Regarding the legitimacy of xChief forex brokers, it provides FSCA, MISA and WikiBit, (also has a graphic survey regarding security).

Is xChief safe?

Pros

Cons

Is xChief markets regulated?

The regulatory license is the strongest proof.

FSCA Derivatives Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

XCHIEF ZA (PTY) LTD

Effective Date:

2025-09-25Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

17 EATON AVENUEBRYANSTONJOHANNESBURG2191Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

MISA Forex Trading License (EP)

Mwali International Services Authority

Mwali International Services Authority

Current Status:

RegulatedLicense Type:

Forex Trading License (EP)

Licensed Entity:

xChief Ltd

Effective Date:

2023-10-10Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

https://www.xchief.com/Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is xChief A Scam?

Introduction

xChief, formerly known as ForexChief, is an online forex and CFD broker that has gained attention for its diverse trading offerings and competitive conditions. Established in 2014, the broker positions itself as a provider of high-quality trading services, catering to both novice and experienced traders. However, as with any financial service provider, it is crucial for traders to conduct thorough due diligence before committing their funds. This article aims to objectively assess the credibility and safety of xChief by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile.

To ensure a comprehensive evaluation, this investigation draws on multiple sources, including user reviews, regulatory databases, and expert assessments. The analysis framework is designed to highlight both the strengths and weaknesses of xChief, providing potential clients with the information necessary to make informed decisions.

Regulation and Legitimacy

The regulatory environment in which a broker operates is a critical determinant of its legitimacy and trustworthiness. xChief is regulated by the Mwali International Services Authority (MISA) in the Comoros and the Vanuatu Financial Services Commission (VFSC). While these regulatory bodies provide a level of oversight, they are not considered tier-one regulators, which typically include authorities like the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC). This raises concerns regarding the robustness of the regulatory framework governing xChief.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| MISA | T2023379 | Comoros | Verified |

| VFSC | 14777 | Vanuatu | Verified |

The quality of regulation is paramount, as it ensures that brokers adhere to strict operational standards designed to protect clients. While xChief claims to follow regulatory requirements, its oversight does not include investor compensation schemes, which can leave clients vulnerable in the event of insolvency. Furthermore, historical compliance issues have been noted, with some users reporting difficulties in fund withdrawals and account management. This lack of stringent regulation and oversight may contribute to the perception of risk associated with trading with xChief.

Company Background Investigation

xChief has its roots in ForexChief, which was established in 2014. The company is registered in the Republic of Comoros, with additional offices in Vanuatu and Nigeria. Over the years, xChief has expanded its offerings and client base, focusing on providing a user-friendly trading environment. However, the offshore nature of its registration and the lack of transparency regarding its ownership structure can raise red flags for potential investors.

The management team behind xChief is composed of individuals with varying backgrounds in finance and trading. While some team members possess considerable experience, there is limited publicly available information about their credentials. This lack of transparency can hinder clients' ability to assess the broker's reliability and trustworthiness. Moreover, the companys information disclosure practices are not as robust as those of more established brokers, which may further contribute to skepticism among potential traders.

Trading Conditions Analysis

xChief offers a variety of trading conditions, including competitive spreads and high leverage options. The broker provides several account types, each with different fee structures and trading conditions. However, an in-depth analysis reveals that certain fees may be higher than industry averages, impacting the overall cost of trading.

| Fee Type | xChief | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | From 0.4 pips | From 0.1 pips |

| Commission Model | $15 per million | $10 per million |

| Overnight Interest Range | Varies | Varies |

The fee structure at xChief can be viewed as competitive for certain account types, particularly for high-volume traders. However, the broker's commission model may not be as attractive for retail traders, especially those who prefer commission-free trading options. Additionally, the presence of withdrawal fees and other hidden charges can further complicate the overall cost of trading.

Client Fund Safety

The safety of client funds is a paramount concern for any trader. xChief claims to implement several measures to protect client funds, including segregated accounts and negative balance protection. Segregated accounts help ensure that client funds are kept separate from the broker's operational funds, which is a positive aspect of their operations.

