BOQ 2025 Review: Everything You Need to Know

Executive Summary

Bank of Queensland (BOQ) shows a mixed picture in our boq review for 2025. This financial institution focuses mainly on traditional banking services and has gained attention in the mortgage lending space while facing criticism about its broker channel relationships and overall service efficiency. The bank performs well in home loan applications, where users report smooth experiences, but it has clear weaknesses in transfer processing speeds and customer service responsiveness.

BOQ's main strength lies in its complete mortgage lending services, especially through its own network and broker partnerships. However, recent changes to reduce broker channel dependency have raised questions about the institution's future position in the competitive lending market. User feedback shows divided opinions, with mortgage applicants praising the smooth loan process while other customers express frustration with outdated transfer systems and slow service delivery.

The main user group for BOQ includes homebuyers and property investors seeking mortgage solutions, though the bank's broader financial services appeal to a wider customer base. Our analysis shows that while BOQ excels in specific lending scenarios, potential users should carefully evaluate their service expectations, particularly regarding transaction processing times and customer support responsiveness.

Important Notice

This boq review uses publicly available information, user feedback, and official company communications. Our evaluation method includes real user testimonials, industry reports, and documented service experiences to provide an objective assessment. Readers should note that banking services and policies may vary by region and individual circumstances.

The evaluation presented here reflects information available as of 2025 and may not capture the most recent operational changes or service updates. We recommend potential customers verify current terms and conditions directly with BOQ before making financial commitments.

Rating Framework

BOQ Overview

Bank of Queensland (BOQ) operates as a regional Australian bank with a significant focus on mortgage lending and commercial banking services. The institution has established itself as a notable player in the Australian financial services sector, though specific founding details and comprehensive historical background remain limited in available documentation. BOQ's business model centers heavily on mortgage creation through both direct channels and broker partnerships, with the BOQ Broker Portal serving as a key technological infrastructure supporting mortgage broker relationships.

The bank's strategic approach emphasizes its own channel development while maintaining broker partnerships, though recent operational decisions suggest a shift toward reducing third-party channel dependency. This strategic change has generated considerable discussion within the mortgage broking community, with industry observers noting BOQ's focus on improving economic returns rather than pursuing growth in less profitable segments.

BOQ's service portfolio includes traditional banking products with particular strength in home lending solutions. The institution's Managing Director and Chief Executive Officer has publicly emphasized the bank's commitment to maintaining stable margins while optimizing portfolio performance, indicating a strategic focus on profitability over volume growth. This approach reflects broader industry trends toward sustainable lending practices and improved risk management.

Regulatory oversight and specific licensing information for BOQ's operations are not clearly detailed in available sources, though as an Australian banking institution, it operates under standard Australian Prudential Regulation Authority (APRA) supervision. The bank's commitment to both retail and commercial broker channels remains officially stated, despite operational changes affecting new customer acquisition through broker networks.

Regulatory Framework: BOQ operates under Australian banking regulations, though specific regulatory numbers and detailed compliance information are not readily available in current documentation. The bank maintains standard Australian banking licenses and operates within established regulatory frameworks.

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal options is not detailed in available sources, though standard Australian banking methods are presumably supported.

Minimum Balance Requirements: Current minimum balance requirements for various account types are not specified in available documentation.

Promotional Offers: No specific bonus promotions or special offers are mentioned in current available information.

Available Financial Products: BOQ's primary focus appears to be mortgage lending, with home loans being the most prominent product offering. Additional banking services are available but not specifically detailed.

Fee Structure: Detailed cost structures, including specific fees, charges, and interest rates, are not provided in available sources, requiring direct inquiry with the institution.

Service Leverage: Not applicable for traditional banking services, though mortgage lending ratios would follow standard Australian banking regulations.

