Forex Club 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive forex club review looks at one of the industry's established brokers that has been serving traders since 1997. Forex Club stands out as a regulated forex broker that helps both beginners and experienced traders through its diverse account offerings and multiple trading platforms. The broker has built a reputation for providing accessible trading solutions. It also maintains regulatory compliance in key jurisdictions.

Two key highlights make Forex Club different in the competitive forex landscape. First, the broker offers multiple trading platforms including MT4, MT5, and Libertex. This gives traders flexibility in choosing their preferred trading environment. Second, Forex Club supports diverse deposit methods including traditional options like Neteller, Skrill, and credit cards, as well as modern cryptocurrency options like Bitcoin. This reflects how it adapts to evolving market needs.

The broker mainly targets beginner traders and those seeking diversified trading tools. According to available user feedback, Forex Club has earned recognition as a "Best Beginner Broker." This shows its effectiveness in serving newcomers to forex trading. However, like many brokers, it faces challenges including withdrawal delays reported by some users. Potential clients should consider this when evaluating their options.

Based on regulatory information and user reviews, Forex Club shows compliance efforts while managing typical operational challenges that affect user experience. This review examines all critical aspects to help traders make informed decisions. It will help you determine whether this broker aligns with your trading objectives and expectations.

Important Disclaimers

Forex Club operates across multiple jurisdictions with varying regulatory frameworks. In the United States, the broker falls under CFTC (Commodity Futures Trading Commission) oversight and has historical interactions with the NFA (National Futures Association). Notably, in October 2012, Forex Club received a $300,000 fine from the NFA for regulatory violations. Traders should understand that regulatory requirements and available services may differ significantly depending on their geographic location. The specific Forex Club entity serving their region also matters.

This evaluation methodology relies on comprehensive analysis of user feedback, publicly available regulatory information, and market research to ensure accuracy and objectivity. All assessments are based on verifiable information from multiple sources including trader reviews, regulatory databases, and industry reports. However, readers should conduct their own due diligence and consider their specific trading needs. Individual experiences may vary significantly from general market observations and regulatory standards continue to evolve.

Rating Framework

Overall Rating: 6.8/10

Broker Overview

Forex Club was established in 1997, originally founded in Russia before expanding its operations globally. The company later established a significant presence in New York City. This positioned it as an international forex trading broker with a focus on serving diverse markets. Over its decades of operation, Forex Club has evolved from a regional player to a broker serving clients across multiple continents. It adapts its services to meet varying regulatory requirements and market demands.

The broker's business model centers on providing comprehensive forex trading services while maintaining regulatory compliance across its operating jurisdictions. Forex Club has built its reputation by focusing on accessibility for new traders. It also offers sophisticated tools for experienced market participants. The company's longevity in the industry reflects its ability to adapt to changing market conditions and regulatory environments.

Forex Club operates multiple trading platforms including MetaTrader 4, MetaTrader 5, and Libertex, catering to different trader preferences and experience levels. The broker offers access to various asset classes beyond traditional forex pairs, including CFDs on multiple financial instruments. According to regulatory filings, Forex Club operates under CFTC oversight in the United States. However, it has faced regulatory challenges, including a notable $300,000 NFA fine in 2012. This forex club review examines how these factors combine to create the current trading environment for clients.

Regulatory Jurisdictions: Forex Club operates under CFTC regulation in the United States and maintains compliance with applicable financial regulations. The broker's regulatory history includes a significant $300,000 fine imposed by the NFA in October 2012 for regulatory violations. Traders should consider this when evaluating the broker's compliance record.

Deposit and Withdrawal Methods: The broker supports multiple funding options including Neteller, Skrill, major credit cards (MasterCard and Visa), and cryptocurrency payments through Bitcoin. This diversity in payment methods reflects Forex Club's effort to accommodate different client preferences and geographic requirements.

Minimum Deposit Requirements: Specific minimum deposit information was not detailed in available sources. It may vary by account type and jurisdiction.

Bonus and Promotional Offers: Current promotional offerings and bonus structures were not specified in available documentation. They may vary by region and account type.

Tradeable Assets: Forex Club provides access to forex markets along with various financial instruments including CFDs. This caters to traders seeking portfolio diversification beyond traditional currency pairs.

Cost Structure: Detailed information about spreads, commissions, and other trading costs was not comprehensively available in source materials. You need to contact the broker directly for current pricing.

Leverage Ratios: Specific leverage information was not detailed in available sources. It likely varies by jurisdiction due to regulatory requirements.

Platform Options: The broker offers MT4, MT5, and Libertex platforms. This provides traders with multiple interface options and functionality levels to match their trading strategies and experience.

Geographic Restrictions: Specific regional limitations were not detailed in available sources. They may vary based on local regulatory requirements.

Customer Service Languages: Supported languages for customer service were not specified in available documentation.

