CIMB Bank 2025 Review: Everything You Need to Know

Executive Summary

CIMB Bank stands out as the Philippines' first fully digital bank. It offers a comprehensive trading ecosystem through its CGS-CIMB iTrade platform alongside traditional banking services. This cimb bank review reveals a financial institution with strong digital infrastructure and diverse trading capabilities, though certain aspects require careful consideration for potential users.

The bank's key strengths lie in its multi-platform trading approach. It provides access to MetaTrader 4, Viewpoint, and the proprietary iTrade platform. CIMB Bank supports both local and foreign stock trading, positioning itself as a versatile option for investors seeking multi-asset exposure. As part of the broader CIMB Group, which originated in Malaysia in 1974, the institution benefits from established regional expertise and brand recognition.

However, our analysis indicates a neutral overall rating due to limited publicly available information regarding regulatory oversight and user feedback. The target audience primarily consists of investors seeking digitized banking services combined with comprehensive trading capabilities across multiple asset classes.

Important Notice

This evaluation focuses specifically on CIMB Bank Philippines. Information may vary significantly from other CIMB banking entities operating in different jurisdictions. Readers should verify specific regional services, regulatory status, and operational details relevant to their location before making any financial decisions.

Our assessment methodology relies on publicly available information and documented features. Due to limited user feedback and regulatory transparency in available sources, certain aspects of this review may require additional verification through direct contact with the institution.

Rating Framework

Broker Overview

CIMB Bank Philippines represents a significant evolution in the country's financial sector. It establishes itself as the nation's first completely digital banking platform. Founded as part of the CIMB Group, which traces its origins to 1974 in Malaysia, the institution brings decades of regional financial expertise to the Philippine market. The bank's business model centers on providing comprehensive digital banking services while maintaining a strong focus on investment and trading capabilities for both individual and institutional clients.

The platform's approach to trading services demonstrates a commitment to accessibility and variety. Through its CGS-CIMB iTrade platform, users can access both domestic and international stock markets, while the integration of established platforms like MetaTrader 4 provides familiar tools for experienced traders. This cimb bank review finds that the institution's positioning as a digital-first bank aligns well with current market trends toward technology-driven financial services.

The bank's asset coverage includes local and foreign stocks. The full scope of available instruments requires direct verification with the institution. CIMB Bank's technological infrastructure appears designed to support modern trading requirements while maintaining the security standards expected of a digital banking platform.

Regulatory Status: Available information does not specify the primary regulatory authorities overseeing CIMB Bank Philippines operations. As a banking institution, it likely operates under relevant Philippine banking regulations.

Deposit and Withdrawal Methods: Specific funding options and withdrawal procedures are not detailed in accessible sources. These would require direct inquiry with the bank.

Minimum Deposit Requirements: Account opening minimums and ongoing balance requirements are not specified in available documentation.

Promotions and Bonuses: Current promotional offerings or account incentives are not outlined in the reviewed materials.

Tradeable Assets: The platform supports trading in local and foreign stocks through its various platforms. The complete range of available instruments requires verification.

Cost Structure: Detailed information about spreads, commissions, and fee schedules is not provided in accessible sources. This represents a key area requiring direct clarification from the institution.

Leverage Options: Maximum leverage ratios and margin requirements are not specified in available materials.

Platform Selection: Three primary platforms are available: MetaTrader 4, Viewpoint, and the proprietary iTrade system. Each potentially serves different trading needs and preferences.

Geographic Restrictions: Service availability limitations are not clearly outlined in reviewed sources.

Customer Support Languages: Supported communication languages for customer service are not specified in available information.

This cimb bank review highlights the need for prospective users to conduct direct due diligence regarding specific service terms and conditions.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of CIMB Bank's account conditions faces significant limitations due to insufficient publicly available information. This includes account types, minimum deposit requirements, and specific terms of service. This represents a notable gap in transparency that potential users should address through direct communication with the institution.

Without clear documentation of account tiers, fee structures, or special account features, it becomes challenging to assess the competitiveness of CIMB Bank's offerings. The absence of information regarding premium account benefits or institutional account features further complicates the evaluation process.

Prospective users should specifically inquire about account opening procedures, required documentation, ongoing maintenance fees, and any minimum balance requirements that may apply. The digital-first nature of the bank suggests streamlined account opening processes, but verification of this assumption requires direct contact with CIMB Bank representatives.

This cimb bank review cannot provide a definitive rating for account conditions due to these information limitations. It emphasizes the importance of thorough due diligence before account establishment.

CIMB Bank demonstrates notable strength in its technological infrastructure and platform diversity. The provision of three distinct trading platforms suggests a commitment to serving various trader preferences and experience levels. MetaTrader 4, in particular, brings established functionality and widespread market acceptance to the platform offering.

