CAPEX 2025 Review: Everything You Need to Know

Executive Summary

This CAPEX review presents a complete analysis of the global online trading platform established in 2016 and headquartered in Cyprus. CAPEX positions itself as a provider of personalized trading experiences while maintaining compliance with international regulatory standards. The platform operates under multiple regulatory jurisdictions including FSA, CySEC, and FSCA, which enhances its credibility in the competitive forex and CFD trading landscape.

Based on available information, CAPEX demonstrates a commitment to regulatory compliance and offers its services through the CAPEX.com trading platform. However, our evaluation reveals significant information gaps regarding specific trading conditions, fee structures, and detailed user feedback. The broker appears to target investors seeking a regulated trading environment with personalized service offerings, though the lack of transparent pricing information and limited user testimonials present challenges for potential clients seeking comprehensive platform details.

This neutral assessment reflects the current state of publicly available information about CAPEX's services and trading conditions as of 2025.

Important Notice

Regional Entity Differences: CAPEX operates under multiple regulatory frameworks including FSA, CySEC, and FSCA jurisdictions. Different regulatory entities may result in varying trading conditions, client protection measures, and available services depending on your region of residence. Prospective clients should verify which regulatory entity governs their account based on their geographical location.

Review Methodology: This evaluation is based on publicly available information and regulatory filings. The assessment does not include comprehensive user feedback analysis or detailed testing of trading conditions, as specific data regarding spreads, commissions, and real user experiences was not available in the reviewed materials.

Rating Framework

Broker Overview

CAPEX emerged in the online trading industry in 2016. The company established its headquarters in Cyprus to serve global markets. The company has positioned itself as a comprehensive online trading platform focused on delivering personalized trading experiences to its client base.

According to available regulatory information, CAPEX operates with a commitment to maintaining compliance across multiple international jurisdictions. This suggests a serious approach to regulatory adherence and client protection. The broker's business model centers on providing online trading services through its proprietary CAPEX.com platform.

While specific details about asset classes and trading instruments remain unclear from available sources, the company appears to follow a customer-centric approach with emphasis on personalization. CAPEX's establishment in Cyprus, a well-known financial services hub within the European Union, indicates strategic positioning to serve both European and international markets under established regulatory frameworks. The platform operates under supervision from multiple regulatory bodies including the Financial Services Authority (FSA), Cyprus Securities and Exchange Commission (CySEC), and Financial Sector Conduct Authority (FSCA).

This multi-jurisdictional regulatory approach demonstrates CAPEX's commitment to maintaining operational standards across different markets. However, specific regulatory numbers and detailed compliance measures were not detailed in available materials.

Regulatory Jurisdictions: CAPEX maintains regulatory compliance through oversight from FSA, CySEC, and FSCA authorities. This ensures adherence to international financial services standards and client protection protocols.

Deposit and Withdrawal Methods: Specific information regarding available deposit and withdrawal options was not detailed in the reviewed materials. Potential clients need to inquire directly with the broker for comprehensive payment method details.

Minimum Deposit Requirements: Available sources did not specify minimum deposit amounts for different account types. This indicates potential clients should contact CAPEX directly for current requirements.

Bonus and Promotional Offers: No specific information regarding welcome bonuses, promotional campaigns, or loyalty programs was found in the reviewed materials.

Tradeable Assets: The range of available trading instruments was not specified in available documentation. This includes forex pairs, commodities, indices, and other asset classes.

Cost Structure: Detailed information about spreads, commission rates, overnight fees, and other trading costs was not available in the reviewed sources. This represents a significant transparency gap for this CAPEX review.

Leverage Ratios: Maximum leverage offerings and margin requirements were not specified in available materials.

