eplanet brokers ltd 2025 Review: Everything You Need to Know

Executive Summary

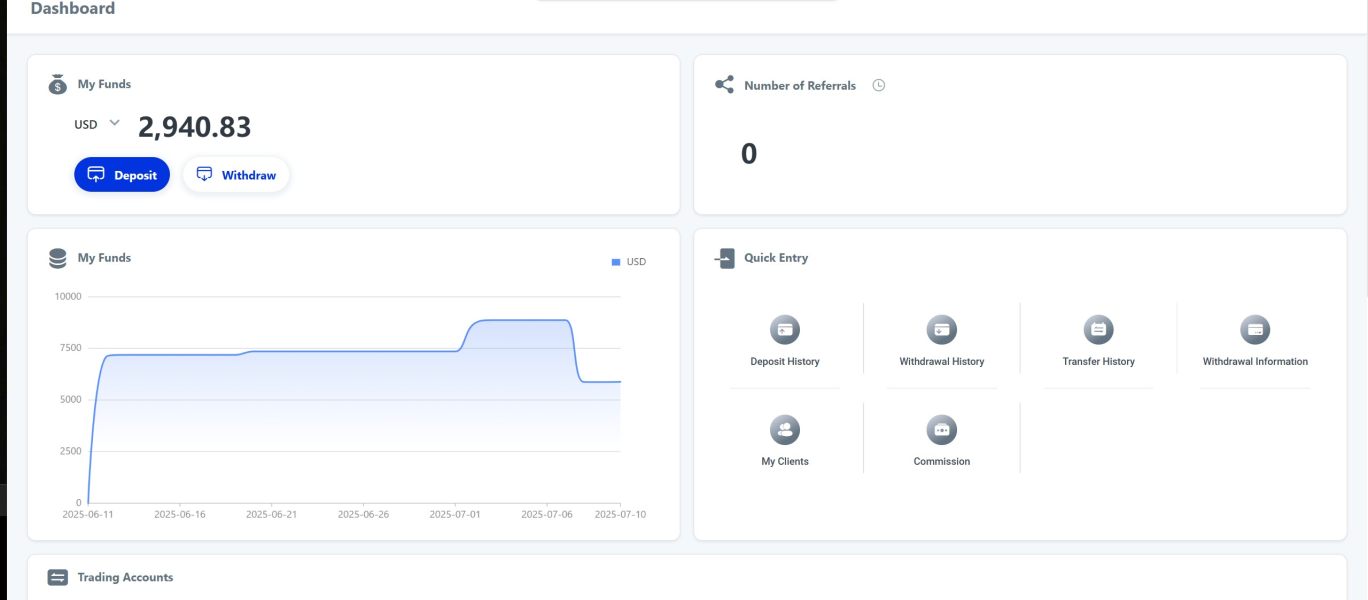

This eplanet brokers ltd review gives you a complete look at this new online trading platform that started in 2022. Based on user feedback and regulatory information, eplanet brokers ltd gets a neutral overall assessment that shows both promise and concerns. The broker shows potential as a newcomer in online trading, but it lacks advanced tools and educational resources that experienced traders need.