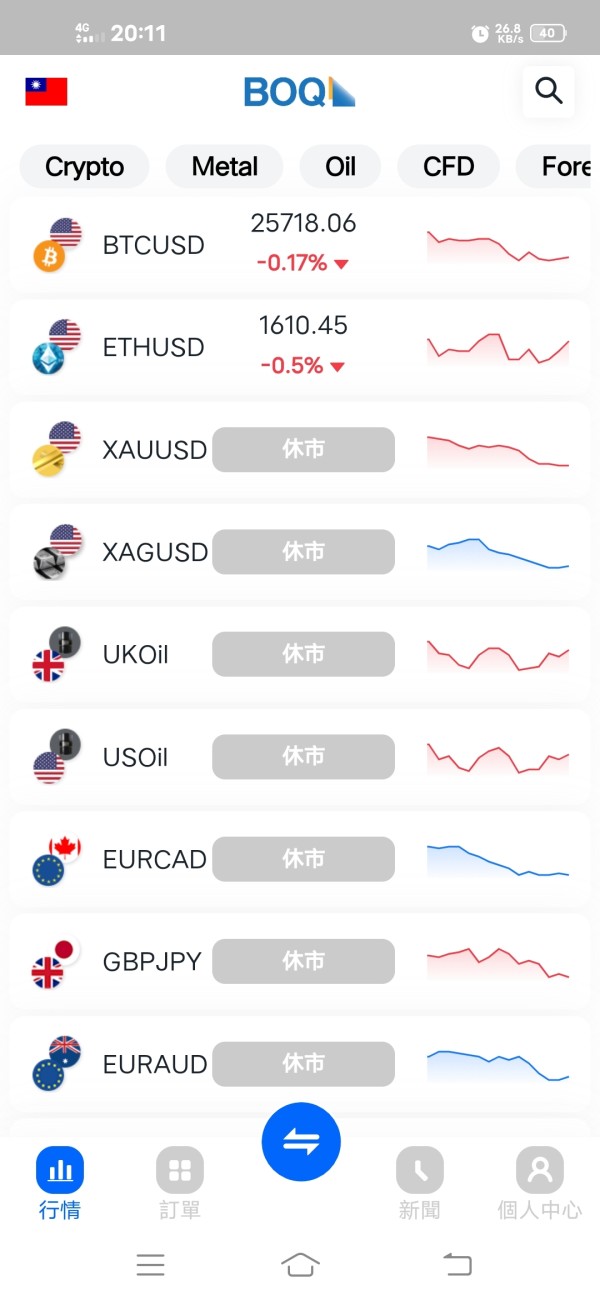

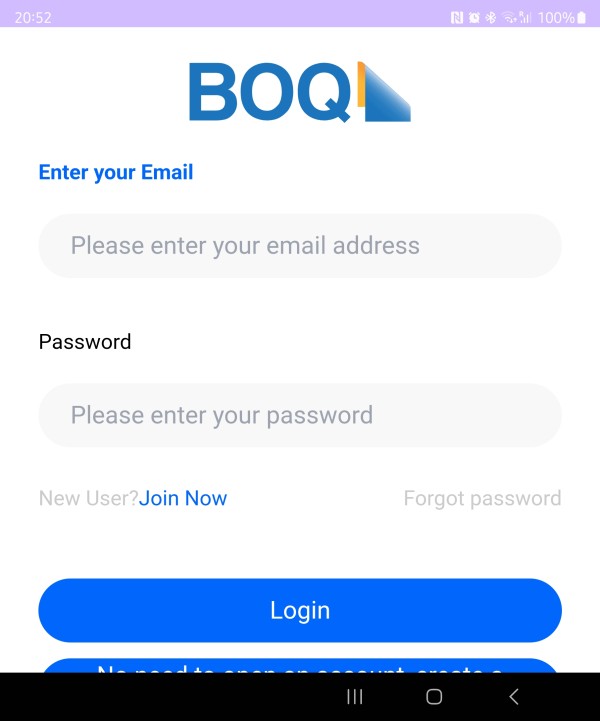

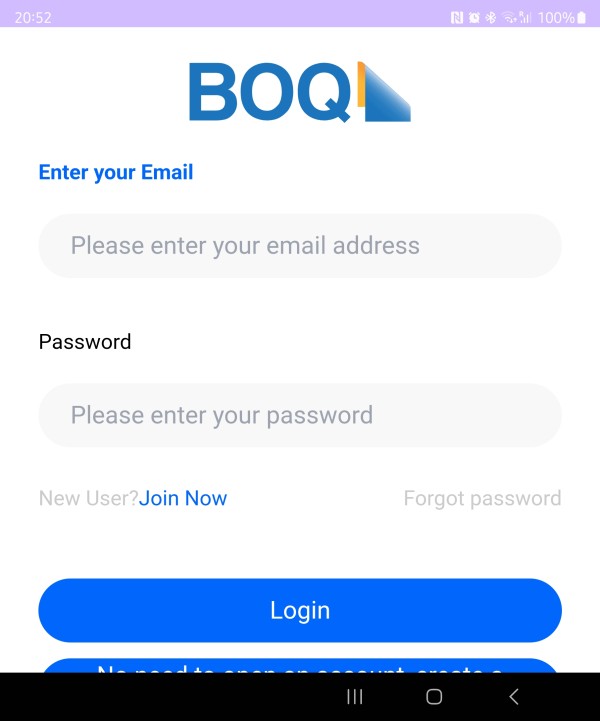

Platform Options: The BOQ Broker Portal represents the primary technological platform for broker partnerships, though consumer-facing platform details are not specified.

Geographic Restrictions: Services appear focused on the Australian market, with specific international service availability not detailed.

Customer Support Languages: Language support options beyond English are not specified in available documentation.

This comprehensive boq review analysis reveals significant information gaps that potential customers should address through direct communication with BOQ representatives.

Detailed Rating Analysis

Account Conditions Analysis

BOQ's account conditions present a mixed evaluation landscape, primarily due to limited publicly available information about specific account types and their associated requirements. The bank appears to maintain standard Australian banking account structures, though detailed comparisons with industry standards are challenging without comprehensive product specifications. Available information suggests that BOQ focuses heavily on mortgage-related accounts and services, potentially indicating streamlined offerings rather than extensive account variety.

The account opening process appears efficient for mortgage applicants, with user feedback highlighting smooth experiences in home loan applications. This suggests that BOQ has optimized its customer onboarding procedures for its primary business focus. However, the lack of detailed information about minimum balance requirements, account maintenance fees, and special account features limits our ability to provide comprehensive assessment.

User experiences vary significantly depending on the service type, with mortgage applicants reporting positive account setup experiences while general banking customers express concerns about service efficiency. This disparity suggests that BOQ's account management resources are primarily allocated toward its core lending business.

