Regarding the legitimacy of Power Trading forex brokers, it provides ASIC and WikiBit, (also has a graphic survey regarding security).

Is Power Trading safe?

Pros

Cons

Is Power Trading markets regulated?

The regulatory license is the strongest proof.

ASIC Forex Execution License (STP)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

RegulatedLicense Type:

Forex Execution License (STP)

Licensed Entity:

POWER TRADING CAPITAL LTD

Effective Date: Change Record

2012-12-20Email Address of Licensed Institution:

info@powertradingcapital.comSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

POWER TRADING CAPITAL LTD L 5 115 PITT ST SYDNEY NSW 2000Phone Number of Licensed Institution:

0416666933Licensed Institution Certified Documents:

Is Power Trading A Scam?

Introduction

Power Trading is a forex broker that has garnered attention in the trading community for its various offerings in the foreign exchange market. As traders navigate an increasingly complex and competitive landscape, the need for due diligence when selecting a broker has never been more critical. With numerous reports of scams and fraudulent activities in the financial sector, traders must carefully assess the credibility and reliability of brokers before entrusting them with their funds. This article aims to provide a comprehensive evaluation of Power Trading, utilizing various sources and methodologies to assess its safety and legitimacy.

The investigation focuses on several key areas: regulatory status, company background, trading conditions, customer fund security, customer experiences, platform performance, and overall risk assessment. By examining these facets, we aim to present a balanced view of whether Power Trading is a safe option for traders or if it exhibits characteristics of a potential scam.

Regulation and Legitimacy

Regulation is a fundamental aspect of any financial broker's credibility. It serves as a safeguard for traders, ensuring that the broker adheres to specific standards and practices designed to protect clients. Power Trading claims to be regulated by the Australian Securities and Investments Commission (ASIC), which is known for its stringent oversight of financial entities. However, the broker's regulatory status has been a point of contention, with conflicting information available.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 001307402 | Australia | Verified |

The above table summarizes the key regulatory information for Power Trading. While it appears that Power Trading holds a license from ASIC, it is essential to note that the broker operates under the designation of an "appointed representative" (AR). This means that while it may be associated with a regulated entity, the level of oversight may not be as robust as that of fully licensed brokers. Furthermore, some reports indicate that Power Trading may also be linked to unregulated operations, leading to questions about its overall legitimacy.

The quality of regulation is critical; brokers operating without stringent oversight are often more susceptible to engaging in unethical practices. Historical compliance records can provide insights into the broker's operational integrity. Unfortunately, Power Trading's lack of transparency regarding its regulatory affiliations and compliance history raises red flags for potential investors.

Company Background Investigation

Power Trading was established with the intent to provide trading services across various financial instruments, including forex, commodities, and CFDs. However, details regarding the companys history and ownership structure remain sparse. The absence of comprehensive information on its management team and their professional backgrounds further complicates the evaluation of its legitimacy.

Transparency is a hallmark of reputable brokers, and Power Trading's limited disclosure of its operational framework raises concerns. The management teams background is crucial in assessing the broker's credibility, as experienced professionals often correlate with a higher level of service and reliability. Unfortunately, the lack of publicly available information on the team behind Power Trading detracts from its perceived legitimacy.

Moreover, the company's website presents a generic narrative about its mission and offerings but lacks specific details that would typically bolster investor confidence. The absence of a physical office address and contact information also contributes to the perception of opacity, making it challenging for potential clients to verify the broker's authenticity.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions they offer is vital. Power Trading claims to provide competitive trading fees and a user-friendly platform. However, the specifics of its fee structure warrant a closer examination.

| Fee Type | Power Trading | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 - 2.0 pips |

| Commission Structure | None | Varies |

| Overnight Interest Range | Varies | Varies |

The table above highlights the core trading costs associated with Power Trading. It is essential to note that while the broker offers variable spreads, some sources indicate that these spreads can be significantly higher than industry averages, particularly during volatile market conditions. Traders should be cautious of any hidden fees or unusual commission structures that could impact their overall profitability.

Additionally, the lack of clarity regarding overnight interest rates and potential fees for withdrawals or inactivity can pose further risks for traders. A transparent fee structure is crucial for traders to make informed decisions, and any ambiguity in this area may suggest a lack of integrity on the broker's part.