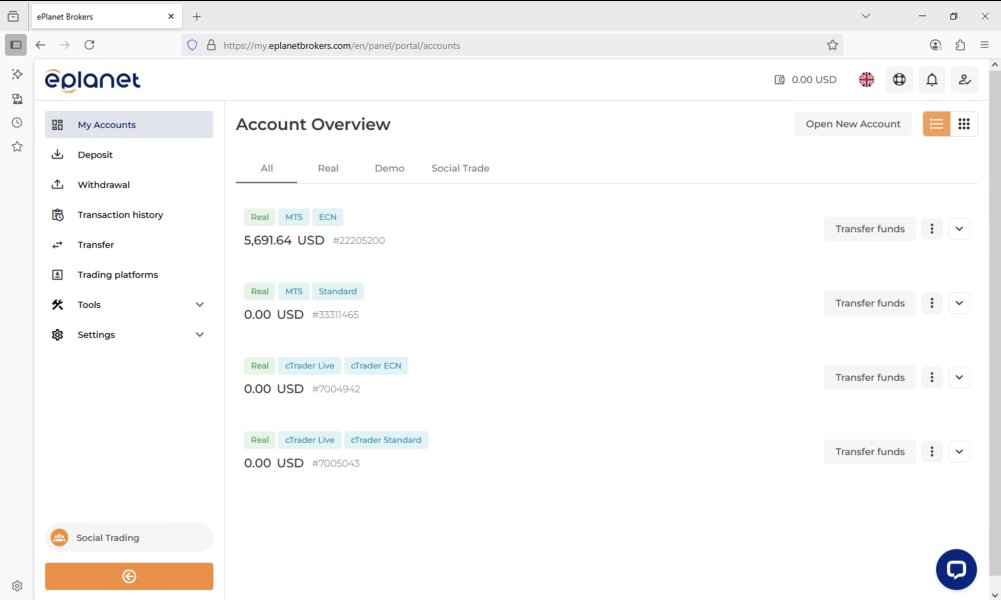

Key highlights from our review include a 4-star user rating that shows the platform works well for beginners. The broker also has responsive customer service that users like. eplanet brokers ltd uses the cTrader platform and offers many trading options including forex, commodities, metals, stock indices, stocks, energy, and cryptocurrencies.

Target audience positioning clearly focuses on new traders and users who want simple trading experiences without complex features. However, you should know that 66% of retail investors lose money when trading CFDs with this provider, which matches industry-wide risk patterns but shows why you need to be careful before trading.

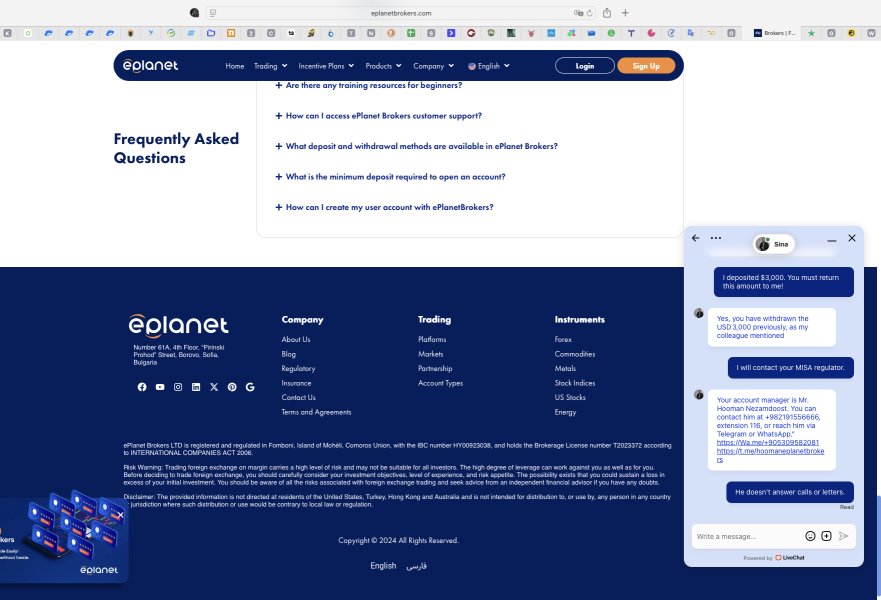

The broker operates under Comoros regulation with license number T2023372, which creates both opportunities and concerns for potential traders. This is especially true when comparing regulatory protection to more established financial centers.

Important Disclaimers

Regional Entity Differences: eplanet brokers ltd is registered in Comoros under the International Companies Act 2006, which may have different regulatory standards and investor protections compared to brokers licensed in major financial areas like the UK, EU, or Australia. You should carefully think about what it means to trade with a Comoros-registered company.

