Make Capital 2025 Review: Everything You Need to Know

Executive Summary

This make capital review gives you a complete look at capital evaluation and assessment services offered through different platforms. Make Capital focuses on capital review processes, venture capital help, and business capital assessment instead of regular forex trading services. The platform puts emphasis on capital strategy evaluation and connects businesses with venture capital resources.

The main features include capital strength and weakness assessment tools, venture capital brokerage services, and complete capital review processes for business planning. However, detailed trading conditions, regulatory information, and user testimonials stay limited in publicly available sources. This make capital review finds that the platform works best for startups seeking venture capital investment and businesses requiring capital evaluation services rather than individual forex traders.

The overall assessment stays neutral due to not enough detailed information about trading conditions, regulatory compliance, and user experiences. Potential users should conduct thorough due diligence before engaging with the platform's services.

Important Disclaimer

This evaluation is based on currently available public information and should not be considered as investment advice. Different regional entities may operate under varying regulatory frameworks, and users should verify local compliance requirements before engaging with any capital services platform.

The review method used here involves analyzing publicly available information, platform documentation, and industry reports. Due to limited specific data about Make Capital's operations, this assessment reflects general observations rather than detailed performance metrics. Users are strongly advised to conduct independent research and seek professional financial advice before making any investment decisions.

Rating Framework

Based on available information, here are the ratings across six key dimensions:

Overall Rating: 3.2/10

Broker Overview

Make Capital operates within the venture capital and business capital assessment sector. The platform focuses on providing capital evaluation services rather than traditional forex brokerage services. According to available information, the platform works through FasterCapital and related entities to help with capital review processes for businesses and startups.

The company appears to specialize in connecting entrepreneurs with venture capital resources and providing complete capital strength and weakness assessments. The business model centers around capital markets brokerage, particularly for commercial real estate assets and venture capital help. As noted in industry sources, "by working with a venture capital broker, startups can gain access to the resources and support they need to take their businesses to the next level."

This make capital review indicates that the platform serves as an intermediary between capital seekers and capital providers rather than offering direct trading services. The platform's approach involves conducting thorough capital strategy reviews and due diligence processes. For capital markets operations, brokers associated with the platform "need to be extremely versed in the due diligence process, capable of successfully closing or initiating deals while maintaining the interests of their clients."

However, specific information about trading platforms, asset classes, and regulatory oversight remains unclear in available documentation.

Regulatory Regions: Specific regulatory information is not detailed in available materials, which raises concerns about oversight and compliance frameworks.

Deposit and Withdrawal Methods: The available sources do not specify particular deposit or withdrawal methods for the platform's services.

Minimum Deposit Requirements: Minimum deposit requirements are not mentioned in the current available information.

Bonuses and Promotions: No specific bonus or promotional structures are detailed in the accessible materials.

Tradeable Assets: The platform appears to focus on capital markets instruments including stocks, bonds, commodities, and currencies, though specific trading offerings are not clearly defined.

Cost Structure: Detailed information about spreads, commissions, or fee structures is not available in current sources, making cost assessment difficult for potential users.

Leverage Ratios: Leverage information is not specified in available documentation.

Platform Options: Specific trading platform options are not detailed in accessible materials.

Regional Restrictions: Geographic limitations are not clearly outlined in available sources.

Customer Service Languages: Supported languages for customer service are not specified in current materials.

This make capital review highlights the significant information gaps that potential users should be aware of when considering the platform's services.

Detailed Rating Analysis

Account Conditions Analysis (4/10)

The account conditions for Make Capital remain largely undefined in publicly available information. This contributes to the below-average rating in this category. Unlike traditional forex brokers that clearly outline account types, minimum deposits, and account features, this platform appears to operate differently within the capital markets space.

Available sources suggest that the platform focuses on capital review processes rather than standard trading accounts. The lack of specific account type information makes it difficult for potential users to understand what services they can access and under what conditions. Traditional account features such as Islamic accounts, demo accounts, or various tier structures are not mentioned in accessible documentation.