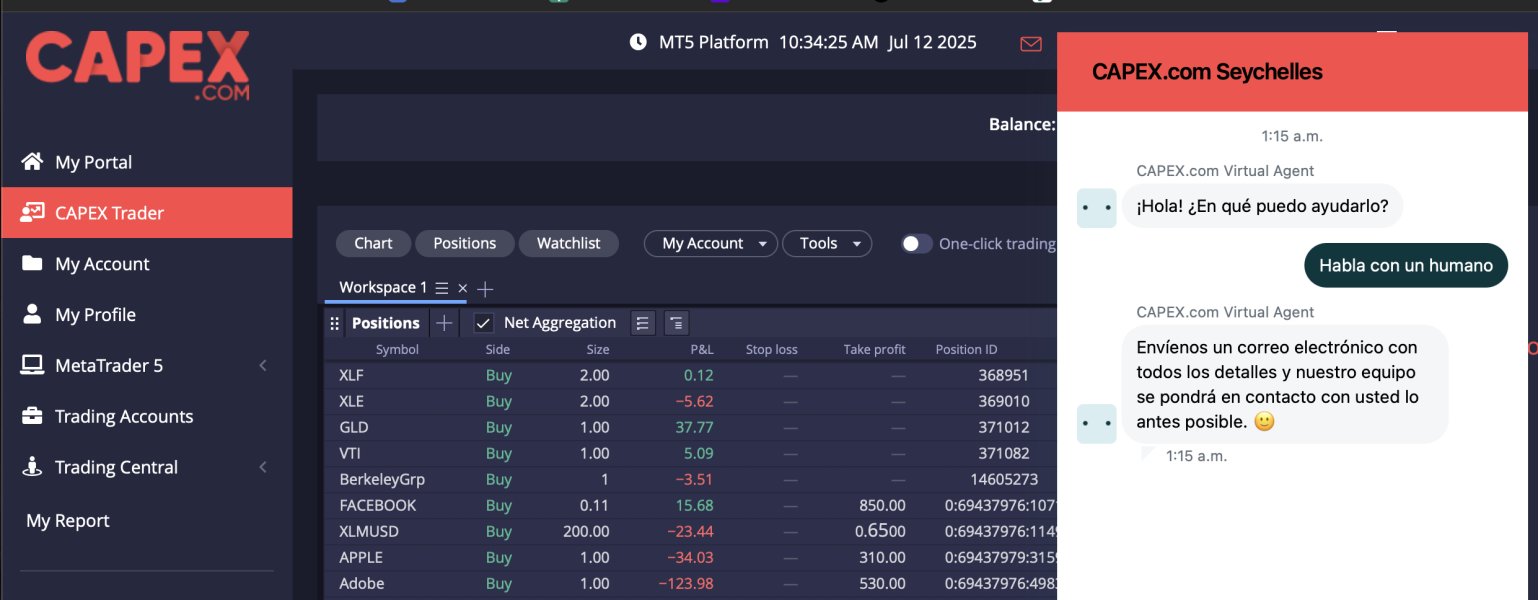

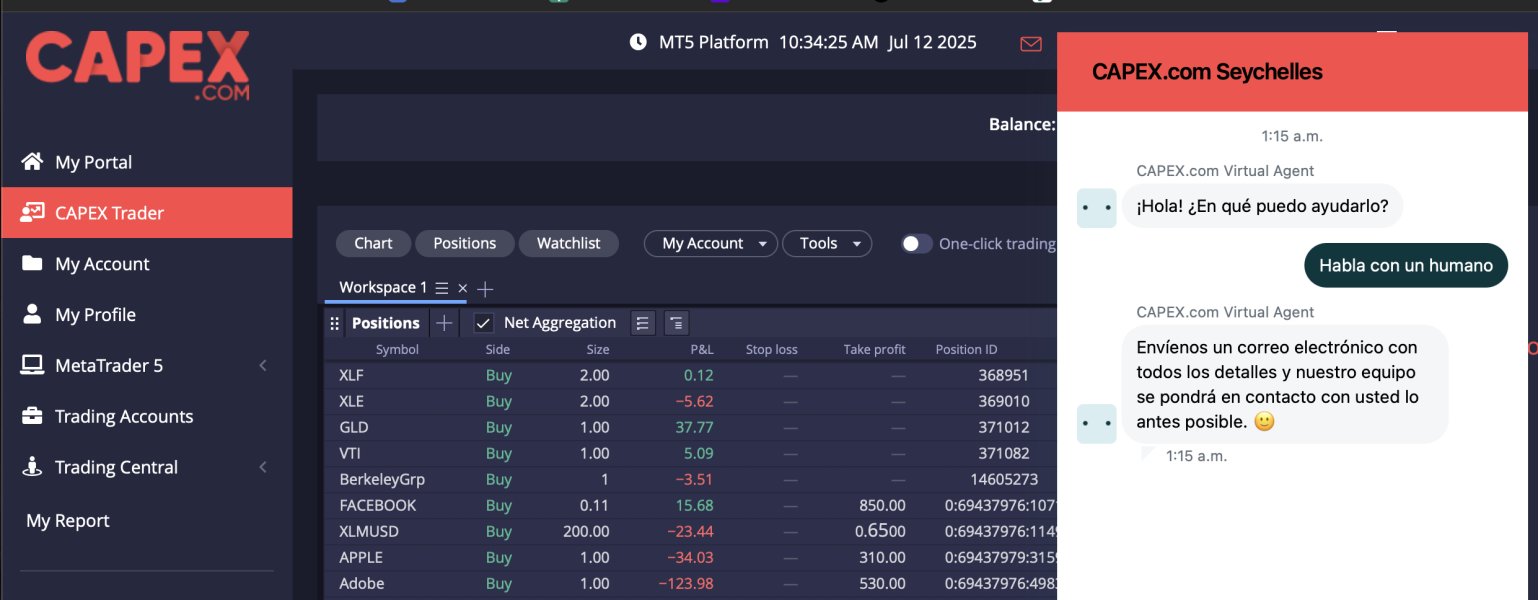

Platform Options: CAPEX operates primarily through its CAPEX.com trading platform. However, detailed platform features and capabilities require further investigation.

Regional Restrictions: Specific geographic limitations or restricted territories were not detailed in available sources.

Customer Support Languages: Available support languages and communication options were not specified in reviewed materials.

Detailed Rating Analysis

Account Conditions Analysis (Score: 5/10)

The account conditions evaluation for CAPEX reveals significant information gaps. These gaps impact our ability to provide a comprehensive assessment. Available sources do not detail specific account types, their respective features, or the minimum deposit requirements for different tier levels.

This lack of transparency regarding basic account structure represents a notable concern for potential clients seeking to understand their options before committing to the platform. The absence of information about account opening procedures, verification requirements, and timeframes further complicates the evaluation process. Additionally, no details were found regarding specialized account offerings such as Islamic accounts for Sharia-compliant trading, professional trader accounts, or managed account services.

