Regarding the legitimacy of BAXIA MARKETS forex brokers, it provides FSA, SCB and WikiBit, .

Is BAXIA MARKETS safe?

Pros

Cons

Is BAXIA MARKETS markets regulated?

The regulatory license is the strongest proof.

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

Baxia Global Ltd

Effective Date:

--Email Address of Licensed Institution:

compliance@baxiamarkets.comSharing Status:

No SharingWebsite of Licensed Institution:

https://baxiamarkets.com/en/Expiration Time:

--Address of Licensed Institution:

CT House, Office 5E, Providence, Mahe, SeychellesPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

SCB Derivatives Trading License (MM)

The Securities Commission of The Bahamas

The Securities Commission of The Bahamas

Current Status:

RevokedLicense Type:

Derivatives Trading License (MM)

Licensed Entity:

Baxia Limited

Effective Date: Change Record

--Email Address of Licensed Institution:

ltinker@thebayshoregroup.org, nwadud@baxiamarkets.com, admin@baxiamarkets.comSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

Capital Union Bank Financial Centre, Western Road, Lyford Cay, Nassau, BahamasPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Baxia Markets A Scam?

Introduction

Baxia Markets is a relatively new player in the forex trading arena, having been established in 2020. The broker operates from the Bahamas and Seychelles, offering a range of trading services that include forex, commodities, and indices. As trading in the forex market can involve significant risks, it is crucial for traders to carefully evaluate the brokers they choose to work with. This includes assessing their regulatory status, trading conditions, and overall reputation. In this article, we will delve into an exhaustive analysis of Baxia Markets, utilizing various sources and criteria to determine its legitimacy and safety for traders.

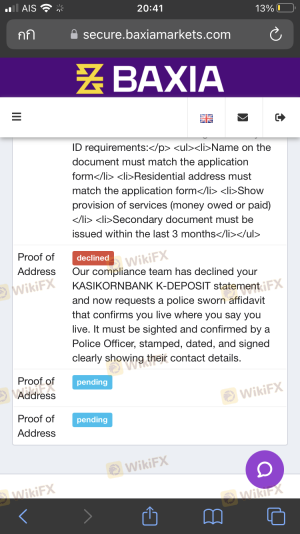

Regulation and Legality

The regulatory status of a forex broker is one of the most critical factors that traders should consider. A well-regulated broker provides a level of security and oversight that can help protect traders' funds. In the case of Baxia Markets, it claims to be regulated by two offshore authorities: the Financial Services Authority (FSA) of Seychelles and the Securities Commission of the Bahamas (SCB). Below is a summary of the regulatory information:

| Regulatory Authority | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| FSA | SD 104 | Seychelles | Verified |

| SCB | SIA-F 234 | Bahamas | Verified |

While Baxia Markets is indeed regulated, it is important to note that both the FSA and SCB are considered tier-3 regulators, which means they have less stringent requirements compared to tier-1 regulators like the FCA or ASIC. This raises concerns about the level of investor protection provided. For instance, there is no investor compensation scheme in place to safeguard traders' funds in case of broker insolvency, which is a standard requirement for brokers regulated by tier-1 authorities.

Moreover, the history of compliance with regulations is another crucial aspect. Although Baxia Markets has not been reported for any major violations since its inception, the lack of stringent oversight from reputable regulatory bodies may pose risks for traders. It is advisable for potential clients to be cautious and consider these factors when deciding whether to engage with this broker.

Company Background Investigation

Baxia Markets was founded with the aim of providing a trustworthy trading environment for forex traders. The company is owned by Baxia Limited and Baxia Global Limited, which are registered in the Bahamas and Seychelles, respectively. The management team comprises professionals with experience in the financial markets, although specific details about their backgrounds are limited.

The transparency of a broker is vital for building trust, and Baxia Markets presents itself as a transparent entity. However, the availability of information regarding its ownership structure and management team is somewhat lacking. This could be a red flag for potential traders who value transparency and accountability in their brokers.

The broker claims to prioritize customer service and has garnered a considerable client base, reportedly over 70,000 accounts worldwide. Nonetheless, the rapid growth of client accounts does not necessarily equate to reliability or trustworthiness, especially for a broker that has only been operational for a few years.

Trading Conditions Analysis

Baxia Markets offers two main types of trading accounts: the BX Zero and BX Standard accounts. Each account type has its own fee structure and trading conditions, which can significantly impact a trader's profitability.

The overall fee structure at Baxia Markets is competitive, but it is essential to scrutinize the details:

| Fee Type | Baxia Markets | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 0.0 - 1.0 pips | 0.5 - 1.0 pips |

| Commission Model | $7 per lot | $3 - $5 per lot |

| Overnight Interest Range | Varies | Varies |

The BX Zero account is designed for active traders and scalpers, offering raw spreads but with a commission of $7 per lot. On the other hand, the BX Standard account provides a spread starting from 1 pip with no additional commission. This flexibility allows traders to choose an account type that best suits their trading style.

