BTC Dana 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

BTC Dana is positioned as a multi-asset trading platform that presents an enticing array of features for potential traders. With high leverage options of up to 500:1 and a diverse set of trading instruments including forex, cryptocurrencies, and commodities, it beckons new and inexperienced traders. The platform promotes user-friendly experiences, fast execution, and low minimum deposit requirements, making it attractive to those seeking accessible trading avenues. However, despite these advantages, potential users must tread carefully. Operating as an unregulated broker, BTC Dana raises substantial concerns regarding fund safety and reliability. Numerous complaints have emerged regarding withdrawal difficulties and poor customer service, indicating systemic issues that could jeopardize investors' assets. Thus, BTC Dana represents a double-edged sword: it may offer lucrative opportunities, but the risks involved merit serious consideration.

⚠️ Important Risk Advisory & Verification Steps

Before proceeding with any investment on BTC Dana, consider the following critical risks:

- Unregulated Nature: BTC Dana operates without official regulatory oversight, posing significant risks to trader funds and leading to potential fraud.

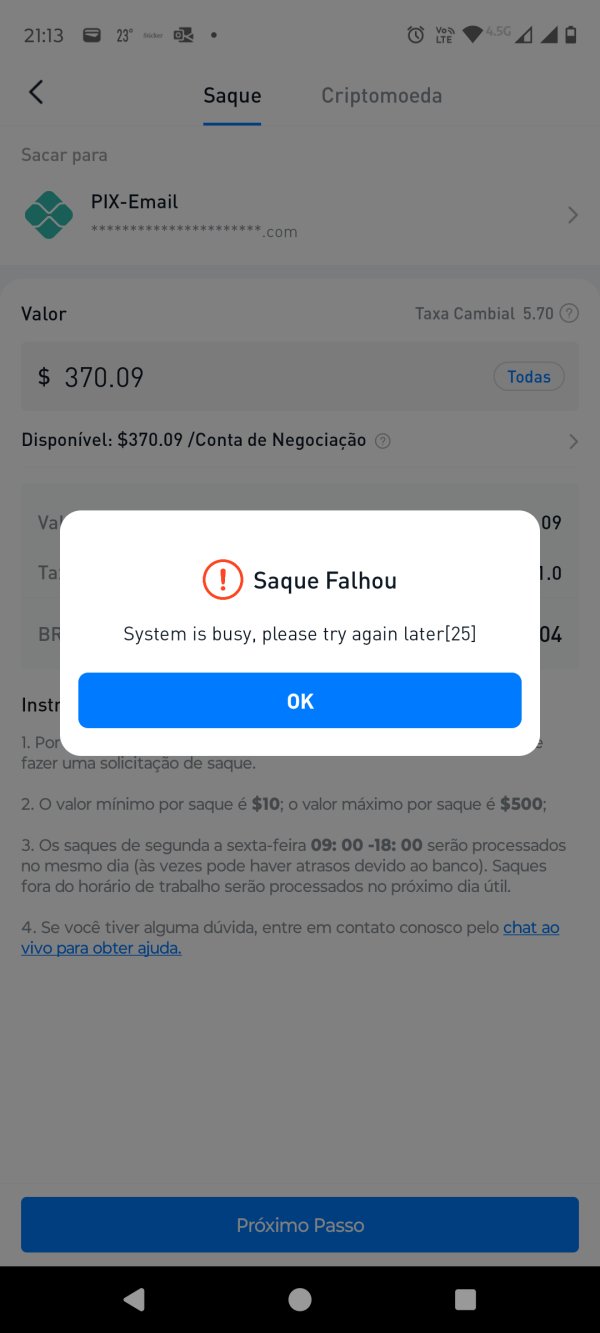

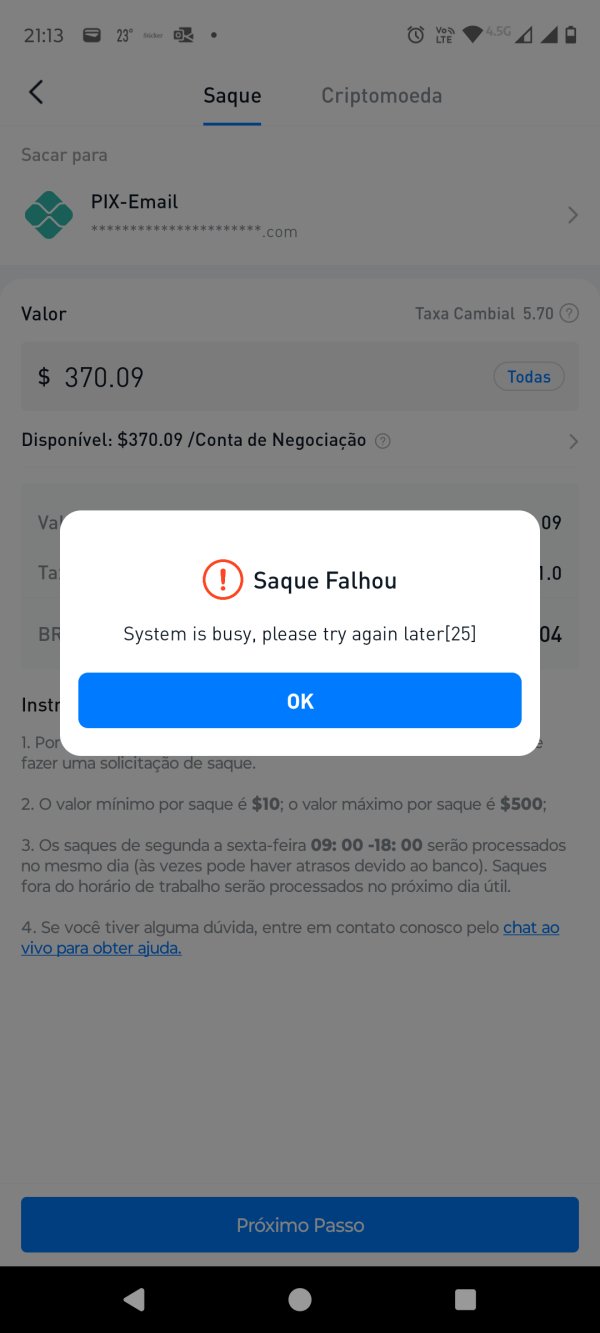

- Withdrawal Complaints: Users have reported numerous instances of being unable to withdraw their funds amidst poor customer support responses.

- High Volume of Complaints: With over 20 complaints registered within three months, systemic issues may indicate a pattern of untrustworthiness.

To verify the safety of your funds:

- Check the broker's regulatory status on official financial authority websites.

- Look for user reviews regarding withdrawal experiences.