The absence of information about specialized account features, such as Islamic banking options or premium account tiers, indicates either limited product diversity or insufficient public communication about available options. Potential customers seeking comprehensive account condition details should engage directly with BOQ representatives for current terms and requirements.

Account Conditions Score: 6/10 - This boq review rating reflects adequate basic account services with strong mortgage-focused offerings but limited transparency about comprehensive account options.

BOQ's tools and resources evaluation reveals an institution primarily focused on traditional banking services rather than advanced financial tools or trading resources. The BOQ Broker Portal represents the most sophisticated technological offering, designed specifically to support mortgage broker partnerships and streamline lending processes. This platform indicates BOQ's commitment to technological infrastructure within its core competency areas.

Research and analysis resources appear limited based on available information, with no evidence of comprehensive market analysis tools, financial planning resources, or investment research capabilities. This aligns with BOQ's positioning as a traditional bank rather than a full-service financial advisory institution. The focus on mortgage lending suggests that available tools likely center around loan calculators, application processing systems, and basic banking utilities.

Educational resources and customer guidance materials are not prominently featured in available documentation, though this may reflect limited public visibility rather than absence of such materials. Banks typically provide financial literacy resources, but BOQ's specific educational offerings are not clearly documented.

Automation and digital banking capabilities appear basic, with user complaints about slow transfer processing suggesting that technological infrastructure may lag behind industry leaders. The contrast between efficient mortgage processing and slow general banking functions indicates uneven technological development across service areas.

