Baxia Markets 2025 Review: Everything You Need to Know

Executive Summary

Baxia Markets has become a real forex broker in the trading world. This happened even though it doesn't have approval from top regulatory authorities like the UK's Financial Conduct Authority. This baxia markets review shows a broker that mainly serves retail investors who want easy access to forex and CFD trading with low barriers to entry.

The company started in 2020. Baxia Markets runs from two headquarters in the Bahamas and Seychelles, giving traders leverage up to 1:2000 and spreads starting from 0 pips. The broker supports many trading platforms including MetaTrader 4, MetaTrader 5, and WebTrader, giving access to different asset classes including forex, stocks, cryptocurrencies, and indices. With just a $50 USD minimum deposit, the platform positions itself as an entry-level option for new traders.

The broker uses STP (Straight Through Processing) and ECN (Electronic Communication Network) business models. It's regulated by the Seychelles Financial Services Authority (SFSA) and the Securities Commission of the Bahamas (SCB). However, user feedback shows mixed experiences, especially about deposit bonus safety and customer service quality, which hurts overall trader confidence and satisfaction levels.

Important Notice

Regional Entity Differences: Baxia Markets operates through different regional entities, which may result in varying levels of service, regulatory protection, and trading conditions depending on your jurisdiction. Traders should check which entity serves their region and understand the regulatory implications.

Review Methodology: This evaluation is based on publicly available information, regulatory filings, and user feedback collected from multiple sources. Individual trading experiences may vary, and traders should do their own research before making investment decisions.

Rating Framework

Broker Overview

Baxia Markets started in 2020. The company quickly found its place in the competitive forex brokerage world through its dual-jurisdiction approach. The company has headquarters in both Nassau, Bahamas, and Mahe, Seychelles, operating under a hybrid business model that combines Straight Through Processing (STP) and Electronic Communication Network (ECN) execution methods. This structure allows the broker to offer direct market access while keeping competitive pricing for its clients.

The broker's regulatory framework includes oversight from the Securities Commission of the Bahamas (SCB) and the Seychelles Financial Services Authority (SFSA). While these jurisdictions provide real regulatory oversight, they are considered lower-tier compared to major financial centers like the UK, EU, or Australia. This regulatory positioning shows the broker's focus on providing accessible trading services to retail investors who may not qualify for accounts with more strictly regulated brokers.

Baxia Markets offers complete trading solutions through industry-standard platforms including MetaTrader 4, MetaTrader 5, WebTrader, and dedicated mobile applications. The broker's asset coverage includes traditional forex pairs, individual stocks, major cryptocurrency instruments, and global indices. According to available information, the platform supports leverage ratios up to 1:2000, though this may vary based on asset class and regional regulations. This baxia markets review shows that the broker targets traders seeking flexible trading conditions with relatively low capital requirements.

Regulatory Jurisdictions: Baxia Markets operates under dual regulatory oversight from the Securities Commission of the Bahamas (SCB) and the Seychelles Financial Services Authority (SFSA), providing basic client protections within these jurisdictions.

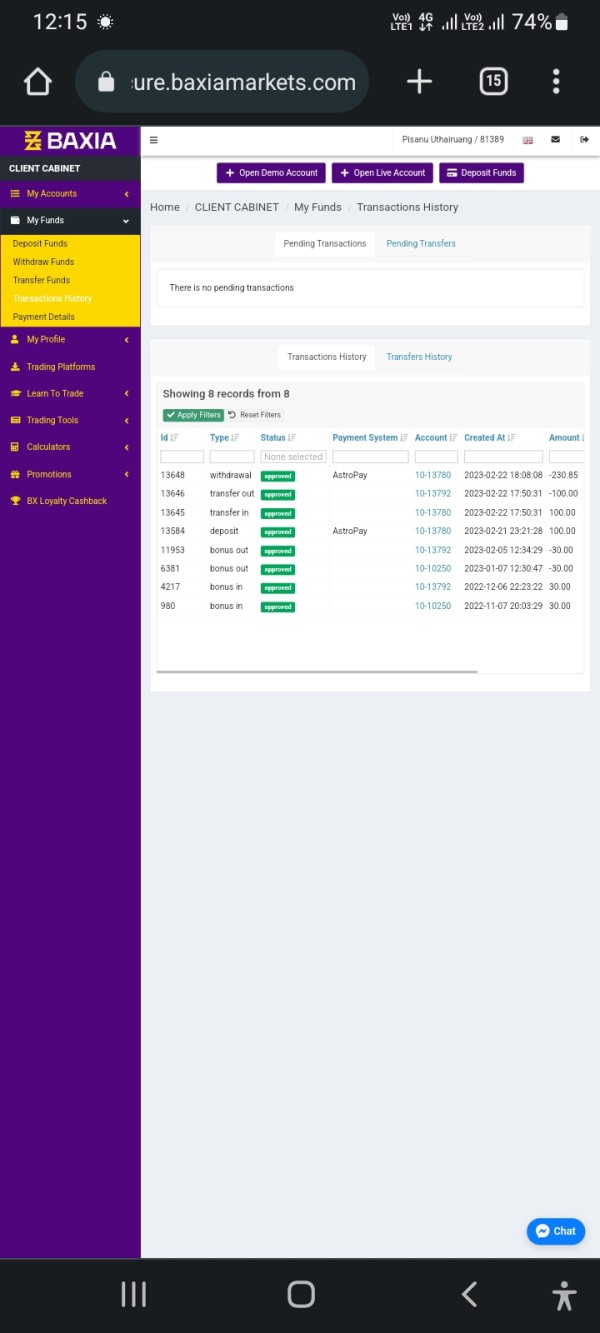

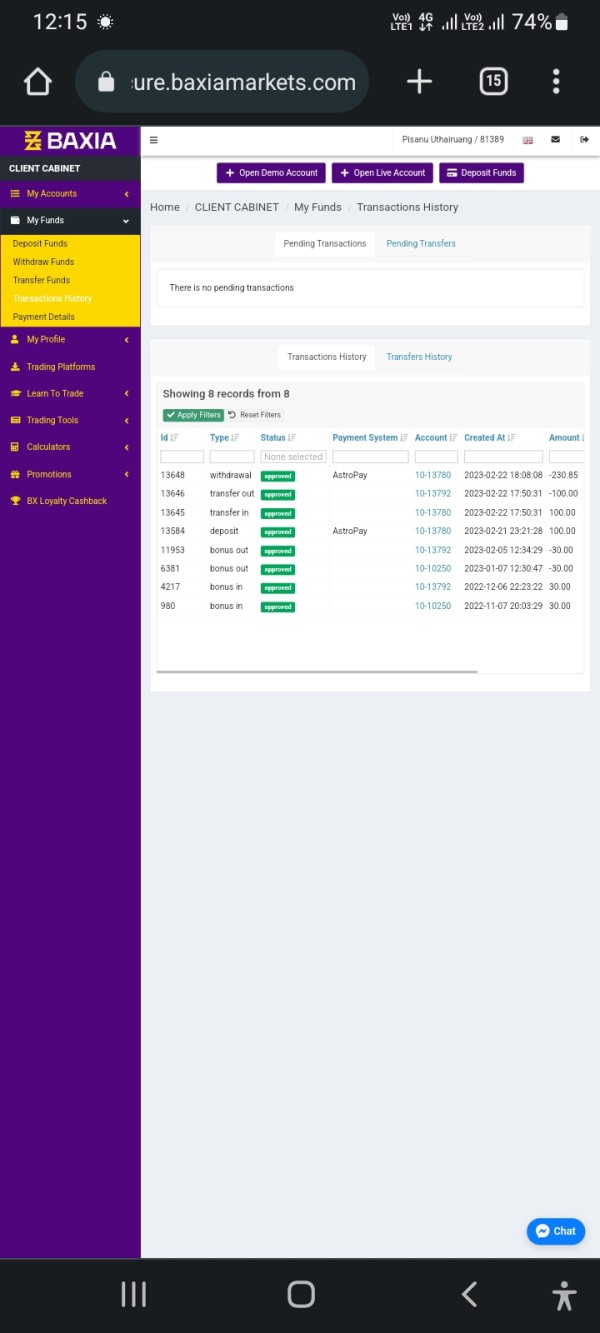

Deposit and Withdrawal Methods: Specific information about available deposit and withdrawal methods was not detailed in available sources, though standard industry options are typically supported.