Review Methodology: This review uses publicly available information, regulatory filings, and user feedback from various sources. Since this broker is relatively new with limited operational history, some assessments are preliminary and may change as more data becomes available. We encourage traders to do their own research and consider their individual situations before making trading decisions.

Rating Framework

Broker Overview

Company Background and Establishment

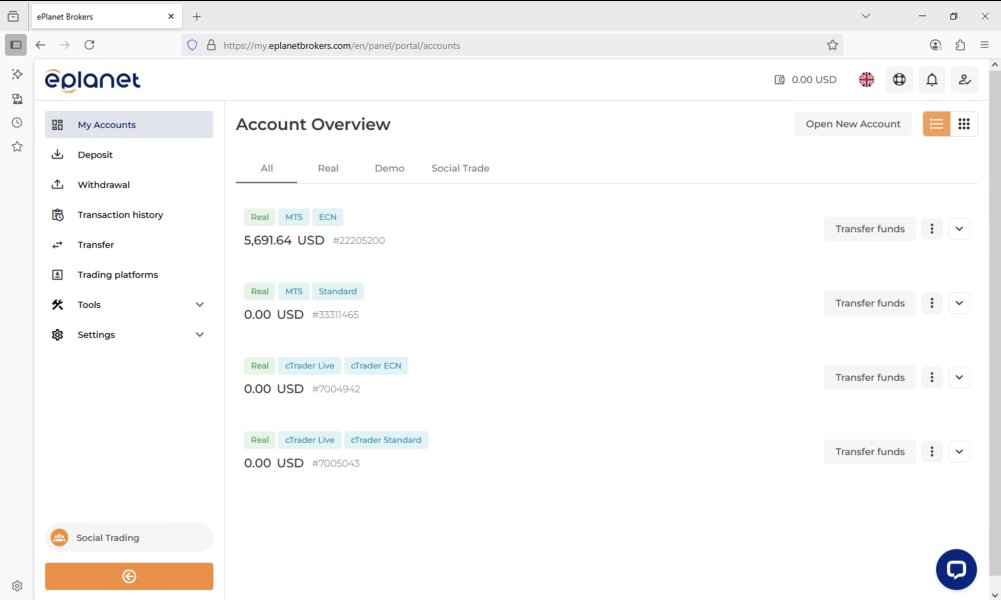

eplanet brokers ltd started in 2022 as a new forex and CFD broker in the online trading world. The company focuses on serving the growing demand for easy-to-use online trading services, especially for retail investors who want straightforward trading solutions. The broker is registered in Comoros under license number T2023372 following the International Companies Act 2006, and it operates by offering diverse trading opportunities across multiple asset classes.

Since the company started recently, it is still building its market presence and developing its services. This eplanet brokers ltd review shows that while the broker has promise in user accessibility and customer service, its short operational history means potential clients should carefully consider whether they need established track records and comprehensive service options.

Trading Infrastructure and Asset Coverage

The broker uses the cTrader platform mainly, which gives users access to professional-grade trading features. This platform choice shows a focus on delivering quality execution and user experience, though having limited platform options may not satisfy traders who prefer different trading environments or proprietary platforms.

The broker covers forex, commodities, metals, stock indices, stocks, energy, and cryptocurrencies, giving traders diversified investment opportunities across major market areas. This wide asset selection makes the broker competitive in the retail trading space and offers enough variety for most trading strategies and portfolio needs. Including cryptocurrency trading shows the broker pays attention to current market trends and trader demands for digital asset exposure.

Regulatory Jurisdiction: eplanet brokers ltd operates under Comoros regulation with license T2023372, which is a more permissive regulatory environment compared to major financial centers. You should consider what this regulatory framework means for dispute resolution and investor protection.

Deposit and Withdrawal Methods: Specific information about funding methods is not detailed in available documentation, so you need to contact the broker directly for complete payment processing information.