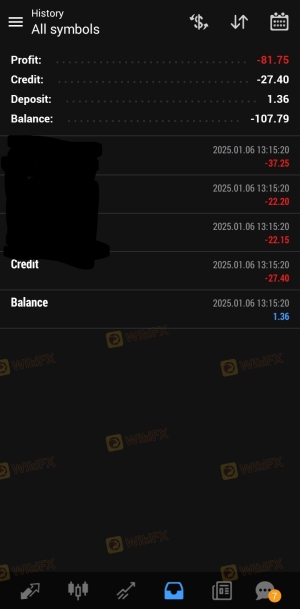

However, the effectiveness of these measures is often contingent on the regulatory framework under which the broker operates. Given that xChief is regulated by offshore authorities, the level of investor protection may not be on par with brokers regulated by tier-one jurisdictions. Additionally, there have been reports of fund withdrawal issues, raising concerns about the broker's reliability and the safety of client capital.

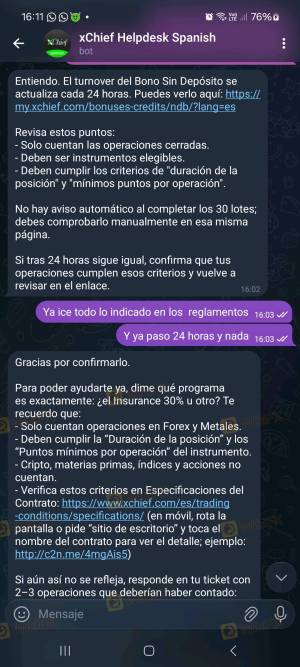

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's performance and reliability. Reviews of xChief reveal a mixed bag of experiences. While some clients report positive trading experiences, others highlight significant issues, particularly regarding withdrawals and customer support.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Account Blocking | High | Unresolved issues |

| Poor Customer Support | Medium | Limited availability |

Typical case studies include instances where clients were unable to withdraw their funds due to account verification issues. Some users reported that their accounts were blocked without clear explanations, leading to frustration and concerns about the broker's legitimacy. On the other hand, there are users who praise the broker for its trading conditions and prompt execution, suggesting that experiences can vary widely among clients.

Platform and Trade Execution

The trading platforms offered by xChief include MetaTrader 4 (MT4) and MetaTrader 5 (MT5), both of which are widely regarded in the trading community for their functionality and user-friendly interfaces. The broker claims to provide high execution speeds and minimal slippage, which are crucial for active traders. However, some user reviews indicate issues with order execution, particularly during periods of high volatility.

The overall performance of the trading platform appears satisfactory for many users, but the presence of slippage and occasional rejected orders raises concerns about the quality of execution. Such issues can negatively impact traders' experiences, especially those relying on precise timing for their trades.

Risk Assessment

Trading with xChief presents several risks that potential clients should consider. The offshore regulatory status, coupled with mixed reviews regarding customer support and fund withdrawals, contributes to an elevated risk profile.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Limited oversight from offshore bodies |

| Fund Safety | Medium | Segregated accounts but limited protection |

| Customer Support | Medium | Mixed reviews about responsiveness |

To mitigate these risks, traders are advised to conduct thorough research, start with a small investment, and utilize demo accounts to familiarize themselves with the trading environment before committing significant capital.

Conclusion and Recommendations

In conclusion, while xChief offers various trading opportunities and competitive conditions, potential clients should approach with caution. The broker's offshore regulatory status, mixed customer experiences, and reports of withdrawal issues raise legitimate concerns about its reliability and safety.

For traders seeking a dependable broker, it may be prudent to consider alternatives that are regulated by reputable authorities, such as the FCA or ASIC, which offer higher levels of investor protection. Brokers like Avatrade, FP Markets, and Swissquote are recommended as they provide robust regulatory frameworks, diverse trading instruments, and superior customer service.

Ultimately, whether xChief is a suitable choice depends on individual risk tolerance and trading needs. Traders should weigh the potential benefits against the risks and make informed decisions based on comprehensive research.

Is xChief a scam, or is it legit?

The latest exposure and evaluation content of xChief brokers.

xChief Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

xChief latest industry rating score is 5.95, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 5.95 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.