Regarding the legitimacy of CentFX forex brokers, it provides FSC, FinCEN and WikiBit, (also has a graphic survey regarding security).

Is CentFX safe?

Pros

Cons

Is CentFX markets regulated?

The regulatory license is the strongest proof.

FSC Securities Trading License (EP)

The Financial Services Commission

The Financial Services Commission

Current Status:

RegulatedLicense Type:

Securities Trading License (EP)

Licensed Entity:

CENT MARKETS LIMITED

Effective Date: Change Record

2023-11-23Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

4th Floor, The Docks 4 The Docks Caudan, Port Louis, MauritiusPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

FinCEN Currency Exchange License (MSB)

Financial Crimes Enforcement Network

Financial Crimes Enforcement Network

Current Status:

RegulatedLicense Type:

Currency Exchange License (MSB)

Licensed Entity:

CENTFX Limited

Effective Date:

2024-09-09Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

C2101, ONTARIO TOWER BUSINESS BAY, DUBAIPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is CentFX A Scam?

Introduction

CentFX is an emerging player in the forex trading market, positioning itself as a broker that caters to a wide range of trading needs, including forex, commodities, and cryptocurrencies. As the trading landscape becomes increasingly saturated, traders must exercise caution when selecting a broker, as the risk of encountering scams or unreliable services is prevalent. The importance of due diligence cannot be overstated; traders need to ensure that their chosen broker adheres to regulatory standards and maintains a transparent operational framework. This article aims to provide a comprehensive evaluation of CentFX, utilizing a structured approach that includes regulatory status, company background, trading conditions, customer experience, and overall risk assessment.

Regulation and Legitimacy

The regulatory landscape is a critical factor in determining the safety and reliability of a forex broker. Regulation serves as a form of oversight that protects traders from potential fraud and malpractice. In the case of CentFX, it claims to be regulated by the Financial Services Commission (FSC) of Mauritius. However, the credibility of this regulation is a subject of scrutiny, as offshore regulation often lacks the stringent oversight found in more established jurisdictions.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Financial Services Commission (FSC) | GB23201644 | Mauritius | Verified |

While the FSC does provide a level of oversight, it is essential to understand that not all regulatory bodies enforce the same standards. Some critics argue that the FSC's regulation may not be as robust as those from authorities like the Financial Conduct Authority (FCA) or the Commodity Futures Trading Commission (CFTC). Additionally, there have been no significant historical compliance issues reported against CentFX, but the lack of major regulatory oversight raises concerns regarding the protection of client funds and the enforcement of ethical trading practices.

Company Background Investigation

CentFX was established in 2022 and operates under the ownership of CentFX Ltd, which is registered in Anguilla. The company claims to provide a user-friendly trading environment and a variety of account types to cater to different trading preferences. However, the relatively short history of the company raises questions about its stability and reliability in the long run.

The management teams background is not extensively documented, which contributes to the opacity surrounding the company. A transparent broker typically provides information about its leadership and their professional backgrounds, but this is not readily available for CentFX. The absence of detailed information about the company's ownership and management can be a red flag, as it may indicate a lack of accountability.

Moreover, the company's website presents a professional appearance, but it is crucial to assess whether this is merely a façade. Transparency in operations is vital for building trust, and the lack of clear information about the management team and their qualifications can lead to skepticism among potential clients.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for evaluating its overall value. CentFX claims to offer competitive spreads and a variety of account types, including micro, standard, and ECN accounts. However, the fee structure and potential hidden costs deserve careful examination.

| Fee Type | CentFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.2 pips |

| Commission Structure | None | $5 - $10 |

| Overnight Interest Range | 0.5% - 1% | 0.5% - 1% |

While the spread for major currency pairs appears competitive, the absence of a commission structure for some accounts may indicate that the broker compensates through wider spreads. This practice is common in the industry but can lead to higher costs for traders who are not aware of the underlying fee structure. Furthermore, CentFX does not clearly disclose any additional fees for deposits or withdrawals, which could result in unexpected costs for traders.

