Power Trading 2025 Review: Everything You Need to Know

Executive Summary

This power trading review looks at the new world of electricity trading platforms and services in 2025. Power trading is a special part of the energy market where people buy and sell electricity through different platforms and direct deals. The sector has caught the attention of both skilled traders and beginners who want to make money from electricity price changes.

TIOmarkets reports show that power trading includes both quick electricity deals and long-term power purchase agreements. This gives traders flexibility for different strategies. User feedback shows mixed results, with average ratings that suggest the industry needs to improve service and platform features. The power trading sector draws many types of people, from energy market experts to retail traders who are trying commodity markets for the first time.

This review must point out big gaps in information about specific rules, detailed trading conditions, and complete platform features that would normally help with a full broker review.

Important Disclaimers

Regional Entity Differences: Power trading works very differently across regions because of different rules, market structures, and electricity grid systems. What works in one area may not apply in another. Traders should check local rules and market conditions.

Review Methodology: This review uses public information, user feedback, and industry reports. We have limited access to complete data about specific rules, detailed trading conditions, and platform details. This review cannot cover all the criteria usually expected in broker reviews.

Rating Framework

Broker Overview

Power trading is a key part of the energy market that focuses on electricity trading activities. TIOmarkets analysis shows that this sector involves buying and selling electricity on different platforms, including power exchanges and direct deals between market players. The main goal is to make profits from electricity price changes, which are affected by supply and demand, weather patterns, fuel costs, and rule changes.

The power trading world has changed a lot, with more participation from both big institutions and individual traders. Trading Brokers reports show that electricity trading has become more popular among skilled traders, especially as global electricity use keeps rising and market ups and downs create profit chances. The sector allows different trading approaches, from quick arbitrage strategies to longer-term positions based on deep analysis of energy markets.

Current market conditions show power trading platforms trying to serve different types of users, from energy market specialists to newcomers exploring commodity trading. But electricity markets are complex and require participants to understand unique features like real-time delivery needs, grid limits, and rule compliance that make power trading different from traditional financial trading.

Regulatory Framework: Available sources do not specify particular regulatory jurisdictions or oversight bodies governing power trading platforms. This represents a big information gap for potential users who need regulatory clarity.

