Evest 2025 Review: Everything You Need to Know

Summary

This evest review gives you a complete look at a new online broker that started making noise in 2020. Evest calls itself a user-friendly trading platform that works with many types of investments like Forex, stocks, indices, commodities, and cryptocurrencies. The broker wants to help both new and experienced traders by offering good trading deals that are easy to access and use.

Evest's main selling point is that they charge 0% commission. Traders only pay spreads when they make trades. This makes it great for people who want to keep their trading costs low. The platform lets users trade many different things, so they can build varied portfolios across different markets.

Evest targets everyone from beginners just starting out to pros who want reliable trading conditions. The broker focuses on making users happy and keeping prices competitive, which shows they want to make trading available to more people. But since this broker is pretty new, potential users should think carefully about things like regulation, how reliable the platform is, and how good customer support is before they decide.

Important Notice

Regional Entity Differences: Users should know that Evest might work under different rules in different places. The specific rules and legal protections for traders can change a lot depending on where they live. Potential clients must check Evest's regulatory status in their area before opening an account.

Review Methodology: This review uses the most current public information, user feedback, and industry reports from 2025. The trading industry changes fast, and broker conditions, services, and regulatory status can shift quickly. Readers should check all information on their own and do their homework before making any trading or investment choices. The assessments here reflect what we knew when writing this and might not show real-time changes in what the broker offers or market conditions.

Rating Framework

Broker Overview

Evest showed up in the online trading world in 2020 as a broker that works with many types of assets. The company wants to be a tech-focused platform that connects complex financial markets with everyday traders. As a pretty new player in the competitive brokerage industry, Evest has worked on building a complete trading system that includes traditional forex trading along with modern assets like cryptocurrencies.

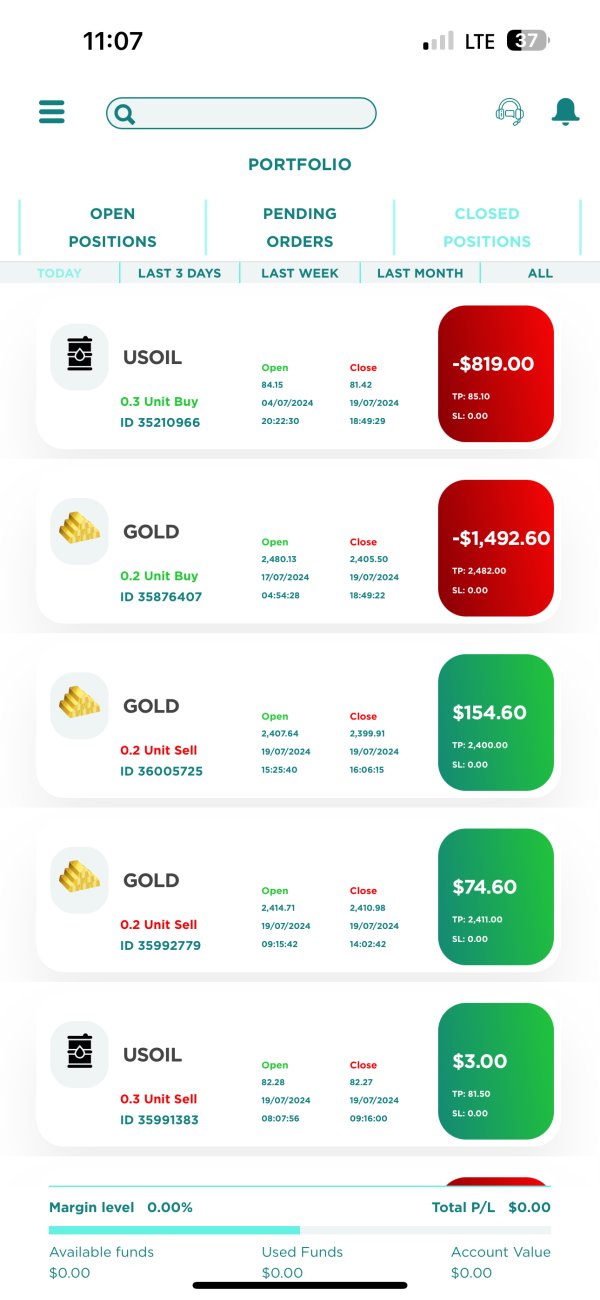

The broker's business plan focuses on providing Contract for Difference (CFD) trading services. This lets clients bet on price movements without owning the actual assets. This approach lets traders access many markets through one platform while keeping the flexibility to trade both long and short positions. Evest's promise to offer 0% commission trading gives them a big competitive edge in an industry where trading costs can really hurt profits.

Based on available information, Evest supports trading across five major types of assets: foreign exchange (Forex), individual stocks, market indices, commodities, and cryptocurrencies. This variety lets traders use different trading strategies and risk management approaches across different market areas. The platform is easier to access through multiple trading interfaces, including web-based platforms for convenience and MetaTrader 5 (MT5) for more advanced trading features.

However, specific details about regulatory oversight stay unclear in current documentation. The regulatory framework that Evest operates under is crucial for trader protection and fund security, but this information doesn't show up prominently in available materials, which may worry potential clients who want fully regulated trading environments.

Regulatory Status: Current available information doesn't give complete details about Evest's regulatory standing or the specific financial authorities watching over its operations. This lack of transparency about regulatory compliance represents a significant information gap for potential clients.

Deposit and Withdrawal Methods: Specific information about supported payment methods, processing times, and any fees for deposits and withdrawals isn't detailed in available documentation. This information is crucial for traders planning their fund management strategies.

Minimum Deposit Requirements: The minimum amount required to open and fund an account with Evest isn't specified in current materials. This makes it difficult for potential clients to assess accessibility and plan their initial investment.

Bonus and Promotional Offers: Details about welcome bonuses, promotional campaigns, or loyalty programs aren't extensively covered in available information. Such offerings are common in the competitive brokerage industry.