Client Fund Safety

The safety of client funds is a paramount concern when evaluating any broker. CentFX claims to implement various safety measures, including segregated accounts for client funds. However, the effectiveness of these measures is contingent upon the regulatory framework under which the broker operates.

Segregated accounts are designed to protect client funds by keeping them separate from the broker's operational funds. This is a positive aspect, but it is essential to verify whether CentFX adheres to this practice consistently. Additionally, the broker's website does not provide information on investor protection schemes, which are often crucial in safeguarding client investments in the event of broker insolvency.

Historical issues related to fund security have not been reported for CentFX, yet the lack of a robust regulatory framework raises questions about the long-term security of client investments. Traders should remain vigilant and consider the potential risks associated with trading with an offshore-regulated broker.

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability and service quality. Reviews of CentFX reveal a mixed bag of experiences, with some clients praising the ease of use of the trading platform, while others express frustration over withdrawal delays and customer support responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Lack of Transparency | Medium | Unresponsive |

| Poor Customer Support | High | Inconsistent |

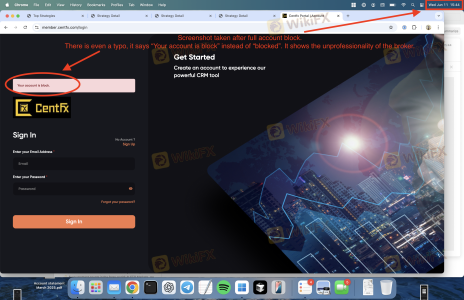

Common complaints include difficulties in withdrawing funds, which is a critical issue for any trading platform. Delays in fund withdrawals can significantly impact a trader's experience and raise concerns about the broker's operational integrity. Additionally, some users have reported a lack of transparency regarding fees and account management, further exacerbating trust issues.

One notable case involved a trader who experienced a prolonged withdrawal process, leading to frustration and a loss of confidence in the broker. This situation highlights the importance of thorough due diligence before committing funds to any trading platform.

Platform and Execution

The trading platform's performance is crucial for a successful trading experience. CentFX offers the popular MetaTrader 5 (MT5) platform, known for its robust features and user-friendly interface. However, the platform's stability and execution quality warrant closer scrutiny.

Traders have reported varying experiences with order execution, with some indicating instances of slippage and order rejections. These issues can significantly affect trading outcomes, especially for those engaging in high-frequency trading or scalping strategies. A reliable broker should ensure minimal slippage and high execution rates to maintain trader confidence.

Risk Assessment

Using CentFX carries several risks that potential clients should be aware of. The combination of offshore regulation, mixed customer feedback, and potential withdrawal issues creates a landscape of uncertainty.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Offshore regulation lacks robust oversight. |

| Withdrawal Risk | High | Reports of delays in processing withdrawals. |

| Transparency Risk | Medium | Insufficient information about management and operations. |

To mitigate these risks, traders should approach their engagement with CentFX cautiously. It is advisable to start with a minimal deposit and closely monitor the trading environment before committing significant funds.

Conclusion and Recommendations

In conclusion, while CentFX presents itself as a competitive broker with a user-friendly platform, several red flags warrant caution. The lack of robust regulatory oversight, mixed customer feedback, and potential withdrawal issues suggest that traders should proceed with care.

For those considering trading with CentFX, it is advisable to conduct thorough research and possibly start with a small investment. Additionally, traders seeking a more secure trading environment may want to explore alternative brokers with stronger regulatory frameworks and better customer reviews. Some reputable options include brokers regulated by the FCA or ASIC, which offer greater transparency and client protection.

Overall, while CentFX may offer attractive trading conditions, the associated risks necessitate a cautious approach.

Is CentFX a scam, or is it legit?

The latest exposure and evaluation content of CentFX brokers.

CentFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

CentFX latest industry rating score is 7.44, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 7.44 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.