The lack of clear fee structures associated with different account levels makes it challenging for traders to make informed decisions about which account type might best suit their trading needs and financial capabilities. Without specific user feedback regarding account opening experiences, deposit processes, or account management features, this CAPEX review cannot provide definitive guidance on the quality of account conditions. Prospective clients would need to engage directly with CAPEX representatives to obtain comprehensive information about available account types and their respective terms and conditions.

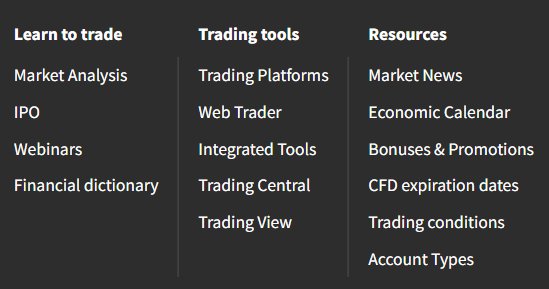

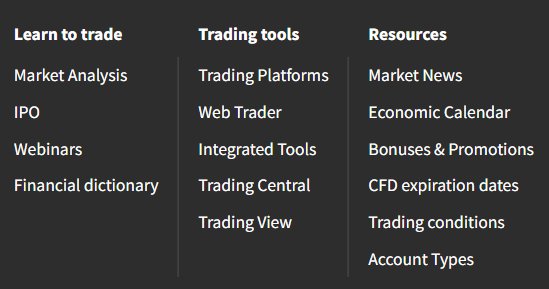

The evaluation of CAPEX's trading tools and resources faces significant limitations due to insufficient publicly available information. No specific details were found regarding the range of technical analysis tools, charting capabilities, or market research resources provided to clients. This informational gap makes it difficult to assess how well CAPEX supports traders in making informed market decisions.

