Scope Markets 2025 Review: Everything You Need to Know

Executive Summary

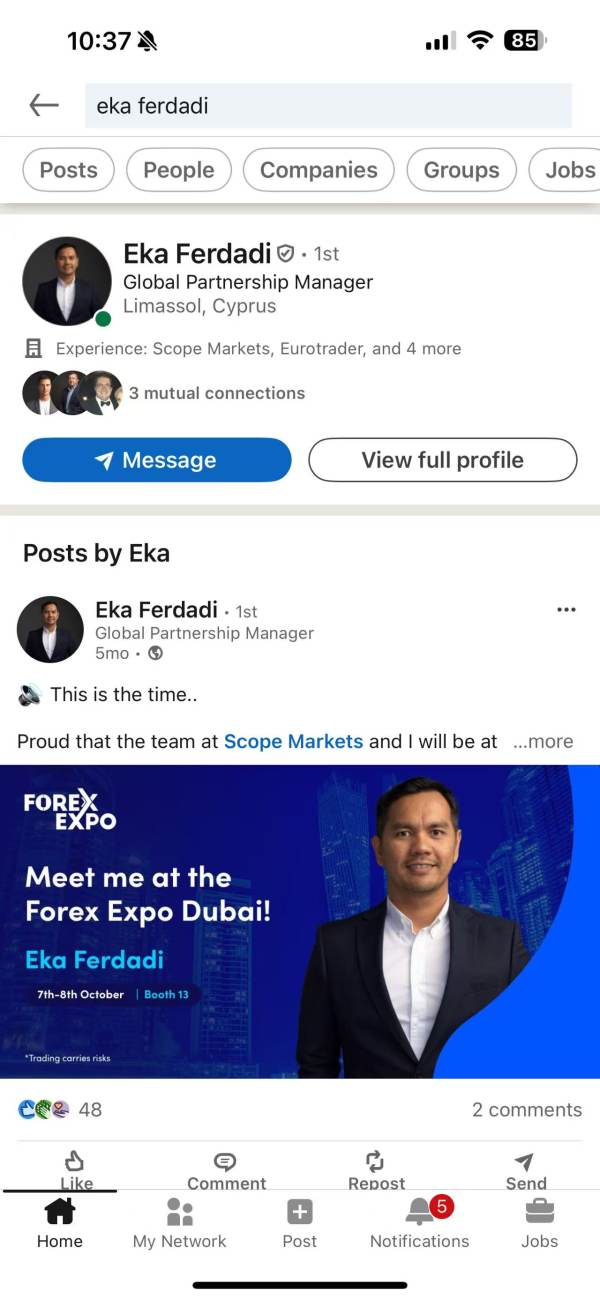

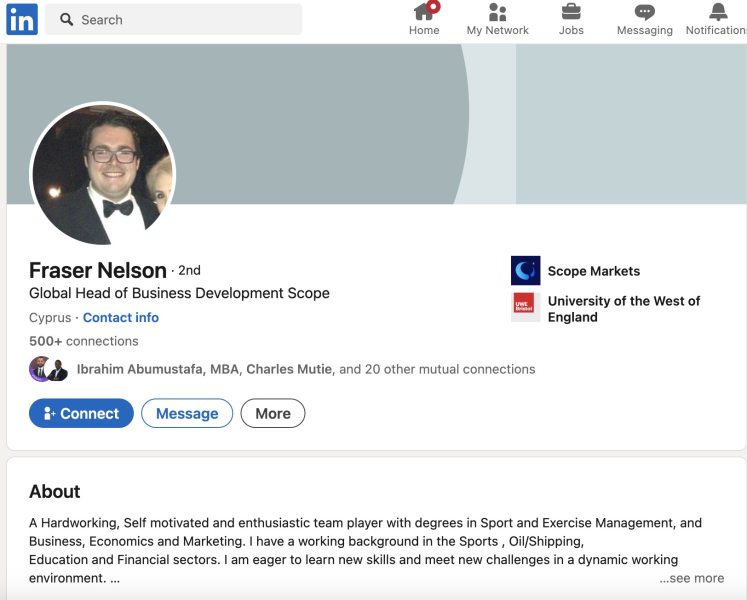

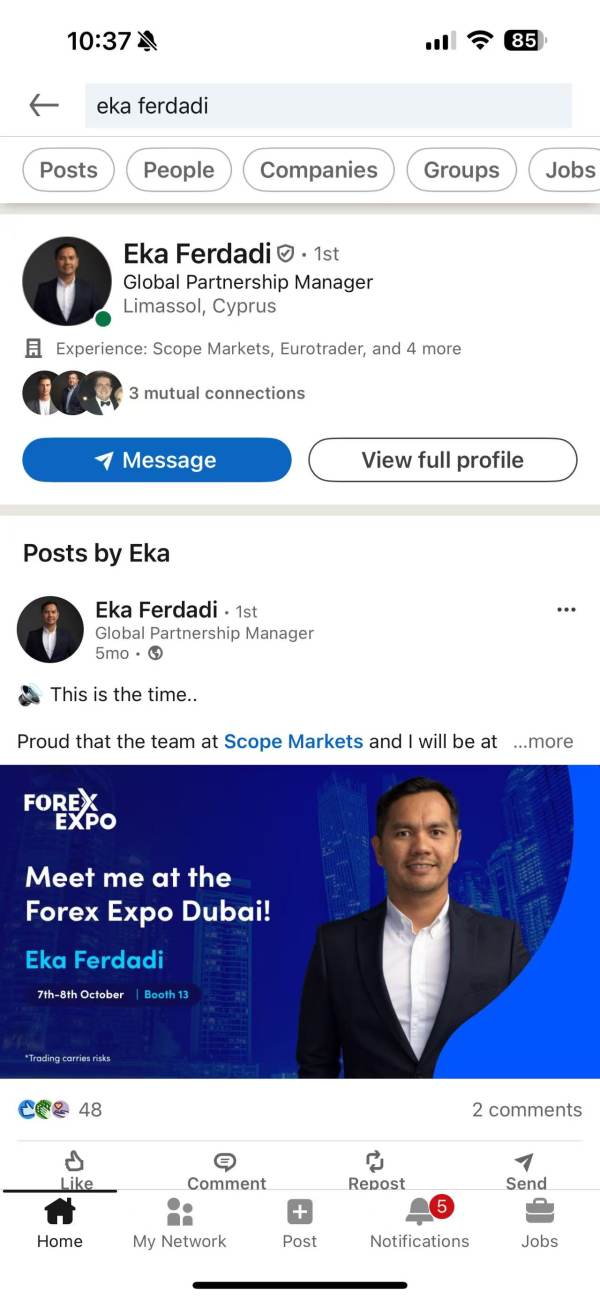

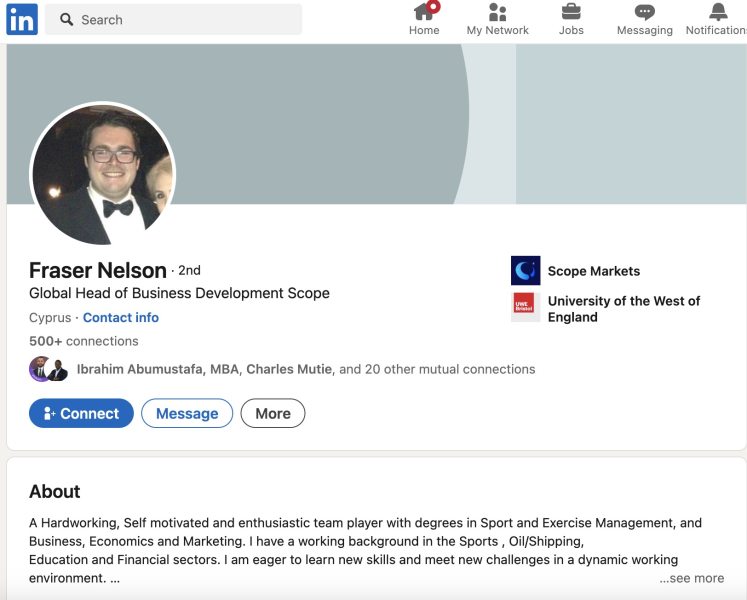

This Scope Markets review gives you a complete look at a Cyprus-based forex broker that started in 2014. Scope Markets calls itself an STP (Straight Through Processing) broker offering over 3,000 trading instruments across multiple asset classes. The broker has regulatory oversight from CySEC (Cyprus Securities and Exchange Commission) and IFSC (International Financial Services Commission of Belize), which provides a foundation of regulatory compliance for its operations.

