Fortrade 2025 Review: Everything You Need to Know

Executive Summary

This fortrade review looks at one of the well-known players in online trading. Fortrade has made itself a safe and easy-to-use forex and CFD broker that works for both beginners and professional traders since it started in 2013. The broker has two main features that make it different from others: it gives traders lots of educational and research materials to help them make smart decisions, and it covers many assets with trading in over 300 tools across different markets.

The platform mainly focuses on active traders who want complete market analysis and trading signals. It also helps newcomers who can use its educational system. Reports show that Fortrade follows rules across many areas and offers both its own and standard trading platforms. The broker combines easy access with professional tools, which appeals to traders who want both learning resources and many trading chances in forex, stocks, and commodities markets.

Important Disclaimers

Traders should know that Fortrade works under different rule-making groups across various regions, including CySEC, ASIC, and FCA supervision. This approach across many areas means that rule protections, available services, and trading conditions may be very different depending on where you live and which Fortrade group serves your region. Traders should check which rule system applies to their account before starting.

This review uses complete analysis of public information, rule filings, and combined user feedback from many sources. Market conditions, rule requirements, and broker offerings can change quickly, so readers should check current terms and conditions directly with Fortrade before making any trading decisions.

Rating Framework

Broker Overview

Fortrade started in the online trading industry in 2013. The company is based in the UK and focuses on being a forex and CFD broker that provides easy but advanced trading solutions. The company has built its name by giving a smooth trading experience that balances simplicity for newcomers with the depth that experienced traders need. As a specialized online broker, Fortrade focuses only on foreign exchange and contracts for difference (CFD) trading services, letting the company put its resources and skills in these specific markets rather than spreading across many financial service areas.

