Regarding the legitimacy of CAPEX.com forex brokers, it provides CYSEC, FSA, CYSEC, FSCA and WikiBit, (also has a graphic survey regarding security).

Is CAPEX.com safe?

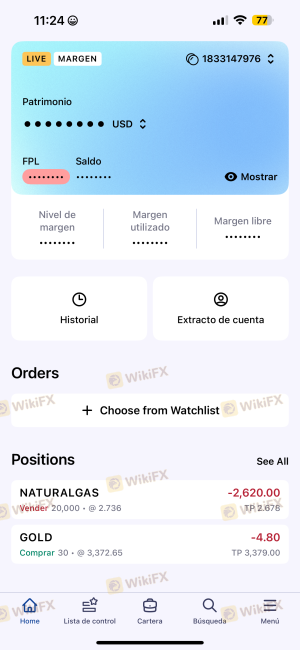

Software Index

Risk Control

Is CAPEX.com markets regulated?

The regulatory license is the strongest proof.

CYSEC Derivatives Trading License (MM) 19

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

RegulatedLicense Type:

Derivatives Trading License (MM)

Licensed Entity:

Key Way Investments Ltd

Effective Date:

2016-01-21Email Address of Licensed Institution:

info@keywayinvestments.comSharing Status:

Website of Licensed Institution:

www.keywayinvestments.ro, www.keywayinvestments.com, www.capex.com/eu, www.capex.com/ro, www.capex.com/es, www.capex.com/it, www.capex.com/de, www.capex.com/hu, www.capex.com/pl, www.capex.com/cz, www.capex.com/elExpiration Time:

--Address of Licensed Institution:

18 Spyrou Kyprianou Avenue, Suite 101, Nicosia 1075, CyprusPhone Number of Licensed Institution:

+357 22 000 936Licensed Institution Certified Documents:

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

KW Investments Ltd

Effective Date:

--Email Address of Licensed Institution:

compliance@kwinvestmentsltd.comSharing Status:

Website of Licensed Institution:

https://clicktrades.com, www.capex.comExpiration Time:

--Address of Licensed Institution:

Unit G, F28 Eden Plaza, Eden Island, Mahe, SeychellesPhone Number of Licensed Institution:

(+248) 4346119Licensed Institution Certified Documents:

CYSEC Market Making License (MM)

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

Naga Markets Europe Ltd

Effective Date:

2013-06-20Email Address of Licensed Institution:

regulatory@nagamarkets.comSharing Status:

No SharingWebsite of Licensed Institution:

www.nagamarkets.com, Naga.com/eu, Naga.com/de, Naga.com/it, Naga.com/es, Naga.com/pl, Naga.com/cz, Naga.com/nl, Naga.com/ro, Naga.com/ntExpiration Time:

--Address of Licensed Institution:

Agias Zonis 11, 3027, Limassol, CyprusPhone Number of Licensed Institution:

+357 25 041 410Licensed Institution Certified Documents:

FSCA Derivatives Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

UnverifiedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

JME FINANCIAL SERVICES (PTY) LTD

Effective Date:

2009-02-10Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

SUITE 1021 LIGHTHOUSE ROAD, 201 BEACON ROCKUMHLANGA ROCKS, KWA-ZULU NATAL4320Phone Number of Licensed Institution:

0040 724 311 322Licensed Institution Certified Documents:

Introduction: Why Every Trader Must Ask This Question

In the fast-paced world of online trading, the line between a legitimate brokerage and a fraudulent operation can sometimes seem blurry. New traders, in particular, are bombarded with advertisements and promises of easy profits, making them prime targets for unscrupulous actors. CAPEX, a broker established in 2016, has grown rapidly, boasting a global presence and a vast portfolio of over 2,100 tradable instruments. But with this rapid growth comes intense scrutiny. Is CAPEX a trustworthy financial partner, or is it another cleverly disguised scam?

This question is not just important; it‘s essential for capital preservation. To answer it definitively, a simple glance at a homepage is not enough. It requires a forensic investigation into the broker’s core components: its regulatory licenses, its corporate history, the true cost of its trading conditions, the security of client funds, and the unfiltered voice of its users. This article undertakes that investigation, providing a clear, evidence-based verdict on the legitimacy of CAPEX for 2025.