This forex club review notes that several key details require direct verification with the broker. Comprehensive current information was not available in public sources.

Detailed Rating Analysis

Account Conditions Analysis (Score: 6/10)

Forex Club offers multiple account types designed to accommodate different trader profiles and experience levels. According to user feedback, the broker provides flexibility in account selection. This allows traders to choose options that align with their trading strategies and capital requirements. The variety of available accounts suggests an effort to serve both newcomers and experienced traders. However, specific details about minimum deposits and account features require direct inquiry with the broker.

The account opening process receives generally positive feedback from users, with reports indicating a relatively straightforward registration procedure. However, the lack of publicly available detailed information about specific account conditions limits transparency for potential clients. This includes minimum deposit requirements and account-specific features, which makes preliminary research difficult.

User reviews suggest that account management services are adequate, though some traders report challenges with certain administrative processes. The absence of detailed information about specialized account features represents a gap in available public information. This includes Islamic accounts for traders requiring Sharia-compliant trading conditions.

Compared to other brokers in the market, Forex Club's account conditions appear competitive. However, the limited transparency regarding specific terms and conditions may concern traders who prefer comprehensive upfront information. This forex club review finds that while account flexibility exists, improved transparency would enhance the overall account conditions rating.

Forex Club demonstrates strong performance in providing diverse trading tools and platform options. The broker offers MetaTrader 4, MetaTrader 5, and Libertex platforms. This gives traders access to industry-standard tools with varying functionality levels. The multi-platform approach allows users to select interfaces that match their trading style, from basic execution to advanced analytical capabilities.

The availability of MT4 and MT5 ensures access to comprehensive charting tools, technical indicators, and automated trading capabilities through Expert Advisors. User feedback indicates that these platforms operate with good stability and provide the analytical resources necessary for informed trading decisions. The inclusion of Libertex adds another dimension, particularly for traders preferring alternative interface designs.

However, available sources do not provide detailed information about proprietary research tools, market analysis resources, or educational materials that might enhance the trading experience. The absence of information about dedicated research departments or analytical content represents a potential limitation. This affects traders seeking comprehensive market insights.

Automated trading support appears adequate through the MT4 and MT5 platforms, allowing for algorithmic trading strategies and Expert Advisor implementation. User reviews suggest positive experiences with platform functionality. However, specific performance metrics and advanced tool availability require direct verification with the broker.

Customer Service and Support Analysis (Score: 7/10)

Forex Club provides customer support through multiple channels including telephone, email, and online chat systems. User feedback indicates that the broker maintains reasonable response times for customer inquiries. Support staff demonstrate professional knowledge of platform operations and account management procedures. The availability of multiple contact methods accommodates different client preferences for communication.

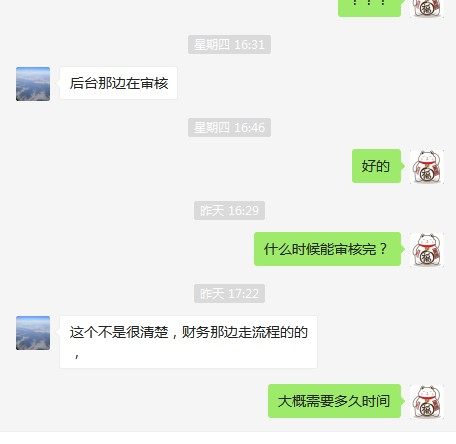

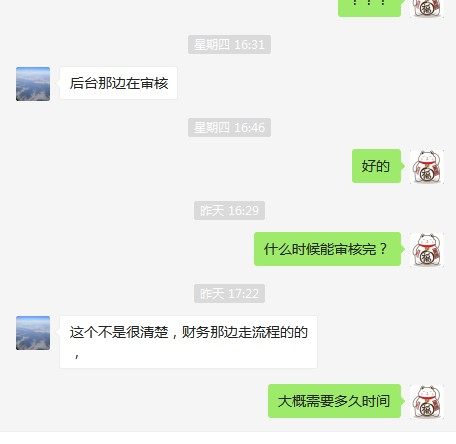

However, user reviews reveal a recurring issue with withdrawal processing delays, which impacts overall service quality ratings. Several traders report extended timeframes for fund withdrawals. This creates frustration and raises concerns about operational efficiency. While customer service representatives are generally responsive to inquiries, the underlying withdrawal processing issues suggest systemic challenges that affect client satisfaction.

The quality of support interactions receives mixed feedback, with some users praising the professionalism and knowledge of support staff. Others report difficulties in resolving specific account or technical issues. This variation in service quality suggests inconsistency in support delivery that could benefit from standardization.

Information about multilingual support capabilities and service hours was not available in source materials, limiting assessment of global service accessibility. The withdrawal delay issues represent a significant concern that impacts the overall customer service evaluation. This occurs despite otherwise adequate support channel availability.