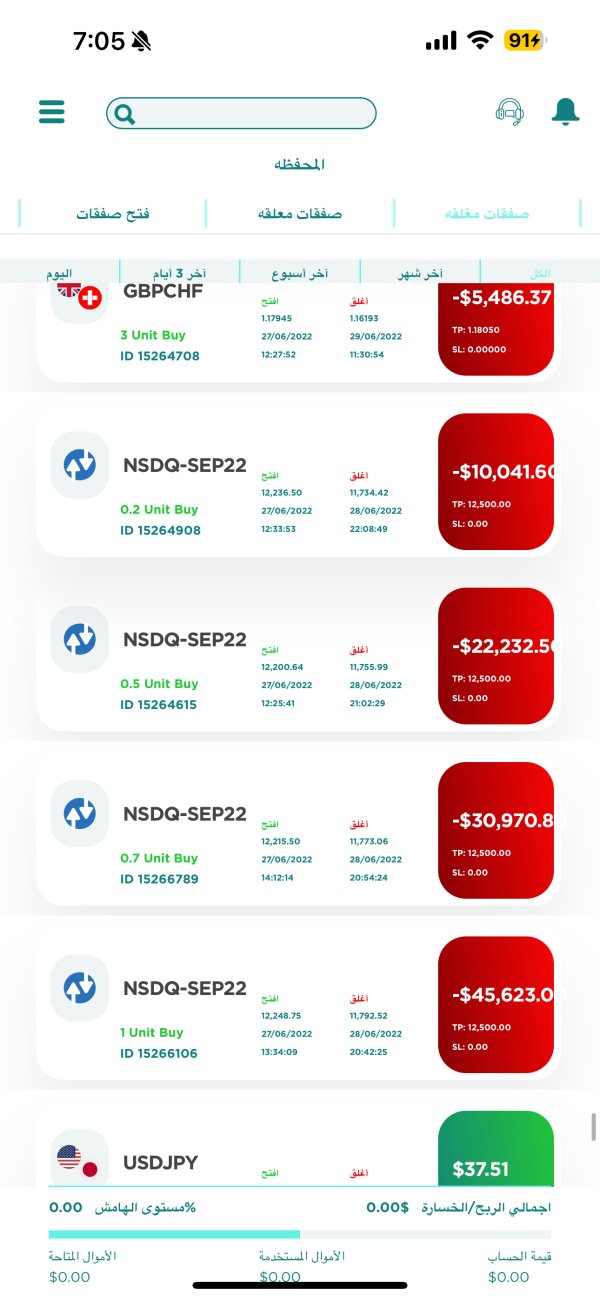

Tradeable Assets: Evest provides access to five major asset categories including Forex pairs, individual stocks from various markets, major indices, commodities such as precious metals and energy products, and a selection of cryptocurrencies. This diverse offering allows for portfolio diversification across different market sectors.

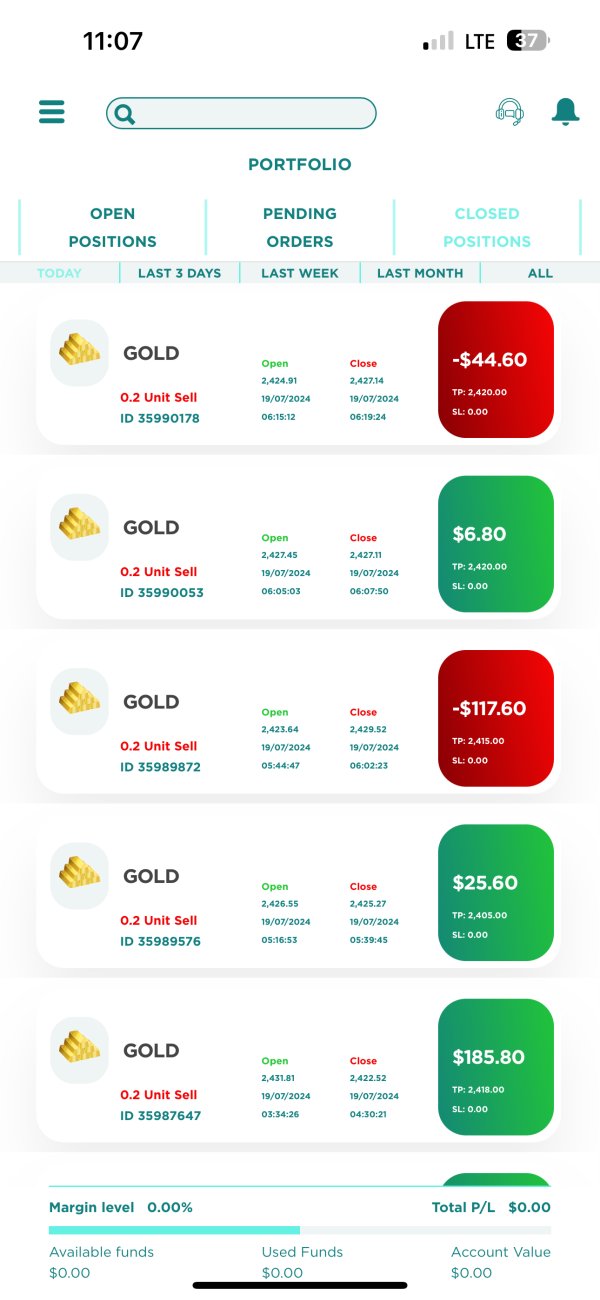

Cost Structure: The broker advertises a 0% commission model where traders only pay spreads on their transactions. However, specific information about typical spread ranges, overnight financing costs, and any additional fees isn't comprehensively detailed in current materials.

Leverage Ratios: Information about maximum leverage ratios available for different asset classes and account types isn't specified in available documentation. This is essential information for risk management planning.

Platform Options: Traders can access markets through both proprietary web-based platforms and the industry-standard MetaTrader 5 (MT5) platform. This provides flexibility for different trading preferences and experience levels.

Geographic Restrictions: Specific information about countries or regions where Evest services are not available isn't detailed in current materials.

Customer Support Languages: The range of languages supported by customer service teams isn't specified in available documentation.

This evest review highlights the need for more comprehensive information disclosure in several key areas that are important for trader decision-making.

Detailed Rating Analysis

Account Conditions Analysis (6/10)

Evest's account conditions show both attractive features and concerning information gaps. The broker's headline feature of 0% commission trading is definitely appealing to cost-conscious traders who want to minimize their transaction expenses. This pricing model means traders only pay spreads, which can result in significant cost savings compared to brokers who charge both spreads and commissions.

