Regarding the legitimacy of Scope Markets forex brokers, it provides CYSEC, FSCA, FSA and WikiBit, (also has a graphic survey regarding security).

Is Scope Markets safe?

Software Index

Risk Control

Is Scope Markets markets regulated?

The regulatory license is the strongest proof.

CYSEC Forex Execution License (STP) 19

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

RegulatedLicense Type:

Forex Execution License (STP)

Licensed Entity:

SM CAPITAL MARKETS Ltd

Effective Date:

2017-11-02Email Address of Licensed Institution:

info@smcapitalmarkets.comSharing Status:

Website of Licensed Institution:

www.smcapitalmarkets.com, www.scopemarkets.eu, www.scopeprime.euExpiration Time:

--Address of Licensed Institution:

23, Spyrou Kyprianou Avenue, Floor 4, 3070 Limassol, CyprusPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

FSCA Derivatives Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

SCOPE MARKETS SA (PTY) LTD

Effective Date:

2016-07-05Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

WEWORK 155 WEST STREET155 WEST STREETSANDOWN2031Phone Number of Licensed Institution:

+27 100065486Licensed Institution Certified Documents:

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

Scope Markets Global Ltd

Effective Date:

--Email Address of Licensed Institution:

compliancegroup@scopemarkets.comSharing Status:

No SharingWebsite of Licensed Institution:

https://www.scopemarkets.scExpiration Time:

--Address of Licensed Institution:

Office 2, Room 4, First Floor, Oliver Maradan Building, Victoria, Mahe, SeychellesPhone Number of Licensed Institution:

4224830Licensed Institution Certified Documents:

Is Scope Markets A Scam?

Introduction

Scope Markets, a forex and CFD broker, has positioned itself as a competitive player in the global trading landscape since its inception in 2014. With a broad range of trading instruments and user-friendly platforms, it caters to both novice and experienced traders. However, the forex market is rife with both legitimate and fraudulent brokers, making it crucial for traders to carefully assess the credibility and reliability of their chosen brokers. This article aims to provide a comprehensive evaluation of Scope Markets, examining its regulatory status, company background, trading conditions, and customer experiences to determine whether it is a safe option for traders or a potential scam.

To conduct this investigation, we utilized a multi-faceted approach that included a review of regulatory information, customer feedback, and an analysis of the broker's trading conditions. By synthesizing data from various credible sources, we aim to present an objective assessment of Scope Markets.

Regulation and Legitimacy

Regulatory oversight is a cornerstone of a broker's legitimacy, as it ensures that the broker adheres to strict financial standards and practices. Scope Markets operates under the jurisdiction of multiple regulatory bodies, primarily the Financial Services Commission (FSC) in Belize and the Cyprus Securities and Exchange Commission (CySEC).

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FSC | 000274/325 | Belize | Verified |

| CySEC | 339/17 | Cyprus | Verified |

The FSC is known for its relatively lenient regulatory framework, often categorized as a Tier-3 regulator. While this means that Scope Markets is legally operating, it raises concerns about the level of protection afforded to traders. On the other hand, CySEC is regarded as a Tier-1 regulator, offering stricter compliance requirements and enhanced investor protection. This dual regulatory framework suggests that while Scope Markets is legitimate, the quality of regulatory oversight may vary significantly depending on the entity under which a trader operates.

Historically, Scope Markets has maintained compliance with regulatory standards, which adds an extra layer of credibility to its operations. However, potential traders should remain vigilant, as the presence of an offshore regulatory entity may indicate increased risks associated with trading.

Company Background Investigation

Scope Markets, previously known as SM Capital Markets, has evolved over the years to establish a reputation in the forex trading industry. The company is headquartered in Limassol, Cyprus, and operates additional offices in Belize and South Africa. This international presence allows Scope Markets to cater to a diverse clientele.

The management team at Scope Markets boasts over two decades of experience in the financial services sector, which is a positive indicator of the broker's operational expertise. The company's ownership structure appears transparent, with publicly available information about its regulatory licenses and operational jurisdictions. However, the overall transparency of the company could be improved, particularly in terms of disclosing detailed information about its financial health and operational practices.

In terms of information disclosure, Scope Markets provides essential details on its website, including regulatory licenses, trading conditions, and contact information. However, potential clients may benefit from more comprehensive insights into the company's financial performance and operational policies.

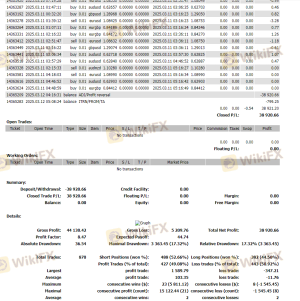

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions they offer is paramount. Scope Markets provides a competitive fee structure, but it is essential to analyze these costs in detail. The broker operates on a commission-free model, with spreads starting from 0.9 pips for major currency pairs.

| Fee Type | Scope Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.9 pips | 1.2 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Varies | Varies |

While the spreads offered by Scope Markets are competitive, potential traders should remain cautious about any hidden fees or unusual charges that may arise. For instance, withdrawal fees of $35 apply after two free withdrawals per month, which could be considered a drawback compared to other brokers that offer unlimited free withdrawals.

Overall, while Scope Markets presents a reasonable fee structure, traders should carefully evaluate their trading strategies to ensure that they align with the broker's cost model.

