Regarding the legitimacy of Blueberry Markets forex brokers, it provides ASIC, ASIC and WikiBit, .

Is Blueberry Markets safe?

Pros

Cons

Is Blueberry Markets markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

BLUEBERRY AUSTRALIA PTY LTD

Effective Date: Change Record

2024-05-27Email Address of Licensed Institution:

james.oneill@blueberrymarkets.comSharing Status:

No SharingWebsite of Licensed Institution:

www.blueberrymarkets.comExpiration Time:

--Address of Licensed Institution:

L 7 107 MOUNT ST NORTH SYDNEY NSW 2060Phone Number of Licensed Institution:

61280397480Licensed Institution Certified Documents:

ASIC Forex Execution License (STP)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

RegulatedLicense Type:

Forex Execution License (STP)

Blueberry Markets

Licensed Entity:

BLUEBERRY PRIME PARTNERS PTY LTD

Effective Date: Change Record

2010-11-10Email Address of Licensed Institution:

dean.hyde@blueberrymarkets.comSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

DEAN HYDE SE 403 L 4 15 BLUE ST NORTH SYDNEY NSW 2060Phone Number of Licensed Institution:

0280397480Licensed Institution Certified Documents:

Is Blueberry Markets A Scam?

Introduction

Blueberry Markets, established in 2016, is an Australian forex and CFD broker that has gained traction among traders seeking a reliable platform for trading various financial instruments. The broker is known for its competitive pricing and user-friendly trading environment, primarily utilizing the popular MetaTrader 4 and 5 platforms. However, as with any financial service provider, it is crucial for traders to conduct thorough due diligence before engaging with a broker. The forex market is rife with potential risks, including scams, which can lead to significant financial losses. This article aims to provide an objective assessment of Blueberry Markets, focusing on its regulatory status, company background, trading conditions, customer fund safety, user experiences, platform performance, and overall risk assessment. The findings are based on a comprehensive review of various credible sources and user feedback.

Regulation and Legitimacy

Regulatory oversight is a critical factor in determining a broker's legitimacy and trustworthiness. Blueberry Markets is regulated by two key authorities: the Australian Securities and Investments Commission (ASIC) and the Vanuatu Financial Services Commission (VFSC). The presence of a regulatory framework is essential for ensuring that brokers adhere to strict operational standards, safeguarding client funds, and maintaining market integrity.

Here is a summary of Blueberry Markets regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 391441 | Australia | Verified |

| VFSC | 012868 | Vanuatu | Verified |

ASIC is recognized as a top-tier regulator, imposing stringent requirements on brokers operating within its jurisdiction. This includes maintaining segregated accounts for client funds, ensuring transparency in operations, and providing negative balance protection. In contrast, the VFSC is considered a lower-tier regulator, which may not offer the same level of investor protection as ASIC. However, the dual regulation provides an added layer of security for traders.

Historically, Blueberry Markets has maintained a clean regulatory record, with no significant compliance issues reported. This reinforces the broker's commitment to adhering to regulatory standards and protecting client interests.

Company Background Investigation

Blueberry Markets was founded by Dean Hyde, a former executive at AxiTrader, and has since developed a reputation as a reliable broker in the forex trading community. The company is headquartered in North Sydney, Australia, and operates under the Blueberry Markets Group, which is a subsidiary of Eightcap Pty Ltd. This ownership structure indicates a well-established framework with experienced management at the helm.

The management team at Blueberry Markets comprises professionals with extensive backgrounds in the financial services industry, further enhancing the brokers credibility. The company emphasizes transparency in its operations, providing clear information about its services, fees, and trading conditions. This level of transparency is crucial for building trust with clients and ensuring that they are well-informed about the trading environment.

Overall, Blueberry Markets appears to prioritize transparency and client communication, which are essential factors in establishing a trustworthy brokerage.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions they offer is paramount. Blueberry Markets provides two primary account types: the Standard Account and the Direct Account. The Standard Account features spreads starting from 1.0 pips, with no commission charged on trades, while the Direct Account offers raw spreads starting from 0.0 pips, accompanied by a commission of $7 per lot.

Heres a breakdown of the core trading costs associated with Blueberry Markets:

| Cost Type | Blueberry Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.0 pips | 1.2 pips |

| Commission Model | $7 per lot (Direct Account) | $6 per lot (varies) |

| Overnight Interest Range | Varies by position | Varies by broker |

The fee structure at Blueberry Markets is competitive, particularly for forex trading. However, the commission charged on the Direct Account may be higher than some other brokers, which could impact high-frequency traders or those with lower trading volumes.

It is essential to note that while the spreads and commission structure appear reasonable, traders should be aware of the potential for hidden fees or unfavorable trading conditions, especially during periods of high market volatility. Transparency regarding all costs is crucial for traders to make informed decisions.

Customer Fund Safety

The safety of client funds is a significant concern for traders when choosing a broker. Blueberry Markets implements several measures to ensure the security of client funds. Client deposits are kept in segregated accounts with reputable banks, ensuring that funds are not used for the broker's operational expenses. This segregation is a fundamental practice that protects clients in the event of broker insolvency.