Minimum Deposit Requirements: The broker keeps an accessible $50 USD minimum deposit requirement across account types, making it suitable for entry-level traders.

Bonus and Promotional Offers: User feedback shows concerns about deposit bonus safety and terms, with traders expressing uncertainty about bonus security in relation to capital preservation.

Available Trading Assets: The platform provides access to forex currency pairs, individual stocks, cryptocurrency instruments, and major global indices, offering diversified trading opportunities.

Cost Structure: Spreads begin from 0 pips according to available information, though specific commission structures and additional fees were not detailed in source materials.

Leverage Options: Maximum leverage extends up to 1:2000, though actual available leverage may depend on asset class, account type, and regional regulatory restrictions.

Platform Selection: Traders can choose from MetaTrader 4, MetaTrader 5, WebTrader, and mobile trading applications, providing flexibility across different trading preferences and devices.

Regional Restrictions: Specific geographical limitations were not detailed in available source materials.

Customer Support Languages: Information about supported languages for customer service was not specified in available sources.

This baxia markets review shows a broker focused on accessibility and flexibility, though some operational details require direct verification with the company.

Detailed Rating Analysis

Account Conditions Analysis (Score: 7/10)

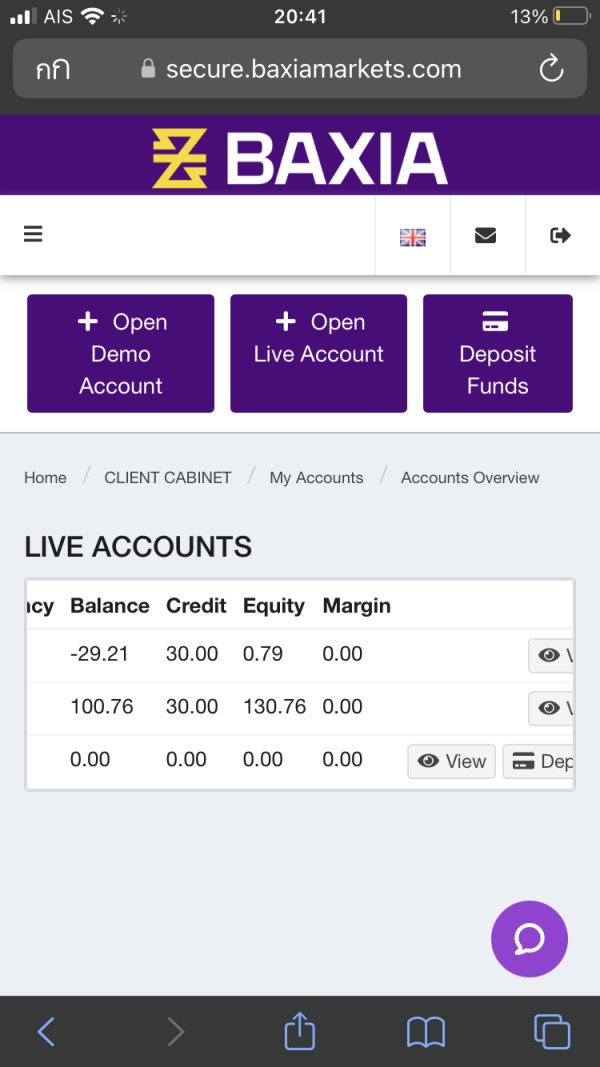

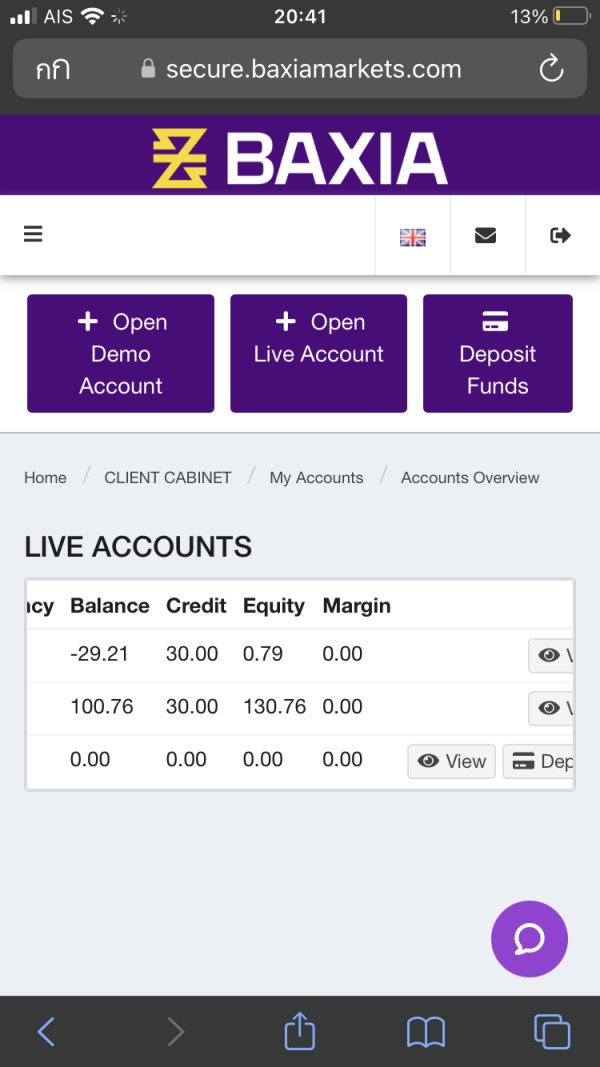

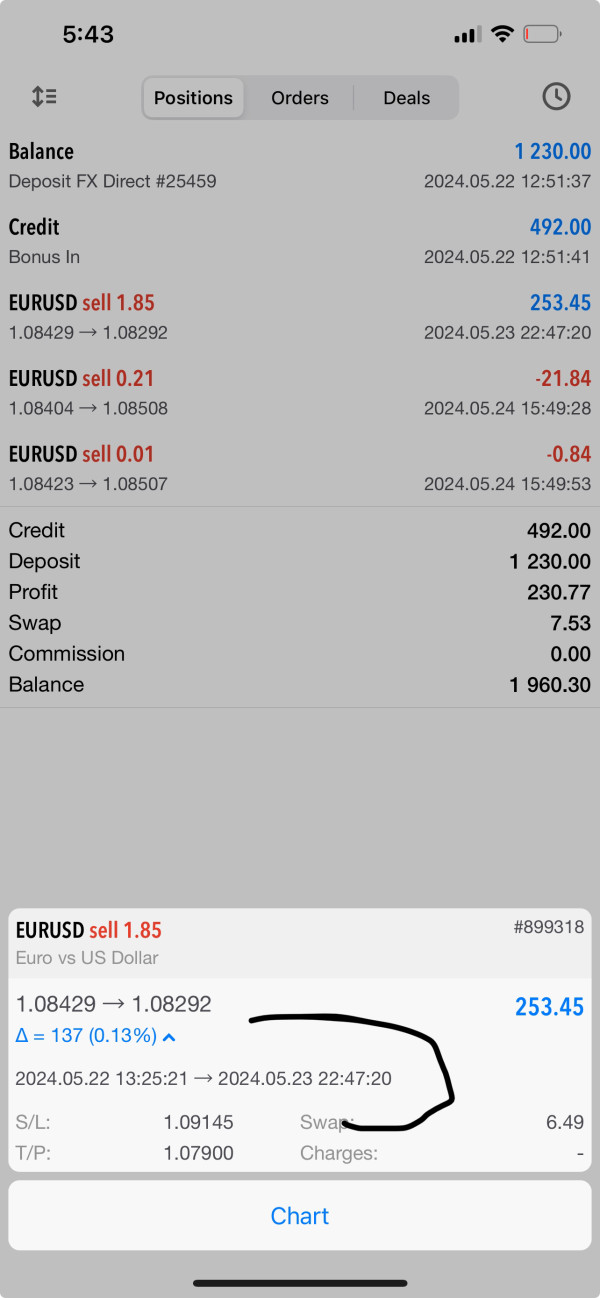

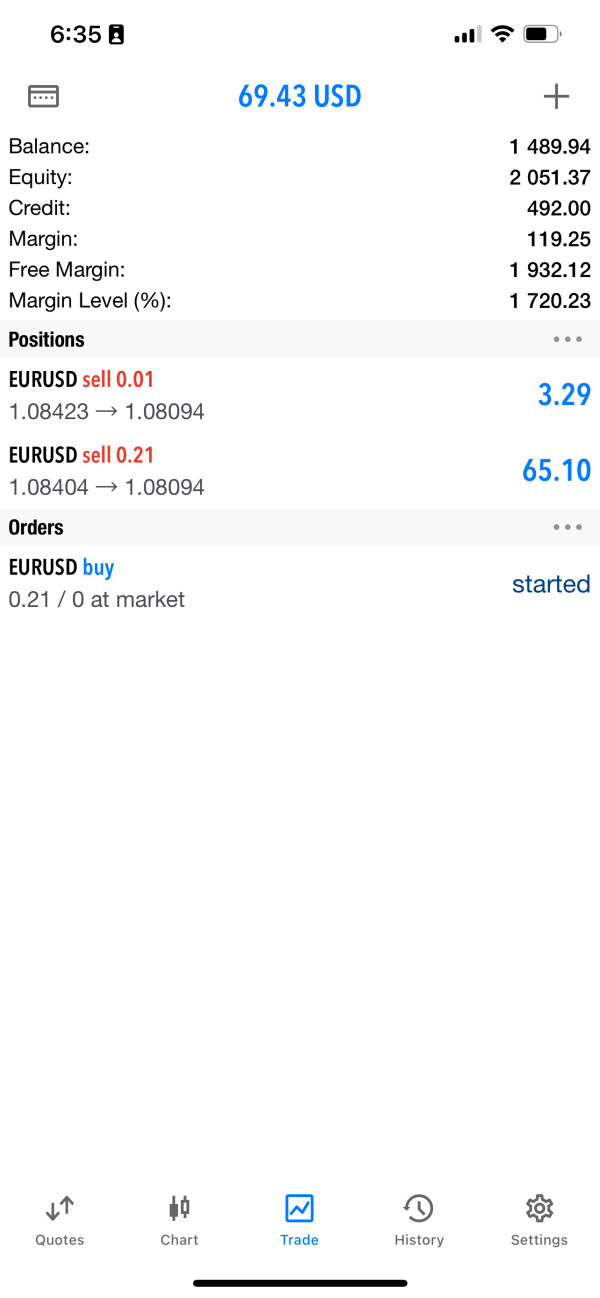

Baxia Markets shows strong accessibility through its account structure. The broker offers both Zero and Standard account types designed to accommodate different trading strategies and experience levels. The $50 USD minimum deposit requirement represents one of the more accessible entry points in the forex brokerage industry, making it particularly attractive for new traders or those with limited initial capital.

The Zero account type appears designed for traders who want low spread costs. The Standard account likely offers alternative pricing structures that may include wider spreads but potentially lower commission fees. This dual-account approach allows traders to select conditions that align with their trading frequency and volume preferences.

User feedback about account conditions has been generally positive. Traders appreciate the low barrier to entry and flexible account options. However, some users have expressed concerns about the terms and conditions surrounding promotional offerings, particularly deposit bonuses, which may affect overall account value propositions.