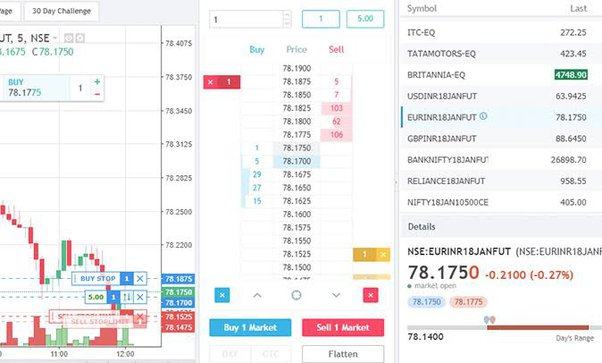

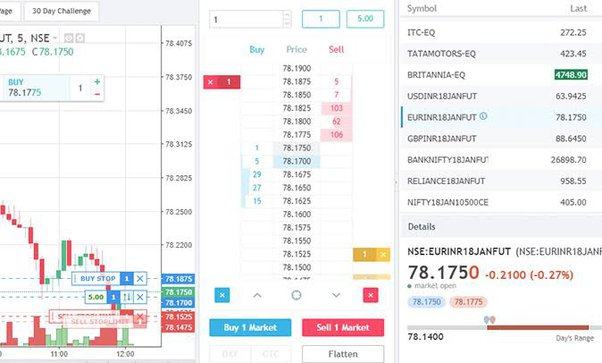

The CGS-CIMB iTrade platform represents the institution's proprietary trading solution. It is designed to handle both local and foreign stock transactions. This multi-asset capability positions CIMB Bank favorably for investors seeking diversified exposure across different markets and instruments.

However, the evaluation is limited by the absence of detailed information regarding research resources, market analysis tools, educational materials, or automated trading capabilities. Modern traders typically expect comprehensive market research, real-time news feeds, technical analysis tools, and educational resources as standard platform features.

The actual user experience with these platforms requires user feedback that is not available in current sources. Despite these limitations, the platform diversity earns a rating of 7/10 based on the variety of options provided.

Customer Service and Support Analysis

The assessment of CIMB Bank's customer service capabilities is severely hampered by the absence of specific information. This includes support channels, operational hours, response times, and service quality metrics. This lack of transparency in customer service documentation represents a significant concern for potential users who may require assistance with account management or trading activities.

Essential details such as available communication methods, multilingual support capabilities, and technical support availability are not specified in accessible sources. For a digital-first banking platform, robust customer support infrastructure is typically crucial for user satisfaction and problem resolution.

The absence of user testimonials or feedback regarding customer service experiences further complicates the evaluation process. Without documented response times, problem resolution effectiveness, or service quality indicators, potential users cannot make informed decisions about the level of support they can expect.

This information gap is particularly concerning given the complexity of trading platforms. Users may encounter the need for technical assistance, account management support, or transaction-related inquiries.

Trading Experience Analysis

Evaluating the actual trading experience with CIMB Bank's platforms presents significant challenges due to limited user feedback and performance data. While the institution offers multiple trading platforms including MT4, Viewpoint, and iTrade, the real-world performance characteristics of these systems remain unclear from available sources.

Critical aspects of trading experience such as order execution speed, slippage rates, platform stability during market volatility, and requote frequency are not documented in accessible materials. These factors significantly impact trader satisfaction and overall platform effectiveness, making their absence notable in this evaluation.

The mobile trading experience, increasingly important for modern traders, lacks detailed documentation regarding app functionality, performance, and feature completeness compared to desktop platforms. Similarly, information about advanced trading features, charting capabilities, and technical analysis tools is not comprehensively available.

Without user reviews or independent testing data, this cimb bank review cannot provide definitive insights into the practical trading experience. Prospective users should consider conducting demo trading or seeking user testimonials to better understand platform performance before committing to live trading activities.

Trust and Safety Analysis

The evaluation of CIMB Bank's trustworthiness faces substantial limitations due to insufficient information regarding regulatory oversight, licensing details, and safety measures. While the institution operates as a banking entity in the Philippines, specific regulatory compliance information, license numbers, and oversight authorities are not clearly documented in available sources.

Fund safety measures such as segregated client accounts, deposit insurance coverage, and financial protection schemes are not detailed in accessible materials. For a digital banking platform handling both banking and trading activities, clear documentation of client fund protection represents a fundamental requirement that appears inadequately addressed in public information.

The absence of information regarding third-party audits, financial reporting transparency, or independent security assessments further complicates the trust evaluation. Additionally, any history of regulatory actions, customer complaints, or operational incidents is not documented in reviewed sources.

The institutional backing of the broader CIMB Group provides some reassurance regarding organizational stability. However, specific safety measures and regulatory compliance for the Philippine operations require direct verification. This information gap represents a significant concern for potential users prioritizing security and regulatory protection.

User Experience Analysis

Comprehensive user experience evaluation is significantly hindered by the absence of user feedback, satisfaction surveys, and detailed interface documentation. The overall user journey from account opening through active trading cannot be adequately assessed without user testimonials and experience reports.

Interface design quality, navigation efficiency, and platform usability across different devices remain undocumented in available sources. For a digital-first banking platform, user experience quality typically represents a crucial differentiator, making this information gap particularly notable.

The registration and verification processes, fund management procedures, and ongoing account maintenance experiences are not detailed in accessible materials. These operational aspects significantly impact user satisfaction and platform adoption success.

Without documented user feedback regarding common issues, platform strengths, or improvement suggestions, potential users lack crucial insights for decision-making. The absence of user ratings, testimonials, or independent reviews further limits the evaluation scope.

Conclusion

This cimb bank review reveals an institution with promising technological infrastructure and platform diversity. However, significant information gaps limit comprehensive evaluation. CIMB Bank's strength lies in its multi-platform approach and digital banking positioning, making it potentially suitable for investors seeking integrated banking and trading services.

However, the absence of detailed information regarding regulatory oversight, customer service quality, and user experiences necessitates careful due diligence before engagement. Prospective users should directly verify account conditions, fee structures, and regulatory compliance before making commitments.

The platform appears most suitable for investors comfortable with digital-first banking who value platform variety and multi-asset trading capabilities. They should recognize the need for independent verification of service quality and regulatory protection.