Additionally, Blueberry Markets offers negative balance protection for its clients, which ensures that traders cannot lose more than their deposited funds. This is particularly important in the highly leveraged forex market, where rapid market movements can lead to significant losses.

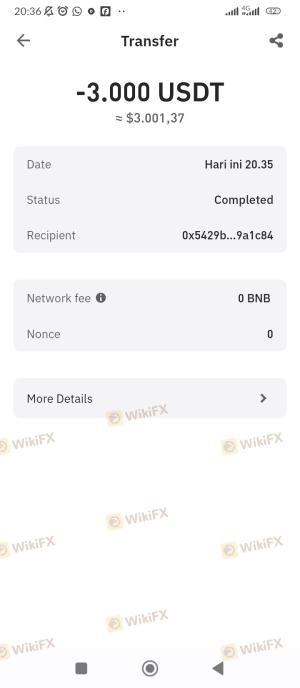

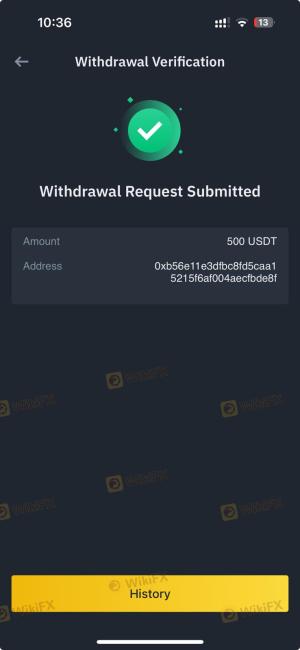

Despite these safety measures, it is essential for traders to remain vigilant. Historical complaints regarding fund withdrawals and execution issues have been noted, which could indicate potential risks. Thus, ongoing scrutiny of the broker's practices and user feedback is advisable.

Customer Experience and Complaints

Customer feedback plays a vital role in assessing a broker's reliability and service quality. Blueberry Markets has generally received positive reviews for its customer support and trading conditions. However, there are notable complaints regarding slow withdrawal processes and issues with trade execution.

Heres a summary of common complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Slow withdrawal processing | Moderate | Timely but inconsistent |

| Trade execution issues | High | Addressed but often unresolved |

| Customer support responsiveness | Low | Generally positive |

For instance, some users have reported delays in receiving their funds after withdrawal requests, with processing times extending beyond the expected timeframe. Others have experienced issues with trade execution, claiming that slippage and price manipulation have occurred during volatile market conditions.

These complaints suggest that while Blueberry Markets offers a generally positive trading environment, there are areas for improvement, particularly in handling withdrawals and ensuring consistent trade execution.

Platform and Trade Execution

The trading platforms offered by Blueberry Markets, namely MetaTrader 4 and 5, are well-regarded in the industry. These platforms provide a robust trading environment with advanced charting tools, technical indicators, and automated trading capabilities. However, the performance of the platform can vary based on market conditions.

Users have reported that the platforms are generally stable, but there have been instances of slippage and execution delays during high volatility. An analysis of order execution quality indicates that while most trades are filled at expected prices, there are occasional discrepancies that could lead to unexpected losses.

The following factors should be considered when evaluating platform performance:

- Execution Speed: Most trades are executed within acceptable timeframes, but high volatility can lead to delays.

- Slippage: Occasional slippage has been reported, particularly during major news events.

- Rejection Rates: Generally low, but some users have experienced rejected orders during peak trading times.

Overall, while the platforms are reliable, traders should be cautious during volatile periods and be prepared for potential execution issues.

Risk Assessment

Engaging with any broker entails inherent risks, and Blueberry Markets is no exception. A comprehensive risk assessment reveals several key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Dual regulation provides some security, but the offshore aspect raises concerns. |

| Fund Safety Risk | Medium | Segregated accounts and negative balance protection are positive, but historical complaints exist. |

| Execution Risk | High | Complaints regarding trade execution and slippage during volatility are notable. |

| Withdrawal Risk | Medium | Delays in processing withdrawals have been reported, indicating potential issues. |

To mitigate these risks, traders should conduct thorough research, maintain awareness of market conditions, and consider diversifying their trading activities across multiple brokers.

Conclusion and Recommendations

In conclusion, Blueberry Markets is a regulated broker that offers a competitive trading environment, but potential traders should exercise caution. While the broker is licensed by ASIC and VFSC, the dual regulatory status does not eliminate all risks associated with trading. The presence of historical complaints regarding withdrawals and execution issues suggests that while Blueberry Markets may not be a scam, there are areas that require scrutiny.

For traders, especially beginners, it is essential to weigh the pros and cons carefully. Those seeking a reliable forex broker with a solid reputation may find Blueberry Markets suitable, but they should also consider alternative options such as Pepperstone or IC Markets, which have established track records and customer satisfaction.

Ultimately, traders should remain vigilant, conduct ongoing research, and ensure that they are comfortable with the broker's policies and practices before committing their funds.

Is Blueberry Markets a scam, or is it legit?

The latest exposure and evaluation content of Blueberry Markets brokers.

Blueberry Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Blueberry Markets latest industry rating score is 7.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 7.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.