Educational resources, which are crucial for trader development, were not detailed in available materials. The absence of information about webinars, trading guides, market analysis, or educational content suggests either limited offerings or poor transparency regarding available learning materials. For a broker established in 2016, the lack of visible educational infrastructure raises questions about commitment to client development.

Automated trading support, including Expert Advisor compatibility, algorithmic trading tools, or copy trading services, was not mentioned in reviewed sources. Modern traders increasingly rely on automated solutions, making this information gap particularly relevant for technology-oriented clients. The platform's capabilities regarding third-party tool integration, API access, or advanced order types remain unclear from available documentation.

Customer Service and Support Analysis (Score: 5/10)

Customer service evaluation for CAPEX is hampered by the absence of specific information regarding support channels, availability hours, and response quality. No details were found about whether the broker offers live chat, phone support, email assistance, or other communication methods. This lack of transparency regarding customer service infrastructure raises concerns about accessibility and support quality.

Response time expectations, service level agreements, and escalation procedures were not detailed in available sources. For traders who may encounter urgent issues during market hours, understanding support availability and response capabilities is crucial. The absence of this information makes it difficult for potential clients to assess whether CAPEX can provide adequate support when needed.

Multilingual support capabilities, which are important for international brokers serving diverse markets, were not specified in reviewed materials. Given CAPEX's multi-jurisdictional regulatory approach, the lack of clear information about language support options represents a notable gap in service transparency. User feedback regarding support quality, problem resolution effectiveness, and overall service satisfaction was not available in the reviewed sources.