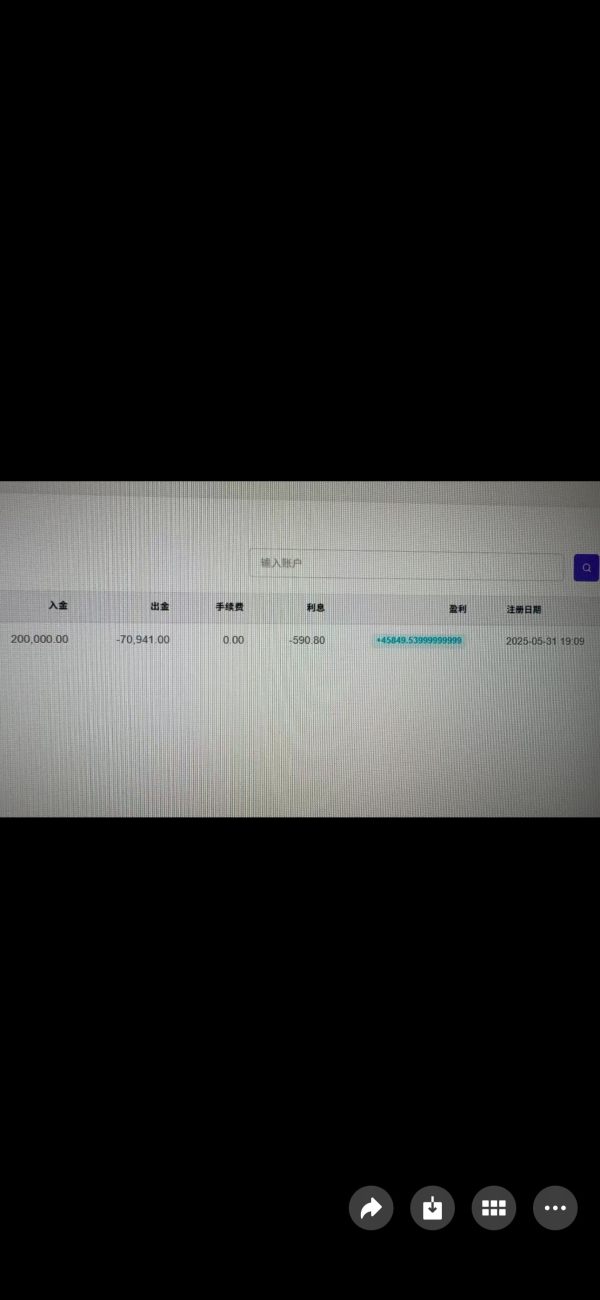

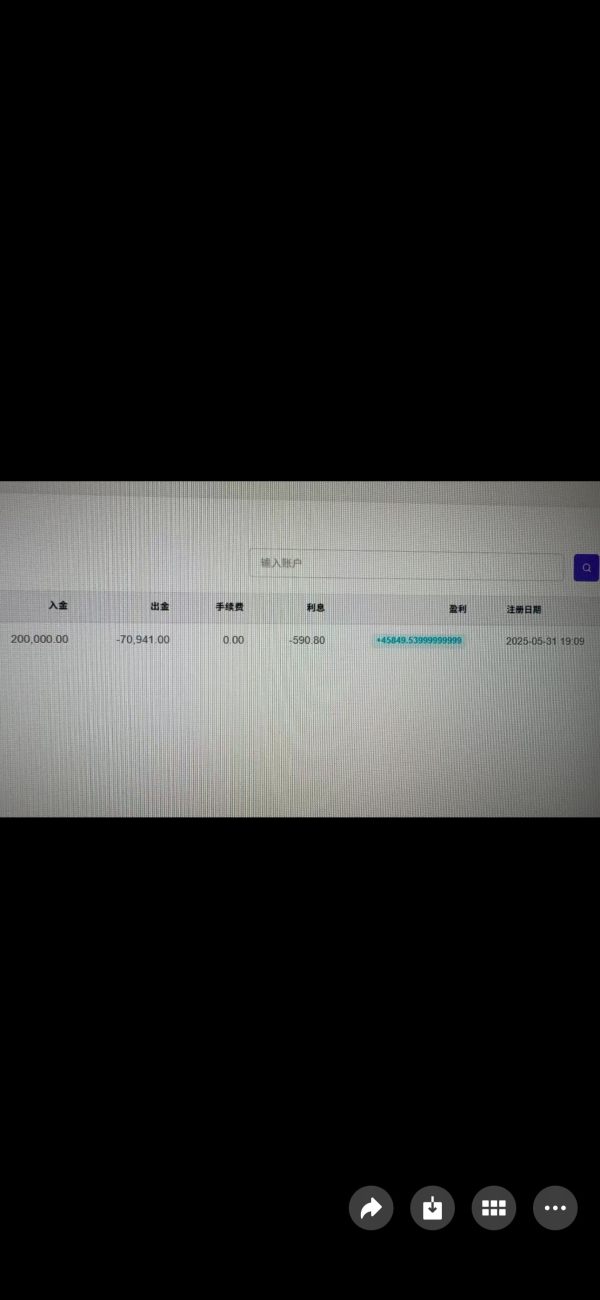

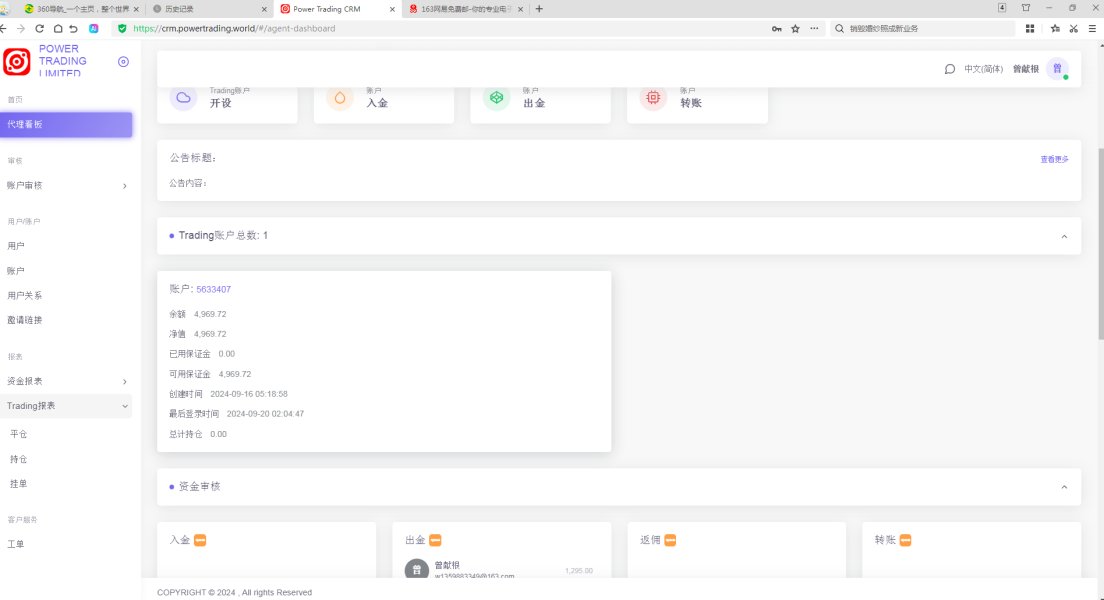

Deposit and Withdrawal Methods: Specific information about funding methods, supported payment options, and withdrawal procedures is not detailed in available documentation. This limits assessment of platform accessibility.

Minimum Deposit Requirements: Source materials do not provide specific minimum deposit amounts. This makes it hard to assess entry barriers for different trader types.

Promotional Offerings: Details about bonus structures, promotional campaigns, or incentive programs are not specified in available information sources.