Minimum Deposit Requirements: Exact minimum deposit amounts are not specified in current available information, which suggests potential flexibility or the need for direct consultation with account representatives.

Promotional Offerings: Current bonus and promotional structures are not detailed in available materials, which indicates either conservative promotional practices or limited marketing disclosure.

Tradeable Assets: The broker provides access to forex, commodities, metals, stock indices, stocks, energy, and cryptocurrency markets, offering complete coverage across major asset classes for diversified trading strategies.

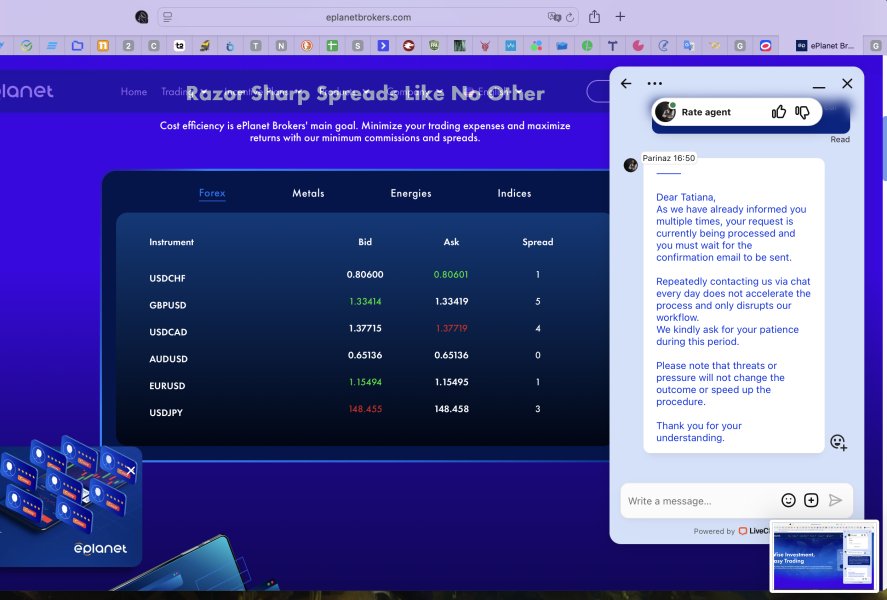

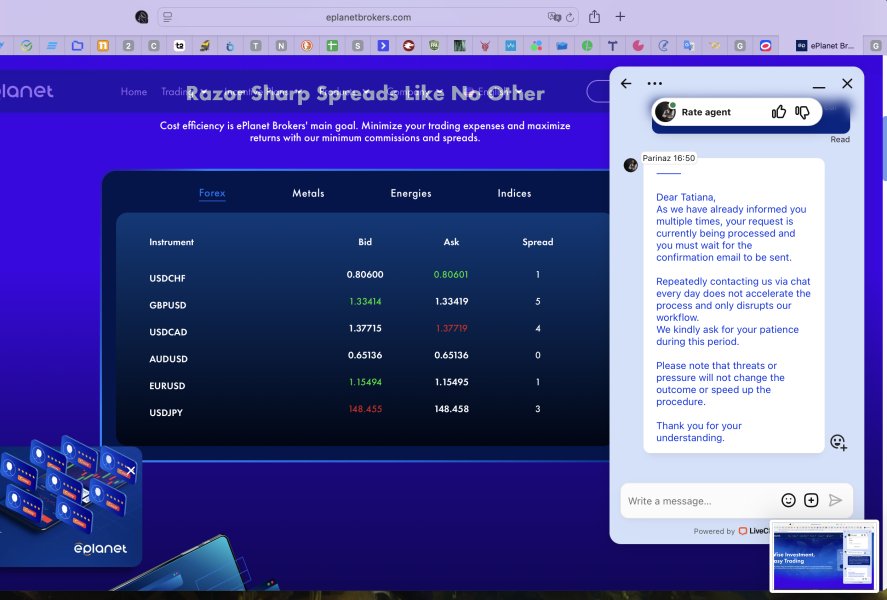

Cost Structure: Available information shows tight spreads as a key pricing feature, though specific commission structures and additional fees need clarification through direct broker contact. The focus on competitive spreads suggests cost-effective trading for active participants.