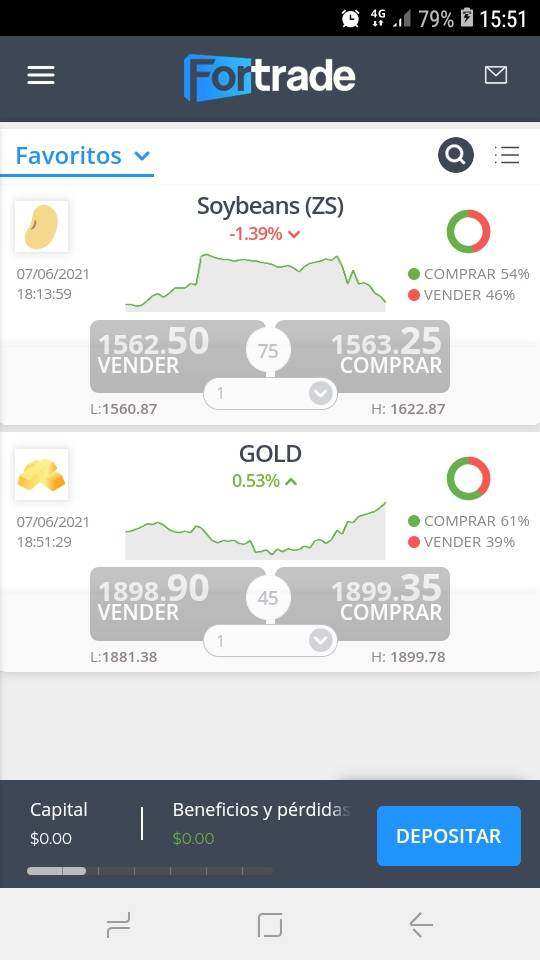

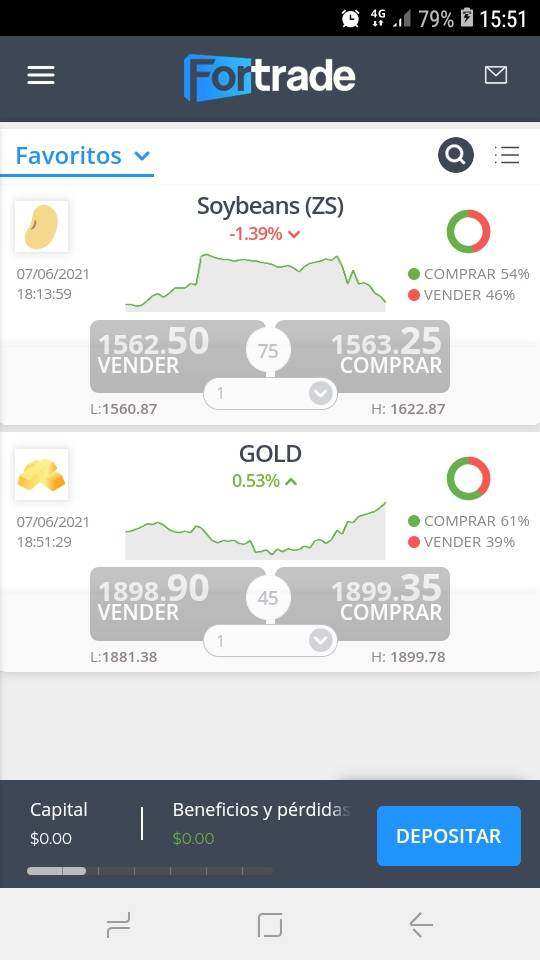

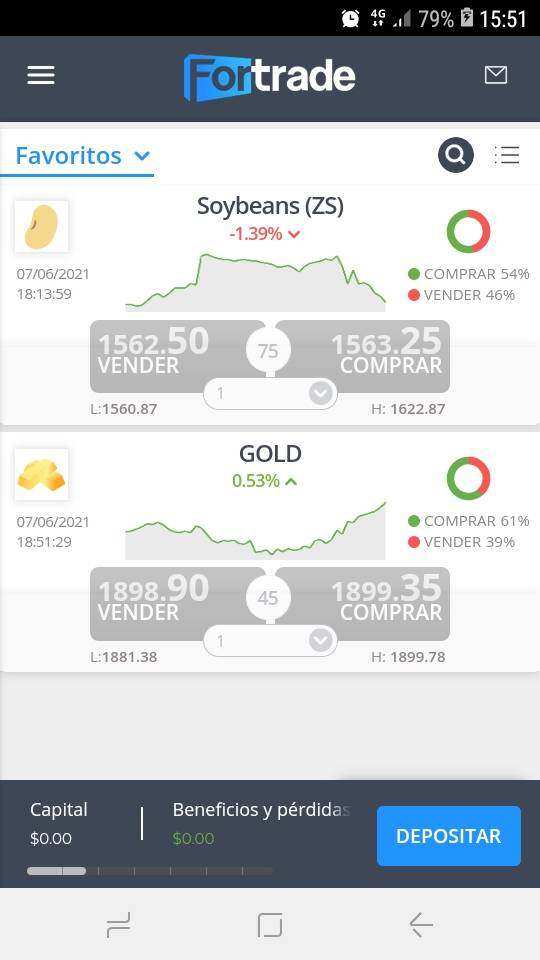

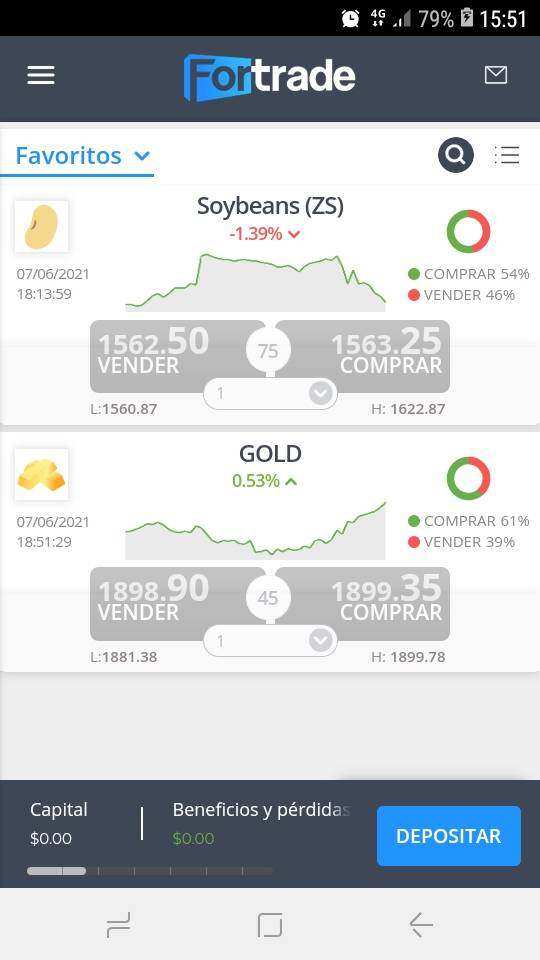

The broker works through two main trading platforms to fit different trader preferences and experience levels. Users can pick between Fortrade's own Fortrader platform, made specifically for the company's trading environment, and the well-known MetaTrader 4 (MT4) platform, which offers familiar features for traders experienced with industry-standard tools. This fortrade review finds that the company's asset coverage includes over 300 tradeable tools, covering major forex pairs, individual stocks from global markets, and various commodity markets. The broker follows rules through multiple oversight groups including CySEC, ASIC, and FCA, giving traders rule protections across different areas.

Regulatory Coverage: Fortrade works under supervision from three major rule authorities - CySEC (Cyprus), ASIC (Australia), and FCA (United Kingdom) - giving traders substantial rule protection and oversight across multiple areas.

Deposit and Withdrawal Methods: Specific information about available payment methods and processing times is not detailed in the available source materials.

Minimum Deposit Requirements: The exact minimum deposit amounts for different account types are not specified in the accessible documentation.

Promotional Offers: Current bonus structures and promotional campaigns are not outlined in the available source materials.

Tradeable Assets: The platform gives access to over 300 trading tools covering foreign exchange pairs, individual equity securities, and commodity markets, offering traders diverse market exposure opportunities.

Cost Structure: Detailed information about spread ranges, commission structures, and additional fees is not provided in the available source materials for this fortrade review.

Leverage Options: Specific leverage ratios available to traders are not detailed in the accessible documentation.

Platform Choices: Traders can select between the company's own Fortrader platform and the established MetaTrader 4 system for their trading activities.

Geographic Restrictions: Information about restricted territories and regional limitations is not specified in the available sources.

Customer Support Languages: Details about multilingual support options are not provided in the accessible materials.

Detailed Rating Analysis

Account Conditions Analysis

The specific details about Fortrade's account structure and conditions remain unclear based on available source materials. While the broker clearly works in the retail trading space, complete information about different account levels, their respective features, and qualification requirements is not easily accessible. This lack of clear information about account types makes it hard for potential traders to understand what options might be available to them based on their trading capital and experience level.