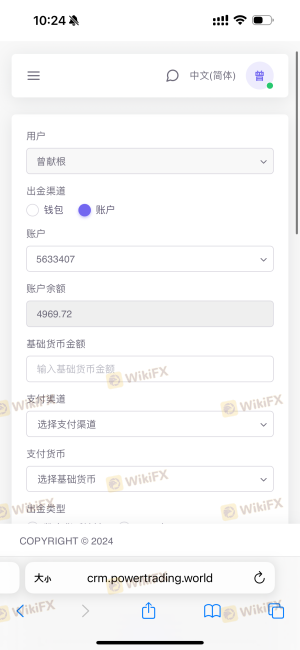

Customer Fund Security

The security of customer funds is paramount in the forex trading environment. Power Trading claims to implement various measures to protect client investments, including segregated accounts and investor protection policies. However, the effectiveness of these measures is contingent upon the broker's regulatory framework.

Traders should be aware of the following aspects when considering fund security with Power Trading:

- Segregated Accounts: This practice ensures that client funds are kept separate from the broker's operational funds, providing an additional layer of security.

- Investor Protection: Depending on the regulatory framework, traders may be entitled to compensation in the event of broker insolvency. However, the specifics of Power Trading's investor protection policies remain unclear.

- Negative Balance Protection: This policy prevents traders from losing more than their initial investment, a critical feature in volatile markets.

While Power Trading asserts that it employs these safety measures, the lack of detailed information and independent verification raises concerns. Historical issues related to fund security or disputes with clients could further exacerbate these worries.

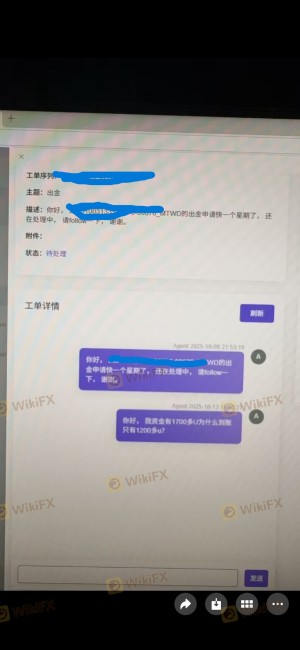

Customer Experience and Complaints

Customer feedback is a valuable resource for assessing the reliability of a broker. Reviews and testimonials can provide insights into the actual experiences of traders using Power Trading. However, the feedback surrounding this broker has been mixed, with numerous complaints surfacing.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| High Pressure Sales Tactics | Medium | Moderate |

| Account Blocking | High | Poor |

The table above summarizes the primary complaints associated with Power Trading. Many users have reported significant delays in processing withdrawals, which is a critical issue that can severely impact a trader's experience. Additionally, reports of aggressive sales tactics and account blocking have raised concerns about the broker's operational practices.

Typical case studies reveal instances where clients were unable to access their funds or faced unresponsive customer service when issues arose. Such experiences are indicative of a broker that may not prioritize customer satisfaction or ethical practices.

Platform and Execution

The trading platform is a crucial element in the trading experience, affecting order execution quality, speed, and user interface. Power Trading utilizes a platform that is generally regarded as user-friendly; however, the performance and reliability of the platform have been questioned.

Traders have reported instances of slippage during high volatility, which can significantly impact trading outcomes. Furthermore, concerns regarding order rejection rates and potential platform manipulation have emerged, adding another layer of risk for traders.

The overall user experience on the platform is essential for traders to execute their strategies effectively. A platform that is prone to technical issues or lacks the necessary features can hinder a trader's ability to capitalize on market opportunities.

Risk Assessment

Using Power Trading presents several risks that traders should be aware of. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Uncertain regulatory status raises concerns. |

| Fund Security Risk | High | Lack of transparency regarding fund protection. |

| Customer Service Risk | Medium | Reports of poor responsiveness and unresolved issues. |

| Platform Reliability Risk | Medium | Potential issues with execution quality and slippage. |

The table above provides a snapshot of the risks associated with Power Trading. Traders are advised to conduct thorough due diligence and consider these risks when deciding whether to engage with this broker. Implementing risk mitigation strategies, such as limiting exposure and using stop-loss orders, can help manage potential downsides.

Conclusion and Recommendations

Based on the comprehensive evaluation of Power Trading, several concerning factors emerge. The broker's ambiguous regulatory status, coupled with numerous complaints related to fund security and customer service, raises significant red flags. While it may present itself as a legitimate trading option, the evidence suggests that potential traders should approach with caution.

For those considering trading with Power Trading, it is advisable to weigh the risks carefully and consider alternative brokers with a proven track record of reliability and transparency. Reputable brokers with strong regulatory oversight and positive customer feedback can provide a more secure trading environment.

In summary, while Power Trading may offer various trading opportunities, the potential risks and indications of unethical practices warrant a careful and cautious approach. Traders should prioritize their financial safety and consider established alternatives in the forex market.

Is Power Trading a scam, or is it legit?

The latest exposure and evaluation content of Power Trading brokers.

Power Trading Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Power Trading latest industry rating score is 3.18, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 3.18 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.