Leverage Ratios: While specific leverage ratios are not detailed, risk warnings show that leverage usage can result in rapid capital loss, which suggests standard industry leverage offerings with appropriate risk disclosures.

Platform Options: The broker uses the cTrader platform for trade execution, focusing on fast trading experiences and professional-grade functionality for users across experience levels.

This eplanet brokers ltd review notes that several key operational details need direct verification with the broker, which reflects either conservative information disclosure practices or the evolving nature of service specifications for this relatively new market entrant.

Comprehensive Rating Analysis

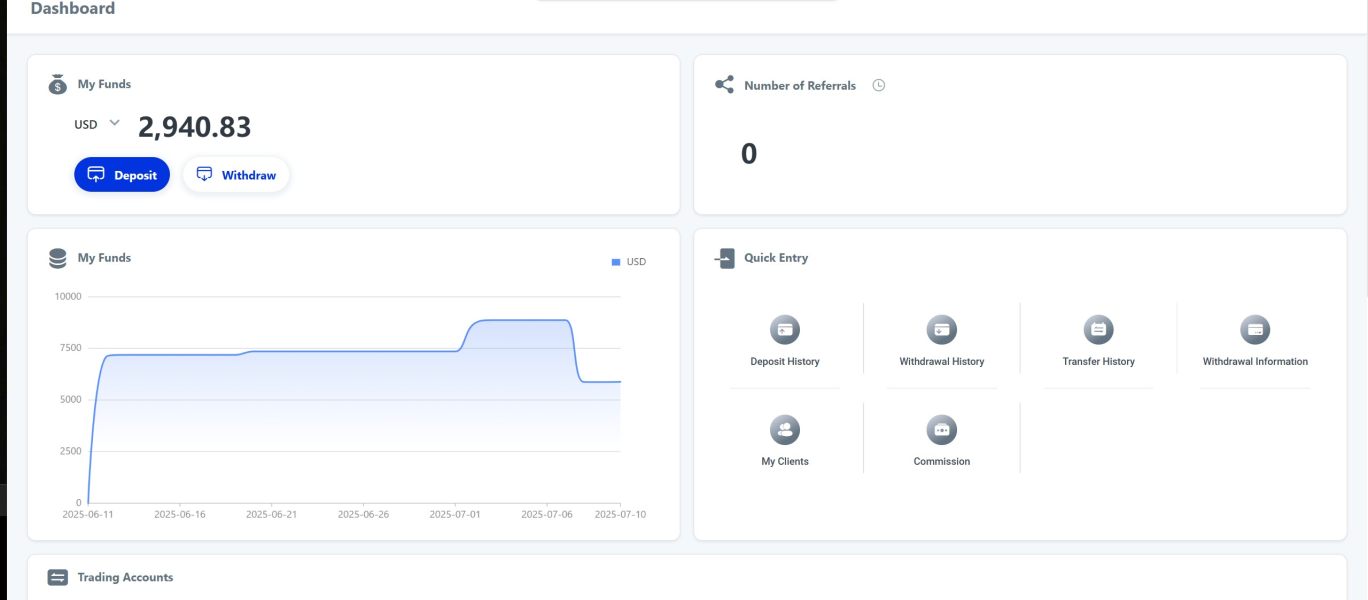

Account Conditions Analysis

The evaluation of eplanet brokers ltd's account conditions shows significant information gaps that limit complete assessment. Available documentation does not specify the range of account types offered, making it hard to determine whether the broker provides tiered service levels such as basic, premium, or VIP accounts that are common industry standards.