Key highlights of Scope Markets include its huge range of trading instruments covering forex, metals, energies, indices, and stocks. This makes it attractive for traders who want to diversify their investments. The broker supports multiple trading platforms including MT4, MT5, and its own Scope Trader platform. With just a $50 USD minimum deposit and leverage options from 1:30 to 1:500, the broker tries to work for both retail and institutional clients.

However, our analysis shows concerning user feedback about account closures and fund withholding issues. Potential clients should carefully consider these problems. The broker's target audience includes retail and institutional investors seeking diverse trading tools and higher leverage options, though the mixed user reviews suggest you should be careful when thinking about this broker for trading activities.

Important Disclaimers

Regional Entity Differences: Scope Markets operates under different regulatory jurisdictions. SM Capital Markets Ltd is regulated by CySEC in Cyprus and Scope Markets Ltd is authorized by IFSC in Belize. Trading conditions, available instruments, and regulatory protections may vary significantly between these entities depending on your location and the specific entity you trade with. Clients should verify which entity they will be trading with and understand the corresponding regulatory framework.

Review Methodology: This evaluation is based on publicly available information, regulatory filings, and user feedback collected from various sources including review platforms and regulatory websites. All data presented reflects information available as of 2025, and trading conditions may change without notice.

Overall Rating Framework

Broker Overview

Company Background and Establishment

Scope Markets was founded in 2014. The company has its headquarters in Cyprus and operates as a Straight Through Processing (STP) broker. The company has positioned itself to serve both retail and institutional clients through its multi-jurisdictional approach, with entities licensed in Cyprus and Belize. This dual-jurisdiction structure allows the broker to offer services to a broader international client base while maintaining regulatory compliance in key markets.

The broker's business model focuses on providing direct market access through its STP execution. This theoretically means client orders are passed directly to liquidity providers without dealing desk intervention. This approach is generally preferred by experienced traders who seek transparent pricing and execution without potential conflicts of interest that can arise with market maker models.

Trading Infrastructure and Asset Coverage

According to available information, Scope Markets offers an impressive selection of over 3,000 trading instruments. These span major asset classes including foreign exchange pairs, precious metals, energy commodities, global indices, and individual stocks. This extensive instrument coverage positions the broker competitively against larger international brokers and provides clients with significant diversification opportunities within a single trading account.

The broker supports multiple trading platforms to accommodate different trader preferences and experience levels. These include the industry-standard MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, as well as the broker's proprietary Scope Trader platform. This Scope Markets review finds that the platform variety demonstrates the broker's commitment to serving diverse trading styles and technical requirements.

Regulatory Framework: Scope Markets operates under dual regulation from CySEC (Cyprus) and IFSC (Belize). The CySEC regulation provides European-standard investor protections, while the IFSC license allows the broker to serve international clients outside EU restrictions.

Minimum Deposit Requirements: The broker sets a relatively accessible minimum deposit of $50 USD. This makes it suitable for beginning traders and those with limited initial capital.

Leverage Options: Traders can access leverage ratios of 1:30 for EU-regulated clients or up to 1:500 for international clients. This depends on their regulatory jurisdiction and account type.

Available Assets: The platform provides access to forex pairs, precious metals (gold, silver), energy commodities (oil, natural gas), major global indices, and individual stocks. The total is over 3,000 instruments.

Trading Platforms: MT4, MT5, and proprietary Scope Trader platform support various trading strategies and analytical tools.