The Verdict Upfront: Is CAPEX a Scam or Legitimate?

Lets address the primary question immediately: No, CAPEX is definitively not a scam.

It is a multi-regulated financial institution operating under the oversight of some of the worlds most reputable financial authorities, including the Cyprus Securities and Exchange Commission (CySEC). The evidence overwhelmingly shows that CAPEX operates within a strict legal and regulatory framework designed to protect clients. It is a legitimate broker.

However, the question of legitimacy is different from the question of suitability. While CAPEX is not a scam, it has a specific business model with distinct advantages and disadvantages that may make it an excellent choice for some traders and a poor choice for others. The remainder of this investigation will provide the detailed evidence behind this verdict and help you determine if CAPEX is the right broker for your specific needs.

1. The Regulatory Fortress: Analyzing CAPEX‘s Multi-License Framework

The single most powerful piece of evidence determining a broker’s legitimacy is its regulatory status. A scam operation cannot and will not subject itself to the scrutiny of a major financial regulator. CAPEX, in contrast, is licensed and supervised by multiple authorities across the globe, creating a “”regulatory fortress“” that ensures compliance and accountability.

| Regulatory Authority | License Number | Jurisdiction | Entity Name | Key Protections |

|---|---|---|---|---|

| CySEC (Cyprus) | 292/16 | European Union | Key Way Investments Ltd | ICF (€20k), MiFID II, Negative Balance Protection |

| ADGM (Abu Dhabi) | 190005 | UAE | Key Way Markets Ltd | High standards of conduct, fund segregation |

| FSCA (South Africa) | 37166 | South Africa | JME Financial Services Ltd | Regional oversight, consumer protection |

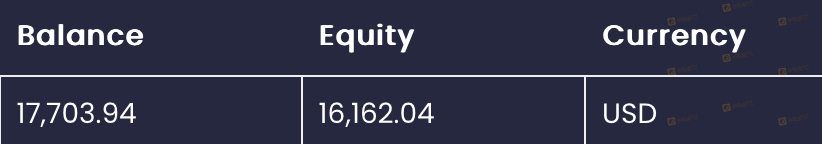

| FSA (Seychelles) | SD020 | International | KW Investments Ltd | Higher leverage for global clients |

Deep Dive: Why CySEC Regulation Matters

CAPEXs primary license from the Cyprus Securities and Exchange Commission (CySEC) is its most important credential. As a regulator within the European Union, CySEC enforces a strict set of rules under the Markets in Financial Instruments Directive II (MiFID II), a cornerstone of European financial regulation. For a trader, this means several non-negotiable protections:

- Investor Compensation Fund (ICF): CAPEX is a member of the ICF. This fund acts as an insurance policy for traders. In the unlikely event of the broker‘s insolvency, the ICF protects eligible retail clients’ funds up to €20,000. Scam brokers offer no such protection.

- Segregation of Client Funds: CySEC mandates that all client funds be held in segregated bank accounts, completely separate from the companys own operational capital. This ensures that CAPEX cannot use client money for its business expenses and that the funds are protected from creditors if the company faces financial difficulty.

- Negative Balance Protection: By law, retail clients under CySEC cannot lose more money than they have deposited in their account. If a volatile market event causes an account to go into a negative balance, CAPEX is required to reset it to zero at no cost to the client.

- Transparency and Fair Practice: Brokers must be transparent about their pricing, execution policies, and the risks involved in trading.

The Role of Other Licenses

- ADGM & FSCA: The licenses in Abu Dhabi and South Africa demonstrate CAPEXs commitment to compliance in key regional markets. These regulators ensure that the broker adheres to local laws and provides a secure environment for traders in the MENA and African regions.

- FSA (Seychelles): This is CAPEXs offshore license. It allows the broker to offer its services to a global audience outside of the EU and other strictly regulated zones. The main difference for clients under this entity is access to higher leverage (up to 1:300), which is restricted under CySEC (capped at 1:30 for retail clients).

Regulatory Conclusion: The existence of these licenses, especially the CySEC one, provides irrefutable proof of CAPEXs legitimacy. The broker is subject to regular audits, capital adequacy requirements, and a legal framework that prioritizes client protection. This is the antithesis of how a scam operates.