Trading Experience Analysis (Score: 7/10)

User feedback indicates that Forex Club's trading platforms operate with good stability and reliability during normal market conditions. Traders report satisfactory execution speeds and platform responsiveness, particularly on the MT4 and MT5 platforms. The availability of multiple platform options allows traders to select environments that best suit their trading strategies and technical requirements.

Platform functionality receives positive reviews for completeness, with users having access to comprehensive charting tools, technical indicators, and order management systems. The integration of standard MetaTrader features ensures that experienced traders can implement familiar strategies and analytical approaches. This happens without significant adaptation periods.

However, specific information about order execution quality, including slippage rates and requote frequency, was not available in source materials. These factors significantly impact trading experience but require direct testing or broker disclosure for accurate assessment. The absence of detailed execution statistics limits the ability to fully evaluate trading condition quality.

User feedback regarding spreads and liquidity presents mixed perspectives, with some traders expressing satisfaction while others indicate concerns about trading costs. The lack of detailed current spread information makes it difficult to assess competitiveness compared to other brokers in the market.

Mobile trading experience information was not available in source materials, though MT4 and MT5 typically offer mobile applications. This forex club review notes that comprehensive trading experience assessment requires additional current information. This includes execution quality and mobile platform performance.

Trust and Reliability Analysis (Score: 6/10)

Forex Club operates under CFTC regulation in the United States, providing a foundation of regulatory oversight that enhances credibility. However, the broker's regulatory history includes a significant $300,000 fine imposed by the NFA in October 2012 for compliance violations. This historical regulatory action raises questions about past operational practices. It occurred over a decade ago and may not reflect current standards.

The broker has received industry recognition, including designation as "Best Beginner Broker" according to available sources, suggesting positive peer and industry assessment. This recognition indicates that despite regulatory challenges, the broker maintains operational standards. These standards serve particular market segments effectively.

Available sources do not provide detailed information about specific fund safety measures, segregated account policies, or financial reporting transparency that would enhance trust assessment. The absence of publicly available financial statements or third-party audits limits the ability to verify operational stability. It also limits verification of client fund protection measures.

User trust feedback presents mixed perspectives, with some traders expressing confidence in the broker's operations while others cite concerns about withdrawal delays and transparency issues. The withdrawal processing delays reported by multiple users create trust concerns. These impact overall reliability perceptions.

Industry reputation appears generally positive for serving beginning traders, though the combination of regulatory history and operational challenges prevents a higher trust rating. Enhanced transparency regarding fund protection and operational procedures would strengthen the trust profile.

User Experience Analysis (Score: 7/10)

Overall user satisfaction with Forex Club shows generally positive trends, with many traders expressing appreciation for the broker's accessibility and platform options. User reviews indicate that the broker successfully serves its target market of beginning traders. Interface designs and account structures facilitate learning and gradual skill development.

Platform interface design receives positive feedback for usability, particularly among newer traders who appreciate the straightforward navigation and standard MetaTrader functionality. The availability of multiple platform options allows users to progress from basic to advanced interfaces. This happens as their trading skills develop.

The registration and account verification process is reported as relatively simple and efficient, with most users completing account setup without significant complications. This streamlined onboarding experience contributes positively to overall user satisfaction. It particularly benefits newcomers to forex trading.

However, withdrawal delays represent the most significant user experience concern, with multiple traders reporting extended processing times that create frustration and operational difficulties. This issue appears systemic and significantly impacts user satisfaction. This happens despite other positive aspects of the service.

User demographics appear to align well with the broker's positioning as a beginner-friendly service, though the withdrawal delays and limited transparency regarding trading conditions create challenges for users seeking reliable operational performance. Improvements in processing efficiency and information transparency would enhance the overall user experience significantly.

Conclusion

This comprehensive forex club review reveals a broker with both strengths and areas requiring improvement. Forex Club demonstrates competency as a regulated forex broker with particular effectiveness in serving beginning traders and those seeking diverse trading platform options. The broker's longevity since 1997 and industry recognition as "Best Beginner Broker" indicate established market presence. It also shows specialized capability in serving newcomers to forex trading.

The broker best suits traders seeking multiple platform options, flexible account types, and diverse funding methods including cryptocurrency options. Beginning traders may particularly benefit from the broker's focus on accessibility and educational support. Meanwhile, experienced traders can leverage the advanced features available through MT4 and MT5 platforms.

Key advantages include the variety of account types that accommodate different trader profiles, positive user feedback regarding platform stability and customer service responsiveness, and regulatory oversight that provides operational legitimacy. The multi-platform approach offers flexibility that serves different trading preferences and experience levels effectively.

However, significant disadvantages include recurring withdrawal delays that impact user satisfaction, the historical NFA fine that raises compliance questions, and limited transparency regarding specific trading conditions including spreads, commissions, and minimum deposits. These limitations require careful consideration by potential clients. This is particularly true for those prioritizing operational efficiency and comprehensive information disclosure.