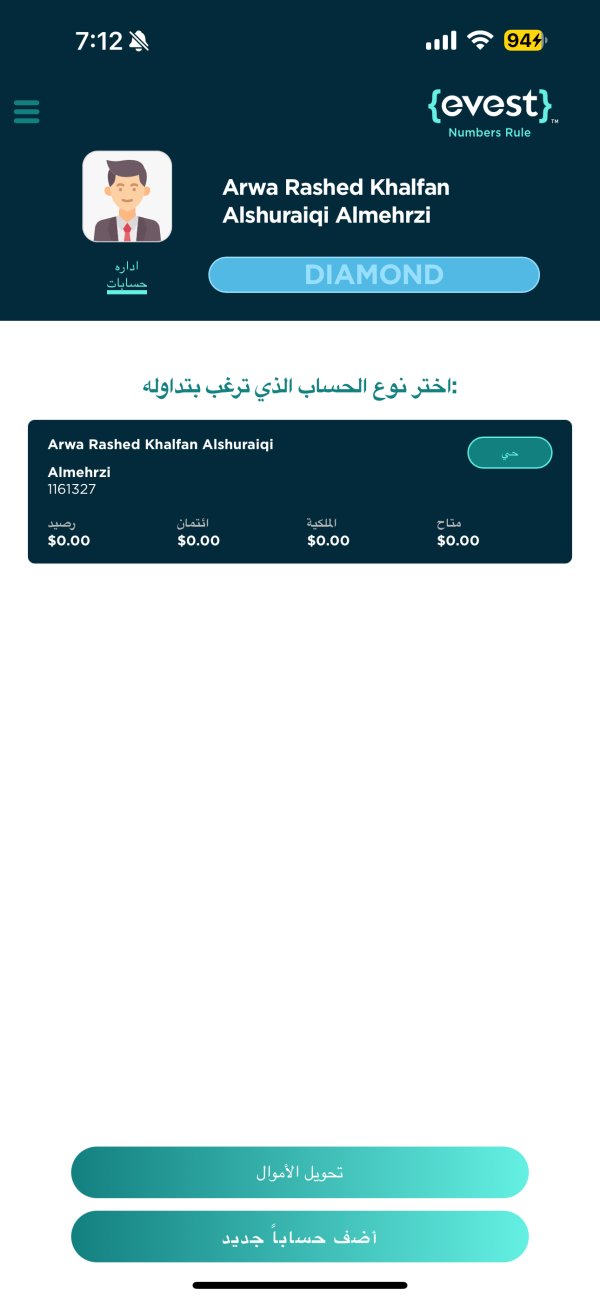

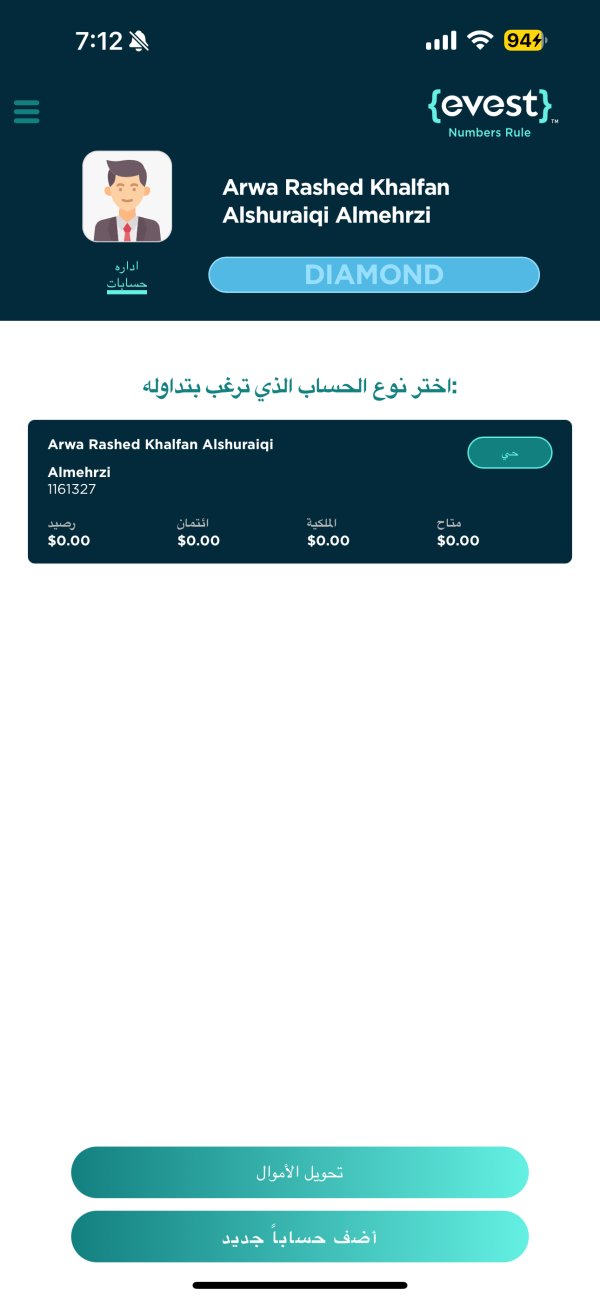

However, the evaluation of account conditions is hurt by the lack of detailed information about account types and their specific features. Many established brokers offer tiered account structures with varying benefits, minimum deposits, and trading conditions, but such details aren't comprehensively available for Evest. The absence of information about minimum deposit requirements makes it difficult to assess the broker's accessibility to traders with different capital levels.

The account opening process and verification requirements aren't detailed in available materials. This is concerning for potential clients who want to understand the onboarding experience. Additionally, information about special account features such as Islamic accounts for Muslim traders, or demo accounts for practice trading, isn't readily available.

User feedback specifically addressing account conditions, fees, and overall satisfaction with account management is limited in current reviews. This lack of comprehensive user testimonials makes it challenging to assess real-world experiences with Evest's account offerings.

The scoring reflects the positive aspect of commission-free trading while acknowledging the significant information gaps that prevent a more thorough evaluation of account conditions. This evest review emphasizes the need for more transparent disclosure of account-related terms and conditions.