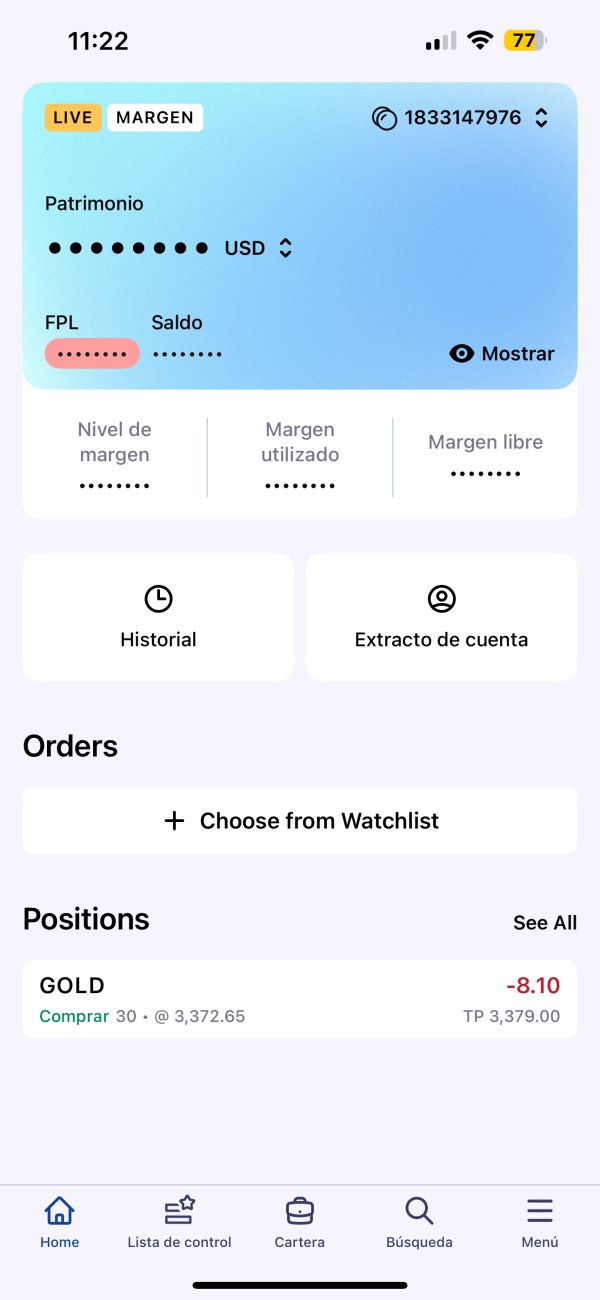

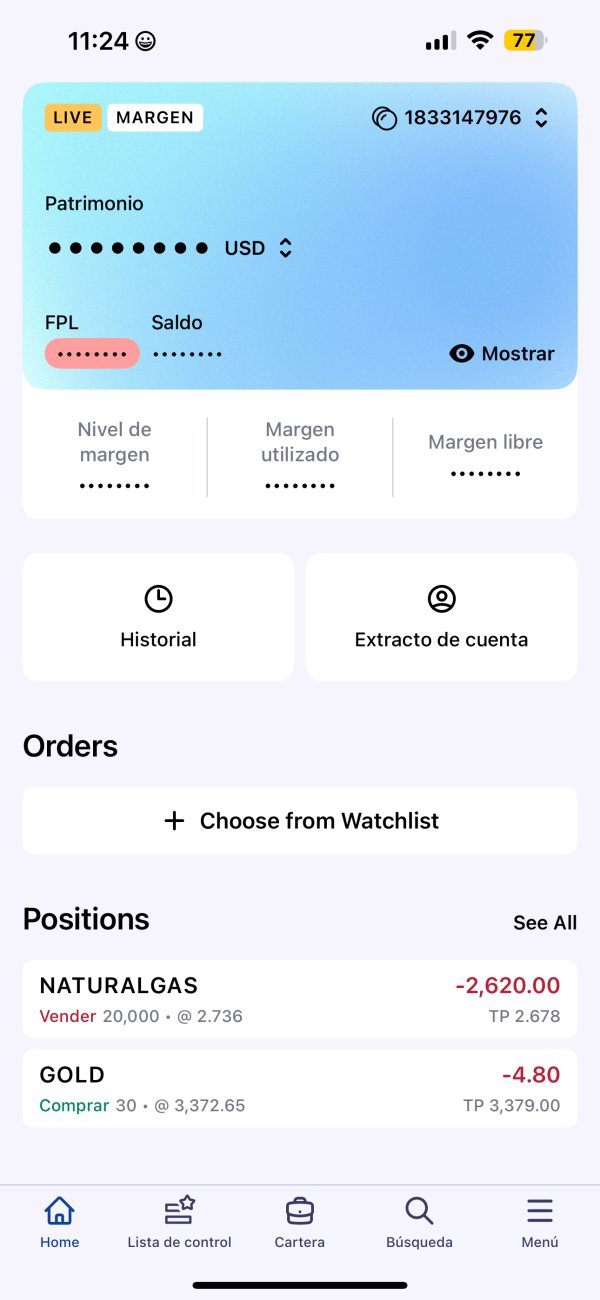

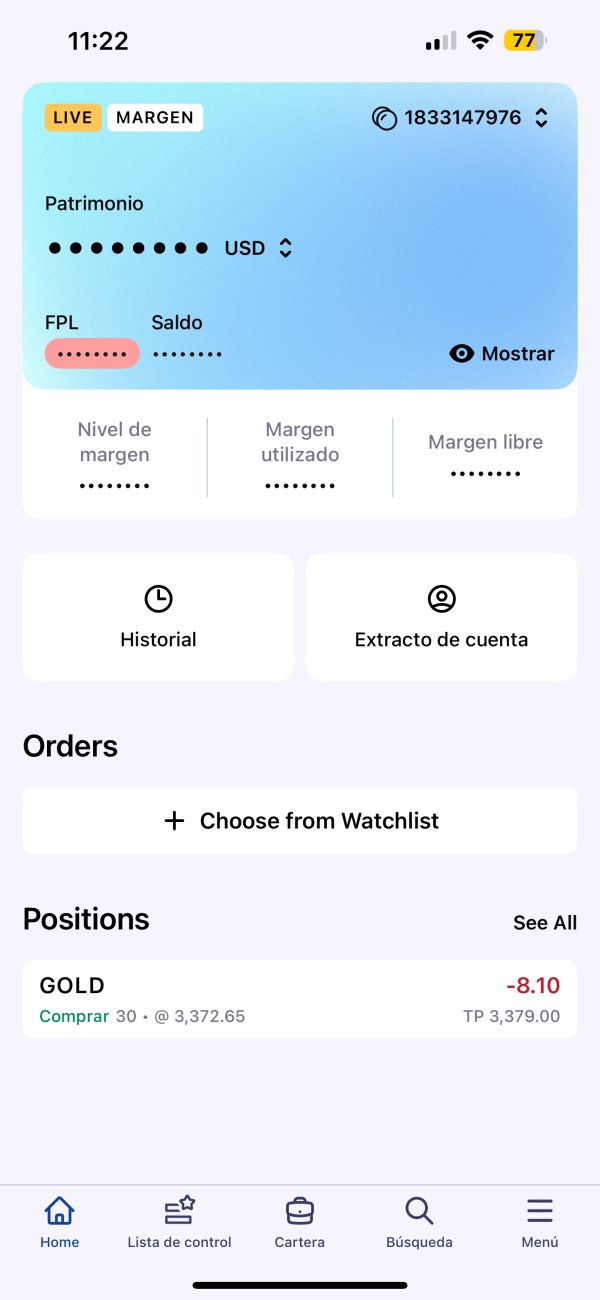

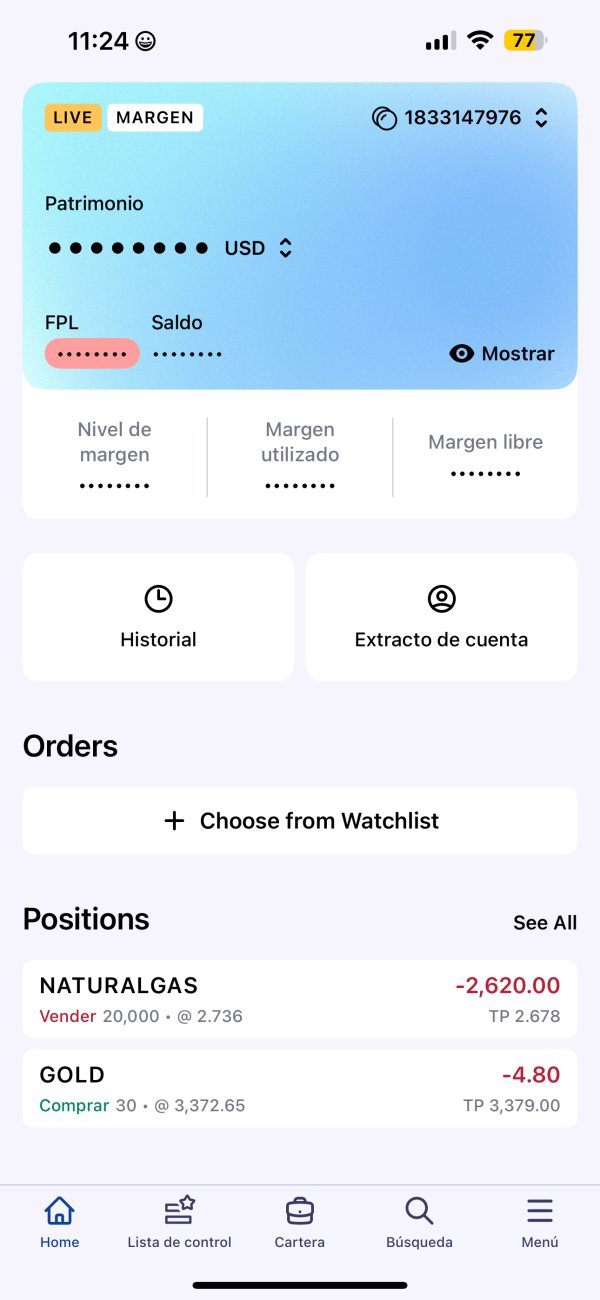

Trading Experience Analysis (Score: 6/10)

The trading experience assessment for CAPEX relies primarily on the confirmed existence of the CAPEX.com trading platform. However, detailed functionality information remains limited. Platform stability, execution speed, and order processing quality could not be evaluated based on available materials, as specific performance data and user experiences were not documented in reviewed sources.