- Assess the reliability of third-party reviews on platforms like WikiFX or Trustpilot.

- consider engaging with experienced traders in forums for insights.

- Maintain realistic expectations about the risks associated with high-leverage trading.

Broker Overview

Company Background and Positioning

Founded in 2022, BTC Dana is based in the United States. Its claim of regulation by the Mauritius Financial Services Commission (FSC) has led to further scrutiny, with many experts questioning its legitimacy given the lack of transparency surrounding its operational practices. This lack of clarity raises significant concerns about the broker's compliance with standard regulatory frameworks. BTC Dana has positioned itself as a flexible, user-focused platform catering to retail and institutional traders across multiple regions, including Asia, the Middle East, Africa, and Latin America.

Core Business Overview

BTC Dana focuses specifically on offering a comprehensive suite of trading products, including Contracts for Difference (CFDs) on various assets such as forex, stocks, indices, cryptocurrencies, and commodities. The broker touts features like micro-lot trading and leverage options to attract traders looking for flexibility, especially in the high-risk trading environment. Despite its diverse offerings, the absence of concise regulatory information serves as a significant warning to potential investors, especially those prioritizing security and compliance in financial markets.

Quick-Look Details

In-Depth Analysis

1. Trustworthiness Analysis

-

Analysis of Regulatory Information Conflicts:

The regulatory status of BTC Dana is murky, as claims of oversight by the FSC lack substantial evidence, raising red flags about its legitimacy. Concerns over user protection and potential scams are prevalent, especially with a low Wikifx score of 1.32/10.