Minimum deposit requirements remain unspecified in current available materials, which could mean either flexible entry requirements or the need for direct consultation with account representatives. This lack of clear pricing information may concern traders who prefer clear upfront cost structures for making decisions.

Account opening procedures are not detailed in accessible documentation, leaving questions about verification requirements, processing timeframes, and documentation needs. The absence of information about specialized account features, such as Islamic accounts for Shariah-compliant trading, further limits the assessment of the broker's accommodation for diverse client needs.

Without specific user feedback about account setup experiences or ongoing account management, this eplanet brokers ltd review cannot provide definitive guidance on account condition competitiveness. Potential clients should directly ask about account specifications, minimum funding requirements, and any account-related fees before proceeding with registration.

The assessment of eplanet brokers ltd's tools and resources shows significant limitations that affect its appeal to experienced traders. User feedback specifically highlights the lack of advanced trading tools and educational resources, which is a substantial gap in service offerings compared to established brokers who typically provide complete analytical tools, market research, and educational content.

Trading tool availability appears limited based on available information, with no specific mention of advanced charting packages, algorithmic trading support, or sophisticated analytical instruments that experienced traders often need. This limitation may restrict the broker's ability to attract and keep clients who depend on complete analytical capabilities for their trading strategies.

Educational resources represent a notable weakness in the broker's service portfolio. The absence of detailed educational content, webinars, trading guides, or market analysis limits the broker's value for novice traders who could benefit from complete learning materials. This gap is particularly significant given the broker's apparent focus on attracting new traders.

Research and analysis capabilities are not prominently featured in available documentation, suggesting limited market commentary, economic calendars, or fundamental analysis resources. The lack of these standard industry offerings may disadvantage traders who rely on broker-provided market insights for making decisions.

The overall tools and resources evaluation shows that while the broker may provide basic trading functionality, the absence of advanced features and educational support significantly limits its competitiveness in the current market environment.