Tools and Resources Score: 5/10 - Limited advanced tools with focus on core banking functions, lacking comprehensive financial resources.

Customer Service and Support Analysis

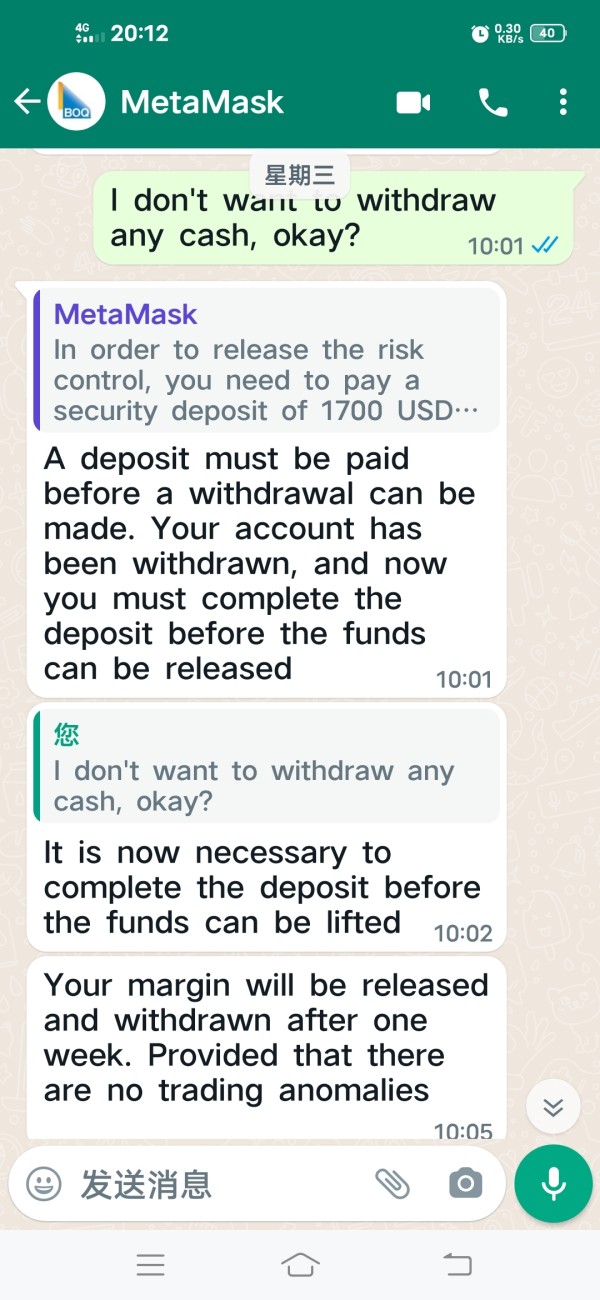

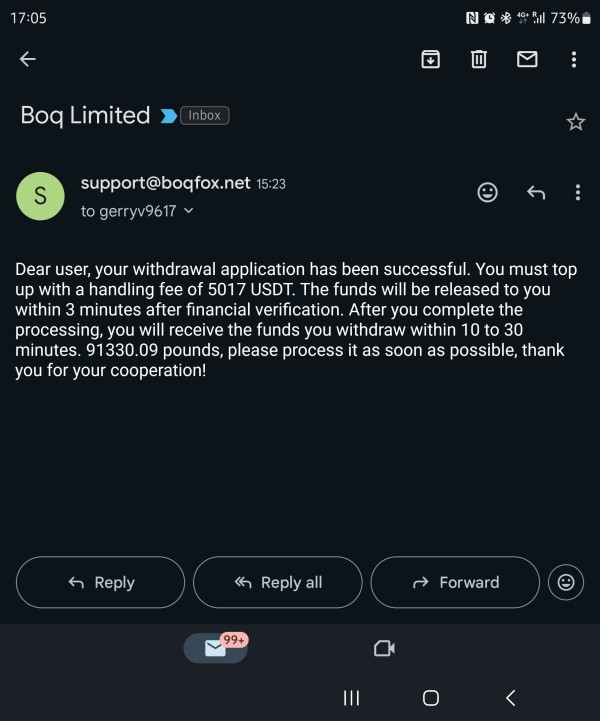

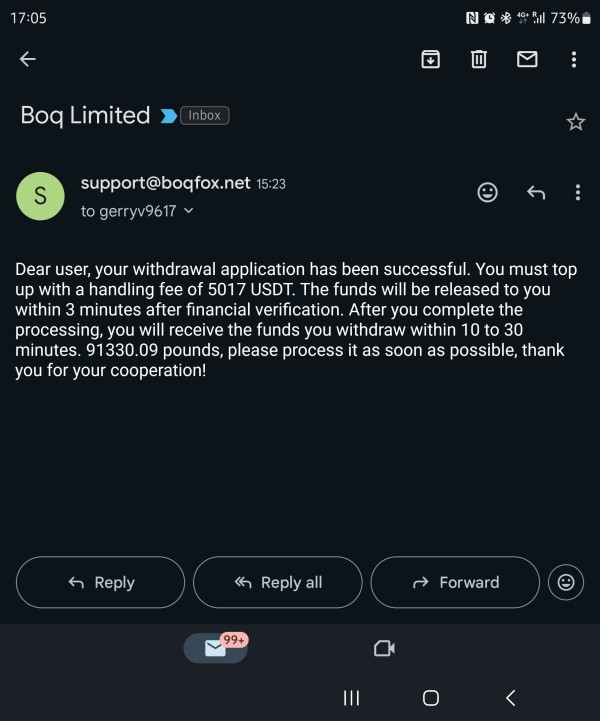

Customer service represents a significant concern area for BOQ based on available user feedback and documented experiences. Multiple user reports indicate substantial delays in service delivery, with one customer describing transfer processing as outdated and inefficient, comparing it humorously to "horse and cart" delivery methods. These complaints suggest systematic issues with service speed and responsiveness that impact customer satisfaction.

Response time concerns are particularly evident in fund transfer scenarios, where customers report extended delays even for internal BOQ account transfers. This indicates potential operational inefficiencies or outdated processing systems that fail to meet modern banking speed expectations. The contrast between instant transfer capabilities offered by competitors and BOQ's slower processing creates customer frustration.

Service quality varies dramatically depending on the service type, with mortgage applicants reporting excellent support experiences while general banking customers express dissatisfaction. This suggests that BOQ allocates premium service resources to its primary revenue-generating activities while potentially understaffing general customer support functions.

Communication channels and availability information are not clearly documented, making it difficult to assess the accessibility of customer support options. The lack of detailed customer service information may itself indicate communication challenges within the organization.