User Self-Verification Guide:

To conduct your own verification:

- Visit the official website of the Mauritius Financial Services Commission and search for BTC Dana.

- Check for any official regulatory announcements concerning BTC Dana's operations.

- Consult trusted financial advisory sites for user reviews and complaints.

- Inquire on trader forums about others' experiences with withdrawals.

- Gather insight from trading groups to assess the reputational standing of the broker.

"I made a deposit and tried to withdraw but faced continuous refusal from support."

These experiences reflect a deeper pattern of issues likely linked to the broker's unregulated status.

2. Trading Costs Analysis

-

Advantages in Commissions:

BTC Dana claims a low-cost commission structure, with a $15 charge per lot and commission-free accounts available on specific trades. However, transparency across its fee structure appears muddled, particularly regarding hidden costs on withdrawals.

The "Traps" of Non-Trading Fees:

Many users have raised concerns about high withdrawal fees, with varied experiences reported depending on the chosen withdrawal method. Notably:

"I faced a $1 withdrawal fee, yet it took days to process."

These difficulties indicate potential hidden costs that may arise during withdrawals.

- Cost Structure Summary:

While BTC Dana's commission fees are competitive, the reported withdrawal issues are significant deterrents. New traders may initially find it appealing, but this could turn disadvantageous, particularly when it comes to getting funds back.

-

Platform Diversity:

BTC Dana primarily operates via the MetaTrader 5 (MT5) platform, which is well-regarded for its user-friendliness. The platform simplifies trading transactions and also supports various mobile devices, promoting accessibility for traders on the go.

Quality of Tools and Resources:

The tools available on MT5, including advanced charting capabilities and various analytical indicators, offer traders the opportunity to make informed decisions. However, the platform lacks sufficient educational resources to aid novice traders in maximizing these tools.

Platform Experience Summary:

User experiences have highlighted both positives and negatives. For instance:

"The user interface is incredibly easy to navigate, but I wish they provided more educational materials."

Users appreciate the ease of operation but often struggle without adequate training resources.

4. User Experience Analysis

-

Overall Usability:

Many users find BTC Dana to offer a seamless user experience, especially new traders utilizing its mobile app for quick trades. The streamlined layout accommodates both novice and experienced traders.

Customization and Features:

Users report robust customization options, particularly regarding charts and indicators, which can be tailored to individual trading strategies, enhancing overall satisfaction.

Potential Issues:

Nevertheless, some users face consistent issues such as:

"The app sometimes freezes, leading to frustrating trading experiences."

This inconsistency reflects a need for quality assurance in their software developments.

5. Customer Support Analysis

-

Customer Interaction Summary:

Review of BTC Dana's customer support indicates a pattern of slow response times. Many users express frustration over vague replies to their inquiries.

Support Limitations:

The service is not available 24/7, which poses challenges for traders in different time zones. Numerous complaints:

"It took me days to get a response, and it felt very generic."

These interactions have not instilled confidence among users needing timely assistance.

6. Account Conditions Analysis

-

Diverse Account Options:

BTC Dana offers a demo account for practice and a real account for live trading, catering to different experience levels. The demo account provides a risk-free environment for users to familiarize themselves with the platform and build their confidence.

Withdrawal and Deposit Options:

While BTC Dana supports various funding and withdrawal methods, users report inconsistencies in the execution:

"Withdrawal requests seem to linger for long periods; I am not sure how they process requests."

Users need to remain vigilant regarding these financial transactions.

Conclusion

BTC Dana presents itself as a compelling trading platform featuring high leverage and an extensive range of trading instruments appealing to novice traders. However, the broker's unregulated status and alarming volume of user complaints present considerable risks. Potential users should approach BTC Dana with caution and perform thorough due diligence before committing funds. With a landscape riddled with brokers that may prioritize short-term profits over client safety, it is crucial for traders to prioritize options that offer robust regulatory protections and verified customer support.