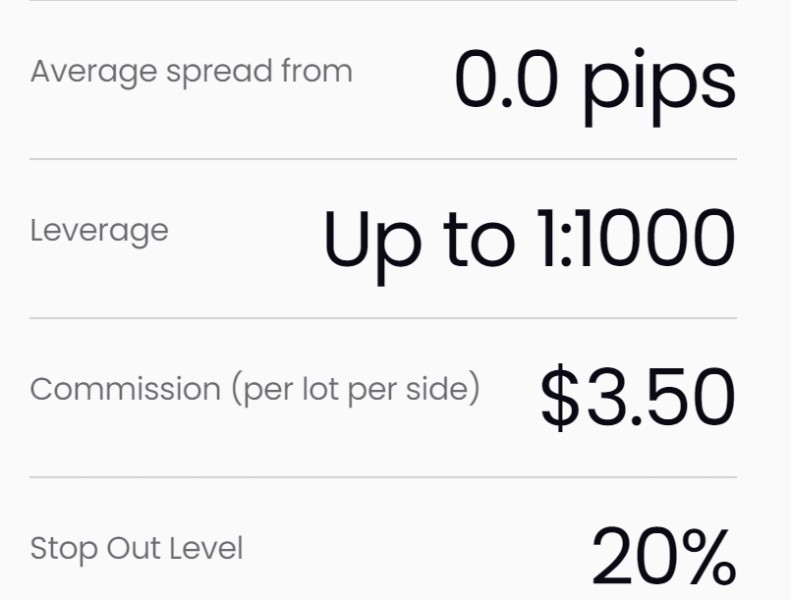

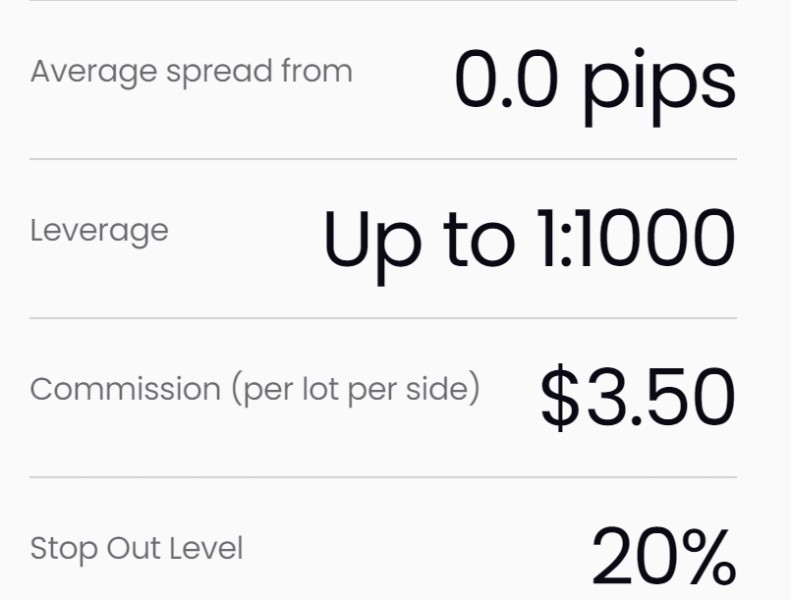

Cost Structure: Specific spread and commission information was not detailed in available sources. However, the broker operates on an STP model which typically features variable spreads.

Geographic Restrictions: Specific country restrictions were not detailed in available documentation.

Customer Support Languages: Multi-language support availability was not specified in accessible materials.

This Scope Markets review notes that while the broker provides comprehensive basic information, some operational details require direct inquiry with the broker for complete clarity.

Detailed Rating Analysis

Account Conditions Analysis (Score: 6/10)

Scope Markets offers account opening with a minimum deposit of $50 USD. This positions it favorably for entry-level traders seeking to begin their trading journey without significant capital requirements. This low barrier to entry is particularly attractive compared to many international brokers that require substantially higher initial deposits.

The leverage offerings vary significantly based on regulatory jurisdiction. EU clients are limited to 1:30 leverage under ESMA regulations, while international clients can access up to 1:500 leverage. This dual-tier approach allows the broker to comply with regional regulations while still offering competitive conditions to clients in jurisdictions that permit higher leverage ratios.

However, concerning user feedback has emerged regarding account closure procedures and fund accessibility. Several complaints documented on review platforms indicate instances where clients experienced unexpected account terminations and difficulties accessing their funds. These reports suggest potential issues with the broker's account management procedures that prospective clients should carefully consider.

The lack of detailed information about specific account types, Islamic account availability, and comprehensive fee structures in publicly available materials limits the transparency that experienced traders typically expect when evaluating potential brokers.

