Regarding the legitimacy of GLOBAL PRIME forex brokers, it provides ASIC and WikiBit, (also has a graphic survey regarding security).

Is GLOBAL PRIME safe?

Pros

Cons

Is GLOBAL PRIME markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

FMGP TRADING GROUP PTY LTD

Effective Date: Change Record

2011-01-05Email Address of Licensed Institution:

jonathan.wine@gleneagle.com.au, david.jiang@globalprime.comSharing Status:

Website of Licensed Institution:

https://www.globalprime.com/Expiration Time:

--Address of Licensed Institution:

L 27 25 BLIGH ST SYDNEY NSW 2000Phone Number of Licensed Institution:

0282776672Licensed Institution Certified Documents:

Is Global Prime A Scam?

Introduction

Global Prime is an Australian-based Forex and CFD broker that has been operational since 2010. Positioned as a prime-of-prime broker, it aims to provide traders with low-latency access to liquidity from tier-1 banks and non-bank liquidity providers. Given the vast number of brokers in the market, it is crucial for traders to carefully evaluate their options to avoid potential scams or unreliable platforms. This article investigates Global Prime's legitimacy by examining its regulatory status, company history, trading conditions, fund safety measures, and customer experiences. The analysis is based on a comprehensive review of multiple sources, including user feedback, regulatory data, and expert evaluations.

Regulation and Legitimacy

The regulatory framework is a fundamental aspect of any broker's credibility. Global Prime is regulated by the Australian Securities and Investments Commission (ASIC) and holds licenses from the Vanuatu Financial Services Commission (VFSC) and the Seychelles Financial Services Authority (FSA). The presence of a tier-1 regulator like ASIC is crucial, as it enforces strict guidelines to protect traders and ensure market integrity.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 385620 | Australia | Verified |

| VFSC | 40256 | Vanuatu | Verified |

| FSA | SD 057 | Seychelles | Verified |

ASIC's oversight means that Global Prime is required to keep client funds in segregated accounts and adhere to strict client money reporting rules. However, the offshore licenses from VFSC and FSA may not provide the same level of protection, as regulations in these jurisdictions are generally less stringent. While Global Prime has not faced any major regulatory issues, the presence of offshore licenses may raise concerns about the quality of service and protection offered to clients in those regions.

Company Background Investigation

Global Prime was founded in 2010 and has since established itself as a reputable broker in the Forex market. The company operates under the ownership of FMGP Trading Group Pty Ltd, with a management team that boasts extensive experience in the financial services industry. The founders, Jeremy Kinstlinger and Elan Bension, have a background in trading and technology, which has contributed to the broker's transparency and commitment to client service.

The company emphasizes transparency, providing clients with trade receipts that show the liquidity provider for each trade executed. This practice is relatively rare in the industry and helps to build trust among traders. Furthermore, Global Prime maintains a high level of information disclosure on its website, detailing trading conditions, fees, and available instruments. This level of transparency is essential for traders who seek to understand the risks and costs associated with their trading activities.

Trading Conditions Analysis

Global Prime offers competitive trading conditions, including tight spreads and a clear fee structure. The broker primarily operates on an ECN model, which allows for direct access to market liquidity. The overall cost structure is designed to be trader-friendly, with minimal fees for deposits and withdrawals.

| Fee Type | Global Prime | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.0 - 0.4 pips | 1.0 - 1.2 pips |

| Commission Model | $7 per lot (ECN) | $7 - $10 per lot |

| Overnight Interest Range | Varies by instrument | Varies by broker |

The spreads for major currency pairs can start as low as 0.0 pips, which is competitive compared to industry standards. However, a commission of $7 per lot is charged on these trades, which may be considered high for some traders. Additionally, while there are no deposit or withdrawal fees, traders should be aware of potential fees from their payment providers, especially for international transfers. Overall, Global Prime's trading conditions are favorable for active traders, particularly those employing strategies that benefit from low spreads and high execution speeds.

Client Fund Safety

The safety of client funds is a primary concern for any trader. Global Prime takes several measures to protect client funds, including keeping them in segregated accounts with reputable banks like HSBC and the National Australia Bank (NAB). This practice ensures that client funds are not used for operational purposes and provides an added layer of security.

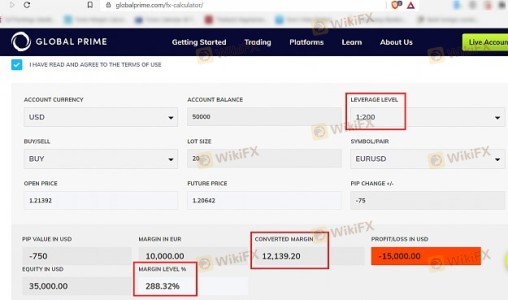

Additionally, Global Prime offers negative balance protection, which prevents clients from losing more than their account balance. This is a critical feature, especially for traders using leverage, as it mitigates the risk of significant losses. While there have been no reported incidents of fund mismanagement or security breaches, the presence of offshore entities may introduce additional risks that traders should consider.

Customer Experience and Complaints

Customer feedback is a vital indicator of a broker's reliability. Global Prime has received generally positive reviews, particularly for its customer service and transparency. However, some common complaints have been noted, primarily related to withdrawal processes and communication.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | Moderate | Timely, but needs improvement |

| Lack of Educational Resources | Low | Addressed through community forums |

One notable case involved a trader who experienced delays in withdrawing funds, which led to frustration. The broker responded promptly, but the situation highlighted a need for improved communication during withdrawal processes. Overall, while the majority of feedback is positive, prospective traders should be aware of these common issues and consider them when evaluating Global Prime.

Platform and Execution

Global Prime offers several trading platforms, including the popular MetaTrader 4 (MT4) and the more advanced Traderevolution platform. The performance of these platforms is generally well-regarded, with users reporting fast execution speeds and minimal slippage. However, there have been occasional reports of order rejections during high volatility, which can be a concern for traders who rely on precise execution.

The overall user experience is enhanced by the broker's commitment to transparency, as clients can view trade receipts that detail the execution of their orders. This level of transparency is a significant advantage for traders who want to ensure that their broker is not trading against them.

Risk Assessment

Using Global Prime comes with a set of risks that traders should be aware of. While the broker is regulated by ASIC, the presence of offshore entities may introduce additional risks.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Offshore regulations may not provide the same level of protection. |

| Execution Risk | Medium | Occasional order rejections during high volatility. |

| Fund Safety | Low | Segregated accounts and negative balance protection. |

To mitigate these risks, traders are advised to conduct thorough research, utilize demo accounts to familiarize themselves with the platform, and maintain a diversified trading strategy that does not expose them to excessive risk.

Conclusion and Recommendations

In conclusion, Global Prime is a reputable broker with a solid regulatory framework and a commitment to transparency. While there are no significant signs of a scam, traders should remain cautious, especially regarding the offshore entities associated with the broker. The trading conditions are competitive, and the platform offers a range of features that cater to both novice and experienced traders.

For those considering Global Prime, it is advisable to start with a demo account to assess the platform's suitability for their trading style. Additionally, traders who prioritize regulatory safety may want to explore alternatives that operate solely under tier-1 jurisdictions. Overall, Global Prime is a legitimate option for traders looking for a reliable broker, but due diligence is always recommended.

Is GLOBAL PRIME a scam, or is it legit?

The latest exposure and evaluation content of GLOBAL PRIME brokers.

GLOBAL PRIME Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GLOBAL PRIME latest industry rating score is 6.92, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.92 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.