2. Company Vitals: History, Ownership, and Transparency

A brokers history and corporate structure provide further clues to its reliability.

- Establishment and Rebranding: CAPEX was founded in 2016. It initially operated under the brand name CFD Global before undergoing a strategic rebrand to CAPEX.com in 2019. This rebranding was part of a broader strategy to position itself as a more comprehensive, multi-asset educational hub for traders.

- Parent Company: The broker is operated by Key Way Investments Limited, a Cypriot investment firm with its headquarters located at 18 Spyrou Kyprianou Avenue, Suite 101, Nicosia, Cyprus. The existence of a physical headquarters in a major EU financial hub adds another layer of credibility.

- Transparency: CAPEX maintains a high degree of corporate transparency. Its website clearly outlines its regulatory details, terms and conditions, risk warnings, and fee structures. While some fees might be considered high (as we will see later), they are disclosed, which is a key trait of a legitimate business.

- Industry Recognition: The broker has received several industry awards, particularly for its educational programs (“”CAPEX Academy“”) and trading tools. While awards can be part of marketing, consistent recognition from multiple industry bodies over the years points towards a positive reputation and a solid operational framework.

3. The Cost of Trading: A Forensic Look at CAPEXs Fees and Spreads

This is where the conversation shifts from “”is it a scam?“” to “”is it a good value?“” A legitimate broker can still be expensive. CAPEX operates on a spread-based, market-maker model.

Trading Costs: The Spreads

CAPEX does not charge commissions on most trades, embedding its fee within the spread (the difference between the buy and sell price).

- EUR/USD Spread: The typical spread for the EUR/USD pair on a standard account is around 1.8 pips.

- Industry Comparison: This is noticeably higher than the industry average for a standard account (which is around 1.2 - 1.5 pips) and significantly higher than ECN-style brokers, where the all-in cost (raw spread + commission) can be as low as 0.7 - 0.9 pips.

Verdict on Spreads: CAPEXs trading costs are not the most competitive on the market. Traders who are highly sensitive to spread costs, such as scalpers or high-frequency traders, will likely find better value elsewhere.

Non-Trading Costs: Where “”Hidden“” Fees Emerge

This is a critical area where many traders feel “”scammed,“” even by legitimate brokers. CAPEX has several non-trading fees that clients MUST be aware of.

| Fee Type | Cost | Conditions |

|---|---|---|

| Inactivity Fee | $10 per month | Charged to an account that has been inactive (no trades, deposits, or withdrawals) for 3 months. |

| Withdrawal Fee | Varies ($10-$20 typical) | A fee is often charged on withdrawals, especially bank wires. This is a significant drawback. |

| Overnight Fees (Swaps) | Varies by instrument | Standard industry practice. Charged for holding a CFD position open overnight. |

Verdict on Non-Trading Fees: The presence of a relatively quick-to-trigger inactivity fee and withdrawal fees is a major disadvantage. While disclosed in their terms and conditions, these fees can erode account balances and lead to negative user experiences if not properly understood beforehand.

Cost Conclusion: CAPEX is not a scam, but it is a relatively expensive broker compared to many competitors, both in its trading spreads and its non-trading fees. The value proposition is therefore not in its cost, but in its platform and tools.

4. Platforms & Tools: CAPEXs Greatest Strength

Where CAPEX justifies its higher costs is in its exceptional platform technology and integrated tools, which are particularly valuable for beginner and intermediate traders.

1. CAPEX WebTrader

This is the broker‘s proprietary, browser-based platform. It’s clean, intuitive, and packed with an incredible suite of integrated third-party tools that are often sold as premium subscriptions elsewhere. These include:

- Trading Central: A world-class market analysis tool providing technical insights, analyst views, and adaptive indicators directly on the charts.

- TipRanks: This powerful tool aggregates and analyzes the performance of financial analysts and bloggers, providing traders with data-driven sentiment on thousands of stocks. Features include Analyst Ratings, Hedge Fund Activity, and Insiders Hot Stocks.

- Advanced Charting Tools: The platform itself offers a comprehensive charting package with a full range of indicators and drawing tools.