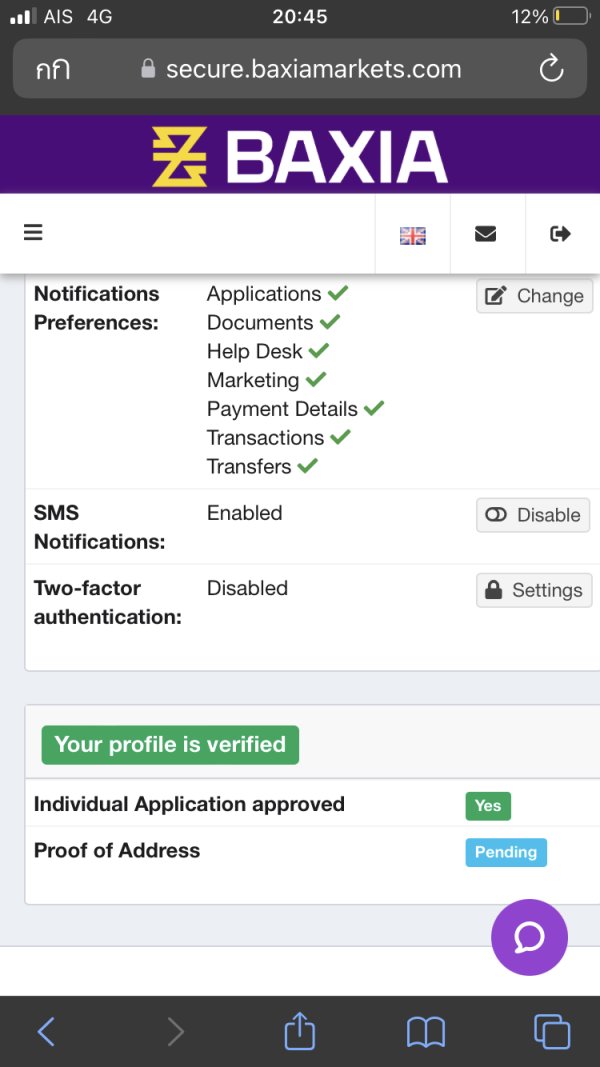

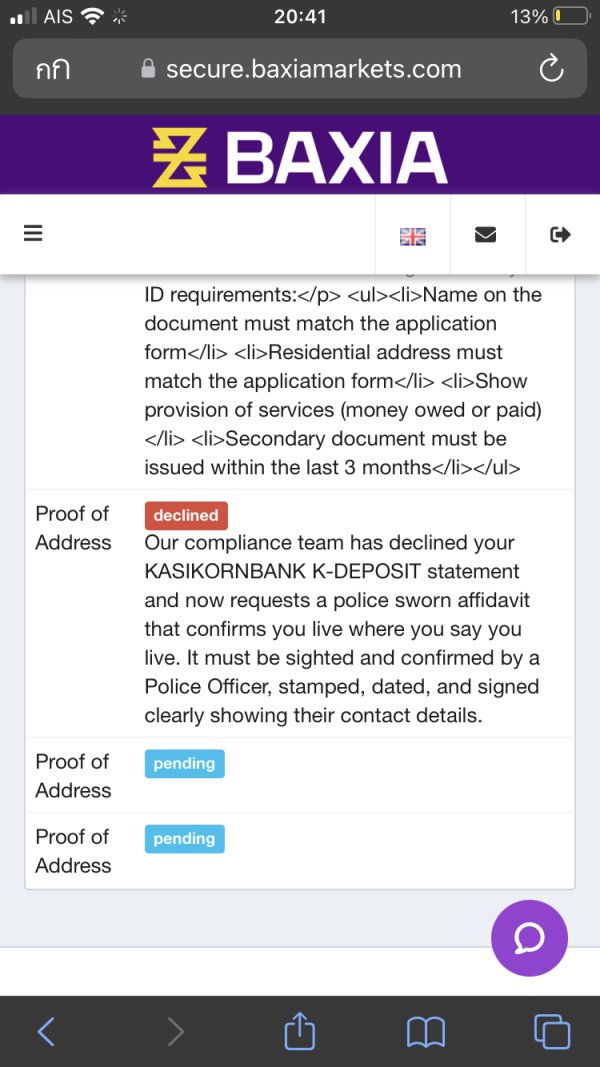

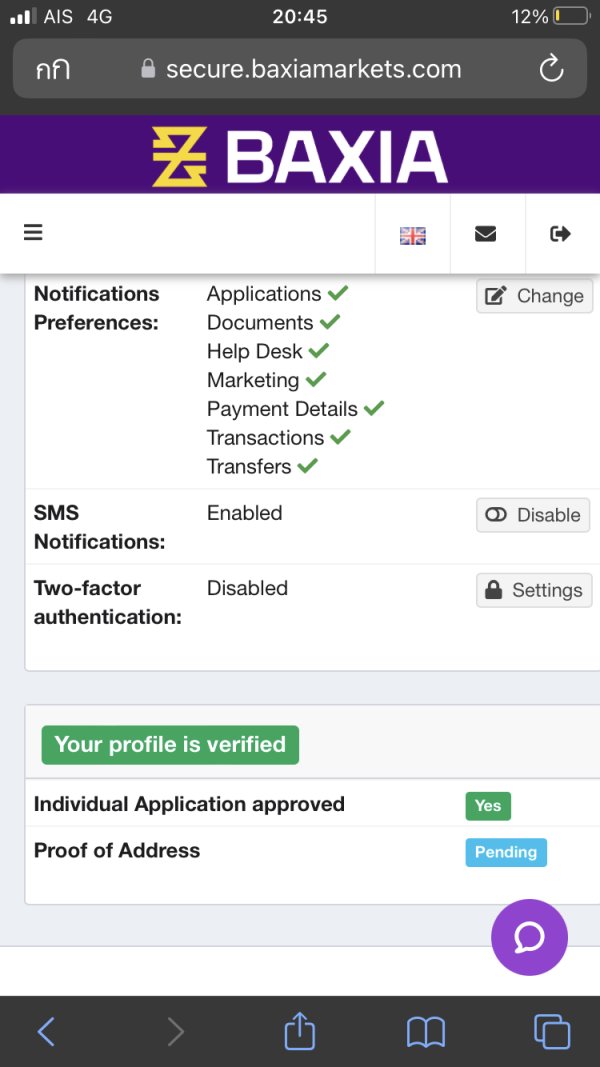

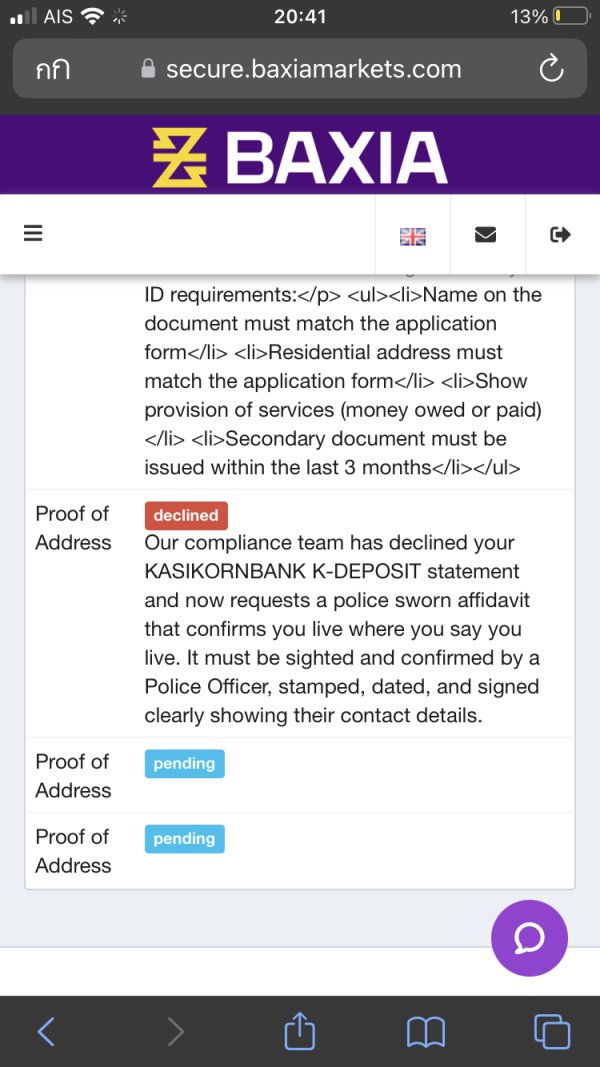

The account opening process appears streamlined, though specific verification timeframes and documentation requirements were not detailed in available sources. This baxia markets review suggests that while account conditions are competitive, traders should carefully review all terms, particularly those related to promotional offerings, before committing funds.

The broker's technology infrastructure centers around industry-standard platforms including MetaTrader 4 and MetaTrader 5. Both platforms are recognized for their comprehensive charting capabilities, technical analysis tools, and automated trading support. The addition of WebTrader functionality ensures accessibility across different devices without requiring software downloads, while dedicated mobile applications provide on-the-go trading capabilities.

According to available information, the platform supports various technical indicators, charting tools, and market analysis resources typically expected from modern trading platforms. The multi-platform approach allows traders to maintain consistency in their trading environment whether accessing markets from desktop or mobile devices.

User feedback shows positive experiences with platform stability and functionality. However, specific details about additional research resources, educational materials, or advanced analytical tools were not comprehensively covered in source materials. The support for automated trading through Expert Advisors (EAs) on MetaTrader platforms adds value for traders interested in algorithmic trading strategies.