The account opening process is not clearly detailed, which creates uncertainty for prospective users. Industry standards typically require clear documentation of account setup procedures, verification requirements, and initial funding processes. This make capital review finds that the absence of such information significantly impacts the user's ability to make informed decisions about engaging with the platform.

Without clear account condition specifications, users cannot adequately assess whether the platform meets their specific capital market needs or investment requirements.

The tools and resources available through Make Capital receive a poor rating due to limited publicly available information about specific offerings. While the platform appears to provide capital evaluation and assessment tools, detailed descriptions of these resources are not readily accessible. According to available information, the platform offers capital strength and weakness assessment capabilities, which could be valuable for businesses seeking capital evaluation.

However, the specific methods, analytical tools, and resource quality remain unclear from current documentation. Educational resources, which are crucial for users navigating capital markets, are not detailed in available materials. Traditional capital market platforms typically provide complete research tools, market analysis, and educational content to support user decision-making.

The absence of clear information about such resources significantly limits the platform's appeal. Automated trading support and advanced analytical tools, which are increasingly important in capital markets operations, are not mentioned in accessible sources. This lack of technological sophistication may limit the platform's competitiveness in the modern capital markets landscape.

Customer Service and Support Analysis (4/10)

Customer service information for Make Capital is notably absent from available documentation. This results in a below-average rating for this crucial aspect. Effective customer support is essential for capital markets operations, where users often require immediate assistance with complex financial matters.

The available sources do not specify customer service channels, availability hours, or response time commitments. This information gap creates uncertainty about the level of support users can expect when engaging with the platform's services. Multilingual support capabilities, which are important for international capital markets operations, are not detailed in current materials.

Given the global nature of capital markets, the absence of clear language support information may limit the platform's accessibility to diverse user bases. Quality assurance measures for customer service, such as service level agreements or satisfaction guarantees, are not mentioned in available documentation. This lack of transparency about service standards makes it difficult for potential users to assess the reliability of support services.

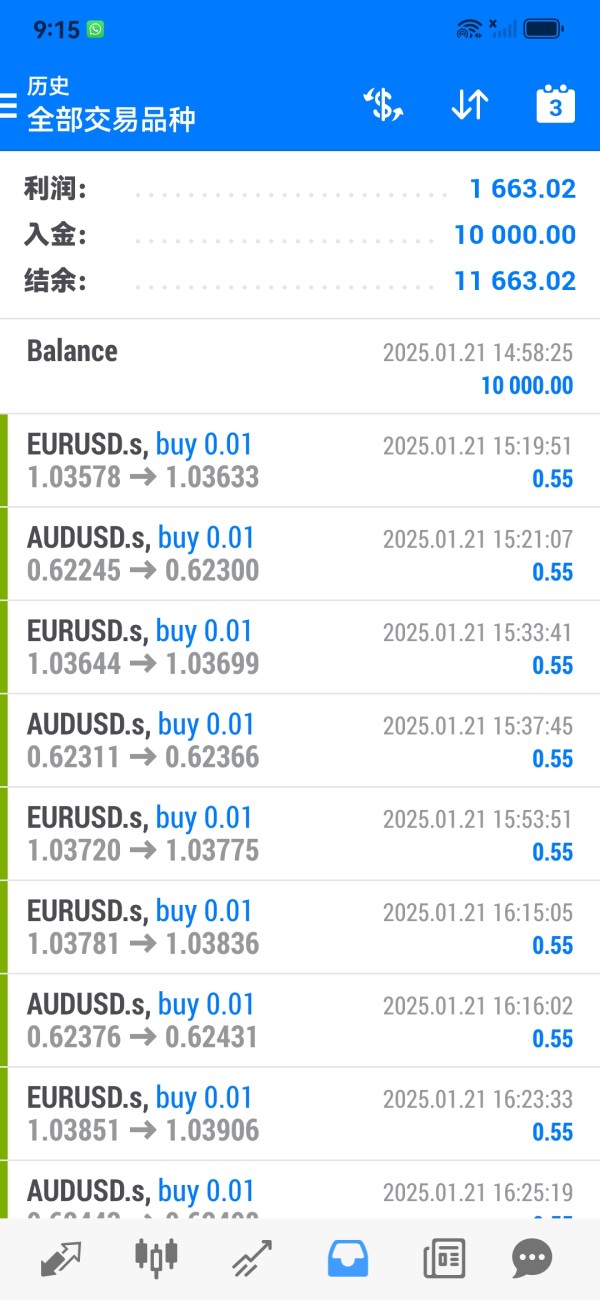

Trading Experience Analysis (3/10)