The absence of clear minimum deposit information in public sources represents a significant information gap for this fortrade review. Most traders consider minimum deposit requirements a crucial factor in broker selection, as these amounts often determine account type eligibility and available features. Without this basic information, prospective clients cannot properly assess whether Fortrade aligns with their financial capacity and trading goals.

Account opening procedures and verification requirements are similarly not detailed in accessible documentation. Modern traders expect smooth onboarding processes, and the availability of specialized account features such as Islamic accounts for Muslim traders has become increasingly important in the global marketplace. The lack of specific information about these aspects limits the ability to provide a complete evaluation of Fortrade's account conditions.

Fortrade shows considerable strength in its trading tool diversity and educational resource provision. According to available reports, the broker offers access to CFDs, foreign exchange, individual stocks, and commodity markets, creating a complete trading environment that allows for portfolio diversification across multiple asset classes. This breadth of available tools positions Fortrade competitively against other brokers in the retail trading space.

The educational and research resources appear to be a particular focus area for Fortrade, with reports indicating substantial investment in helping traders make informed decisions. The provision of market analysis and trading signals specifically targets active traders who rely on technical and fundamental analysis for their trading strategies. This focus on educational content suggests that Fortrade recognizes the importance of trader development and long-term client success rather than simply facilitating transactions.

However, specific details about the quality and depth of these educational materials are not provided in available sources. Modern traders expect complete learning resources including video tutorials, webinars, market commentary, and analytical tools. While the presence of educational resources is confirmed, the actual scope and effectiveness of these tools cannot be fully assessed without more detailed information about their content and delivery methods.

Customer Service and Support Analysis

Customer service quality and availability represent critical factors in broker selection, yet specific information about Fortrade's support infrastructure is not detailed in available source materials. Modern traders expect multiple communication channels including live chat, email support, and telephone assistance, with response times that accommodate active trading schedules. The absence of clear information about available support channels creates uncertainty for potential clients who prioritize responsive customer service.