The broker's tool suite appears well-suited for both manual and automated trading approaches. However, traders seeking extensive educational resources or advanced research capabilities may need to supplement with third-party tools.

Customer Service and Support Analysis (Score: 6/10)

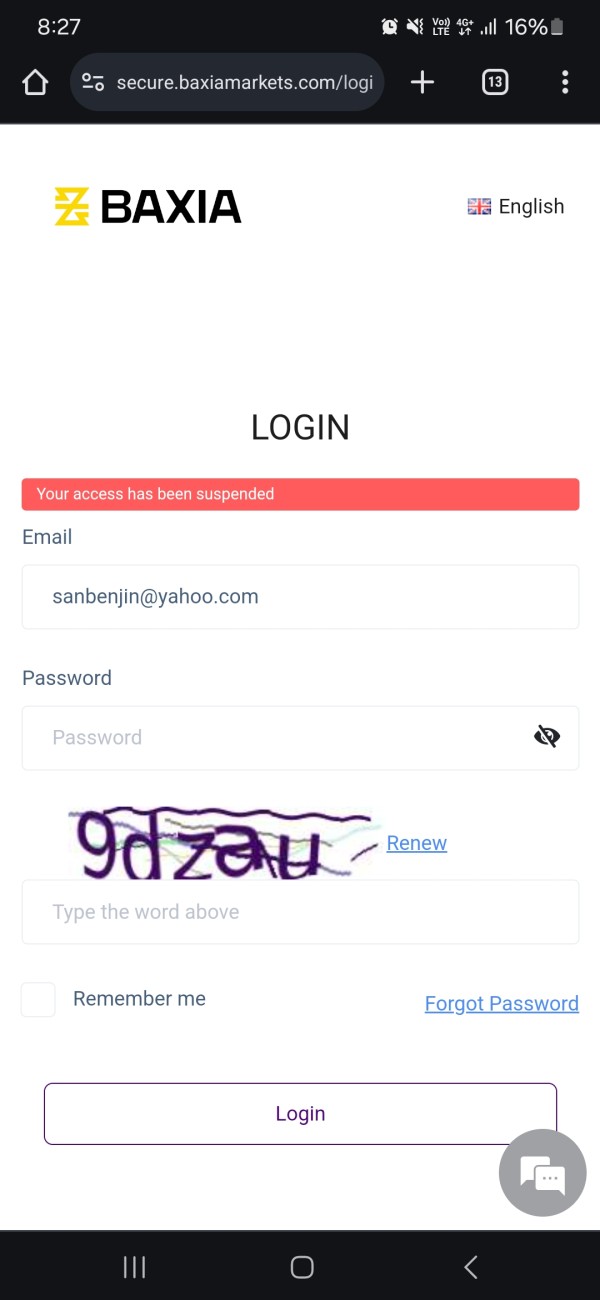

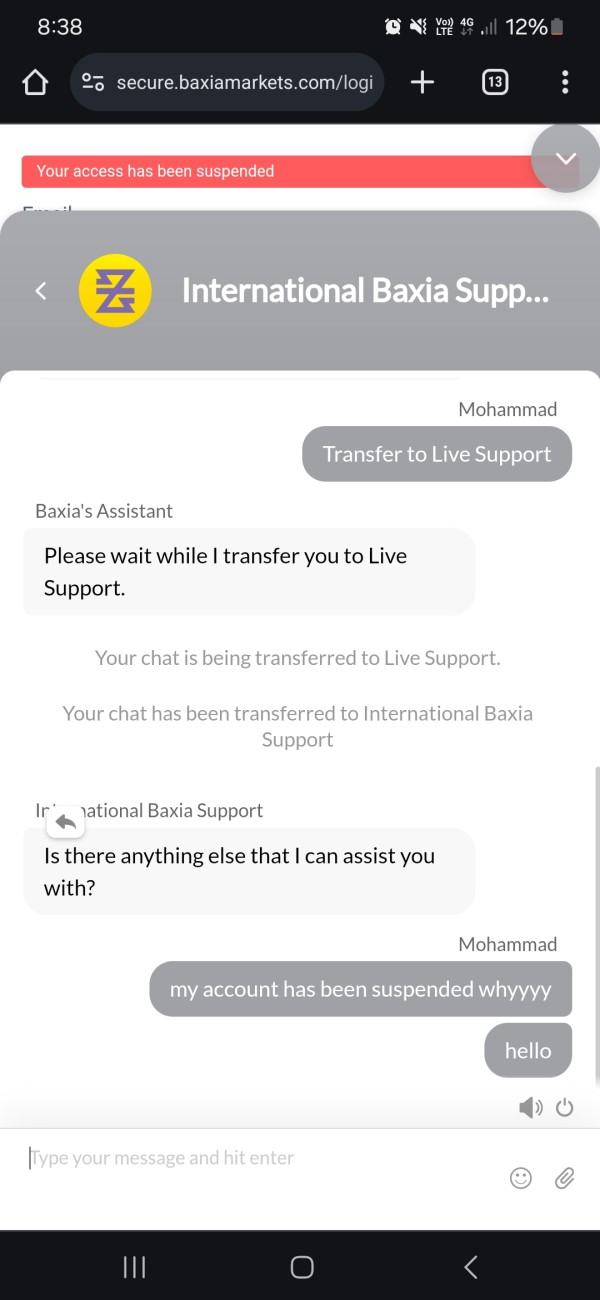

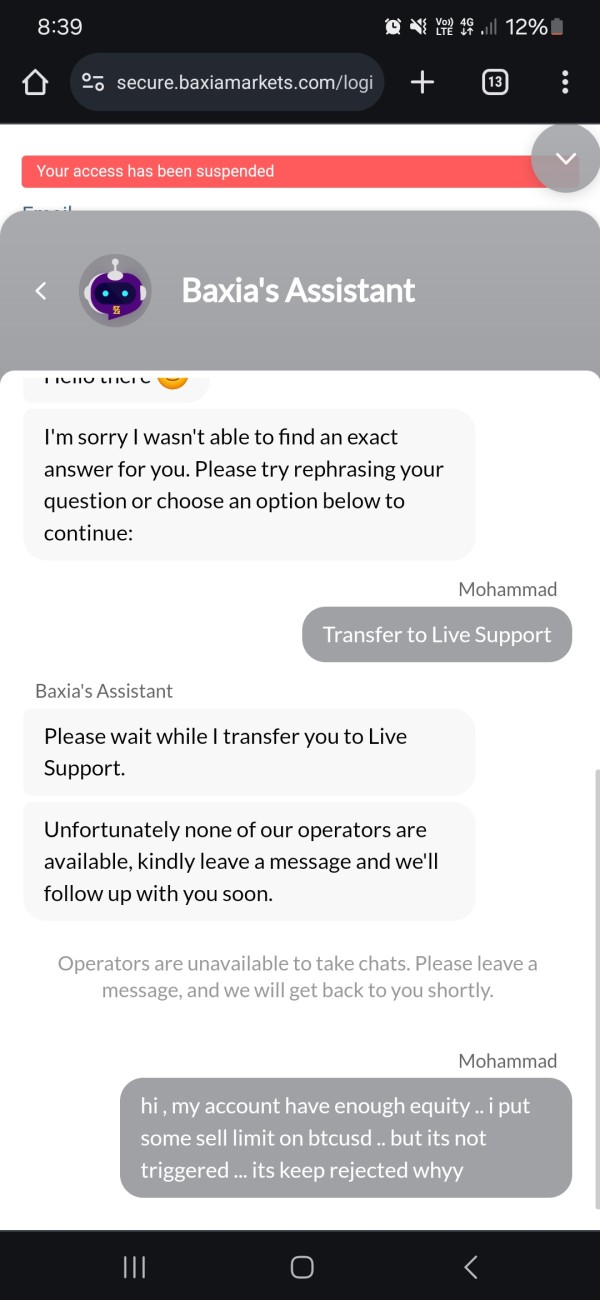