Problem resolution effectiveness appears inconsistent, with some customers reporting satisfactory outcomes while others express ongoing frustration with service delivery. This inconsistency suggests training or resource allocation issues within the customer service organization.

Customer Service Score: 4/10 - Significant service efficiency concerns with inconsistent quality across different banking functions.

Transaction Experience Analysis

BOQ's transaction experience presents perhaps the most concerning aspect of our evaluation, with multiple user reports highlighting significant delays and inefficiencies in fund processing. The most striking complaint involves transfers between BOQ accounts taking excessive time to complete, suggesting fundamental operational issues with transaction processing systems.

Platform stability and transaction speed appear problematic based on user feedback, with customers expressing shock at the slow pace of transfers in an era of instant digital transactions. This indicates that BOQ's technological infrastructure may require significant upgrades to meet contemporary banking standards and customer expectations.

Order execution quality, while not applicable in traditional trading terms, translates to transaction processing accuracy and timeliness in banking context. The documented delays suggest potential issues with both speed and reliability of transaction processing, creating customer dissatisfaction and operational concerns.

Mobile and digital banking experiences are not well-documented, though the general complaints about transaction speeds suggest that digital platforms may share the same underlying processing limitations. The absence of positive feedback about digital banking capabilities indicates potential weaknesses in user interface design or functionality.