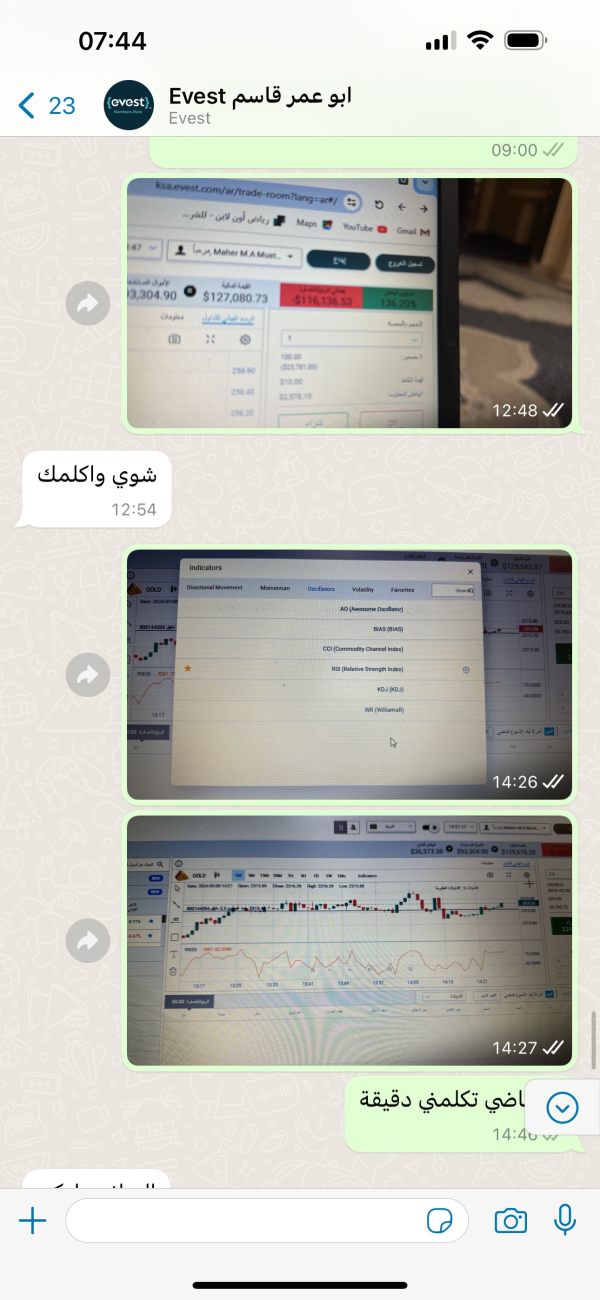

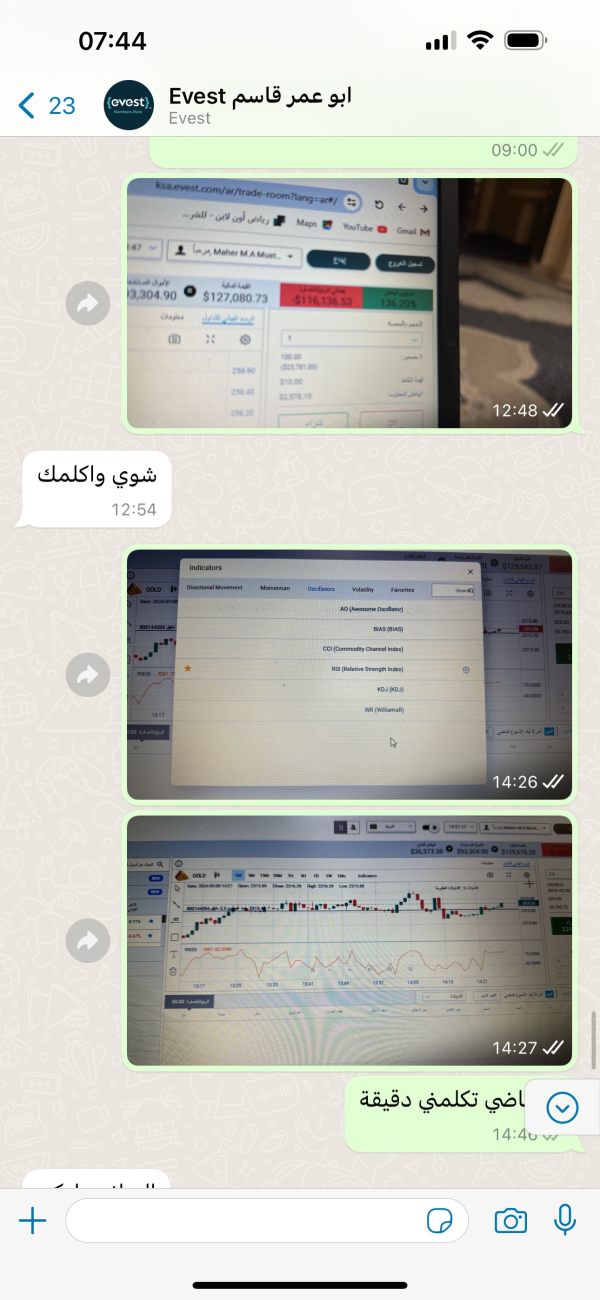

Evest shows reasonable strength in platform diversity by offering both web-based trading interfaces and MetaTrader 5 (MT5) access. The inclusion of MT5 is particularly valuable as it provides traders with access to advanced charting tools, technical indicators, and automated trading capabilities through Expert Advisors (EAs). This platform choice caters to different trader preferences, from those who prefer simple web interfaces to advanced users requiring sophisticated analytical tools.

The broker's asset coverage across five major categories (Forex, stocks, indices, commodities, and cryptocurrencies) provides traders with significant diversification opportunities. This multi-asset approach allows for various trading strategies and risk management techniques across different market sectors, which is valuable for both portfolio diversification and trading education.

However, the evaluation is limited by the lack of detailed information about proprietary research tools, market analysis resources, and educational materials. Many competitive brokers provide daily market commentary, economic calendars, trading signals, and comprehensive educational programs. The absence of detailed information about such resources makes it difficult to assess Evest's value proposition comprehensively.

Information about mobile trading applications, their functionality, and user ratings isn't extensively covered in available materials. In today's trading environment, mobile accessibility is crucial for active traders who need to monitor and manage positions on the go.

The availability of automated trading support, algorithmic trading tools, and third-party integrations isn't clearly documented. This could be important for traders seeking advanced trading automation capabilities.