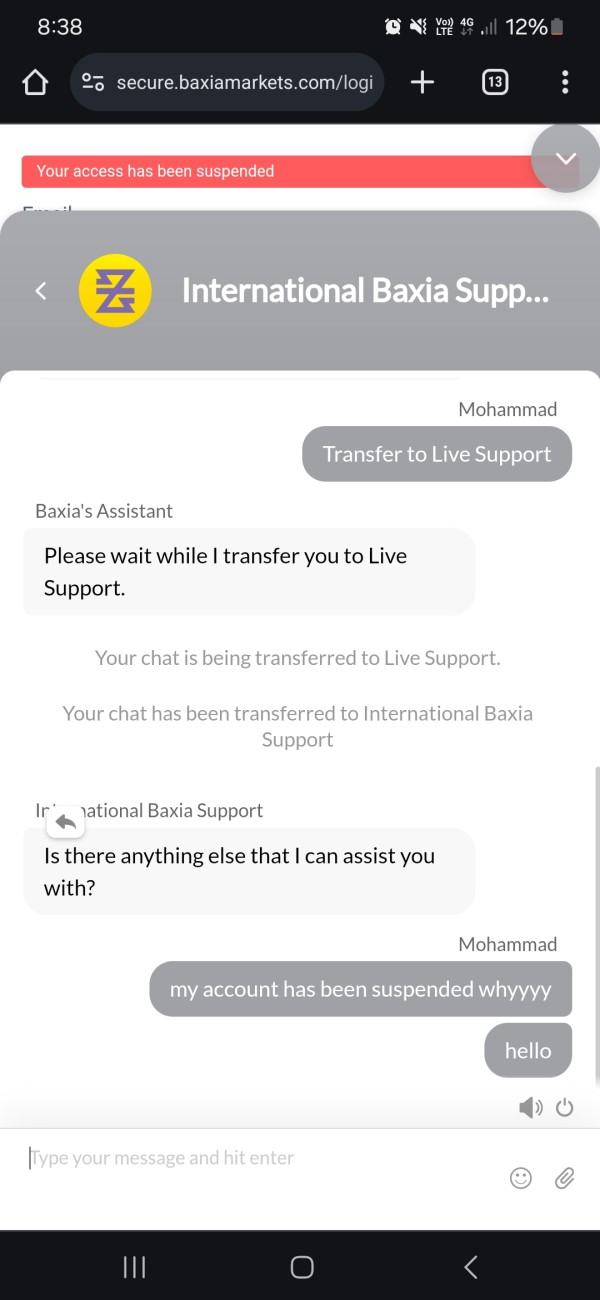

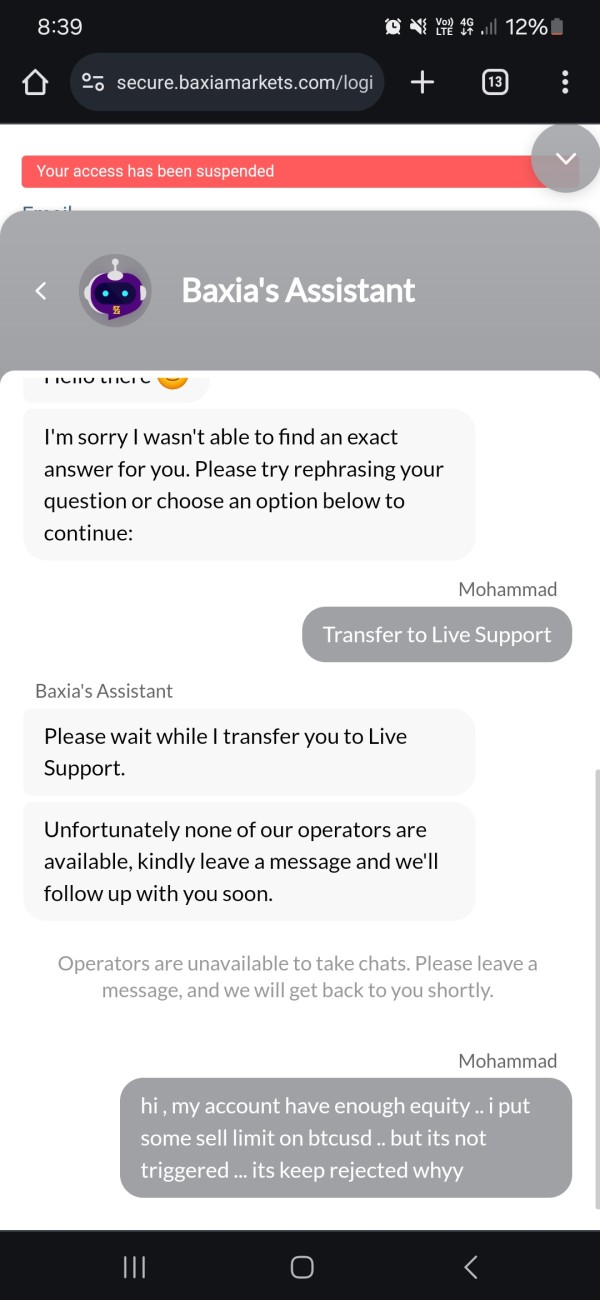

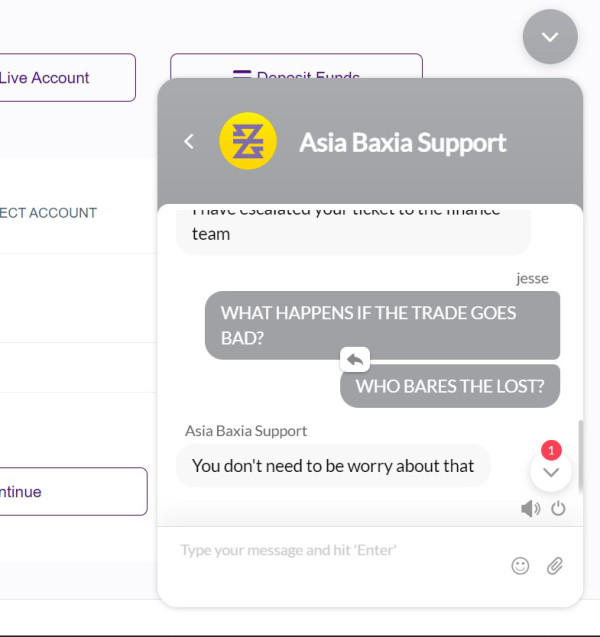

Customer service represents an area where Baxia Markets shows room for improvement based on available user feedback. While specific support channels and availability hours were not detailed in source materials, user experiences suggest mixed satisfaction levels with response times and service quality.

