Regarding the legitimacy of MAKE CAPITAL forex brokers, it provides FSCA and WikiBit, .

Is MAKE CAPITAL safe?

Pros

Cons

Is MAKE CAPITAL markets regulated?

The regulatory license is the strongest proof.

FSCA Derivatives Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

MAKE CAPITAL MARKET (PTY) LTD

Effective Date: Change Record

2023-10-17Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

36 NEWMARKET ROADGLENHAZELJOHANNESBURG2192Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Make Capital A Scam?

Introduction

Make Capital is a relatively new player in the forex market, having been established in 2022 and headquartered in the Cayman Islands. As a forex brokerage, it offers a variety of trading services, including access to forex, commodities, and contracts for differences (CFDs). In a landscape where numerous brokers claim to provide excellent trading conditions, it is essential for traders to conduct thorough due diligence before investing their hard-earned money. The forex market, with its high volatility and potential for significant losses, necessitates a cautious approach towards selecting a brokerage.

This article aims to evaluate the legitimacy and safety of Make Capital by analyzing its regulatory status, company background, trading conditions, client fund security, customer experiences, platform performance, and associated risks. The information is gathered from various trusted sources, including broker reviews and regulatory databases, ensuring a comprehensive assessment of the broker's credibility.

Regulation and Legitimacy

The regulatory environment in which a brokerage operates is crucial for ensuring the safety of clients' funds and the integrity of trading practices. Make Capital is currently unregulated, which raises significant concerns regarding its legitimacy and operational practices. Unregulated brokers often have fewer obligations to adhere to industry standards, making them riskier for traders.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Cayman Islands | Unregulated |

The absence of regulation means that Make Capital does not have to comply with strict guidelines that protect investors. This lack of oversight can lead to potential issues such as unfair trading practices, withdrawal delays, and inadequate client fund protection. Historically, unregulated brokers have been associated with scams and fraudulent activities, as they operate without accountability. Therefore, the lack of a regulatory framework for Make Capital is a significant red flag for potential investors.

Company Background Investigation

Make Capital was founded in 2022 and is based in the Cayman Islands, a jurisdiction often chosen for its favorable regulatory environment. However, the company has not provided substantial information about its ownership structure or the backgrounds of its management team. This lack of transparency can be concerning for potential clients who want to know who is managing their investments.

The management team's experience is crucial in assessing the broker's reliability. Without clear information available, it is challenging to evaluate whether the individuals behind Make Capital possess the necessary expertise and industry experience to run a reputable brokerage. Furthermore, the company's transparency regarding its operational practices and policies is limited, which may indicate a lack of accountability.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions they offer is essential. Make Capital claims to provide competitive trading conditions, but the specifics of their fee structure are not well-documented. Transparency regarding fees is vital, as hidden charges can significantly impact a trader's profitability.

| Fee Type | Make Capital | Industry Average |

|---|---|---|

| Spread for Major Currency Pairs | Variable | 1.0 - 1.5 pips |

| Commission Structure | Unknown | $0 - $10 per lot |

| Overnight Interest Rates | Not Disclosed | 0.5% - 2% |

The lack of clarity regarding the spread and commission structure can be a cause for concern. If the fees are higher than the industry average, traders may find their profits significantly diminished. Additionally, the absence of information about overnight interest rates raises questions about the broker's practices, as these rates can impact long-term positions.

Client Fund Security

The security of client funds is paramount in the forex trading environment. Make Capital claims to ensure the safety of client funds by holding them in segregated accounts. However, without regulatory oversight, the effectiveness of these measures is questionable.

The absence of investor protection schemes or negative balance protection policies further exacerbates the risk associated with trading with Make Capital. In the event of a financial dispute or insolvency, clients may find themselves without any recourse to recover lost funds. Furthermore, there have been no reported incidents of fund security breaches or disputes, but the lack of a regulatory framework means that there is no independent verification of the broker's claims regarding fund safety.

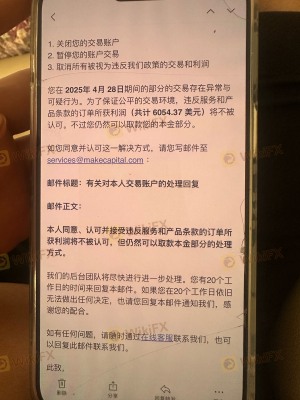

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability and service quality. Reviews and testimonials about Make Capital reveal a mixed bag of experiences. Some clients report satisfactory trading conditions and prompt customer service, while others express concerns over withdrawal delays and unresponsive support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Unresponsive Support | Medium | Inconsistent |

| Account Verification | Low | Generally prompt |

Common complaints include issues with withdrawal processes, which can be a significant concern for traders who need quick access to their funds. The severity of these complaints indicates a need for improvement in customer service and operational efficiency. A few case studies highlight instances where clients experienced significant delays in receiving their funds, leading to frustration and distrust.

Platform and Execution

The trading platform offered by Make Capital is a critical component of the trading experience. The broker utilizes the popular MetaTrader 4 (MT4) platform, which is known for its user-friendly interface and robust functionality. However, user experiences with the platform's stability and execution quality vary.

Traders have reported instances of slippage during high volatility periods, which can negatively impact trading outcomes. Furthermore, any signs of platform manipulation or excessive requotes can raise serious concerns about the broker's integrity. The overall performance of the trading platform is satisfactory, but traders should remain cautious and monitor their execution closely.

Risk Assessment

Using Make Capital comes with inherent risks that traders must consider. The lack of regulation, transparency issues, and mixed customer experiences contribute to a higher risk profile for this broker.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight |

| Fund Security Risk | Medium | Limited protection for client funds |

| Customer Service Risk | Medium | Complaints about withdrawal delays |

To mitigate these risks, potential clients should consider starting with a small investment and carefully monitor their trading activities. Additionally, seeking alternative brokers with robust regulatory oversight and proven track records may be a prudent approach.

Conclusion and Recommendations

In conclusion, the evidence suggests that Make Capital operates in a high-risk environment due to its unregulated status and lack of transparency. While some traders may find success with this broker, the potential for issues related to fund security, customer service, and trading conditions cannot be ignored.

For traders seeking a reliable forex broker, it is advisable to consider alternatives that are regulated by reputable authorities and provide clear information about their fees, trading conditions, and fund protection measures. Brokers such as IG, OANDA, or Forex.com are examples of firms that offer regulated trading environments with strong reputations.

Ultimately, conducting thorough research and exercising caution can help traders navigate the complexities of the forex market while safeguarding their investments.

Is MAKE CAPITAL a scam, or is it legit?

The latest exposure and evaluation content of MAKE CAPITAL brokers.

MAKE CAPITAL Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

MAKE CAPITAL latest industry rating score is 4.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 4.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.