Response time expectations have evolved significantly in the online trading industry, with many traders expecting near-instant support for urgent trading-related issues. Without specific data about Fortrade's customer service response times and availability hours, it becomes difficult to assess whether the broker meets contemporary service standards. This information gap is particularly significant for traders in different time zones who may require support outside traditional business hours.

The quality of customer service often distinguishes premium brokers from basic service providers, yet available sources do not provide insights into user experiences with Fortrade's support team. Effective problem resolution, knowledgeable staff, and proactive communication are hallmarks of quality customer service in the trading industry. Without access to user feedback or service quality metrics, this aspect of Fortrade's offering remains largely unknown.

Trading Experience Analysis

The trading experience encompasses platform performance, execution quality, and overall system reliability - factors that directly impact trader success and satisfaction. While Fortrade offers both MT4 and its own Fortrader platform, specific information about platform stability, execution speeds, and system uptime is not provided in available source materials. These technical performance metrics are crucial for active traders who depend on consistent platform availability and rapid order processing.

Order execution quality represents another critical component of the trading experience that lacks detailed coverage in accessible sources. Modern traders expect transparent execution policies, minimal slippage, and fair pricing without hidden markups. The absence of specific information about Fortrade's execution model, whether market maker or ECN-style, limits the ability to assess how the broker handles client orders and potential conflicts of interest.

Mobile trading capabilities have become essential in today's trading environment, yet specific details about Fortrade's mobile platform features and performance are not available in the source materials. This fortrade review cannot adequately assess the mobile trading experience, which is increasingly important for traders who need to monitor and manage positions while away from their primary trading setups. The lack of detailed information about mobile functionality represents a significant evaluation limitation.

Trustworthiness Analysis

Fortrade's regulatory framework provides a solid foundation for trustworthiness assessment. The broker's supervision under CySEC, ASIC, and FCA represents compliance with three major regulatory areas known for strict oversight of financial service providers. These regulatory bodies enforce capital requirements, client fund segregation, and operational standards that protect trader interests and ensure broker stability.

However, specific details about Fortrade's capital adequacy, insurance coverage, and client fund protection measures are not detailed in available source materials. Modern traders expect transparency regarding how their funds are protected, including segregated account arrangements and potential compensation schemes. While regulatory oversight provides baseline protections, the absence of specific information about additional safeguards limits the complete assessment of fund security.

Company transparency and public disclosure practices are not well documented in accessible sources. Established brokers typically provide detailed information about their corporate structure, financial backing, and operational policies. The limited availability of such information makes it challenging to assess Fortrade's overall transparency and commitment to open communication with clients and the broader trading community.

User Experience Analysis

User experience evaluation requires detailed information about interface design, navigation efficiency, and overall platform usability - areas where specific data about Fortrade is not readily available in source materials. Modern trading platforms must balance functionality with accessibility, ensuring that both novice and experienced traders can efficiently navigate the system and execute their trading strategies.

The registration and account verification process significantly impacts initial user experience, yet specific details about Fortrade's onboarding procedures are not documented in accessible sources. Smooth registration processes that balance regulatory compliance with user convenience have become industry standards, but without specific information about Fortrade's approach, this aspect cannot be adequately evaluated.

Overall user satisfaction metrics and feedback compilation are not available in the source materials reviewed. User experience optimization depends heavily on ongoing feedback collection and platform improvements based on actual trader needs and preferences. The absence of combined user feedback or satisfaction surveys limits the ability to assess how well Fortrade meets real-world user expectations and requirements.

Conclusion

This fortrade review reveals a broker with solid regulatory foundations and a clear focus on educational resources and diverse trading opportunities. Fortrade appears well-positioned to serve both beginning traders who benefit from educational support and active traders seeking complete market analysis and trading signals. The broker's regulatory compliance across multiple areas through CySEC, ASIC, and FCA oversight provides substantial credibility and trader protection.

The primary strengths identified include the extensive asset coverage of over 300 tools and the emphasis on educational and research resources that support informed trading decisions. However, significant information gaps regarding account conditions, specific cost structures, and detailed user feedback limit the completeness of this evaluation. Prospective traders should conduct additional research to obtain specific information about spreads, commissions, minimum deposits, and platform performance before making final decisions about using Fortrade's services.