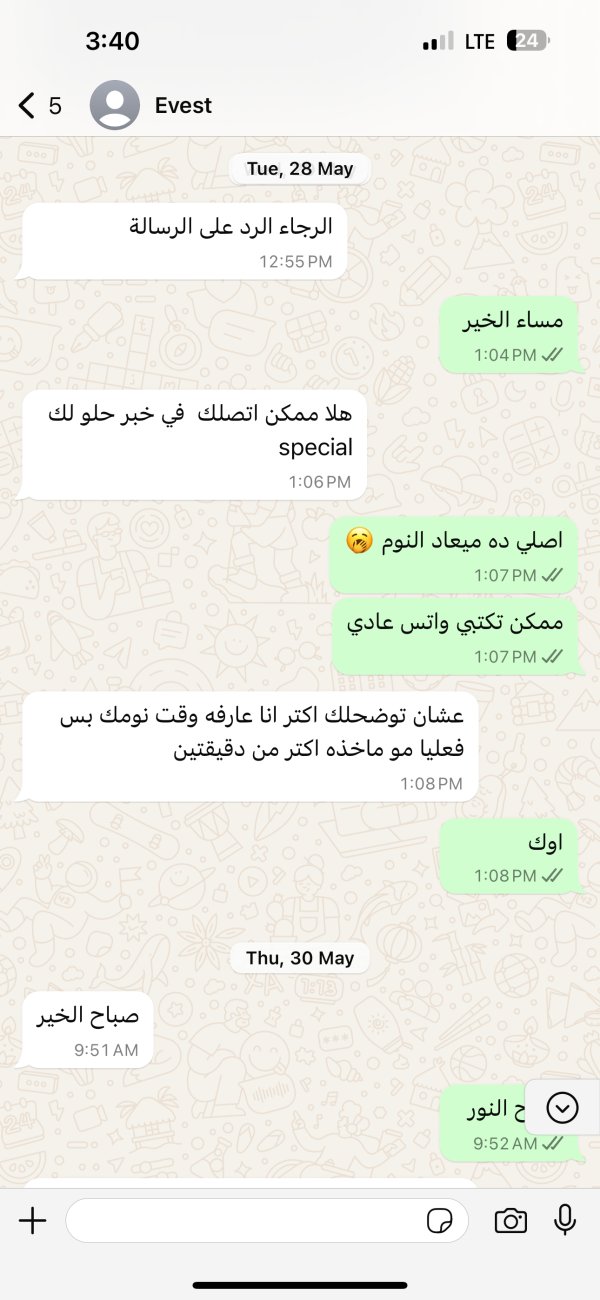

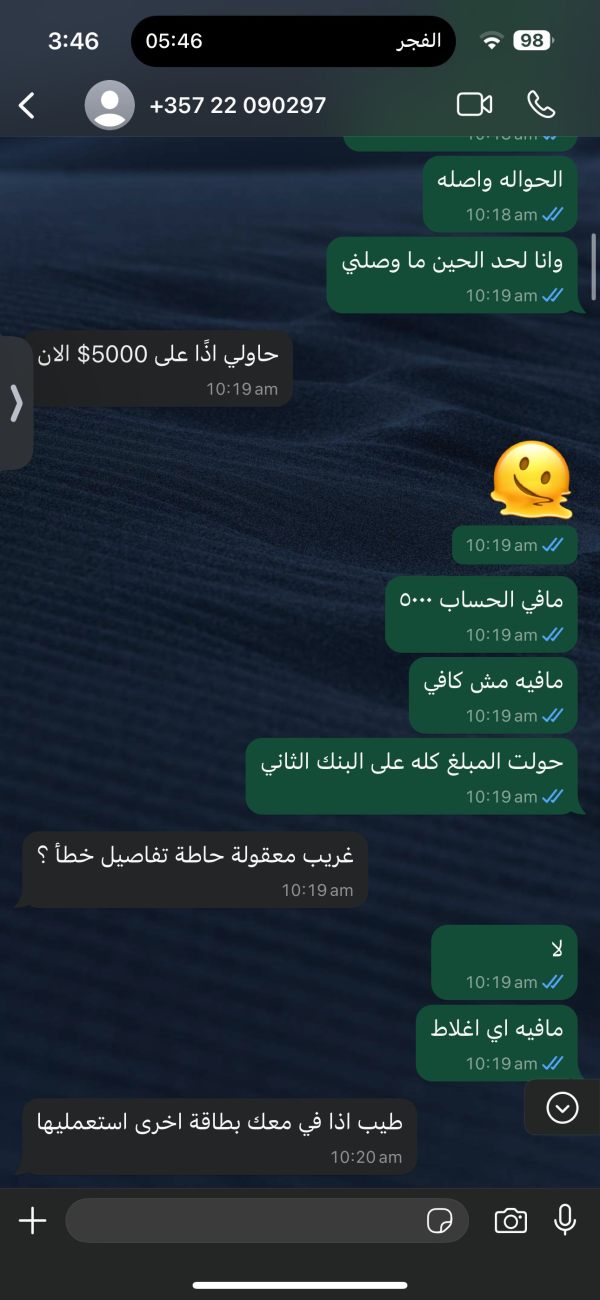

Customer Service and Support Analysis (5/10)

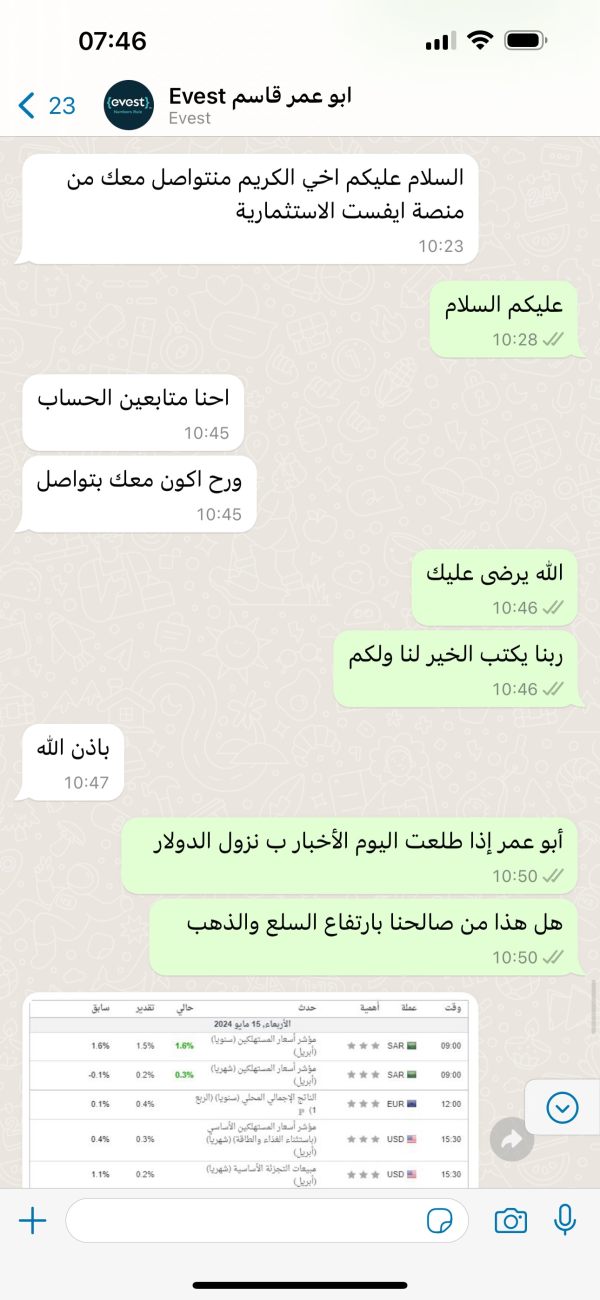

Customer service quality is a critical factor in broker evaluation, yet available information about Evest's support infrastructure is notably limited. The absence of detailed information about customer service channels, availability hours, and response times creates uncertainty about the level of support traders can expect when they encounter issues or have questions.

Effective customer support typically includes multiple contact methods such as live chat, telephone support, email assistance, and comprehensive FAQ sections. However, current materials don't provide comprehensive details about which channels Evest offers or their operational hours. This information gap is particularly concerning for traders who may need assistance during volatile market conditions or outside standard business hours.

The quality of customer service is often best assessed through user feedback and testimonials, but such detailed reviews aren't extensively available in current materials. User experiences with problem resolution, account management assistance, and technical support aren't well documented, making it difficult to gauge service effectiveness.

Multi-language support capabilities are increasingly important in the global trading environment, but information about the languages supported by Evest's customer service team isn't specified. This could be a significant consideration for non-English speaking traders who prefer support in their native language.

Training and competency of support staff, particularly their understanding of trading-related issues and platform functionality, cannot be assessed due to limited available feedback. The scoring reflects these information limitations and the importance of reliable customer support in the trading industry.

Trading Experience Analysis (6/10)