Transaction environment reliability appears questionable based on user experiences, with customers reporting urgent fund access needs not being met due to processing delays. This creates significant trust issues and practical problems for customers requiring timely access to their funds.

Transaction Experience Score: 3/10 - This boq review identifies serious transaction processing delays that significantly impact user experience and banking efficiency.

Trust and Reliability Analysis

BOQ's trust and reliability assessment presents a complex picture, with the institution's status as an established Australian bank providing fundamental credibility while operational issues raise concerns about service reliability. As a regulated financial institution, BOQ operates under Australian banking supervision, providing basic regulatory protection for customers.

Regulatory compliance appears adequate given BOQ's continued operation as a licensed bank, though specific regulatory numbers and detailed compliance information are not readily available. The bank's public statements about strategic direction and operational focus suggest transparency in business communications, though detailed operational transparency could be improved.

Company transparency regarding service issues appears limited, with user complaints about service delays not being prominently addressed in public communications. This suggests potential communication gaps between customer experience and corporate messaging, which could impact trust development.

Industry reputation shows mixed signals, with BOQ maintaining its position as a recognized Australian bank while facing scrutiny regarding broker channel relationships and service delivery. The bank's strategic shifts have generated industry discussion, indicating active engagement with market dynamics but also creating uncertainty about future direction.

Fund security measures and customer protection protocols are presumably standard for Australian banking institutions, though specific security information is not detailed in available sources. The regulatory framework provides baseline protection, but additional security features are not prominently communicated.

Trust and Reliability Score: 6/10 - Established banking credentials offset by service delivery concerns and limited transparency about operational improvements.

User Experience Analysis

User experience with BOQ varies dramatically depending on the specific service utilized, creating a polarized customer satisfaction landscape. Mortgage applicants consistently report positive experiences, with one user specifically noting that "getting my home loan with BOQ was seamless" compared to other lenders. This indicates that BOQ has successfully optimized its core business processes for customer satisfaction.

Interface design and usability information for digital platforms is not well-documented, though the existence of the BOQ Broker Portal suggests investment in specialized user interfaces for professional users. Consumer-facing platform design and functionality details are not available for comprehensive evaluation.

Registration and verification processes appear efficient for mortgage applications based on user feedback, though general account opening experiences are not specifically documented. The positive mortgage application feedback suggests streamlined processes for the bank's primary business focus.

Fund management and account operation experiences present significant concerns, with users reporting frustration about transfer delays and processing inefficiencies. One customer expressed being "in dire need of funds" while experiencing delays with BOQ transfers, indicating serious practical impacts on user experience.

Common user complaints center on service speed and transaction processing delays, with customers expressing surprise at the slow pace of basic banking functions. These complaints suggest systematic user experience issues that extend beyond isolated incidents to operational patterns.

User demographic analysis suggests BOQ serves primarily mortgage-seeking customers effectively while struggling to meet expectations for general banking services. The bank appears optimized for specific user types rather than providing comprehensive banking excellence.

User Experience Score: 5/10 - Strong mortgage application experience offset by significant general banking service deficiencies.

Conclusion

This comprehensive boq review reveals Bank of Queensland as a specialized financial institution with distinct strengths in mortgage lending services contrasted by notable weaknesses in general banking operations. BOQ demonstrates excellence in its core competency of home loan processing, with users consistently reporting smooth mortgage application experiences that compare favorably to other lenders.

However, the bank's performance in general banking services raises significant concerns, particularly regarding transaction processing speeds and customer service responsiveness. The documented delays in fund transfers and user frustration with service efficiency suggest operational challenges that impact overall customer satisfaction.

BOQ appears most suitable for customers specifically seeking mortgage lending services, where the bank's expertise and streamlined processes provide genuine value. However, users requiring comprehensive banking services with modern transaction speeds and responsive customer support may find BOQ's offerings insufficient for their needs. Potential customers should carefully evaluate their specific banking requirements against BOQ's demonstrated strengths and weaknesses before committing to the institution's services.