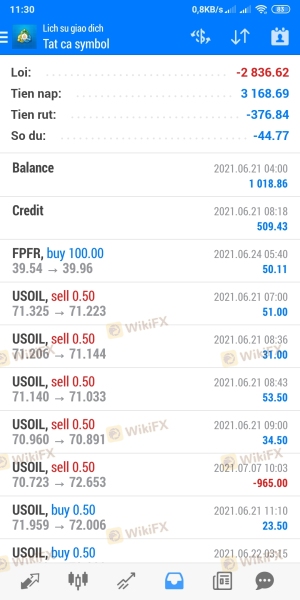

Customer Fund Safety

The safety of customer funds is a critical aspect of any broker's credibility. Scope Markets employs several measures to safeguard client funds, including segregated accounts and negative balance protection. These practices ensure that client funds are kept separate from the broker's operational funds, providing an added layer of security.

Additionally, Scope Markets is subject to the investor compensation schemes mandated by CySEC, which offers further protection to traders in the event of the broker's insolvency. However, the absence of such compensation schemes under the FSC's regulations in Belize raises concerns about the level of protection afforded to traders operating under that jurisdiction.

Historically, Scope Markets has not experienced significant security breaches or fund-related controversies, which is a positive sign for potential clients. Nevertheless, traders should remain aware of the inherent risks associated with trading in offshore jurisdictions.

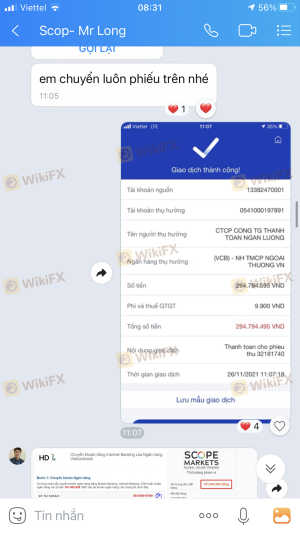

Customer Experience and Complaints

Customer feedback is a vital indicator of a broker's reputation and service quality. Overall, Scope Markets has received mixed reviews from its users. While many traders praise the broker for its competitive spreads and user-friendly platforms, there are also notable complaints regarding customer service and withdrawal processes.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Mixed |

| Customer Service Issues | Medium | Moderate |

| Account Management Issues | High | Poor |

Several users have reported difficulties in withdrawing funds, citing delays and lack of communication from customer support. For instance, one trader described a frustrating experience with delayed withdrawals and unresponsive customer service, which ultimately led to dissatisfaction with the broker.

On the other hand, some users have reported positive experiences with the broker's trading platforms and execution quality. This dichotomy in customer experiences suggests that while Scope Markets may offer competitive trading conditions, there are areas for improvement in customer service and support.

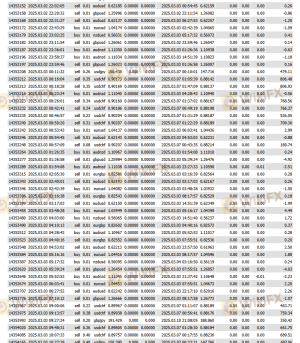

Platform and Execution

The performance of a trading platform is crucial for a seamless trading experience. Scope Markets offers MetaTrader 4 (MT4) and MetaTrader 5 (MT5), both of which are highly regarded in the trading community for their robust features and user-friendly interfaces. Users report that the platforms provide stable connections and fast order execution, which are essential for trading in volatile markets.

However, there have been isolated complaints regarding slippage and order rejections during high volatility periods. Traders have noted instances where their stop-loss orders were not executed at the desired prices, leading to unexpected losses. While slippage is a common occurrence in the forex market, the frequency and severity reported by some users warrant attention.

Risk Assessment

Using Scope Markets entails various risks that traders should be aware of. While the broker is regulated, the presence of an offshore entity raises concerns about the level of investor protection. Additionally, the mixed customer feedback regarding withdrawal processes and customer service indicates potential operational risks.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Mixed regulatory oversight |

| Operational Risk | High | Complaints regarding withdrawals |

| Market Risk | High | High volatility in forex trading |

To mitigate these risks, traders are advised to conduct thorough research before opening an account. It is essential to understand the broker's fee structure, withdrawal policies, and customer service responsiveness. Additionally, traders should only invest funds they can afford to lose and consider starting with a demo account to familiarize themselves with the trading environment.

Conclusion and Recommendations

In summary, Scope Markets presents a mixed picture regarding its credibility and safety as a forex broker. While it is regulated by both the FSC in Belize and CySEC in Cyprus, the varying levels of regulatory oversight raise concerns. The broker offers competitive trading conditions and user-friendly platforms, but customer feedback indicates potential issues with withdrawals and customer service.

For traders considering Scope Markets, it is crucial to weigh the benefits against the risks. If you are a beginner or a trader looking for a straightforward trading experience, Scope Markets may be a viable option. However, if you prioritize high levels of regulatory protection and robust customer service, it may be prudent to explore alternative brokers with stronger reputations.

Some reliable alternatives include brokers regulated by Tier-1 authorities such as the FCA in the UK or ASIC in Australia, which generally offer higher levels of investor protection and service quality. Always conduct thorough due diligence before making a decision, ensuring that your chosen broker aligns with your trading needs and risk tolerance.

Is Scope Markets a scam, or is it legit?

The latest exposure and evaluation content of Scope Markets brokers.

Scope Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Scope Markets latest industry rating score is 6.06, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.06 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.