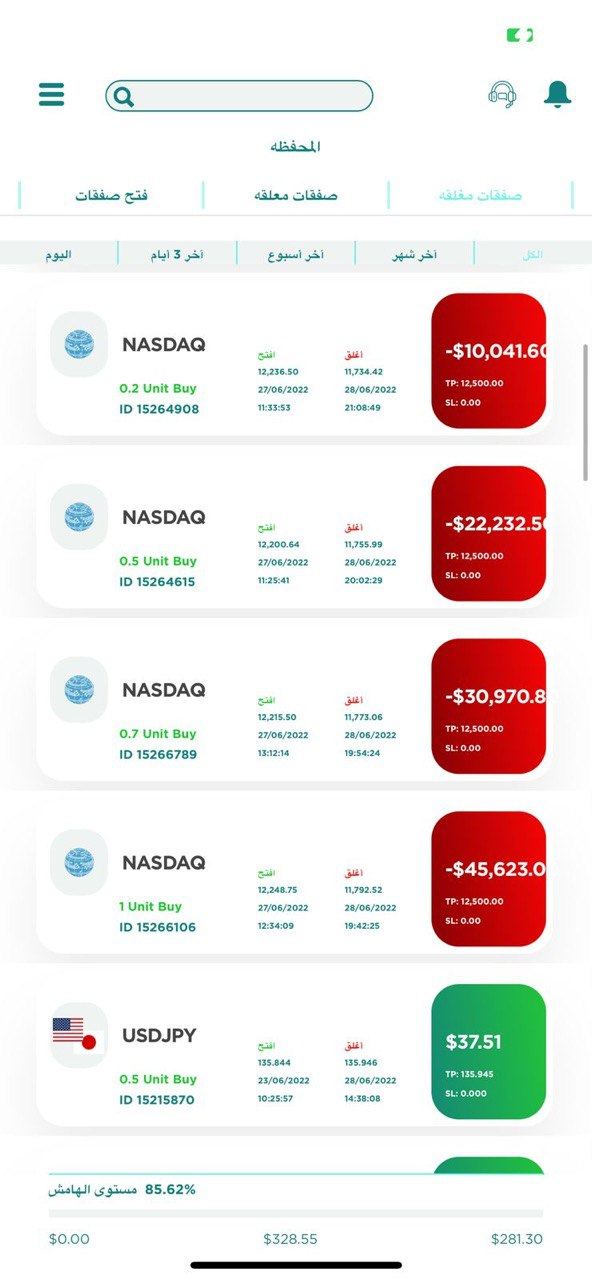

The trading experience evaluation focuses on platform performance, execution quality, and overall user satisfaction with the trading environment. Evest's offering of both web-based platforms and MetaTrader 5 provides flexibility for different trading styles and experience levels. MT5 is particularly valuable for its advanced charting capabilities, technical analysis tools, and support for automated trading strategies.

Platform stability and execution speed are crucial factors for active traders, especially during volatile market conditions. However, detailed performance metrics, uptime statistics, and execution quality data aren't comprehensively available in current materials. User feedback about platform reliability, order execution speed, and slippage experiences would be valuable for assessment but isn't extensively documented.

The diversity of tradeable assets across Forex, stocks, indices, commodities, and cryptocurrencies suggests a comprehensive trading environment. This variety allows traders to implement different strategies and respond to various market opportunities, which enhances the overall trading experience.

Mobile trading capabilities are increasingly important, but detailed information about mobile app functionality, user ratings, and feature completeness isn't readily available. Modern traders expect seamless transitions between desktop and mobile platforms, with full functionality available across all devices.

Order types, risk management tools, and advanced trading features are important components of the trading experience, but specific details about these capabilities aren't comprehensively covered in available materials. This evest review notes that while the foundation appears solid, more detailed user experience data would strengthen the evaluation.

Trust and Regulation Analysis (4/10)

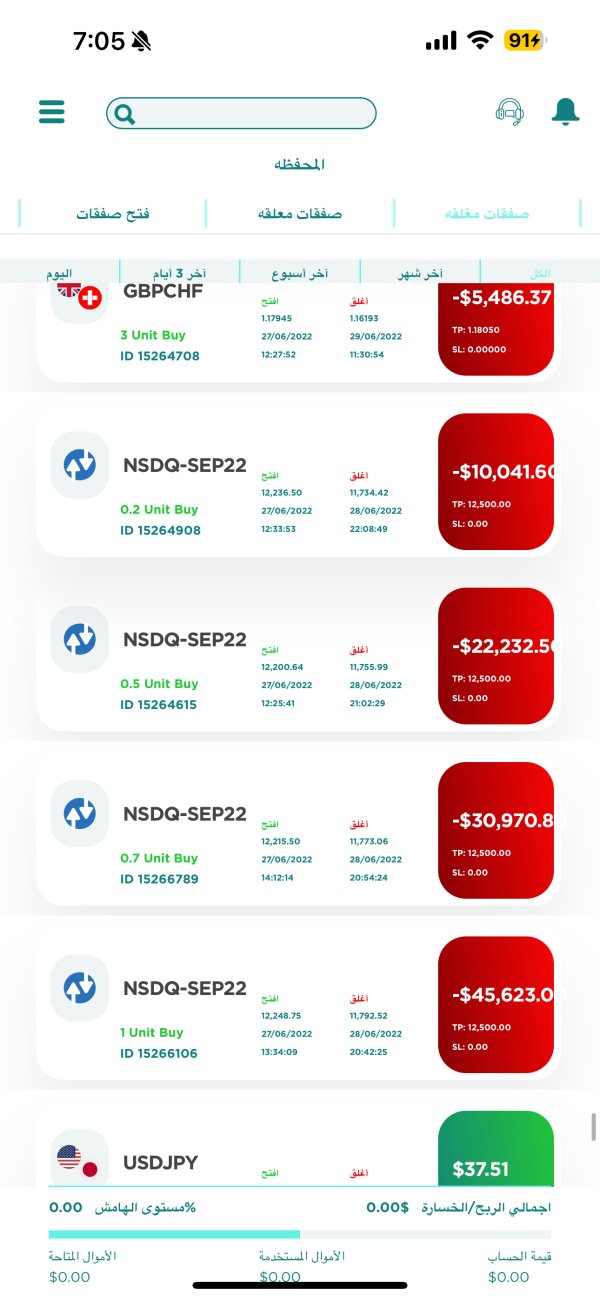

Trust and regulatory compliance represent perhaps the most concerning aspect of this evaluation due to the limited availability of clear regulatory information. Regulatory oversight is fundamental to trader protection, ensuring segregated client funds, dispute resolution mechanisms, and adherence to industry standards. The absence of prominently displayed regulatory credentials raises significant concerns about trader protection and fund security.

Established brokers typically operate under the oversight of respected financial authorities such as the FCA (UK), CySEC (Cyprus), ASIC (Australia), or other recognized regulators. These authorities require strict compliance standards, regular audits, and client fund segregation. Without clear regulatory information, it's impossible to assess what protections are available to Evest clients.

Transparency about company ownership, management team, and corporate structure is also limited in available materials. Reputable brokers typically provide comprehensive information about their corporate background, key personnel, and business operations. This transparency helps build trust and allows potential clients to make informed decisions.

Client fund protection measures, including segregated account arrangements and insurance coverage, aren't detailed in current materials. These protections are crucial for trader confidence and are typically highlighted by regulated brokers as key safety features.

The handling of any past regulatory issues, customer complaints, or negative incidents cannot be assessed due to limited available information. Industry reputation and track record are important trust indicators that require more comprehensive documentation.

User Experience Analysis (5/10)

User experience encompasses the overall satisfaction of traders with the broker's services, from account opening through daily trading activities. While Evest positions itself as suitable for both beginners and experienced traders, detailed user satisfaction metrics and comprehensive feedback aren't extensively available in current materials.

The account registration and verification process is a crucial first impression for new clients, but detailed information about the efficiency and user-friendliness of these procedures isn't well documented. Smooth onboarding experiences are essential for user satisfaction and early engagement with the platform.

Interface design and platform usability significantly impact daily trading experiences. While MT5 is a well-established platform with proven functionality, information about Evest's proprietary web platforms and their user-friendliness is limited. Modern traders expect intuitive interfaces that don't require extensive learning curves.