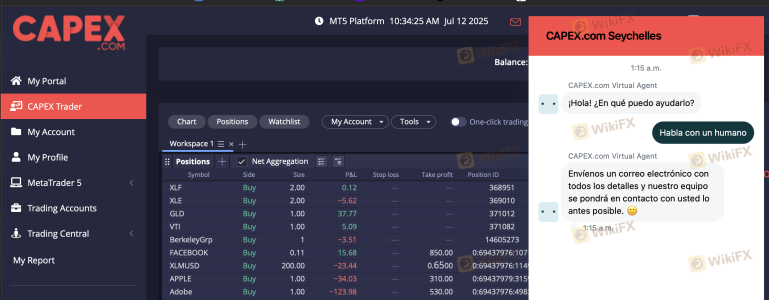

2. MetaTrader 5 (MT5)

For traders who prefer the industry standard, CAPEX also offers the full MT5 platform. This provides access to:

- Algorithmic Trading: The ability to use and develop complex Expert Advisors (EAs).

- Advanced Analytics: More timeframes, indicators, and analytical objects than its predecessor, MT4.

- Market Depth: A full view of order book liquidity for more transparent pricing.

Educational Resources: The CAPEX Academy

CAPEX has invested heavily in education. The CAPEX Academy includes a vast library of video courses, articles, webinars, and market analysis designed to take a trader from a complete novice to a confident market participant.

Platform & Tools Conclusion: CAPEX offers an outstanding ecosystem for learning and analysis. The value of the integrated tools like Trading Central and TipRanks cannot be overstated and could easily be worth more than the higher spread costs for traders who use them actively.

5. User Experience & Common Complaints: The Voice of the Trader

To get a complete picture, we must look at real user feedback from platforms like Trustpilot and Forex Peace Army.

Common Positives:

- User-Friendly Platform: Many users praise the WebTrader platform for being easy to navigate and visually appealing.

- Excellent Tools: The integrated research and analysis tools are frequently highlighted as a major benefit.

- Educational Content: The quality of the CAPEX Academy is often commended by beginner traders.

Common Complaints & Context:

- Withdrawal Delays: This is a common complaint across many brokers. While CAPEX processes withdrawals, it can take several business days. These delays are often due to mandatory anti-money laundering (AML) and compliance checks, not a refusal to pay. However, the process could be faster and more transparent.

- Pushy Account Managers: Some users have reported feeling pressured by account managers to deposit more funds or take on more risk. This is a classic issue with the market-maker model, where broker revenue is tied to client trading volume. Its a significant negative and something traders should be firm about.

- High Fees: Complaints about the inactivity and withdrawal fees are common, highlighting the importance of reading the terms and conditions.

Final Conclusion: Legitimate, But With Important Caveats

After a thorough investigation, the evidence is clear: CAPEX is a legitimate and heavily regulated broker, not a scam. Its robust multi-jurisdictional licensing, particularly from CySEC, provides a secure framework with significant client protections.

However, its legitimacy does not automatically make it the best choice for everyone.

CAPEX is likely a good choice for:

- Beginner to Intermediate Traders: This is their target audience. These traders will benefit immensely from the user-friendly WebTrader platform, the outstanding integrated analytical tools (Trading Central, TipRanks), and the comprehensive educational resources of the CAPEX Academy. For this group, the higher costs may be a worthwhile trade-off for the supportive ecosystem.

CAPEX is likely a poor choice for:

- Cost-Sensitive, Experienced Traders: Scalpers, high-frequency traders, and those who prioritize the lowest possible transaction costs will find CAPEXs spreads and non-trading fees uncompetitive compared to true ECN brokers.

- Traders Who Prefer a Hands-Off Approach: The potential for contact from account managers might be off-putting for traders who prefer to be left alone to conduct their business.

Ultimately, traders should approach CAPEX with their eyes open. It is a safe and regulated environment, but you are paying a premium for its feature-rich, user-friendly platform. If you will use those features, it can be a great partner. If you will not, you can find lower-cost options elsewhere.

Is CAPEX.com a scam, or is it legit?

The latest exposure and evaluation content of CAPEX.com brokers.

CAPEX.com Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

CAPEX.com latest industry rating score is 4.18, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 4.18 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.