Customer Service and Support Analysis

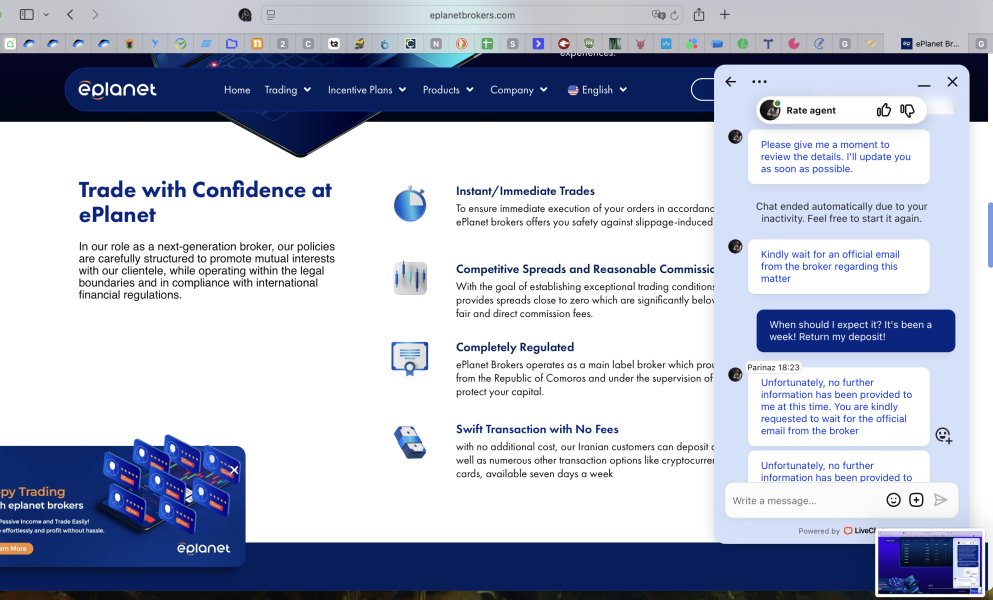

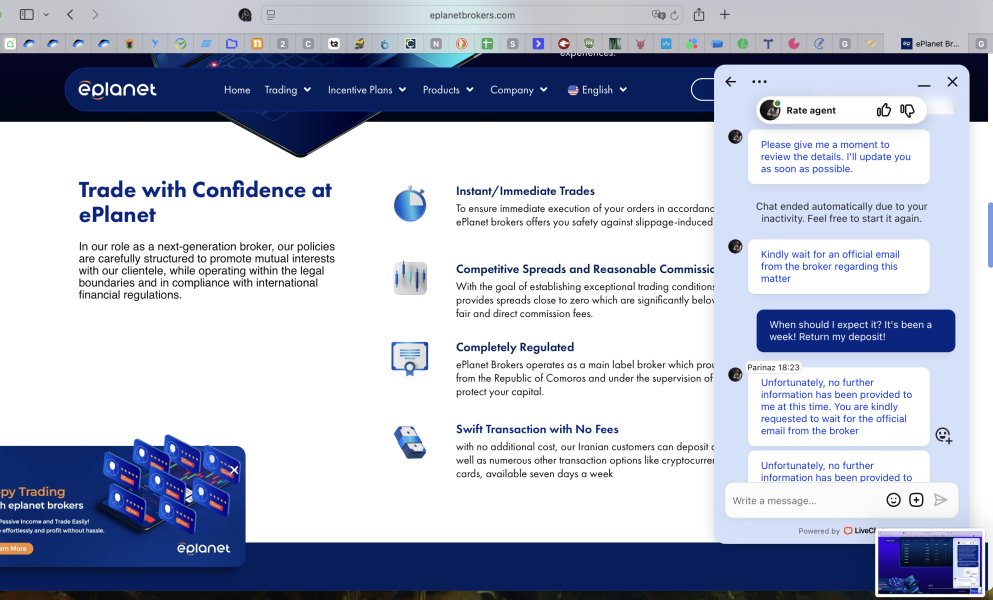

Customer service emerges as a notable strength in this eplanet brokers ltd review, with user feedback consistently highlighting rapid response times and quality support interactions. This positive assessment suggests the broker has made customer service excellence a key difference in its service delivery approach.

Response efficiency receives particular praise from users, showing that the broker maintains adequate staffing levels and effective support processes to address client questions promptly. This responsiveness is particularly valuable for traders who may need immediate help with technical issues or account-related questions during active trading periods.

Service quality appears to meet user expectations based on available feedback, though specific examples of problem resolution or complex issue handling are not detailed in current documentation. The positive user sentiment suggests that support representatives are adequately trained and empowered to address common client concerns effectively.

Communication channels and availability are not specifically detailed in available information, leaving questions about 24/7 support availability, live chat options, phone support, or email response timeframes. Similarly, multilingual support capabilities remain unspecified, which may affect the broker's accessibility for international clients.

Despite these information gaps, the consistently positive user feedback about customer service responsiveness suggests that eplanet brokers ltd has established effective support processes that contribute positively to overall user experience and satisfaction levels.

Trading Experience Analysis

The trading experience evaluation shows generally positive user sentiment, particularly regarding platform usability and accessibility for new traders. User feedback consistently emphasizes the platform's user-friendly design, suggesting that eplanet brokers ltd has successfully made ease of use a priority in its platform development and implementation.

Platform stability and performance appear adequate based on user experiences, though specific technical performance metrics such as execution speeds, server uptime, or slippage rates are not detailed in available documentation. The emphasis on cTrader platform use suggests professional-grade infrastructure, though complete performance data requires direct user experience for verification.

Beginner accessibility represents a clear strength in the broker's trading experience offering. Multiple user references to the platform's suitability for new traders show intuitive interface design and straightforward navigation that reduces the learning curve for trading platform adoption.

Order execution quality and advanced trading features are not specifically addressed in available user feedback, leaving questions about execution speeds, order types availability, and advanced trading functionalities that experienced traders might need. This information gap suggests either limited advanced features or insufficient user feedback from experienced traders.