Some traders have reported longer-than-expected response times when seeking assistance, particularly regarding account-related inquiries and technical support issues. The quality of support interactions appears inconsistent, with some users receiving satisfactory assistance while others express frustration with problem resolution processes.

Language support options and regional availability of customer service were not specified in available sources. This may impact accessibility for international traders. The lack of detailed information about support channels (live chat, phone, email) and operating hours represents a transparency gap that could affect user confidence.

Given the broker's focus on retail traders, many of whom may be new to forex trading, comprehensive and responsive customer support is crucial for user satisfaction and retention. Current feedback suggests this area requires attention to meet user expectations effectively.

Trading Experience Analysis (Score: 7/10)

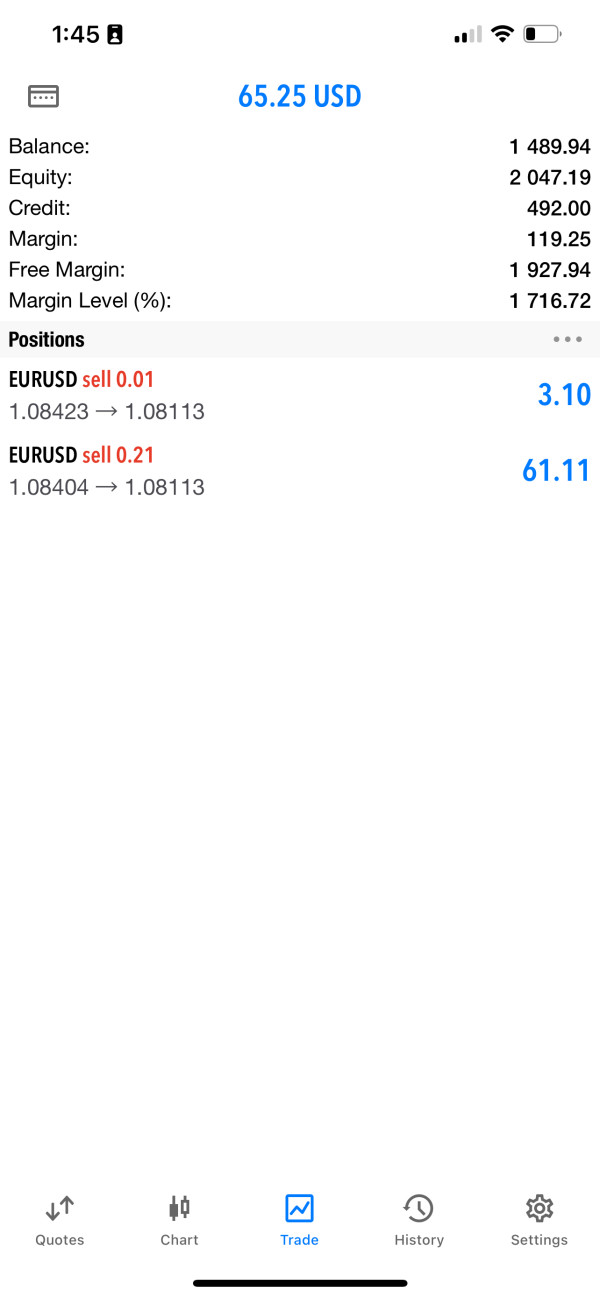

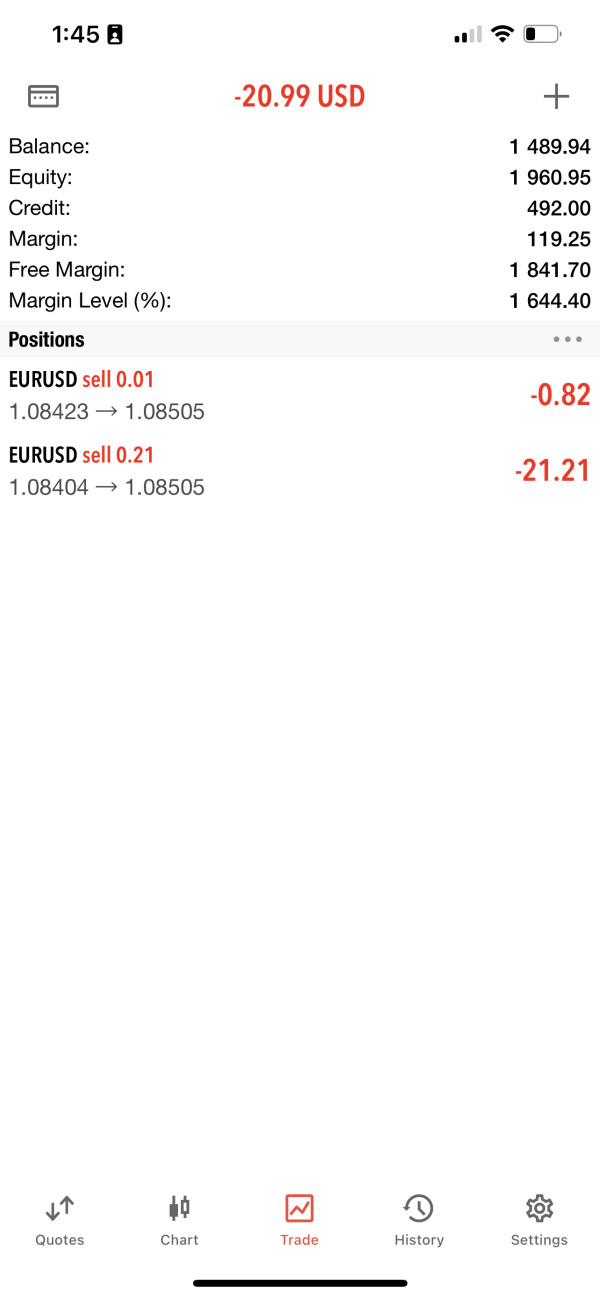

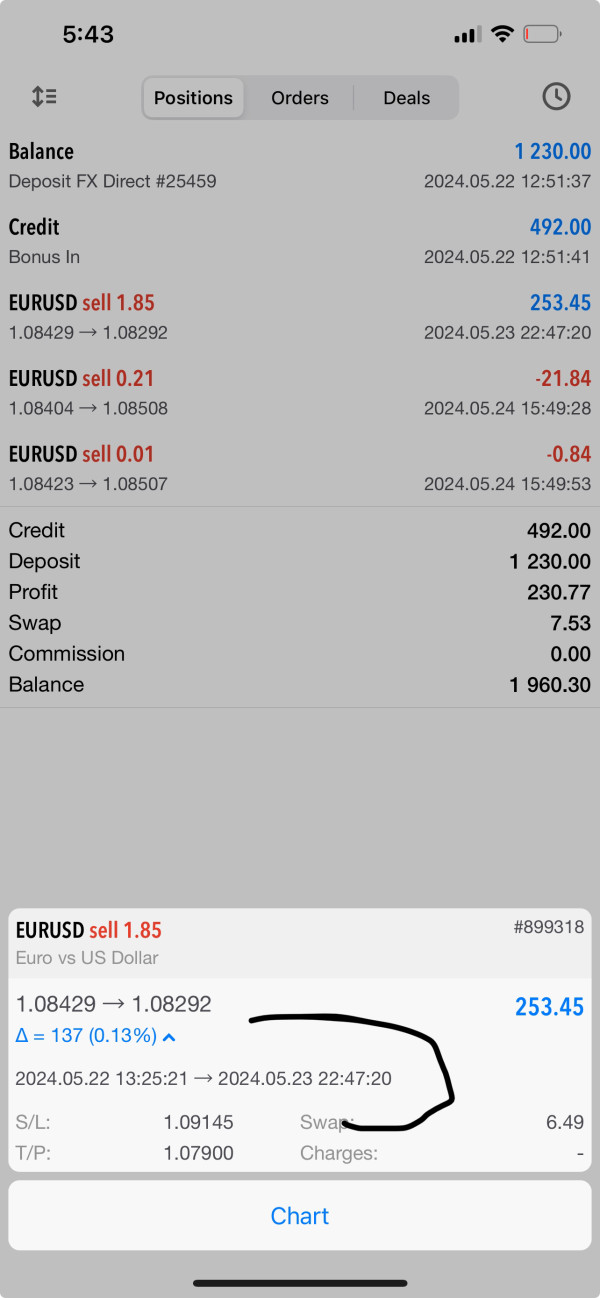

User feedback about the actual trading experience with Baxia Markets has been generally positive. Traders report stable platform performance and competitive execution conditions. The availability of spreads starting from 0 pips, combined with the high leverage options up to 1:2000, provides flexibility for different trading strategies and capital levels.

Platform stability appears satisfactory based on user reports. There are minimal complaints about system downtime or technical disruptions during trading hours. The execution quality receives positive mentions from users, suggesting that order processing and slippage management meet reasonable expectations for the broker's market positioning.

The multi-platform environment allows traders to maintain consistent experiences across different devices. This is particularly valuable for active traders who require mobility. The support for both manual and automated trading strategies through MetaTrader platforms adds versatility to the trading experience.

However, some users have expressed concerns about certain operational aspects, particularly related to promotional terms and conditions, which can impact overall trading satisfaction. This baxia markets review shows that while the core trading functionality performs well, peripheral services may require improvement to enhance overall user experience.

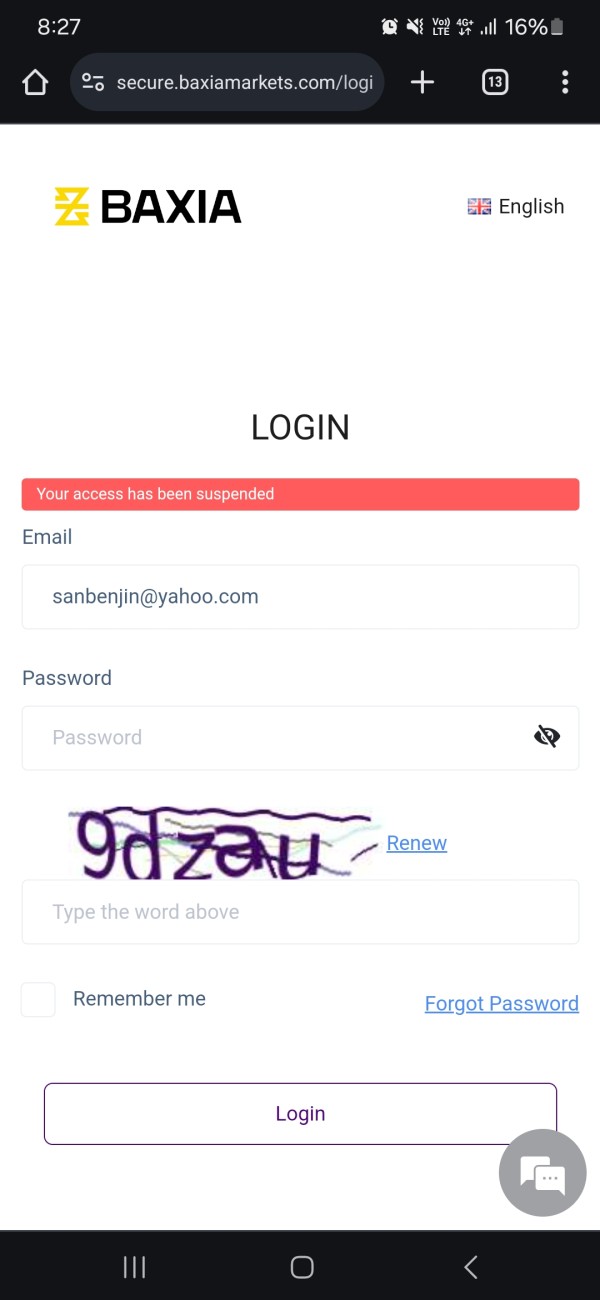

Trust and Safety Analysis (Score: 5/10)

Trust and safety represent significant considerations for Baxia Markets, particularly given its regulatory positioning under lower-tier jurisdictions. While the broker maintains legitimate regulatory oversight through the Securities Commission of the Bahamas (SCB) and the Seychelles Financial Services Authority (SFSA), these authorities provide less comprehensive investor protection compared to major financial centers.

User concerns about deposit bonus safety and terms indicate transparency issues that affect trader confidence. Some users have specifically questioned the security of promotional funds and their relationship to overall capital protection, suggesting unclear or concerning terms and conditions in these areas.