Tradeable Assets: The primary focus centers on electricity trading, including both short-term market transactions and longer-term power purchase agreements. However, specific contract types and market access details need clarification.

Cost Structure: Complete fee schedules, spread information, commission rates, and other trading costs are not detailed in source materials. This represents a critical information gap for cost-conscious traders.

Leverage Options: Specific leverage ratios, margin requirements, and risk management parameters are not specified in available documentation.

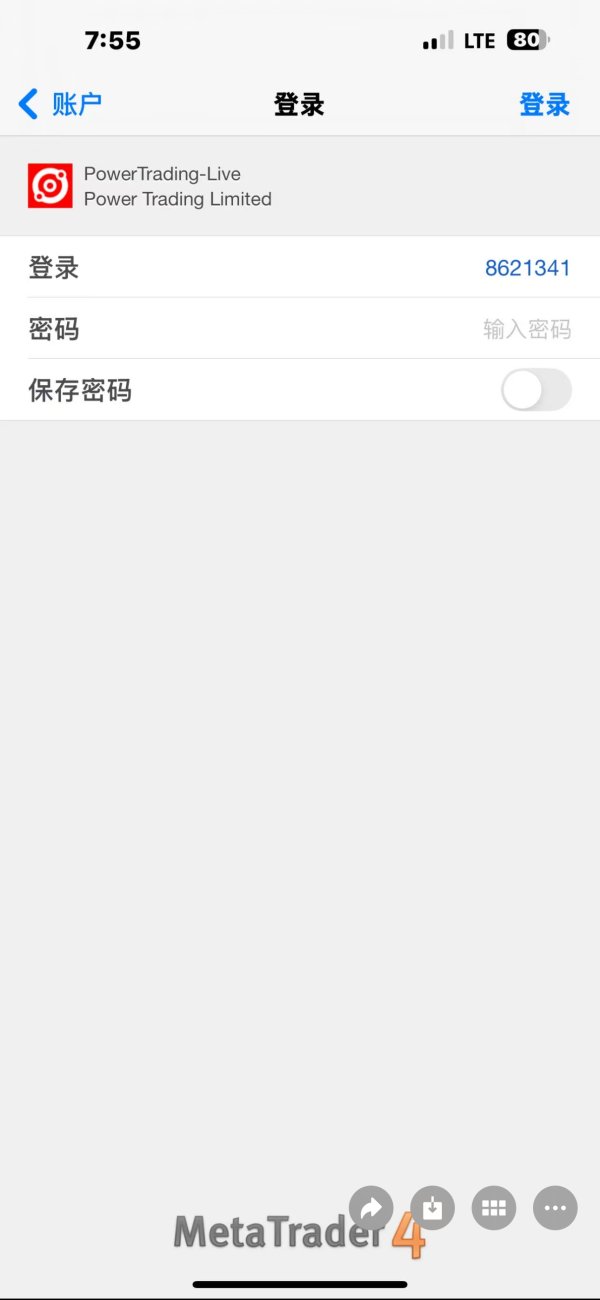

Platform Selection: Technical specifications, platform types, software options, and trading interface details are not fully covered in source materials.