The broker's strongest selling point lies in its extensive instrument coverage. It offers over 3,000 trading instruments across multiple asset classes. This comprehensive selection rivals much larger international brokers and provides exceptional diversification opportunities for traders seeking exposure to various markets from a single account.

The platform selection demonstrates technical sophistication, supporting both MT4 and MT5 platforms alongside the proprietary Scope Trader platform. MetaTrader platforms provide access to extensive technical analysis tools, automated trading capabilities through Expert Advisors (EAs), and the ability to utilize trading signals and copy trading services.

The availability of multiple asset classes including forex, metals, energies, indices, and stocks allows traders to implement sophisticated portfolio strategies. This diversity is particularly valuable for institutional clients and experienced retail traders who require comprehensive market access.

However, specific information about research resources, market analysis tools, educational materials, and economic calendar features was not detailed in available sources. This represents a potential gap in the broker's resource offering transparency.

Customer Service and Support Analysis (Score: 5/10)

Customer service represents a significant concern area for Scope Markets based on available user feedback. Multiple complaints have surfaced regarding account closure issues and fund withholding problems, suggesting systemic issues with customer support responsiveness and problem resolution capabilities.

User reports indicate difficulties in communicating with support representatives when facing account-related issues. This is particularly true concerning fund withdrawals and account access problems. These complaints suggest that the broker may lack adequate customer service infrastructure to handle complex client issues effectively.

The absence of detailed information about support channels, response time commitments, available support hours, and multi-language capabilities in publicly accessible materials further compounds concerns about the broker's commitment to customer service excellence.

These customer service limitations could pose significant challenges for traders who require reliable support. This is especially true during volatile market conditions or when facing technical issues that require immediate assistance.

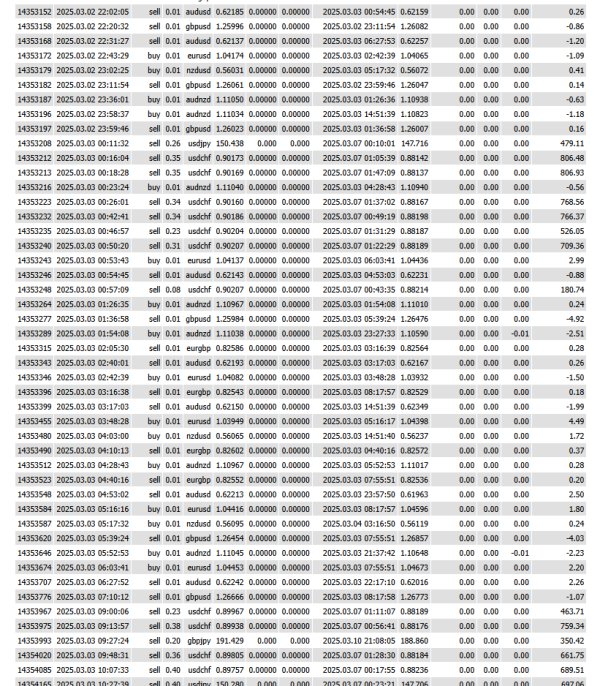

Trading Experience Analysis (Score: 7/10)