Order execution quality, including slippage rates, rejection frequencies, and fill rates during high volatility periods, was not detailed in available information. These factors significantly impact trading profitability and user satisfaction, making their absence notable in this CAPEX review. The platform's handling of different order types, stop-loss execution, and partial fills remains unclear from current documentation.

Mobile trading capabilities, which are essential for modern traders, were not specifically addressed in available materials. The functionality, reliability, and feature parity between desktop and mobile platforms could not be assessed. Additionally, information about platform customization options, workspace saving, and user interface adaptability was not found in reviewed sources, limiting our ability to evaluate the overall trading environment quality.

Trustworthiness Analysis (Score: 7/10)

CAPEX demonstrates enhanced trustworthiness through its multi-regulatory oversight structure, operating under FSA, CySEC, and FSCA supervision. This regulatory diversification suggests a commitment to maintaining operational standards across different jurisdictions and provides multiple layers of client protection. The broker's establishment in Cyprus, a recognized financial services jurisdiction within the EU framework, further supports its regulatory credibility.

However, specific fund safety measures, including client money segregation practices, compensation schemes, and deposit protection amounts, were not detailed in available sources. While regulatory oversight provides general protection frameworks, the absence of specific safety measure details limits our ability to fully assess fund security protocols. Information about insurance coverage, negative balance protection, and emergency fund access procedures was not available in reviewed materials.

The company's transparency regarding ownership structure, financial statements, and operational history could not be evaluated based on available information. Additionally, no information was found regarding any regulatory actions, fines, or compliance issues that might impact the broker's reputation. The absence of detailed third-party audits or independent verification reports represents a gap in transparency assessment.

User Experience Analysis (Score: 5/10)

User experience evaluation for CAPEX faces significant limitations due to the absence of comprehensive user feedback and satisfaction data in reviewed sources. No specific information was found regarding overall client satisfaction rates, common user complaints, or positive experience testimonials that could inform potential clients about real-world platform usage.

Interface design quality, navigation intuitiveness, and platform learning curves could not be assessed based on available materials. The registration and account verification process efficiency, which significantly impacts initial user experience, was not detailed in reviewed sources. Additionally, funding and withdrawal experience quality, including processing times and procedure complexity, remains unclear from current documentation.

Common user pain points, feature requests, and platform improvement suggestions were not documented in available materials. The absence of user-generated content, community feedback, or independent user reviews makes it challenging to provide guidance on which trader types might find CAPEX most suitable. Platform accessibility features, customer onboarding quality, and long-term user retention factors could not be evaluated comprehensively.

Conclusion

This CAPEX review reveals a broker that demonstrates regulatory credibility through multi-jurisdictional oversight but suffers from significant transparency gaps regarding essential trading information. While CAPEX's regulation by FSA, CySEC, and FSCA authorities provides a foundation of trustworthiness, the absence of detailed information about trading conditions, fee structures, and user experiences limits our ability to provide comprehensive guidance to potential clients.

CAPEX appears most suitable for investors who prioritize regulatory compliance and are willing to engage directly with the broker to obtain detailed information about trading conditions and services. The platform may appeal to traders seeking personalized service in a regulated environment, though the lack of transparent pricing and limited public feedback requires careful consideration.

The primary advantages include multi-regulatory oversight and established operations since 2016, while the main disadvantages center on limited transparency regarding trading conditions and insufficient publicly available user feedback. Prospective clients should conduct direct due diligence with CAPEX representatives to obtain comprehensive information before making trading decisions.