Geographic Restrictions: Specific regional limitations, country restrictions, or market access constraints are not detailed in available information.

Customer Support Languages: Supported languages and communication channels for customer service are not specified in source documentation.

This power trading review identifies substantial information gaps that limit comprehensive platform evaluation.

Detailed Rating Analysis

Account Conditions Analysis

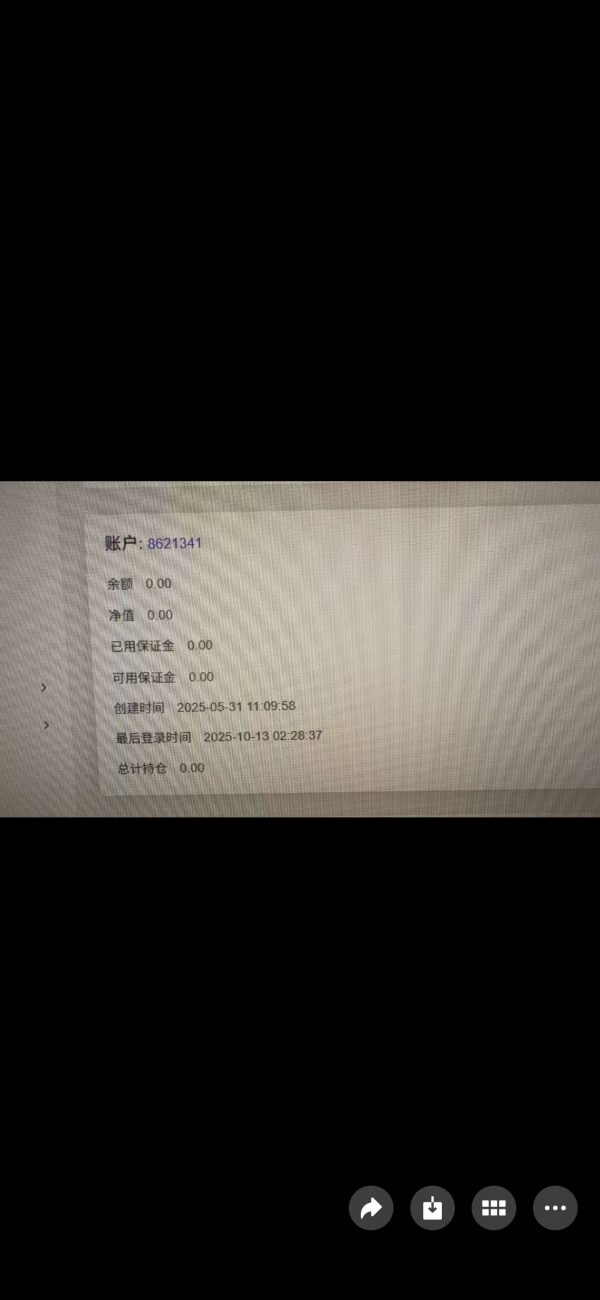

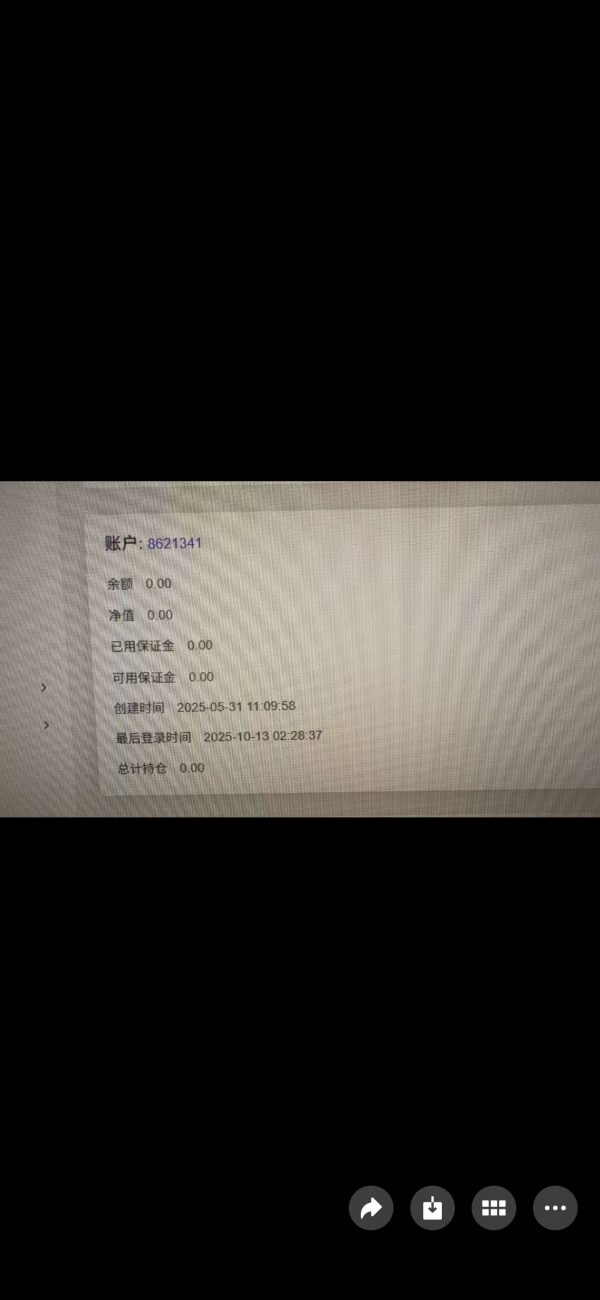

The evaluation of account conditions for power trading platforms faces big limitations due to insufficient information in available source materials. Traditional broker assessments would look at account tier structures, minimum deposit requirements, account opening procedures, and specialized account features such as Islamic trading accounts or professional trader classifications.

Without specific details about account types, deposit thresholds, or verification requirements, potential users cannot properly assess whether power trading platforms meet their particular needs and financial situations. The absence of clear account condition information represents a big gap in this power trading review and prevents meaningful comparison with industry standards.

Industry best practices typically include transparent account structures with clear eligibility criteria, reasonable minimum deposits for different trader categories, and streamlined account opening processes. However, the available documentation does not provide enough detail to evaluate how power trading platforms perform against these benchmarks.

The lack of account condition transparency may indicate either incomplete public disclosure by platform operators or the specialized nature of electricity trading markets that operate differently from conventional forex or CFD brokers.

Power trading platforms show notable strength in providing flexibility for both short-term electricity trading and long-term power purchase agreements, according to available industry reports. This versatility represents a big advantage for traders seeking to implement diverse strategies across different time horizons in electricity markets.

The ability to engage in both immediate delivery contracts and forward-looking power purchase agreements suggests sophisticated market access that accommodates various trading approaches. Short-term trading opportunities allow participants to capitalize on immediate price movements, while longer-term agreements provide opportunities for fundamental analysis-based strategies.

However, specific details about research tools, market analysis resources, educational materials, or automated trading support systems are not fully covered in available source materials. Traditional broker evaluations would examine charting capabilities, fundamental analysis tools, economic calendars, and educational resources that support trader decision-making.

The specialized nature of electricity markets likely requires unique analytical tools that account for factors such as load forecasting, weather impact analysis, and grid constraint considerations that distinguish power trading from conventional financial markets.