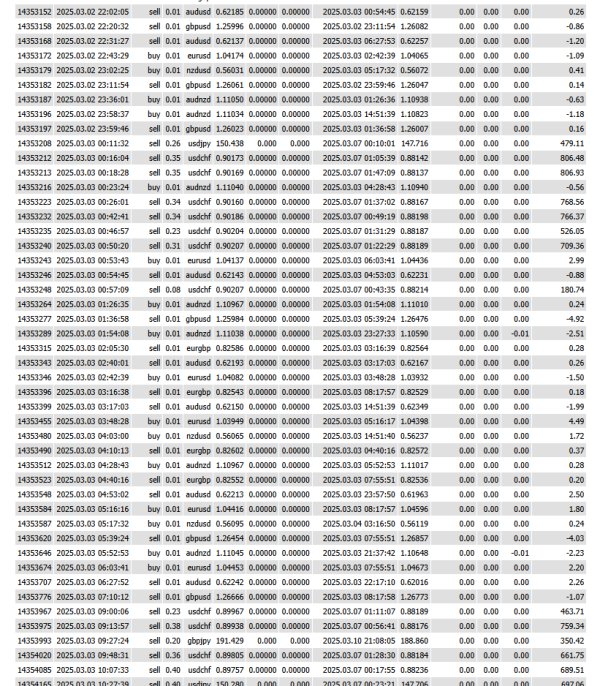

From a technical perspective, Scope Markets appears to offer a solid trading infrastructure through its support of industry-standard MT4 and MT5 platforms. These provide reliable order execution and comprehensive analytical tools. The STP business model should theoretically provide transparent pricing and direct market access without dealing desk intervention.

The extensive instrument selection enhances the trading experience by allowing clients to diversify across multiple markets. It also lets them implement various trading strategies within a single account. This comprehensive access is particularly valuable for traders who employ correlation strategies or seek to hedge positions across different asset classes.

The availability of leverage options up to 1:500 for eligible clients provides flexibility for various trading styles. This ranges from conservative position trading to more aggressive scalping strategies. However, specific information about execution speeds, typical spreads, slippage rates, and requote frequency was not available in accessible sources.

Mobile trading capabilities and platform stability information was not detailed in available materials. These represent important considerations for active traders who require reliable access across multiple devices and trading environments.

Trust and Safety Analysis (Score: 6/10)

Scope Markets maintains regulatory oversight from both CySEC and IFSC. This provides a foundation of regulatory compliance and oversight. CySEC regulation offers European-standard investor protections, including segregated client funds and participation in the Cyprus Investor Compensation Fund, which provides some level of financial protection for eligible clients.

However, the dual regulatory structure creates complexity regarding which protections apply to different clients based on their jurisdiction and the specific entity they trade with. This complexity can create confusion about applicable investor protections and regulatory recourse options.

The concerning pattern of user complaints regarding account closures and fund accessibility raises questions about the broker's operational procedures and commitment to client fund safety. These reports suggest potential issues with internal compliance procedures that could affect client fund security.

The lack of transparent information about additional safety measures limits the ability to fully assess the broker's commitment to client fund protection beyond basic regulatory requirements. This includes detailed segregated account procedures, professional indemnity insurance, or third-party fund administration.

User Experience Analysis (Score: 5/10)

Overall user satisfaction appears mixed based on available feedback. Particular concerns center around account management and fund accessibility issues. The pattern of complaints regarding account closures and withdrawal difficulties suggests systemic problems that significantly impact user experience.

The low minimum deposit requirement and extensive instrument selection provide positive aspects of the user experience. This is particularly true for traders seeking diverse market access without substantial capital requirements. The platform variety should accommodate different trading preferences and technical skill levels.

However, the lack of detailed information about account opening procedures, verification requirements, deposit and withdrawal methods, and processing times creates uncertainty for potential clients evaluating the broker's operational efficiency.

The absence of comprehensive educational resources, market research materials, and client communication tools in publicly available information suggests potential gaps in the overall client experience. Many modern brokers address these through comprehensive client portals and educational programs.

Common user complaints focus on communication difficulties with customer support, unexpected account restrictions, and challenges accessing funds. These represent fundamental operational issues that significantly impact user satisfaction and confidence in the broker's services.

Conclusion

This Scope Markets review reveals a broker with both notable strengths and significant concerns that potential clients must carefully weigh. The broker's extensive offering of over 3,000 trading instruments and support for multiple platforms including MT4, MT5, and proprietary Scope Trader represents genuine value for traders seeking comprehensive market access. The low $50 minimum deposit and dual regulatory framework from CySEC and IFSC provide basic credibility and accessibility.

However, the concerning pattern of user complaints regarding account closures and fund withholding issues raises serious questions about operational reliability and client service quality. These issues, combined with limited transparency about important operational details, suggest that potential clients should exercise significant caution when considering this broker.

Scope Markets may be suitable for experienced traders who prioritize instrument diversity and can navigate potential customer service challenges. However, new traders or those requiring reliable support should carefully consider these limitations. The broker's mixed track record suggests that while the technical offering appears adequate, the operational execution may not meet the standards that serious traders require for their trading activities.