find this session particularly appealing. Lower volatility can benefit strategic planning. Keeping an eye on major economic news releases is crucial during this time.

London Session Forex Time in India

London's session is crucial, marking the peak of trading volume. In India, it operates from 1:30 PM to 10:30 PM IST. This session boosts liquidity, enticing both speculators and long-term traders.

Key features of the London session include:

- Highest Liquidity: Offers better trading spreads.

- Currency Pairs: EUR, GBP, and CHF.

- Market Overlap: Crosses with the New York session.

During this period, market trends often establish, making it essential for traders to act. Its a strategic time for traders working with European currencies. Proactive monitoring of geopolitical events can enhance trading outcomes.

New York Session Forex Time in India

The New York session unfolds as markets gear up for high volatility. In India, it spans from 6:30 PM to 1:30 AM IST. This session presents significant price moves, notably during news releases.

Core characteristics of the New York session include:

- Volatile Activity: Driven by economic indicators.

- Focus Currencies: USD, CAD.

- Overlap Benefit: Lasts with London till closing.

A lot happens during this session, making it ideal for experienced traders. Economic releases from the U.S. can cause quick market shifts. Traders must brace for action and plan ahead when engaging within this sessions timeline.

Sydney Session Forex Time in India

The Sydney session kicks off the trading week, presenting calmer markets. Operating from 5:30 AM to 2:30 PM IST, it often sets the tone for other sessions.

Sydney session hallmarks include:

- Calmer Markets: Results in limited movements.

- Currency Involvement: AUD, NZD.

- Trading Environment: Favorable for strategic entries.

This session is suited for traders preferring less volatile conditions. It's also a great time to assess market trends before the busier sessions commence. Traders can use this session for planning and strategizing their trades for the week ahead.

Best Time to Trade Forex in India

Trading forex successfully relies heavily on timing. In India, identifying optimal times can enhance a trader's success.

Strategically, trading during overlapping sessions is ideal. The London-New York overlap, from 6:30 PM to 10:30 PM IST, offers peak activity and liquidity. This window is beneficial as both sessions are highly active.

Important considerations for finding the best trading time include:

- Liquidity and Volatility: More activity means better execution of trades.

- Market Overlaps: Utilize these times for increased trading opportunities.

- Personal Schedule: Align trading with your lifestyle.

Traders should also consider major economic announcements. These events can create significant volatility, offering potential for profit. Indian traders often find the period when European and American markets are both active to be highly productive. Ultimately, successful trading comes from aligning strategies to these busy times. Balancing your personal schedule with these insights can significantly improve your trading performance.

XAUUSD (Gold) Trading Hours and Best Time to Trade XAUUSD in India

Trading XAUUSD, or gold, requires understanding its trading hours. In India, gold is a popular trading asset due to its value and stability.

The XAUUSD market operates 24 hours from Monday to Friday. However, trading volume and volatility vary throughout the day.

Key considerations for trading gold effectively include:

- Market Sessions: Active during both London and New York sessions.

- Volatility Peaks: Best during session overlaps, especially London-New York.

- Economic News: Influential on gold prices, especially U.S. data.

In India, the best time typically aligns with evening hours. The overlap between the London and New York sessions, around 5:30 PM to 8:30 PM IST, is particularly favorable. This period offers increased trading activity, leading to potential opportunities. Aligning trading strategies with these peak times can enhance trading outcomes. Being mindful of market-moving events can also improve timing decisions.

Forex Market Timings in India: When Trading Starts on Monday and Ends on Friday

The forex market functions continuously from Monday morning to Friday night, given its global nature. In India, the market becomes accessible early Monday at 5:30 AM IST. This timing coincides with the market opening in Wellington, New Zealand.

As the week progresses, trading continues round the clock until it closes on Friday night. The market shuts down at 2:30 AM IST on Saturday.

Key points about forex market timings in India include:

- Opens: Monday at 5:30 AM IST

- Closes: Saturday at 2:30 AM IST

- Operates: 24/5 every week

Understanding these hours helps traders plan strategies accordingly, ensuring they capitalize on the best trading opportunities within the week. Proper timing can significantly enhance trading effectiveness and risk management.

Factors Affecting Forex Market Volatility and Liquidity

Forex market volatility and liquidity fluctuate due to numerous factors. These changes can influence trading strategies and outcomes significantly. Awareness of these factors can aid traders in making informed decisions.

Key factors include:

- Economic Indicators: Reports such as GDP, unemployment rates, and inflation data can cause significant market shifts.

- Political Events: Elections, policy changes, and geopolitical tensions often lead to unpredictable market behavior.

- Central Bank Policies: Interest rate decisions and monetary policy announcements affect currency values and liquidity levels.

Traders must keep abreast of these events, as they can create high volatility and rapidly alter price trends. Staying updated with news and analysis helps mitigate risks and optimize trading strategies.

Forex Trading Schedule and Currency Trading Hours in India

Understanding India's forex trading schedule is crucial for all traders. The forex market operates around the clock due to varying time zones. Awareness of these shifts helps traders optimize their strategies.

In India, the forex market follows this schedule:

- Monday Opening: Begins at 5:30 a.m. IST

- Friday Closing: Ends at 2:30 a.m. IST

- Weekly Cycle: Trading resumes every Monday

Currency trading hours in India align with global forex market timings. This continuous schedule ensures liquidity and ample trading opportunities across sessions. By aligning your strategies with these hours, you can enhance your trading effectiveness and potentially increase profits. Keeping up with these times will help traders achieve better results.

Tips for Choosing the Best Trading Times in India

Choosing the optimal trading times involves strategic planning. Many traders focus on periods of high volatility for potential gains. This typically occurs during the overlap of major sessions.

Consider these tips to maximize trading success:

- Session Overlaps: Trade during overlaps for increased activity.

- News Releases: Stay informed on economic announcements.

- Personal Schedule: Ensure trading times fit your routine.

By focusing on these elements, traders can align their activities with market dynamics. Identifying your peak trading periods is vital. It ensures you engage the market when opportunities are greatest. Being strategic about timing can greatly impact your trading results.

Frequently Asked Questions about Forex Trading Time in India

Understanding Forex trading hours can be puzzling. Here are some common questions answered for clarity.

What are the Forex market hours in India?

In India, the Forex market operates 24 hours starting from Monday morning to Friday night. However, the best times to trade can vary.

What is the best time for Forex trading in India?

Optimal trading hours typically include session overlaps. This is when liquidity and volatility are highest.

Is Forex trading legal in India?

Yes, but under strict regulations. Indian residents must trade Forex pairs with INR as the base currency.

How do session times impact trading?

Session times affect volatility, liquidity, and price movements. Traders should choose times based on market activity.

Conclusion: Making the Most of Forex Trading Hours in India

Navigating Forex trading hours in India requires both understanding and strategy. By aligning with key trading sessions, traders can capitalize on market activities. This knowledge enables informed decisions, enhancing potential success.

Traders should remain aware of session overlaps, as these periods offer high liquidity. Understanding the nature of major Forex sessions aids in optimizing trading strategies. Moreover, staying informed about market trends can further support effective trading.

Ultimately, a trader's success is often tied to their adaptability and strategic planning. Leveraging optimal trading times is crucial, ensuring that you make well-timed decisions.

More News

Best Forex Broker

latest News