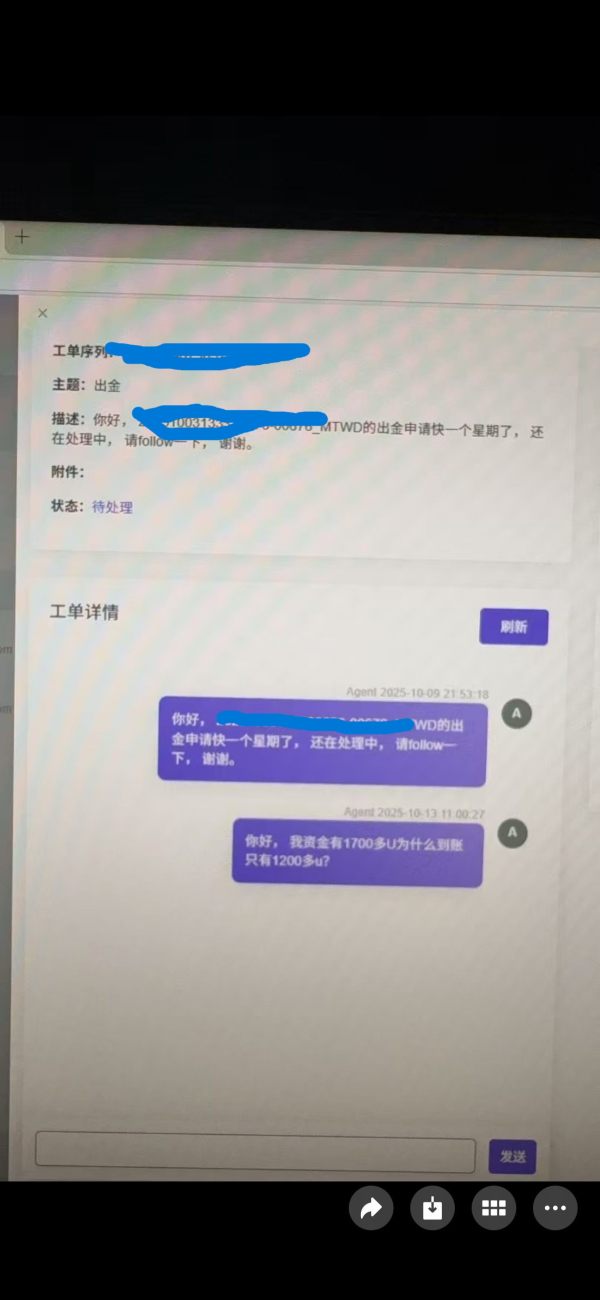

Customer Service and Support Analysis

Available source materials do not provide specific information about customer service channels, response times, service quality metrics, or multilingual support capabilities for power trading platforms. This represents a critical evaluation gap, as customer support quality significantly impacts trader experience, particularly in complex markets like electricity trading.

Effective customer service in power trading environments typically requires specialized knowledge of electricity markets, regulatory requirements, and technical platform functionality that exceeds standard financial broker support needs. The complexity of power markets suggests that quality customer support should include access to energy market specialists who understand unique trading challenges.

Without specific user feedback about support experiences, response times, or problem resolution effectiveness, this review cannot properly assess customer service quality. Industry standards typically include multiple communication channels, reasonable response times, and knowledgeable support staff capable of addressing both technical and market-related inquiries.

The absence of customer service information may reflect either limited public disclosure or the specialized nature of power trading platforms that operate with different service models compared to retail forex brokers.

Trading Experience Analysis

The assessment of trading experience quality faces limitations due to insufficient specific information about platform stability, order execution quality, functionality completeness, or mobile trading capabilities in available source materials. These factors critically impact trader satisfaction and operational effectiveness, particularly in fast-moving electricity markets.

Power trading environments typically require robust technical infrastructure capable of handling real-time price updates, immediate order execution, and reliable connectivity to electricity market data feeds. The time-sensitive nature of electricity trading, where physical delivery requirements create unique urgency, demands superior platform performance compared to many traditional financial instruments.

Available user feedback suggests mixed experiences, though specific details about platform performance, execution quality, or technical reliability are not fully documented. The complexity of electricity markets may require specialized trading interfaces that accommodate unique features such as delivery scheduling, grid constraint awareness, and real-time balancing requirements.

Without detailed technical performance data or comprehensive user experience feedback, this evaluation cannot provide definitive assessment of trading experience quality, representing a significant gap in this analysis.