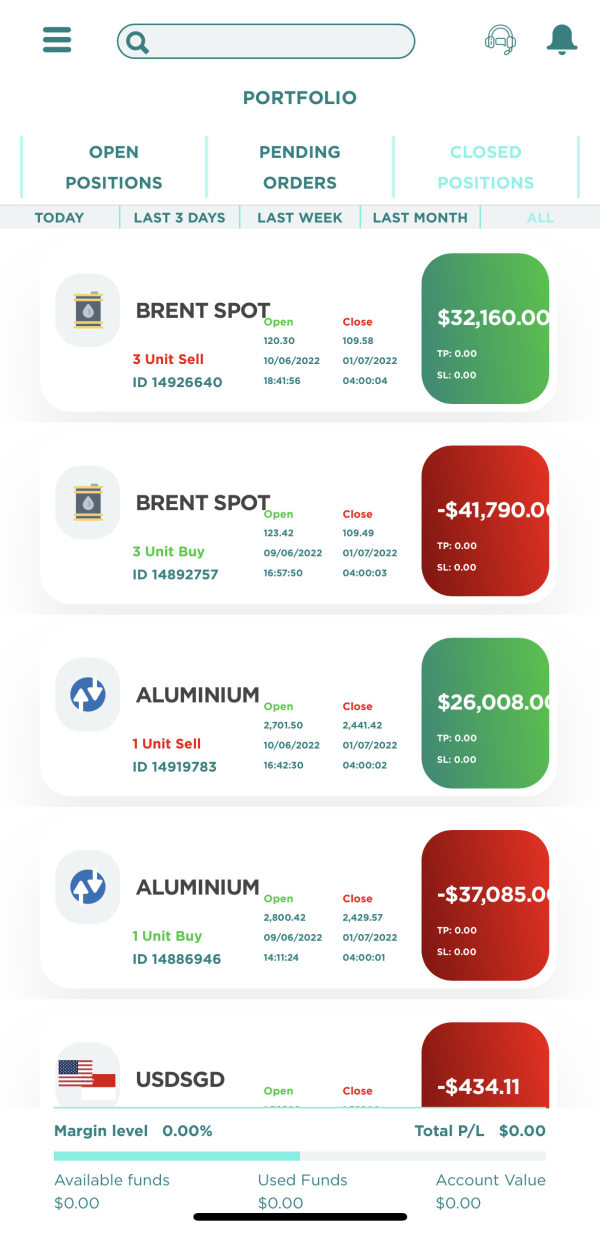

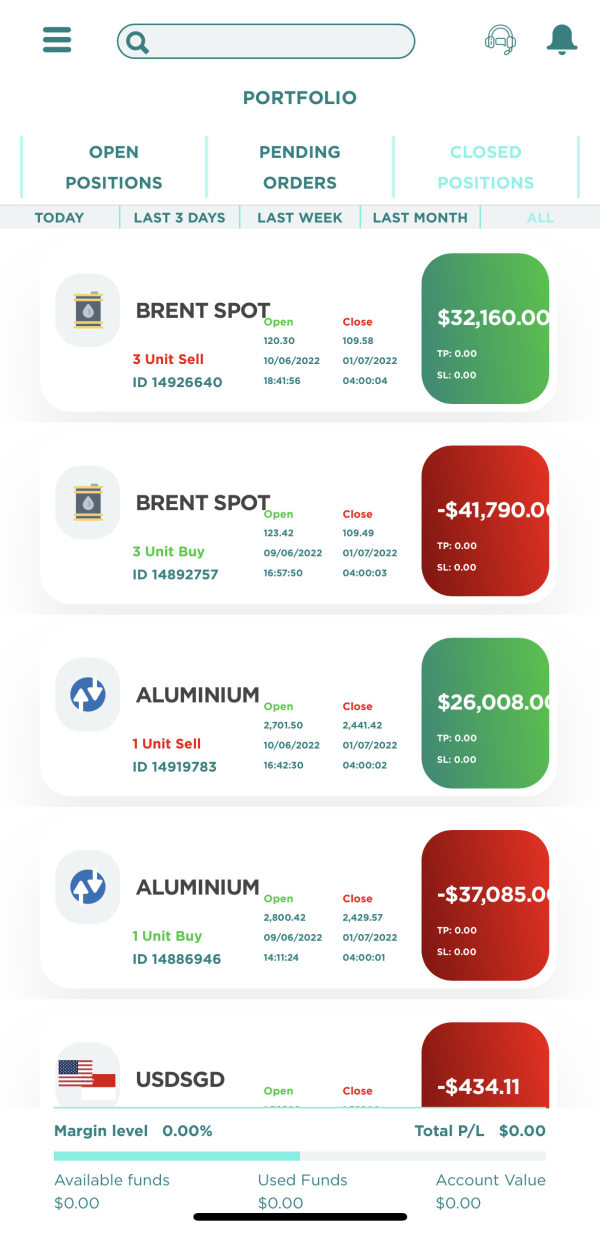

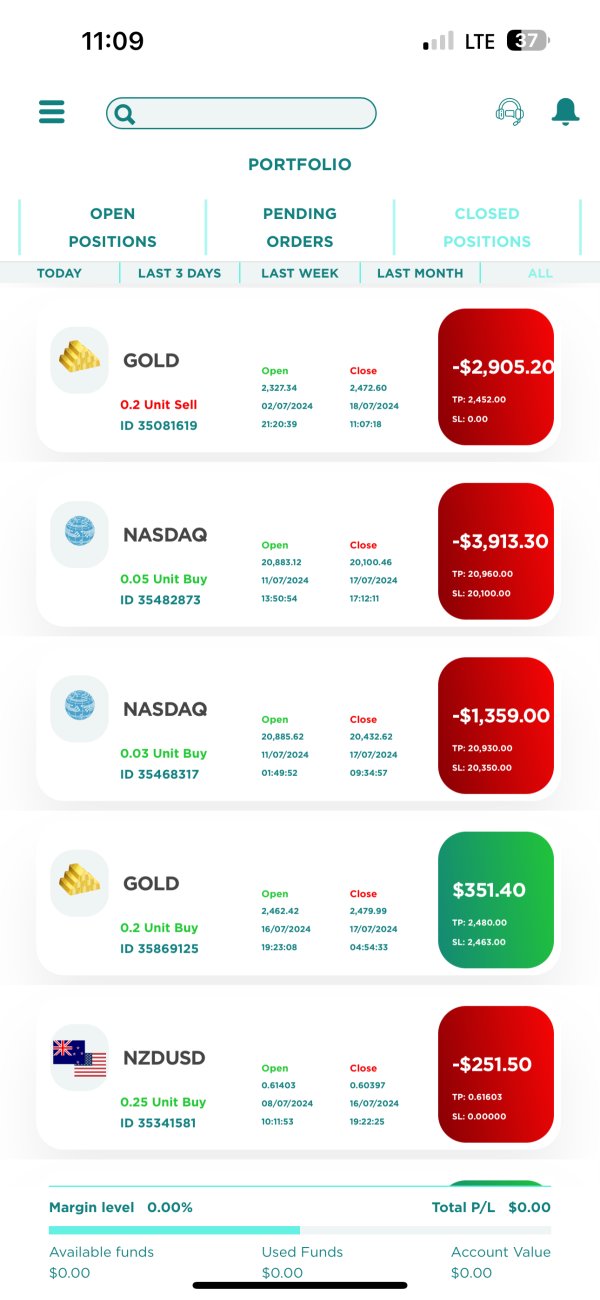

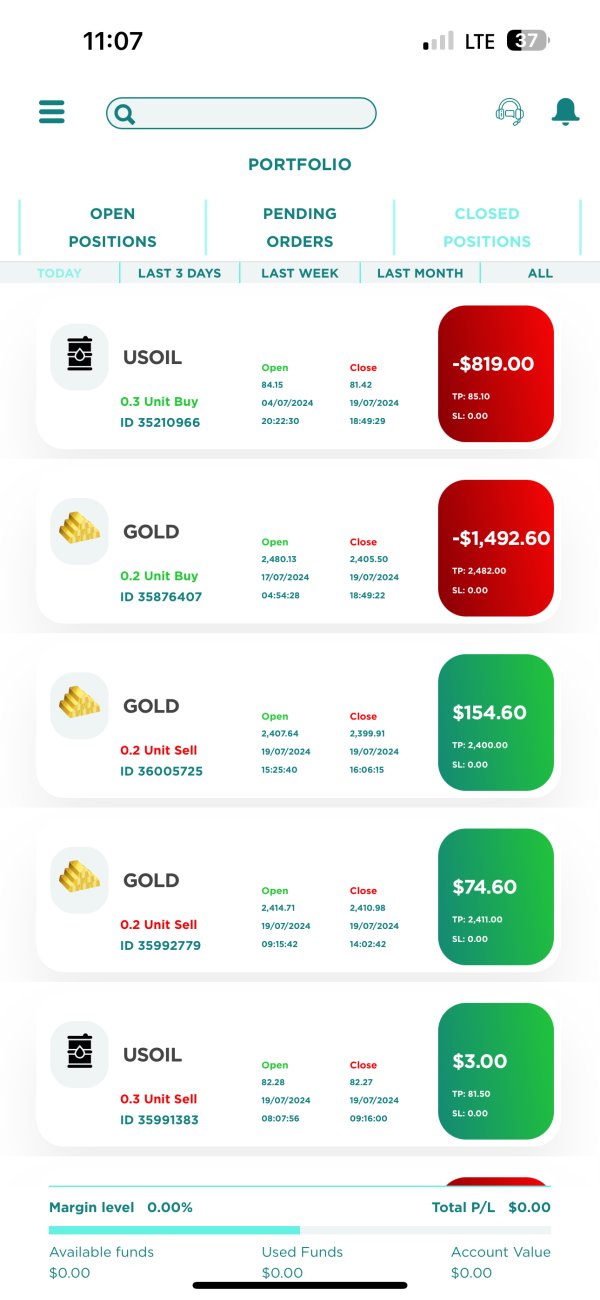

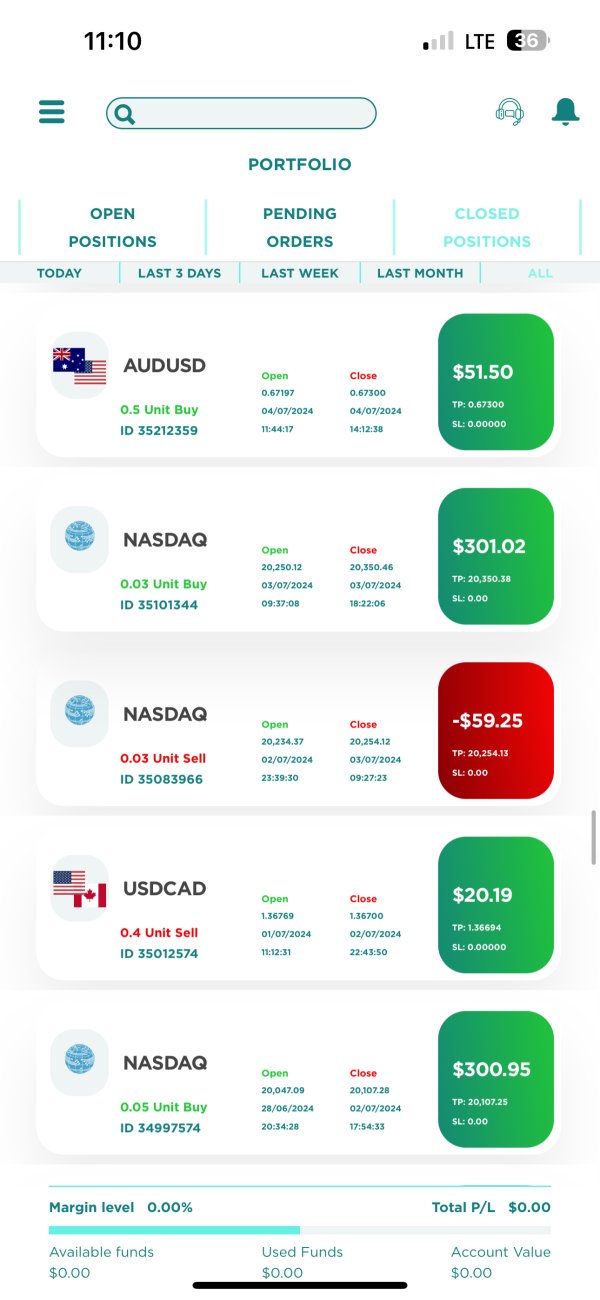

Fund management experiences, including deposit and withdrawal processes, processing times, and any associated difficulties, aren't comprehensively covered in available user feedback. These operational aspects significantly impact overall user satisfaction and trust in the broker.

Common user complaints and areas for improvement aren't well documented in current materials, making it difficult to identify potential pain points or areas where Evest excels compared to competitors. Comprehensive user feedback would provide valuable insights into real-world experiences and satisfaction levels.

The broker's responsiveness to user feedback and continuous improvement efforts aren't detailed in available materials, though such information would be valuable for assessing long-term user experience trends.

Conclusion

This evest review reveals a broker with both promising features and significant information gaps that potential clients should carefully consider. Evest's 0% commission structure and diverse asset offering across Forex, stocks, indices, commodities, and cryptocurrencies present attractive propositions for traders seeking cost-effective access to multiple markets. The availability of both web-based platforms and MetaTrader 5 provides flexibility for different trading preferences and experience levels.

However, the evaluation is significantly hampered by limited transparency in crucial areas, particularly regarding regulatory oversight, detailed account conditions, and comprehensive user feedback. The absence of clear regulatory information is especially concerning, as proper oversight is fundamental to trader protection and fund security.

Evest may be suitable for traders who prioritize low-cost trading and multi-asset access, but potential clients should exercise caution and conduct thorough due diligence before committing funds. The broker appears to target both novice and experienced traders, but the lack of detailed information about educational resources, customer support quality, and user satisfaction makes it difficult to assess how well it serves these different user groups.

Before choosing Evest, potential clients should seek clarification on regulatory status, account terms, and customer protection measures. While the broker shows promise in certain areas, the information gaps identified in this review suggest that more transparency and comprehensive disclosure would benefit potential clients' decision-making processes.