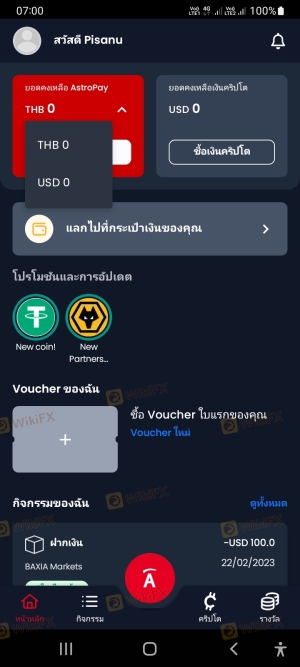

However, there are concerns regarding the transparency of the commission structure and any potential hidden fees that could affect overall trading costs. Some reviews indicate that traders have experienced issues with withdrawal fees and processing times, which could be problematic for those looking to access their funds quickly.

Client Funds Security

The safety of client funds is paramount in the trading industry. Baxia Markets claims to keep client funds in segregated accounts, which is a standard practice among reputable brokers. This means that client funds are kept separate from the brokers operational funds, thereby providing a layer of protection in case of financial difficulties.

However, it is crucial to note that Baxia Markets does not offer negative balance protection, which is a significant risk factor for traders. Without this safeguard, traders could potentially lose more than their initial investment, especially when trading with high leverage.

Historically, there have been no major incidents reported regarding the security of client funds at Baxia Markets, but the lack of robust regulatory oversight raises concerns about the broker's overall commitment to safeguarding client assets.

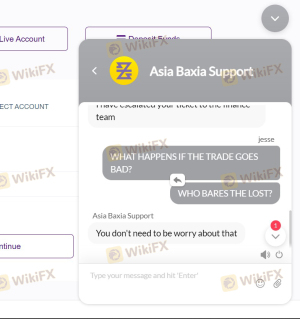

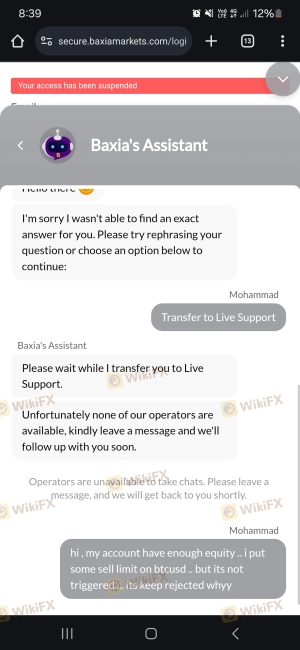

Customer Experience and Complaints

Analyzing customer feedback is essential for understanding the overall reputation of a broker. Baxia Markets has received mixed reviews from its clients. While some traders report positive experiences, others have raised concerns about withdrawal issues and customer service responsiveness.

Common complaints include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Account Suspension | Medium | Unresolved issues |

| Poor Customer Support | High | Inconsistent |

For instance, one user reported difficulties in withdrawing profits, claiming that the broker imposed unreasonable conditions that prevented access to their funds. Additionally, there are reports of slow response times from customer support, which can exacerbate frustrations for traders facing issues.

These complaints highlight the importance of considering customer service quality when choosing a broker, as a responsive and helpful support team can significantly enhance the trading experience.

Platform and Trade Execution

Baxia Markets provides access to popular trading platforms, including MetaTrader 4 and MetaTrader 5. These platforms are known for their user-friendly interfaces and advanced trading features. However, the performance of the trading platforms is crucial for successful trading.

Traders have reported varying experiences with order execution quality. While some users praise the fast execution speeds, others have mentioned instances of slippage and order rejections. Such issues can be detrimental, especially for scalpers who rely on precision and speed.

Additionally, there are concerns about potential platform manipulation, which can lead to unfair trading conditions. Traders should remain vigilant and monitor their trading activity closely to identify any irregularities.

Risk Assessment

Engaging with Baxia Markets involves several risks that traders should be aware of. The following risk assessment summarizes key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Offshore regulation may lack sufficient oversight. |

| Fund Security | High | No negative balance protection and limited investor protection. |

| Withdrawal Issues | High | Reports of delayed withdrawals and unclear fee structures. |

| Platform Reliability | Medium | Mixed reviews on execution quality and potential manipulation. |

To mitigate these risks, traders should approach their engagement with Baxia Markets cautiously. It is advisable to start with a demo account to test the platform and trading conditions without risking real money. Additionally, traders should implement strict risk management strategies to protect their capital.

Conclusion and Recommendations

In conclusion, while Baxia Markets is not outright a scam, it does present several red flags that potential traders should consider. The broker is regulated by tier-3 authorities, which may not provide the same level of protection as more reputable regulators. Furthermore, there have been numerous complaints regarding withdrawal issues and customer service responsiveness.

For traders who prioritize security and regulatory oversight, it may be wise to explore alternatives that are regulated by tier-1 authorities, such as FCA or ASIC. Brokers like AvaTrade, FP Markets, and IC Markets offer robust regulatory frameworks, excellent customer support, and a wider range of trading instruments.

Ultimately, traders should conduct thorough due diligence and carefully weigh the risks before deciding to engage with Baxia Markets.

Is BAXIA MARKETS a scam, or is it legit?

The latest exposure and evaluation content of BAXIA MARKETS brokers.

BAXIA MARKETS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

BAXIA MARKETS latest industry rating score is 3.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 3.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.