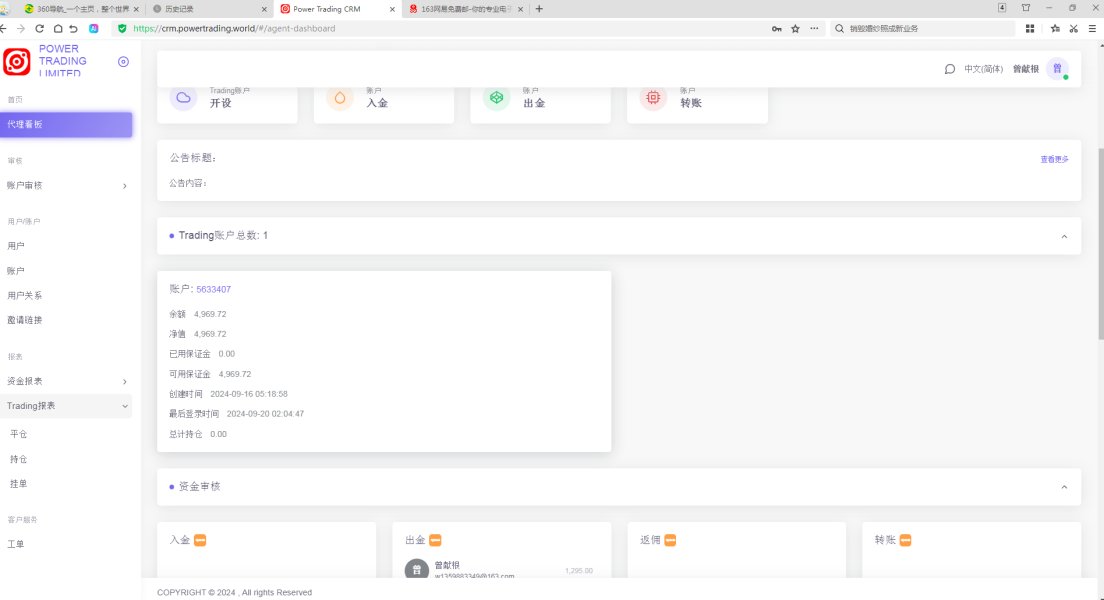

Trust and Regulation Analysis

The evaluation of trust and regulatory compliance faces substantial limitations due to the absence of specific regulatory information in available source materials. Regulatory oversight represents a fundamental consideration for traders, particularly in specialized markets like electricity trading that often involve substantial financial commitments and complex compliance requirements.

Power trading typically operates under multiple regulatory frameworks, including energy market regulators, financial services authorities, and grid operators, depending on jurisdiction and trading activities. The absence of clear regulatory disclosure prevents assessment of compliance standards, investor protection measures, and dispute resolution mechanisms.

Industry transparency standards typically include clear regulatory registration details, segregated client fund protections, regular financial reporting, and established complaint procedures. Without specific information about these critical trust factors, potential users cannot properly assess platform reliability and safety.

The specialized nature of electricity markets may involve regulatory complexities that differ significantly from traditional financial broker oversight, but the absence of clear regulatory information represents a significant concern for risk-conscious traders.

User Experience Analysis

Available information indicates mixed user satisfaction levels, with feedback suggesting moderate performance in overall user experience delivery. The power trading sector appears to serve both experienced energy market professionals and newcomers to commodity trading, though specific user experience details remain limited in available documentation.

User interface design, registration processes, verification procedures, and fund management experiences are not fully detailed in source materials, limiting assessment of overall platform usability. The complexity of electricity markets typically requires sophisticated yet accessible interface design that accommodates both expert traders and learning participants.

The diversity of user types, from energy market specialists to retail traders exploring commodity opportunities, suggests platforms must balance advanced functionality with user-friendly design. However, without specific user feedback about interface quality, process efficiency, or common user challenges, this evaluation cannot provide detailed user experience assessment.

Available feedback suggests room for improvement in service delivery and platform functionality, though specific enhancement areas and user satisfaction drivers require additional investigation beyond available source materials.

Conclusion

This power trading review provides a neutral assessment based on available information, though significant data limitations prevent comprehensive evaluation across all critical criteria. The power trading sector demonstrates particular strength in offering flexible electricity trading options encompassing both short-term market opportunities and longer-term strategic positions.

The platform appears suitable for both experienced energy market professionals and newcomers to commodity trading, though the complexity of electricity markets suggests users benefit from prior market knowledge or commitment to learning specialized trading concepts. Primary advantages include trading flexibility across different time horizons and access to growing electricity market opportunities.

However, substantial information gaps about regulatory oversight, detailed trading conditions, customer service quality, and comprehensive platform features limit the completeness of this evaluation and may concern potential users requiring full transparency before platform selection.