The trading experience assessment for Make Capital receives a poor rating primarily due to insufficient information about platform performance and user experience. Unlike traditional forex brokers that provide detailed platform specifications, this platform's technical capabilities remain unclear. Platform stability and execution speed, which are critical factors in capital markets operations, are not addressed in available documentation.

Users require reliable platforms that can handle market volatility and execute transactions efficiently, but such performance metrics are not available for evaluation. Order execution quality and trading environment details are absent from accessible sources. According to industry information, capital markets brokers should be "extremely versed in the due diligence process," but specific execution capabilities of this platform are not documented.

Mobile trading capabilities, which are increasingly important for modern traders, are not mentioned in available materials. This make capital review finds that the absence of clear platform functionality information significantly impacts the overall trading experience assessment. The lack of user feedback about actual trading experiences further compounds the difficulty in evaluating this dimension effectively.

Trust Factor Analysis (2/10)

The trust factor for Make Capital receives the lowest rating due to significant gaps in regulatory and transparency information. Trust is fundamental in capital markets operations, where users entrust platforms with significant financial resources and sensitive information. Regulatory compliance information is notably absent from available documentation.

Traditional capital markets platforms typically provide clear regulatory registration details, licensing information, and oversight body affiliations. The absence of such information raises serious concerns about the platform's legitimacy and regulatory standing. Fund security measures, which are critical for user protection, are not detailed in accessible sources.

Users need assurance about segregated accounts, insurance coverage, and other protective measures, but such information is not available for evaluation. Company transparency regarding ownership, management, and operational history is lacking in current documentation. This opacity makes it difficult for users to assess the platform's credibility and long-term viability.

The absence of verifiable third-party endorsements or industry recognition further impacts the trust assessment for this platform.

User Experience Analysis (3/10)

User experience evaluation for Make Capital is hampered by the lack of available user feedback and interface information. The platform's usability and overall user satisfaction cannot be adequately assessed without direct user testimonials or detailed interface descriptions. Registration and verification processes are not clearly outlined in available documentation, making it difficult for potential users to understand the onboarding experience.

Streamlined registration processes are important for user adoption, but specific procedures are not detailed. Fund operation experiences, including deposit and withdrawal processes, are not described in accessible materials. These operational aspects significantly impact overall user satisfaction but cannot be evaluated based on current information.

Interface design and navigation ease are not addressed in available sources, preventing assessment of the platform's user-friendliness. Modern users expect intuitive interfaces and efficient navigation, but such features cannot be evaluated without specific information. Common user complaints or satisfaction indicators are absent from available documentation, making it impossible to gauge actual user experiences with the platform's services.

Conclusion

This make capital review concludes with a neutral to negative overall assessment due to significant information gaps across all evaluation dimensions. While the platform appears to operate in the capital markets space with a focus on venture capital and business capital assessment, the lack of detailed information about operations, regulatory compliance, and user experiences creates substantial uncertainty.

The platform may be suitable for businesses seeking capital evaluation services or startups looking for venture capital connections, but potential users should exercise extreme caution due to limited transparency. The absence of clear regulatory information, trading conditions, and user feedback makes it difficult to recommend the platform for serious capital markets activities. Primary weaknesses include the lack of regulatory transparency, insufficient operational details, and absence of user testimonials.

Until more comprehensive information becomes available, potential users are advised to seek alternative platforms with clearer operational frameworks and stronger regulatory compliance records.