The absence of authorization from major regulatory authorities like the FCA, ASIC, or CySEC limits the level of investor protection available to traders. While this doesn't necessarily indicate illegitimate operations, it does mean that dispute resolution options and compensation schemes may be more limited compared to brokers under higher-tier regulation.

Company transparency about financial reports, management information, and operational procedures appears limited based on available public information. This lack of comprehensive disclosure can impact user confidence, particularly for traders considering larger deposits or long-term relationships with the broker.

User Experience Analysis (Score: 6/10)

Overall user experience with Baxia Markets shows mixed results. Satisfaction levels vary significantly among different user groups. New traders often appreciate the low minimum deposit and accessible platform options, while more experienced traders may have higher expectations regarding service quality and operational transparency.

The platform interface receives generally positive feedback for user-friendliness and navigation. However, some users report longer-than-expected verification processes during account opening. The multi-platform approach allows users to find trading environments that suit their preferences and technical requirements.

Deposit and withdrawal experiences show varied feedback. Some users report smooth processes while others encounter delays or complications. The concerns about promotional terms and conditions particularly impact new users who may be attracted by deposit bonuses but later discover restrictive conditions.

User complaints frequently center around customer service responsiveness and clarity of terms and conditions, particularly regarding promotional offerings. These issues can significantly impact overall satisfaction, especially for traders who encounter problems requiring support assistance.

The broker appears most suitable for traders who prioritize low entry barriers and basic trading functionality over comprehensive service and high-level regulatory protection.

Conclusion

This baxia markets review shows a broker that successfully addresses the needs of entry-level traders through accessible account conditions and competitive trading terms. However, it faces challenges in areas crucial for building long-term trader relationships. The combination of low minimum deposits, high leverage options, and multiple platform choices creates an attractive proposition for new traders seeking flexible market access.

However, concerns about regulatory oversight, customer service quality, and promotional term transparency limit the broker's appeal to more experienced traders or those prioritizing comprehensive investor protection. The mixed user feedback, particularly around deposit bonus safety and service responsiveness, suggests that while basic trading functionality performs adequately, peripheral services require improvement.

Baxia Markets appears best suited for retail investors who prioritize low-cost market entry and are comfortable with lower-tier regulatory oversight. Traders seeking premium service levels and maximum investor protection may find better alternatives among more established, highly-regulated brokers.