Mobile trading capabilities and cross-platform functionality are not detailed in current documentation, representing potential areas for improvement or simply limited information disclosure. This eplanet brokers ltd review notes that complete trading experience assessment requires additional user feedback and technical specifications from the broker directly.

Trustworthiness Analysis

The trustworthiness evaluation presents mixed considerations that require careful analysis by potential clients. Regulatory status under Comoros jurisdiction with license number T2023372 provides legal operating authority but may offer limited regulatory protection compared to major financial centers such as the UK's FCA or Australia's ASIC.

Financial safety measures and client fund protection protocols are not detailed in available documentation, creating uncertainty about segregated account practices, deposit insurance, or compensation schemes that are standard in more established regulatory jurisdictions. This information gap represents a significant consideration for traders who prioritize capital protection.

Operational transparency appears limited based on available public information, with key operational details such as company ownership, financial statements, or detailed regulatory compliance reports not readily accessible. This limited transparency may concern traders who prefer complete due diligence information.

Risk disclosure is appropriately prominent, with clear warnings that 66% of retail investors lose money when trading CFDs with this provider. This transparent risk communication aligns with regulatory requirements and demonstrates responsible disclosure practices, though the loss rate aligns with concerning industry-wide patterns.

Company track record remains limited due to the broker's recent 2022 establishment, providing insufficient operational history for complete reliability assessment. The absence of significant negative incidents or regulatory actions may show satisfactory compliance, though limited operational history restricts definitive trustworthiness conclusions.

User Experience Analysis

User experience assessment shows generally positive sentiment with an overall 4-star rating that reflects satisfactory service delivery across key user touchpoints. This rating suggests that while the broker meets basic user expectations, there remains room for improvement in service completeness and feature development.

Interface design and usability receive consistent praise from users, particularly regarding the platform's accessibility for new traders. The emphasis on user-friendly design appears to successfully lower barriers to entry for individuals new to online trading, contributing positively to overall user satisfaction and engagement.

User satisfaction patterns show that positive experiences center on ease of use and customer service quality, while negative feedback focuses on limited advanced tools and educational resources. This feedback pattern suggests a clear service positioning toward basic trading needs rather than complete professional trading support.

Target user alignment appears well-executed, with the broker successfully attracting and satisfying users seeking straightforward trading experiences without complex features. However, this positioning may limit growth potential among experienced traders who require advanced functionality and complete analytical tools.

Common user concerns consistently highlight the need for enhanced educational resources and more sophisticated trading tools. These feedback patterns suggest clear improvement opportunities that could expand the broker's appeal and user satisfaction across broader trader demographics.

User retention factors appear centered on customer service quality and platform simplicity, though complete retention data requires longer operational history for meaningful analysis. The current user feedback suggests a foundation for positive user relationships, though service expansion may be necessary for long-term competitive positioning.

Conclusion

This comprehensive eplanet brokers ltd review concludes that the broker represents a viable option for specific trader demographics while presenting notable limitations for others. The broker's neutral overall assessment reflects a service offering that successfully addresses basic trading needs but falls short of complete professional trading support.

Recommended user types include novice traders seeking user-friendly platforms and individuals prioritizing straightforward trading experiences over advanced analytical capabilities. The broker's emphasis on accessibility and responsive customer service creates particular value for users who prioritize support quality and ease of use over complete feature sets.

Primary advantages center on platform usability and customer service responsiveness, which contribute to positive user experiences and satisfaction. However, significant disadvantages include limited advanced tools, insufficient educational resources, and regulatory considerations associated with Comoros jurisdiction that may affect long-term trader confidence and protection.

Potential clients should carefully weigh these factors against their individual trading requirements, experience levels, and risk tolerance before proceeding with account opening. The broker's recent establishment and evolving service portfolio suggest potential for improvement, though current limitations require realistic expectation management for optimal user experience.